Global Ceramic Hexagon Nuts Market size was valued at USD 1.26 Bn in 2022 and is expected to reach USD 1.71 Bn by 2029, at a CAGR of 4.5%.Ceramic Hexagon Nuts Market Overview

Ceramic hexagon nuts signify a weighty innovation in the world of fastening systems, providing to the ever-growing demand for advanced, lightweight solutions across several industries. These nuts are engineered to offer exceptional performance characteristics, such as high strength, corrosion resistance, and temperature stability, making them indispensable in Materials where precision and durability are paramount. Crafted from rapid ceramic materials including alumina, zirconia and silicon carbide, ceramic hexagon nuts exhibit significant mechanical properties and exceptional resistance to wear and tear. In essence, ceramic hexagon nuts are specialized fasteners designed for the secure assembly of several components. Their distinctive hexagonal shape and internal threads allow them to be securely tightened onto bolts or threaded rods. However, what sets them apart from conventional metal nuts is their composition – they are crafted entirely from ceramic materials. This departure from tradition results in a fastening solution that not only meets the stringent demands of modern industries but also exceeds expectations in terms of performance and longevity.To know about the Research Methodology :- Request Free Sample Report The versatile Material of ceramic hexagon nuts spans a multitude of industries, with machinery, electronics, automotive, and aerospace sectors being among the primary beneficiaries of their unique advantages. In these industries, where precision and dependability are non-negotiable, ceramic hexagon nuts have become the go-to choice. Their exceptional strength ensures the structural integrity of critical components, while their corrosion resistance guarantees a longer lifespan in harsh environments. Furthermore, their temperature stability allows them to function seamlessly under extreme conditions, making them ideal for Materials that demand consistent performance regardless of thermal fluctuations. One of the key attributes that sets ceramic hexagon nuts apart is their remarkable strength. Composed of ceramic materials known for their inherent toughness, such as alumina, zirconia, and silicon carbide, these nuts exhibit a level of robustness that exceeds that of traditional metal counterparts. This high strength not only ensures the structural integrity of assembled components but also contributes to enhanced safety and reliability, making them particularly valuable in industries where failure is not an option.

Ceramic Hexagon Nuts Market Dynamics:

Driver Increasing demand for lightweight and high-performance fastening solutions in various industries to boost Market Growth In industries such as aerospace and automotive, where weight plays a critical role in performance and fuel efficiency, the demand for lightweight fastening solutions is substantial. Ceramic hexagon nuts are significantly lighter than their metal counterparts, making them an attractive choice for reducing the overall weight of components and structures. This weight reduction led to fuel savings, increased payload capacity, and improved overall performance, driving the adoption of ceramic hexagon nuts. Lightweight fasteners like ceramic hexagon nuts contribute to improved efficiency in a variety of Materials. In sectors like robotics and electronics, where precision and quick movement are essential, reducing the weight of fasteners leads to more agile and responsive systems. This, in turn, boosts overall productivity and performance, making ceramic hexagon nuts a preferred choice. While being lightweight, ceramic hexagon nuts also offer high strength and exceptional mechanical properties. They withstand heavy loads and provide reliable fastening in demanding conditions. This strength and durability are essential in industries where the safety and integrity of components are paramount, such as aerospace and construction. The ability to maintain structural integrity under stress and vibration is a crucial factor driving their adoption. Ceramic hexagon nuts exhibit excellent corrosion resistance, making them ideal for industries exposed to harsh environments, moisture, and chemicals. This is particularly significant in sectors like marine, chemical processing, and oil and gas, where traditional metal fasteners may degrade over time. The corrosion-resistant properties of ceramic hexagon nuts contribute to their longevity and reliability, further driving market demand. Industries that operate in extreme temperature environments, such as aerospace, energy generation, and high-performance electronics, require fasteners that endure high or low temperatures without losing their integrity. Ceramic hexagon nuts excel in this regard, as they maintain their performance under extreme temperature conditions. This makes them a preferred choice in industries where temperature stability is a key consideration. Trend Growing interest in advanced materials and additive manufacturing techniques to produce customized and complex ceramic hexagon nuts Industries are increasingly seeking specialized fastening solutions to meet their unique requirements. Customized ceramic hexagon nuts are precisely designed to fit specific components and Materials, enhancing performance, reliability, and efficiency. Additive manufacturing enables the creation of fasteners tailored to meet these specific demands. Additive manufacturing allows for the exploration and utilization of a wider range of ceramic materials. This includes composite ceramics with specific properties tailored to the Material's needs. Manufacturers experiment with different ceramic compositions to achieve desired characteristics, such as improved strength, enhanced thermal conductivity, or electrical insulation. This flexibility opens up new possibilities for ceramic hexagon nuts to address a broader range of Materials. Additive manufacturing enables fast and cost-effective prototyping and iterative design processes. In industries like aerospace and automotive, where fastener design may need to adapt quickly to evolving requirements, the ability to rapidly prototype and test new ceramic hexagon nut designs is invaluable. This results in faster innovation and product development. Additive manufacturing is inherently efficient in material usage. It minimizes waste by using only the precise amount of material needed for production, reducing costs and environmental impact. This aligns with sustainability goals and the growing focus on environmentally responsible manufacturing. Restraints High Production Cost Hamper Market Growth Ceramic materials used in the production of hexagon nuts are expensive, especially high-quality ceramics that offer desirable properties such as high-temperature resistance and electrical insulation. The cost of procuring and processing these materials significantly contribute to the overall production cost. The production of ceramic hexagon nuts often requires specialized and precise manufacturing processes, such as sintering and machining. These processes are energy-intensive and may require costly equipment and skilled labor. Energy costs, maintenance, and labor expenses all increase the production cost. Ceramic hexagon nuts need to meet strict quality standards to ensure their performance and durability. Quality control measures, testing and inspection add to the production cost as they need additional resources and time. Ceramics are more stimulating to mass-produce compared to other materials including metals or plastics. This limitation results in economies of scale not being fully realized, resulting in higher per-unit production costs.Ceramic Hexagon Nuts Market Segment Analysis:

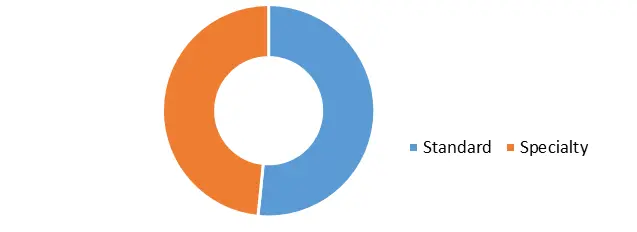

Based on Product Type, the market is segmented into the Standard and Specialty Ceramic Hexagon Nuts. Standard Ceramic Hexagon Nuts dominated the Ceramic Hexagon Nuts Market in 2022 with the largest market share. Standard Ceramic Hexagon Nuts, distinguished by their versatility and cost-effectiveness, have firmly established their dominance in the Ceramic Hexagon Nuts market. Their widespread usage is attributed to their flexibility, making them preferable for a diverse range of Materials. These nuts are engineered to meet general industry requirements, offering a standardized solution for Materials that demand moderate temperature resistance, corrosion resistance, and electrical insulation. This versatility ensures that they are a suitable choice for various industries such as electronics, automotive and general manufacturing. Their cost-effectiveness stems from the fact that they are manufactured in larger quantities, which permits manufacturers to advantage of economies of scale, eventually reducing production costs. This makes standard ceramic hexagon nuts an attractive option for industries looking to harness the advantages of ceramic materials without incurring the higher expense associated with customization. The widespread use of standard hexagon nuts has led to their ready availability from various suppliers and distributors, simplifying procurement processes and ensuring a stable supply chain for businesses and industries. Standard ceramic hexagon nuts are not only versatile and cost-effective but also recognized for their compliance with industry standards and specifications. This conformity is particularly crucial in Materials where adherence to established norms is a necessity. By adhering to industry standards, these nuts seamlessly integrated into different sectors without the need for extensive modifications, further contributing to their dominance in the market. The broad market demand for standard ceramic hexagon nuts is driven by their consistent and ongoing usage in various industries. For example, they are utilized in the electronics industry for electronic components and circuit boards, as well as in high-temperature Materials. In the automotive sector, standard ceramic hexagon nuts find Material in engine components and exhaust systems. Their presence is also prevalent in general manufacturing, where they serve as essential fasteners in machinery and equipment. Their ease of replacement in maintenance or repair situations is another key advantage.Global Ceramic Hexagon Nuts Market Share, by Product Type in 2022 (%)

Ceramic Hexagon Nuts Market Regional Insights

Asia Pacific dominated the Ceramic Hexagon Nuts Market in 2022 and is expected to continue its dominance during the forecast period. Asia-Pacific, and particularly China, has established itself as a manufacturing hub for a wide range of products such as ceramic components like hexagon nuts. The region aids in cost-effective production processes, a skilled workforce, and access to raw materials. Labor costs in Asia-Pacific, particularly in countries such as China, are lower compared to many Western countries. This cost advantage makes it an attractive destination for manufacturing, leading to the cost-effective production of ceramic hexagon nuts. The Asia-Pacific region has experienced substantial industrial growth in sectors such as electronics, automotive and machinery. These industries often require ceramic components such as hexagon nuts for their high-temperature resistance, electrical insulation, and corrosion resistance. The growing industrialization and infrastructure development in countries across Asia-Pacific has resulted in a higher demand for industrial components ceramic hexagon nuts, especially in Materials such as electronics, energy and transportation. Asian countries, such as Japan, have a strong history of technological advancements and innovation in ceramics. This expertise has allowed them to produce high-quality ceramic hexagon nuts that provide several industries. Many Asian manufacturers are export-oriented and have established international supply chains. This has allowed them to meet the global demand for ceramic hexagon nuts and other components. Several Asian countries have invested in research and development in the ceramics field, resulting in the development of new materials and enhanced production techniques.Ceramic Hexagon Nuts Market Scope : Inquire Before Buying

Global Ceramic Hexagon Nuts Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.26 Bn. Forecast Period 2023 to 2029 CAGR: 4.5% Market Size in 2029: US $ 1.71 Bn. Segments Covered: by Product Type Standard Specialty by Material Alumina Zirconia Silicon Carbide Other by End User Electronics and Semiconductor Aerospace and Defense Automotive Medical and Healthcare Energy and Power Generation Others Ceramic Hexagon Nuts Market

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Ceramic Hexagon Nuts Key Players

1. Kyocera Corporation 2. Morgan Advanced Materials 3. CoorsTek, Inc. 4. Ortech, Inc. 5. Precision Ceramics 6. H.C. Starck Ceramics GmbH 7. LSP Industrial Ceramics, Inc. 8. Sentro Tech Corporation 9. McDanel Advanced Ceramic Technologies 10. Mantec Technical Ceramics Ltd. 11. International Ceramic Engineering (ICE) 12. Ferro-Ceramic Grinding Inc. 13. MACOR - Corning Inc. 14. San Jose Delta Associates, Inc. 15. Astro Met, Inc. 16. Ceramco, Inc. 17. Earthwater Global 18. Alumina Technology 19. Maruwai Advanced Ceramics L.P. 20. C-Mac International, LLC 21. KT Refractories 22. Dyson Technical Ceramics 23. FLSmidth 24. Versiclad Pty Ltd. 25. Porzellanfabrik Langensalza GmbH Frequently Asked Questions: 1] What is the growth rate of the Global Ceramic Hexagon Nuts Market? Ans. The Global Ceramic Hexagon Nuts Market is growing at a significant rate of 4.5% during the forecast period. 2] Which region is expected to dominate the Global Ceramic Hexagon Nuts Market? Ans. Asia Pacific is expected to dominate the Ceramic Hexagon Nuts Market during the forecast period. 3] What is the expected Global Ceramic Hexagon Nuts Market size by 2029? Ans. The Ceramic Hexagon Nuts Market size is expected to reach USD 13.74 Bn by 2029. 4] Which are the top players in the Global Ceramic Hexagon Nuts Market? Ans. The major top players in the Global Ceramic Hexagon Nuts Market are Kyocera Corporation, Morgan Advanced Materials, CoorsTek, Inc., Ortech, Inc., Precision Ceramics, H.C. Starck Ceramics GmbH, LSP Industrial Ceramics, Inc., Sentro Tech Corporation, McDanel Advanced Ceramic Technologies, Mantec Technical Ceramics Ltd., International Ceramic Engineering (ICE), Ferro-Ceramic Grinding Inc., MACOR - Corning Inc., San Jose Delta Associates, Inc., Astro Met, Inc. and Others. 5] What are the factors driving the Global Ceramic Hexagon Nuts Market growth? Ans. Increasing demand for lightweight and high-performance fastening solutions in various industries is expected to drive market growth during the forecast period.

1. Ceramic Hexagon Nuts Market: Research Methodology 2. Ceramic Hexagon Nuts Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Ceramic Hexagon Nuts Market: Dynamics 3.1 Ceramic Hexagon Nuts Market Trends by Region 3.1.1 North America Ceramic Hexagon Nuts Market Trends 3.1.2 Europe Ceramic Hexagon Nuts Market Trends 3.1.3 Asia Pacific Ceramic Hexagon Nuts Market Trends 3.1.4 Middle East and Africa Ceramic Hexagon Nuts Market Trends 3.1.5 South America Ceramic Hexagon Nuts Market Trends 3.2 Ceramic Hexagon Nuts Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Ceramic Hexagon Nuts Market Drivers 3.2.1.2 North America Ceramic Hexagon Nuts Market Restraints 3.2.1.3 North America Ceramic Hexagon Nuts Market Opportunities 3.2.1.4 North America Ceramic Hexagon Nuts Market Challenges 3.2.2 Europe 3.2.2.1 Europe Ceramic Hexagon Nuts Market Drivers 3.2.2.2 Europe Ceramic Hexagon Nuts Market Restraints 3.2.2.3 Europe Ceramic Hexagon Nuts Market Opportunities 3.2.2.4 Europe Ceramic Hexagon Nuts Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Ceramic Hexagon Nuts Market Drivers 3.2.3.2 Asia Pacific Ceramic Hexagon Nuts Market Restraints 3.2.3.3 Asia Pacific Ceramic Hexagon Nuts Market Opportunities 3.2.3.4 Asia Pacific Ceramic Hexagon Nuts Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Ceramic Hexagon Nuts Market Drivers 3.2.4.2 Middle East and Africa Ceramic Hexagon Nuts Market Restraints 3.2.4.3 Middle East and Africa Ceramic Hexagon Nuts Market Opportunities 3.2.4.4 Middle East and Africa Ceramic Hexagon Nuts Market Challenges 3.2.5 South America 3.2.5.1 South America Ceramic Hexagon Nuts Market Drivers 3.2.5.2 South America Ceramic Hexagon Nuts Market Restraints 3.2.5.3 South America Ceramic Hexagon Nuts Market Opportunities 3.2.5.4 South America Ceramic Hexagon Nuts Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Ceramic Hexagon Nuts Industry 3.7 The Global Pandemic Impact on the Ceramic Hexagon Nuts Industry 3.8 Technological Road Map 4. Global Ceramic Hexagon Nuts Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 4.1 Global Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 4.1.1 Standard 4.1.2 Specialty 4.2 Global Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 4.2.1 Alumina 4.2.2 Zirconia 4.2.3 Silicon Carbide 4.2.4 Other 4.3 Global Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 4.3.1 Electronics and Semiconductor 4.3.2 Aerospace and Defense 4.3.3 Automotive 4.3.4 Medical and Healthcare 4.3.5 Energy and Power Generation 4.3.6 Others 4.4 Global Ceramic Hexagon Nuts Market Size and Forecast, by Region (2022-2029) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Ceramic Hexagon Nuts Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 5.1 North America Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 5.1.1 Standard 5.1.2 Specialty 5.2 North America Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 5.2.1 Alumina 5.2.2 Zirconia 5.2.3 Silicon Carbide 5.2.4 Other 5.3 North America Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 5.3.1 Electronics and Semiconductor 5.3.2 Aerospace and Defense 5.3.3 Automotive 5.3.4 Medical and Healthcare 5.3.5 Energy and Power Generation 5.3.6 Others 5.4 North America Ceramic Hexagon Nuts Market Size and Forecast, by Country (2022-2029) 5.4.1 United States 5.4.1.1 United States Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 5.4.1.1.1 Standard 5.4.1.1.2 Specialty 5.4.1.2 United States Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 5.4.1.2.1 Alumina 5.4.1.2.2 Zirconia 5.4.1.2.3 Silicon Carbide 5.4.1.2.4 Other 5.4.1.3 United States Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 5.4.1.3.1 Electronics and Semiconductor 5.4.1.3.2 Aerospace and Defense 5.4.1.3.3 Automotive 5.4.1.3.4 Medical and Healthcare 5.4.1.3.5 Energy and Power Generation 5.4.1.3.6 Others 5.4.2 Canada 5.4.2.1 Canada Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 5.4.2.1.1 Standard 5.4.2.1.2 Specialty 5.4.2.2 Canada Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 5.4.2.2.1 Alumina 5.4.2.2.2 Zirconia 5.4.2.2.3 Silicon Carbide 5.4.2.2.4 Others 5.4.2.3 Canada Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 5.4.2.3.1 Electronics and Semiconductor 5.4.2.3.2 Aerospace and Defense 5.4.2.3.3 Automotive 5.4.2.3.4 Medical and Healthcare 5.4.2.3.5 Energy and Power Generation 5.4.2.3.6 Others 5.4.3 Mexico 5.4.3.1 Mexico Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 5.4.3.1.1 Standard 5.4.3.1.2 Specialty 5.4.3.2 Mexico Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 5.4.3.2.1 Alumina 5.4.3.2.2 Zirconia 5.4.3.2.3 Silicon Carbide 5.4.3.2.4 Other 5.4.3.3 Mexico Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 5.4.3.3.1 Electronics and Semiconductor 5.4.3.3.2 Aerospace and Defense 5.4.3.3.3 Automotive 5.4.3.3.4 Medical and Healthcare 5.4.3.3.5 Energy and Power Generation 5.4.3.3.6 Others 6. Europe Ceramic Hexagon Nuts Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 6.1 Europe Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.2 Europe Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.3 Europe Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4 Europe Ceramic Hexagon Nuts Market Size and Forecast, by Country (2022-2029) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.1.2 United Kingdom Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.1.3 United Kingdom Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.2 France 6.4.2.1 France Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.2.2 France Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.2.3 France Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.3 Germany 6.4.3.1 Germany Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.3.2 Germany Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.3.3 Germany Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.4 Italy 6.4.4.1 Italy Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.4.2 Italy Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.4.3 Italy Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.5 Spain 6.4.5.1 Spain Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.5.2 Spain Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.5.3 Spain Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.6 Sweden 6.4.6.1 Sweden Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.6.2 Sweden Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.6.3 Sweden Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.7 Austria 6.4.7.1 Austria Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.7.2 Austria Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 6.4.7.3 Austria Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 6.4.8.2 Rest of Europe Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029). 6.4.8.3 Rest of Europe Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7. Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 7.1 Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.2 Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.3 Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4 Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by Country (2022-2029) 7.4.1 China 7.4.1.1 China Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.1.2 China Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.1.3 China Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.2 South Korea 7.4.2.1 S Korea Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.2.2 S Korea Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.2.3 S Korea Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.3 Japan 7.4.3.1 Japan Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.3.2 Japan Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.3.3 Japan Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.4 India 7.4.4.1 India Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.4.2 India Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.4.3 India Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.5 Australia 7.4.5.1 Australia Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.5.2 Australia Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.5.3 Australia Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.6 Indonesia 7.4.6.1 Indonesia Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.6.2 Indonesia Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.6.3 Indonesia Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.7 Malaysia 7.4.7.1 Malaysia Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.7.2 Malaysia Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.7.3 Malaysia Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.8 Vietnam 7.4.8.1 Vietnam Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.8.2 Vietnam Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.8.3 Vietnam Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.9 Taiwan 7.4.9.1 Taiwan Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.9.2 Taiwan Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.9.3 Taiwan Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.10.2 Bangladesh Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.10.3 Bangladesh Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.11 Pakistan 7.4.11.1 Pakistan Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.11.2 Pakistan Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.11.3 Pakistan Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 7.4.12.2 Rest of Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 7.4.12.3 Rest of Asia Pacific Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 8. Middle East and Africa Ceramic Hexagon Nuts Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 8.1 Middle East and Africa Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 8.2 Middle East and Africa Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 8.3 Middle East and Africa Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 8.4 Middle East and Africa Ceramic Hexagon Nuts Market Size and Forecast, by Country (2022-2029) 8.4.1 South Africa 8.4.1.1 South Africa Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 8.4.1.2 South Africa Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 8.4.1.3 South Africa Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 8.4.2 GCC 8.4.2.1 GCC Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 8.4.2.2 GCC Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 8.4.2.3 GCC Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 8.4.3 Egypt 8.4.3.1 Egypt Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 8.4.3.2 Egypt Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 8.4.3.3 Egypt Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 8.4.4 Nigeria 8.4.4.1 Nigeria Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 8.4.4.2 Nigeria Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 8.4.4.3 Nigeria Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 8.4.5.2 Rest of ME&A Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 8.4.5.3 Rest of ME&A Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 9. South America Ceramic Hexagon Nuts Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 9.1 South America Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 9.2 South America Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 9.3 South America Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 9.4 South America Ceramic Hexagon Nuts Market Size and Forecast, by Country (2022-2029) 9.4.1 Brazil 9.4.1.1 Brazil Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 9.4.1.2 Brazil Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 9.4.1.3 Brazil Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 9.4.2 Argentina 9.4.2.1 Argentina Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 9.4.2.2 Argentina Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 9.4.2.3 Argentina Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Ceramic Hexagon Nuts Market Size and Forecast, by Product Type (2022-2029) 9.4.3.2 Rest Of South America Ceramic Hexagon Nuts Market Size and Forecast, by Material (2022-2029) 9.4.3.3 Rest Of South America Ceramic Hexagon Nuts Market Size and Forecast, by End User (2022-2029) 10. Global Ceramic Hexagon Nuts Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Type Segment 10.3.3 End User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Ceramic Hexagon Nuts Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Kyocera Corporation 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium and large) 11.1.7 Recent Developments 11.2 Kyocera Corporation 11.3 Morgan Advanced Materials 11.4 CoorsTek, Inc. 11.5 Ortech, Inc. 11.6 Precision Ceramics 11.7 H.C. Starck Ceramics GmbH 11.8 LSP Industrial Ceramics, Inc. 11.9 Sentro Tech Corporation 11.10 McDanel Advanced Ceramic Technologies 11.11 Mantec Technical Ceramics Ltd. 11.12 International Ceramic Engineering (ICE) 11.13 Ferro-Ceramic Grinding Inc. 11.14 MACOR - Corning Inc. 11.15 San Jose Delta Associates, Inc. 11.16 Astro Met, Inc. 11.17 Ceramco, Inc. 11.18 Earthwater Global 11.19 Alumina Technology 11.20 Maruwai Advanced Ceramics L.P. 11.21 C-Mac International, LLC 11.22 KT Refractories 11.23 Dyson Technical Ceramics 11.24 FLSmidth 11.25 Versiclad Pty Ltd. 11.26 Porzellanfabrik Langensalza GmbH 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary