Global Chlorinated Paraffin Market was valued at USD 2.02 Billion in 2023, and is expected to reach USD 2.93 Billion by 2030, exhibiting a CAGR of 5.45% during the forecast period (2024-2030)Chlorinated Paraffin Market Overview

Chlorinated paraffins are colorless or yellowish, viscous, dense oils, except for the chlorinated paraffins of long carbon chain length with high chlorine content (about 70%), which are solid. These offer advantages such as flame retardancy and low-temperature strength and increase the flexibility of the materials. Chlorinated paraffins are used as extreme pressure additives as metalworking lubricants or cutting oils, owing to their compatibility with oils, viscous nature, and property of emancipating hydrochloric acid at high temperatures. They improve the resistance to water and chemicals, which is most suitable when they are used in marine paints, as coatings for industrial flooring, vessels, and swimming pools. These factors are expected to drive the growth of the chlorinated paraffin market. Medium-chain chlorinated paraffin is expected to maintain its dominance in the global chlorinated paraffin market during the forecast period. This is attributed to its use as a substitute to short-chain chlorinated paraffins in many End-User Types. However, short-chain chlorinated paraffin is estimated to hold one-fourth of the market share in Asia-Pacific due to a lack of regulations to prohibit its use. Metalworking fluids and lubricating additives End-User Types cumulatively dominated the global chlorinated paraffin industry, with more than half a share in terms of volume in 2021. An increase in demand for flame retardant properties across various end-use industries such as automotive and aerospace is anticipated to drive the market during the analysis period. The demand for medium-chain and long-chain chlorinated paraffin in End-User Types, such as metalworking fluids and additives, is relatively high. A shift of manufacturing base from developed regions to the Asia-Pacific region is expected in the near future. This is mainly attributed to the absence of stringent regulations in this region.To know about the Research Methodology :- Request Free Sample Report

Chlorinated Paraffin Market Dynamics

Expansion of the PVC industry to drive the growth of the chlorinated paraffin market Chlorinated paraffins are used as fire retardants and secondary plasticizers, which are used as an alternative to primary plasticizers (phthalates). Chlorinated paraffin is added to PVC to improve its flame retardancy while maintaining low-temperature properties such as the strength of plastic. Growth in the global PVC industry is expected to boost the demand for chlorinated paraffin during the forecast period. Moreover, technological advances coupled with escalating demand for products with PVC content, such as sheets, tubes, pipes, wires, and cables globally, are expected to drive the growth of the chlorinated paraffin market over the forecast period. With the rapid development in the plastic sector in Asia-Pacific, especially in China, the demand for flame retarding agents and plasticizers has increased notably. Major plasticizers such as dibutyl phthalate (DBP) and dioctyl phthalate (DOP) have high prices due to an unstable supply of raw materials and hence do not meet the requirements in the plastic sector. Thus, the demand for low-priced chlorinated paraffin is expected to increase, further driving the chlorinated paraffin industry during the forecast period. One significant growth driver of the chlorinated paraffin wax market is the expanding End-User Type scope in the manufacturing of flexible PVC products. Chlorinated paraffin waxes are widely used as plasticizers and flame retardants in the PVC industry, contributing to the market's growth as the demand for flexible PVC materials, such as wires, cables, and hoses, continues to rise.The shift of production to long-chain chlorinated paraffins to drive the growth of chlorinated paraffin market Short-chain chlorinated paraffins are used in wide range of End-User Types such as plasticizers in plastics, extreme pressure additives in metalworking fluids, and flame retardants and additives in paints. However, these paraffins are subject to regulations at both national and international levels due to their chemical properties and adverse effects on the environment. Several actions have been initiated to restrict and ban the production and consumption of short chain chlorinated paraffins. This has led to research for use of medium- and long-chain chlorinated paraffins as substitutes to short-chain chlorinated paraffins. In addition, medium- and long-chain chlorinate paraffins do not have any alternatives in certain End-User Types till date. Though these types are also under risk assessment, they are expected to provide lucrative growth opportunities to manufacturers in the chlorinated paraffin market during the forecast period. Environmental concerns coupled with stringent regulations to restrain the chlorinated paraffin market growth Short-chain chlorinated paraffins are considered toxic, bioaccumulative, and persistent; thus, the EPA is conducting a risk assessment for chlorinated paraffin. As part of the settlement, companies producing chlorinated paraffins have agreed to cease their production and import of in the U.S. In addition, they have agreed to submit pre-manufacture notices of other forms of chlorinated paraffins to EPA for review, which are also expected to be considered for risk assessment. The above-mentioned factor is expected to restrain the chlorinated paraffin market growth during the forecast period. Availability of substitutes a competition for chlorinated paraffin Chlorinated paraffins are continuously reviewed for risk assessment, and hence the possibility of ceasing their production has increased. This has led to the increase in need for the development of an alternative for chlorinated paraffin in these End-User Types. Companies have developed alternatives that are biodegradable, offer ease of disposal, and are free of stringent regulations. These alternatives include chlorinated fatty esters and acids, boundary ester lubricants, hydrogen phosphites, and nitrogen containing compounds.Modern metalworking processes require advanced lubricant technology; however, the performance of chlorinated paraffin decreases with increasing machining speed or temperature due to chemical decomposition. It is therefore possible to adjust the characteristics of metalworking fluids by combining suitable lubricant additives to meet the specific demands of the processes and to even exceed the performance of chlorinated paraffins. Hence, advancements in substitutes to chlorinated paraffin are expected to hamper the growth of chlorinated paraffin market.

Chlorinated Paraffin Market Segment Analysis

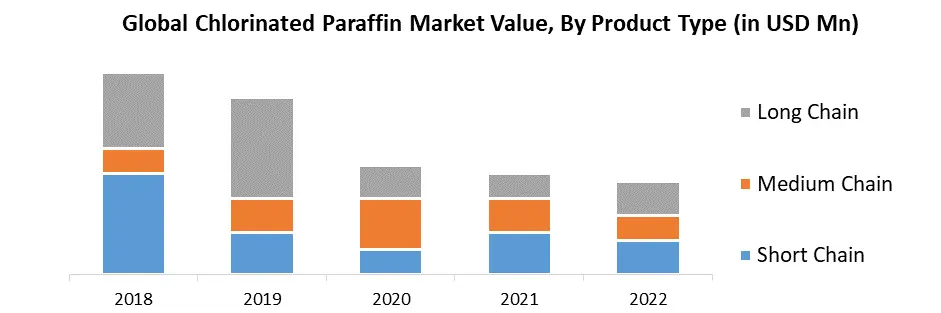

The global chlorinated paraffin market is segmented based on product type as short-, medium-, and long-chain chlorinated paraffins. Each product type is further classified based on its chlorine content as less than 40%, 40–70%, and more than 70%. The long-chain chlorinated paraffin segment dominated the market in 2023 and is expected to witness the highest CAGR, in terms of value and volume, during the forecast period. Long-chain chlorinated paraffins are used as extreme-pressure additives to metal machining fluids, pastes, emulsions, and lubricants. Chlorinated paraffins with long-chain and more than 70% chlorine content are used in metalworking industry as they possess flame retardant properties. Medium-chain chlorinated paraffins held a significant chlorinated paraffin market share in 2023. They are often used to substitute short-chain chlorinated paraffins, as the latter is banned in some countries. Medium-chain chlorinated paraffins find End-User Type as ingredients in cooling lubricant oils, but their usage is limited due to costly disposal and rejection by customers for health, safety, and environmental reasons. Short-chain chlorinated paraffins is expected to grow at a significant CAGR during the forecast period. Short-chain chlorinated paraffins are widely used as lubricants and coolants in metal cutting and metal forming operations, and as secondary plasticizers and flame retardants in plastics. They are bioaccumulative, persistent, and toxic to aquatic organisms at low concentrations. They can remain in the environment for a substantial amount of time and can bioaccumulate in animal tissues, thus increasing the probability and duration of exposure, leading to adverse effects on the environment.

Chlorinated Paraffin Market Regional Insights

Asia Pacific held the largest share of the global chlorinated paraffin market in 2023. The region constituted more than 58% share of the global chlorinated paraffin in 2023. The easy availability of raw materials, moderate growth in the metalworking industry, and the economical cost of chlorinated paraffins have boosted the market in the region. Asia Pacific is also likely to be the fastest-growing regional market for chlorinated paraffins during the forecast period. Increasing demand for PVC compounds and metalworking fluids, primarily due to rapid surge in the plastic and metalworking industries, respectively, in China, India and ASEAN countries, is expected to drive the demand for chlorinated paraffins in the region in the next few years. However, the chlorinated paraffin market is expected to witness low growth in developed regions owing to rising environmental and health concerns associated with chlorinated paraffin. Middle East & Africa is estimated to witness moderate growth during the forecast period. Factors such as the presence of better substitutes and modest growth in downstream industries are affecting the growth of the chlorinated paraffin companies in the region. The chlorinated paraffin market in South America is expected to expand modestly, owing to supply constraints from North America and moderate to high growth in the plastic and metalworking industries over the forecast period. In North America, chlorinated paraffins have received a bit of consideration from the U.S. authorities in the past. However, EPA has placed short-chain chlorinated paraffins on a short list of troublesome chemicals that the agency might regulate owing to the risks they pose to the wildlife and environment. Moreover, many governments in Europe have already restricted the use of short-chain chlorinated paraffin.Chlorinated Paraffin Market Scope: Inquiry Before Buying

Chlorinated Paraffin Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.02 Bn. Forecast Period 2024 to 2030 CAGR: 5.45% Market Size in 2030: US $ 2.93 Bn. Segments Covered: by Product Short Chain Medium Chain Long Chain by Application Lubricating Additives Plastics Rubber Paints Metal Working Fluids Adhesives by End User Type Paints & Coatings Rubber Manufacturing Textile Leather Others Chlorinated Paraffin Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Chlorinated Paraffin Key Players

1. KH Chemicals 2. Guangzhou Jiangyan Chemicals Co., Ltd. 3. Caffaro Industrie SPA 4. Zhengzhou Saihang Chemicals Technology Co., Ltd. 5. Dover Chemical Corporation 6. Golden Dyechem 7. Handy Chemical Corporation, Inc. 8. Altair Chimica S.p.A. 9. Ajinomoto Fine-Techno Co. 10. Aditya Birla Chemicals 11. Chlorpras 12. LEUNA Tenside GmbH 13. NCP Chlorchem 14. KLJ Group 15. Qualice, LLC 16. Qumica del Cinca 17. United Group, Makwell Group 18. Inovyn Chlorvinyls Ltd. 19. Ineos Frequently Asked Questions: 1] What is the growth rate of the Chlorinated Paraffin Market? Ans. The Global Chlorinated Paraffin Market is growing at a significant rate of 5.45 % over the forecast period. 2] Which region is expected to dominate the Chlorinated Paraffin Market? Ans. Asia Pacific region is expected to dominate the Chlorinated Paraffin Market over the forecast period. 3] What is the expected Global Chlorinated Paraffin Market size by 2030? Ans. The market size of the Chlorinated Paraffin Market is expected to reach USD 2.93 Billion by 2030. 4] Who are the top players in the Chlorinated Paraffin Market? Ans. The major key players in the Global Chlorinated Paraffin Market are KH Chemicals, Guangzhou Jiangyan Chemicals Co., Ltd., Caffaro Industrie SPA and others. 5] Which factors are expected to drive the Chlorinated Paraffin Market growth by 2030? Ans. Environmental concerns coupled with stringent regulations to restrain the chlorinated paraffin market growth. 6] Which countries dominated the Chlorinated Paraffin market in 2023? Ans. The China held largest Chlorinated Paraffin market share in 2023.

1. Chlorinated Paraffin Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Chlorinated Paraffin Market: Dynamics 2.1 Chlorinated Paraffin Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Chlorinated Paraffin Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Chlorinated Paraffin Market Restraints 2.4 Chlorinated Paraffin Market Opportunities 2.5 Chlorinated Paraffin Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Chlorinated Paraffin Industry 2.11 The Global Pandemic and Redefining of The Chlorinated Paraffin Industry Landscape 2.12 Price Trend Analysis 2.13 Technological Road Map 2.14 Global Chlorinated Paraffin Trade Analysis (2017-2023) 2.14.1 Global Import of Chlorinated Paraffin 2.14.1.1 Ten largest Importer 2.14.2 Global Export of Chlorinated Paraffin 2.14.2.1 Ten largest Exporter 2.15 Chlorinated Paraffin Production Capacity Analysis 2.15.1 Chapter Overview 2.15.2 Key Assumptions and Methodology 2.15.3 Chlorinated Paraffin Manufacturers: Global Installed Capacity 2.15.4 Analysis by Size of Manufacturer 2.15.5 Analysis by Demand Side 2.15.6 Analysis by Supply Side 3. Chlorinated Paraffin Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Chlorinated Paraffin Market, by Product (2023-2030) 3.1.1 Short Chain 3.1.2 Medium Chain 3.1.3 Long Chain 3.2 Global Chlorinated Paraffin Market, by Application (2023-2030) 3.2.1 Lubricating Additives 3.2.2 Plastics 3.2.3 Rubber 3.2.4 Paints 3.2.5 Metal Working Fluids 3.2.6 Adhesives 3.3 Global Chlorinated Paraffin Market, by End-User Type (2023-2030) 3.3.1 Paints & Coatings 3.3.2 Rubber 3.3.3 Manufacturing 3.3.4 Textile 3.3.5 Leather 3.3.6 Others 3.4 Global Chlorinated Paraffin Market, by Region (2023-2030) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North America Chlorinated Paraffin Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Chlorinated Paraffin Market, by Product (2023-2030) 4.1.1 Short Chain 4.1.2 Medium Chain 4.1.3 Long Chain 4.2 North America Chlorinated Paraffin Market, by Application (2023-2030) 4.2.1 Lubricating Additives 4.2.2 Plastics 4.2.3 Rubber 4.2.4 Paints 4.2.5 Metal Working Fluids 4.2.6 Adhesives 4.3 Chlorinated Paraffin Market, by End-User Type (2023-2030) 4.3.1 Paints & Coatings 4.3.2 Rubber 4.3.3 Manufacturing 4.3.4 Textile 4.3.5 Leather 4.3.6 Others 4.4 North America Chlorinated Paraffin Market, by Country (2023-2030) 4.4.1 United States 4.4.1.1 United States Chlorinated Paraffin Market, by Product (2023-2030) 4.4.1.1.1 Short Chain 4.4.1.1.2 Medium Chain 4.4.1.1.3 Long Chain 4.4.1.2 United States Chlorinated Paraffin Market, by Application (2023-2030) 4.4.1.2.1 Lubricating Additives 4.4.1.2.2 Plastics 4.4.1.2.3 Rubber 4.4.1.2.4 Paints 4.4.1.2.5 Metal Working Fluids 4.4.1.2.6 Adhesives 4.4.1.3 United States Chlorinated Paraffin Market, by End-User Type (2023-2030) 4.4.1.3.1 Paints & Coatings 4.4.1.3.2 Rubber 4.4.1.3.3 Manufacturing 4.4.1.3.4 Textile 4.4.1.3.5 Leather 4.4.1.3.6 Others 4.4.2 Canada 4.4.2.1 Canada Chlorinated Paraffin Market, by Product (2023-2030) 4.4.2.1.1 Short Chain 4.4.2.1.2 Medium Chain 4.4.2.1.3 Long Chain 4.4.2.2 Canada Chlorinated Paraffin Market, by Application (2023-2030) 4.4.2.2.1 Lubricating Additives 4.4.2.2.2 Plastics 4.4.2.2.3 Rubber 4.4.2.2.4 Paints 4.4.2.2.5 Metal Working Fluids 4.4.2.2.6 Adhesives 4.4.2.3 Canada Chlorinated Paraffin Market, by End-User Type (2023-2030) 4.4.2.3.1 Paints & Coatings 4.4.2.3.2 Rubber 4.4.2.3.3 Manufacturing 4.4.2.3.4 Textile 4.4.2.3.5 Leather 4.4.2.3.6 Others 4.4.3 Mexico 4.4.3.1 Mexico Chlorinated Paraffin Market, by Product (2023-2030) 4.4.3.1.1 Short Chain 4.4.3.1.2 Medium Chain 4.4.3.1.3 Long Chain 4.4.3.2 Mexico Chlorinated Paraffin Market, by Application (2023-2030) 4.4.3.2.1 Lubricating Additives 4.4.3.2.2 Plastics 4.4.3.2.3 Rubber 4.4.3.2.4 Paints 4.4.3.2.5 Metal Working Fluids 4.4.3.2.6 Adhesives 4.4.3.3 Mexico Chlorinated Paraffin Market, by End-User Type (2023-2030) 4.4.3.3.1 Paints & Coatings 4.4.3.3.2 Rubber 4.4.3.3.3 Manufacturing 4.4.3.3.4 Textile 4.4.3.3.5 Leather 4.4.3.3.6 Others 5. Europe Chlorinated Paraffin Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Chlorinated Paraffin Market, by Product (2023-2030) 5.2 Europe Chlorinated Paraffin Market, by Application (2023-2030) 5.3 Europe Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4 Europe Chlorinated Paraffin Market, by Country (2023-2030) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Chlorinated Paraffin Market, by Product (2023-2030) 5.4.1.2 United Kingdom Chlorinated Paraffin Market, by Application (2023-2030) 5.4.1.3 United Kingdom Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.2 France 5.4.2.1 France Chlorinated Paraffin Market, by Product (2023-2030) 5.4.2.2 France Chlorinated Paraffin Market, by Application (2023-2030) 5.4.2.3 France Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.2.4 5.4.3 Germany 5.4.3.1 Germany Chlorinated Paraffin Market, by Product (2023-2030) 5.4.3.2 Germany Chlorinated Paraffin Market, by Application (2023-2030) 5.4.3.3 Germany Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.4 Italy 5.4.4.1 Italy Chlorinated Paraffin Market, by Product (2023-2030) 5.4.4.2 Italy Chlorinated Paraffin Market, by Application (2023-2030) 5.4.4.3 Italy Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.5 Spain 5.4.5.1 Spain Chlorinated Paraffin Market, by Product (2023-2030) 5.4.5.2 Spain Chlorinated Paraffin Market, by Application (2023-2030) 5.4.5.3 Spain Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.6 Sweden 5.4.6.1 Sweden Chlorinated Paraffin Market, by Product (2023-2030) 5.4.6.2 Sweden Chlorinated Paraffin Market, by Application (2023-2030) 5.4.6.3 Sweden Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.7 Austria 5.4.7.1 Austria Chlorinated Paraffin Market, by Product (2023-2030) 5.4.7.2 Austria Chlorinated Paraffin Market, by Application (2023-2030) 5.4.7.3 Austria Chlorinated Paraffin Market, by End-User Type (2023-2030) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Chlorinated Paraffin Market, by Product (2023-2030) 5.4.8.2 Rest of Europe Chlorinated Paraffin Market, by Application (2023-2030). 5.4.8.3 Rest of Europe Chlorinated Paraffin Market, by End-User Type (2023-2030) 6. Asia Pacific Chlorinated Paraffin Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Chlorinated Paraffin Market, by Product (2023-2030) 6.2 Asia Pacific Chlorinated Paraffin Market, by Application (2023-2030) 6.3 Asia Pacific Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4 Asia Pacific Chlorinated Paraffin Market, by Country (2023-2030) 6.4.1 China 6.4.1.1 China Chlorinated Paraffin Market, by Product (2023-2030) 6.4.1.2 China Chlorinated Paraffin Market, by Application (2023-2030) 6.4.1.3 China Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.2 South Korea 6.4.2.1 S Korea Chlorinated Paraffin Market, by Product (2023-2030) 6.4.2.2 S Korea Chlorinated Paraffin Market, by Application (2023-2030) 6.4.2.3 S Korea Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.3 Japan 6.4.3.1 Japan Chlorinated Paraffin Market, by Product (2023-2030) 6.4.3.2 Japan Chlorinated Paraffin Market, by Application (2023-2030) 6.4.3.3 Japan Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.4 India 6.4.4.1 India Chlorinated Paraffin Market, by Product (2023-2030) 6.4.4.2 India Chlorinated Paraffin Market, by Application (2023-2030) 6.4.4.3 India Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.5 Australia 6.4.5.1 Australia Chlorinated Paraffin Market, by Product (2023-2030) 6.4.5.2 Australia Chlorinated Paraffin Market, by Application (2023-2030) 6.4.5.3 Australia Chlorinated Paraffin Market, by End-Use (2023-2030) 6.4.6 Indonesia 6.4.6.1 Indonesia Chlorinated Paraffin Market, by Product (2023-2030) 6.4.6.2 Indonesia Chlorinated Paraffin Market, by Application (2023-2030) 6.4.6.3 Indonesia Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.7 Malaysia 6.4.7.1 Malaysia Chlorinated Paraffin Market, by Product (2023-2030) 6.4.7.2 Malaysia Chlorinated Paraffin Market, by Application (2023-2030) 6.4.7.3 Malaysia Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.8 Vietnam 6.4.8.1 Vietnam Chlorinated Paraffin Market, by Product (2023-2030) 6.4.8.2 Vietnam Chlorinated Paraffin Market, by Application (2023-2030) 6.4.8.3 Vietnam Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.9 Taiwan 6.4.9.1 Taiwan Chlorinated Paraffin Market, by Product (2023-2030) 6.4.9.2 Taiwan Chlorinated Paraffin Market, by Application (2023-2030) 6.4.9.3 Taiwan Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Chlorinated Paraffin Market, by Product (2023-2030) 6.4.10.2 Bangladesh Chlorinated Paraffin Market, by Application (2023-2030) 6.4.10.3 Bangladesh Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.11 Pakistan 6.4.11.1 Pakistan Chlorinated Paraffin Market, by Product (2023-2030) 6.4.11.2 Pakistan Chlorinated Paraffin Market, by Application (2023-2030) 6.4.11.3 Pakistan Chlorinated Paraffin Market, by End-User Type (2023-2030) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Chlorinated Paraffin Market, by Product (2023-2030) 6.4.12.2 Rest of Asia PacificChlorinated Paraffin Market, by Application (2023-2030) 6.4.12.3 Rest of Asia Pacific Chlorinated Paraffin Market, by End-User Type (2023-2030) 7. Middle East and Africa Chlorinated Paraffin Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Chlorinated Paraffin Market, by Product (2023-2030) 7.2 Middle East and Africa Chlorinated Paraffin Market, by Application (2023-2030) 7.3 Middle East and Africa Chlorinated Paraffin Market, by End-User Type (2023-2030) 7.4 Middle East and Africa Chlorinated Paraffin Market, by Country (2023-2030) 7.4.1 South Africa 7.4.1.1 South Africa Chlorinated Paraffin Market, by Product (2023-2030) 7.4.1.2 South Africa Chlorinated Paraffin Market, by Application (2023-2030) 7.4.1.3 South Africa Chlorinated Paraffin Market, by End-User Type (2023-2030) 7.4.2 GCC 7.4.2.1 GCC Chlorinated Paraffin Market, by Product (2023-2030) 7.4.2.2 GCC Chlorinated Paraffin Market, by Application (2023-2030) 7.4.2.3 GCC Chlorinated Paraffin Market, by End-User Type (2023-2030) 7.4.3 Egypt 7.4.3.1 Egypt Chlorinated Paraffin Market, by Product (2023-2030) 7.4.3.2 Egypt Chlorinated Paraffin Market, by Application (2023-2030) 7.4.3.3 Egypt Chlorinated Paraffin Market, by End-User Type (2023-2030) 7.4.4 Nigeria 7.4.4.1 Nigeria Chlorinated Paraffin Market, by Product (2023-2030) 7.4.4.2 Nigeria Chlorinated Paraffin Market, by Application (2023-2030) 7.4.4.3 Nigeria Chlorinated Paraffin Market, by End-User Type (2023-2030) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Chlorinated Paraffin Market, by Product (2023-2030) 7.4.5.2 Rest of ME&A Chlorinated Paraffin Market, by Application (2023-2030) 7.4.5.3 Rest of ME&A Chlorinated Paraffin Market, by End-User Type (2023-2030) 8. South America Chlorinated Paraffin Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Chlorinated Paraffin Market, by Product (2023-2030) 8.2 South America Chlorinated Paraffin Market, by Application (2023-2030) 8.3 South America Chlorinated Paraffin Market, by End-User Type (2023-2030) 8.4 South America Chlorinated Paraffin Market, by Country (2023-2030) 8.4.1 Brazil 8.4.1.1 Brazil Chlorinated Paraffin Market, by Product (2023-2030) 8.4.1.2 Brazil Chlorinated Paraffin Market, by Application (2023-2030) 8.4.1.3 Brazil Chlorinated Paraffin Market, by End-User Type (2023-2030) 8.4.2 Argentina 8.4.2.1 Argentina Chlorinated Paraffin Market, by Product (2023-2030) 8.4.2.2 Argentina Chlorinated Paraffin Market, by Application (2023-2030) 8.4.2.3 Argentina Chlorinated Paraffin Market, by End-User Type (2023-2030) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Chlorinated Paraffin Market, by Product (2023-2030) 8.4.3.2 Rest Of South America Chlorinated Paraffin Market, by Application (2023-2030) 8.4.3.3 Rest Of South America Chlorinated Paraffin Market, by End-User Type (2023-2030) 9. Global Chlorinated Paraffin Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2023) 9.3.5 Manufacturing Locations 9.3.6 Production Capacity 9.3.7 Production for 2023 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Chlorinated Paraffin Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 KH Chemicals 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 Guangzhou Jiangyan Chemicals Co., Ltd. 10.3 Caffaro Industrie SPA 10.4 Zhengzhou Saihang Chemicals Technology Co., Ltd. 10.5 Dover Chemical Corporation 10.6 Golden Dyechem 10.7 Handy Chemical Corporation, Inc. 10.8 Altair Chimica S.p.A. 10.9 Ajinomoto Fine-Techno Co. 10.10 Aditya Birla Chemicals 10.11 Chlorpras 10.12 LEUNA Tenside GmbH 10.13 NCP Chlorchem 10.14 KLJ Group 10.15 Qualice, LLC 10.16 Qumica del Cinca 10.17 United Group, Makwell Group 10.18 Inovyn Chlorvinyls Ltd. 10.19 Ineos 11. Key Findings 12. Industry Recommendations 13. Chlorinated Paraffin Market: Research Methodology 14. Terms and Glossary