Autoinjectors Market size was valued at USD 1.54 Billion in 2023 and the total Autoinjectors Market revenue is expected to grow at a CAGR of 14.20% from 2024 to 2030, reaching nearly USD 3.90 Billion by 2030.Autoinjectors Market Overview:

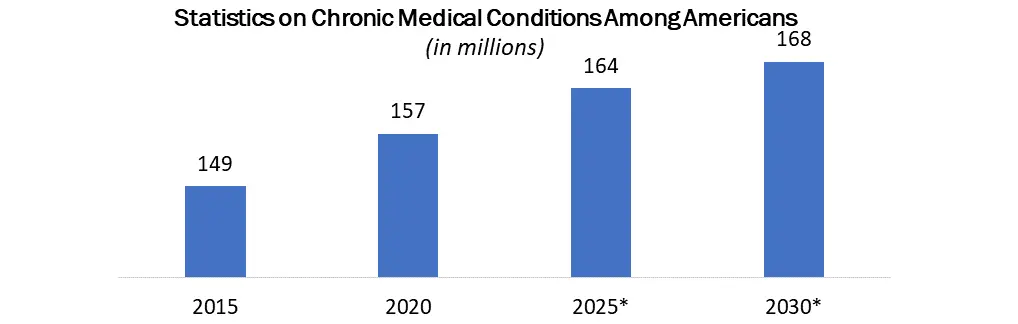

Autoinjectors are innovative medical devices that revolutionize allergy treatment. Unlike traditional syringes, autoinjectors deliver medication with precision and comfort, making them a preferred choice among patients and healthcare professionals. According to the National Health Interview Survey (NHIS), over half of the adult population in the US suffers from at least one chronic condition, such as asthma, diabetes, or hypertension. These conditions generate an annual cost burden of around USD 3.7 trillion, equivalent to nearly 20% of the country's GDP. A significant portion of this expense stems from the frequent need for medication, often requiring repeated visits to healthcare facilities. Patient adherence to treatment regimens also poses a challenge. To address these issues, a range of self-injectable drugs have been developed, offering patients greater independence and psychological benefits compared to traditional medication administration. Among these self-injection devices, autoinjectors have gained prominence, particularly for managing emergency and chronic conditions like anaphylactic shock and rheumatoid arthritis. Autoinjectors incorporate additional features like integrated needle safety, Bluetooth connectivity, and injection dose history tracking, effectively resolving several injection-related compliance concerns faced by patients. The MMR reports also help in understanding the Autoinjectors Market dynamic, structure by analysing the market segments and projecting the Autoinjectors Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Autoinjectors Market make the report investor’s guide.

Autoinjectors Market Dynamics-

The Rise of Chronic Diseases: The increasing prevalence of chronic diseases is a major driver of the global Autoinjectors market. Autoinjectors offer a convenient and easy-to-use way to administer injectable medications, which is particularly beneficial for patients who require long-term treatment. The growth of the Autoinjectors market is expected to be driven by a number of factors, including the increasing prevalence of chronic diseases, the growing demand for home healthcare, the development of new and innovative autoinjector devices, the increasing adoption of biologics, and the growing awareness of the benefits of autoinjectors. Some of the chronic diseases that are driving the demand for autoinjectors include:The prevalence of chronic diseases is increasing owing to a number of factors, including:

Disease Prevalence Diabetes 463 million adults worldwide Rheumatoid arthritis 2.1 million adults in the United States Multiple sclerosis 2.3 million adults worldwide 1. Aging populations: As the global population ages, there is an increased risk of developing chronic diseases such as diabetes and heart disease.

2. Unhealthy lifestyles: Unhealthy lifestyles, such as smoking, poor diet, and lack of physical activity, are major risk factors for chronic diseases.

3. Urbanization: People who live in cities are more likely to be exposed to environmental pollutants and have less access to healthy food and exercise.

Home Healthcare Trend Amplifies Demand for Autoinjectors: The escalating demand for home healthcare services is a significant factor propelling the growth of the global autoinjectors market. The global home healthcare market is expected to reach a valuation of nearly USD 1.5 trillion by 2027. This surge in demand is primarily attributed to the aging population and the rising prevalence of chronic diseases. With the increasing number of individuals requiring ongoing medical care at home, there is a growing need for convenient and user-friendly drug delivery systems. Autoinjectors aptly fulfil this requirement, as they empower patients to self-administer injectable medications without the need for frequent healthcare professional visits. The growing number of regulatory approvals and reimbursement policies for autoinjectors, coupled with government support, is fuelling the market's revenue growth. For instance, several Medicare prescription drug plans cover generic epinephrine autoinjectors, and some may also cover EpiPens, a brand-name autoinjector that administers epinephrine to individuals experiencing potentially life-threatening allergic reactions. Pfizer is also collaborating with the Food and Drug Administration (FDA) to extend the expiration dates of specific batches of EpiPen 0.3 mg Auto-Injectors and its authorized generic version to alleviate EpiPen shortages and enhance access to the medication. Prescription drug coverage under Medicare Part D is contingent upon the plan's terms and other factors. Autoinjectors represent the most effective first-line therapy for managing anaphylaxis in community settings. In anaphylactic emergencies, autoinjectors are crucial owing to their ability to deliver a precise dose, ensure consistent needle penetration and depth, facilitate rapid administration, and achieve a predictable dispersion pattern. Accurate and prompt self-administration of intramuscular adrenaline using an ampoule, needle, and syringe poses a greater challenge for patients and caregivers. Moreover, the rising prevalence of anaphylaxis is expected to further propel autoinjectors market revenue growth.To know about the Research Methodology :- Request Free Sample Report Regulatory Approvals: Fuelling Autoinjector Innovation and Autoinjectors market Growth The growing number of regulatory approvals and reimbursement policies for autoinjectors, coupled with government support, is driving the autoinjectors market's revenue growth. For instance, several Medicare prescription drug plans cover generic epinephrine autoinjectors, and some may also cover EpiPens, a brand-name autoinjector that administers epinephrine to individuals experiencing potentially life-threatening allergic reactions. Pfizer is also collaborating with the Food and Drug Administration (FDA) to extend the expiration dates of specific batches of EpiPen 0.3 mg Auto-Injectors and its authorized generic version to alleviate EpiPen shortages and enhance access to the medication. Prescription drug coverage under Medicare Part D is contingent upon the plan's terms and other factors. Autoinjectors represent the most effective first-line therapy for managing anaphylaxis in community settings. In anaphylactic emergencies, autoinjectors are crucial due to their ability to deliver a precise dose, ensure consistent needle penetration and depth, facilitate rapid administration, and achieve a predictable dispersion pattern. Accurate and prompt self-administration of intramuscular adrenaline using an ampoule, needle, and syringe poses a greater challenge for patients and caregivers. Moreover, the rising prevalence of anaphylaxis is expected to further propel autoinjectors market revenue growth. Lack of Knowledge and Abundance of Alternatives in Autoinjector Utilization: The Autoinjectors Market growth hampered by a lack of knowledge about how to use them and the availability of alternative medical treatments, such as oral tablets. Many patients fail to properly mix insulin suspension pen injectors by tipping and rolling them, resulting in large clumps of accumulated insulin being expelled from the device during the first injection. This error can lead to the administration of subtherapeutic doses when using new cartridges, potentially causing hypoglycemia symptoms and hindering market revenue growth. Furthermore, autoinjectors may increase costs in healthcare settings compared to manual syringes and needles. Oral medication remains the most popular administration method due to its practicality, safety, and affordability. A wide range of drugs can be taken orally in the form of chewable tablets, liquids, capsules, or pills. Threat of New Entrants in the Autoinjectors Market The threat of new entrants in the autoinjectors market is moderate to high. While the market boasts high entry barriers, the growing demand for autoinjectors and the potential profitability of the market could attract new players. High Entry Barriers:

1. Regulatory Requirements: Autoinjectors are classified as Class II medical devices by the FDA, requiring stringent regulatory approval processes. This can be a significant hurdle for new companies, particularly those without extensive experience in the medical device industry.

2. Technology and Manufacturing Expertise: Developing and manufacturing safe and effective autoinjectors requires advanced technology and expertise in precision engineering, material science, and drug delivery systems. New entrants may lack these capabilities, requiring significant investments in research and development.

3. Brand Recognition and Distribution Network: Established players in the autoinjectors market enjoy strong brand recognition and established distribution networks, making it difficult for new entrants to gain market share.

4. Intellectual Property: Existing players have a strong intellectual property portfolio, including patents and trademarks, that can further limit the entry of new competitors.

Drivers for New Entrants:1. Growing Autoinjectors Market Demand: The rising prevalence of chronic diseases and increasing awareness about autoinjector benefits are driving significant market growth, attracting new players seeking lucrative opportunities.

2. Technological Advancements: Advancements in materials science, drug delivery systems, and digital technology are creating new opportunities for innovation and differentiation, potentially opening doors for new entrants with unique product offerings.

3. Focus on Cost-Effectiveness: As healthcare providers and payers strive for cost-effective solutions, new entrants may offer lower-priced autoinjectors, disrupting the autoinjectors market landscape.

4. Partnerships and Acquisitions: Collaborations between established companies and new entrants with specific expertise can accelerate entry and overcome some of the traditional barriers.

Overall, the threat of new entrants in the autoinjectors market is a dynamic factor influenced by market trends, technological advancements, and strategic decisions of established players. While entry barriers remain significant, the potential for growth and profitability could incentivize new entrants to overcome these challenges and reshape the autoinjectors market landscape.Autoinjectors Market Segment Analysis:

Subcutaneous is the most popular route of administration of autoinjectors, accounting for an autoinjectors market share of nearly XX% in 2023. Subcutaneous autoinjectors play a pivotal role in the delivery of various medications, offering a convenient and effective way for patients to self-administer their medications. These autoinjectors are specifically designed for subcutaneous administration, ensuring reliable absorption and helping to maintain therapeutic drug levels over an extended period. This consistent and accurate medication delivery system empowers patients to manage their chronic conditions independently, enhancing treatment adherence and improving overall quality of life.Subcutaneous autoinjectors are particularly well-suited for home use, allowing patients to administer their medications in the comfort of their own homes, reducing the need for frequent healthcare provider visits. This not only enhances patient convenience but also alleviates the burden on healthcare systems. The growing prevalence of chronic diseases and the increasing demand for home healthcare are driving the adoption of subcutaneous autoinjectors. As the global autoinjectors market continues to expand, subcutaneous autoinjectors are expected to play an increasingly significant role in improving patient care and treatment outcomes. Rheumatoid Arthritis Expected to Hold Significant Autoinjectors Market Share Over the Forecast Period: Rheumatoid arthritis (RA), an autoimmune disorder characterized by the immune system attacking the joints, is a significant contributor to the growth of the autoinjectors market. The inflammation of the synovium and swelling and pain in and around the joints caused by RA primarily affects the elderly population, with females experiencing a higher prevalence than males. According to the United Nations World Population Prospects 2020 report, 727 million people aged 65 years or above currently reside worldwide, and this number is projected to more than double by 2050. The increased prevalence of RA among the aging population is expected to fuel the demand for autoinjectors, as these devices offer a convenient and effective method for self-administering medications for RA treatment. Autoinjectors play a crucial role in managing RA, allowing patients to self-administer medications such as methotrexate, adalimumab, and etanercept with ease and accuracy. The ease of use of autoinjectors enhances patient compliance and adherence to treatment regimens, improving overall disease management and treatment outcomes. The rising prevalence of RA, coupled with the aging population and the growing demand for home healthcare, is expected to drive the autoinjectors market for RA treatment significantly over the forecast period. Autoinjectors are poised to revolutionize RA management, empowering patients to take control of their health and improve their quality of life.

Autoinjectors Market Regional Analysis:

North America Dominates the Autoinjectors market The North American Autoinjectors Market held the largest revenue share in the global autoinjectors market in 2023. North American pharmaceutical companies are actively investing in research and development, leading to the introduction of innovative autoinjector devices. For instance, on April 12, 2020, Teva Pharmaceuticals USA, Inc., a subsidiary of Teva Pharmaceutical Industries Ltd., introduced AJOVY autoinjector devices. AJOVY is the only anti-calcitonin Gene-Related Peptide (CGRP) migraine medicine available with quarterly (675 mg) and monthly (225 mg) subcutaneous dose options. It is approved for the preventive treatment of migraine in adults. Asia Pacific Market Poised for Rapid Growth: The Asia Pacific Autoinjectors Market is expected to register the fastest revenue growth rate in the global autoinjectors market during the forecast period. Pharmaceutical companies are expanding their presence in the Asia Pacific region, bringing innovative autoinjector technologies to the market. For instance, on July 30, 2021, ALK and China Grand Pharmaceutical and Healthcare Holdings Limited announced an exclusive licensing agreement to bring ALK's AAI Jext to the Chinese market. This collaboration aims to address the growing demand for effective and convenient allergy treatment options in the region. The prevalence of chronic diseases, such as diabetes and rheumatoid arthritis, is rising in the Asia Pacific region. Autoinjectors offer a convenient and effective method for self-administering medications for these chronic conditions, driving the demand for these devices.Recent Development News in the Global Autoinjectors market:

The global autoinjectors market is witnessing a surge of innovation and development, driven by the increasing demand for convenient and user-friendly drug delivery solutions. Several recent advancements underscore the market's growth trajectory and highlight the continued focus on enhancing patient care and treatment outcomes. • Qfinity Autoinjector Platform: A Cost-Effective Solution for Subcutaneous Drug Delivery: In May 2022, Jabil Healthcare, a division of Jabil Inc., introduced the Qfinity autoinjector platform. Designed for subcutaneous (SC) drug self-administration, Qfinity stands out as a simple, reusable, and modular solution that offers enhanced affordability compared to existing market alternatives. This cost-effective platform is expected to expand access to autoinjector technology and improve patient adherence to treatment regimens. • Aidaptus Auto-Injector: A Collaboration for Enhanced Patient Experience: In May 2022, Stevanato Group S.p.A. and Owen Mumford Ltd., a leading medical device developer and manufacturer, entered into an exclusive agreement for the development and commercialization of the Aidaptus auto-injector. This collaboration aims to bring forth an innovative autoinjector device that prioritizes patient comfort, ease of use, and safety.Key Company Strategies:

Key players in autoinjectors market have adopted various strategies to expand their global presence and increase their market shares. Partnerships, agreements, mergers and acquisitions, and new product developments are some of the major strategies adopted by the market players, to achieve growth in the autoinjectors market. For example, In May 2023, MoonLake initiated a partnership with SHL Medical to jointly work on the development of an autoinjector intended for the clinical and commercial distribution of MoonLake's Nanobody® sonelokimab.Autoinjectors Industry Ecosystem

Autoinjectors Market Scope: Inquiry Before Buying

Autoinjectors Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1.54 Bn. Forecast Period 2024 to 2030 CAGR: 14.2% Market Size in 2030: USD 3.90 Bn. Segments Covered: by Type Reusable Autoinjectors Disposable Autoinjectors by Route of Administration Intramuscular Subcutaneous by Indication Multiple Sclerosis Rheumatoid Arthritis Diabetes Anaphylaxis Others by End-User Homecare Settings Hospitals & Clinics Ambulatory Surgical Centers Autoinjectors Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Autoinjectors Market Key Players:

1. Becton, Dickinson, and Company 2. Sanofi 3. Pfizer, Inc 4. Mylan N.V. 5. Novartis AG 6. Bayer AG 7. Janssen Global Services, LLC 8. Antares Pharma, Inc. 9. Amgen Inc 10. Eli Lilly and Company 11. Teva Pharmaceutical 12. Merck KgaA 13. GlaxoSmithKline plc 14. Ypsomed 15. SHL Medical 16. Gerresheimer AG 17. Midas Pharma GmbH 18. Aptar Pharma 19. Solteam Medical 20. Stevanato Group 21. E3D 22. West Pharmaceutical Services, IncFAQs:

1. What are the growth drivers for the Autoinjectors Market? Ans. The increasing prevalence of chronic diseases is the major driver for the Autoinjectors Market. 2. What is the major restraint for the Autoinjectors Market growth? Ans. Lack of Knowledge and Abundance of Alternatives in Autoinjector Utilization is expected to be the major restraining factor for the Autoinjectors Market growth. 3. Which Region is expected to lead the global Autoinjectors Market during the forecast period? Ans. North America is expected to lead the global Autoinjectors Market during the forecast period. 4. What is the projected Autoinjectors Market size & growth rate of the Autoinjectors Market? Ans. The Autoinjectors Market size was valued at USD 1.54 Billion in 2023 and the total Autoinjectors Market revenue is expected to grow at a CAGR of 14.20 % from 2024 to 2030, reaching nearly USD 3.90 Billion. 5. What segments are covered in the Autoinjectors Market report? Ans. The segments covered in the Autoinjectors Market report are Route of Administration, Indication, Type, End-Use, and Region.

1. Autoinjectors Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Autoinjectors Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Market Size Estimation Methodology 3.1.1. Bottom-Up Approach 3.1.2. Top-Down Approach 4. Market Dynamics 4.1. Autoinjectors Market Trends By Region 4.1.1. North America Autoinjectors Market Trends 4.1.2. Europe Autoinjectors Market Trends 4.1.3. Asia Pacific Autoinjectors Market Trends 4.1.4. South America Autoinjectors Market Trends 4.1.5. Middle East & Africa (MEA) Autoinjectors Market Trends 4.2. Autoinjectors Market Dynamics 4.2.1.1. Drivers 4.2.1.2. Restraints 4.2.1.3. Opportunities 4.2.1.4. Challenges 4.3. PORTER’s Five Forces Analysis 4.3.1. Threat of New Entrants 4.3.2. Threat of Substitutes 4.3.3. Bargaining Power of Suppliers 4.3.4. Bargaining Power of Buyers 4.3.5. Intensity of Competitive Rivalry 4.4. PESTLE Analysis 4.5. Regulatory Landscape By Region 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. South America 4.5.5. MEA 4.6. Analysis of Government Schemes and Initiatives For the Autoinjectors Industry 4.7. Value Chain Analysis 4.7.1. Value Chain Analysis of Autoinjector Device Manufacturers 4.7.2. Value Chain Analysis of Autoinjector Finished Formulation Manufacturers 4.8. Supply Chain Analysis 4.9. Pricing Analysis 4.9.1. Average Selling Price Trend, By Product Type 4.9.2. Indicative Autoinjector Finished Formulations Pricing Analysis, By Key Players 4.10. Autoinjectors Industry Ecosystem 4.10.1. Autoinjector Providers 4.10.2. End Users 4.10.3. Regulatory Bodies 4.11. Patent Analysis 4.11.1. Key Companies with the Highest number of Patents 4.11.2. Patent Registration Analysis 4.11.3. Number of Patents Granted Still 2024 4.12. Trade Data Analysis 4.13. Investment and Funding Scenario 4.13.1. Major Investment and Funding 5. Autoinjectors Market: Global Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 5.1. Autoinjectors Market Size and Forecast, By Type (2023-2030) 5.1.1. Reusable Autoinjectors 5.1.2. Disposable Autoinjectors 5.2. Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 5.2.1. Intramuscular 5.2.2. Subcutaneous 5.3. Autoinjectors Market Size and Forecast, By Indication(2023-2030) 5.3.1. Multiple Sclerosis 5.3.2. Rheumatoid Arthritis 5.3.3. Diabetes 5.3.4. Anaphylaxis 5.3.5. Others 5.4. Autoinjectors Market Size and Forecast, By End-Use(2023-2030) 5.4.1. Homecare Settings 5.4.2. Hospitals & Clinics 5.4.3. Ambulatory Surgical Centers 5.5. Autoinjectors Market Size and Forecast, By Region (2023-2030) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. South America 5.5.5. MEA 6. North America Autoinjectors Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 6.1. North America Autoinjectors Market Size and Forecast, By Type (2023-2030) 6.1.1. Reusable Autoinjectors 6.1.2. Disposable Autoinjectors 6.2. North America Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 6.2.1. Intramuscular 6.2.2. Subcutaneous 6.3. North America Autoinjectors Market Size and Forecast, By Indication(2023-2030) 6.3.1. Multiple Sclerosis 6.3.2. Rheumatoid Arthritis 6.3.3. Diabetes 6.3.4. Anaphylaxis 6.3.5. Others 6.4. North America Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 6.4.1. Homecare Settings 6.4.2. Hospitals & Clinics 6.4.3. Ambulatory Surgical Centers 6.5. North America Autoinjectors Market Size and Forecast, By Country (2023-2030) 6.5.1. United States 6.5.1.1. United States Autoinjectors Market Size and Forecast, By Type (2023-2030) 6.5.1.1.1. Reusable Autoinjectors 6.5.1.1.2. Disposable Autoinjectors 6.5.1.2. United States Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 6.5.1.2.1. Intramuscular 6.5.1.2.2. Subcutaneous 6.5.1.3. United States Autoinjectors Market Size and Forecast, By Indication(2023-2030) 6.5.1.3.1. Multiple Sclerosis 6.5.1.3.2. Rheumatoid Arthritis 6.5.1.3.3. Diabetes 6.5.1.3.4. Anaphylaxis 6.5.1.3.5. Others 6.5.1.4. United States Autoinjectors Market Size and Forecast By End-Use (2023-2030) 6.5.1.4.1. Homecare Settings 6.5.1.4.2. Hospitals & Clinics 6.5.1.4.3. Ambulatory Surgical Centers 6.5.2. Canada 6.5.2.1. Canada Autoinjectors Market Size and Forecast, By Type (2023-2030) 6.5.2.1.1. Reusable Autoinjectors 6.5.2.1.2. Disposable Autoinjectors 6.5.2.2. Canada Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 6.5.2.2.1. Intramuscular 6.5.2.2.2. Subcutaneous 6.5.2.3. Canada Autoinjectors Market Size and Forecast, By Indication(2023-2030) 6.5.2.3.1. Multiple Sclerosis 6.5.2.3.2. Rheumatoid Arthritis 6.5.2.3.3. Diabetes 6.5.2.3.4. Anaphylaxis 6.5.2.3.5. Others 6.5.2.4. Canada Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 6.5.2.4.1. Homecare Settings 6.5.2.4.2. Hospitals & Clinics 6.5.2.4.3. Ambulatory Surgical Centers 6.5.3. Mexico 6.5.3.1. Mexico Autoinjectors Market Size and Forecast, By Type (2023-2030) 6.5.3.1.1. Reusable Autoinjectors 6.5.3.1.2. Disposable Autoinjectors 6.5.3.2. Mexico Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 6.5.3.2.1. Intramuscular 6.5.3.2.2. Subcutaneous 6.5.3.3. Mexico Autoinjectors Market Size and Forecast, By Indication(2023-2030) 6.5.3.3.1. Multiple Sclerosis 6.5.3.3.2. Rheumatoid Arthritis 6.5.3.3.3. Diabetes 6.5.3.3.4. Anaphylaxis 6.5.3.3.5. Others 6.5.3.4. Mexico Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 6.5.3.4.1. Homecare Settings 6.5.3.4.2. Hospitals & Clinics 6.5.3.4.3. Ambulatory Surgical Centers 7. Europe Autoinjectors Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 7.1. Europe Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.2. Europe Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.3. Europe Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.4. Europe Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5. Europe Autoinjectors Market Size and Forecast, By Country (2023-2030) 7.5.1. United Kingdom 7.5.1.1. United Kingdom Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.1.2. United Kingdom Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.1.3. United Kingdom Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.1.4. United Kingdom Autoinjectors Market Size and Forecast By End-Use (2023-2030) 7.5.2. France 7.5.2.1. France Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.2.2. France Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.2.3. France Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.2.4. France Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5.3. Germany 7.5.3.1. Germany Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.3.2. Germany Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.3.3. Germany Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.3.4. Germany Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5.4. Italy 7.5.4.1. Italy Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.4.2. Italy Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.4.3. Italy Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.4.4. Italy Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5.5. Spain 7.5.5.1. Spain Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.5.2. Spain Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.5.3. Spain Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.5.4. Spain Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5.6. Sweden 7.5.6.1. Sweden Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.6.2. Sweden Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.6.3. Sweden Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.6.4. Sweden Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5.7. Austria 7.5.7.1. Austria Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.7.2. Austria Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.7.3. Austria Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.7.4. Austria Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 7.5.8. Rest of Europe 7.5.8.1. Rest of Europe Autoinjectors Market Size and Forecast, By Type (2023-2030) 7.5.8.2. Rest of Europe Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 7.5.8.3. Rest of Europe Autoinjectors Market Size and Forecast, By Indication(2023-2030) 7.5.8.4. Rest of Europe Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8. Asia Pacific Autoinjectors Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 8.1. Asia Pacific Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.2. Asia Pacific Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.3. Asia Pacific Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.4. Asia Pacific Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5. Asia Pacific Autoinjectors Market Size and Forecast, By Country (2023-2030) 8.5.1. China 8.5.1.1. China Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.1.2. China Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.1.3. China Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.1.4. China Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5.2. S Korea 8.5.2.1. S Korea Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.2.2. S Korea Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.2.3. S Korea Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.2.4. S Korea Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5.3. Japan 8.5.3.1. Japan Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.3.2. Japan Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.3.3. Japan Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.3.4. Japan Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5.4. India 8.5.4.1. India Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.4.2. India Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.4.3. India Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.4.4. India Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5.5. Australia 8.5.5.1. Australia Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.5.2. Australia Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.5.3. Australia Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.5.4. Australia Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5.6. ASEAN 8.5.6.1. ASEAN Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.6.2. ASEAN Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.6.3. ASEAN Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.6.4. ASEAN Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 8.5.7. Rest of Asia Pacific 8.5.7.1. Rest of Asia Pacific Autoinjectors Market Size and Forecast, By Type (2023-2030) 8.5.7.2. Rest of Asia Pacific Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 8.5.7.3. Rest of Asia Pacific Autoinjectors Market Size and Forecast, By Indication(2023-2030) 8.5.7.4. Rest of Asia Pacific Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 9. South America Autoinjectors Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 9.1. South America Autoinjectors Market Size and Forecast, By Type (2023-2030) 9.2. South America Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 9.3. South America Autoinjectors Market Size and Forecast, By Indication(2023-2030) 9.4. South America Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 9.5. South America Autoinjectors Market Size and Forecast, By Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Autoinjectors Market Size and Forecast, By Type (2023-2030) 9.5.1.2. Brazil Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 9.5.1.3. Brazil Autoinjectors Market Size and Forecast, By Indication(2023-2030) 9.5.1.4. Brazil Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Autoinjectors Market Size and Forecast, By Type (2023-2030) 9.5.2.2. Argentina Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 9.5.2.3. Argentina Autoinjectors Market Size and Forecast, By Indication(2023-2030) 9.5.2.4. Argentina Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Autoinjectors Market Size and Forecast, By Type (2023-2030) 9.5.3.2. Rest Of South America Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 9.5.3.3. Rest Of South America Autoinjectors Market Size and Forecast, By Indication(2023-2030) 9.5.3.4. Rest Of South America Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 10. Middle East and Africa Autoinjectors Market Size and Forecast By Segmentation (By Value USD Bn) (2023-2030) 10.1. Middle East and Africa Autoinjectors Market Size and Forecast, By Type (2023-2030) 10.2. Middle East and Africa Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 10.3. Middle East and Africa Autoinjectors Market Size and Forecast, By Indication(2023-2030) 10.4. Middle East and Africa Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 10.5. Middle East and Africa Autoinjectors Market Size and Forecast, By Country (2023-2030) 10.5.1. South Africa 10.5.1.1. South Africa Autoinjectors Market Size and Forecast, By Type (2023-2030) 10.5.1.2. South Africa Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 10.5.1.3. South Africa Autoinjectors Market Size and Forecast, By Indication(2023-2030) 10.5.1.4. South Africa Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 10.5.2. GCC 10.5.2.1. GCC Autoinjectors Market Size and Forecast, By Type (2023-2030) 10.5.2.2. GCC Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 10.5.2.3. GCC Autoinjectors Market Size and Forecast, By Indication(2023-2030) 10.5.2.4. GCC Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 10.5.3. Rest Of MEA 10.5.3.1. Rest Of MEA Autoinjectors Market Size and Forecast, By Type (2023-2030) 10.5.3.2. Rest Of MEA Autoinjectors Market Size and Forecast, By Route of Administration(2023-2030) 10.5.3.3. Rest Of MEA Autoinjectors Market Size and Forecast, By Indication(2023-2030) 10.5.3.4. Rest Of MEA Autoinjectors Market Size and Forecast, By End-Use (2023-2030) 11. Company Profile: Key Players 11.1. Becton, Dickinson, and Company 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Sanofi 11.3. Pfizer, Inc 11.4. Mylan N.V. 11.5. Novartis AG 11.6. Bayer AG 11.7. Janssen Global Services, LLC 11.8. Antares Pharma, Inc. 11.9. Amgen Inc 11.10. Eli Lilly and Company 11.11. Teva Pharmaceutical 11.12. Merck KgaA 11.13. GlaxoSmithKline plc 11.14. Ypsomed 11.15. SHL Medical 11.16. Gerresheimer AG 11.17. Midas Pharma GmbH 11.18. Aptar Pharma 11.19. Solteam Medical 11.20. Stevanato Group 11.21. E3D 11.22. West Pharmaceutical Services, Inc 12. Key Findings 13. Analyst Recommendations 13.1. Attractive Opportunities for Players in the Autoinjectors Market 13.2. Future Outlooks 14. Autoinjectors Market: Research Methodology