Global Biostimulants Market size was valued at USD 3.90 Billion in 2023 and the total Global Biostimulants revenue is expected to grow at 12.2 % from 2024 to 2030, reaching nearly USD 8.73 Billion by 2030. Biostimulants are substances, which work like microorganisms to improve nutrient use efficiency, tolerance to abiotic stress, and crop quality traits. Biostimulants, when applied to plants or the rhizosphere, stimulate natural processes independent of the product's nutrient content. Biostimulants are becoming increasingly important in the development of sustainable agriculture techniques.To know about the Research Methodology :- Request Free Sample Report The biostimulants market is experiencing robust growth driven by key factors like the demand for high-value crops, and plantation crops. Sustainable and environmentally friendly alternatives to traditional agrochemicals are the main drivers of the biostimulant market. By the segment of active ingredients, the humic acid and amino acid have the largest share in the biostimulant market. Amino acid-based biostimulant has the largest share approximately 31% due to increasing demand for organic food and beverages. Europe dominates the biostimulants market share of 43.9% in 2023, followed by North America and Asia-Pacific. The major players in the biostimulants market include BASF, Bayer CropScience, Novozymes A/S, Koppert Biological Systems, Verdesian Life Sciences, Lallemand Plant Care, Valagro, Syngenta, West Coast Marine Bio-Processing Corp., Italpollina S.p.A, these key players are investing in various R&D department for new innovative products.

Biostimulants Market Dynamics:

Sustainable Agriculture Drives the Biostimulants Market Biostimulants enhance nutrients in plants. Use of fertilizers, reducing the need for excessive application and minimizing nutrient runoff, which contributes to water pollution, Biostimulants elevate crop quality but also contribute to sustainable and eco-friendly agricultural practices, promote a healthy ecosystem by preserving beneficial organisms and reducing the impact of harmful chemicals on the environment. This Quality of biostimulants drives the Biostimulants market. Environmental stresses, like drought, salinity, and temperature fluctuations lead to more challenging conditions, Biostimulants improve a crop's ability to withstand and reduce the risk of crop failure. Organic Farming Practices Drives the Biostimulants Market Growth Biostimulants are compatible with organic farming and provide a natural and sustainable alternative to adhere to organic certification standards while still achieving crop productivity, which drives the Biostimulants market growth. Organic farming is expected to grow during the forecast period. Some Biostimulants contain beneficial microorganisms that help nutrients and contribute to sustainable nutrient organization. The organic farming market was valued at USD 173 billion in 2023. The organic farming market is expected to have a CAGR of 10.41% from 2024 to 2030. The increasing demand for organic food significant driver of the Biostimulants market. Asia Pacific region led the biostimulant market, due to increasing demand for organic farming with rising disposal income and urbanization. High Cost and Limited Product Availability Restraint the Biostimulant Market Growth The biostimulants market faces a challenge in the form of high production costs, requiring high investments in research and development. The increase in amount of time taken by key players to manufacture a new product creates challenges to biostimulants market growth and that leads to limited product availability, adding another level of complexity, and hindering market growth. Innovative Product Development and Collaborative R&D Drive Biostimulants Market Growth Innovative biostimulant products exhibit effectiveness across a diverse range of crops. Key industry players like West Coast Marine Bio-Processing Corp., Italpollina S.p.A are developing unique and effective biostimulants, positioning themselves for substantial market expansion. Collaboration with research and development departments and significant investments in internal R&D initiatives to more sustainable and effective biostimulant products. Rising consumer preferences for organic products expect biostimulants market growth. Research initiatives lead to continuous product innovation and the evolving needs of the agricultural sector.Biostimulants Market Segment Analysis:

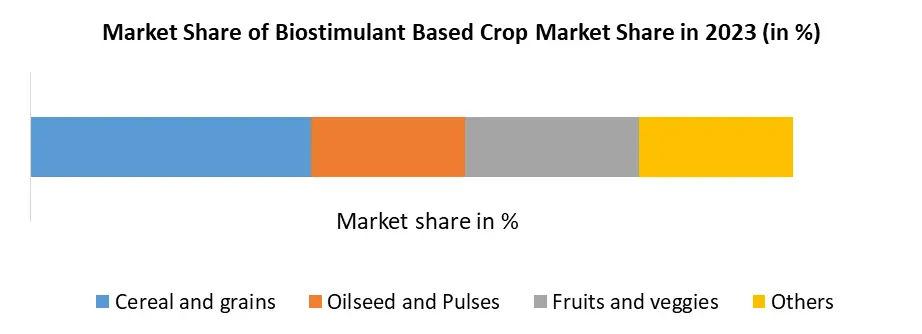

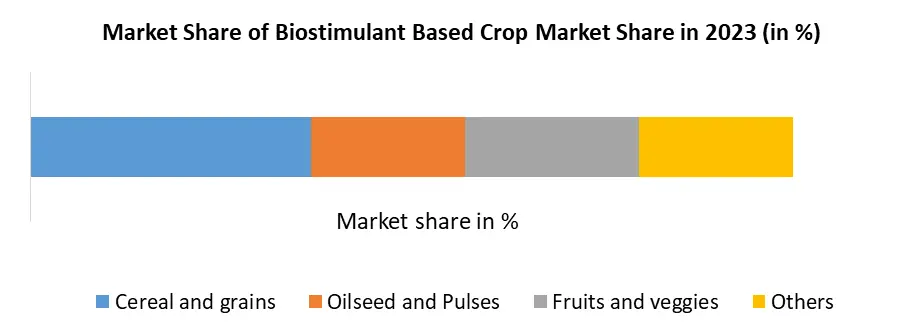

By Active Ingredient, humic compounds are naturally occurring by-products of fungi, bacteria, and the chemical breakdown of plant and animal waste in soils. Biostimulants based on humic acid accounted for a significant share globally. Throughout the forecast period, biostimulants based on humic acid, valued at USD 0.688 billion in 2023, are expected to grow at a CAGR of 11.52% to reach USD 1.58 billion. In 2023, the Active Ingredients sector based on amino acids took 31% of the market share, next to the segment based on humic acid.The global amino acid-based biostimulants market is expected to reach USD 3.21 Billion by 2030, growing at a CAGR of 11.2% during the forecast period. Amino acid-based biostimulants are popular in the agricultural field because of their capacity to increase plant growth and tolerance to stress. Seaweed extracts contain a variety of nutritional metal components, including aluminum, iron, nitrogen, potassium, manganese, and plant development compounds like cytokinins, auxins, and gibberellins polysaccharides. These elements primarily function as biostimulants. Seaweed extracts primarily come in three varieties: brown, green, and red algal extracts. By Crop Type, The biostimulants market is further categorized into Cereals and grains, Oilseeds and pulses, Fruits and vegetables, Turfs and ornamentals, and others (forage and plantation crops). The organic biostimulants-based cereals and grains held the largest market share of 14.5% in 2023, the organic cereal and grains market has grown at a CAGR of 5-6% in 2023 and is expected to hold a steady position during the forecast period (2024-2030). The crops like corn, soybeans, barley, oats, millets, and cotton are grown broadly across the globe and offer productive growth opportunities for the biostimulants industry. Biostimulants increase the percentage of seed size, cell division, and yields for row crops such as barley, corn, and soybeans. They contain amino acids, polyamines, and indole-3-acetic acid (IAA), which help in controlling barriers to cell division and cell growth.

Biostimulants Market Regional Insights:

Europe dominated the biostimulants market, with a market share of 43.9% in 2023. Followed by North America and Asia-Pacific. The demand for organic products such as biostimulants is a rising trend in the EU, Europe many biostimulant key players like BASF SE (Germany) BASF SE's biostimulants segment is to be around USD 200 million in 2023, Valagro offers a wide range of humic and Fulvic acids-based biostimulants in Europe. The United States is the largest biostimulants market in the region, next to Canada. Throughout the forecast period, the Asia-Pacific biostimulants market is driven by rising consumer demand for food safety as well as enhanced crop productivity and quality. China holds the greatest market share in this region. Due to the increasing demand for environmentally friendly farming methods and food safety concerns, the biostimulants market is growing in South America. In the region, Brazil holds the greatest market share, followed by Argentina and Mexico. Competitive Landscapes: On April 19, 2023, Tradecorp agricultural industry leaders, experts, and innovators, gathered in Barcelona at the leading biostimulant conference Industry talks about various trends, recent developments, and innovations. Tradecorp's agricultural industry is developing innovative research projects such as BIOTOOL with Italian research center LANDLAB collaboration. The project aims to examine the effect of seaweed-based biostimulants on plants and improve crop yields through efficient water management, studies show that a reduction of around 25-40% of water and the use of novel biostimulants are effective in maintaining plants active with the same level of production. On December 6, 2023, Yara launched its first biostimulant product YaraAmplix, in China Their purpose is to maximize crop yield and quality via the improvement of crops. With huge market potential China is the largest biostimulant market in the Asia-Pacific region, with a market value of about USD 152 million at a CAGR approx. 11%. YaraAmplix is a highly concentrated liquid biostimulant containing the yellow tang extract. They have a high content of bioactive ingredients, which activate the natural mechanism of plants, improves nutrient efficiency, effectively promote crop growth, and improve plant tolerance to abiotic stresses such as drought or extreme temperature.

Biostimulants Market Scope: Inquiry Before Buying

Global Biostimulants Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 3.90 Bn. Forecast Period 2024 to 2030 CAGR: 12.2% Market Size in 2030: US $ 8.73 Bn. Segments Covered: by Active Ingredients Humic substances Humic acid Fulvic acid Seaweed extracts Microbial amendments Amino acids Other active ingredients (include vitamins, trace minerals, and polysaccharides) by Crop Type Cereals & grains Oilseeds & pulses Fruits & vegetables Turfs & ornamentals Others (forage and plantation crops) by Application Foliar Soil Treatment Seed Treatment by Form Liquid Dry Biostimulants Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Biostimulants Market Key Players:

Key Players in the North American Biostimulants Market 1. Actagro LLC 2. Agrinos 3. Hello Nature USA Inc. 4. Humic Growth Solutions Inc. 5. Valagro USA 6. Gowanda Group 7. Lallemand Inc. 8. Summit Agro Key Players in the South American Biostimulants Market 1.Biolchim SPA 2.Atlantica Agricola 3.Vittia Group Key Players in the Europe Biostimulants Market 1. BASF SE 2. Valagro S.p.A 3. ILSA S.p.A 4. Italpollina Spa 5. Tradecorp International 6. Key Players in the Asia Pacific Biostimulants Market 7. Rallis India Limited 8. Haifa Group 9. Biostadt India Limited 10. UPL FAQs: 1. What are the growth drivers for the Biostimulants market? Ans. The increasing Organic farming and sustainability in agriculture are the major drivers for the biostimulants market. 2. Which sector is expected to grow the Biostimulants Market? Ans. The Organic farming industries are expected to grow in the Biostimulants Market during the forecast period. 3. Which region is expected to lead the global Biostimulants Market during the forecast period? Ans. North America is expected to lead the global Biostimulants Market during the forecast period. 4. What is the projected market size and growth rate of the Market? Ans. The biostimulants market size was valued at USD 3.90 Billion in 2023 and the total Biostimulants revenue is expected to grow at a CAGR of 12.2% from 2024 to 2030, reaching nearly USD 8.73 Billion by 2030. 5. What segments are covered in the Market report? Ans. The segments covered in the Market report are Active Ingredients, Application, Form, Crop Type, and Region.

1. Biostimulants Market: Research Methodology 2. Biostimulants Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Biostimulants Market: Dynamics 3.1 Biostimulants Market Trends by Region 3.1.1 Global Biostimulants Market Trends 3.1.2 North America Biostimulants Market Trends 3.1.3 Europe Biostimulants Market Trends 3.1.4 Asia Pacific Biostimulants Market Trends 3.1.5 Middle East and Africa Biostimulants Market Trends 3.1.6 South America Biostimulants Market Trends 3.2 Biostimulants Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Biostimulants Market Drivers 3.2.1.2 North America Biostimulants Market Restraints 3.2.1.3 North America Biostimulants Market Opportunities 3.2.1.4 North America Biostimulants Market Challenges 3.2.2 Europe 3.2.2.1 Europe Biostimulants Market Drivers 3.2.2.2 Europe Biostimulants Market Restraints 3.2.2.3 Europe Biostimulants Market Opportunities 3.2.2.4 Europe Biostimulants Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Biostimulants Market Drivers 3.2.3.2 Asia Pacific Biostimulants Market Restraints 3.2.3.3 Asia Pacific Biostimulants Market Opportunities 3.2.3.4 Asia Pacific Biostimulants Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Biostimulants Market Drivers 3.2.4.2 Middle East and Africa Biostimulants Market Restraints 3.2.4.3 Middle East and Africa Biostimulants Market Opportunities 3.2.4.4 Middle East and Africa Biostimulants Market Challenges 3.2.5 South America 3.2.5.1 South America Biostimulants Market Drivers 3.2.5.2 South America Biostimulants Market Restraints 3.2.5.3 South America Biostimulants Market Opportunities 3.2.5.4 South America Biostimulants Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power of Suppliers 3.3.2 Bargaining Power of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Biostimulants Industry 3.8 The Global Pandemic and Redefining of The Biostimulants Industry Landscape 3.9 Technological Road Map 3.10 Global Biostimulants Trade Analysis (2018-2023) 3.10.1 Global Import of Biostimulants 3.10.2 Global Export of Biostimulants 4. Global Biostimulants Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 4.1 Global Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 4.1.1 Humic substances 4.1.2 Humic acid 4.1.3 Fulvic acid 4.1.4 Seaweed extracts 4.1.5 Microbial amendments 4.1.6 Amino acids 4.1.7 Other active ingredients (include vitamins, trace minerals, and polysaccharides) 4.2 Global Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 4.2.1 Gasoline 4.2.2 MTO/MTP 4.2.3 Formaldehyde 4.2.4 Methyl Tertiary Butyl Ether (MTBE) 4.2.5 Acetic Acid 4.2.6 Dimethyl Ether (DME) 4.2.7 Methyl Methacrylate (MMA) 4.2.8 Biodiesel 4.2.9 Others 4.3 Global Biostimulants Market Size and Forecast, By Application (2024-2030) 4.3.1 Gasoline additives 4.3.2 Olefins 4.3.3 UF/PF resins 4.3.4 VAM 4.3.5 Polyacetals 4.3.6 MDI 4.3.7 PTA 4.3.8 Acetate Esters 4.3.9 Acetic anhydride 4.3.10 Fuels 4.4 Global Biostimulants Market Size and Forecast, By Form (2024-2030) 4.4.1 Liquid 4.4.2 Dry 4.5 Global Biostimulants Market Size and Forecast, by Region (2024-2030) 4.5.1 North America 4.5.2 Europe 4.5.3 Asia Pacific 4.5.4 Middle East and Africa 4.5.5 South America 5. North America Biostimulants Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 5.1 North America Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 5.1.1 Humic substances 5.1.2 Humic acid 5.1.3 Fulvic acid 5.1.4 Seaweed extracts 5.1.5 Microbial amendments 5.1.6 Amino acids 5.1.7 Other active ingredients (include vitamins, trace minerals, and polysaccharides) 5.2 North America Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 5.2.1 Cereals & grains 5.2.2 Oilseeds & pulses 5.2.3 Fruits & vegetables 5.2.4 Turfs & ornamentals 5.2.5 Others (forage and plantation crops) 5.3 North America Biostimulants Market Size and Forecast, By Application (2024-2030) 5.3.1 Foliar 5.3.2 Soil Treatment 5.3.3 Seed Treatment 5.4 North America Biostimulants Market Size and Forecast, By Form (2024-2030) 5.4.1 Liquid 5.4.2 Dry 5.5 North America Biostimulants Market Size and Forecast, by Country (2024-2030) 5.5.1 United States 5.5.1.1 United States Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 5.5.1.1.1 Humic substances 5.5.1.1.2 Humic acid 5.5.1.1.3 Fulvic acid 5.5.1.1.4 Seaweed extracts 5.5.1.1.5 Microbial amendments 5.5.1.1.6 Amino acids 5.5.1.1.7 Other active ingredients (include vitamins, trace minerals, and polysaccharides) 5.5.1.2 United States Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 5.5.1.2.1 Cereals & grains 5.5.1.2.2 Oilseeds & pulses 5.5.1.2.3 Fruits & vegetables 5.5.1.2.4 Turfs & ornamentals 5.5.1.2.5 Others (forage and plantation crops) 5.5.1.3 United States Biostimulants Market Size and Forecast, By Application (2024-2030) 5.5.1.3.1 Foliar 5.5.1.3.2 Soil Treatment 5.5.1.3.3 Seed Treatment 5.5.1.4 United States Biostimulants Market Size and Forecast, By Form (2024-2030) 5.5.1.4.1 Liquid 5.5.1.4.2 Dry 5.5.2 Canada 5.5.2.1 Canada Biostimulants Market Size and Forecast, By Active Ingredient (2024-2030) 5.5.2.1.1 Humic substances 5.5.2.1.2 Humic acid 5.5.2.1.3 Fulvic acid 5.5.2.1.4 Seaweed extracts 5.5.2.1.5 Microbial amendments 5.5.2.1.6 Amino acids 5.5.2.1.7 Other active ingredients (include vitamins, trace minerals, and polysaccharides) 5.5.2.2 Canada Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 5.5.2.2.1 Cereals & grains 5.5.2.2.2 Oilseeds & pulses 5.5.2.2.3 Fruits & vegetables 5.5.2.2.4 Turfs & ornamentals 5.5.2.2.5 Others (forage and plantation crops) 5.5.2.3 Canada Biostimulants Market Size and Forecast, By Application (2024-2030) 5.5.2.3.1 Foliar 5.5.2.3.2 Soil Treatment 5.5.2.3.3 Seed Treatment 5.5.2.4 Canada Biostimulants Market Size and Forecast, By Form (2024-2030) 5.5.2.4.1 Liquid 5.5.2.4.2 Dry 5.5.3 Mexico 5.5.3.1 Mexico Biostimulants Market Size and Forecast, By Active Ingredient (2024-2030) 5.5.3.1.1 Humic substances 5.5.3.1.2 Humic acid 5.5.3.1.3 Fulvic acid 5.5.3.1.4 Seaweed extracts 5.5.3.1.5 Microbial amendments 5.5.3.1.6 Amino acids 5.5.3.1.7 Other active ingredients (include vitamins, trace minerals, and polysaccharides) 5.5.3.2 Mexico Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 5.5.3.2.1 Cereals & grains 5.5.3.2.2 Oilseeds & pulses 5.5.3.2.3 Fruits & vegetables 5.5.3.2.4 Turfs & ornamentals 5.5.3.2.5 Others (forage and plantation crops) 5.5.3.3 Mexico Biostimulants Market Size and Forecast, By Application (2024-2030) 5.5.3.3.1 Foliar 5.5.3.3.2 Soil Treatment 5.5.3.3.3 Seed Treatment 5.5.3.4 Mexico Biostimulants Market Size and Forecast, By Form (2024-2030) 5.5.3.4.1 Liquid 5.5.3.4.2 Dry 6. Europe Biostimulants Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 6.1 Europe Biostimulants Market Size and Forecast, By Active Ingredient (2024-2030) 6.2 Europe Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.3 Europe Biostimulants Market Size and Forecast, By Application (2024-2030) 6.4 Europe Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5 Europe Biostimulants Market Size and Forecast, by Country (2024-2030) 6.5.1 United Kingdom 6.5.1.1 United Kingdom Biostimulants Market Size and Forecast, By Active Ingredient (2024-2030) 6.5.1.2 United Kingdom Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.1.3 United Kingdom Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.1.4 United Kingdom Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.2 France 6.5.2.1 France Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.2.2 France Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.2.3 France Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.2.4 France Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.3 Germany 6.5.3.1 Germany Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.3.2 Germany Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.3.3 Germany Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.3.4 Germany Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.4 Italy 6.5.4.1 Italy Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.4.2 Italy Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.4.3 Italy Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.4.4 Italy Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.5 Spain 6.5.5.1 Spain Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.5.2 Spain Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.5.3 Spain Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.5.4 Spain Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.6 Sweden 6.5.6.1 Sweden Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.6.2 Sweden Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.6.3 Sweden Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.6.4 Sweden Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.7 Austria 6.5.7.1 Austria Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.7.2 Austria Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 6.5.7.3 Austria Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.7.4 Austria Biostimulants Market Size and Forecast, By Form (2024-2030) 6.5.8 Rest of Europe 6.5.8.1 Rest of Europe Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 6.5.8.2 Rest of Europe Biostimulants Market Size and Forecast, By Crop Type (2024-2030). 6.5.8.3 Rest of Europe Biostimulants Market Size and Forecast, By Application (2024-2030) 6.5.8.4 Rest of Europe Biostimulants Market Size and Forecast, By Form (2024-2030) 7. Asia Pacific Biostimulants Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 7.1 Asia Pacific Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.2 Asia Pacific Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.3 Asia Pacific Biostimulants Market Size and Forecast, By Application (2024-2030) 7.4 Asia Pacific Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5 Asia Pacific Biostimulants Market Size and Forecast, by Country (2024-2030) 7.5.1 China 7.5.1.1 China Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.1.2 China Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.1.3 China Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.1.4 China Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.2 South Korea 7.5.2.1 S Korea Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.2.2 S Korea Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.2.3 S Korea Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.2.4 S Korea Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.3 Japan 7.5.3.1 Japan Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.3.2 Japan Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.3.3 Japan Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.3.4 Japan Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.4 India 7.5.4.1 India Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.4.2 India Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.4.3 India Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.4.4 India Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.5 Australia 7.5.5.1 Australia Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.5.2 Australia Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.5.3 Australia Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.5.4 Australia Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.6 Indonesia 7.5.6.1 Indonesia Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.6.2 Indonesia Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.6.3 Indonesia Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.6.4 Indonesia Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.7 Malaysia 7.5.7.1 Malaysia Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.7.2 Malaysia Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.7.3 Malaysia Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.7.4 Malaysia Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.8 Vietnam 7.5.8.1 Vietnam Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.8.2 Vietnam Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.8.3 Vietnam Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.8.4 Vietnam Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.9 Taiwan 7.5.9.1 Taiwan Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.9.2 Taiwan Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.9.3 Taiwan Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.9.4 Taiwan Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.10 Bangladesh 7.5.10.1 Bangladesh Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.10.2 Bangladesh Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.10.3 Bangladesh Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.10.4 Bangladesh Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.11 Pakistan 7.5.11.1 Pakistan Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.11.2 Pakistan Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.11.3 Pakistan Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.11.4 Pakistan Biostimulants Market Size and Forecast, By Form (2024-2030) 7.5.12 Rest of Asia Pacific 7.5.12.1 Rest of Asia Pacific Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 7.5.12.2 Rest of Asia Pacific Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 7.5.12.3 Rest of Asia Pacific Biostimulants Market Size and Forecast, By Application (2024-2030) 7.5.12.4 Rest of Asia Pacific Biostimulants Market Size and Forecast, By Form (2024-2030) 8. Middle East and Africa Biostimulants Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 8.1 Middle East and Africa Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 8.2 Middle East and Africa Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 8.3 Middle East and Africa Biostimulants Market Size and Forecast, By Application (2024-2030) 8.4 Middle East and Africa Biostimulants Market Size and Forecast, By Form (2024-2030) 8.5 Middle East and Africa Biostimulants Market Size and Forecast, by Country (2024-2030) 8.5.1 South Africa 8.5.1.1 South Africa Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 8.5.1.2 South Africa Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 8.5.1.3 South Africa Biostimulants Market Size and Forecast, By Application (2024-2030) 8.5.1.4 South Africa Biostimulants Market Size and Forecast, By Form (2024-2030) 8.5.2 GCC 8.5.2.1 GCC Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 8.5.2.2 GCC Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 8.5.2.3 GCC Biostimulants Market Size and Forecast, By Application (2024-2030) 8.5.2.4 GCC Biostimulants Market Size and Forecast, By Form (2024-2030) 8.5.3 Egypt 8.5.3.1 Egypt Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 8.5.3.2 Egypt Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 8.5.3.3 Egypt Biostimulants Market Size and Forecast, By Application (2024-2030) 8.5.3.4 Egypt Biostimulants Market Size and Forecast, By Form (2024-2030) 8.5.4 Nigeria 8.5.4.1 Nigeria Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 8.5.4.2 Nigeria Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 8.5.4.3 Nigeria Biostimulants Market Size and Forecast, By Application (2024-2030) 8.5.4.4 Nigeria Biostimulants Market Size and Forecast, By Form (2024-2030) 8.5.5 Rest of ME&A 8.5.5.1 Rest of ME&A Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 8.5.5.2 Rest of ME&A Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 8.5.5.3 Rest of ME&A Biostimulants Market Size and Forecast, By Application (2024-2030) 8.5.5.4 Rest of ME&A Biostimulants Market Size and Forecast, By Form (2024-2030) 9. South America Biostimulants Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2024-2030) 9.1 South America Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 9.2 South America Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 9.3 South America Biostimulants Market Size and Forecast, By Application (2024-2030) 9.4 South America Biostimulants Market Size and Forecast, By Form (2024-2030) 9.5 South America Biostimulants Market Size and Forecast, by Country (2024-2030) 9.5.1 Brazil 9.5.1.1 Brazil Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 9.5.1.2 Brazil Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 9.5.1.3 Brazil Biostimulants Market Size and Forecast, By Application (2024-2030) 9.5.1.4 Brazil Biostimulants Market Size and Forecast, By Form (2024-2030) 9.5.2 Argentina 9.5.2.1 Argentina Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 9.5.2.2 Argentina Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 9.5.2.3 Argentina Biostimulants Market Size and Forecast, By Application (2024-2030) 9.5.2.4 Argentina Biostimulants Market Size and Forecast, By Form (2024-2030) 9.5.3 Rest Of South America 9.5.3.1 Rest Of South America Biostimulants Market Size and Forecast, By Active Ingredient(2024-2030) 9.5.3.2 Rest Of South America Biostimulants Market Size and Forecast, By Crop Type (2024-2030) 9.5.3.3 Rest Of South America Biostimulants Market Size and Forecast, By Application (2024-2030) 9.5.3.4 Rest Of South America Biostimulants Market Size and Forecast, By Form (2024-2030) 10. Global Biostimulants Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 Form Segment 10.3.4 Revenue (2023) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2023 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Biostimulants Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 BASF SE 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Rallis India Limited 11.3 Haifa Group 11.4 Biostadt India Limited 11.5 UPL 11.6 Actagro LLC 11.7 Agrinos 11.8 Hello Nature USA Inc 11.9 Humic Growth Solutions Inc 11.10 Valagro USA 11.11 Gowan Group 11.12 Lallemand Inc. 11.13 SummitAgro 11.14 Biolchim SpA 11.15 Atlantica Agricola 11.16 Vittia Group 11.17 Valagro S.p.A 11.18 ILSA S.p.A 11.19 Italpollina Spa 11.20 Tradecorp International 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary