The Coal Bed Methane Market size was valued at USD 20.23 Billion in 2024 and the total Coal Bed Methane revenue is expected to grow at a CAGR of 6.20% from 2025 to 2032, reaching nearly USD 32.73 Billion.Overview

Coal bed Methane Market is a coal formation in its mid-stage of maturation, with coal being both the gas source and reservoir. It is a mixture of gases dominated by CH4, with the remaining gases including C2H6, CO2, N2, He, O2, H2, and also some trace amounts of H2S. During coalification, large quantities of methane-rich gas are generated and stored within the coal on internal surfaces. As a key driving force for the development of the energy industry, technological innovation is regarded as an inevitable iterative process, which is used to meet new demands in the market.To know about the Research Methodology :- Request Free Sample Report The surge in electricity consumption around the world thanks to improving income levels and increasing construction of residential homes represents one of the key factors bolstering the growth of the market. Companies on the GCEL are planning to develop new thermal coal mining projects with a total capacity of 2.5 billion tons per year, an amount equal to over 35% of the world’s current Production. Technological advancement and constant population growth have led to an increase in energy demand. Technology enablement in coal mines for transformation across the business value chain and leveraging the digital technology as an accelerator for demonstrating performance enhancement in the coal mines. According to MMR analysis, about 532 operational landfill gas energy projects in the U.S. and 466 landfills are suitable for energy projects. It is observed that the price of methane for developed countries is higher compared to a non-developed country which is mainly on account of taxation policy imposed locally.

Coal Bed Methane Market Dynamics

Surging grlobal demand in manufacturing, residential and automotive sector to drive the market The rise in the emission of methane from conventional fuel and the lower price of coal bed methane compared to other unconventional natural gases are expected to propel the growth of the global coal bed methane market. Thanks to the increase in the exploration and extraction of coal bed globally, which drives the market of coal bed methane Production over the forecast period. In addition, increasing concern about environmental issues such as an increase in carbon-di-oxide levels and earning carbon credits are other factors estimated to fuel the growth of the global coal bed market. Owing to this, the coal bed methane exploration activities are expected to increase in the forecast period and add to the growth of the coal bed methane market. According to the MMR analysis, India has the fifth-largest known coal reserves in the world, providing substantial opportunities for CBM exploration and Production. India's CBM resources are estimated at roughly 92 trillion cubic feet (TCF) or 2,600 billion cubic meters (BCM). India's coal and CBM deposits are spread throughout 12 states. The majority of coal and CBM reserves are found in the Gondwana strata of eastern India.Unraveling the High Drilling Costs and Barriers in the Global Coal Bed Methane Market In the Coal Bed Methane process drilling cost is estimated to account for 74.3% of the total cost for one cubic meter of Coal Bed Methane gas produced that as a result restrained the growth of the market. The key factor that affects the market is the high drilling cost and potential barriers to the requirements for the logistics of importing equipment. The risk involved in the extraction of methane from coal beds hinders the global coal bed methane market. Improvement is hindered by institutional, legal, and regulatory barriers together with technical and technological barriers. Navigating High Costs, Subsidy Gaps, and Environmental Impacts The high cost of Coal Bed Methane and the lack of effective subsidy and stimulus policies, the development of the Coal Bed Methane industry is limited, unable to expand the source of the supply side. Due to the limitation of cost, the well selection cannot reach the optimal level in the development process. Additionally, inadequate Coal Bed Methane infrastructure in China, Coal Bed Methane Production is out of touch with downstream consumption. Faced with huge infrastructure costs, the development of CBM is limited and resources cannot be used effectively. The difference in the buried depth of multiple Coal Bed Methane Production points will lead to the difference in coal seam permeability and gas content. With the increase of buried depth, the gas content of the coal seam decreases. As a consequence, in the process of extraction of CBM, a large amount of salinized water is released into freshwater ecosystems. Disposal of salinized water is an issue and this as a result poses adverse impacts.

Coal Bed Methane Market Segment Analysis

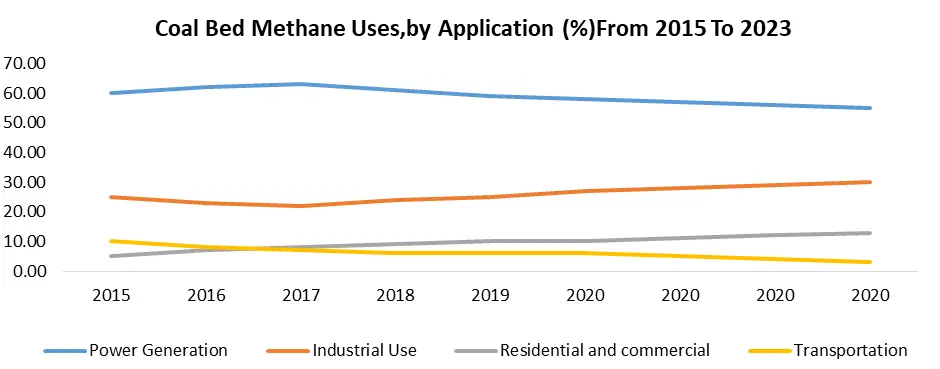

Based on Technology, the Power generation Market held the largest market share of about 44% in the global Coal Bed Methane market in 2024. Power generation remains the largest driver of global gas consumption. Gas consumption in the power sector decreased by 0.2% to 6,050 terawatt hour (TWh), driven by gas-to-coal switching in various regions amidst high gas prices, which made natural gas less competitive compared to other fuels. Additionally, power generation will likely remain the largest driver of global gas consumption, as more countries transition away from coal-fired power plants. High gas prices led to an increase in Production costs for heavily gas-reliant industries Global gas consumption in the industrial sector is estimated to have declined by 4% y-o-y to 740 billion cubic metres (bcm) in 2024 due to high gas prices, which caused a reduction in Production or partial shutdown in some heavy industries such as cement, fertiliser, and steel. However, with the expected lower gas prices, gas consumption in the industrial sector is likely to rise in 2024, as natural gas remains a cost-effective, reliable, and environmentally friendly energy source for many industries

Regional Insights

Asia Pacific region is expected to be the fastest-growing market where developing countries like China, India, and Indonesia, continuously grow the demand for energy at a rate of about 8%.To maintain this growth rate they need around 7.1 btoe (billion tons of oil equivalent) in the forecast period, which accounts for 42% of the world’s primary energy demand. To meet this demand, they need clean energy fuel where CBM natural gas best fits in. The world’s top 3 coal mine developers are Coal India with projects totaling 591 million tons of new coal Production per year, China Energy Investment with 169 million tons, and the Adani Group with 94 million tons. India has set a target for natural gas to account for 15% of its energy mix by 2032, up from the current 6.7%, while the global average of more than 20%. Through 2032, China is expected to be the biggest spender on energy resources. Major driving sectors for this growth in China are mainly the transportation and domestic household market. According to the MMR analysis, China’s natural gas consumption will reach 398 billion square meters by 2032. In 2024, global gas Production decreased by 0.1% to 4.04 tcm, primarily due to a drop in global gas demand. The Eurasia and Africa regions experienced the most significant decline, while North America, the Middle East, Latin America and the Caribbean (LAC), Europe, and Asia Pacific recorded an increase in gas output. Global gas Production is expected to increase by around 1% in 2024, driven by North America, the Middle East, and Africa. Mexico’s demand for natural gas will continue to increase between 2020 and 2032 due to Mexico’s expansion of its domestic pipeline infrastructure, increased power generation gas demand, and lower domestic Production. Since 2015, Mexico’s imports of U.S. gas have undergone a 124% increase, reaching 6.4 Bcfd in 2022. ICF projects that exports will reach 8.2 Bcfd by 2032. ICF assumes the first phase of the Costa Azul LNG export facility will be built in Mexico, further increasing pipeline exports to Mexico from the United States. Europe and Australia have been significant contributors to the market and are aggressively expanding to new regions.Coal Bed Methane Market Competitive Landscapes In May 2024, Government Initiatives Promote CBM Development several governments in key CBM regions unveiled Comprehensive policies and incentives to promote the development of CBM resources. These initiatives CBM Production, contribute to energy security and economic growth. In June 2024, Collaboration between CBM operators and environmental groups for sustainable practices to mitigate environmental concerns led Coal Bed Methane operators to partner with environmental organizations to develop best practices for responsible Coal Bed Methane Production. The Collaboration focuses on minimizing water usage, reducing greenhouse gas emissions, and implementing stringent monitoring and mitigation measures. According to the 2024 GCEL, companies are still planning to develop an additional 516 GW of new coal-fired capacity. If built, these projects would increase the world’s current installed coal-fired capacity by 25%. Out of the 39 countries where new coal power plants are still in the pipeline, the largest capacity additions are planned in India (72 GW), Indonesia (21 GW), Vietnam (14 GW), Russia (12 GW) and Bangladesh (10 GW)

Coal Bed Methane Market Scope: Inquire before buying

Global Coal Bed Methane Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 20.37 Bn. Forecast Period 2025 to 2032 CAGR: 6.20% Market Size in 2032: USD 32.73 Bn. Segments Covered: by Type Coal Mines CBM wells by Application Power Generation Chemical Fertilizers Residential Commercial Industrial Transportation by Technology Hydraulic Fracturing Horizontal Drilling CO2 sequestration Coal Bed Methane Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (razil, Argentina Rest of South America)Coal Bed Methane Key driver

1. Arrow Energy 2. Santso Ltd 15 3. China United Coal Bed Methane Corporation 4. Royal dutch shel plc 5. ConocoPhillips 6. BP PLC 7. Exxon Mobil (XTO Energy) 8. Petroloam Nasional Berhad 9. Encana 10. G3 Exploration 11. Tlou Energy 12. BG Group 13. IGas Energy 14. G3 Exploration 15. cnpc 16. Black Diamond Energy 17. Great Eastern Energy Frequently Asked Questions: 1] What segments are covered in the Global Coal Bed Methane Market report? Ans. The segments covered in the Coal Bed Methane Market report are based on Extraction Technology and Application. 2] Which region is expected to hold the highest share in the Global Coal Bed Methane Market? Ans. The Asia Pacific region is expected to hold the highest share in the Coal Bed Methane Market. 3] What is the market size of the Global Coal Bed Methane Market by 2032? Ans. The market size of the Coal Bed Methane Market by 2032 is expected to reach USD 32.73 Bn. 4] What is the forecast period for the Global Coal Bed Methane Market? Ans. The forecast period for the Coal Bed Methane Market is 2025-2032. 5} What was the Global Coal Bed Methane Market size in 2024? Ans: The Global Coal Bed Methane Market size was USD 20.23 Billion in 2024.

1. Coal Bed Methane Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Coal Bed Methane Market: Dynamics 2.1. Coal Bed Methane Market Trends by Region 2.1.1. North America Coal Bed Methane Market Trends 2.1.2. Europe Coal Bed Methane Market Trends 2.1.3. Asia Pacific Coal Bed Methane Market Trends 2.1.4. Middle East and Africa Coal Bed Methane Market Trends 2.1.5. South America Coal Bed Methane Market Trends 2.2. Coal Bed Methane Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Coal Bed Methane Market Drivers 2.2.1.2. North America Coal Bed Methane Market Restraints 2.2.1.3. North America Coal Bed Methane Market Opportunities 2.2.1.4. North America Coal Bed Methane Market Challenges 2.2.2. Europe 2.2.2.1. Europe Coal Bed Methane Market Drivers 2.2.2.2. Europe Coal Bed Methane Market Restraints 2.2.2.3. Europe Coal Bed Methane Market Opportunities 2.2.2.4. Europe Coal Bed Methane Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Coal Bed Methane Market Drivers 2.2.3.2. Asia Pacific Coal Bed Methane Market Restraints 2.2.3.3. Asia Pacific Coal Bed Methane Market Opportunities 2.2.3.4. Asia Pacific Coal Bed Methane Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Coal Bed Methane Market Drivers 2.2.4.2. Middle East and Africa Coal Bed Methane Market Restraints 2.2.4.3. Middle East and Africa Coal Bed Methane Market Opportunities 2.2.4.4. Middle East and Africa Coal Bed Methane Market Challenges 2.2.5. South America 2.2.5.1. South America Coal Bed Methane Market Drivers 2.2.5.2. South America Coal Bed Methane Market Restraints 2.2.5.3. South America Coal Bed Methane Market Opportunities 2.2.5.4. South America Coal Bed Methane Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Coal Bed Methane Industry 2.8. Analysis of Government Schemes and Initiatives For Coal Bed Methane Industry 2.9. Coal Bed Methane Market Trade Analysis 2.10. The Global Pandemic Impact on Coal Bed Methane Market 3. Coal Bed Methane Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 3.1.1. Coal Mines 3.1.2. CBM wells 3.2. Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 3.2.1. Power Generation 3.2.2. Chemical 3.2.3. Fertilizers 3.2.4. Residential 3.2.5. Commercial 3.2.6. Industrial 3.2.7. Transportation 3.3. Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 3.3.1. Hydraulic Fracturing 3.3.2. Horizontal Drilling 3.3.3. CO2 sequestration 3.4. Coal Bed Methane Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Coal Bed Methane Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 4.1.1. Coal Mines 4.1.2. CBM wells 4.2. North America Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 4.2.1. Power Generation 4.2.2. Chemical 4.2.3. Fertilizers 4.2.4. Residential 4.2.5. Commercial 4.2.6. Industrial 4.2.7. Transportation 4.3. North America Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 4.3.1. Hydraulic Fracturing 4.3.2. Horizontal Drilling 4.3.3. CO2 sequestration 4.4. North America Coal Bed Methane Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 4.4.1.1.1. Coal Mines 4.4.1.1.2. CBM wells 4.4.1.2. United States Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 4.4.1.2.1. Power Generation 4.4.1.2.2. Chemical 4.4.1.2.3. Fertilizers 4.4.1.2.4. Residential 4.4.1.2.5. Commercial 4.4.1.2.6. Industrial 4.4.1.2.7. Transportation 4.4.1.3. United States Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 4.4.1.3.1. Hydraulic Fracturing 4.4.1.3.2. Horizontal Drilling 4.4.1.3.3. CO2 sequestration 4.4.2. Canada 4.4.2.1. Canada Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 4.4.2.1.1. Coal Mines 4.4.2.1.2. CBM wells 4.4.2.2. Canada Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 4.4.2.2.1. Power Generation 4.4.2.2.2. Chemical 4.4.2.2.3. Fertilizers 4.4.2.2.4. Residential 4.4.2.2.5. Commercial 4.4.2.2.6. Industrial 4.4.2.2.7. Transportation 4.4.2.3. Canada Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 4.4.2.3.1. Hydraulic Fracturing 4.4.2.3.2. Horizontal Drilling 4.4.2.3.3. CO2 sequestration 4.4.3. Mexico 4.4.3.1. Mexico Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 4.4.3.1.1. Coal Mines 4.4.3.1.2. CBM wells 4.4.3.2. Mexico Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 4.4.3.2.1. Power Generation 4.4.3.2.2. Chemical 4.4.3.2.3. Fertilizers 4.4.3.2.4. Residential 4.4.3.2.5. Commercial 4.4.3.2.6. Industrial 4.4.3.2.7. Transportation 4.4.3.3. Mexico Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 4.4.3.3.1. Hydraulic Fracturing 4.4.3.3.2. Horizontal Drilling 4.4.3.3.3. CO2 sequestration 5. Europe Coal Bed Methane Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.2. Europe Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.3. Europe Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4. Europe Coal Bed Methane Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.1.2. United Kingdom Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.1.3. United Kingdom Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.2. France 5.4.2.1. France Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.2.2. France Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.2.3. France Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.3.2. Germany Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.3.3. Germany Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.4.2. Italy Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.4.3. Italy Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.5.2. Spain Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.5.3. Spain Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.6.2. Sweden Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.6.3. Sweden Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.7.2. Austria Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.7.3. Austria Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 5.4.8.2. Rest of Europe Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 5.4.8.3. Rest of Europe Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6. Asia Pacific Coal Bed Methane Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.2. Asia Pacific Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.3. Asia Pacific Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4. Asia Pacific Coal Bed Methane Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.1.2. China Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.1.3. China Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.2.2. S Korea Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.2.3. S Korea Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.3.2. Japan Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.3.3. Japan Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.4. India 6.4.4.1. India Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.4.2. India Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.4.3. India Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.5.2. Australia Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.5.3. Australia Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.6.2. Indonesia Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.6.3. Indonesia Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.7.2. Malaysia Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.7.3. Malaysia Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.8.2. Vietnam Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.8.3. Vietnam Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.9.2. Taiwan Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.9.3. Taiwan Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 6.4.10.3. Rest of Asia Pacific Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 7. Middle East and Africa Coal Bed Methane Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 7.2. Middle East and Africa Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 7.3. Middle East and Africa Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 7.4. Middle East and Africa Coal Bed Methane Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 7.4.1.2. South Africa Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 7.4.1.3. South Africa Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 7.4.2.2. GCC Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 7.4.2.3. GCC Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 7.4.3.2. Nigeria Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 7.4.3.3. Nigeria Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 7.4.4.2. Rest of ME&A Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 7.4.4.3. Rest of ME&A Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 8. South America Coal Bed Methane Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 8.2. South America Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 8.3. South America Coal Bed Methane Market Size and Forecast, by Technology(2024-2032) 8.4. South America Coal Bed Methane Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 8.4.1.2. Brazil Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 8.4.1.3. Brazil Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 8.4.2.2. Argentina Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 8.4.2.3. Argentina Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Coal Bed Methane Market Size and Forecast, by Type (2024-2032) 8.4.3.2. Rest Of South America Coal Bed Methane Market Size and Forecast, by Application (2024-2032) 8.4.3.3. Rest Of South America Coal Bed Methane Market Size and Forecast, by Technology (2024-2032) 9. Global Coal Bed Methane Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Coal Bed Methane Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Arrow Energy 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Santso Ltd 15 10.3. China United Coal Bed Methane Corporation 10.4. Royal dutch shel plc 10.5. ConocoPhillips 10.6. BP PLC 10.7. Exxon Mobil (XTO Energy) 10.8. Petroloam Nasional Berhad 10.9. Encana 10.10. G3 Exploration 10.11. Tlou Energy 10.12. BG Group 10.13. IGas Energy 10.14. G3 Exploration 10.15. cnpc 10.16. Black Diamond Energy 10.17. Great Eastern Energy 11. Key Findings 12. Industry Recommendations 13. Coal Bed Methane Market: Research Methodology 14. Terms and Glossary