The Cable Joints Market size was valued at USD 19.94 Billion in 2025 and the total Cable Joints revenue is expected to grow at a CAGR of 6.1% from 2025 to 2032, reaching nearly USD 30.19 Billion by 2032.Cable Joints Market Overview

Cable Joints are used to connect low, medium and high-voltage cables. The basic role of cable joints is to maintain the continuity of electrical cables over long distances. Increasing industrialization and penetration of IT&ITES worldwide has been creating lucrative opportunities for cable joint manufacturers. The report has analyzed the total market opportunity for cable joints by end user segment by countries. At the same time the report has focused on contribution of local players in the market vs big consolidated players.Cable Joints Market Research Methodology

The report includes growth hubs, opportunities, restraints and regional insights in major geographic regions such as North America, Asia Pacific, Middle East and Africa, Europe and South America. The report analyses the data through size, product penetration, new market trends and share of the market held by Cable Joints Market Key players. The report provides data regarding recent developments, partnerships and collaborations happening in the market. The report analyses the market through segments such as type, voltage and industry vertical along with their multiple sub-segments. The bottom-up approach was used to estimate the size of the market by value and volume. Primary and secondary research methods were used to collect data. Primary research was conducted based on interviews with market leaders and opinions from senior research analysts. Whereas, data from annual reports, public records and white papers from organizations were collected in secondary. Collected data was later analysed by tools such as SWOT analysis and PORTER’s five force model.To know about the Research Methodology :- Request Free Sample Report

Cable Joints Market Dynamics

Drivers: The growing demand for high-speed networking and data communication solutions with increasing demand for renewable energy is expected to drive market growth. The 5G revolution in industries indicated growth opportunities for cables and connections. The latest advancements in technology and the arrival of 5G increase the demand for speed and functionality. 5G network requires access points for better connectivity, which can be possible with a robust cable network. The expansion and adoption of the 5G network across the world are expected to drive the Cable Joints industry growth. The emergence of Industry 4.0 increased the number of interconnected devices to the network. Network traffic and data transfer are important parts of the factories. The communication advancements and digitization of the factories have enabled remote access and remote maintenance that ensures quick service. These advancements in factories are expected to drive the Market. Despite all technological advancements, it is impossible to eliminate cables and wires from usage. Also, to minimize power consumption, focus on improving safety and security and the growth in the installation of high-end electronics is expected to drive the Cable Joints Market. The increasing development and investment in the renewable energy industry is a lucrative growth opportunity for the Market. The market growth is driven by rapid industrialization and growing infrastructure in every sector in the developing economies. The government regulations in expanding transmission and distribution systems are expected to drive the growth of the market. The growing projects in developing both on and off-grid infrastructure are expected to majorly drive the market. Also, government initiatives in most countries regarding the development of renewable projects such as wind turbines, hydropower, geothermal energy, bioenergy and ocean energy are expected to drive the Cable Joints Market. Restraining factors for global Market: The uncertainty in prices of raw materials since copper is one of the raw materials used in cable manufacturing and the price of copper is determined by the state of the world economy is expected to hinder the Market. For the installation of transmission and distribution lines, it needs permission from several authorities, which slows down the process of installation and acts as a restraining factor for the Cable Joints Market. The report provides assistance to understand the process of approvals in major geographic regions along with their countries.Regional Insights of Cable Joints Market

North America held the largest share of the market in 2025 and is expected to grow at the highest CAGR of 4.9 percent during the forecast period (2025-2032). The exponential growth in the communication industry with increased investment in grid infrastructure and growing use of renewable energy sources along with advanced grid structure are expected to drive the North American Market. North America is highly dependent on raw materials and components through import, which is expected to create a restraint for the region’s Cable Joints Market. Also, SAB North America launched the SABmed line series of cables that are highly flexible and compatible. As, the company said these cables can bear high temperatures, moisture and rough handling. Such advancements by some Cable Joints Market Key Players in the region are expected to drive the North America Market. Asia Pacific is expected to hold the largest Market share throughout the forecast period. The cable joints demand is directly proportional to the growth in manufacturing and infrastructure in the power, residential and commercial sectors in the region. Developing economies such as China and India are expected to hold the largest share of the market due to all these factors. Manufacturing activities and announcements in the Middle East and Africa by Cable Joints Market Competitors such as Nexans announced Mobiway MOB drum kit, a smart packaging solution for effortless cable installation. The product is designed to make the process of manipulating and unwinding cables safe and faster. These factors are expected to drive the Middle East and Africa Cable Joints Market.

Competitive Landscape

The report provides a detailed analysis of the data regarding the Cable Joints Market Key Competitors’ business strategies, recent developments and their investment feasibility in the market. Nexans S.A., TE Connectivity Ltd., Fujikura, Prysmian Group (General Cable) and ABB Ltd are some of the major Cable Joints Key Players. On April 14, 2022, Nexans completes Centelsa’s acquisition, which indicates Nexan’s strategy to become a pure electrification player focusing on the overall value chain originating in a generation and flowing through transmission, distribution and usage of sustainable energy. On January 10, 2023, TE Connectivity acquired Smart Grid Company Kries to expand their portfolio in power grid monitoring, cable joints and protection and automation systems. The Cable Joints Market report includes detailed company profiling of Cable Joints Key Players.Segment Analysis of Market:

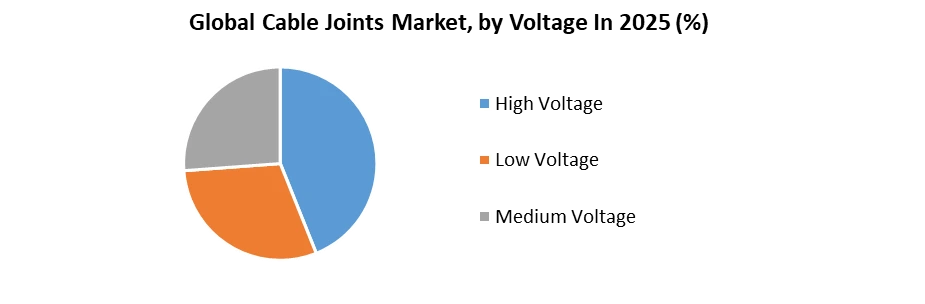

Based on Voltage, the high voltage segment held the largest share of the Cable Joints Market in 2025. The growing electricity generation and consumption due to growth in the manufacturing industry of all sectors are expected to drive the segment to hold the largest share. Strategic partnerships and collaborations are major factors for the growth of the high voltage segment. Industrial and technological developments in Market are driving the growth of the high-voltage segment. Based on Industry Vertical, the energy and power segment dominates the Cable Joints Market in segments. The increased infrastructure and the need to provide power in remote areas are driving the segment to grow in Market. The energy-producing sources are located far away from the application areas and produced energy transported through cables, to avoid any failures cable joints are used. IT & telecommunication, industrial and other segments are also expected to hold the largest share.Cable Joints Market Scope: Inquiry Before Buying

Cable Joints Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 19.94 Bn. Forecast Period 2026 to 2032 CAGR: 6.1% Market Size in 2032: USD 30.19 Bn. Segments Covered: by Type 1.Indoor 2.Outdoor by Voltage 1.High Voltage 2.Low Voltage 3.Medium Voltage by Industry Vertical 1.Industrial 2. Aerospace and defense 3. Oil and gas 4.Energy and Power 5.IT and Telecommunication 6.Others Cable Joints Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Cable Joints Key Players include:

1. Nexans S.A. 2.TE Connectivity Ltd. 3.Fujikura 4.Prysmian Group (General Cable) 5.ABB Ltd 6.Yamuna Power & Infrastructure Ltd 7.Cable Jointer Solutions 8.Connect Cable Accessories Co., Ltd. 9. Prysmian Group 10.CommScope 11. Belden 12. SAB 13. 3M 14. NKTFrequently Asked Questions:

1] What is the growth rate of the Cable Joints Market? Ans. The Cable Joints Market is growing at a CAGR of 6.1% during the forecast period. 2] Which region is expected to dominate the Cable Joints Market? Ans. North America is expected to dominate the Cable Joints Market during the forecast period from 2026 to 2032. 3] What is the expected Cable Joints Market size by 2032? Ans. The size of the Cable Joints Market by 2032 is expected to reach USD 30.19 Bn. 4] Who are the top players in the Cable Joints Market? Ans. The major key players in the Cable Joints Market are Nexans S.A., TE Connectivity Ltd, ABB, SAB and NKT. 5] Which factors contributed to the growth of the Cable Joints Market in 2025? Ans. The Cable Joints Market is expected to grow due to the increased number of interconnected devices.

1. Global Cable Joints Market: Research Methodology 2. Global Cable Joints Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Cable Joints Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Cable Joints Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Cable Joints Market Segmentation 4.1 Global Cable Joints Market, by Type (2025-2032) • Indoor • Outdoor 4.2 Global Cable Joints Market, by Voltage (2025-2032) • High Voltage • Low Voltage • Medium Voltage 4.3 Global Cable Joints Market, by Industry Vertical (2025-2032) • Industrial • Aerospace and defense • Oil and gas • Energy and Power • IT and Telecommunication • Others 5. North America Cable Joints Market(2025-2032) 5.1 North America Cable Joints Market, by Type (2025-2032) • Indoor • Outdoor 5.2 North America Cable Joints Market, by Voltage (2025-2032) • High Voltage • Low Voltage • Medium Voltage 5.3 North America Cable Joints Market, by Industry Vertical (2025-2032) • Industrial • Aerospace and defense • Oil and gas • Energy and Power • IT and Telecommunication • Others 5.4 North America Cable Joints Market, by Country (2025-2032) • United States • Canada • Mexico 6. Europe Cable Joints Market (2025-2032) 6.1. European Cable Joints Market, by Type (2025-2032) 6.2. European Cable Joints Market, by Voltage (2025-2032) 6.3. European Cable Joints Market, by Industry Vertical (2025-2032) 6.4. European Cable Joints Market, by Country (2025-2032) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Cable Joints Market (2025-2032) 7.1. Asia Pacific Cable Joints Market, by Type (2025-2032) 7.2. Asia Pacific Cable Joints Market, by Voltage (2025-2032) 7.3. Asia Pacific Cable Joints Market, by Industry Vertical (2025-2032) 7.4. Asia Pacific Cable Joints Market, by Country (2025-2032) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Cable Joints Market (2025-2032) 8.1 Middle East and Africa Cable Joints Market, by Type (2025-2032) 8.2. Middle East and Africa Cable Joints Market, by Voltage (2025-2032) 8.3. Middle East and Africa Cable Joints Market, by Industry Vertical (2025-2032) 8.4. Middle East and Africa Cable Joints Market, by Country (2025-2032) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Cable Joints Market (2025-2032) 9.1. South America Cable Joints Market, by Type (2025-2032) 9.2. South America Cable Joints Market, by Voltage (2025-2032) 9.3. South America Cable Joints Market, by Industry Vertical (2025-2032) 9.4 South America Cable Joints Market, by Country (2025-2032) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Nexans S.A. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 TE Connectivity Ltd. 10.3 Fujikura 10.4 Prysmian Group (General Cable) 10.5 ABB Ltd 10.6 Yamuna Power & Infrastructure Ltd 10.7 Cable Jointer Solutions 10.8 Connect Cable Accessories Co., Ltd. 10.9 Prysmian Group 10.10 CommScope 10.11 Belden 10.12 SAB 10.13 3M 10.14 NKT