The Global Electrophysiology Market was valued at USD 8.2 Bn in the year 2023 and is expected to reach USD 15.78 Bn by 2030 with a growing CAGR of 9.8% over the forecast period.Electrophysiology Market Overview:

Electrophysiology refers to the study of tests that examines the electrical activity of heart and records the produced signals that control the time of heartbeats. The rising prevalence of cardiovascular diseases, increasing rates of obesity are key drivers for the market. For instance, 58% of U.S. adults with obesity have high blood pressure, a risk factor for heart disease and 23% of U.S. adults with obesity have diabetes Technological advancements are fueling the market growth by implementing improved devices and techniques, which are precise and effective for diagnosis of heart conditions. This shift in the market is driven by both patient preference for quick recovery and reduced pain. The laboratory devices segment by product of electrophysiology market held the largest share in 2023. Hospitals are the primary end-users of the market, with in-built infrastructure and are first recommended by physicians. However ambulatory surgery centres (ASCs) are performing electrophysiology procedures due to their minimally invasive nature and improved efficiency. North America is currently dominating the global electrophysiology market due to well-established healthcare infrastructure, frequent occurrence of cardiovascular diseases among the population, and investment in research and development within the region. Regions like Europe and Asia-Pacific are witnessing significant growth as their healthcare systems are improving and affordability concerns are getting addressed. These regions present a vast market potential, for cost-effective electrophysiology treatments. High procedure costs in developing regions, shortages of qualified personnel are some of the challenges faced by the market. Competition from established therapies and complex regulatory processes for new devices require attention of manufacturers. Despite of the challenges and competition, the electrophysiology market has promising opportunities over the forecast period. The report gives a brief about the major driving factors of the market, its restraints and challenges which are taken into account for growth of the industry. The competitive landscape highlights the current competition in the market by advancements and innovations by leading companies in electrophysiology market.To know about the Research Methodology :- Request Free Sample Report

Electrophysiology Market Dynamics:

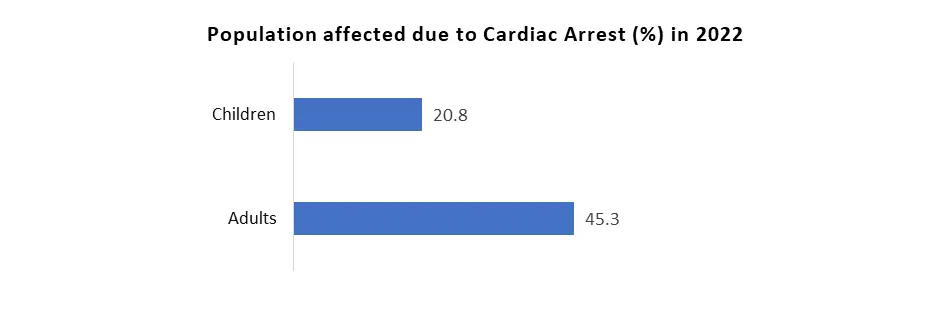

Widespread presence of cardiovascular diseases, technological advancements are driving the electrophysiology market: Conditions like arrhythmias and atrial fibrillation are becoming more common in aging population and rising rates of obesity and diabetes. This is creating a larger number of patients who are benefiting from electrophysiological procedures. The electrophysiology market is evolving, by introduction of improved devices and techniques being developed. These advancements are making it possible to diagnose and treat heart conditions more effectively and with less tedious procedures. The examples of recent advancements are high-resolution mapping systems and catheter ablation techniques. This trend is driving the growth of the electrophysiology market. The government initiatives like schemes and policies and high investments are leading to growth of the market. The shift of population towards minimally invasive treatment hold opportunities in the electrophysiology market: Remote monitoring and analysis of heart rhythms by using wearable devices can expand access to care, especially in remote areas. Companies can offer cost-effective solutions to cater specific needs of patients. The focus on specific conditions and treatment options for the same can be done by electrophysiology. The field of tele-electrophysiology is gaining attention by its capability to treat conditions over long distance. Collaboration of healthcare providers and policymakers to create reimbursement structures for electrophysiology procedures can increase adoption of electrophysiology treatments. Cost of treatment and trained workforce are challenges for the electrophysiology market: The electrophysiology equipment and procedures are expensive, which stand as a barrier in developing regions and for patients with limited financial resources. Finding ways to reduce costs, such as through more efficient manufacturing or developing cost-effective alternatives, is crucial for wider access. Performing electrophysiology procedures require specially skilled workforce and number of qualified electrophysiologists, nurses, and technicians are comparatively lower to meet the growing demand for these services. Regulatory processes for approval of new electrophysiology devices are complex while maintaining safety standards can accelerate innovation and lead to the growth of electrophysiology market.

Global Electrophysiology Market Segmentation:

By product, electrophysiology laboratory devices held the largest market share for electrophysiology market in 2023. These devices are essential for electrophysiology procedures and provide crucial functions like mapping arrhythmia sources, recording electrical signals, and delivering stimuli for diagnosis and treatment. The ablation catheters are experiencing significant growth, as a result of increased technological advancements and developments in ablation catheters and increased cardiac complications are boosting the market growth. For instance, 1. In 2023, University Hospitals (UH) Parma Medical Centre has opened a new laboratory to help patients seeking treatment for cardiac arrhythmias. The new lab will help meet the increased demand for patients seeking treatment of atrial fibrillation, the most common cardiac arrhythmia and a leading cause of stroke. 2. A study in 2022 under the title 'Optimal Catheter Ablation Strategy for Patients with Persistent Atrial Fibrillation and Heart Failure: A Retrospective Study', published that, for patients with persistent atrial fibrillation (PeAF) and heart failure (HF), catheter ablation appears to improve the left ventricular function. By Industry, hospitals hold a dominant share by end-user in electrophysiology market in 2023 as these are the primary centres, equipped with electrophysiology labs and are favoured by patients for counselling and treatment. Hospitals have in built specialized cardiac units and electrophysiology labs equipped with infrastructure and skilled personnel to perform complex procedures. Also, patients with cardiac arrhythmias are often first referred to hospitals by primary physicians and cardiologists for further specialized treatment and care. The government initiatives and medical fundings by regulatory bodies promote healthcare services in hospitals, thus are driving the growth of the segment. The ambulatory surgery segment is steadily growing by focusing on treatment of specific conditions and implementing invasive procedures that are more cost effective.Competitive landscape of Electrophysiology Market: The electrophysiology market is highly competitive, with a diverse range of global players contributing to specialized technologies and solutions. Leading companies such as Medtronic, Boston Scientific, Abbott Laboratories and Johnson & Johnson's Biosense Webster division dominate the market with comprehensive portfolios including diagnostic catheters, mapping systems, ablation technologies, and cardiac rhythm management devices. Emerging players such as AtriCure, specializing in surgical electrophysiology solutions, and MicroPort, with a growing portfolio of electrophysiology devices, contribute to the competitive landscape by targeting niches like atrial fibrillation management or advancing catheter-based ablation techniques. Overall, competition in the EP market is driven by continuous innovation, strategic acquisitions, and a commitment to improving therapies for arrhythmias and other cardiac disorders. The following are 1) In 2023, Boston Scientific Corporation launched POLARx cryoablation system, used to treat patients with paroxysmal atrial fibrillation. 2) In 2023, Abbott Laboratories launched Tactiflex ablation catheter, a sensor enabled device to treat abnormal heart rhythm. 3) In 2022, BioSig Technologies released a commercial launch campaign to expedite the sales of PURE EP system. The device has been approved by FDA and it promotes efficiency in cardiac physiology.

Electrophysiology Industry Ecosystem:

Electrophysiology Market, Regional Insights:

The electrophysiology market in North America region accounted largest market share in 2023. North America, known for its robust healthcare infrastructure, research and development, and availability of medical technologies. In the region, the electrophysiology market is expanding on account of an environment for the adoption of breakthrough treatment methodologies and highly skilled doctors and technicians. As per records, there are 2000+ highly qualified and trained electrophysiologists in US, which highlights the presence of well-trained personnel in hospitals. The presence of major electrophysiology manufacturers is further contributing to the growth of the market. In Asia-Pacific region, the vast population hold significant opportunities for new entrants by introducing cost-effective treatment options. In Europe, the electrophysiology market is driven by the increased frequency of arrhythmias, rising count of ablation centres and procedures, and utilization of electrophysiology devices. Some of the common factors driving the market growth are the increasing prevalence of atrial fibrillation, the surging elderly population, rising healthcare expenditures, and technological advancements in electrophysiology.

Electrophysiology Market Scope: Inquire before buying

Electrophysiology Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 8.2 Bn. Forecast Period 2024 to 2030 CAGR: 9.8% Market Size in 2030: US $ 15.78 Bn. Segments Covered: by Product Laboratory Devices Ablation Catheters Diagnostic Catheters Others by Indication Atrial fibrillation Wolf Parkinson white syndrome (WPWS) AVNRT Other by End User Hospitals & Cardiac centres Ambulatory Surgery Centers Others Electrophysiology Market, by Region:

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Electrophysiology Market, Key Players:

1. Johnson & Johnson (US) 2. Abbott Laboratories (US) 3. Medtronic (Ireland) 4. Ge Healthcare (US) 5. AtriCure (US) 6. Boston Scientific (US) 7. Siemens Healthcare (Germany 8. Hansen Medical (US) 9. Pioneer Medical Devices (India) 10. VascoMed (Germany) 11. General Electric (US) 12. Medline Industries (US) 13. Danaher (US) 14. Koninklije Philips (Netherlands) 15. LivaNova PLC (UK) 16. Japan Lifeline Co Ltd (Japan) 17. Argon Medical Devices (US) 18. Baxter (US) 19. Biotronik (India) 20. Cardiofocus (US) 21. MicroPort (China) Frequently Asked Questions FAQ’s 1. Which region held the largest Electrophysiology Market share in 2023? Ans. North America region is expected to hold the largest Electrophysiology Market share in 2023. 2. Which segment is expected to hold the largest Electrophysiology Market share by 2030? Ans. The hospital segment is expected to hold the largest Electrophysiology Market share by 2030. 3. What is the expected Global Organic Electronics size by 2030? Ans. The expected Global Electrophysiology Market size is US$ 15.78 Bn by 2030. 4. What was the Global Organic Electronics size in 2023? Ans. The Global Electrophysiology Market size was worth US$ 8.2 Bn in 2023. 5. What is the growing CAGR of electrophysiology market? Ans. The electrophysiology market is growing at a CAGR of 9.8% over the forecast period.

1. Electrophysiology Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.2.1. Electrophysiology: Market Segmentation 1.2.2. Region Covered 1.3. Executive Summary 2. Global Electrophysiology Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Market Share 2.6. Industry Ecosystem 2.6.1. Key players in the Electrophysiology ecosystem 2.6.2. Role of companies in the Electrophysiology ecosystem 2.7. Upcoming Technological and Advancement Initiatives by Key Players 2.8. Market Structure 2.8.1. Market Leaders 2.8.2. Market Followers 2.8.3. Emerging Players 2.9. Consolidation of the Market 2.9.1. Strategic Initiatives and Developments 2.9.2. Mergers and Acquisitions 2.9.3. Collaborations and Partnerships 2.9.4. Product Launches and Innovations 2.10. Pricing Analysis: Average Selling Price of Electrophysiology Offered by Key Players in the Market 3. Electrophysiology Market: Dynamics 3.1. Electrophysiology Market Trends by Region 3.1.1. North America Electrophysiology Market Trends 3.1.2. Europe Electrophysiology Market Trends 3.1.3. Asia Pacific Electrophysiology Market Trends 3.1.4. South America Electrophysiology Market Trends 3.1.5. Middle East & Africa (MEA) Electrophysiology Market Trends 3.2. Electrophysiology Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. PORTER’s Five Forces Analysis 3.3.1. Threat of New Entrants 3.3.2. Threat of Substitutes 3.3.3. Bargaining Power of Suppliers 3.3.4. Bargaining Power of Buyers 3.3.5. Intensity of Competitive Rivalry 3.4. Supply Chain Analysis 3.4.1. Prominent companies 3.4.2. End users 3.5. Value Chain Analysis 3.5.1. Research & development 3.5.2. Procurement and product development 3.5.3. Marketing, sales and distribution and post-sales services 3.6. Treads and Disruption Impacting Customer Business 3.6.1. Treads and Disruption Impacting Customer Business 3.7. Technological Analysis 3.8. Ecosystem/Market map 3.8.1. Electrophysiology Market: Ecosystem 3.9. Key Stakeholder and Buying Criteria 3.9.1. Influence of Stakeholders on the Buying Process for the Top Applications 3.9.2. Key Buying Criteria for Top Applications 3.10. Regulatory Landscape 3.10.1. Regulation by Region 3.10.2. Tariff and Taxes 3.10.3. Regulatory Bodies, Government agencies, and other organizations by Region 3.11. Patent Analysis 3.11.1. Top 10 Patent Holders 3.11.2. Top 10 Companies with Highest Number of Patents 3.11.3. Patent Registration Analysis 3.11.4. Number of Patents Granted Still 2024 4. Trade Data Analysis: 4.1.1. Import/ Export of Electrophysiology 5. Electrophysiology Market: Global Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 5.1. Global Electrophysiology Market Size and Forecast, by Product (2023-2030) 5.1.1. Laboratory Devices 5.1.2. Ablation Catheters 5.1.3. Diagnostic Catheters 5.1.4. Others 5.2. Global Electrophysiology Market Size and Forecast, by Indication (2023-2030) 5.2.1. Atrial fibrillation 5.2.2. Wolf Parkinson white syndrome (WPWS) 5.2.3. AVNRT 5.2.4. Other 5.3. Global Electrophysiology Market Size and Forecast, by End User (2023-2030) 5.3.1. Hospitals & Cardiac centres 5.3.2. Ambulatory Surgery Centers 5.3.3. Others 5.4. Global Electrophysiology Market Size and Forecast, by Region (2023-2030) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. South America 5.4.5. MEA 6. North America Electrophysiology Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 6.1. North America Electrophysiology Market Size and Forecast, by Product (2023-2030) 6.1.1. Laboratory Devices 6.1.2. Ablation Catheters 6.1.3. Diagnostic Catheters 6.1.4. Others 6.2. North America Electrophysiology Market Size and Forecast, by Indication (2023-2030) 6.2.1. Atrial fibrillation 6.2.2. Wolf Parkinson white syndrome (WPWS) 6.2.3. AVNRT 6.2.4. Other 6.3. North America Electrophysiology Market Size and Forecast, by End User (2023-2030) 6.3.1. Hospitals & Cardiac centres 6.3.2. Ambulatory Surgery Centers 6.3.3. Others 6.4. North America Electrophysiology Market Size and Forecast, by Country (2023-2030) 6.4.1. United States 6.4.1.1. United States Electrophysiology Market Size and Forecast, by Product (2023-2030) 6.4.1.1.1. Laboratory Devices 6.4.1.1.2. Ablation Catheters 6.4.1.1.3. Diagnostic Catheters 6.4.1.1.4. Others 6.4.1.2. United States Electrophysiology Market Size and Forecast, by Indication (2023-2030) 6.4.1.2.1. Atrial fibrillation 6.4.1.2.2. Wolf Parkinson white syndrome (WPWS) 6.4.1.2.3. AVNRT 6.4.1.2.4. Other 6.4.1.3. United States Electrophysiology Market Size and Forecast, by End User (2023-2030) 6.4.1.3.1. Hospitals & Cardiac centres 6.4.1.3.2. Ambulatory Surgery Centers 6.4.1.3.3. Others 6.4.2. Canada 6.4.2.1. Canada Electrophysiology Market Size and Forecast, by Product (2023-2030) 6.4.2.1.1. Laboratory Devices 6.4.2.1.2. Ablation Catheters 6.4.2.1.3. Diagnostic Catheters 6.4.2.1.4. Others 6.4.2.2. Canada Electrophysiology Market Size and Forecast, by Indication (2023-2030) 6.4.2.2.1. Atrial fibrillation 6.4.2.2.2. Wolf Parkinson white syndrome (WPWS) 6.4.2.2.3. AVNRT 6.4.2.2.4. Other 6.4.2.3. Canada Electrophysiology Market Size and Forecast, by End User (2023-2030) 6.4.2.3.1. Hospitals & Cardiac centres 6.4.2.3.2. Ambulatory Surgery Centers 6.4.2.3.3. Others 6.4.3. Mexico 6.4.3.1. Mexico Electrophysiology Market Size and Forecast, by Product (2023-2030) 6.4.3.1.1. Laboratory Devices 6.4.3.1.2. Ablation Catheters 6.4.3.1.3. Diagnostic Catheters 6.4.3.1.4. Others 6.4.3.2. Mexico Electrophysiology Market Size and Forecast, by Indication (2023-2030) 6.4.3.2.1. Atrial fibrillation 6.4.3.2.2. Wolf Parkinson white syndrome (WPWS) 6.4.3.2.3. AVNRT 6.4.3.2.4. Other 6.4.3.3. Mexico Electrophysiology Market Size and Forecast, by End User (2023-2030) 6.4.3.3.1. Hospitals & Cardiac centres 6.4.3.3.2. Ambulatory Surgery Centers 6.4.3.3.3. Others 7. Europe Electrophysiology Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 7.1. Europe Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.2. Europe Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.3. Europe Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4. Europe Electrophysiology Market Size and Forecast, by Country (2023-2030) 7.4.1. United Kingdom 7.4.1.1. United Kingdom Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.1.2. United Kingdom Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.1.3. United Kingdom Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.2. France 7.4.2.1. France Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.2.2. France Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.2.3. France Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.3. Germany 7.4.3.1. Germany Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.3.2. Germany Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.3.3. Germany Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.4. Italy 7.4.4.1. Italy Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.4.2. Italy Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.4.3. Italy Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.5. Spain 7.4.5.1. Spain Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.5.2. Spain Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.5.3. Spain Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.6. Sweden 7.4.6.1. Sweden Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.6.2. Sweden Electrophysiology Market Size and Forecast, by Ingredient (2023-2030) 7.4.6.3. Sweden Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.7. Austria 7.4.7.1. Austria Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.7.2. Austria Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.7.3. Austria Electrophysiology Market Size and Forecast, by End User (2023-2030) 7.4.8. Rest of Europe 7.4.8.1. Rest of Europe Electrophysiology Market Size and Forecast, by Product (2023-2030) 7.4.8.2. Rest of Europe Electrophysiology Market Size and Forecast, by Indication (2023-2030) 7.4.8.3. Rest of Europe Electrophysiology Market Size and Forecast, by End User (2023-2030) 8. Asia Pacific Electrophysiology Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 8.1. Asia Pacific Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.2. Asia Pacific Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.3. Asia Pacific Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4. Asia Pacific Electrophysiology Market Size and Forecast, by Country (2023-2030) 8.4.1. China 8.4.1.1. China Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.1.2. China Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.1.3. China Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4.2. S Korea 8.4.2.1. S Korea Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.2.2. S Korea Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.2.3. S Korea Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4.3. Japan 8.4.3.1. Japan Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.3.2. Japan Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.3.3. Japan Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4.4. India 8.4.4.1. India Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.4.2. India Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.4.3. India Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4.5. Australia 8.4.5.1. Australia Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.5.2. Australia Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.5.3. Australia Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4.6. ASEAN 8.4.6.1. ASEAN Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.6.2. ASEAN Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.6.3. ASEAN Electrophysiology Market Size and Forecast, by End User (2023-2030) 8.4.7. Rest of Asia Pacific 8.4.7.1. Rest of Asia Pacific Electrophysiology Market Size and Forecast, by Product (2023-2030) 8.4.7.2. Rest of Asia Pacific Electrophysiology Market Size and Forecast, by Indication (2023-2030) 8.4.7.3. Rest of Asia Pacific Electrophysiology Market Size and Forecast, by End User (2023-2030) 9. South America Electrophysiology Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 9.1. South America Electrophysiology Market Size and Forecast, by Product (2023-2030) 9.2. South America Electrophysiology Market Size and Forecast, by Indication (2023-2030) 9.3. South America Electrophysiology Market Size and Forecast, by End User (2023-2030) 9.4. South America Electrophysiology Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Electrophysiology Market Size and Forecast, by Product (2023-2030) 9.4.1.2. Brazil Electrophysiology Market Size and Forecast, by Indication (2023-2030) 9.4.1.3. Brazil Electrophysiology Market Size and Forecast, by End User (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Electrophysiology Market Size and Forecast, by Product (2023-2030) 9.4.2.2. Argentina Electrophysiology Market Size and Forecast, by Indication (2023-2030) 9.4.2.3. Argentina Electrophysiology Market Size and Forecast, by End User (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Electrophysiology Market Size and Forecast, by Product (2023-2030) 9.4.3.2. Rest Of South America Electrophysiology Market Size and Forecast, by Indication (2023-2030) 9.4.3.3. Rest Of South America Electrophysiology Market Size and Forecast, by End User (2023-2030) 10. Middle East and Africa Electrophysiology Market Size and Forecast by Segmentation (by Value USD Bn) (2023-2030) 10.1. Middle East and Africa Electrophysiology Market Size and Forecast, by Product (2023-2030) 10.2. Middle East and Africa Electrophysiology Market Size and Forecast, by Indication (2023-2030) 10.3. Middle East and Africa Electrophysiology Market Size and Forecast, by End User (2023-2030) 10.4. Middle East and Africa Electrophysiology Market Size and Forecast, by Country (2023-2030) 10.4.1. South Africa 10.4.1.1. South Africa Electrophysiology Market Size and Forecast, by Product (2023-2030) 10.4.1.2. South Africa Electrophysiology Market Size and Forecast, by Indication (2023-2030) 10.4.1.3. South Africa Electrophysiology Market Size and Forecast, by End User (2023-2030) 10.4.2. GCC 10.4.2.1. GCC Electrophysiology Market Size and Forecast, by Product (2023-2030) 10.4.2.2. GCC Electrophysiology Market Size and Forecast, by Indication (2023-2030) 10.4.2.3. GCC Electrophysiology Market Size and Forecast, by End User (2023-2030) 10.4.3. Rest Of MEA 10.4.3.1. Rest Of MEA Electrophysiology Market Size and Forecast, by Product (2023-2030) 10.4.3.2. Rest Of MEA Electrophysiology Market Size and Forecast, by Indication (2023-2030) 10.4.3.3. Rest Of MEA Electrophysiology Market Size and Forecast, by End User (2023-2030) 11. Company Profile: Key Players 11.1. Ge Healthcare (US) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis (Technological strengths and weaknesses) 11.1.5. Strategic Analysis (Recent strategic moves) 11.1.6. Recent Developments 11.2. Johnson & Johnson (US) 11.3. bbott Laboratories (US) 11.4. Medtronic (Ireland) 11.5. Ge Healthcare (US) 11.6. AtriCure (US) 11.7. Boston Scientific (US) 11.8. Siemens Healthcare (Germany 11.9. Hansen Medical (US) 11.10. Pioneer Medical Devices (India) 11.11. VascoMed (Germany) 11.12. General Electric (US) 11.13. Medline Industries (US) 11.14. Danaher (US) 11.15. Koninklije Philips (Netherlands) 11.16. LivaNova PLC (UK) 11.17. Japan Lifeline Co Ltd (Japan) 11.18. Argon Medical Devices (US) 11.19. Baxter (US) 11.20. Biotronik (India) 11.21. Cardiofocus (US) 11.22. MicroPort (China) 11.23. Others 12. Key Findings and Analyst Recommendations 12.1. Attractive Opportunities for Players in the Electrophysiology Market 13. Electrophysiology Market : Research Methodology 13.1. Market Size Estimation