The Global Bakery and Cereal Market size was valued at $684.32 million in 2022 and is expected to reach $965.43 million by 2029, expanding at a compound annual growth rate (CAGR) of 5.04 per cent. The market includes a variety of baked delicacies like cakes, pastries, bread, and biscuits, cereals like granola bars and cereal-based breakfast snacks. It serves the assorted choices of consumers, providing a diverse palette of textures, flavors, and nutritional profiles. Changing consumer dietary habits and lifestyles have increased the demand for ready-to-eat and commodious munching options. These products provide a suitable and often nutritious choice for consumers seeking on-the-go expedient snacks. The growing awareness of healthier food selections and the broadening awareness of the significance of a balanced diet have incited the market. Manufacturers suggest introducing products that are low in fat, sugar, or calories, as well as those that are organic, gluten-free, or enriched with functional and flexible ingredients like vitamins or fibers. The bakery and cereal market also witness trends influenced by cultural preferences and regional variations. For example, croissants are a classic and popular traditional baked good in France. These flaky, buttery pastries are enjoyed by locals and visitors, often accompanied by a cup of coffee or a delicious breakfast spread. Similarly, in Italy, panettone is a beloved sweet bread loaf traditionally enjoyed during the Christmas season, featuring candied fruits and raisins. These examples highlight how traditional baked goods cater to local tastes, adding a unique touch to the bakery and cereal market worldwide.To know about the Research Methodology :- Request Free Sample Report

Bakery and Cereal Market Dynamics

The bakery and cereal market is a thriving industry with immense growth potential, as indicated by its market size reaching 684.32 million USD in 2022. Changing consumer lifestyles play a significant role. As individuals lead busier lives, they seek convenient and ready-to-eat breakfast and snack options, driving the demand for bakery and cereal products. The popularity of fast-food culture has also contributed to the growth of this market, with consumers looking for quick and easy meal solutions. Key Market Drivers in the Bakery and Cereal Industry: Evolving Preferences, Convenience, Globalization, and Technological Advancement Today's consumers are increasingly health-conscious, driving the demand for organic, gluten-free, and whole-grain bakery and cereal products. To meet these changing preferences, manufacturers are offering a wider variety of healthier options. Convenience has become a significant driver as busy lifestyles and the need for quick meals fuel the popularity of ready-to-eat bakery products and breakfast cereals. Consumers seek products that require minimal preparation time and can be consumed on the go, leading to a growing demand for individually packaged items, portion-controlled servings, and single-serve cereal cups. Globalization has influenced the industry by facilitating the exchange of culinary traditions and flavors. This has introduced various products from the world’s scattered regions in this market, giving consumers accessibility to a broad range of international options. Advancements in technology have majorly contributed as well in revolutionizing this industry. Automation, advanced machinery, and innovative baking techniques have enhanced production efficiency, product quality, and shelf life. This enables manufacturers to meet increasing demands while maintaining consistency and quality standards. The report provides valuable information to stakeholders, such as manufacturers, suppliers, distributors, and investors, to assist them in making informed decisions.Managing Raw Material Costs and Perishability: Key Challenges in the Bakery and Cereal Industry Fluctuations in the prices of raw materials, including wheat, sugar, and cocoa, pose a significant challenge for bakery and cereal businesses. Sudden increases in raw material costs can squeeze profit margins and necessitate adjustments in pricing strategies or the exploration of alternative ingredients. The ability to manage and mitigate the impact of volatile raw material costs is crucial for maintaining profitability in a competitive market. Bakery and cereal products often have a limited shelf-life due to their perishable nature. Maintaining product freshness and quality throughout the supply chain is challenging, especially for larger scale companies. Ensuring proper storage, packaging, and distribution practices is important to prevent spoilage and maintain customer satisfaction. Evolving Regulatory Landscape in the Bakery and Cereal Market Regulatory compliance and food safety are critical considerations in the bakery and cereal industry. A Business must stick to strict standards and regulations to ensure the quality and safety of its products. Hygiene standards, labelling requirements, and allergen control measures’ compliance can be expensive and complex, especially for small-scale manufacturers. Meeting these obligations is essential to maintain consumer trust and meet legal requirements. Retail and Distribution Challenges: Navigating Seasonality and Establishing Effective Networks in the Bakery and Cereal Market The bakery and cereal industry face significant restraints when it comes to retail and distribution. One of the major challenges is securing shelf space in supermarkets and managing inventory. With limited shelf space available, competition is fierce, and smaller bakery and cereal businesses often struggle to secure prominent placements. Managing inventory efficiently becomes crucial to meet demand while minimizing waste or shortages. Another restraint in the bakery and cereal market is the impact of seasonality. Certain products experience peak demand during specific times of the year, such as holiday-themed pastries or breakfast cereals. This poses challenges in managing production, inventory, and marketing strategies to align with seasonal variations in demand. Businesses need to carefully forecast and plan production quantities, ensuring they have enough stock to meet increased demand during peak seasons while avoiding excess inventory during slower periods. Companies need reliable and efficient networks to ensure their products reach retailers and consumers in a timely manner. Managing logistics, transportation, and maintaining product freshness throughout the supply chain are critical factors for success in the bakery and cereal market. Health-Conscious Shifts and Plant-Based Boom: Market Trends in the Bakery and Cereal Industry Health and Wellness: The market is shifting toward healthier options. Consumers know these products with low in fat, sugar, and artificial additives. To reach this expectation, businesses are launching products with whole grains, natural ingredients, and fortifications, aiming at those prioritizing wellness and nutrition. Organic and Clean Label: The traction of clean and organic label products is on the surge in the market. Consumers are alert to an upswing in the origin and quality of ingredients in their food. They look for products free from GMOs, pesticides, and artificial preservatives. Accordingly, businesses are inculcating clean and organic clean-label claims into their offerings to satisfy the upscaling segment of consumers who are health-conscious. Plant-Based and Vegan Products: The market is also observing the effect of the vegan and plant-based movement. Consumers look for alternatives that are plant-based as compared to old-school breakfast cereals and bakery products. In reciprocation, businesses develop plant-based pastries, bread, cakes, and vegan-friendly cereals with ingredients like seeds, nuts, non-dairy milk, and legumes. This trend shows the heightening demand for environmentally friendly options in cruelty-free and sustainable.

Bakery and Cereal Market Segment Analysis

By Product: The bakery and cereal market encompasses diverse product types. It includes pastries, bread, cookies, cakes, granola bars, breakfast cereals, and more. Each product type offers distinctive textures, flavours, and nutritional profiles, catering to various consumer occasions and preferences. Old-school bakery products like pastries and bread remain popular. There is also an increasing demand for healthier options, like gluten-free bread, organic cereals, and whole-grain pastries. Easy accessibility, versatility, and affordability makes bread a highly admired product in the market. It is a staple food, providing different versions and flavours to cater to various consumer preferences. Bread provides nutritional value, with options like whole grain bread offering dietary fibre, vitamins, minerals, and essential nutrients necessary for a balanced diet. By Packaging: Packaging plays a crucial role in the bakery and cereal market, ensuring freshness, convenience, and visual appeal. The packaging type segment includes various formats such as bags, boxes, cartons, and individual wrappers. Packaging options may differ based on the product type and target audience. Breakfast cereals and snacks have standard single-serving packaging convenient for on-the-go consumption. Single-serve packaging is more common in the bakery and cereal market due to its convenience for on-the-go consumption, portion control benefits, and ability to maintain product freshness and shelf life. The rising demand for grab-and-go options and the need for accessible, portable solutions have driven the popularity of single-serve packaging in this industry. By Distribution Channel: The distribution channel segment identifies the different channels through which bakery and cereal products are made available to consumers. This includes supermarkets, hypermarkets, convenience stores, online retailers, and specialty bakery shops. Supermarkets and hypermarkets typically offer a wide range of bakery and cereal products, catering to diverse consumer preferences. Convenience stores provide convenient access for quick purchases. Online retailing has witnessed significant growth, allowing consumers to browse and purchase bakery and cereal products from the comfort of their homes. Specialty bakery shops often focus on artisanal and high-quality offerings, attracting niche customer segments seeking unique bakery experiences. Supermarkets and hypermarkets are the most popular distribution channels for bakery and cereal products due to their wide product range, convenience, accessibility, competitive pricing, and high brand visibility. These channels provide a one-stop shopping experience and cater to diverse consumer preferences, making them the preferred choice for most customers. By End User: The end user segment focuses on the various consumer groups that drive demand in the bakery and cereal market. Household consumers form the largest end user group, purchasing bakery and cereal products for daily consumption, breakfast, snacks, and special occasions. The foodservice industry represents another significant end user segment, including restaurants, cafes, hotels, and catering services. These establishments source bakery products for their menus, offering a wide array of bakery items to their customers. The retail and wholesale industry serve as an essential end user segment, sourcing bakery and cereal products for further distribution or resale to other businesses and consumers.Bakery and Cereal Market Regional Insights

North America: The market is highly competitive and mature. 2022 the market size was anticipated to be approximately $240 million. The region has an entrenched industry that offers different products like bread, breakfast cereals, and pastries. The ask for organic and healthier bakery items is increasing, with a forecasted growth rate in the organic segment. Online sales of cereal and bakery products have been consistently increasing by approximately 24%. Europe: Europe is a prominent market for bakery and cereal products. Diverse bakery offerings characterise the market, including artisanal bread, pastries, and speciality cakes. The convenience and on-the-go bakery products segment are also witnessing significant growth, driven by changing consumer lifestyles. Asia-Pacific: The Asia-Pacific bakery and cereal market is experiencing rapid growth, driven by increasing disposable incomes, urbanisation, and westernization of diets. Traditional bakery items, including bread, buns, and pastries, remain popular in the region, but there is also a rising demand for international bakery products and breakfast cereals. The online sales of bakery products in Asia-Pacific have grown substantially. Latin America: Latin America showcases a vibrant bakery and cereal market. The market is characterised by various traditional bakery products influenced by regional flavors and ingredients. Convenience and packaged bakery products are gaining popularity. The demand for premium and artisanal bakery products is also increasing, driven by the rising middle-class population and consumer preferences for indulgent options. The online bakery market in Latin America is expected to grow significantly during the forecast period. Middle East and Africa: The Middle East and Africa region market is driven by changing dietary habits, urbanisation, and an increasing preference for convenience foods. old-school bakery products, such as Arabic bread, pastries, and sweets, are popular in the region. The online sales of bakery and cereal products in the Middle East and Africa are also increasing, contributing to the market growth. The report comprehensively analyses the Bakery and Cereal market in North America, Europe, Asia-Pacific, South America and the Middle East & Africa, covering all the key metrics such as market size, market share, growth rate, regulatory landscape, and competitive landscape.Bakery and Cereal Market Competitive Landscape

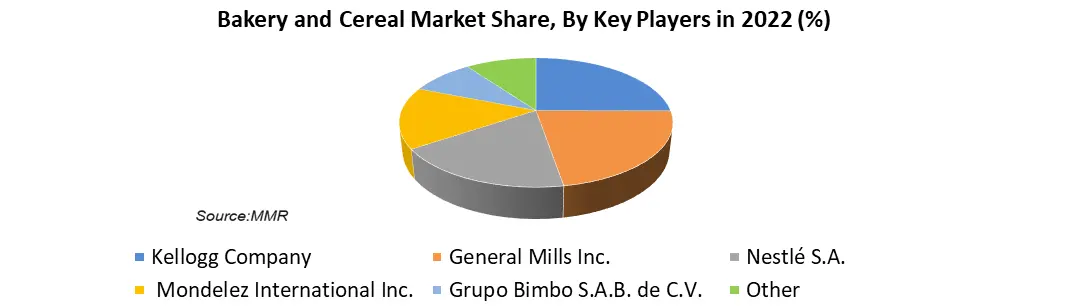

The competitive landscape section of the Bakery and Cereal market report provides a comprehensive analysis of the key market participants. The report examines the company profiles, product portfolios, financial performance, SWOT analysis, and most recent developments of the market's leading competitors. Kellogg's Strengthens Portfolio with Acquisition of MorningStar Farms On January 24, 2023, Kellogg’s revealed its agreement to acquire MorningStar Farms for $1.5 million to expand its plant based offerings. It is a leading plant-based food company that produces high-quality plant-based meat alternatives, such as burgers, sausages, and nuggets, Kellogg's vision of meeting evolving consumer preferences and diversifying its product portfolio is aligned with this strategic acquisition. Kellogg's aims to position itself at the forefront of the growing plant-based food market by integrating MorningStar Farms' expertise and products into its lineup. $1 Billion Investment in U.S. Cereal Plants Committed by Kellogg’s On May 10, 2023, Kellogg’s announced a substantial investment of $1 billion in new U.S. cereal plants. This significant financial commitment will be used to construct two state-of-the-art cereal facilities and enhance the capabilities of two existing plants. The expansion project is a testimony to Kellogg's confidence in the cereal market and demonstrates the company's commitment to job creation, as it is expected to generate 500 new employment opportunities. General Mills Embraces Regenerative Agriculture with New Partnerships and Initiatives On May 10, 2023, General Mills reinforced its commitment to regenerative agriculture by announcing strategic partnerships and initiatives. Collaborating with farmers, universities, and NGOs, General Mills aims to advance the adoption of regenerative agriculture practices. Regenerative agriculture focuses on enhancing soil health, improving water quality, and reducing greenhouse gas emissions. Through these partnerships, General Mills strives to make a positive impact on the environment and contribute to sustainable farming practices.

Bakery and Cereal Market Scope: Inquire before buying

Bakery and Cereal Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 684.32 Mn. Forecast Period 2023 to 2029 CAGR: 5.04% Market Size in 2029: US $ 965.43 Mn. Segments Covered: by Product 1.Bread 2.Pastries 3.Cakes 4.Cookies 5.Breakfast cereals 6.Granola bars by Packaging 1.Bag/ Pouch 2.Box 3.Cartons 4.Individual wrappers by Distribution Channel 1.Supermarkets and Hypermarkets 2.Convenience Stores 3.Online Retailing 4.Specialty bakery shops by End-User 1.Household Consumers 2.Foodservice Industry 3.Retail and Wholesale Industry Bakery and Cereal Market, by region

North America: United States, Canada, Mexico Europe: Germany, United Kingdom, France, Italy, Spain, Russia Asia Pacific: China, Japan, India, South Korea, Australia, Indonesia, Thailand Middle East & Africa: Saudi Arabia, United Arab Emirates, South Africa, Egypt, Nigeria South America: Brazil, Argentina, ColombiaBakery and Cereal Market Key Players

These companies represent a mix of global leaders, regional players, and niche brands, collectively shaping the competitive landscape of the Bakery and Cereal market. The report covers how each player in the Bakery and Cereal market brings distinct offerings, product innovations, well-established distribution networks, and effective marketing strategies to cater to the diverse preferences of consumers on a global scale. 1. Kellogg Company 2. General Mills Inc. 3. Nestlé S.A. 4. Mondelez International Inc. 5. Grupo Bimbo S.A.B. de C.V. 6. The Kraft Heinz Company 7. PepsiCo Inc. 8. Post Holdings Inc. 9. Conagra Brands Inc. 10. Campbell Soup Company 11. J.M. Smucker Company 12. Aryzta AG 13. Barilla G. e R. Fratelli S.p.A. 14. Britannia Industries Limited 15. Premier Foods Group Limited 16. The Hain Celestial Group Inc. 17. Flower Foods Inc. 18. George Weston Limited 19. MHP S.E. 20. Lantmännen Unibake International 21. Muffin Break 22. Quaker Oats Company 23. Uncle Tobys 24. Weetabix Limited 25. Yamazaki Baking Co. Ltd FAQ Q1: What was the value of the Bakery and Cereal market in 2022? A1: The Bakery and Cereal market was valued at $684.32 million in 2022. Q2: What is the projected size of the Bakery and Cereal market by 2029, and what is the expected compound annual growth rate (CAGR)? A2: The Bakery and Cereal market is expected to reach $965.43 million by 2029, expanding at a compound annual growth rate (CAGR) of 5.04 percent. Q3: What are the key drivers in the bakery and cereal industry? A3: The key drivers in the bakery and cereal industry include evolving consumer preferences, convenience, globalization, and technological advancements. Consumers are becoming more health-conscious that increases demand for healthier options. Hectic lifestyles drive the popularity of ready-to-eat bakery products and breakfast cereals. Globalization has brought diverse culinary traditions and flavors, while technological advancements have improved production efficiency and product quality. Q4: What are the challenges in the bakery and cereal industry? A4: Challenges in the bakery and cereal industry include managing raw material costs and perishability, navigating retail and distribution challenges, and complying with evolving regulations. Fluctuations in raw material prices can impact profitability, and perishability requires proper storage and distribution practices. Securing shelf space and managing inventory in retail stores can be challenging. Regulatory compliance and food safety standards must be met to ensure product quality and consumer trust. Q5: What are the market trends in the bakery and cereal industry? A5: Market trends in the bakery and cereal industry see a shift towards healthier options, organic and clean label products, and the increasing demand of plant-based and vegan offerings. Consumers are seeking low-sugar, low-fat, and natural ingredient options. Organic and clean label products are gaining popularity. The demand for plant-based alternatives to traditional bakery products and cereals is increasing, driven by sustainability and health-consciousness.

1. Bakery and Cereal Market: Research Methodology 2. Bakery and Cereal Market: Executive Summary 3. Bakery and Cereal Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Bakery and Cereal Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Bakery and Cereal Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Bakery and Cereal Market Size and Forecast, by Product (2022-2029) 5.1.1. Bread 5.1.2. Pastries 5.1.3. Cakes 5.1.4. Cookies 5.1.5. Breakfast cereals 5.1.6. Granola bars 5.2. Bakery and Cereal Market Size and Forecast, by Packaging (2022-2029) 5.2.1. Bag/ Pouch 5.2.2. Box 5.2.3. Cartons 5.2.4. Individual wrappers 5.3. Bakery and Cereal Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.1. Supermarkets and Hypermarkets 5.3.2. Convenience Stores 5.3.3. Online Retailing 5.3.4. Specialty bakery shops 5.3.5. Others 5.4. Bakery and Cereal Market Size and Forecast, by End-user (2022-2029) 5.4.1. Household Consumers 5.4.2. Foodservice Industry 5.4.3. Retail and Wholesale Industry 5.5. Bakery and Cereal Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Bakery and Cereal Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Bakery and Cereal Market Size and Forecast, by Product (2022-2029) 6.1.1. Bread 6.1.2. Pastries 6.1.3. Cakes 6.1.4. Cookies 6.1.5. Breakfast cereals 6.1.6. Granola bars 6.2. North America Bakery and Cereal Market Size and Forecast, by Packaging (2022-2029) 6.2.1. Bag/ Pouch 6.2.2. Box 6.2.3. Cartons 6.2.4. Individual wrappers 6.3. North America Bakery and Cereal Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.1. Supermarkets and Hypermarkets 6.3.2. Convenience Stores 6.3.3. Online Retailing 6.3.4. Specialty bakery shops 6.3.5. Others 6.4. North America Bakery and Cereal Market Size and Forecast, by End-user (2022-2029) 6.4.1. Household Consumers 6.4.2. Foodservice Industry 6.4.3. Retail and Wholesale Industry 6.5. North America Bakery and Cereal Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Bakery and Cereal Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Bakery and Cereal Market Size and Forecast, by Product (2022-2029) 7.1.1. Bread 7.1.2. Pastries 7.1.3. Cakes 7.1.4. Cookies 7.1.5. Breakfast cereals 7.1.6. Granola bars 7.2. Europe Bakery and Cereal Market Size and Forecast, by Packaging (2022-2029) 7.2.1. Bag/ Pouch 7.2.2. Box 7.2.3. Cartons 7.2.4. Individual wrappers 7.3. Europe Bakery and Cereal Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.1. Supermarkets and Hypermarkets 7.3.2. Convenience Stores 7.3.3. Online Retailing 7.3.4. Specialty bakery shops 7.3.5. Others 7.4. Europe Bakery and Cereal Market Size and Forecast, by End-user (2022-2029) 7.4.1. Household Consumers 7.4.2. Foodservice Industry 7.4.3. Retail and Wholesale Industry 7.5. Europe Bakery and Cereal Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Bakery and Cereal Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Bakery and Cereal Market Size and Forecast, by Product (2022-2029) 8.1.1. Bread 8.1.2. Pastries 8.1.3. Cakes 8.1.4. Cookies 8.1.5. Breakfast cereals 8.1.6. Granola bars 8.2. Asia Pacific Bakery and Cereal Market Size and Forecast, by Packaging (2022-2029) 8.2.1. Bag/ Pouch 8.2.2. Box 8.2.3. Cartons 8.2.4. Individual wrappers 8.3. Asia Pacific Bakery and Cereal Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.1. Supermarkets and Hypermarkets 8.3.2. Convenience Stores 8.3.3. Online Retailing 8.3.4. Specialty bakery shops 8.3.5. Others 8.4. Asia Pacific Bakery and Cereal Market Size and Forecast, by End-user (2022-2029) 8.4.1. Household Consumers 8.4.2. Foodservice Industry 8.4.3. Retail and Wholesale Industry 8.5. Asia Pacific Bakery and Cereal Market Size and Forecast, by Segment5 (2022-2029) 8.6. Asia Pacific Bakery and Cereal Market Size and Forecast, by Country (2022-2029) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Bakery and Cereal Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Bakery and Cereal Market Size and Forecast, by Product (2022-2029) 9.1.1. Bread 9.1.2. Pastries 9.1.3. Cakes 9.1.4. Cookies 9.1.5. Breakfast cereals 9.1.6. Granola bars 9.2. Middle East and Africa Bakery and Cereal Market Size and Forecast, by Packaging (2022-2029) 9.2.1. Bag/ Pouch 9.2.2. Box 9.2.3. Cartons 9.2.4. Individual wrappers 9.3. Middle East and Africa Bakery and Cereal Market Size and Forecast, by Distribution Channel (2022-2029) 9.3.1. Supermarkets and Hypermarkets 9.3.2. Convenience Stores 9.3.3. Online Retailing 9.3.4. Specialty bakery shops 9.3.5. Others 9.4. Middle East and Africa Bakery and Cereal Market Size and Forecast, by End-user (2022-2029) 9.4.1. Household Consumers 9.4.2. Foodservice Industry 9.4.3. Retail and Wholesale Industry 9.5. Middle East and Africa Bakery and Cereal Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Bakery and Cereal Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Bakery and Cereal Market Size and Forecast, by Product (2022-2029) 10.1.1. Bread 10.1.2. Pastries 10.1.3. Cakes 10.1.4. Cookies 10.1.5. Breakfast cereals 10.1.6. Granola bars 10.2. South America Bakery and Cereal Market Size and Forecast, by Packaging (2022-2029) 10.2.1. Bag/ Pouch 10.2.2. Box 10.2.3. Resealable Packaging 10.2.4. Single-serving Packs 10.2.5. Bulk Packaging 10.3. South America Bakery and Cereal Market Size and Forecast, by Distribution Channel (2022-2029) 10.3.1. Supermarkets and Hypermarkets 10.3.2. Convenience Stores 10.3.3. Online Retailing 10.3.4. Specialty bakery shops 10.3.5. Others 10.4. South America Bakery and Cereal Market Size and Forecast, by End-user (2022-2029) 10.4.1. Household Consumers 10.4.2. Foodservice Industry 10.4.3. Retail and Wholesale Industry 10.5. South America Bakery and Cereal Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Kellogg Company 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. General Mills Inc. 11.3. Nestlé S.A. 11.4. Mondelez International Inc. 11.5. Grupo Bimbo S.A.B. de C.V. 11.6. The Kraft Heinz Company 11.7. PepsiCo Inc. 11.8. Post Holdings Inc. 11.9. Conagra Brands Inc. 11.10. Campbell Soup Company 11.11. J.M. Smucker Company 11.12. Aryzta AG 11.13. Barilla G. e R. Fratelli S.p.A. 11.14. Britannia Industries Limited 11.15. Premier Foods Group Limited 11.16. The Hain Celestial Group Inc. 11.17. Flower Foods Inc. 11.18. George Weston Limited 11.19. MHP S.E. 11.20. Lantmännen Unibake International 11.21. Muffin Break 11.22. Quaker Oats Company 11.23. Uncle Tobys 11.24. Weetabix Limited 11.25. Yamazaki Baking Co. Ltd 11.26. Key Findings 12. Industry Recommendation