The Baby Electrolyte Market size was valued at USD 1.45 Billion in 2023 and the total Baby Electrolyte revenue is expected to grow at a CAGR of 9.7% from 2024 to 2030, reaching nearly USD 2.82 Billion by 2030.Baby Electrolyte Market Overview

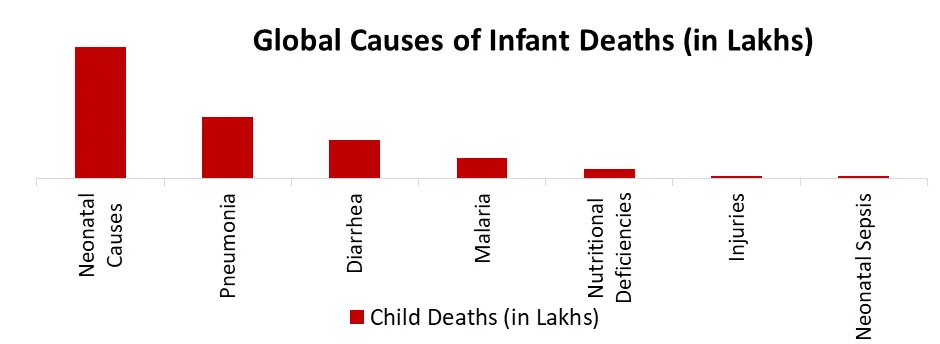

The baby electrolyte is a mixture of water and vital minerals, including sodium, potassium, and chloride, specially prepared for newborns and young children to assist avoid dehydration brought on by vomiting, diarrhoea, or other illnesses.To know about the Research Methodology :- Request Free Sample Report 1.According to MMR analysis, there are nearly 1.7 billion cases of childhood diarrhoeal disease every year globally. The Baby Electrolyte Market witnessed significant growth with the dedication to providing hydration and replenishing electrolytes for infants and young children. The major factors that drive the demand for baby electrolytes are the Increase in global population and the rising prevalence of diarrhoea. In the countries like United States, the United Kingdom, and India; the focus on women's employment and education has increased awareness and disposable income. More women are working globally, leading to a decline in breastfeeding rates and lack of breastfeeding has caused an increase in demand for baby electrolytes. Consumers are aware of proper hydration, thanks to health campaigns and professionals as they understand the risks of dehydration and the role of electrolytes, making them proactive in seeking solutions. Online platforms and subscription services offer convenience, while traditional channels like pharmacies and baby speciality stores provide expert guidance. Additionally, common childhood illnesses like vomiting and fever can cause fluid and electrolyte loss. Electrolyte solutions are an effective way to restore balance and aid in faster recovery. Manufacturers are innovating with new formats, flavours, and personalized options to cater to diverse needs and preferences. Major company strategies, technological advancements, and advanced ingredient science are shaping the market for customizable electrolyte formulations. Demand for plant-based and natural ingredients, awareness about electrolyte benefits for babies, and new baby electrolyte flavours are driving the market growth. In 2023, Asia Pacific held a market share of 22% and is the fastest-growing Baby Electrolyte Market. Economies in countries like China, India, and Vietnam are developing, household disposable incomes are increasing allowing families to spend more on baby care products, including electrolytes. Public health initiatives and rising health consciousness in the region are leading to greater awareness about proper hydration for babies and children driving the demand for electrolyte solutions. Additionally, some developing countries within APAC, with limited access to clean potable water, making electrolyte solutions a valuable source of hydration for babies. The government implementing programs to improve child health and nutrition, which can indirectly support the growth of the baby electrolyte market.

Baby Electrolyte Market Dynamics

Transformative Shift towards Natural, Organic, and Personalized Baby Electrolytes Parents prioritize transparency and natural ingredients for their children's electrolyte solutions. Organic certifications assure clean, sustainable sourcing while avoiding artificial additives, colours, and flavours. The increasing demand for plant-based and natural components in baby electrolytes reflects a growing preference for wholesome options, including eco-friendly packaging materials. The demand for clear labelling and detailed information about ingredients and processing methods has also increased. Brands that communicate transparently gain a competitive edge. The children's needs are unique and personalized electrolyte solutions that cater to specific age groups, activity levels, or existing health conditions are gaining popularity. For example, prebiotic-infused options are becoming more popular because of the growing awareness of gut health. Technological advancements play a crucial role in enabling personalization. Data-driven insights and the increasing sophistication of ingredient science pave the way for customizable electrolyte formulations. The focus on natural, organic, and personalized ingredients signifies a transformative shift in the baby electrolyte market. Additionally, the rising demand for personalized ingredients is contributing to market expansion, with manufacturers introducing products tailored to specific needs, such as electrolytes for babies with allergies or sensitivities. The market's dynamic evolution is shaped by the increasing preference for natural and personalized solutions, reflecting parental priorities centred on safety, quality, and individualized care for their children.Balancing Innovation and Affordability Consumer expectations evolve and awareness about infant health grows, as electrolyte options not only cater to the specific needs of infants but also align with their preferences for transparency, sustainability, and organic ingredients. The demand for innovation pushes manufacturers to invest in research and development, leading to the introduction of new flavours, formats, and advanced nutritional features. The cost factor remains a critical consideration for a large segment of consumers, making it imperative for manufacturers to balance innovation without pricing themselves out of the market. Affordability is particularly crucial for ensuring accessibility to a wide range of parents, including those with varying financial capacities. Striking the right balance between innovation and affordability while maintaining high-quality standards necessitates exploring cost-effective yet sustainable sourcing practices. Solving the challenge will sustain the baby electrolyte market and demonstrate the industry's dedication to providing effective and accessible solutions for infant hydration and health.

Baby Electrolyte Market Segment Analysis

Based on Application, the up-to-12-month segment held the largest market share of about 48% in the Global Baby Electrolyte Market in 2023. According to MMR analysis, the segment is further expected to grow at a CAGR of 9.7% during the forecast period and stands out as the dominant segment within the Baby Electrolyte Market. Infants below 12 months old have immature digestive systems and are highly prone to dehydration, which increases the demand for electrolyte solutions as parents are proactive in addressing dehydration. The prevalence of diarrheal diseases among infants is contributing to the higher demand for electrolyte solutions in the age group. The rising awareness about the benefits of electrolytes for this age group, coupled with the introduction of new flavours and formats of baby electrolytes by manufacturers, is driving the growth of this segment. Manufacturers like Abbott Laboratories, Johnson & Johnson, The Hain Celestial Group, and Cera Products, Inc., address the segment through targeted marketing campaigns and product development, providing age-appropriate flavours and formats, and highlighting the safety and purity of ingredients. Additionally, while breastmilk is the ideal hydration source, for formula-fed babies or illnesses, electrolyte solutions become a more effective option making the up to 12 months segment dominant in the Baby Electrolyte Market.Apart from that, the 12 to 36-month segment is expected to grow at a significant CAGR of XX% during the forecast period. Toddlers in the age group experience fluid and electrolyte imbalances such as diarrhoea, vomiting, or fever, leading to a heightened need for electrolyte solutions. The introduction of new flavours and formats of baby electrolytes by manufacturers, along with the rising awareness about the benefits of electrolytes for toddlers, is fueling the growth of this segment. Additionally, the market is influenced by major companies such as Abbott Laboratories, Johnson & Johnson, and The Hain Celestial Group, Inc., who are constantly engaged in various developmental strategies to strengthen their position in the Baby Electrolyte Market.

Baby Electrolyte Market Regional Insights

North America dominated the Global Baby Electrolyte Market with the highest share of over 35% in 2023. The region is expected to grow at a CAGR of 9.7% during the forecast period and maintain its dominance. The rise in the number of product launches and the introduction of new flavours and formats of baby electrolytes by the manufacturers boosts the market growth in the region. Public health campaigns and healthcare professionals actively promote the importance of proper hydration in children, creating a strong demand for electrolyte solutions. The major Key Players in the baby electrolyte market are Prestige Consumer Healthcare, Inc., Halewood Laboratories Pvt. Ltd., Goodonya, Otsuka Holdings Co., Ltd., The Hain Celestial Group, Inc., Johnson & Johnson, Cipla Ltd., Sanofi, Cera Products, Inc., Monico S.p.A., Mead Johnson & Company, LLC., Kinderfarms, LLC., FDC Limited, Unilab, Inc, Additionally, North American families have more disposable income, allowing them to spend on premium baby products like electrolytes. Extensive networks of supermarkets, pharmacies, and online platforms ensure easy access to the products for parents across the region. Stringent regulations in North America guarantee product safety and quality, which resonates with parents concerned about their children's well-being. The introduction of new products and flavours, with the increasing awareness about the benefits of electrolytes for babies, are the factors driving the growth of the baby electrolyte market in North America.Europe held a significant position in the baby electrolyte market, contributing 28% of the global market share in 2023. European parents favour familiar brands like Danone and Nurofen, leading to brand loyalty. The region has a strong preference for organic and natural ingredients, driving innovation and attracting health-conscious parents. Countries like France and Germany experience stable to slightly increasing birth rates, creating a consistent demand for baby products. Additionally, some European countries offer reimbursement for electrolyte solutions in specific cases, creating accessibility and boosting utilization. The increasing awareness about the benefits of electrolytes for babies is fueling market growth in Europe. Baby Electrolyte Market Competitive Landscapes The baby electrolyte market is competitive, combining established players and emerging brands. Market leaders with major market presence and strong brand recognition lead the Baby Electrolyte industry. Established players like Abbott and Johnson & Johnson benefit from strong brand recognition and trust among parents. Constant innovation with new flavours, formats (like popsicles), added ingredients like prebiotics, engaging in marketing campaigns and promotional offers for purchase decisions, and adherence to stringent safety and quality regulations make the market dynamic landscape. Additionally, the key players constantly engaging in various developmental strategies such as partnerships, mergers, and acquisitions further drive the market. 1. Nestlé acquired a majority stake in personalized vitamin company Persona Nutrition in 2023 to suggest an interest in tailoring nutritional solutions to individual needs, which could translate to personalized electrolyte options for babies. 2. Abbott Laboratories partnered with the American Academy of Pediatrics in 2023 to create educational resources about managing childhood dehydration to build brand trust and awareness within the target audience. 3. The Hain Celestial Group launched a partnership with online baby food company Little Spoon in 2023 to potentially lead co-branded electrolyte products in the future. 4. In 2023, the FDA proposed revisions to regulations on infant formula, potentially impacting some electrolyte ingredients that will influence future product development.

Baby Electrolyte Market Scope: Inquire before buying

Global Baby Electrolyte Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 1.45 Bn. Forecast Period 2024 to 2030 CAGR: 9.7% Market Size in 2030: US $ 2.82 Bn. Segments Covered: by Application 36 Months to 60 months Upto 12 Months 12 to 36 Months by Form Powder Liquid by Flavour Unflavoured Fruit-Flavoured by Distribution Channel Modern Trade General Trade Online Stores Baby Electrolyte Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Baby Electrolyte Market Key Players

1. Abbott Laboratories 2. The Hain Celestial Group, Inc. 3. Johnson & Johnson 4. Cipla Ltd. 5. Sanofi, Cera Products, Inc. 6. Cera Products Inc 7. Monico S.p.A. 8. Mead Johnson & Company, LLC. 9. Kinderfarms 10. FDC Limited 11. Unilab, Inc. 12. Prestige Consumer Healthcare, Inc. 13. Halewood Laboratories Pvt. Ltd. 14. Goodonya, and Otsuka Holdings Co. Ltd 15. Nestlé 16. Fresenius Kabi 17. Wellements 18. Zarbee's Naturals (acquired by Johnson & Johnson) 19. DripDrop 20. Boiron 21. Biostime International Holdings Limited 22. Otsuka Pharmaceutical Co., Ltd. 23. Kimberly-Clark Corporation 24. Bayer AG 25. Perrigo Company plc 26. Hydralyte 27. SmartyPants Vitamins 28. Rafters Pharma 29. Grifols 30. OraSure Technologies, Inc. 31. Meiji Holdings Co., Ltd. 32. Redd Remedies 33. Watson Nutritional Products Co., Ltd FAQs: 1. What are the growth drivers for the Baby Electrolyte market? Ans. Rising disposable incomes, population growth, frequent childhood illness and innovation are the drivers of the Global Baby Electrolyte Market. 2. What are the opportunities for the Baby Electrolyte market growth? Ans. The emerging markets and the rise in e-commerce platforms are opportunities for the Baby Electrolyte Market. 3. Which region is the fastest-growing region in the Global Baby Electrolyte market during the forecast period? Ans. Asia Pacific is the fastest-growing region in the global Baby Electrolyte market during the forecast period. 4. What is the projected market size & and growth rate of the Baby Electrolyte Market? Ans. The Baby Electrolyte Market size was valued at USD 1.45 Billion in 2023 and the total Baby Electrolyte revenue is expected to grow at a CAGR of 9.7% from 2024 to 2030, reaching nearly USD 2.82 Billion by 2030. 5. What segments are covered in the Baby Electrolyte Market report? Ans. The segments covered in the Baby Electrolyte market report are Application, form, flavour, distribution channel, and region.

1. Baby Electrolyte Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Baby Electrolyte Market: Dynamics 2.1. Baby Electrolyte Market Trends by Region 2.1.1. North America Baby Electrolyte Market Trends 2.1.2. Europe Baby Electrolyte Market Trends 2.1.3. Asia Pacific Baby Electrolyte Market Trends 2.1.4. Middle East and Africa Baby Electrolyte Market Trends 2.1.5. South America Baby Electrolyte Market Trends 2.2. Baby Electrolyte Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Baby Electrolyte Market Drivers 2.2.1.2. North America Baby Electrolyte Market Restraints 2.2.1.3. North America Baby Electrolyte Market Opportunities 2.2.1.4. North America Baby Electrolyte Market Challenges 2.2.2. Europe 2.2.2.1. Europe Baby Electrolyte Market Drivers 2.2.2.2. Europe Baby Electrolyte Market Restraints 2.2.2.3. Europe Baby Electrolyte Market Opportunities 2.2.2.4. Europe Baby Electrolyte Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Baby Electrolyte Market Drivers 2.2.3.2. Asia Pacific Baby Electrolyte Market Restraints 2.2.3.3. Asia Pacific Baby Electrolyte Market Opportunities 2.2.3.4. Asia Pacific Baby Electrolyte Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Baby Electrolyte Market Drivers 2.2.4.2. Middle East and Africa Baby Electrolyte Market Restraints 2.2.4.3. Middle East and Africa Baby Electrolyte Market Opportunities 2.2.4.4. Middle East and Africa Baby Electrolyte Market Challenges 2.2.5. South America 2.2.5.1. South America Baby Electrolyte Market Drivers 2.2.5.2. South America Baby Electrolyte Market Restraints 2.2.5.3. South America Baby Electrolyte Market Opportunities 2.2.5.4. South America Baby Electrolyte Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Baby Electrolyte Industry 2.8. Analysis of Government Schemes and Initiatives For Baby Electrolyte Industry 2.9. Baby Electrolyte Market Trade Analysis 2.10. The Global Pandemic Impact on Baby Electrolyte Market 3. Baby Electrolyte Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 3.1.1. 36 Months to 60 months 3.1.2. Upto 12 Months 3.1.3. 12 to 36 Months 3.2. Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 3.2.1. Powder 3.2.2. Liquid 3.3. Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 3.3.1. Unflavoured 3.3.2. Fruit-Flavoured 3.4. Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 3.4.1. Modern Trade 3.4.2. General Trade 3.4.3. Online Stores 3.5. Baby Electrolyte Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Baby Electrolyte Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 4.1.1. 36 Months to 60 months 4.1.2. Upto 12 Months 4.1.3. 12 to 36 Months 4.2. North America Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 4.2.1. Powder 4.2.2. Liquid 4.3. North America Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 4.3.1. Unflavoured 4.3.2. Fruit-Flavoured 4.4. North America Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 4.4.1. Modern Trade 4.4.2. General Trade 4.4.3. Online Stores 4.5. North America Baby Electrolyte Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 4.5.1.1.1. 36 Months to 60 months 4.5.1.1.2. Upto 12 Months 4.5.1.1.3. 12 to 36 Months 4.5.1.2. United States Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 4.5.1.2.1. Powder 4.5.1.2.2. Liquid 4.5.1.3. United States Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 4.5.1.3.1. Unflavoured 4.5.1.3.2. Fruit-Flavoured 4.5.1.4. United States Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 4.5.1.4.1. Modern Trade 4.5.1.4.2. General Trade 4.5.1.4.3. Online Stores 4.5.2. Canada 4.5.2.1. Canada Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 4.5.2.1.1. 36 Months to 60 months 4.5.2.1.2. Upto 12 Months 4.5.2.1.3. 12 to 36 Months 4.5.2.2. Canada Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 4.5.2.2.1. Powder 4.5.2.2.2. Liquid 4.5.2.3. Canada Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 4.5.2.3.1. Unflavoured 4.5.2.3.2. Fruit-Flavoured 4.5.2.4. Canada Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 4.5.2.4.1. Modern Trade 4.5.2.4.2. General Trade 4.5.2.4.3. Online Stores 4.5.3. Mexico 4.5.3.1. Mexico Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 4.5.3.1.1. 36 Months to 60 months 4.5.3.1.2. Upto 12 Months 4.5.3.1.3. 12 to 36 Months 4.5.3.2. Mexico Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 4.5.3.2.1. Powder 4.5.3.2.2. Liquid 4.5.3.3. Mexico Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 4.5.3.3.1. Unflavoured 4.5.3.3.2. Fruit-Flavoured 4.5.3.4. Mexico Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 4.5.3.4.1. Modern Trade 4.5.3.4.2. General Trade 4.5.3.4.3. Online Stores 5. Europe Baby Electrolyte Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.2. Europe Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.3. Europe Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.4. Europe Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5. Europe Baby Electrolyte Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.1.2. United Kingdom Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.1.3. United Kingdom Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.1.4. United Kingdom Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.2. France 5.5.2.1. France Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.2.2. France Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.2.3. France Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.2.4. France Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.3.2. Germany Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.3.3. Germany Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.3.4. Germany Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.4.2. Italy Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.4.3. Italy Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.4.4. Italy Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.5.2. Spain Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.5.3. Spain Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.5.4. Spain Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.6.2. Sweden Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.6.3. Sweden Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.6.4. Sweden Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.7.2. Austria Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.7.3. Austria Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.7.4. Austria Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 5.5.8.2. Rest of Europe Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 5.5.8.3. Rest of Europe Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 5.5.8.4. Rest of Europe Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6. Asia Pacific Baby Electrolyte Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.2. Asia Pacific Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.4. Asia Pacific Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5. Asia Pacific Baby Electrolyte Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.1.2. China Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.1.3. China Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.1.4. China Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.2.2. S Korea Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.2.3. S Korea Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.2.4. S Korea Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.3.2. Japan Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.3.3. Japan Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.3.4. Japan Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.4. India 6.5.4.1. India Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.4.2. India Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.4.3. India Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.4.4. India Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.5.2. Australia Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.5.3. Australia Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.5.4. Australia Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.6.2. Indonesia Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.6.3. Indonesia Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.6.4. Indonesia Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.7.2. Malaysia Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.7.3. Malaysia Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.7.4. Malaysia Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.8.2. Vietnam Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.8.3. Vietnam Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.8.4. Vietnam Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.9.2. Taiwan Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.9.3. Taiwan Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.9.4. Taiwan Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 6.5.10.2. Rest of Asia Pacific Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 6.5.10.3. Rest of Asia Pacific Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 6.5.10.4. Rest of Asia Pacific Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 7. Middle East and Africa Baby Electrolyte Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 7.2. Middle East and Africa Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 7.4. Middle East and Africa Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 7.5. Middle East and Africa Baby Electrolyte Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 7.5.1.2. South Africa Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 7.5.1.3. South Africa Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 7.5.1.4. South Africa Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 7.5.2.2. GCC Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 7.5.2.3. GCC Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 7.5.2.4. GCC Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 7.5.3.2. Nigeria Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 7.5.3.3. Nigeria Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 7.5.3.4. Nigeria Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 7.5.4.2. Rest of ME&A Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 7.5.4.3. Rest of ME&A Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 7.5.4.4. Rest of ME&A Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 8. South America Baby Electrolyte Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 8.2. South America Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 8.3. South America Baby Electrolyte Market Size and Forecast, by Flavour(2023-2030) 8.4. South America Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 8.5. South America Baby Electrolyte Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 8.5.1.2. Brazil Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 8.5.1.3. Brazil Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 8.5.1.4. Brazil Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 8.5.2.2. Argentina Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 8.5.2.3. Argentina Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 8.5.2.4. Argentina Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Baby Electrolyte Market Size and Forecast, by Application (2023-2030) 8.5.3.2. Rest Of South America Baby Electrolyte Market Size and Forecast, by Form (2023-2030) 8.5.3.3. Rest Of South America Baby Electrolyte Market Size and Forecast, by Flavour (2023-2030) 8.5.3.4. Rest Of South America Baby Electrolyte Market Size and Forecast, by Distribution channel (2023-2030) 9. Global Baby Electrolyte Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Baby Electrolyte Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abbott Laboratories 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. The Hain Celestial Group, Inc. 10.3. Johnson & Johnson 10.4. Cipla Ltd. 10.5. Sanofi, Cera Products, Inc. 10.6. Cera Products Inc 10.7. Monico S.p.A. 10.8. Mead Johnson & Company, LLC. 10.9. Kinderfarms 10.10. FDC Limited 10.11. Unilab, Inc. 10.12. Prestige Consumer Healthcare, Inc. 10.13. Halewood Laboratories Pvt. Ltd. 10.14. Goodonya, and Otsuka Holdings Co. Ltd 10.15. Nestlé 10.16. Fresenius Kabi 10.17. Wellements 10.18. Zarbee's Naturals (acquired by Johnson & Johnson) 10.19. DripDrop 10.20. Boiron 10.21. Biostime International Holdings Limited 10.22. Otsuka Pharmaceutical Co., Ltd. 10.23. Kimberly-Clark Corporation 10.24. Bayer AG 10.25. Perrigo Company plc 10.26. Hydralyte 10.27. SmartyPants Vitamins 10.28. Rafters Pharma 10.29. Grifols 10.30. OraSure Technologies, Inc. 10.31. Meiji Holdings Co., Ltd. 10.32. Redd Remedies 10.33. Watson Nutritional Products Co., Ltd 11. Key Findings 12. Industry Recommendations 13. Baby Electrolyte Market: Research Methodology 14. Terms and Glossary