Biliary Stents Market size was valued at USD 141.96 Million in 2023 and the Biliary Stents Market revenue is expected to reach USD 198.96 Million by 2030, at a CAGR of 5.5 % over the forecast period.Biliary Stents Market Overview

The biliary stent is a flexible metallic tube that is specially designed to keep blocked or partially blocked bile duct open. When the bile duct becomes blocked, fluids such as bile juice are unable to flow into the intestine to aid digestion in the Biliary Stents Market. Bile, which is secreted by the liver into the intestinal passage via the bile duct, which opens in the intestine, plays an important role in food digestion. Biliary stents are stents used to treat biliary disorders. Metal stents and plastic stents are the two types of biliary stents. Polyethylene, polyurethane, or Teflon is used to make plastic biliary stents. The diameter and length of a stent range from 5F to 12F and 1 to 18 cm, respectively. 10F stents require an endoscope with a 3.7-mm accessory channel, while 11F and larger stents require a 4.2-mm channel. Plastic biliary stents come in a variety of sizes and shapes. Pigtail stents are coiled at either one or both ends (single or double pigtail). Along the curved pigtail ends, side holes are drilled. In the Tannenbaum design, flanged stents have a single flap proximally and distally with a side hole or four flaps proximally and distally without side holes. Metal (e.g., stainless steel, Nitinol) or plastic stents can be used (e.g., expanded polytetrafluoroethylene). Biliary stents is not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Biliary Stents Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Biliary Stents Market report showcases the Biliary Stents market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.To know about the Research Methodology :- Request Free Sample Report

Biliary Stents Market Dynamics

Rise in biliary duct disorders, rise in geriatric population, rise in urbanization influencing sedentary lifestyle is the major driving factors of the biliary stent market during the forecast period. Moreover, a rise in surgical procedures, malignant biliary obstruction, biliary stricture and leakage of the bile duct are also propelling the growth of the market shortly. Furthermore, the rise in technological advancement is boosting the growth of the market. For instance, minimally invasive procedures that help in the patient's early diagnosis, quick treatment, and faster recovery, plastic stents provide greater procedure control, and efficiency for navigation into tight strictures in the bile duct. The rise in surgical procedures for biliary-related diseases due to aging and a lack of exercise are two factors that are expected to drive the global Biliary Stents Market. Positive growth in this market is being driven by increased population awareness and a rise in demand for effective post-operative care. Postoperative complications and stringent government approval regulations are expected to restrain market growth. Scientists have developed biodegradable stents that do not require removal, making post-operative care much less expensive. The global prevalence of biliary diseases is driving the Biliary Stents Market. The use of biliary stents in surgical procedures for biliary diseases is expected to drive the global Biliary Stents Market. The growing use of substitutes in biliary surgeries is expected to restrain the Biliary Stents Market. The increased cost of biliary stent insertion is also hampering market growth. Further research into how to increase the patency period of plastic and metal stents could be a research highlight shortly. Modern technological advancements and effective diagnostic procedures have improved the accuracy of ERCP and PTC tests. The global biliary stent market is growing due to advancements and developments in biliary stents. Biliary stent technology, for example, has come a long way since its inception. Material advancements, as well as design and deployment strategies, have been significant. From plastic and metallic stents to a wider range of materials and manufacturing technologies, clinicians now have several options, including self-expandable metallic stents and bioresorbable stents. Bioresorbable biliary stents are still in the experimental stage. Furthermore, Biliary Stents Market developments are propelling global market growth.Biliary Stents Market Segment Analysis

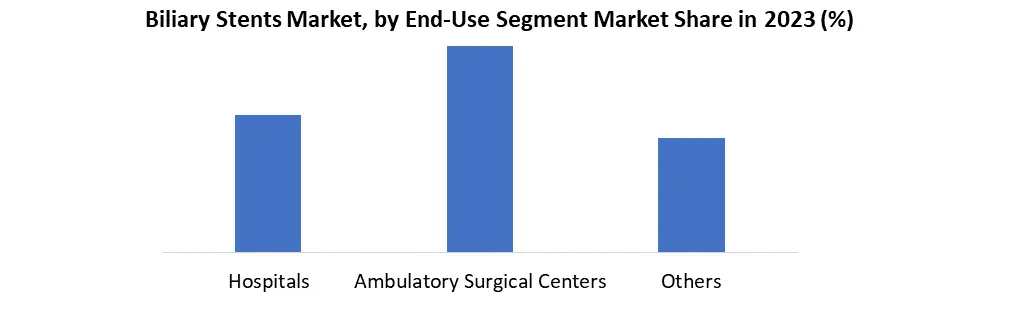

Type: The metal biliary stents segment held the largest revenue share of 66.99% in 2023 in the Biliary Stents Market. The introduction of fully covered self-expandable metal stents (FCSEMS) marks a significant advancement in endoscopic treatment for obstructive biliary issues, as highlighted in an October 2021 NCBI article. The prevalence of FCSEMS can be attributed to various factors. Their substantial diameter and the synthetic covering enveloping the tubular mesh contribute to prolonged stent patency, enhancing their effectiveness and reducing the risk of tissue hyperplasia and tumor ingrowth. A notable feature of FCSEMS is their easy removal, addressing a critical limitation faced by plastic and uncovered metal stents. This removal ease adds a layer of versatility to their application. The polymer stents segment is anticipated to witness the fastest market growth over the forecast period in the Biliary Stents Market. One significant driver is the continuous innovation and advancements in polymer technology, leading to the development of stents with enhanced flexibility and biocompatibility. Polymer stents offer a viable alternative to traditional metal stents, as they are often more easily deployable and adaptable to various anatomical structures. In addition, the polymer's inherent non-metallic nature reduces the risk of interference with imaging modalities such as MRI. The growing preference for minimally invasive procedures further fuels the demand for polymer stents, given their ability to provide effective relief in treating biliary obstructions while minimizing patient discomfort.Application: The gallstones segment held the largest revenue share in 2023 in the Biliary Stents Market. The rising incidence of gallstone-related issues necessitates effective and minimally invasive treatment options. Biliary stents designed specifically for gallstone management offer a targeted approach, aiding in alleviating symptoms and promoting smoother bile flow. Advancements in stent technology, including improved materials and design, enhance efficacy in addressing gallstone-related complications. The growing awareness among healthcare professionals and patients regarding the advantages of using stents for gallstone management further boosts the demand for such specialized devices. As a result, the gallstone stents segment is poised for sustained growth within the broader market. The benign biliary structures segment is estimated to register the fastest CAGR over the forecast period in the Biliary Stents Market. The demand for effective and minimally invasive treatment options has led to the development and adoption of specialized biliary stents tailored to address benign strictures. Technological advancements in stent design and materials contribute to improved efficacy and durability, providing long-term relief for patients with benign biliary strictures. Moreover, the growing emphasis on enhancing patient outcomes and reducing the need for repeated interventions further fuels the demand for specialized stents in this segment. End-Use: The hospitals segment held the largest revenue share in 2023 in the Biliary Stents Market. Hospitals primarily contribute to the biliary stents industry growth, serving as prime centers for comprehensive medical care. Equipped with diverse medical services and specialized departments, hospitals play a central role in addressing a wide range of patient needs. In the context of biliary stents, hospitals provide the infrastructure and expertise necessary for intricate procedures and interventions. The ambulatory surgical centers segment has also been anticipated to grow rapidly during the forecast period. Ambulatory surgical centers play a vital role in the biliary stents industry by offering a convenient and efficient setting for outpatient procedures, including those involving biliary stents. ASCs provide an alternative to traditional hospital settings, allowing for same-day surgical interventions. Patients benefit from the streamlined processes and specialized care within ASCs, contributing to the accessibility and utilization of biliary stent procedures. The ambulatory nature of these centers aligns with the growing trend towards outpatient care and minimally invasive interventions in the Biliary Stents Market.

Biliary Stents Market Regional Analysis

North America held the largest revenue share of 43.69% in 2023, which is attributed to the growing demand for minimally invasive procedures in North America in the Biliary Stents Market. According to the American Cancer Society, the incidence of bile duct cancer (cholangiocarcinoma), a rare condition with around 8,000 annual diagnoses in the U.S., signifies a distinctive healthcare concern. In this scenario, biliary stents emerge as pivotal therapeutic tools for managing conditions associated with bile duct cancer, addressing issues like tumor-induced obstructions or narrowing. The prevalence of bile duct cancer cases creates a specific and significant demand for biliary stents and highlights their integral role in North America's healthcare landscape. The U.S. held the largest share of the Biliary Stents Market in North America in 2023. Growing incidence of cancer and growing awareness regarding early disease diagnosis are some of the major factors anticipated to foster the country’s growth. For instance, according to the Cleveland article, the substantial incidence of acute and chronic pancreatitis in the U.S., leads to 275,000 and 86,000 hospital stays per year, respectively, which positions biliary stents as crucial therapeutic tools. With about 20% of acute cases considered severe, the demand for effective interventions, including biliary stents, is evident. The high number of hospital stays underscores the critical role of biliary stents in addressing complications associated with pancreatitis, thereby contributing to the growth of the U.S. Biliary Stents Market. The Asia Pacific region is anticipated to register the fastest growth during the forecast period, driven by a surge in patient numbers and the expanding presence of prominent healthcare providers in rapidly developing economies such as India and China in the Biliary Stents Market. Growth opportunities are created by the increasing demand for healthcare services in the region, coupled with government support for advancements in healthcare utilization. For instance, the Indian government's financial aid to indigent cancer patients through the Tertiary Care Cancer Centers (TCCC) scheme, which aims to strengthen or establish 20 State Cancer Institutes (SCI) and 50 TCCCs, is expected to stimulate the demand for biliary stent devices, contributing to the region's overall growth. Japan's healthcare system is shifting from nursing care to preventive care in disease management due to rising healthcare expenditures in the Biliary Stents Market. In February 2023, Olympus strategically acquired South Korean stent maker Taewoong Medical for approximately USD 370 million, emerging as a pivotal driver for the growth of the Japan market. This strategic move by the Japanese medical device’s giant reflects a deliberate effort to enhance its medical device offerings and diversify revenue streams. Olympus' strategic investment is anticipated to introduce advanced technologies and innovative solutions to the Japan Biliary Stents Market, fostering increased demand and shaping the competitive landscape.Biliary Stents Market Recent Developments

In February 2023, Olympus Corporation announced the acquisition of Taewoong Medical, a South Korean manufacturer of gastrointestinal (including biliary tract) metallic stents. Taewoong will receive $370 million in cash under the agreement, with $255.5 million paid at closing and the remaining $114.5 million paid based on future milestones in the Biliary Stents Market. In May 2021, amg International GmbH, a wholly owned subsidiary of Dublin, Ireland-based Q3 Medical Devices Limited (Q3), strengthens its position as a leader in the rapid development of novel biodegradable implants. The Company announced that its second fully biodegradable product, the UNITY-B balloon expandable biodegradable biliary stent (BEBS) for endoscopic use, has received CE Mark approval. The UNITY-B will be used in conjunction with the ARCHIMEDESTM, the world’s first CE-approved pancreaticobiliary biodegradable implant.Biliary Stents Market Scope: Inquiry Before Buying

Biliary Stents Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 141.96 Mn. Forecast Period 2024 to 2030 CAGR: 5.5% Market Size in 2030: US $ 198.96 Mn. Segments Covered: by Type Metal Polymer Plastic by Application Bilio-pancreatic Leakages Pancreatic Cancer Benign Biliary Structures Gallstones Others by End-use Hospitals Ambulatory Surgical Centers Others Biliary Stents Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Biliary Stents Key Players Include

1. Boston Scientific 2. Cook Group 3. ENDO-FLEX GmbH 4. Olympus Corporation 5. B Braun Melsungen 6. CONMED Corporation 7. M.I Tech 8. Becton 9. Dickinson & Company 10. Medtronic plc 11. Cardinal Health 12. Merit Medical System. 13. Allium Medical Solutions 14. Brainlab 15. Abbott 16. Aohua Endoscopy Co. Ltd 17. W. L. Gore & Associates, Inc., 18. Q3 Medical Devices LimitedFrequently Asked Questions

1. How big is the biliary stents market? Ans: The global biliary stents market size was estimated at USD 141.96 Million in 2023. 2. What is the biliary stents market growth? Ans: The global biliary stents market is expected to grow at a compound annual growth rate of 5.5 % from 2024 to 2030 to reach USD 198.96 Million by 2030. 3. Which segment accounted for the largest biliary stents market share? Ans: In 2023, North America held the market's largest revenue share of 43.69%. The region's advanced healthcare infrastructure, increasing awareness about overall health, and a growing aging population contribute to the market's dominance. 4. Who are the key players in the biliary stents market? Ans: Some key market players are Boston Scientific, Cook Group, Olympus Corporation, Taewoong Medical Co., Ltd., Becton, Dickinson and Company, and Others. 5. What are the factors driving the biliary stents market? Ans: The biliary stents market is experiencing robust growth, driven by the growing incidence of biliary disorders and chronic liver diseases.

1. Biliary Stents Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Biliary Stents Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2022) 2.3.5. Company Locations 2.4. Biliary Stents Market Companies, share% 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Biliary Stents Market: Dynamics 3.1. Biliary Stents Market Trends 3.2. Biliary Stents Market Dynamics 3.2.1. Biliary Stents Market Drivers 3.2.2. Biliary Stents Market Restraints 3.2.3. Biliary Stents Market Opportunities 3.2.4. Biliary Stents Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape 4. Biliary Stents Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Biliary Stents Market Size and Forecast, By Type (2023-2030) 4.1.1. Metal 4.1.2. Polymer 4.1.3. Plastic 4.2. Biliary Stents Market Size and Forecast, By Application (2023-2030) 4.2.1. Bilio-pancreatic Leakages 4.2.2. Pancreatic Cancer 4.2.3. Benign Biliary Structures 4.2.4. Gallstones 4.2.5. Others 4.3. Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 4.3.1. Hospitals 4.3.2. Ambulatory Surgical Centers 4.3.3. Others 4.4. Biliary Stents Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Biliary Stents Market Size and Forecast, By Type (2023-2030) 5.1.1. Metal 5.1.2. Polymer 5.1.3. Plastic 5.2. North America Biliary Stents Market Size and Forecast, By Application (2023-2030) 5.2.1. Bilio-pancreatic Leakages 5.2.2. Pancreatic Cancer 5.2.3. Benign Biliary Structures 5.2.4. Gallstones 5.2.5. Others 5.3. Others North America Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 5.3.1. Hospitals 5.3.2. Ambulatory Surgical Centers 5.3.3. Others 5.4. North America Biliary Stents Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Biliary Stents Market Size and Forecast, By Type(2023-2030) 5.4.1.1.1. Metal 5.4.1.1.2. Polymer 5.4.1.1.3. Plastic 5.4.1.2. United States Biliary Stents Market Size and Forecast, By Application (2023-2030) 5.4.1.2.1. Bilio-pancreatic Leakages 5.4.1.2.2. Pancreatic Cancer 5.4.1.2.3. Benign Biliary Structures 5.4.1.2.4. Gallstones 5.4.1.2.5. Others 5.4.1.3. United States Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 5.4.1.3.1. Hospitals 5.4.1.3.2. Ambulatory Surgical Centers 5.4.1.3.3. Others 5.4.2. Canada 5.4.2.1. Canada Biliary Stents Market Size and Forecast, By Type (2023-2030) 5.4.2.1.1. Metal 5.4.2.1.2. Polymer 5.4.2.1.3. Plastic 5.4.2.2. Canada Biliary Stents Market Size and Forecast, By Application (2023-2030) 5.4.2.2.1. Bilio-pancreatic Leakages 5.4.2.2.2. Pancreatic Cancer 5.4.2.2.3. Benign Biliary Structures 5.4.2.2.4. Gallstones 5.4.2.2.5. Others 5.4.2.3. Canada Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 5.4.2.3.1. Hospitals 5.4.2.3.2. Ambulatory Surgical Centers 5.4.2.3.3. Others 5.4.3. Mexico 5.4.3.1. Mexico Biliary Stents Market Size and Forecast, By Type (2023-2030) 5.4.3.1.1. Metal 5.4.3.1.2. Polymer 5.4.3.1.3. Plastic 5.4.3.2. Mexico Biliary Stents Market Size and Forecast, By Application (2023-2030) 5.4.3.2.1. Bilio-pancreatic Leakages 5.4.3.2.2. Pancreatic Cancer 5.4.3.2.3. Benign Biliary Structures 5.4.3.2.4. Gallstones 5.4.3.2.5. Others 5.4.3.3. Mexico Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 5.4.3.3.1. Hospitals 5.4.3.3.2. Ambulatory Surgical Centers 5.4.3.3.3. Others 6. Europe Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.2. Europe Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.3. Europe Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4. Europe Biliary Stents Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.1.2. United Kingdom Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.1.3. United Kingdom Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.2. France 6.4.2.1. France Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.2.2. France Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.2.3. France Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.3.2. Germany Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.3.3. Germany Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.4.2. Italy Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.4.3. Italy Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.5.2. Spain Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.5.3. Spain Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.6.2. Sweden Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.6.3. Sweden Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.7. Russia 6.4.7.1. Russia Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.7.2. Russia Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.7.3. Russia Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Biliary Stents Market Size and Forecast, By Type (2023-2030) 6.4.8.2. Rest of Europe Biliary Stents Market Size and Forecast, By Application (2023-2030) 6.4.8.3. Rest of Europe Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7. Asia Pacific Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.2. Asia Pacific Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4. Asia Pacific Biliary Stents Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.1.2. China Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.1.3. China Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.2.2. S Korea Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.2.3. S Korea Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.3.2. Japan Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.3.3. Japan Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4.4. India 7.4.4.1. India Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.4.2. India Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.4.3. India Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.5.2. Australia Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.5.3. Australia Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4.6. ASEAN 7.4.6.1. ASEAN Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.6.2. ASEAN Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.6.3. ASEAN Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Biliary Stents Market Size and Forecast, By Type (2023-2030) 7.4.7.2. Rest of Asia Pacific Biliary Stents Market Size and Forecast, By Application (2023-2030) 7.4.7.3. Rest of Asia Pacific Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 8. Middle East and Africa Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Biliary Stents Market Size and Forecast, By Type (2023-2030) 8.2. Middle East and Africa Biliary Stents Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 8.4. Middle East and Africa Biliary Stents Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Biliary Stents Market Size and Forecast, By Type (2023-2030) 8.4.1.2. South Africa Biliary Stents Market Size and Forecast, By Application (2023-2030) 8.4.1.3. South Africa Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Biliary Stents Market Size and Forecast, By Type (2023-2030) 8.4.2.2. GCC Biliary Stents Market Size and Forecast, By Application (2023-2030) 8.4.2.3. GCC Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 8.4.3. Rest of ME&A 8.4.3.1. Rest of ME&A Biliary Stents Market Size and Forecast, By Type (2023-2030) 8.4.3.2. Rest of ME&A Biliary Stents Market Size and Forecast, By Application (2023-2030) 8.4.3.3. Rest of ME&A Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 9. South America Biliary Stents Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Biliary Stents Market Size and Forecast, By Type (2023-2030) 9.2. South America Biliary Stents Market Size and Forecast, By Application (2023-2030) 9.3. South America Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 9.4. South America Biliary Stents Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Biliary Stents Market Size and Forecast, By Type (2023-2030) 9.4.1.2. Brazil Biliary Stents Market Size and Forecast, By Application (2023-2030) 9.4.1.3. Brazil Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Biliary Stents Market Size and Forecast, By Type (2023-2030) 9.4.2.2. Argentina Biliary Stents Market Size and Forecast, By Application (2023-2030) 9.4.2.3. Argentina Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Biliary Stents Market Size and Forecast, By Type (2023-2030) 9.4.3.2. Rest Of South America Biliary Stents Market Size and Forecast, By Application (2023-2030) 9.4.3.3. Rest Of South America Biliary Stents Market Size and Forecast, By End-Use (2023-2030) 10. Company Profile: Key Players 10.1. Boston Scientific 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Cook Group 10.3. ENDO-FLEX GmbH 10.4. Olympus Corporation 10.5. B Braun Melsungen 10.6. CONMED Corporation 10.7. M.I Tech 10.8. Becton 10.9. Dickinson & Company 10.10. Medtronic plc 10.11. Cardinal Health 10.12. Merit Medical System. 10.13. Allium Medical Solutions 10.14. Brainlab 10.15. Abbott 10.16. Aohua Endoscopy Co. Ltd 10.17. W. L. Gore & Associates, Inc., 10.18. Q3 Medical Devices Limited 11. Key Findings 12. Analyst Recommendations 13. Biliary Stents Market: Research Methodology