The Calcium Lignosulfonate Market size was valued at USD 923.40 Million in 2023 and the total Calcium Lignosulfonate Market revenue is expected to grow at a CAGR of 3.7% from 2024 to 2030, reaching nearly USD 1190.81 Million in 2030.Calcium Lignosulfonate Market Overview

Calcium lignosulfonate is a natural anionic surface-active agent derived from sulfurous acid pulping waste utilizing advanced production techniques. It is widely utilized in diverse concrete projects, including preformed concrete, reinforced concrete, and prestressed concrete. Particularly suited for commercial concrete, anti-freezing concrete, waterproof concrete, bulk concrete, and pumping concrete, calcium lignosulfonate offers high economic advantages with these applications. Calcium lignosulphonate is a flexible chemical, which is applicable as a water-reducing agent in concrete, a dispersant in pesticides, and a binder in animal feed, among others. The Calcium lignosulfonate market is growing thanks to increased demand in the building and construction sector, driven by factors like construction management efficiency, sustainable practices, and the use of innovative building materials, agriculture, and animal feed additives.To know about the Research Methodology:- Request Free Sample Report 1. According to MMR, the United States ranks as the world's second-largest importer of calcium lignosulfonate, and it acquires goods from China, Germany, and Hong Kong. Nutriwell Co. Ltd. holds the top spot in export market share with 23 shipments, followed by Borregaard AS with 12 shipments, and Unique Logistic International in third place with 11 shipments. Some of major key players that are actively working in the Calcium Sulfonate market include Borregaard, LignoTech, Tembec Inc., Burgo Group S.p.A, Sappi, Wuhan Xinyingda Chemicals Co. Ltd. Shenyang Xingzhenghe Chemical Co. Ltd. Flambeau River Papers, Nippon Paper Industries, HUBEI AGING CHEMICAL COMPANY, Mudanjiang Honglin Chemical, Shanghai Yeats Additive. Asia-Pacific region is the fastest-growing region with a market share of about 36.4% in 2023. The region is expected to grow at a CAGR of 3.6 % during the forecast period and maintain its dominance by 2030. The Asia-Pacific region, particularly China and Japan significantly affects the Calcium Lignosulfonate market. It is attributed to the increasing demand for calcium lignosulfonate in various industries such as construction, agriculture, and animal feed. North America is also expected to establish a market with steady growth.

Calcium Lignosulfonate Market Dynamics:

Rising Demand for Calcium Lignosulfonate and Sustainable Innovation Calcium lignosulfonate, a key component in construction, serves as a dispersing agent and plasticizer in concrete, enhancing workability, strength, and setting time. With global construction activity on the rise, especially in infrastructure development and urbanization projects, the demand for calcium lignosulfonate is increasing. The compound acts as a water reducer in cement mixtures, improving flow ability and pump ability while maintaining strength. It also enhances workability by reducing the water-to-cement ratio, leading to better construction practices and consistent concrete quality. Calcium lignosulfonate contributes to improved strength, durability, control of setting time, shrinkage reduction, and compatibility with other cement admixtures. Derived from renewable sources, the compound is eco-friendly and supports sustainable construction practices. The constant epidemic has highlighted the need for innovative construction methods that prioritize worker safety and adhere to industry standards. Many start-ups and scaleups are turning to prefabrication, construction robotics, and worker safety measures to ensure safer and more efficient building processes. The use of 3D printing and green building technologies is gaining popularity, as they help to reduce the negative environmental impact of construction. Calcium Lignosulfonates are primarily used as animal feed binders like Pellet binders in the animal feed industry. They provide calcium and sodium serves as inorganic electrolytes for animal health. The toxicity of lignosulfonates makes them preferred binders in feed manufacturers.Calcium Lignosulfonate Market Restraints: Calcium Lignosulfonate faces chemical alternatives and additives that have a similar quality to calcium Lignosulphate chemical. The high cost of raw materials used in the production of calcium Lignosulfonate market is the price issue that hampers the development of the Calcium Lignosulfonate Market. Lignosulfonates have high water solubility, when exposed to excessive rain the calcium lignosulfonate is leached out of concrete and other applications. They reduce the efficacy and require more repeat application, which increases the costs. The excessive use of concrete with high water solubility significantly obstructs the formation of strong cement bonds, in turn, can severely compromise the overall strength of the concrete. Leaching of calcium lignosulfonate from applications is introduced into the surrounding environment. Depending on the concentration and local regulations, environmental concerns, require extra measures to moderate its impact. Therefore, manufacturers are constantly working on developing modified versions of calcium lignosulfonate with reduced water solubility while maintaining its beneficial properties. It helps to address restraint and broaden the applicability of calcium lignosulfonate in various industries.

Trends of Calcium Lignosulfonate Market:

Manufacturers are focusing on leveraging lignin-based biopolymers and increasing output capacities for calcium lignosulfonate to meet the growing demand in industries like oil well drilling fluids, pigments dispersion, cement additives, ceramic body reinforcement, and more the technique effectively satisfies a variety of application needs while being in line with sustainability standards. Calcium lignosulfonate is a water-soluble compound that finds its use in various products, including oil drilling muds, concrete admixtures and agricultural chemicals. It has high binding and dispersion sustainability, as well as emulsifying properties, making it useful in dust suppressants and ceramics. Calcium lignosulfonate is also used in organic polymerization, which has helped in expanding the market for it. The market for calcium lignosulfonate has been growing due to the commercial availability of calcium and sodium salts, leading to several profitable opportunities in the industry.Calcium Lignosulfonate Market Segment Analysis:

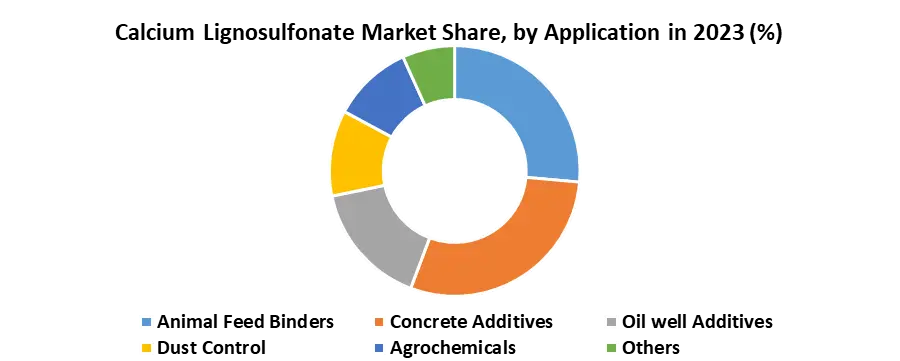

Based on Type, the Sodium Lignosulfonate segment holds the largest market share of about 39.23% in the Calcium Lignosulfonate Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 3.3% during the forecast period and maintain its dominance till 2030. The demand for sodium lignosulfonate is growing because of its properties such as binding capacity and viscosity including oil well. Sodium lignosulfonate is widely used for water solubility and dispersing agents like concrete admixtures, ceramic production, and textile dyes. Based on Application, the Concrete Additives Segment held the largest market share in the Calcium Lignosulfonate Market in 2023 and is expected to maintain its dominance till 2030 Calcium Lignosulphonates increase the strength of cement concrete and many admixtures used in lignosulphonates to enhance the durability of the cement. Its primary function is to improve the workability of concrete mixes by reducing water contents and maintaining its flow. Animal feed binder is growing in the calcium lignosulfonate market because a binder in animal feed pellets, prevents disintegrating and dust formation during transportation and storage It also improves pellet quality and digestibility for animals.

Calcium Lignosulfonate Market Regional Analysis:

Europe dominates the Calcium Lignosulfonate Market with the largest market share accounting for 46.03% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. Europe region has been dominating thanks to European Government regulations favoring sustainable products like calcium lignosulfonate enhancing its market stability and driving the calcium Lignosulfonate Market. The strong presence of established industries, which use calcium lignosulfonate, such as the construction and animal feed industries. A robust infrastructure supports its production and distribution.North America is growing in the Calcium Lignosulfonate Market holds a market share of 22.6% and is significantly growing during its forecast period. North America has steady growth because of the increasing demand for calcium Lignosulfonate in industries in Construction, Agriculture, and Animal feed, regulatory policies, economic conditions, and technological advancements. The rising construction projects in the region, mainly in the United States and Canada, have been a significant cater for the calcium lignosulphonate market. The use of calcium lignosulphonate in agriculture for soil stabilization and dust control has contributed to the growth of the Calcium Lignosulphonate market. Competitive Landscape for Calcium Lignosulfonate Market: The competitive landscape of the Calcium Lignosulfonate Market is constantly evolving, with new players emerging and established players adapting their strategies. A key component of their strategy is their constant commitment to research and development (R&D) to maintain a leading position in technological development. Building Partnerships and collaboration with established players, research institutions, and investors to leverage expertise and resources. 1. In October 2020, Borregaard and Sappi Group, who are the owners of Lignotech South Africa, decided to discontinue the production of Lignin in South Africa. 2. Borregaard has invested 100 million in a new green technology platform to produce lignin-based biopolymers and other products at their Sarpsborg biorefinery. 3. Nippon Paper Industries initiated cooperative marine transport with Daio Paper Corporation to achieve a modal shift in product transport, aiming to reduce CO2 emissions and contribute to a sustainable society 4. Nippon Paper Crecia Co., Ltd. continues its collaboration with Körber Business, emphasizing efficiency in its operations. 5. Burgo Group is part of the Together for Sustainable Packaging alliance, which aims to promote a truly sustainable approach to the EU’s Packaging and Packaging Waste Regulation (PPWR) by advocating for environmentally friendly packaging solutions.

Calcium Lignosulfonate Market Scope: Inquire before buying

Global Calcium Lignosulfonate Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 923.40 Mn. Forecast Period 2024 to 2030 CAGR: 3.7% Market Size in 2030: US $ 1190.81 Mn. Segments Covered: by Type Sodium Lignosulphonate Calcium Lignosulphonate Magnesium Lignosulphonate Others by Application Animal Feed Binders Concrete Additives Oil well Additives Dust Control Agrochemicals Others Calcium Lignosulfonate Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Calcium Lignosulfonate Market Key Players:

North America: 1) Borregaard(Norway) 2) Rayonier Advanced Material (US) 3) Dallas Group Of America (US) 4) Ingevity (US) 5) Tembec Inc (Canada) 6) Flambeau River Papers(Wisconsin) Europe: 1) Domsjo Fabriker (Sweden) 2) Burgo Group S.p.A (Italy) 3) Mosaico SRL (Italy) 4) Lignostar Group 5) Innova Priority Solutions (Italy) 6) Biotech Lignosulphonate Handle GMBH Asia-Pacific Region: 1) Henan Yulin Chemical Co. Ltd. (China) 2) Shandong Jufu Chemical (China) 3) Wuhan Xinyingda Chemicals Co. Ltd. ( China) 4) Abelin Polymers (India) 5) Cardinal Chemicals Pvt Ltd. (India) 6) Nippon Paper Industries Co. ltd. (Japan) 7) Tokyo Chemical Industry (Japan) 8) Tianjin Yeat Additives Co. Ltd. (China) 9) GREENaGROCHEM (China) 10) Shenyang Xingzhenghe Chemical Co. Ltd. (China) 11) HUBEI AGING CHEMICAL COMPANY (China) 12) Mudanjiang Honglin Chemical (China) 13) Shanghai Yeats Additive (China) Middle East & Africa: 1) Sappi Limited (South Africa) Frequently Asked Questions: 1] What is the growth rate of the Calcium Lignosulfonate Market? Ans. The Calcium Lignosulfonate Market is expected to grow at a CAGR of 3.7% during the forecast period of 2023 to 2030. 2] Which region is expected to hold the highest share in the Calcium Lignosulfonate Market? Ans. North America region is expected to hold the highest share of the Calcium Lignosulfonate Market. 3] What is the market size of the Calcium Lignosulfonate Market? Ans. The Calcium Lignosulfonate Market size was valued at USD 923.40 Million in 2023 reaching nearly USD 1190.81 Million in 2030. 4] What is the forecast period for the Calcium Lignosulfonate Market? Ans. The forecast period for the Calcium Lignosulfonate Market is 2023-2030. 5] What segments are covered in the Calcium Lignosulfonate Market report? Ans. The segments covered in the Calcium Lignosulfonate Market report are based on Type and Application.

1. Calcium Lignosulfonate Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Calcium Lignosulfonate Market: Dynamics 2.1. Calcium Lignosulfonate Market Trends by Region 2.1.1. North America Calcium Lignosulfonate Market Trends 2.1.2. Europe Calcium Lignosulfonate Market Trends 2.1.3. Asia Pacific Calcium Lignosulfonate Market Trends 2.1.4. Middle East and Africa Calcium Lignosulfonate Market Trends 2.1.5. South America Calcium Lignosulfonate Market Trends 2.2. Calcium Lignosulfonate Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Calcium Lignosulfonate Market Drivers 2.2.1.2. North America Calcium Lignosulfonate Market Restraints 2.2.1.3. North America Calcium Lignosulfonate Market Opportunities 2.2.1.4. North America Calcium Lignosulfonate Market Challenges 2.2.2. Europe 2.2.2.1. Europe Calcium Lignosulfonate Market Drivers 2.2.2.2. Europe Calcium Lignosulfonate Market Restraints 2.2.2.3. Europe Calcium Lignosulfonate Market Opportunities 2.2.2.4. Europe Calcium Lignosulfonate Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Calcium Lignosulfonate Market Drivers 2.2.3.2. Asia Pacific Calcium Lignosulfonate Market Restraints 2.2.3.3. Asia Pacific Calcium Lignosulfonate Market Opportunities 2.2.3.4. Asia Pacific Calcium Lignosulfonate Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Calcium Lignosulfonate Market Drivers 2.2.4.2. Middle East and Africa Calcium Lignosulfonate Market Restraints 2.2.4.3. Middle East and Africa Calcium Lignosulfonate Market Opportunities 2.2.4.4. Middle East and Africa Calcium Lignosulfonate Market Challenges 2.2.5. South America 2.2.5.1. South America Calcium Lignosulfonate Market Drivers 2.2.5.2. South America Calcium Lignosulfonate Market Restraints 2.2.5.3. South America Calcium Lignosulfonate Market Opportunities 2.2.5.4. South America Calcium Lignosulfonate Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Calcium Lignosulfonate Industry 2.8. Analysis of Government Schemes and Initiatives For Calcium Lignosulfonate Industry 2.9. Calcium Lignosulfonate Market Trade Analysis 2.10. The Global Pandemic Impact on Calcium Lignosulfonate Market 3. Calcium Lignosulfonate Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 3.1.1. Sodium Lignosulphonate 3.1.2. Calcium Lignosulphonate 3.1.3. Magnesium Lignosulphonate 3.1.4. Others 3.2. Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 3.2.1. Animal Feed Binders 3.2.2. Concrete Additives 3.2.3. Oil well Additives 3.2.4. Dust Control 3.2.5. Agrochemicals 3.2.6. Others 3.3. Calcium Lignosulfonate Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Calcium Lignosulfonate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 4.1.1. Sodium Lignosulphonate 4.1.2. Calcium Lignosulphonate 4.1.3. Magnesium Lignosulphonate 4.1.4. Others 4.2. North America Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 4.2.1. Animal Feed Binders 4.2.2. Concrete Additives 4.2.3. Oil well Additives 4.2.4. Dust Control 4.2.5. Agrochemicals 4.2.6. Others 4.3. North America Calcium Lignosulfonate Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Sodium Lignosulphonate 4.3.1.1.2. Calcium Lignosulphonate 4.3.1.1.3. Magnesium Lignosulphonate 4.3.1.1.4. Others 4.3.1.2. United States Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Animal Feed Binders 4.3.1.2.2. Concrete Additives 4.3.1.2.3. Oil well Additives 4.3.1.2.4. Dust Control 4.3.1.2.5. Agrochemicals 4.3.1.2.6. Others 4.3.2. Canada 4.3.2.1. Canada Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Sodium Lignosulphonate 4.3.2.1.2. Calcium Lignosulphonate 4.3.2.1.3. Magnesium Lignosulphonate 4.3.2.1.4. Others 4.3.2.2. Canada Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Animal Feed Binders 4.3.2.2.2. Concrete Additives 4.3.2.2.3. Oil well Additives 4.3.2.2.4. Dust Control 4.3.2.2.5. Agrochemicals 4.3.2.2.6. Others 4.3.3. Mexico 4.3.3.1. Mexico Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Sodium Lignosulphonate 4.3.3.1.2. Calcium Lignosulphonate 4.3.3.1.3. Magnesium Lignosulphonate 4.3.3.1.4. Others 4.3.3.2. Mexico Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Animal Feed Binders 4.3.3.2.2. Concrete Additives 4.3.3.2.3. Oil well Additives 4.3.3.2.4. Dust Control 4.3.3.2.5. Agrochemicals 4.3.3.2.6. Others 5. Europe Calcium Lignosulfonate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.2. Europe Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3. Europe Calcium Lignosulfonate Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Calcium Lignosulfonate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Calcium Lignosulfonate Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Calcium Lignosulfonate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Calcium Lignosulfonate Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 8. South America Calcium Lignosulfonate Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 8.2. South America Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 8.3. South America Calcium Lignosulfonate Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Calcium Lignosulfonate Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Calcium Lignosulfonate Market Size and Forecast, by Application (2023-2030) 9. Global Calcium Lignosulfonate Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Calcium Lignosulfonate Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Borregaard(Norway) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Rayonier Advanced Material (US) 10.3. Dallas Group Of America (US) 10.4. Ingevity (US) 10.5. Tembec Inc (Canada) 10.6. Flambeau River Papers (Wisconsin) 10.7. Domsjo Fabriker (Sweden) 10.8. Burgo Group (Italy) 10.9. Mosaico SRL (Italy) 10.10. Lignostar Group 10.11. Innova Priority Solutions (Italy) 10.12. Biotech Lignosulphonate Handle GMBH 10.13. Henan Yulin Chemical Co. Ltd. (China) 10.14. Shandong Jufu Chemical (China) 10.15. Wuhan Xinyingda Chemicals Co. Ltd. ( China) 10.16. Abelin Polymers (India) 10.17. Cardinal Chemicals Pvt Ltd. (India) 10.18. Nippon Paper Industries Co. ltd. (Japan) 10.19. Tokyo Chemical Industry (Japan) 10.20. Tianjin Yeat Additives Co. Ltd. (China) 10.21. GREENaGROCHEM (China) 10.22. Shenyang Xingzhenghe Chemical Co. Ltd. (China) 10.23. HUBEI AGING CHEMICAL COMPANY (China) 10.24. Mudanjiang Honglin Chemical (China) 10.25. Shanghai Yeats Additive (China) 10.26. Sappi Limited (South Africa) 11. Key Findings 12. Industry Recommendations 13. Calcium Lignosulfonate Market: Research Methodology 14. Terms and Glossary