Chickpea Flour Market size was valued at USD 2.11 Bn. in 2022 and the total Chickpea Flour Market revenue is expected to grow at 5.5 % from 2023 to 2029, reaching nearly USD 3.06 Bn.Chickpea Flour Market Overview:

Garbanzo flour, gramme flour, and besan are all names for the flour formed from dry chickpeas. Popular in Middle Eastern and Indian cuisine, chickpeas have a nutty flavour and gritty texture. The flatbread socca, hummus, and falafel are all made from chickpea flour. Tropical and subtropical locations are where it is grown. The pulse group that includes chickpeas is noted for its low cholesterol content as well as its high protein and fibre content. In Indian cooking and baking, chickpea flour is a common ingredient. It also contains a lot of vitamins and minerals, which greatly increases the amount of manganese and folate you consume. The growing popularity of chickpeas is a result of their excellent nutritional content. Chickpea flour has become a useful ingredient for the food processing industry because of its well-balanced amino acid composition, high quantities of complex carbohydrates, comparatively low levels of anti-nutritional factors, and bioavailability of proteins. Additionally, chickpea flour helps to prevent diseases including cancer, diabetes, obesity, and coronary heart disease, which encourages more people to eat it.Report Scope:

The research provides a thorough examination of the Chickpea Flour market's drivers, restraints, trends, and projections. In order to make profitable decisions, networks of suppliers and customers can be built, according to research on Porter's five forces. The potential of the current Chickpea Flour Market is ascertained by extensive research, market size, and segmentation. The research provides investors with a comprehensive perspective of the industry's future and includes information on the elements that are expected to have an impact on the company either favourably or unfavourably. The market is well understood through research for those who want to make investments. For the Chickpea Flour industry, this research offers historical and forecasted market sizes. The report's thorough analysis of key rivals, including market leaders, followers, and new entrants, covers every element of the market. The study includes the strategic profiles of the leading industry participants as well as details on the company-specific plans for the launch of new products, growth, partnerships, joint ventures, and acquisitions. With its clear representation of competitive analysis of significant firms by Type , pricing, financial situation, product portfolio, growth strategies, and geographical presence in the domestic as well as the local market, the report provides a reference for investors.To know about the Research Methodology :- Request Free Sample Report

Chickpea Flour Market Dynamics:

Growing awareness of the health benefits of chickpea consumption

Both inflammation and immunity are improved by chickpea flour. Along with avoiding diabetes, it can stabilize blood sugar. Because chickpeas have high fibre content, they can lower cholesterol, regulate blood pressure, and prevent heart disease. The demand for chickpea flour has increased significantly as a result of consumers' growing health consciousness. It is expected that changing dietary habits and a changing way of life fuels the market's growth for chickpea flour. Additionally, the growing use of chickpea flour in the bakery, snack, and savoury markets is expected to have a substantial impact on the market's revenue growth. To better service their sizable client base, market participants in the chickpea flour space are eager to introduce new product innovations.Growing consumption in different regoins of the world

Any product depends greatly on consumer preference. The preferences of consumers are constantly changing. Consumer desire for Chickpea flour is having a favorable effect on this market. Many people are embracing Chickpea flour as a result of awareness of its uses and advantages. It is generating a market with extraordinary demand. The product is in great demand because of its low-fat content, ease of digestion, and medicinal advantages. Additionally, a significant driver is a growing desire for foods with the "green" label. Natural and organic food products are becoming increasingly popular today. People favor healthy diets that consist of organic and natural foods. The market's revenue rates grow as a result of the soaring demand for these organic food products. A significant driver is also the market's increasing demand in developing regions. Demands peculiar to emerging countries' consumers exist. Demand for flours like chickpea and lentils is increasing as a result. The highest Chickpea flour use is seen in Asia Pacific nations including China, India, and Japan. Positive Pulse Flour Market Trends are produced by the demand from these areas.Increasing use in bakeries and confectioneries

Chickpea flour has become a leading substitute for other bean crops because of its nutty flavour and other benefits such as being low-glycemic and gluten-free. It has forged its way into the market for baked goods and confections, which is expanding steadily. Currently, Asia will overtake Germany and other European countries as the largest consumers of confectionary goods, which would boost the demand for chickpea flour. However, this trend is anticipated to change. Asia is the region with the most inhabitants on the planet (4.68 billion), the popularity of garbanzo beans among Asian customers is a boon for the global market for chickpea flour. Additionally, the expansion of the relevant market is significantly influenced by rising GDP per capita incomes. Bangladesh's GDP per capita (PPP terms) decreased by around $5,733 as of 2022, whilst India's GDP per capita (PPP terms) was $7319. As both countries' economies are booming, it is anticipated that the number will continue to increase over time. Market Restraints:Government restrictions and a lack of consumer awareness

A deficiency in dietary fiber in goods made with chickpea flour leads to constipation and other digestive system issues. The lack of knowledge about the need for chickpea flour in developing nations and the high price of gluten-free flour relative to wheat flour soon impede the market growth. Market enlargement is further hampered by the lack of infrastructure and technological resources in developing countries with strict rules. Market Opportunities:Popularatiy among vegans and vegeterins

The market for chickpea flour is expected to grow as a result of changing dietary preferences mixed with changing lifestyles. Additionally, the growing use of chickpea flour in the savoury, sweet, and snack markets is expected to significantly contribute to the market's growth. Market competitors for chickpea flour are eager to introduce cutting-edge product development to reach their sizable client base. The factor driving the Chickpea Flour bean market during the forecast period is the growing food and beverage industry. Additionally, the affordable price of Chickpea Flour is expected to support its growth in emerging markets like the Middle East, Africa, and the Asia Pacific. During the forecast period, the trending factors in the Chickpea flour market will be mergers and acquisitions between supply chain entities and suppliers. Marketers of Chickpea flour on a global scale are concentrating on bolstering their supply chains and concentrating on high priority markets. The growing demand for healthy food products in these regions presents prospects for Chickpea flour producers in North America, Europe, and Asia-Pacific. Market Challenges: People have put the safety of the environment at risk in their unrelenting effort to create a more contemporary and technologically advanced society. People wax poetic about pollution and climate change without actually doing anything to stop it. As a result, the length of the seasons is shifting naturally due to difficulties with pollution and climate change. In addition, rising temperatures are causing severe floods and threatening to lower crop yields overall. Furthermore, the quality of the seeds should be established, particularly with regard to germination, the number of living seeds in each pound, and the presence of ascochyta blight. According to a case, the U.S.'s chickpea crop fields were impacted by various tests and shortfalls in 2019 in about 60–70% of the country's fields. Furthermore, consuming too many chickpeas can cause kidney stones, digestive problems, uric acid problems, and allergic reactions.Chickpea Flour Market Segment Analysis:

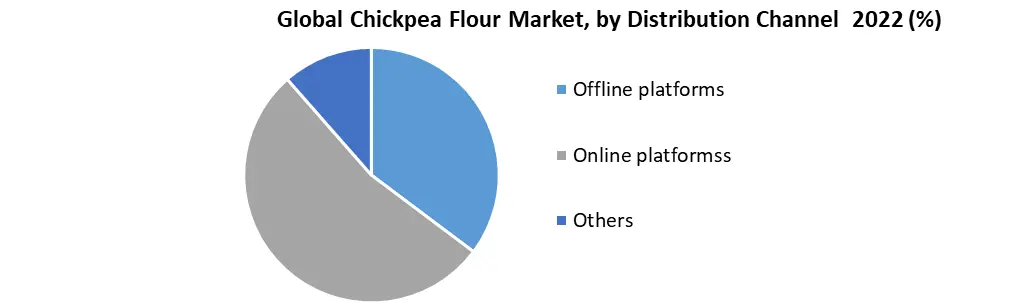

Based on Type, the Kabuli segment is expected to grow at the highest CAGR during the forecast period. Kabuli chickpeas have a higher nutritional value than desi chickpeas, hence they perform better. According to a physiochemical and nutritional quality study, the Kabuli chickpea has a larger seed than the desi kind, weighing 26 g/100 seeds, whereas the desi form has seeds that weigh 21 g/100 seeds. Additionally, Kabuli chickpeas take less time to cook on average—37.5 minutes as opposed to 32.8 minutes—and take less time to cook when soaked in water and a sodium bicarbonate solution overnight—28.8 minutes as opposed to 22.5 minutes. The Kabuli segment is expected to experience a 5.5% CAGR.Based on Application, the Dairy products segment is expected to grow at the highest CAGR during the forecast period. In 2022, the food sector had the biggest proportion. Chickpea flour is used extensively in the creation of food, particularly confections and bread goods, which accounts for the rise. It has taken the place of wheat flour in a number of baking recipes. Traditional Indian foods like fritters, samosas, and many other inventive treats now contain this mild and nutty-tasting flour. Additionally, gramme flour (also known as chickpea flour) is regarded as a natural curry thickener. The use of gram flour in cosmetics is far behind that in food, despite the fact that it is a crucial component of many home treatments for beauty that aim to lighten skin tone. As a result, the cosmetic sector cannot surpass the food business. The CAGR for the food industry segment is expected to be 5.8%, making it the fastest-growing industry segment. This expansion is the result of growing public knowledge of the advantages of chickpea flour for health. Due to the availability of antioxidants and plant polyphenols, the detrimental effects of processed food can be mitigated by consuming up to 25% of the Iron RDI in one cup of chickpea flour. Based on Distribution Channel, the offline platforms segment is expected to grow at the highest CAGR during the forecast period. The development is attributable to offline retail shops' many benefits, including the way they foster a human connection between customers and businesses. Customers always prefer to shop on offline platforms as a result. Additionally, they provide customers the chance to touch and feel the goods before making a purchase. As a result, customers can discover any hidden flaws. Additionally, buyers are drawn to offline retail establishments because of their rapid purchase and sales support capabilities. Furthermore, contemporary stores are making their way into certain rural communities in an effort to capitalize on the untapped potential. However, the internet sector is expected to increase at the quickest rate, with a CAGR of 6.0%. The tremendous rise in smartphone usage, digitalization, and simple access to the internet even in remote locations are all factors in this expansion. Online platforms are available constantly and have no time restrictions. Online platforms are also relatively less expensive to operate and set up than traditional platforms.

Chickpea Flour Market Regional Insights:

With 40% of the global market, Asia-Pacific held the highest share in 2022. Owing to the existence of nations like India, which is the world's largest producer and consumer of chickpeas, this market is growing. An article claims that India produces almost 8 million tonnes of garbanzo beans annually, accounting for 68–70% of global production. Australia, on the other hand, has over 12% of the global chickpea market while being the second-largest producer. Additionally, countries in South Asia like Bangladesh, India, Pakistan, Nepal, and others use chickpeas in particular ways in their pastries and confections. Additionally, it is expected that Asia-Pacific would present profitable growth prospects during the forecast period. This growth is the result of rising demand for bakeries and confectioneries as people's disposable income slowly starts to take off. On the other side, fast modernization is raising people's overall quality of life, making them more conscious of the advantages such chemicals provide for their health.Chickpea Flour Market Scope: Inquire before buying

Chickpea Flour Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 2.11 Bn. Forecast Period 2023 to 2029 CAGR: 5.5% Market Size in 2029: USD 3.06 Bn. Segments Covered: by Type Kabuli Desi by Application Dairy products Animal feeds Confectionery and bakery Cosmetics Others by Distribution Channel Offline platforms Supermarket/Hypermarkets Convenience and departmental stores Small Retail Shops

Online platforms OthersChickpea Flour Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Chickpea Flour Market, Key Players are

1. Ingredion 2. ADM 3. The Scoular Company 4. SunOpta 5. Anchor Ingredients 6. EHL 7. Batory Foods 8. Blue Ribbon 9. Diefenbaker Spice and Pulse 10. Great Western Grain 11. Best Cooking Pulses 12. Bean Growers Australia 13. Parakh Agro Industries 14. CanMar Grain Products 15. Jain Group of Companies 16. Parakh Agro Industries Ltd 17. The Scoular Company Frequently Asked Questions: 1] What segments are covered in the Global Chickpea Flour Market report? Ans. The segments covered in the Chickpea Flour Market report are based on Type, application, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Chickpea Flour Market? Ans. The Asia Pacific region is expected to hold the highest share in the Chickpea Flour Market. 3] What is the market size of the Global Chickpea Flour Market by 2029? Ans. The market size of the Chickpea Flour Market by 2029 is expected to reach USD 3.06 Bn. 4] What is the forecast period for the Global Chickpea Flour Market? Ans. The forecast period for the Chickpea Flour Market is 2023-2029. 5] What was the market size of the Global Chickpea Flour Market in 2022? Ans. The market size of the Chickpea Flour Market in 2022 was valued at USD 2.11 Bn.

1. Global Chickpea Flour Market Size: Research Methodology 2. Global Chickpea Flour Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Chickpea Flour Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Chickpea Flour Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Chickpea Flour Market Size Segmentation 4.1. Global Chickpea Flour Market Size, by Type (2022-2029) • Kabuli • Desi 4.2. Global Chickpea Flour Market Size, by Application (2022-2029) • Dairy products • Animal feeds • Confectionery and bakery • Cosmetics • Others 4.3. Global Chickpea Flour Market Size, by Distribution Channel (2022-2029) • Offline platforms o Supermarket/Hypermarkets o Convenience and departmental stores o Small Retail Shops • Others • Online platforms 5. North America Chickpea Flour Market (2022-2029) 5.1. North America Chickpea Flour Market Size, by Type (2022-2029) • Kabuli • Desi 5.2. North America Chickpea Flour Market Size, by Application (2022-2029) • Dairy products • Animal feeds • Confectionery and bakery • Cosmetics • Others 5.3. North America Chickpea Flour Market Size, by Distribution Channel (2022-2029) • Offline platforms o Supermarket/Hypermarkets o Convenience and departmental stores o Small Retail Shops • Others • Online platforms 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Chickpea Flour Market (2022-2029) 6.1. European Chickpea Flour Market, by Type (2022-2029) 6.2. European Chickpea Flour Market, by Application (2022-2029) 6.3. European Chickpea Flour Market, by Distribution Channel (2022-2029) 6.4. European Chickpea Flour Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Chickpea Flour Market (2022-2029) 7.1. Asia Pacific Chickpea Flour Market, by Type (2022-2029) 7.2. Asia Pacific Chickpea Flour Market, by Application (2022-2029) 7.3. Asia Pacific Chickpea Flour Market, by Distribution Channel (2022-2029) 7.4. Asia Pacific Chickpea Flour Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Chickpea Flour Market (2022-2029) 8.1. Middle East and Africa Chickpea Flour Market, by Type (2022-2029) 8.2. Middle East and Africa Chickpea Flour Market, by Application (2022-2029) 8.3. Middle East and Africa Chickpea Flour Market, by Distribution Channel (2022-2029) 8.4. Middle East and Africa Chickpea Flour Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Chickpea Flour Market (2022-2029) 9.1. South America Chickpea Flour Market, by Type (2022-2029) 9.2. South America Chickpea Flour Market, by Application (2022-2029) 9.3. South America Chickpea Flour Market, by Distribution Channel(2022-2029) 9.4. South America Chickpea Flour Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Ingredion 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. ADM 10.3. The Scoular Company 10.4. SunOpta 10.5. Anchor Ingredients 10.6. EHL 10.7. Batory Foods 10.8. Blue Ribbon 10.9. Diefenbaker Spice and Pulse 10.10. Great Western Grain 10.11. Best Cooking Pulses 10.12. Bean Growers Australia 10.13. Parakh Agro Industries 10.14. CanMar Grain Products 10.15. Jain Group of Companies 10.16. Parakh Agro Industries Ltd 10.17. The Scoular Company