Global Cloud Data Security Market size was valued at USD 4.5 Bn in 2022 and Cloud Data Security market revenue is expected to reach USD 12.57 Bn by 2029, at a CAGR of 15.8% over the forecast period.Cloud Data Security Market Overview

Cloud data security is a technology used for protecting data and other digital information assets from security threats, and human errors. It leverages technology to keep consumers’ data confidential and still accessible for the cloud-based environment. Cloud computing delivers numerous benefits that allow to access data from any device through internet connection to reduce the chances of data loss during some incidents and also improve scalability. Access management and control over data is expected to boost the Cloud Data Security Market growth.To know about the Research Methodology :- Request Free Sample Report

Cloud Data Security Market Dynamics

Strong cloud data security allows to maintain visibility into the inner working of the cloud, importantly that allows to maintain visibility into inner working of cloud such as what data is searched, who is using cloud services, and many more, which is expected to boost the Cloud Data Security Market growth. An increasing number of internet user with increased use of cloud services are primary factors responsible for the growth of the market. Adoption of cloud based services by various businesses to secure their data is significantly contributing for the growth of the market. All these factors is expected to boost the market growth. Benefits of Cloud Data Security While protection of data it is important that the same controls and processes benefit the Cloud Data security companies too. There are some benefits mentioned below: Mitigate Data Breach Risk: In first half 2022, the weekly cyber-attacks increased by 42%. 23% of data is multipurpose malware, which includes bonnets and banking Trojans, 15% is crypto miners, 13% is infostealer, 12% data is from mobile, and 8% is from ransomware. Cloud data security controls reduce a cyber-attack success rate. For example, the implementation of data access controls makes it difficult for attackers to collect information easily. Encryption of data make the data unusable if the attackers succeed. Protect Brand Reputation: Reputation of brand generates customer interest and provides insight into financial performance. According to research 72% of business leaders believes that reputation is big driver of business performance that origins for many years. Enhance Customer Trust: Companies data privacy policies are considered by the companies and data protection is the part of buying decisions. Consumer’s wants companies to provide transparency around digital trust policies findings: according to 85% of respondents knowing company data privacy is important factor before purchasing. 46% of consumers always consider another brand if they are having doubt whether company will use their data. 53% of consumers make an online purchase and use digital services only after surety of brand regarding protecting customers’ data. Avoid Fines and Fees: Data privacy law leads to costly fines and legal fees. For example, a company that violates General Data Protection Regulation faces fine up to 10 Mn Euros. Challenges in Cloud Data Security Market Expanded Attack Surface: Cloud environments are flexible and scalable where organizations are able to add new applications or workloads easily. It is possible for people to deploy cloud assets outside the organizations security policy creating misconfiguration risks. IT security teams may not be aware of these assets due to traditional asset management tools and a lack of real-time detection capabilities, which is expected to limit the Cloud Data Security Market growth. Complex Environment: Modern IT Environment include more than one cloud provider, On-premises servers, SaaS applications, Virtual machines, Containers, and Instances. As data travel between these assets, it is found that organizations are discovering all type of sensitive data and also used for mapping data flow challenges. All the complex environment factors pose new and unique challenges for the Cloud Data Security Market key players. IT environment add new layers of abstraction, data security protection team needs to focus on discovering all mentioned assets and also maintain secure configurations and is expected to limit the Cloud data security market growth. Divergent Permissions: According to research, 89% of Cloud Data Security companies have multi-cloud environments. Maintaining awareness as per the situation and proper security practices poses a challenge due to the lack of data normalization across logs. Vendors provide monitoring tools, different field names are used by each provider, and number of field also varies in the logs. Without the normalization of data in a centralized location, Cloud Data Security organizations struggle to gain visibility across disparate, which contains permissions, log formats, network configurations, and encryption configurations. Dynamic Environment: IT department create and delete volumes of cloud assets. Cloud flexibility and scalability enable Cloud Data Security organizations to save money, continuously applying for security policy is becoming difficult. Lack of real-time policy enforcement capabilities due to traditional environment built for security tool. Cloud asset configurations fall out of compliance weakening Cloud Data security companies’ posture. Shadow Data: Cloud Database technologies are leveraged by the engineering team as they duplicate data. For e.g., they have DB backups generated with sensitive information, which are moved to the cloud and are never deleted. Most of the time tools fail to discover this data, and organizations are left with shadow data, which lead to data breach. Regulatory Compliance: Implementation of data security controls in most the most challenging factor in cloud security service. Increasing regulatory focus on the privacy of data means that companies have to maintain the data security posture and also document their activities. Inconsistent access permissions, and visibility issues lead to compliance violations and audit failures. Practices for Implementation of Cloud Data Security By following best practices for the Implementation of Cloud Data Security user can implement controls and technologies the secure data from hacker. • Identify Sensitive Data • Classify Data Using Context • Limit Access to Resources • Encrypt Data-in-Transit and Data-at-Rest • Implement Data Loss Prevention (DLP) • Harden Data Posture • Continuously Monitor Real-Time Data RiskCloud Data Security Market Segment Analysis

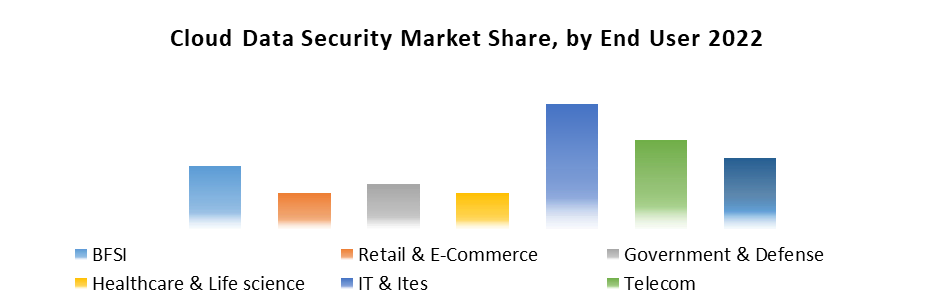

Based on Offerings, the market is segmented into solution and services. The solution segment held the largest Cloud Data Security market share in 2022 and is expected to dominate the market over the forecast period. Growing demand for security solution to protect data across different cloud environments is expected to boost the Cloud Data Security industry growth over the forecast period. Various organizations are transferring their data and operations to the cloud, which requires high-security solutions to integrate with existing systems and to provide end-to-end data protection through Cloud Data Security service provider. The components in the segment include identity and access management, data encryption, and many more, which are critical components for the protection of data in the cloud. Based on Organization size, the market is segmented into Large Enterprises, and Small & Medium Size Enterprises (SMEs). SMEs segment dominated the Cloud Data Security market in 2022 and is expected to continue the dominance over the forecast period. The rising complexity with cloud data security solutions presents a lucrative opportunities to SMEs, which is expected to boost the Cloud Data Security Market share. Cloud Data security provider provides cost-effective solutions to gain a competitive edge in the market.Based on End User, the Cloud Data Security industry is segmented into BFSI, Retail & E-commerce, Government & Defense, Healthcare & Life science, IT & ITes, Telecom, and Others. IT and Telecommunication held the largest Cloud Data Security Market share in 2022 and is expected to dominate the market over the forecast period. The IT sector deals with large volumes of sensitive data and proprietary information as they are prime target of cyber-attacks. Due to this problem, companies require robust solutions to protect data and infrastructure, which is expected to boost the market growth.

Cloud Data Security Market Regional Insight

North America region dominated the Cloud Data Security industry in 2022 and is expected to continue the dominance over the forecast period. The regional market refers to the market for securing data stored, which transmitted through cloud computing service. The regional market is gaining popularity due to scalability, cost-effectiveness, and flexibility. US, Canada, and Mexico are the countries where the Cloud Data security market is growing significantly due to its strong technology infrastructure and high adoption of cloud computing services. Rise in cyber threats and data breaches is expected to boost the regional Cloud Data Security Market growth. Encryption solutions ensures that data remains unreadable to unauthorized users, which is adopted by the North American regional market. The solution protects data both at rest i.e. stored in cloud server and during transmission. Access control is another factor that ensures that only authorized individuals or entities can access and manipulate data in the cloud. The implementation of strong authentication and authorization protocols is involved during access control mechanism. Data Loss Prevention (DLP), Threat Intelligence and Monitoring, and Compliance and Governance are factors that helps organizations adhere to data privacy regulations, industry standards, and internal governance policies. The regional market included established cybersecurity companies and cloud service providers, which offer integrated cyber security solution and is expected to boost the Cloud Data Security market size. Increasing adoption of cloud computing services and prioritize data protection is expected to boost the regional market growth.Cloud Data Security Market Competitive Landscape

The Global Cloud Data Security industry is consolidated with the presence of a large sized companies and also small-sized regional Cloud Data Security companies. Each Cloud Data Security key players are profiled in the market report based on the different parameters. Key service provider are establishing networks and partnerships with companies in the Cloud Data Security industry. The key players in the market are investing in Research & Development activities for new technologies. The strategies adopted by the major player, such as expansion of product portfolio, mergers & acquisitions, geographical expansion, and collaborations, to enhance the Cloud Data Security market penetration. In October 2022, Check Point enhanced a solution i.e. Check Point Quantum Titan, which combines Artificial Intelligence and Deep learning technology to defend from attacks such as zero day pishing.Cloud Data Security Market Scope: Inquire before buying

Cloud Data Security Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 4.5 Bn. Forecast Period 2023 to 2029 CAGR: 15.8% Market Size in 2029: US $ 12.57 Bn. Segments Covered: by Offering • Solution o Hardware o Software • Services by Offering Type • Fully Managed • Co-Managed by Organization Size • Large Enterprises • Small & Medium Size Enterprises(SMEs) by End User • BFSI • Retail & E-commerce • Government & Defence • Healthcare & Life science • IT & ITes • Telecom • Others Cloud Data Security Market by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Cloud Data Security Key Players Include

• IBM Corporation • Google • Palo Alto Networks • Imperva • Dig Security • Zscaler • Thales • Tata Communications • Fortinet, Inc. • Eureka Security • Rubrik – Zero Trust Data Security • Lookout, Inc • Cisco • Veritas • Fortra, LLC • Commvault • Orca Security • Veeam Software • Infrascale Inc. • Druva Inc • Cohesity, Inc • Cloudian • Polar Security • Check Point Frequently Asked Questions: 1] What is the growth rate of the Global Cloud Data Security Market? Ans. The Global Cloud Data Security Market is growing at a significant rate of 15.8% over the forecast period. 2] Which region is expected to dominate the Global Cloud Data Security Market? Ans. North America region is expected to dominate the Cloud Data Security Market over the forecast period. 3] What is the expected Global Cloud Data Security Market size by 2029? Ans. The market size of the Cloud Data Security Market is expected to reach USD 12.57 Bn by 2029. 4] Who are the top players in the Global Cloud Data Security Industry? Ans. The major key players in the Global Cloud Data Security Market are Dig Security, Zscaler, Thales, Tata Communications, and Fortinet, Inc. 5] Which factors are expected to drive the Global Cloud Data Security Market growth by 2029? Ans. An increasing number of internet user are is expected to drive the Cloud Data Security Market growth over the forecast period (2023-2029).

1. Cloud Data Security Recycling Market: Research Methodology 2. Cloud Data Security Market: Executive Summary 3. Cloud Data Security Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Cloud Data Security Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Cloud Data Security Market Size and Forecast by Segments (by Value USD) 5.1. Cloud Data Security Market Size and Forecast, by Offering (2022-2029) 5.1.1. Solution 5.1.1.1. Hardware 5.1.1.2. Software 5.1.2. Services 5.2. Cloud Data Security Market Size and Forecast, by Offering Type (2022-2029) 5.2.1. Fully Managed 5.2.2. Co-Managed 5.3. Cloud Data Security Market Size and Forecast, by Organization Size (2022-2029) 5.3.1. Large Enterprises 5.3.2. Small & Medium Size Enterprises(SMEs) 5.4. Cloud Data Security Market Size and Forecast, by End-user (2022-2029) 5.4.1. BFSI 5.4.2. Retail & E-commerce 5.4.3. Government & Defence 5.4.4. Healthcare & Life science 5.4.5. IT & ITes 5.4.6. Telecom 5.4.7. Others 5.5. Cloud Data Security Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Cloud Data Security Market Size and Forecast (by Value USD) 6.1. North America Cloud Data Security Market Size and Forecast, by Offering (2022-2029) 6.1.1. Solution 6.1.1.1. Hardware 6.1.1.2. Software 6.1.2. Services 6.2. North America Cloud Data Security Market Size and Forecast, by Offering Type (2022-2029) 6.2.1. Fully Managed 6.2.2. Co-Managed 6.3. North America Cloud Data Security Market Size and Forecast, by Organization Size (2022-2029) 6.3.1. Large Enterprises 6.3.2. Small & Medium Size Enterprises(SMEs) 6.4. North America Cloud Data Security Market Size and Forecast, by End-user (2022-2029) 6.4.1. BFSI 6.4.2. Retail & E-commerce 6.4.3. Government & Defence 6.4.4. Healthcare & Life science 6.4.5. IT & ITes 6.4.6. Telecom 6.4.7. Others 6.5. North America Cloud Data Security Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Cloud Data Security Market Size and Forecast (by Value USD) 7.1. Europe Cloud Data Security Market Size and Forecast, by Offering (2022-2029) 7.1.1. Solution 7.1.1.1. Hardware 7.1.1.2. Software 7.1.2. Services 7.2. Europe Cloud Data Security Market Size and Forecast, by Offering Type (2022-2029) 7.2.1. Fully Managed 7.2.2. Co-Managed 7.3. Europe Cloud Data Security Market Size and Forecast, by Organization Size (2022-2029) 7.3.1. Large Enterprises 7.3.2. Small & Medium Size Enterprises(SMEs) 7.4. Europe Cloud Data Security Market Size and Forecast, by End-user (2022-2029) 7.4.1. BFSI 7.4.2. Retail & E-commerce 7.4.3. Government & Defence 7.4.4. Healthcare & Life science 7.4.5. IT & ITes 7.4.6. Telecom 7.4.7. Others 7.5. Europe Cloud Data Security Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Cloud Data Security Market Size and Forecast (by Value USD) 8.1. Asia Pacific Cloud Data Security Market Size and Forecast, by Offering (2022-2029) 8.1.1. Solution 8.1.1.1. Hardware 8.1.1.2. Software 8.1.2. Services 8.2. Asia Pacific Cloud Data Security Market Size and Forecast, by Offering Type (2022-2029) 8.2.1. Fully Managed 8.2.2. Co-Managed 8.3. Asia Pacific Cloud Data Security Market Size and Forecast, by Organization Size (2022-2029) 8.3.1. Large Enterprises 8.3.2. Small & Medium Size Enterprises(SMEs) 8.4. Asia Pacific Cloud Data Security Market Size and Forecast, by End-user (2022-2029) 8.4.1. BFSI 8.4.2. Retail & E-commerce 8.4.3. Government & Defence 8.4.4. Healthcare & Life science 8.4.5. IT & ITes 8.4.6. Telecom 8.4.7. Others 8.5. Asia Pacific Cloud Data Security Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Cloud Data Security Market Size and Forecast (by Value USD) 9.1. Middle East and Africa Cloud Data Security Market Size and Forecast, by Offering (2022-2029) 9.1.1. Solution 9.1.1.1. Hardware 9.1.1.2. Software 9.1.2. Services 9.2. Middle East and Africa Cloud Data Security Market Size and Forecast, by Offering Type (2022-2029) 9.2.1. Fully Managed 9.2.2. Co-Managed 9.3. Middle East and Africa Cloud Data Security Market Size and Forecast, by Organization Size (2022-2029) 9.3.1. Large Enterprises 9.3.2. Small & Medium Size Enterprises(SMEs) 9.4. Middle East and Africa Cloud Data Security Market Size and Forecast, by End-user (2022-2029) 9.4.1. BFSI 9.4.2. Retail & E-commerce 9.4.3. Government & Defence 9.4.4. Healthcare & Life science 9.4.5. IT & ITes 9.4.6. Telecom 9.4.7. Others 9.5. Middle East and Africa Cloud Data Security Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Cloud Data Security Market Size and Forecast (by Value USD) 10.1. South America Cloud Data Security Market Size and Forecast, by Offering (2022-2029) 10.1.1. Solution 10.1.1.1. Hardware 10.1.1.2. Software 10.1.2. Services 10.2. South America Cloud Data Security Market Size and Forecast, by Offering Type (2022-2029) 10.2.1. Fully Managed 10.2.2. Co-Managed 10.3. South America Cloud Data Security Market Size and Forecast, by Organization Size (2022-2029) 10.3.1. Large Enterprises 10.3.2. Small & Medium Size Enterprises(SMEs) 10.4. South America Cloud Data Security Market Size and Forecast, by End-user (2022-2029) 10.4.1. BFSI 10.4.2. Retail & E-commerce 10.4.3. Government & Defence 10.4.4. Healthcare & Life science 10.4.5. IT & ITes 10.4.6. Telecom 10.4.7. Others 10.5. South America Cloud Data Security Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. IBM Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Google 11.3. Palo Alto Networks 11.4. Imperva 11.5. Dig Security 11.6. Zscaler 11.7. Thales 11.8. Tata Communications 11.9. Fortinet, Inc. 11.10. Eureka Security 11.11. Rubrik – Zero Trust Data Security 11.12. Lookout, Inc 11.13. Cisco 11.14. Veritas 11.15. Fortra, LLC 11.16. Commvault 11.17. Orca Security 11.18. Veeam Software 11.19. Infrascale Inc. 11.20. Druva Inc 11.21. Cohesity, Inc 11.22. Cloudian 11.23. Polar Security 12. Key Findings 13. Industry Recommendation