Beef Market was valued at US$ 508.48 Billion in 2029. The Beef Market size is estimated to grow at a CAGR of 3.2% over the forecast period.Beef Market Overview:

Beef is a culinary name for cattle meat. Meat that has been cured in a salt solution is called corned beef. The meat was salted and cured before refrigeration to help preserve Beef and veal have the highest protein content, which is expected to enhance the demand as a primary source of protein. Veal has the highest protein level of any meat, with 33.9% per 100 gm cooked. Pork provides 29.3% protein, and chicken has 28.9%. China is expected to be a major market, with rising disposable income fueling beef demand. People’s living standards have improved, and now they choose beef-based items over pork and chicken-based products. Burgers and rolls produced from these items are becoming increasingly popular among young people. The report explores the Beef Market's segments (Product, Cut, and Region). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2018 to 2022.To know about the Research Methodology :- Request Free Sample Report The market outlook focuses on the market’s dynamics, such as drivers, constraints, opportunities, and challenges. Market intrinsic factors are drivers and restrictions, and extrinsic include opportunities and difficulties. This MMR report includes investor recommendations based on a thorough examination of the Beef Market's contemporary competitive scenario.

Beef Market Dynamics:

Increase in Emerging Market’s Disposable Income The factor driving the increase in disposable income is due to consumer demand for healthful, protein-rich meat products. Consumption of these products is growing in the emerging economies of China and Thailand, especially among the middle class. China’s income has risen by double digits and is expected to grow continuously and it is anticipated that beef consumption during the forecast period. Increasing living standards and awareness of the importance of animal protein have led consumers to include meat products in their diets. The other important factor rising the growth of the market is government initiatives related to the food industry. The Chinese government has lifted the ban on Australian refrigerated and frozen foods. The government is also expected to remove the ban on Brazil’s imports in a few years. The factors attributing to the growth of the US market are the demands from restaurants like Burger King and McDonald’s. Increasing sales through the distribution channel The beef market growth is supported by the continuing increase in meat distribution channels around the world in a few years. It is expected that the growing demand for meat preparations in the food service sector is due to the rising popularity of eating out in cafes, hotels, and restaurants. The online channels are expected to rise the sales of fresh and chilled products with a large range of product variations and discount systems. The growing knowledge of fresh food health has supported the sale of meat through various retail distribution channels like supermarkets, hypermarkets, specialty stores, and online retailers. Supermarkets and hypermarkets are popular places to buy fresh produce, as they have access to a variety of meat fillets and guarantee product reliability. The rising popularity of online shopping is expected to boost their sales. These stores allow to order a wide range of products and deliver them to the home. Buying fresh cuts online guarantees safety and security because the seller only needs to label the product if it is certified by a particular food safety organization. Increased awareness of health risks associated with excessive fat consumption Several types of research are conducted by the institutes to determine the impact of lean meat consumption. For example, according to the British Medical Association, eating lean meat products causes cardiovascular disease, diabetes, and certain Product of cancer. Excessive consumption of raw lean products increases mortality by 9%. These are the factors impeding the market growth and affecting the overall consumption of lean meat products in developed countries like the US, China, Canada, and the European Union. Environmental activists launch protests to reduce animal consumption because of the rising risk of global warming and irreversible climate change. The U.S. is the largest beef producer in the world market but in the last few years, it has seen majorly imports of chilled grass beef. The rising Islamic population is expected to increase the demand for halal beef during the forecast period. The shortage of cattle in some countries, causes a rise in product prices creating an imbalance in the value chain. The demand for Kosher beef in North America is anticipated to drive by its safety and high quality. The value chain is expected to benefit from improvements in slaughtering processes and animal feed technologies. Existence of plant-based beef Plant-based beef and mince are used in vegan cooking. The goal of the plant-based alternatives for the least environmentally friendly ingredients in the food industry, such as beef, is to create a global chain that is better for animals and the environment. The goal is to find meat substitutes. Plant-based hot dogs, veggie burgers, and vegan sausages are becoming increasingly popular in restaurants and supermarkets. Since its inception in 2009, a plant-based company in the U.S. has been at the forefront of the alternative-meat sector. It has the flexibility and freedom to turn any recipe into a meaty plant-based masterpiece. The presence of plant-based beef is expected to hamper the beef market’s growth.Beef Market Segment Analysis

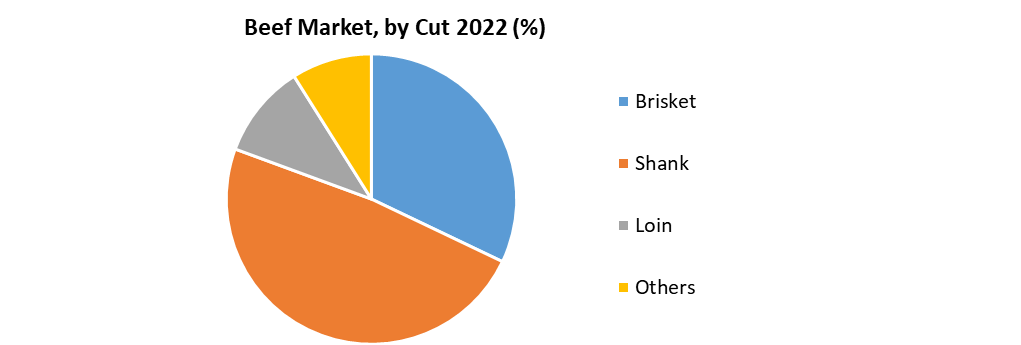

Based on Product, the market is divided into Ground Roasts, Streaks, and Cubed. Ground beef has expected to account for the largest market share during the forecast period because it is more cost-effective than other cuts and is suitable for a variety of budgetary needs. Steaks and roasts are used to produce a variety of cuisines. Fine dining restaurants employ these cuts for patrons who demand premium, high-quality meals. The increased consumption of ground beef is expected to increase the market. Ground beef has health benefits, like it helps to create cells, stimulates the immune system, supports hormone production, and replenishes iron levels. The segment’s growth is expected to boost because of ground beef’s fat and protein content. The cubed beef is expected to rise at a fast rate of CAGR of 3.8% from 2022 to 2029, which are delectable cuts of beef that are pre-tenderized and easy to fry in combination with other ingredients. Based on Cut, the market is segmented into Brisket, Shank, Loin, and Others. The brisket segment is expected to dominate the market during the forecast period. The factors attributing to the growth are the increasing use of brisket in the preparation of corned beef around the world, mostly among the Jews. The brisket is the meat wrapped around the breastbone. The factor fuelling the segment is the convenience of slow-cooking brisket on a grill, including the fact that it is one of the most delectable pieces of meat. The shank is anticipated to rise at the fastest rate of CAGR of xx% during the forecast period, owing to the growing use of shank in the creation of low-fat grounded beef due to its leanness.

Beef Market Regional Insights:

North America held 37% of the total market in 2022 because of the presence of dominant global producers like the US which is contributing to its growth in this region. The factors driving the region’s beef market are the rising Jewish and Islamic population in the US that consumes halal dishes and corned beef. Also, the presence of major firms in this area like Cargill in the US is fueling the growth of the beef market in this region. The Asia-Pacific is anticipated to grow at the highest CAGR of xx% during the forecast period because of the people consuming more beef in the countries like China, Australia, and Japan. The increasing cattle production in South-East Asia’s rising economies, combined with the widespread use of concentrated animal feeds to improve animal development and meat quality, especially components like brisket is boosting the Asia Pacific beef market ahead. The objective of the report is to present a comprehensive analysis of the global Beef Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Beef Market dynamic, and structure by analyzing the market segments and projecting the Beef Market size. Clear representation of competitive analysis of key players by tyoe, price, financial position, Product portfolio, growth strategies, and regional presence in the Beef Market make the report investor’s guide.Beef Market Scope: Inquire before buying

Beef Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 407.86 Bn. Forecast Period 2023 to 2029 CAGR: 3.2% Market Size in 2029: US $ 508.48 Bn. Segments Covered: by Product Ground Roasts Streaks Cubed by Cut Brisket Shank Loin Others by Slaughter Method Kosher Halal Others by Distribution Channel Retail Sales HoReCa Butcher Shops Beef Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Beef Market, Key Players:

1. JBS SA 2. National Beef Packing Company, LLC 3. American Foods Group, LLC 4. Agri Beef Co. 5. Perdue Farms Inc. 6. Tyson Foods, Inc 7. Strauss Brands LLC 8. Cargill, Incorporated 9. Central Valley Meat 10.Danish Crown A/S 11.NH Foods Ltd 12.Vion Food group 13.Hormel Foods Corporation 14.St Helen’s Meat Packers Frequently asked questions: 1. What is the market growth of the Beef Market? Ans. The modified market was valued at US$ 407.86 Bn. in 2022 and is expected to reach US$ 508.48 Bn. by 2029, at a CAGR of 3.2% during the forecast period. 2. Which are the major key players in the Beef Market? Ans. The key players in this market include JBS SA, National Beef Packing Company, LLC, American Foods Group, LLC, Agri Beef Co., and Perdue Farms Inc. 3. Which region is anticipated to account for the largest market share? Ans. North America is anticipated to dominate the Beef Market, 4. what is the forecast period for the Beef Market? Ans. The forecast period for the Beef Markets is from 2023 to 2029. 5. what is the segment in which the Beef Markets are divided? Ans. The Beef Markets are fragmented based on Product and Cut. It is also divided on basis of different regions.

1. Global Beef Market: Research Methodology 2. Global Beef Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Beef Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Beef Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Beef Market Segmentation 4.1 Global Beef Market, by Product (2022-2029) • Ground Roasts • Streaks • Cubed 4.2 Global Beef Market, by Cut (2022-2029) • Brisket • Shank • Loin • Others 4.3 Global Beef Market, by Slaughter Method (2022-2029) • Kosher • Halal • Others 4.4 Global Beef Market, by Distribution Channel (2022-2029) • Retail Sales • HoReCa • Butcher Shops 5. North America Beef Market(2022-2029) 5.1 North America Beef Market, by Product (2022-2029) • Ground Roasts • Streaks • Cubed 5.2 North America Beef Market, by Cut (2022-2029) • Brisket • Shank • Loin • Others 5.3 North America Beef Market, by Slaughter Method (2022-2029) • Kosher • Halal • Others 5.4 North America Beef Market, by Distribution Channel (2022-2029) • Retail Sales • HoReCa • Butcher Shops 5.5 North America Beef Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Beef Market (2022-2029) 6.1. European Beef Market, by Product (2022-2029) 6.2. European Beef Market, by Cut (2022-2029) 6.3. European Beef Market, by Slaughter Method (2022-2029) 6.4. European Beef Market, by Distribution Channel (2022-2029) 6.5. European Beef Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Beef Market (2022-2029) 7.1. Asia Pacific Beef Market, by Product (2022-2029) 7.2. Asia Pacific Beef Market, by Cut (2022-2029) 7.3. Asia Pacific Beef Market, by Slaughter Method (2022-2029) 7.4. Asia Pacific Beef Market, by Distribution Channel (2022-2029) 7.5. Asia Pacific Beef Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Beef Market (2022-2029) 8.1 Middle East and Africa Beef Market, by Product (2022-2029) 8.2. Middle East and Africa Beef Market, by Cut (2022-2029) 8.3. Middle East and Africa Beef Market, by Slaughter Method (2022-2029) 8.4. Middle East and Africa Beef Market, by Distribution Channel (2022-2029) 8.5. Middle East and Africa Beef Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Beef Market (2022-2029) 9.1. South America Beef Market, by Product (2022-2029) 9.2. South America Beef Market, by Cut (2022-2029) 9.3. South America Beef Market, by Slaughter Method (2022-2029) 9.4. South America Beef Market, by Distribution Channel (2022-2029) 9.5. South America Beef Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 JBS SA 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 National Beef Packing Company, LLC 10.3 American Foods Group, LLC 10.4 Agri Beef Co. 10.5 Perdue Farms Inc. 10.6 Tyson Foods, Inc 10.7 Strauss Brands LLC 10.8 Cargill, Incorporated 10.9 Central Valley Meat 10.10 Danish Crown A/S 10.11 NH Foods Ltd 10.12 Vion Food group 10.13 Hormel Foods Corporation 10.14 St Helen’s Meat Packers