The China Over the Counter Pharmaceuticals Market size was valued at USD 32.20 Billion in 2023 and the total China Over-The-Count (OTC) Pharmaceutical Market revenue is expected to grow at a CAGR of 7.02 % from 2023 to 2030, reaching nearly USD 51.77 Billion.China Over the Counter Pharmaceuticals Market Overview

The research report of MMR offers a medium- and long-term development outlook for China's Over Counter (OTC) Pharmaceuticals Market along with an economic evaluation of the market. It offers a comprehensive summary of the market dynamics, trends, insights, growth factors and constraints, competitive landscape, segmentation, healthcare laws and regulations, reimbursement scenario, difficulties, and outlook for the future. In 2023, The OTC Pharmaceuticals market generated USD 32.20 Billion in Revenue, Showcasing its substantial size and contribution to the Chinese economy. This higher revenue attracts additional investment from established pharmaceutical companies and new entrants, which leads to OTC Pharmaceutical market growth and Product innovations. The sales of OTC Medicines in China continue to climb, fuelled by rising disposable incomes, growing health awareness, and an aging population with increased healthcare needs. China's OTC Pharmaceuticals market presents a lucrative opportunity for players with foresight and strategic planning. By understanding the forces driving its growth, addressing challenges, and capitalizing on emerging trends, companies have succeeded in this vibrant and continuously evolving landscape.To know about the Research Methodology :- Request Free Sample Report

Rise of E-Commerce in China

The rise of e-commerce platforms has played a crucial role in the distribution and accessibility of OTC pharmaceuticals. Consumers prefer the convenience of online purchasing, and this trend has been particularly evident in China, where e-commerce platforms have become major channels for OTC product sales. Alibaba's Tmall Health and JD.com's Health channel dominate the scene, accounting for around 73% of the market share. These platforms offer a vast selection of products, attractive discounts, and swift delivery, attracting millions of health-conscious consumers.Rising in Disposable Income

As living standards improve, Chinese consumers are increasingly willing to spend on preventative healthcare and self-medication for minor ailments. This drives demand for a wider variety of OTC products. According to MMR research, in 2023 Chinese Consumers spent 29% more on Vitamins and supplements. Online retailer JD.com observed a 36% surge in demand for premium OTC skincare products within the first half of 2023.Table: OTC Anxiety and Stress Relief Medicine Options in China and Their Impact on China’s OTC Pharmaceuticals Market

Category Product Example Impacts on China’s OTC Pharmaceutical Market Herbal Remedies Tianma Goutou Wan, Suan Zao Ren Tang, Jia Wei Xiao Yao San Increased demand for TCM anxiety & stress solutions, focus on quality & safety of herbal products Western OTC Drugs Probiotics (Yakult, Culturelle), Melatonin (Yatsen Sleep Aid, Life Extension), L-theanine (Doctor's Best, Swisse) Diversification of market with new product categories Additional Resources Mindful breathing & meditation apps (Headspace, Calm), Physical activity, Healthy lifestyle choices Shift towards preventive & self-care approaches Healthcare Infrastructure Disparities

Disparities in healthcare infrastructure between urban and rural areas can impact the distribution and accessibility of OTC products. Remote locations and poor infrastructure can make it difficult for rural residents to reach pharmacies, further limiting access. 57% of Chinese citizens live in rural areas, yet access to healthcare facilities and pharmacies remains skewed towards urban centers.Some Inspiring Initiatives take by Key Players

Alibaba's Rural Taobao program: Connects rural consumers with online merchants, including pharmaceutical companies, improving access to products like OTC medications. JD.com's "Health for Everyone" initiative: It Provides rural communities with healthcare resources, including online consultations and delivery of essential medicines. GSK's "Healthy Villages" program: Partners with local health facilities to educate villagers about self-care and provide basic OTC medications.

China Over the Counter Pharmaceuticals Market Segment Analysis

This segment alone is expected to reach a huge USD 8.75 billion by 2024, accounting for a significant amount of the overall market. China's cough, cold, and flu segment is a goldmine for OTC pharmaceutical companies. The Report has covered Driving Forces, dominant players in the market, and what is the emerging trends in this segment, and how it is crucial for navigating the market dynamics and capitalizing on its immense potential.China Over the Counter Pharmaceuticals Market Scope: Inquiry Before Buying

China Over the Counter Pharmaceuticals Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 32.2 Bn. Forecast Period 2024 to 2030 CAGR: 7.02% Market Size in 2030: US $ 51.77 Bn. Segments Covered: by Product Type Cough, Cold, and Flu Products Analgesics Dermatology Products Gastrointestinal Products Others by Formulation Type Tablets Liquids Ointments Sprays by Sales Distribution Hospitals Pharmacies Retail Pharmacies Online Pharmacy Key Players of China Over the Count Pharmaceutical Market

1. Johnson & Johnson 2. GlaxoSmithKline (GSK) 3. Bayer AG 4. Sanofi 5. Boehringer Ingelheim 6. Sinopharm Group 7. Beijing Tongrentang Co., Ltd 8. Yunnan Baiyao Group Co., Ltd 9. Eisai Co., Ltd. 10. Meiweiyuan (China National Medicines Corporation Ltd.)

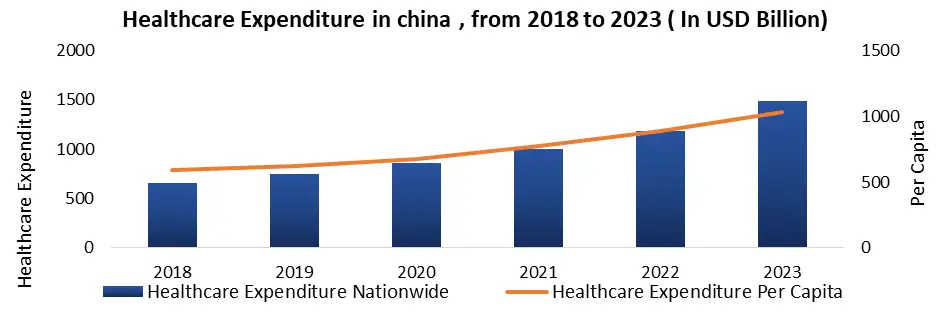

1. China Over the Counter Pharmaceuticals Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. China Over the Counter Pharmaceuticals Market: Dynamics 2.1. China Over the Counter Pharmaceuticals Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Challenges and Opportunities in the OTC Pharmaceutical Market in China 2.6. Regulatory Landscape of China Over the Counter Pharmaceuticals Market 2.7. Technological Advancements in China Over the Counter Pharmaceuticals Market 2.8. Factors Driving the Growth of the OTC Market in China 2.9. Rise Of E-Commerce in China 2.10. Key Player's Initiatives for Healthcare Infrastructure in China 2.11. Growth of Generics Medicine in China 2.12. OTC Anxiety and Stress Medicine Options in China’s Market 2.13. Healthcare Expenditure in China (Nationwide & Per Capita) 2.14. Key Opinion Leader Analysis for China Over-The-Count (OTC) Pharmaceutical Industry 2.15. China Over the Counter Pharmaceuticals Market Price Trend Analysis (2022-23) 3. China Over the Counter Pharmaceuticals Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. China Over the Counter Pharmaceuticals Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Cough, Cold, and Flu Products 3.1.2. Analgesics 3.1.3. Dermatology Products 3.1.4. Gastrointestinal Products 3.1.5. Others 3.2. China Over the Counter Pharmaceuticals Market Size and Forecast, by Formulation Type (2023-2030) 3.2.1. Tablets 3.2.2. Liquids 3.2.3. Ointments 3.2.4. Sprays 3.3. China Over the Counter Pharmaceuticals Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Hospitals Pharmacies 3.3.2. Retail Pharmacies 3.3.3. Online Pharmacy 4. China Over the Counter Pharmaceuticals Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading China Over the Counter Pharmaceuticals Market Companies, by market capitalization 4.6. Market Trends and Challenges in China 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Johnson & Johnson 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. GlaxoSmithKline (GSK) 5.3. Bayer AG 5.4. Sanofi 5.5. Boehringer Ingelheim 5.6. Sinopharm Group 5.7. Beijing Tongrentang Co., Ltd 5.8. Yunnan Baiyao Group Co., Ltd 5.9. Eisai Co., Ltd. 5.10. Meiweiyuan (China National Medicines Corporation Ltd.) 6. Key Findings 7. Industry Recommendations 8. China Over the Counter Pharmaceuticals Market: Research Methodology