Breast Cancer Drug Market size was valued at USD 32.5 Billion in 2022 and the total Breast Cancer Drug revenue is expected to grow at a CAGR of 14.8% from 2023 to 2029, reaching nearly USD 98.04 Billion.Breast Cancer Drug Market Overview:

Breast Cancer remains to be the most commonly diagnosed malignant tumor among women globally. Despite advances in the field, the death rate remains high for advanced and metastatic diseases. Breast cancer is the world's second biggest cause of death. It applies not only to women but also to men and animals. It has become a tangible threat to humans. Over one million people around the world have been given a diagnosis with this lethal disease, which is causing an increase in deaths each year. Meanwhile, it has become a fatal condition, and the risk factors associated with breast cancer seem to be growing day by day. As a result, the increasing prevalence of breast cancer is expected to increase the demand for effective treatments. Hence this is expected to drive the breast cancer drug market growth during the forecast period. In addition, significant investments in research and development projects and advancements in oncogenesis and pharmacology, are promoting drug development and clinical trial procedures. Hence, boosting the breast cancer drug market growth. The increasing emphasis on research studies by market participants provides a profitable growth rate for the market. For example, Novartis partnered with SOLTI Innovative Cancer Research (SOLTI) on HARMONIA, an international, randomized, Phase III, multicenter, and open-label trial of Kisqali (ribociclib) vs Ibrance (palbociclib), both in conjunction with endocrine treatment, in September 2022. This research included patients with advanced or metastatic hormone receptor-positive, human epidermal growth factor receptor 2-negative (HR+/HER2-) breast cancer with a HER2-enriched (HER2E) intrinsic subtype. On the other hand, the high costs of drugs, the risk of adverse effects of drugs, and stringent regulatory scenarios are expected to restrain the breast cancer drug market growth during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Breast Cancer Drug Market Dynamics:

High prevalence of Breast Cancer amongst populations across the world Breast cancer is the second leading cause of mortality all across the world. It has a tremendous impact on many people's lives. Breast cancer risk increases with age, and altering lifestyle factors such as increased intake of alcohol and smoking as well as a lack of physical activity, all contribute to an increase in the prevalence of breast cancer in the general population. The rising global incidence of breast cancer is expected to result in a huge patient population demanding precise and efficient treatment options. This factor is expected to be the key driver of growth in the breast cancer drug market. For example, according to World Cancer Research Fund (WCRF) data, 2,088,849 new instances of breast cancer were detected globally in 2018. According to MMR analysis, it is estimated that 20,030 new cases of breast cancer were diagnosed in Australia in 2022. (164 males and 19,866 females). Additionally, a person had a 1 in 15 (or 6.7%) chance of developing breast cancer by the age of 85 (1 in 8 or 13% for females and 1 in 829 or 0.12% for males). As a result, the high prevalence of breast cancer is raising demand for the anticancer drugs, adding to market growth. As a result, the presence of a significant patient population, which is expected to rise throughout the forecast period, is expected to drive market growth. Besides that, the rising need for preventative care and early treatment has led many people to undertake cancer screening tests, which is further expected to increase the number of patients seeking treatment throughout the forecast period. Besides that, the increasing patient awareness due to such alarming statistics is expected to boost the breast cancer drug market growth.Growing preferences for personalized medicine The increased awareness of personalized medications, which rely on excised human tissue to generate a unique test for use in patient care, is driving up demand for excised human tissue. Personalized medicine for breast cancer is a method of diagnosing, treating, and preventing the disease that takes into consideration both the genes people are born with (genetic makeup) and the genes or other markers present within cancer cells. This method involves collecting blood or tumor tissue for genetic examination. With breakthroughs in diagnostic techniques, the demand for personalized medicine in the treatment of breast cancer is rapidly increasing. For example, one of the advanced diagnostics for personalized medicine, Oncotype DX, evaluates 21 genes and identifies women with breast cancer who may be treated without chemotherapy. Personalized medicines accounted for more than a third of new medication approvals in 2022, as well as 25% or more of all FDA approvals in each of the previous seven years. Precision medicines presently account for about 90% of clinical development revenue for major pharmaceutical firms such as AstraZeneca. Novartis, Roche, Genentech, Astra Zeneca, Pfizer, BMS, Merck, and Amgen are among the major pharmaceutical firms in precision medicine. Additionally, it has been expected that the personalized medicine industry would reach roughly 112 billion USD by 2029. Similarly, the number of personalized medications on the market in the United States has increased from 132 in 2016 to 286 by 2020. As a result, the rising preference for personalized medicines is expected to generate lucrative growth opportunities for the breast cancer drug market during the forecast period. Adverse Effects of Drugs Chemotherapy medications have adverse effects on human health, depending on the type and amount of drugs used, as well as the duration of treatment. Hair loss, nail changes, mouth sores, loss of appetite or weight fluctuations, nausea and vomiting, diarrhea, fatigue, and other side effects are prevalent in most cases. Chemotherapy can also harm the bone marrow's blood-forming cells, leading to anemia: 1. Increased chance of infections (from low white blood cell counts) 2. Easy bruising or bleeding (from low blood platelet counts) 3. Fatigue (from low red blood cell counts and other reasons) In addition, the undesirable effects of breast cancer treatments, such as Targeted Medication Therapy for Breast Cancer, are expected to hamper the growth of the breast cancer drug market during the forecast period. According to the MMR analysis, targeted treatments include a number of adverse effects, including skin problems, gastrointestinal issues, and elevated blood pressure. In situations with severe adverse effects, the patient may be unable to utilize the medicine and may need to switch to another form of therapy. For example, serious adverse effects of targeted treatment include rashes in various places of the body as well as the formation of blisters. Similarly, immunotherapy produces a variety of adverse effects, including tiredness and nausea. As a result, these adverse reactions are expected to restrain the breast cancer drug market growth in the forecast period.

Breast Cancer Drug Market Segment Analysis:

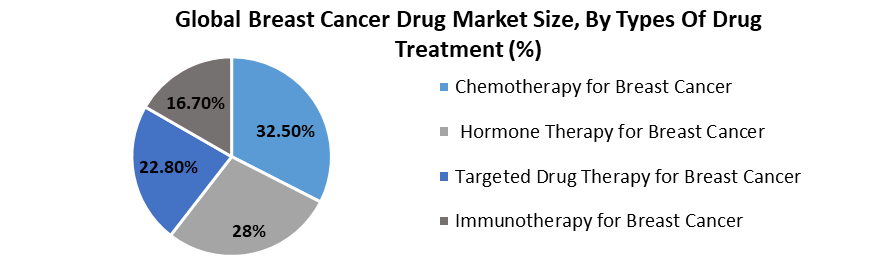

By Types of Drug Treatment, the Chemotherapy for Breast Cancer segment dominated the breast cancer drug market with the highest market share in terms of value and volume in 2022. The segment is expected to maintain its dominance by 2029 with the highest CAGR of XX%. Chemotherapy is the most commonly utilized type of therapy to halt or delay the development of malignant cells. It is the most often used therapy for people with triple-negative breast cancer. According to a November 2022 update from the Centers for Disease Control and Prevention, about 650,000 cancer patients (including breast cancer patients) undergo chemotherapy in the United States each year. As a result, the rising number of chemotherapy patients and the development of new medications are expected to significantly boost the breast cancer drug market growth. Additionally, an aging global population, greater incidence and survival, and ever-expanding treatment choices have all contributed to an increase in chemotherapy outpatient service demand. In addition, the increase in new product launches in this segment is expected to increase the market growth. For example, Merck, commonly known as MSD outside the United States and Canada, said in July 2022 that the US Food and Drug Administration (FDA) had authorized KEYTRUDA, Merck's anti-PD-1 medication, for the treatment of patients with high-risk early-stage triple-negative breast cancer (TNBC). According to the Phase 3 KEYNOTE-522 study, this is intended to be used as a neoadjuvant treatment in conjunction with chemotherapy and then continued as a single agent as adjuvant treatment following surgery. In addition, Zydus Cadila will introduce a next-generation breast cancer medication in India in May 2022. Trastuzumab emtansine is regarded as the first targeted chemotherapeutic medication for breast cancer. As a result, these mentioned factors are expected to increase segment growth and eventually generate a potential result for the breast cancer drug market.Breast Cancer Drug Market Regional Insights:

The North American region dominated the breast cancer drug market in terms of value and volume in 2022. The region is expected to grow at a CAGR of XX% and maintain its dominance by 2029. The presence of major players in the region is expected to launch new and advanced drugs in the region. This is expected to be the major growth factor driving the market growth. For example, Kisqali was authorized by the Food and Drug Administration (FDA) in March 2017 as the first-line therapy for metastatic breast cancer in conjunction with an aromatase inhibitor. Kisqali is the only CDK 4/6 inhibitor licensed in the United States for the treatment of advanced stages of this illness. In addition, the strong prevalence of breast cancer in the region, increasing demand for preventative drugs, the increasing number of breast cancer therapeutics R&D clinical trials, and the increased awareness about breast cancer treatments, high adoption of advanced drugs, increasing healthcare infrastructures, and increasing adoption of advanced drugs and medicines are further expected to be the major growth factors driving the North American breast cancer drug market during the forecast period. According to the MMR analysis, in 2020, approximately 276,480 new cases of invasive breast cancer were diagnosed in women in the United States. The United States is expected to offer lucrative growth opportunities for the breast cancer drug market during the forecast period, as the region generated a high market share of 48% in terms of revenue in 2022. Breast cancer is one of the most common cancers in the United States. According to the January 2022 report from breastcancer.org, around one in every eight women in the country (13%) would acquire invasive breast cancer over their lifetime. Meanwhile, about 287,850 new instances of invasive breast cancer, as well as 51,400 new cases of non-invasive (in situ) breast cancer, are expected to be diagnosed in women in the United States. According to the same source, around 2,710 new instances of invasive breast cancer in men are expected to be diagnosed by the end of 2022. A man's lifetime chance of developing breast cancer is around 1 in 833.Besides that, according to an October 2022 update from the University of North Carolina's School of Medicine, Susan G. Komen, the world's leading breast cancer organization, announced that it would award USD 1.5 million for three new research projects focusing on three distinct areas of metastatic breast cancer (MBC). Trodelvy (sacituzumab govitecan-hziy) received full FDA approval in April 2022 for adult patients with unresectable locally advanced or metastatic triple-negative breast cancer (TNBC) who have received two or more prior systemic therapies, at least one of which was for metastatic disease, according to Gilead Sciences Inc. As a result, these above factors are expected to generate the highest revenue in the region during the forecast period. The European market is expected to hold the second-highest position in the global breast cancer drug market by 2029. This is due to the increasing prevalence of breast cancer, and the high adoption of advanced drugs in the region for better patient care. Female breast cancer, for example, is the most prevalent disease diagnosed in Europe, according to statistics released by the European Union's Joint Research Center (JRC). Over 355,000 women in the EU-27 were expected to be diagnosed with breast cancer in 2020. The Asia-Pacific market is expected to generate high growth potential for the breast cancer drug market players. The increased demand for effective and advanced drugs, the increasing patient population, and the significant surge in healthcare expenditure are expected to be the key factors driving regional growth. For example, F. Hoffmann-La Roche Ltd. announced the availability of the immunotherapy medication atezolizumab in India in April 2020 for the treatment of metastatic triple-negative breast cancer (TNBC). In addition, South American, Middle East & African market is expected to grow at a moderate rate during the forecast period due to the rising presence of key players, increasing healthcare expenditure, increasing breast cancer patient population, and high demand for advanced drugs and medicines in the region. Competitive Scenario: The breast cancer drug market is highly competitive. The dominance of a few significant players involved in the sales of cancer treatments is one of the prominent factors in the global market. Genentech (F. Hoffmann-La Roche Ltd), AstraZeneca, Pfizer Inc., and Novartis AG are among them. Collectively, these organizations account for the major share of the breast cancer drugs market due to their unique and strong product portfolios of drugs for breast cancer treatment. Similarly, these firms are involved in cutting-edge research and development for the creation of medications for the treatment of breast cancer. For example, Genentech (F. Hoffmann-La Roche Ltd) has a diverse array of effective breast cancer medicines, including Kadcyla, Xeloda, Perjeta, and Herceptin.

Sanofi, Bristol Myers Squibb (Celgene Corporation), Eli Lilly and Company, and Eisai Co. Ltd. are other significant participants in the breast cancer drug market. Their different strategic executions are expected to be beneficial to their efforts in the growth of their market revenue during the forecast period. In addition, Major organizations' significant strategic initiatives to maintain market stability include new product development, acquisitions, collaborations, and geographical expansions are further expected to boost the breast cancer drug market. 1. For example, Arvinas Inc. and Pfizer Inc. partnered in July 2022 to develop and market ARV-471, an experimental oral PROTAC (PROteolysis TArgeting Chimera) estrogen receptor protein degrader. In most breast tumors, the estrogen receptor is a well-known disease driver. 2. In September 2020, Natco Pharma stated that its marketing partner, Lupin, introduced Lapatinib Tablets, 250 mg, in the United States after Natco acquired final FDA clearance for its Abbreviated New Drug Application (ANDA) (USFDA). NATCO was the first ANDA applicant with a Paragraph IV certification for Lapatinib Tablets, 250mg. 3. In June 2020, the US Food and Drug Administration approved Phesgo, a combination of pertuzumab, trastuzumab, and hyaluronidase-zzxf, for injection under the skin to treat adult patients with HER2-positive breast cancer that has spread to other parts of the body, as well as adult patients with early HER2-positive breast cancer. Patients who receive this treatment should be chosen using an FDA-approved companion diagnostic test.

Breast Cancer Drug Market Scope: Inquiry Before Buying

Breast Cancer Drug Market Report Coverage Details Base Year: 2021 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: USD 37.31 Billion Forecast Period 2023to 2029 CAGR: 14.8 % Market Size in 2029: USD 98.04 Billion Segments Covered: by Breast Cancer Type 1. Ductal Carcinoma In Situ (DCIS) 2. Invasive Ductal Carcinoma (IDC) 3. Tubular Carcinoma of the Breast 4.Medullary Carcinoma of the Breast 5. Mucinous Carcinoma of the Breast 6. Papillary Carcinoma of the Breast 7. Male Breast Cancer 8. Others by Cancer Stages 1. T: Primary Tumor Size 2. N: Lymph Node Involvement 3. M: Cancer spread beyond the breast and lymph nodes by Drug Type 1. Herceptin Hylecta 2. Atezolizumab 3. Talazoparib 4. Ribociclib 5. Abemaciclib 6. Neratinib 7. Palbociclib 8. Others by Drug Mechanism 1. HER2 Inhibitors 2. Mitotic Inhibitors 3. Anti-metabolites 4. Aromatase Inhibitors 5. CDK 4/6 Inhibitors 6. Hormonal Receptor by Types Of Drug Treatment 1. Chemotherapy for Breast Cancer 2. Hormone Therapy for Breast Cancer 3. Targeted Drug Therapy for Breast Cancer 4. Immunotherapy for Breast Cancer by Route of Administration 1. Oral 2. Injection by Distribution Channel 1. Hospital Pharmacies 2. Retail Pharmacies 3. Online Pharmacies 4. Others Breast Cancer Drug Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Breast Cancer Drug Market, Key Players are

1. JOHNSON & JOHNSON (United States) 2. Merck & Co (United States) 3. Bristol-Myers Squibb (United States) 4. Eli Lilly (United States) 5. Celgene (New Jersey) 6. Gilead Sciences (California) 7. Allergen (California) 8. Bayer (New Jersey) 9. Astellas Pharma (Illinois) 10. PFIZER (New York) 11. Amgen (California) 12. ABBVIE (Illinois) 13. AstraZeneca (United Kingdom) 14. GlaxoSmithKline (United Kingdom) 15. Sanofi (France) 16. UCB (Belgium) 17. Les Laboratoires Servier (France) 18. Roche (Switzerland) 19. Novartis(Switzerland) 20. BeiGene (Beijing) 21. Incyte (Switzerland) 22. Bausch Health Company (Canada) 23. Fresenius (Germany) 24. Novo Nordisk (Denmark) 25. Shire (England) 26. Grifols (Spain) 27. Dr.Reddy (India) 28. Daiichi Sankyo (Japan) 29. Takeda (Japan) 30. CSL (Australia) 31. Otsuka Holdings (Japan) 32. Chugai Pharmaceutical (Japan) 33. Sumitomo Dainippon Pharma (Japan) 34. Sun Pharmaceuticals Industries (India) 35. Eisai (Japan) FAQs: 1. What are the growth drivers for the Breast Cancer Drug market? Ans. The high prevalence of breast cancer amongst the population and significant investments in research and development projects and advancements in oncogenesis and pharmacology are expected to be the major driver for the Breast Cancer Drug market. 2. What is the major restraint for the Breast Cancer Drug market growth? Ans. The Stringent Regulations on Breast Cancer Drug adoption and the high costs of drugs are expected to be the major restraining factor for the Breast Cancer Drug market growth. 3. Which region is expected to lead the global Breast Cancer Drug market during the forecast period? Ans. The North American market is expected to lead the global Breast Cancer Drug market during the forecast period. 4. What is the projected market size & growth rate of the Breast Cancer Drug Market? Ans. Breast Cancer Drug Market size was valued at USD 37.31 Billion in 2022 and the total Breast Cancer Drug revenue is expected to grow at a CAGR of 14.8% from 2023 to 2029, reaching nearly USD 98.04 Billion. 5. What segments are covered in the Breast Cancer Drug Market report? Ans. The segments covered in the Breast Cancer Drug market report are Breast Cancer Type, Cancer Stages, Drug Type, Drug Mechanism, Types of Drug Treatment, Route of Administration, Distribution Channel, and Region.

1. Global Breast Cancer Drug Market: Research Methodology 2. Global Breast Cancer Drug Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Breast Cancer Drug Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Breast Cancer Drug Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 . COVID-19 Impact 4. Global Breast Cancer Drug Market Segmentation 4.1 Global Breast Cancer Drug Market, by Breast Cancer Type (2022-2029) • Ductal Carcinoma In Situ (DCIS) • Invasive Ductal Carcinoma (IDC) • Tubular Carcinoma of the Breast • Medullary Carcinoma of the Breast • Mucinous Carcinoma of the Breast • Papillary Carcinoma of the Breast • Male Breast Cancer • Others 4.2 Global Breast Cancer Drug Market, by Cancer Stages (2022-2029) • T: Primary Tumor Size • N: Lymph Node Involvement • M: Cancer spread beyond the breast and lymph nodes 4.3 Global Breast Cancer Drug Market, by Drug Type (2022-2029) • Herceptin Hylecta • Atezolizumab • Talazoparib • Ribociclib • Abemaciclib • Neratinib • Palbociclib • Others 4.4 Global Breast Cancer Drug Market, by Drug Mechanism (2022-2029) • HER2 Inhibitors • Mitotic Inhibitors • Anti-metabolites • Aromatase Inhibitors • CDK 4/6 Inhibitors • Hormonal Receptor 4.5 Global Breast Cancer Drug Market, by Types Of Drug Treatment (2022-2029) • Chemotherapy for Breast Cancer • Hormone Therapy for Breast Cancer • Targeted Drug Therapy for Breast Cancer • Immunotherapy for Breast Cancer 4.6 Global Breast Cancer Drug Market, by Route of Administration (2022-2029) • Oral • Injection 4.7 Global Breast Cancer Drug Market, by Distribution Channel (2022-2029) • Hospital Pharmacies • Retail Pharmacies • Online Pharmacies • Others 4.8 Global Breast Cancer Drug Market, by Region (2022-2029) • North America • Europe • Asia Pacific • The Middle East and Africa • South America 5. North America Breast Cancer Drug Market(2022-2029) 5.1 North America Breast Cancer Drug Market, by Breast Cancer Type (2022-2029) • Ductal Carcinoma In Situ (DCIS) • Invasive Ductal Carcinoma (IDC) • Tubular Carcinoma of the Breast • Medullary Carcinoma of the Breast • Mucinous Carcinoma of the Breast • Papillary Carcinoma of the Breast • Male Breast Cancer • Others 5.2 North America Breast Cancer Drug Market, by Cancer Stages (2022-2029) • T: Primary Tumor Size • N: Lymph Node Involvement • M: Cancer spread beyond the breast and lymph nodes 5.3 North America Breast Cancer Drug Market, by Drug Type (2022-2029) • Herceptin Hylecta • Atezolizumab • Talazoparib • Ribociclib • Abemaciclib • Neratinib • Palbociclib • Others 5.4 North America Breast Cancer Drug Market, by Drug Mechanism (2022-2029) • HER2 Inhibitors • Mitotic Inhibitors • Anti-metabolites • Aromatase Inhibitors • CDK 4/6 Inhibitors • Hormonal Receptor 5.5 North America Breast Cancer Drug Market, by Types Of Drug Treatment (2022-2029) • Chemotherapy for Breast Cancer • Hormone Therapy for Breast Cancer • Targeted Drug Therapy for Breast Cancer • Immunotherapy for Breast Cancer 5.6 North America Breast Cancer Drug Market, by Route of Administration (2022-2029) • Oral • Injection 5.7 North America Breast Cancer Drug Market, by Distribution Channel (2022-2029) • Hospital Pharmacies • Retail Pharmacies • Online Pharmacies • Others 5.8 North America Breast Cancer Drug Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Breast Cancer Drug Market (2022-2029) 6.1. European Breast Cancer Drug Market, by Breast Cancer Type (2022-2029) 6.2. European Breast Cancer Drug Market, by Cancer Stages (2022-2029) 6.3. European Breast Cancer Drug Market, by Drug Type (2022-2029) 6.4. European Breast Cancer Drug Market, by Drug Mechanism (2022-2029) 6.5. European Breast Cancer Drug Market, by Types Of Drug Treatment (2022-2029) 6.6. European Breast Cancer Drug Market, by Route of Administration (2022-2029) 6.7. European Breast Cancer Drug Market, by Distribution Channel (2022-2029) 6.8. European Breast Cancer Drug Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Breast Cancer Drug Market (2022-2029) 7.1. Asia Pacific Breast Cancer Drug Market, by Breast Cancer Type (2022-2029) 7.2. Asia Pacific Breast Cancer Drug Market, by Cancer Stages (2022-2029) 7.3. Asia Pacific Breast Cancer Drug Market, by Drug Type (2022-2029) 7.4. Asia Pacific Breast Cancer Drug Market, by Drug Mechanism (2022-2029) 7.5. Asia Pacific Breast Cancer Drug Market, by Types Of Drug Treatment (2022-2029) 7.6. Asia Pacific Breast Cancer Drug Market, by Route of Administration (2022-2029) 7.7. Asia Pacific Breast Cancer Drug Market, by Distribution Channel (2022-2029) 7.8. Asia Pacific Breast Cancer Drug Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Breast Cancer Drug Market (2022-2029) 8.1 Middle East and Africa Breast Cancer Drug Market, by Breast Cancer Type (2022-2029) 8.2. Middle East and Africa Breast Cancer Drug Market, by Cancer Stages (2022-2029) 8.3. Middle East and Africa Breast Cancer Drug Market, by Drug Type (2022-2029) 8.4. Middle East and Africa Breast Cancer Drug Market, by Drug Mechanism (2022-2029) 8.5. Middle East and Africa Breast Cancer Drug Market, by Types Of Drug Treatment (2022-2029) 8.6. Middle East and Africa Breast Cancer Drug Market, by Route of Administration (2022-2029) 8.7. Middle East and Africa Breast Cancer Drug Market, by Distribution Channel (2022-2029) 8.8. Middle East and Africa Breast Cancer Drug Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Breast Cancer Drug Market (2022-2029) 9.1. South America Breast Cancer Drug Market, by Breast Cancer Type (2022-2029) 9.2. South America Breast Cancer Drug Market, by Cancer Stages (2022-2029) 9.3. South America Breast Cancer Drug Market, by Drug Type (2022-2029) 9.4. South America Breast Cancer Drug Market, by Drug Mechanism (2022-2029) 9.5. South America Breast Cancer Drug Market, by Types Of Drug Treatment (2022-2029) 9.6. South America Breast Cancer Drug Market, by Route of Administration (2022-2029) 9.7. South America Breast Cancer Drug Market, by Distribution Channel (2022-2029) 9.8. South America Breast Cancer Drug Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 JOHNSON & JOHNSON (United States) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Merck & Co (United States) 10.3 Bristol-Myers Squibb (United States) 10.4 Eli Lilly (United States) 10.5 Celgene (New Jersey) 10.6 Gilead Sciences (California) 10.7 Allergen (California) 10.8 Bayer (New Jersey) 10.9 Astellas Pharma (Illinois) 10.10 PFIZER (New York) 10.11 Amgen (California) 10.12 ABBVIE (Illinois) 10.13 AstraZeneca (United Kingdom) 10.14 GlaxoSmithKline (United Kingdom) 10.15 Sanofi (France) 10.16 UCB (Belgium) 10.17 Les Laboratoires Servier (France) 10.18 Roche (Switzerland) 10.19 Novartis (Switzerland) 10.20 BeiGene (Beijing) 10.21 Incyte (Switzerland) 10.22 Bausch Health Company (Canada) 10.23 Fresenius (Germany) 10.24 Novo Nordisk (Denmark) 10.25 Shire (England) 10.26 Grifols (Spain) 10.27 Dr.Reddy (India) 10.28 Daiichi Sankyo (Japan) 10.29 Takeda (Japan) 10.30 CSL (Australia) 10.31 Otsuka Holdings (Japan) 10.32 Chugai Pharmaceutical (Japan) 10.33 Sumitomo Dainippon Pharma (Japan) 10.34 Sun Pharmaceuticals Industries (India) 10.35 Eisai (Japan)