Global Ben Oil Market size was valued at USD 7.89 billion in 2022 and expected to reach USD 15.9 billion by 2029, at CAGR of 10.52%.Ben Oil Market Overview

Ben Oil is also known as Moringa Oil, is extracted from the Moringa Oleifera Seed. It is high in minerals, vitamins and antioxidants which makes it more popular in variety of products. Ben oil is utilised in skin care products because it hydrates the skin. It is widely used as perfume base and is used in cosmetics and pharmaceutical applications for extended period of time. The Ben Oil Market growth is driven by increasing demand of natural and organic products, rising awareness of health benefits and growing popularity of Ayurveda and other traditional medicines. Ben Oil market is highly competitive and fragmented. Some of the major key players of Ben Oil Market are Avi Naturals, Dawn Moringa, AOS Products Pvt.Ltd. NOW Foods, Nature's Way, Frontier Co-op, Spectrum Naturals, and Mountain Rose Herbs. These companies are spending a lot of money on Research and Development (R & D) to create Ben Oil so that they can meet needs of customers. All of these major players are actively working to develop new products and distribution channel to meet increasing demand for Ben Oil.To know about the Research Methodology :- Request Free Sample Report

Ben Oil Market Scope and Research Methodology

The report highlights the competitive market view, segment analysis based on the End-User, Distribution channel and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Ben Oil Market. The Market is segmented by end-user including Food & Beverages, Cosmetic, Pharmaceutical and others. Market also segmented by Distribution Channel includes Offline & Online Channels. The market size and trends for the Ben Oil Market were analysed by using both primary and secondary data. Top down approach is used to estimate market size of the Ben Oil Market. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, was also included in the research to provide a thorough knowledge of the market dynamics. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Ben Oil Market Dynamics

Key Drivers: Increasing Demand for Natural & Organic Products: Ben Oil has many health benefits and it is widely used in natural and organic products. Consumers are widely looking for products which are free from synthetic chemicals or additives. They are looking for healthier and more sustainable alternatives. Ben Oil meets this requirement of consumers because it has high concentration of antioxidants, vitamins, minerals and fatty acids. Ben oil’s natural properties are in line with the growing preferences for eco-friendly products and cruelty-free alternatives. As the market of natural and organic products continues to grow, it is expected that the demand for ben oil will continue to grow due to its extraordinary properties and its compatibility with the changing preferences of conscious consumers. Rising awareness about the health benefits of ben oil The ben oil market is growing due to the growing awareness of its health benefits. People are increasingly health conscious and looking for natural, nutritious alternatives. Ben/ moringa oil has attracted a lot of attention for its many health benefits. Bean oil contains many antioxidants, vitamins, essential fatty acids and other nutrients. Ben oil supports many aspects of health, including healthy skin and hair. It also supports the immune system and digestion. Ben oil is useful in the treatment of chronic health disorders such as diabetes and inflammation. People are looking for products that meet their interests as they grow more conscious and focused on holistic health. Therefore, the ben oil market is expected to continue to grow as more people understand and appreciate the health benefits of this natural and nutritious oil. Expansion of Distribution Channel: The demand for Ben oil can be greatly increased by the expansion of the distribution channels. Currently, Ben oil is considered to be a niche product. It is mainly available in specialty health stores and online retailers. But as the distribution channels expand to mainstream supermarkets and pharmacies, as well as the natural food section within large retail chains, Ben oil becomes more accessible to the general public. As a result, the demand for Ben oil increases as more people discover and purchase it. Additionally, if the product is available at multiple retail locations, it increases credibility and trust among customers who may have tried the product first. As the product becomes more visible in these distribution channels, consumers are increasingly aware of the many health benefits and applications of ben oil, such as skin, hair care and dietary supplements. More people are likely to add ben oil to their daily routine which will increase in demand of ben oil. In conclusion, increasing distribution channels not only improves accessibility, but also increases the overall demand for Ben oil by reaching a wider and more varied audience of potential consumers.Market Trends

The Ayurvedic and other traditional medicine is one of the important market trends in the market of ben oil. The Ben Oil is derived from the Moringa tree and has been a part of traditional medicine practices for centuries. As the world continues to embrace holistic and natural health and wellness approaches, the acceptance of these traditional medicine systems has increased significantly. This has led to an increase in the demand for Natural and herbal remedies such as Ben Oil. In Ben oil Market innovation is a dominant trend. Ben oil manufacturers are innovating to make a variety of products based on ben oil, such as ben oil skincare, ben oil hair care, ben oil dietary supplements, and ben oil functional foods. New products are created to meet different consumer needs and preferences, taking advantage of the rich nutrient profile of ben oil and its versatility. Consumers are increasingly turning to natural and plant based products, giving them more options and applications for using ben oil in their daily lives. The emergence of new advance techniques is one of the most significant trends in the Ben oil market. Ben oil has traditionally been extracted through cold-pressing processes, but modern extraction methods like supercritical CO2 and solvent extraction are becoming increasingly popular. These improved extraction methods offer several advantages such as higher yield, higher purity and retention of bioactive compounds in ben oil. This is due to the need to improve the quality and productivity of ben oil production to meet the growing demand for this versatile, nutrient-rich oil in various industries such as cosmetics, food, nutraceuticals, etc. As technology advances, it is expected to play an important role in defining the future of the ben oil market, making them more sustainable and economically profitable.Market Opportunities

The market for Ben oil has opportunity in the food and beverage industry. Ben oil, which is rich in vitamins and antioxidants, is becoming more and more popular as an ingredient for health-conscious food products such as cooking oils and salad dressings, as well as functional beverages. Ben oil’s natural and nutritional advantages are in line with consumers’ increasing preference for plant-based alternatives in their diet. Ben oil’s versatility and ability to improve the nutritional profile of a variety of food and beverage products make it an ideal ingredient for manufacturers who want to meet the needs of health conscious consumers and broaden their product offerings. Ben oil also has a lot of opportunities in cosmetic industry. Ben Oil is known for its moisturizing and anti-aging properties. So it is present in lotions, serums creams and hail care products. It is high in minerals, vitamins and antioxidants which makes it more popular in variety of products. Consumers are looking for natural & effective cosmetic solutions. Ben oil is in high demand in the pharmaceutical industry. Ben oil can be used in many pharmaceutical products. It can be used as a supplement, capsule or tablet. For instance, ben oil can be used to improve the joint health in dietary supplements. Ben oil can also be used as a capsule or tablet to treat various health conditions, including diabetes and hypertension.Market Challenges

Ben Oil Market has several challenges in term of production system, distribution channel and overall profitability of organisation. One of the difficult challenges is the limited geographical distribution of the moringa tree, which is mostly found in Asia, Africa and America. Due to this geographical limitation, supply of ben oil can vary. Another major challenge is the sustainability of tree populations, which are threatened by unsustainable agricultural practices such as deforestation and overexploitation. Another challenge is quality control, as the extraction process and seed quality can vary and affect the consistency and the market value of Ben oil. Ben oil also faces competition from other vegetable oils, challenges in market awareness, regulatory complexity, and infrastructure constraints in certain producing regions. Finally, Ben oil price volatility and sustainability concerns make the market even more complex. All of these challenges need to be addressed by concentrated efforts by stakeholders, such as sustainable practices, better infrastructure, awareness campaigns and adherence to ethics and environmental standards.Ben Oil Market Segmentation

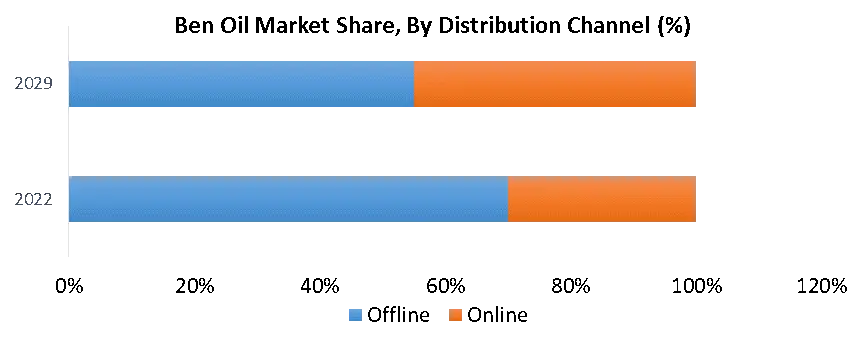

Based on end user Ben Oil Market is segmented into Food & Beverages, Cosmetic, Pharmaceuticals and Others (Such as Chemical & Technology). Cosmetic Industry segment has the largest market share due to the growing demand of ben oil in skin and hair care products. In 2022, the cosmetics industry accounted for 40% of the global ben oil market. The market share is expected to increase to 49% by 2029. This is due to the growing preference for organic and natural products within the cosmetics sector. The food and beverage segment held the second-largest market share and is expected to increase at a CAGR of 9% during the forecast period due to the increasing demand for ben oil as a flavoring ingredient and preservative. The pharmaceutical industry has the third largest market share with a projected CAGR of 8.5% during forecasted period. This is due to this is due to growing demand of ben oil in dietary supplements and capsules.On the basis of distribution channel, Ben Oil Market is segmented as Offline and Online channel. The offline channel held over 70% of the market share and is anticipated to maintain its dominance with a anticipated CAGR of 9.1% during the forecasted period. This is due to traditional consumer preference to purchase ben oil from offline channel such as supermarkets, Food Stores, and pharmacies. However, the online channel is expected to grow at a significant rate during the forecast period, with a CAGR of 10%. The reason for this is the growing popularity of online stores and the growing awareness of the benefits of ben oil.

Table Showing Ben oil Market Share, By Distribution Channel in 2022 and expected in 2029

Distribution Channel Market Share in 2022 Market Share in 2029 Offline 70% 55% Online 30% 45%

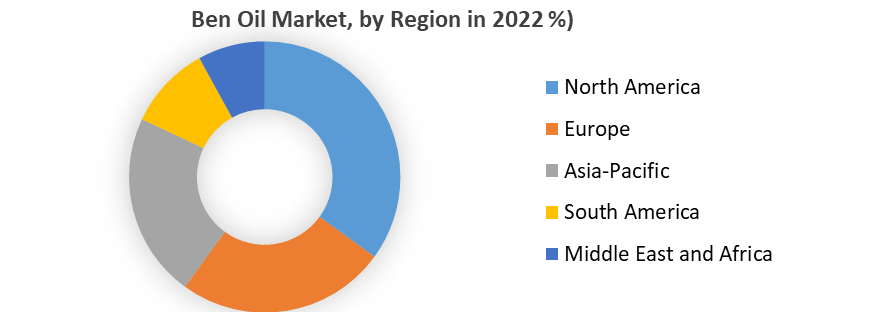

Ben Oil Market Regional Insights

North America is one of the largest Ben Oil Market in the world. This is due to several factors, such as the growing demand for ben oil in the cosmetic and pharmaceutical industries of the region. More than 35% of the market revenue came from this segment in 2022 and it is expected to grow by more than 8 percent. This is largely due to the presence of ben oil companies and the growing popularity of vegan and organic products among health conscious consumers. In addition, consumers in the region are increasingly concerned about the environment and are looking for natural and sustainable products. Health and wellness trends, especially in the US and Canada, are also contributing to the growth of the global market. Europe is estimated to have the second fastest growth over the entire forecast period. The region is expected to post a CAGR of 8.5 percent in the global Ben Oil market during the period 2022-2029.This is due to increasing demand for ben oil in pharmaceutical and cosmetic industries in this region. The fast expansion of the European ben oil market is largely attributable to the region's population development and the migration of people from other emerging nations at this time. France, Germany, and the United Kingdom are the largest markets for ben oil in Europe. The Third largest market share in Asia Pacific is mainly due to the larger population, led by India and China. Asia Pacific is expected to be the region with the highest CAGR during the forecasted period. This is due to the growing usage of the product in the food sector as a healthy cooking oil and a nutritional supplement, as well as the increasing use of the product in various natural and organic skin care products. Governments in the Asia-Pacific region support the use of organic and natural products, including Ben oil, to support the region's agricultural sector, and invest in R & D to explore the sustainability of the product as an alternative to conventional oils, creating new growth opportunities for the region.

Ben Oil Market Competitive Landscape

Ben Oil market is highly competitive and fragmented. Some of the major key players of Ben Oil Market are Avi Naturals, Dawn Moringa, AOS Products Pvt.Ltd. NOW Foods, Nature's Way, Frontier Co-op, Spectrum Naturals, and Mountain Rose Herbs. These companies are spending a lot of money on Research and Development (R & D) to create Ben Oil so that they can meet needs of customers. All of these major players are actively working to develop new products and distribution channel to meet increasing demand for Ben Oil. The leading players in the ben oil production market are focusing on sales and increasing product quality. They are aiming to capture the maximum market share opportunities in global markets. They are focused on expanding their supply chain network and retail distribution capabilities. They are also looking for strategic partnerships and large-scale marketing campaigns to provide customers with more information about the benefits of their product. They are looking to expand their production and supply capacities of ben oil in order to improve their overall profitability. Some of the emerging players in Ben Oil Market are Green India, Moringa Connect, MoSagri, Moringa Malawi, Botanica Natural Products, Organic India, Ayuritz, Marudhar Impex, True Moringa and Genera Nutrients. These companies are new to the industry, but growing rapidly. They target specific niches and use cutting-edge marketing techniques to increase their market share.Ben Oil Market Scope: Inquiry Before Buying

Ben Oil Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 7.89 Bn. Forecast Period 2023 to 2029 CAGR: 10.52% Market Size in 2029: US $ 15.9 Bn. Segments Covered: by End-User Food & Beverages Cosmetic Pharmaceuticals Others by Distribution Channel Offline Online Ben Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Ben Oil Market Key Players

1. Avi Naturals 2. Dawn Moringa 3. Katyani Exports 4. Dawn Naturals 5. Jedwards International, Inc. 6. AETOS Essential Oils 7. AOS Products Pvt.Ltd 8. Green India 9. Ayuritz 10. NOW Foods 11. Asili Natural Oils 12. Genera Nutrients 13. Kerfoot Group 14. Nature's Way 15. Frontier Co-op 16. Spectrum Naturals 17. Mountain Rose Herbs.Frequently Asked Questions:

1] What segments are covered in the Global Ben Oil Market report? Ans. The segments covered in the Ben Oil Market report are based on End-User, Distribution Channel, and Region. 2] Which region is expected to hold the highest share of the Global Ben Oil Market? Ans. The North American region is expected to hold the highest share of the Ben Oil Market. 3] What is the market size of the Global Ben Oil Market by 2029? Ans. The market size of the Ben Oil Market by 2029 is expected to reach USD 15.9 Billion. 4] What is the forecast period for the Global Ben Oil Market? Ans. The forecast period for the Ben Oil Market is 2023-2029. 5] What was the market size of the Global Ben Oil Market in 2022? Ans. The market size of the Ben Oil Market in 2022 was valued at USD 7.89 Billion.

1. Ben Oil Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Ben Oil Market: Dynamics 2.1. Ben Oil Market Trends by Region 2.1.1. Global Ben Oil Market Trends 2.1.2. North America Ben Oil Market Trends 2.1.3. Europe Ben Oil Market Trends 2.1.4. Asia Pacific Ben Oil Market Trends 2.1.5. Middle East and Africa Ben Oil Market Trends 2.1.6. South America Ben Oil Market Trends 2.1.7. Preference Analysis 2.2. Ben Oil Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Ben Oil Market Drivers 2.2.1.2. North America Ben Oil Market Restraints 2.2.1.3. North America Ben Oil Market Opportunities 2.2.1.4. North America Ben Oil Market Challenges 2.2.2. Europe 2.2.2.1. Europe Ben Oil Market Drivers 2.2.2.2. Europe Ben Oil Market Restraints 2.2.2.3. Europe Ben Oil Market Opportunities 2.2.2.4. Europe Ben Oil Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Ben Oil Market Drivers 2.2.3.2. Asia Pacific Ben Oil Market Restraints 2.2.3.3. Asia Pacific Ben Oil Market Opportunities 2.2.3.4. Asia Pacific Ben Oil Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Ben Oil Market Drivers 2.2.4.2. Middle East and Africa Ben Oil Market Restraints 2.2.4.3. Middle East and Africa Ben Oil Market Opportunities 2.2.4.4. Middle East and Africa Ben Oil Market Challenges 2.2.5. South America 2.2.5.1. South America Ben Oil Market Drivers 2.2.5.2. South America Ben Oil Market Restraints 2.2.5.3. South America Ben Oil Market Opportunities 2.2.5.4. South America Ben Oil Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 2.9. Analysis of Government Schemes and Initiatives For Ben Oil Industry 2.10. The Global Pandemic Impact on Ben Oil Market 2.11. Ben Oil Price Trend Analysis (2021-22) 2.12. Global Ben Oil Market Trade Analysis (2017-2022) 2.12.1. Global Import of Coffee 2.12.1.1. Ten Largest Importer 2.12.2. Global Export of Coffee 2.12.3. Ten Largest Exporter 2.13. Production Capacity Analysis 2.13.1. Chapter Overview 2.13.2. Key Assumptions and Methodology 2.13.3. Ben Oil Manufacturers: Global Installed Capacity 3. Ben Oil Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Ben Oil Market Size and Forecast, by End-User (2022-2029) 3.1.1. Food & Beverages 3.1.2. Cosmetic 3.1.3. Pharmaceuticals 3.1.4. Others 3.2. Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 3.2.1. Online 3.2.2. Offline 3.3. Ben Oil Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Ben Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 4.1. North America Ben Oil Market Size and Forecast, by End-User (2022-2029) 4.1.1. Food & Beverages 4.1.2. Cosmetic 4.1.3. Pharmaceuticals 4.1.4. Other 4.2. North America Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.2.1. Online 4.2.2. Offline 4.3. North America Ben Oil Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Ben Oil Market Size and Forecast, by End-User (2022-2029) 4.3.1.1.1. Food & Beverages 4.3.1.1.2. Cosmetic 4.3.1.1.3. Pharmaceuticals 4.3.1.1.4. Others 4.3.1.2. United States Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1.2.1. Online 4.3.1.2.2. Offline 4.3.2. Canada 4.3.2.1. Canada Ben Oil Market Size and Forecast, by End-User (2022-2029) 4.3.2.1.1. Food & Beverages 4.3.2.1.2. Cosmetic 4.3.2.1.3. Pharmaceuticals 4.3.2.1.4. Others 4.3.2.2. Canada Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.2.2.1. Online 4.3.2.2.2. Offline 4.3.3. Mexico 4.3.3.1. Mexico Ben Oil Market Size and Forecast, by End-User (2022-2029) 4.3.3.1.1. Food & Beverages 4.3.3.1.2. Cosmetic 4.3.3.1.3. Pharmaceuticals 4.3.3.1.4. Others 4.3.3.2. Mexico Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.3.2.1. Online 4.3.3.2.2. Offline 5. Europe Ben Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 5.1. Europe Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.2. Europe Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3. Europe Ben Oil Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.1.2. United Kingdom Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.2. France 5.3.2.1. France Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.2.2. France Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.3.2. Germany Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.4.2. Italy Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.5.2. Spain Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.6.2. Sweden Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.7.2. Austria Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Ben Oil Market Size and Forecast, by End-User (2022-2029) 5.3.8.2. Rest of Europe Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Ben Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029) 6.1. Asia Pacific Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.2. Asia Pacific Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3. Asia Pacific Ben Oil Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.1.2. China Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.2.2. S Korea Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.3.2. Japan Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.4. India 6.3.4.1. India Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.4.2. India Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.5.2. Australia Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.6.2. Indonesia Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.7.2. Malaysia Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.8.2. Vietnam Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.8.3. Vietnam Ben Oil Market Size and Forecast, by Industry Vertical(2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.9.2. Taiwan Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Ben Oil Market Size and Forecast, by End-User (2022-2029) 6.3.10.2. Rest of Asia Pacific Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Ben Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Ben Oil Market Size and Forecast, by End-User (2022-2029) 7.2. Middle East and Africa Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.3. Middle East and Africa Ben Oil Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Ben Oil Market Size and Forecast, by End-User (2022-2029) 7.3.1.2. South Africa Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Ben Oil Market Size and Forecast, by End-User (2022-2029) 7.3.2.2. GCC Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Ben Oil Market Size and Forecast, by End-User (2022-2029) 7.3.3.2. Nigeria Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Ben Oil Market Size and Forecast, by End-User (2022-2029) 7.3.4.2. Rest of ME&A Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Ben Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Ben Oil Market Size and Forecast, by End-User (2022-2029) 8.2. South America Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8.3. South America Ben Oil Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Ben Oil Market Size and Forecast, by End-User (2022-2029) 8.3.1.2. Brazil Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Ben Oil Market Size and Forecast, by End-User (2022-2029) 8.3.2.2. Argentina Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Ben Oil Market Size and Forecast, by End-User (2022-2029) 8.3.3.2. Rest Of South America Ben Oil Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Ben Oil Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. End-User Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Ben Oil Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Avi Naturals 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Dawn Moringa 10.3. Katyani Exports 10.4. Dawn Naturals 10.5. Jedwards International, Inc. 10.6. AETOS Essential Oils 10.7. AOS Products Pvt.Ltd 10.8. Green India 10.9. Ayuritz 10.10. NOW Foods 10.11. Asili Natural Oils 10.12. Genera Nutrients 10.13. Kerfoot Group 10.14. Nature's Way 10.15. Frontier Co-op 10.16. Spectrum Naturals 10.17. Mountain Rose Herbs. 11. Key Findings 12. Industry Recommendations 13. Ben Oil Market: Research Methodology 14. Terms and Glossary