Centrifugal Compressors Market was valued at USD 13446.53 Mn in 2023 and is expected to reach USD 18471.17 Mn by 2030, at a CAGR of 4.64 percent during the forecast period.Centrifugal Compressors Market Overview

Centrifugal compressors are considered suitable for large gas flow with low compression ratio and stable operational conditions. As a result, this type of compressor is widely used across the oil and gas industry for processing petrochemicals in oil refineries, and for natural gas boosting in pipelines. Global demand for oil and gas is at its highest levels ever, with mainly dramatic Centrifugal Compressors Market growth in the Asia Pacific, the Middle East & Africa, and America. Nowadays, centrifugal compressors are utilized for many applications. Centrifugal compressors are equipment, which is used in a wide variety of applications in the chemical process industries. Almost every manufacturing and industrial facility, and many services and process industry applications, use air compression, vacuum, and blower products in a variety of process-critical applications such as the operation of pneumatic tools, pumps and motion control components, air and gas separation, vacuum packaging of food products.To know about the Research Methodology :- Request Free Sample Report

Centrifugal Compressors Market Dynamics

Increasing Demand from the Oil and Gas and Power Sectors Centrifugal compressors are widely used in several industries, such as process, oil and gas, power generation, wastewater treatment, and refrigeration processes. However, the oil and gas and power industries remain the largest end users of these compressors, accounting for more than 65% of the total Centrifugal Compressors Market. As a result, growth in these sectors is expected to augment the demand for centrifugal compressors. Large-scale facilities for gas transportation and processing, as well as oil processing, prefer the use centrifugal compressors for a continuous supply of compressed air/gas at high pressure, due to the absence of gearbox and the resultant lubrication system, which offers the supply of 100% oil-free compressed air, critical for various applications in the industry. Centrifugal compressors are used in a large number of different compression applications in the oil and gas industry, due their wide ranges of compression and ability to handle high flows. The global crude oil demand is expected to increase by about 5.5 mb/d in during 2017-2022, and there is an increasing pressure among the top oil and gas operating companies to increase their production to meet the rising energy demand.The power sector has witnessed a massive change over the years. New technologies are implemented for clean and efficient harnessing of natural resources for commercial power generation. Among all the other technologies, natural gas-based power generation has proven to be the most efficient and clean way to meet the increasing global power demand. In the power sector, natural gas is an attractive choice for new power generating plants, because of its fuel efficiency. Natural gas also burns cleaner than coal or oil, and as more governments are implementing national or regional plans to reduce carbon dioxide (CO2) emissions, they are also encouraging the use of natural gas to substitute the more carbon-intensive coal and liquid fuels. Natural gas-fired electricity is expected to account for 80% of all future electricity generation capacities by 2035. Moreover, many countries have started phasing out nuclear and coal power generations, and have started adopting natural gas-based power plants. Gas-fired power plants are one of the major consumers of centrifugal compressors, and thus, developments in this sector are expected to propel the growth of Centrifugal Compressors Market during the forecast period. High Investment in Oil and Gas Exploration and Production Activities: As centrifugal compressors are widely used in various applications in the oil and gas industry, including the exploration and development stages, transportation applications using pipeline and LNG, and throughout refineries and petrochemical plants, the demand for these devices is constantly increasing. With low compression ratios and steady operating conditions, centrifugal compressors are considered to be ideal for huge gas flows. As a result, they are frequently utilized in the oil and gas sector for pipeline natural gas boosting and process gas services in petrochemical and oil refineries. Global energy consumption is expected to increase by more than 25.38% between 2022 and 2040, with oil and gas accounting for over half of the demand. The oil and gas industry is expected to produce more oil and gas in an effort to keep up with the increased demand, as well as build new LNG terminals, refineries, and petrochemical plants to process and transport the pumped-out oil and gas to the end users.

The oil and gas industry uses the centrifugal compressor significantly in upstream, midstream, and downstream operations. To increase the production of hydrocarbons, several countries have taken steps to raise investments in oil and gas E&P activities. For example, Frontera Energy Corporation, a Canadian company, said in March 2022 that it had found 27.2-degree light crude oil at the Tui-1 exploration well on the Perico block in Ecuador. A subsidiary of the government-owned Emirates National Oil Company with headquarters in the United Arab Emirates, Dragon Oil PLC, stated in February 2022 that it had discovered its first oil in the Gulf of Suez. During the forecast period, these initiatives are expected to fuel the growth of the Centrifugal Compressors Market. Growing Demand for Energy Efficient Compressors Air/Gas compression is an energy intensive process and has significant impact on the energy consumption, and the efficiency of manufacturing/production systems. Centrifugal compressors are better suited for applications requiring very high capacities, typically above 12,000 cfm, and hence, utilize relatively more energy than the smaller compressors. Energy costs typically dominate the life-cycle costs of centrifugal compressors used in various industrial processes, making them an attractive target for energy efficiency improvements. Poor design, poor maintenance, wear and tear, leaks, wasted heat, and/or pressure losses, among other factors, add to the energy inefficiency of these compressors, through the lifecycle. Additional, it has been estimated that a highly energy-efficient centrifugal compressor can result in energy savings of 20%-50%. Rising electricity prices are further giving rise to the demand for energy-efficient compressors across all the industries utilizing compressors. As a result, improvement in energy efficiency of centrifugal compressor has become a fundamental concern for any business, to reduce cost and increase profitability. Manufacturers of these compressors are now addressing the energy efficiency problems, by adopting various techniques. These techniques are not limited to new compressors, and also take into consideration the existing compressors installed in the facilities.

Centrifugal Compressors Market Segment Analysis

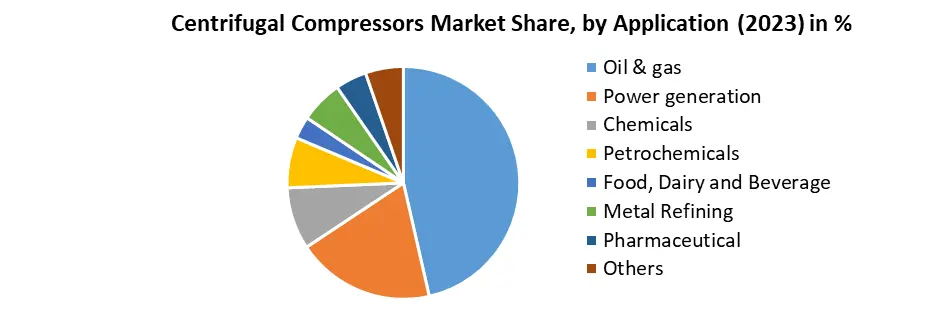

Based on Product Type, the Centrifugal Compressors Market is segmented into Single-Stage and Multi-Stage. Single-Stage segment held the dominated share accounting for 61.53 % in 2023 and is expected to grow at significant growth rate through the forecast period. An increase in adoption of the single-stage centrifugal compressors for various applications like petrochemicals, refineries, and oil & gas. The single-stage centrifugal compressors are the combination of one impeller with its associated inlet guide vane and diffuser. The single-stage centrifugal compressors have ease of maintenance and simple and rigid construction for lower maintenance requirements.Based on Application, the Centrifugal Compressors Market is segmented into Oil & gas, Power generation, Chemicals, Petrochemicals, Food, Dairy and Beverage, Metal Refining, Pharmaceutical, and Others. The Oil & gas segment held the largest share accounting for 46.43% in 2023. The oil and gas sector offers widespread applications for centrifugal compressors, which include the upstream, midstream, and downstream industries. The centrifugal compressors serve various purposes across the oil and gas industry, such as gas transportation, compression for gas injection, gas gathering, gas lift, etc. The global crude oil demand is expected to increase by 1.2 mb/d in the next four years, and there is an increasing pressure among the top oil and gas operating companies to increase their production, to meet the increasing energy demand. As a result, several operating countries have shifted their focus toward the exploitation of unconventional reserve. The surge in upstream activities is expected to promulgate the Centrifugal Compressors market during the forecast period.

Centrifugal Compressors Market Regional Insight

The Emergence of Oil and Gas Downstream Sector in North America The development of oil and unconventional natural gas resources are expected to create an opportunity to increase economic growth throughout North America and improve the region’s competitiveness in global Centrifugal Compressors Market. The growth of the oil and gas downstream sector in North America and refining capacity of the United States are expected to drive the demand for centrifugal air compressors during the forecast period. For instance, Oil refining capacity in North America amounted to 21.4 million barrels per day in 2021, slightly down from 21.8 million barrels daily in 2020. North America is expected to continue to upgrade and improve existing infrastructure as it has the highest number of refineries in any region. In addition, the United States has uplifted the ban on exploration and production activity on its coastline. As a result, upstream activity is expected to get a boost offshore, which, in turn, is expected to positively impact the Centrifugal Compressors Market in the region. Key players are heavily investing into the oil and gas downstream sector that drive the need for centrifugal compressors. For Instance, ExxonMobil has invested USD 20 billion in the downstream sector in the Gulf of Mexico region for constructing 11 major chemicals, refining, lubricant, and LNG projects, along Texas and Louisiana coasts.Centrifugal Compressors Market: Global Players Revenue by Power Rating (Input Power) (In Percent)

North America Oil and Gas Projects Outlook to 2025 – Development Stage, Capacity, Capex, and Contractor Details of All New Build and Expansion Projects indicates that North America is expected to witness 603 projects commence operations during the period of 2021-2025. Out of these, upstream projects would be 104, midstream would be the highest with 333 projects with refinery and petrochemical at 23 and 143 respectively. Canada is the fifth-largest producer of natural gas and the sixth-largest producer of crude oil in the world, with extensive oil and natural gas reserves across the country. In addition, the development of oil and gas resources, such as oil sands, natural gas, conventional oil, and unconventional oil are promising market sign for the Centrifugal Compressors Market during the forecast period. In conclusion, the global Centrifugal Compressors Market growth is primarily fueled by escalating demand from the oil and gas and power sectors. Centrifugal compressors find extensive use in large-scale gas flow applications, particularly in oil refineries and natural gas pipelines, driven by their efficiency and stable operational conditions. The oil and gas industry, witnessing unprecedented demand, relies heavily on centrifugal compressors, contributing to over 65% of the market. Factors such as increased investment in oil and gas exploration, coupled with the growing emphasis on energy-efficient compressors, further propel market expansion. The North American oil and gas downstream sector's emergence is a key regional driver, with projects in the pipeline expected to significantly boost centrifugal compressor demand, highlighting a positive industry outlook through 2030.

Sr. No. Company Name 0-1000kW 1000-2000kW 2000-6000kW 6000-10000kW 10000-15000kW Greater than 15000 kW 1 Atlas Copco AB 14.73% 20.72% 24.98% 23.86% 11.46% 4.25% 2 Baker Hughes Co. 18.25% 21.54% 20.24% 22.36% 9.85% 7.76% 3 Elliott Group 28.61% 26.71% 15.73% 18.21% 5.14% 5.60% 4 Ingersoll-Rand PLC 13.57% 24.57% 29.43% 21.71% 5.86% 4.86% 5 Kaishan Compressor 21.41% 27.30% 18.36% 17.91% 8.73% 6.29% Centrifugal Compressors Market Scope: Inquiry Before Buying

Centrifugal Compressors Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 13446.53 Mn. Forecast Period 2024 to 2030 CAGR: 4.64% Market Size in 2030: US $ 18471.17 Mn. Segments Covered: by Product Single-Stage Integral Geared Single-Stage Other Multi-Stage Integral Geared Single-Stage Other by Technology Gas Compressor Natural Gas Carbon Dioxide Hydrogen Nitrogen Steam (MVR) Air Compressor Air Separation Instrument & Plant Air Combustion and Process Reactor Air by Application Oil & gas Power generation Chemicals Petrochemicals Food, Dairy and Beverage Metal Refining Pharmaceutical Others Centrifugal Compressors Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Centrifugal Compressors Manufacturers include:

Asia-Pacific: 1. Elliott Group (Japan) 2. Kaishan Compressor CO. LTD. (China) 3. Kobe Steel, Ltd.(Japan) 4. Mitsubishi Heavy Industries Compressor Corporation (Japan) 5. Shenyang Blower Works Group Corporation.(China) Europe: 6. Atlas Copco AB (Sweden) 7. Howden Group (Scotland) 8. MAN Energy Solutions SE (Germany) 9. Siemens (Germany) North America: 10. Baker Hughes Co. (United States) 11. Ingersoll-Rand PLC (United States) 12. Sullair, LLC (United States) 13. Sundyne (United States)Frequently asked Questions:

1: What is the primary application of centrifugal compressors in the oil and gas industry? Ans: Centrifugal compressors are extensively used in the oil and gas industry for various purposes, including gas transportation, compression for gas injection, and gas gathering due to their ability to provide a continuous supply of compressed air/gas at high pressure. 2: Why is there a growing demand for centrifugal compressors in the power sector? Ans: The power sector's shift towards natural gas-based power generation, known for its efficiency and cleaner burning, is propelling the demand for centrifugal compressors, especially in gas-fired power plants expected to account for 80% of future electricity generation capacities by 2035. 3: How is the Centrifugal Compressors Market expected to grow in response to oil and gas exploration and production activities? Ans: Increasing investments in oil and gas exploration and production activities are anticipated to fuel the growth of the centrifugal compressor market, playing a crucial role in various stages, from exploration and development to transportation and processing. 4: What role does energy efficiency play in the demand for centrifugal compressors? Ans: Energy efficiency is a key driver in the demand for centrifugal compressors, with highly energy-efficient compressors capable of achieving energy savings of 20%-50%. Rising electricity prices further contribute to the demand for energy-efficient compressors across industries. 5: Which segment dominates the Centrifugal Compressors Market based on product type? Ans: The single-stage segment holds the dominant share in the Centrifugal Compressors Market, accounting for 61.53% in 2023. Single-stage centrifugal compressors are preferred for their ease of maintenance, simple construction, and suitability for various industrial applications.

1. Centrifugal Compressors Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Centrifugal Compressors Market: Dynamics 2.1. Centrifugal Compressors Market Trends by Region 2.1.1. Global Centrifugal Compressors Market Trends 2.1.2. North America Centrifugal Compressors Market Trends 2.1.3. Europe Centrifugal Compressors Market Trends 2.1.4. Asia Pacific Centrifugal Compressors Market Trends 2.1.5. Middle East and Africa Centrifugal Compressors Market Trends 2.1.6. South America Centrifugal Compressors Market Trends 2.2. Centrifugal Compressors Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Centrifugal Compressors Market Drivers 2.2.1.2. North America Centrifugal Compressors Market Restraints 2.2.1.3. North America Centrifugal Compressors Market Opportunities 2.2.1.4. North America Centrifugal Compressors Market Challenges 2.2.2. Europe 2.2.2.1. Europe Centrifugal Compressors Market Drivers 2.2.2.2. Europe Centrifugal Compressors Market Restraints 2.2.2.3. Europe Centrifugal Compressors Market Opportunities 2.2.2.4. Europe Centrifugal Compressors Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Centrifugal Compressors Market Drivers 2.2.3.2. Asia Pacific Centrifugal Compressors Market Restraints 2.2.3.3. Asia Pacific Centrifugal Compressors Market Opportunities 2.2.3.4. Asia Pacific Centrifugal Compressors Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Centrifugal Compressors Market Drivers 2.2.4.2. Middle East and Africa Centrifugal Compressors Market Restraints 2.2.4.3. Middle East and Africa Centrifugal Compressors Market Opportunities 2.2.4.4. Middle East and Africa Centrifugal Compressors Market Challenges 2.2.5. South America 2.2.5.1. South America Centrifugal Compressors Market Drivers 2.2.5.2. South America Centrifugal Compressors Market Restraints 2.2.5.3. South America Centrifugal Compressors Market Opportunities 2.2.5.4. South America Centrifugal Compressors Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis for Floating Solar Panels Industry 2.9. Analysis of Government Schemes and Initiatives for Floating Solar Panels Industry 2.10. The Global Pandemic Impact on Centrifugal Compressors Market 2.11. Floating Solar Panels Price Trend Analysis (2021-22) 3. Centrifugal Compressors Market: Global Market Size and Forecast by Segmentation by (by Value) (2023-2030) 3.1. Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 3.1.1. Single-Stage 3.1.1.1. Integral Geared Single-Stage 3.1.1.2. Other 3.1.2. Multi-Stage 3.1.2.1. Integral Geared Single-Stage 3.1.2.2. Other 3.2. Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 3.2.1. Gas Compressor 3.2.1.1. Natural Gas 3.2.1.2. Carbon Dioxide 3.2.1.3. Hydrogen 3.2.1.4. Nitrogen 3.2.1.5. Steam (MVR) 3.2.2. Air Compressor 3.2.2.1. Air Separation 3.2.2.2. Instrument & Plant Air 3.2.2.3. Combustion and Process Reactor Air 3.3. Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 3.3.1. Oil & gas 3.3.2. Power generation 3.3.3. Chemicals 3.3.4. Petrochemicals 3.3.5. Food, Dairy and Beverage 3.3.6. Metal Refining 3.3.7. Pharmaceutical 3.3.8. Others 3.4. Centrifugal Compressors Market Size and Forecast, by region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Centrifugal Compressors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 4.1.1. Single-Stage 4.1.1.1. Integral Geared Single-Stage 4.1.1.2. Other 4.1.2. Multi-Stage 4.1.2.1. Integral Geared Single-Stage 4.1.2.2. Other 4.2. North America Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 4.2.1. Gas Compressor 4.2.1.1. Natural Gas 4.2.1.2. Carbon Dioxide 4.2.1.3. Hydrogen 4.2.1.4. Nitrogen 4.2.1.5. Steam (MVR) 4.2.2. Air Compressor 4.2.2.1. Air Separation 4.2.2.2. Instrument & Plant Air 4.2.2.3. Combustion and Process Reactor Air 4.3. North America Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 4.3.1. Oil & gas 4.3.2. Power generation 4.3.3. Chemicals 4.3.4. Petrochemicals 4.3.5. Food, Dairy and Beverage 4.3.6. Metal Refining 4.3.7. Pharmaceutical 4.3.8. Others 4.4. North America Centrifugal Compressors Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 4.4.1.1.1. Single-Stage 4.4.1.1.1.1. Integral Geared Single-Stage 4.4.1.1.1.2. Other 4.4.1.1.2. Multi-Stage 4.4.1.1.2.1. Integral Geared Single-Stage 4.4.1.1.2.2. Other 4.4.1.2. United States Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 4.4.1.2.1. Gas Compressor 4.4.1.2.1.1. Natural Gas 4.4.1.2.1.2. Carbon Dioxide 4.4.1.2.1.3. Hydrogen 4.4.1.2.1.4. Nitrogen 4.4.1.2.1.5. Steam (MVR) 4.4.1.2.2. Air Compressor 4.4.1.2.2.1. Air Separation 4.4.1.2.2.2. Instrument & Plant Air 4.4.1.2.2.3. Combustion and Process Reactor Air 4.4.1.3. United States Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 4.4.1.3.1. Oil & gas 4.4.1.3.2. Power generation 4.4.1.3.3. Chemicals 4.4.1.3.4. Petrochemicals 4.4.1.3.5. Food, Dairy and Beverage 4.4.1.3.6. Metal Refining 4.4.1.3.7. Pharmaceutical 4.4.1.3.8. Others 4.4.2. Canada 4.4.2.1. Canada Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 4.4.2.1.1. Single-Stage 4.4.2.1.1.1. Integral Geared Single-Stage 4.4.2.1.1.2. Other 4.4.2.1.2. Multi-Stage 4.4.2.1.2.1. Integral Geared Single-Stage 4.4.2.1.2.2. Other 4.4.2.2. Canada Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 4.4.2.2.1. Gas Compressor 4.4.2.2.1.1. Natural Gas 4.4.2.2.1.2. Carbon Dioxide 4.4.2.2.1.3. Hydrogen 4.4.2.2.1.4. Nitrogen 4.4.2.2.1.5. Steam (MVR) 4.4.2.2.2. Air Compressor 4.4.2.2.2.1. Air Separation 4.4.2.2.2.2. Instrument & Plant Air 4.4.2.2.2.3. Combustion and Process Reactor Air 4.4.2.3. Canada Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 4.4.2.3.1. Oil & gas 4.4.2.3.2. Power generation 4.4.2.3.3. Chemicals 4.4.2.3.4. Petrochemicals 4.4.2.3.5. Food, Dairy and Beverage 4.4.2.3.6. Metal Refining 4.4.2.3.7. Pharmaceutical 4.4.2.3.8. Others 4.4.3. Mexico 4.4.3.1. Mexico Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 4.4.3.1.1. Single-Stage 4.4.3.1.1.1. Integral Geared Single-Stage 4.4.3.1.1.2. Other 4.4.3.1.2. Multi-Stage 4.4.3.1.2.1. Integral Geared Single-Stage 4.4.3.1.2.2. Other 4.4.3.2. Mexico Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 4.4.3.2.1. Gas Compressor 4.4.3.2.1.1. Natural Gas 4.4.3.2.1.2. Carbon Dioxide 4.4.3.2.1.3. Hydrogen 4.4.3.2.1.4. Nitrogen 4.4.3.2.1.5. Steam (MVR) 4.4.3.2.2. Air Compressor 4.4.3.2.2.1. Air Separation 4.4.3.2.2.2. Instrument & Plant Air 4.4.3.2.2.3. Combustion and Process Reactor Air 4.4.3.3. Mexico Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 4.4.3.3.1. Oil & gas 4.4.3.3.2. Power generation 4.4.3.3.3. Chemicals 4.4.3.3.4. Petrochemicals 4.4.3.3.5. Food, Dairy and Beverage 4.4.3.3.6. Metal Refining 4.4.3.3.7. Pharmaceutical 4.4.3.3.8. Others 5. Europe Centrifugal Compressors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. Europe Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.2. Europe Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.3. Europe Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4. Europe Centrifugal Compressors Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.1.2. United Kingdom Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.1.3. United Kingdom Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4.2. France 5.4.2.1. France Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.2.2. France Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.2.3. France Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.3.2. Germany Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.3.3. Germany Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.4.2. Italy Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.4.3. Italy Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.5.2. Spain Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.5.3. Spain Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.6.2. Sweden Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.6.3. Sweden Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 5.4.7. Austria 5.4.7.1. Austria Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.7.2. Austria Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.7.3. Austria Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 5.4.8.2. Rest of Europe Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 5.4.8.3. Rest of Europe Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6. Asia Pacific Centrifugal Compressors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.2. Asia Pacific Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.3. Asia Pacific Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4. Asia Pacific Centrifugal Compressors Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.1.2. China Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.1.3. China Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.2.2. S Korea Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.2.3. S Korea Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.3. Japan 6.4.3.1. Japan Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.3.2. Japan Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.3.3. Japan Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.4. India 6.4.4.1. India Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.4.2. India Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.4.3. India Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.5. Australia 6.4.5.1. Australia Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.5.2. Australia Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.5.3. Australia Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.6.2. Indonesia Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.6.3. Indonesia Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.7.2. Malaysia Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.7.3. Malaysia Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.8.2. Vietnam Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.8.3. Vietnam Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.9.2. Taiwan Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.9.3. Taiwan Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 6.4.10.2. Rest of Asia Pacific Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 7. Middle East and Africa Centrifugal Compressors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Middle East and Africa Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 7.2. Middle East and Africa Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 7.3. Middle East and Africa Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 7.4. Middle East and Africa Centrifugal Compressors Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 7.4.1.2. South Africa Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 7.4.1.3. South Africa Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 7.4.2. GCC 7.4.2.1. GCC Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 7.4.2.2. GCC Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 7.4.2.3. GCC Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 7.4.3.2. Nigeria Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 7.4.3.3. Nigeria Centrifugal Compressors Market Size and Forecast, By Application(2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 7.4.4.2. Rest of ME&A Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 7.4.4.3. Rest of ME&A Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 8. South America Centrifugal Compressors Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. South America Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 8.2. South America Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 8.3. South America Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 8.4. South America Centrifugal Compressors Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 8.4.1.2. Brazil Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 8.4.1.3. Brazil Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 8.4.2.2. Argentina Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 8.4.2.3. Argentina Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Centrifugal Compressors Market Size and Forecast, By Product(2023-2030) 8.4.3.2. Rest Of South America Centrifugal Compressors Market Size and Forecast, By Technology (2023-2030) 8.4.3.3. Rest Of South America Centrifugal Compressors Market Size and Forecast, By Application (2023-2030) 9. Global Centrifugal Compressors Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Centrifugal Compressors Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Atlas Copco AB 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Baker Hughes Co. 10.3. Elliott Group 10.4. Howden Group 10.5. Ingersoll-Rand PLC 10.6. Kaishan Compressor CO. LTD. 10.7. Kobe Steel, Ltd. 10.8. MAN Energy Solutions SE 10.9. Mitsubishi Heavy Industries Compressor Corporation 10.10. Shenyang Blower Works Group Corporation. 10.11. Siemens 10.12. Sullair, LLC 10.13. Sundyne 11. Key Findings 12. Industry Recommendations 13. Centrifugal Compressors Market: Research Methodology 14. Terms and Glossary