The Australia Medical and Diagnostic Laboratory Service Market size was valued at USD 829 million in 2023. The total Australian Medical and Diagnostic Laboratory Service Market revenue is expected to grow at a CAGR of 7.9% from 2023 to 2030, reaching nearly USD 1411.58 Million.Australia Medical and Diagnostic Laboratory Service Market Analysis

The MMR report focuses on examining the Medical and Diagnostic Laboratory Service industry's current landscape, including market size, key players, and technological trends. The Australian medical and diagnostic laboratory service sector offers promising investment opportunities, driven by strong growth, diverse segments, and a commitment to innovative technologies. The molecular diagnostics sector continues to grow thanks to rising demand for genetic testing and targeted medicines. Opportunities exist for companies that provide the necessary tools and reagents. Decentralized Point-of-Care (POC) testing improves accessibility and generates a market for POC devices. Companies that provide specialized tests and genetic data analysis tools are meeting an increasing need in the field of customized medicine. Additionally, the implementation of digital pathology systems for fast analysis and remote communication offers promising investment opportunities. Profitable returns are able to be obtained by investing in sophisticated Laboratory Information Systems (LIS) for process improvement and data management. Companies that use artificial intelligence (AI) and machine learning for diagnostics present interesting opportunities. Platforms concentrating on Big Data and Analytics for Personalized Medicine, Prognostic Diagnostics, and Clinical Research have great promise for growth.

High-margin segments: - Molecular diagnostics and personalized medicine offer margins above 25% because of higher test costs and specialized expertise. The annual sales of diagnostic equipment in Australia are expected to reach around $XX billion in 2023. In Vitro Diagnostics (IVD) equipment accounts for a large share, possibly reaching $XX million yearly. Australia imported $XX billion worth of medical equipment, including various diagnostic devices. To know about the Research Methodology :- Request Free Sample Report

The integration of telehealth services

The integration of telehealth services with diagnostic laboratories is on the rise. The trend is facilitating remote sample collection, test consultations, and result deliveries, contributing to improved accessibility for patients. Laboratories are tapping into untapped patient demographics by embracing telehealth, which includes remote sample collection and online results delivery. It improves market reach and generates additional revenue streams. Telehealth improves accessibility, especially for rural or time-constrained patients, resulting in increased service consumption and possible market expansion. In addition, labs use telehealth to broaden their offers, delivering specialized remote services that increase market competitiveness and reveal new opportunities. 1. Telemedicine consultations in Germany Increased by 40% during the COVID-19 pandemic, highlighting rapid adoption.Data Security Concerns in Australia The increased dependence on digital platforms in laboratories has raised data security concerns, affecting the market in a variety of ways. In Australia, these concerns led to significant expenditures in cybersecurity measures to protect patient data. According to MMR studies, the health sector continues to experience the highest number of data breaches, accounting for 19% of reported incidents in the first quarter of 2021. It shows the significant impact of data security concerns on the healthcare industry and highlights the urgent need for robust cybersecurity measures in laboratories. In addition, the impact of data security concerns is reflected in the allocation of budgets and resources within laboratories. A study by MMR revealed that healthcare organizations in Australia are increasingly allocating funds to enhance their cybersecurity posture, with particular importance on protecting sensitive patient data. 1. In Australia, 42% increase in cyberattacks on healthcare organizations in 2021-22 compared to the previous year, underlining the rising threat. 2. Affected over 223,000 individuals in 2022, with data including medical records, credit card details, and Medicare numbers compromised. The incident served as a stark reminder of the potential severity of data breaches.

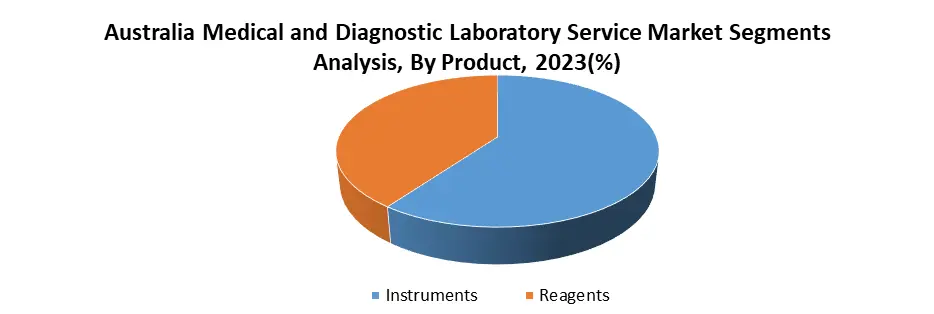

Australia Medical and Diagnostic Laboratory Service Market Segments Analysis

By Product, the Instruments segment accounts for an estimated 60% of the overall Australian Medical and Diagnostic Laboratory Service Market. Instruments are the foundation of laboratory operations, enabling a wide range of tests from routine blood testing to complex genetic analysis. Technological advancements in automation, precision, and speed drive market growth while improving diagnostic efficiency. The evolution of specialized devices for genetic testing and targeted therapies helps grow the industry, particularly in the field of customized medicine. Regional differences influence instrument preferences, with rural and remote places selecting smaller, portable devices and larger laboratories investing in high-throughput automated systems. The diversity in instrument adoption meets the particular needs of various healthcare settings and geographical circumstances.

Australia Medical and Diagnostic Laboratory Service Market Scope: Inquire Before Buying

Australia Medical and Diagnostic Laboratory Service Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 829 Mn. Forecast Period 2024 to 2030 CAGR: 7.9% Market Size in 2030: US $ 1411.58 Mn. Segments Covered: by Test Lipid Panel Liver Panel Renal Panel Complete Blood Count Electrolyte Testing Infectious Disease Testing by Product Instruments Reagents by End User Hospital Laboratory Diagnostic Laboratory Point-of-care Testing Key Players in the Australia Medical and Diagnostic Laboratory Service Market

1. Australian Clinical Labs 2. Abbott 3. Healthscope 4. Danaher Corporation 5. Dickinson and Company 6. Bio-Rad Laboratories 7. Primary Health Care 8. Sonic Healthcare 9. Quest Diagnostics 10. F. Hoffmann-La Roche 11. Healius Limited 12. Austech Medical Laboratories 13. I-Med Radiology Network 14. Healius 15. Ellume FAQs: 1. What is the purpose of clinical trials for growth hormone deficiency in Australia? Ans. Clinical trials for growth hormone deficiency in Australia aim to assess the safety and efficacy of new treatments, medications, or interventions, advancing medical knowledge and improving therapeutic options for individuals with growth hormone deficiency. 2. What are the eligibility criteria for enrollment in these clinical trials? Ans. Eligibility criteria for growth hormone deficiency clinical trials in Australia typically include age, health status, and specific medical conditions. Participants must meet these criteria to ensure the trial's safety and effectiveness assessment. 3. What is the projected market size & and growth rate of the Australia medical AND Diagnostic Laboratory Service Market Ans. The Australia Medical AND Diagnostic Laboratory Service Market size was valued at USD 829 Million in 2023. The total Australia Medical AND Diagnostic Laboratory Service market revenue is expected to grow at a CAGR of 7.9% from 2023 to 2030, reaching nearly USD 1411.58 Million By 2030.

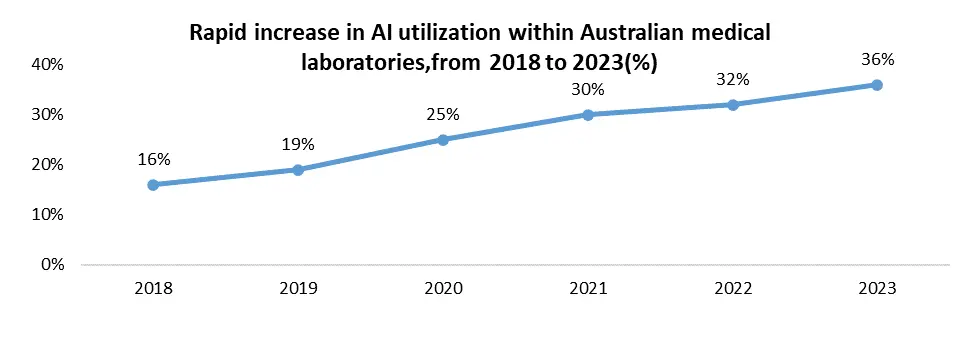

1. Australia Medical and Diagnostic Laboratory Service Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Australia Medical and Diagnostic Laboratory Service Market: Dynamics 2.1. Australia Medical and Diagnostic Laboratory Service Market Trends 2.2. PORTER’s Five Forces Analysis 2.3. PESTLE Analysis 2.4. Value Chain Analysis 2.5. Regulatory Landscape of Australia Medical and Diagnostic Laboratory Service Market 2.6. Technological Advancements in the Australian Medical and Diagnostic Laboratory Service Market 2.7. Factors Driving the Growth of the Medical and Diagnostic Laboratory Service Market in Australia 2.8. Number of Diagnostic Laboratory Services in Australia 2.9. IVF Diagnostics shares in Australia 2.10. AI Utilization in Australia Diagnostic Equipment 2.11. Telemedicine adoption and growth in Australia 2.12. Profit margin and gross profit margin of the Medical and Diagnostic Laboratory Service Market in Australia 2.13. Telehealth Integration in Australia 2.14. Key Opinion Leader Analysis for the Australian Medical and Diagnostic Laboratory Service Industry 2.15. Australia Medical and Diagnostic Laboratory Service Market Price Trend Analysis (2022-23) 3. Australia Medical and Diagnostic Laboratory Service Market: Market Size and Forecast by Segmentation for (by Value in USD Million) (2023-2030) 3.1. Australia Medical and Diagnostic Laboratory Service Market Size and Forecast, by Test (2023-2030) 3.1.1. Lipid Panel 3.1.2. Liver Panel 3.1.3. Renal Panel 3.1.4. Complete Blood Count 3.1.5. Electrolyte Testing 3.1.6. Infectious Disease Testing 3.2. Australia Medical and Diagnostic Laboratory Service Market Size and Forecast, by Product (2023-2030) 3.2.1. Instruments 3.2.2. Reagents 3.3. Australia Medical and Diagnostic Laboratory Service Market Size and Forecast, by End User (2023-2030) 3.3.1. Hospital Laboratory 3.3.2. Diagnostic Laboratory 3.3.3. Point-of-care Testing 4. Australia Medical and Diagnostic Laboratory Service Market: Competitive Landscape 4.1. MMR Competition Matrix 4.2. Competitive Landscape 4.3. Key Players Benchmarking 4.3.1. Company Name 4.3.2. Product Segment 4.3.3. End-user Segment 4.3.4. Revenue (2023) 4.4. Market Analysis by Organized Players vs. Unorganized Players 4.4.1. Organized Players 4.4.2. Unorganized Players 4.5. Leading Australia Medical and Diagnostic Laboratory Service Market Companies, by market capitalization 4.6. Market Trends and Challenges in Australia 4.6.1. Technological Advancements 4.6.2. Affordability and Accessibility 4.6.3. Shortage of Skilled Professionals 4.7. Market Structure 4.7.1. Market Leaders 4.7.2. Market Followers 4.7.3. Emerging Players in the Market 4.7.4. Challenges 4.7.5. Mergers and Acquisitions Details 5. Company Profile: Key Players 5.1. Australian Clinical Labs 5.1.1. Company Overview 5.1.2. Business Portfolio 5.1.3. Financial Overview 5.1.4. SWOT Analysis 5.1.5. Strategic Analysis 5.1.6. Details on Partnership 5.1.7. Potential Impact of Emerging Technologies 5.1.8. Regulatory Accreditations and Certifications Received by Them 5.1.9. Strategies Adopted by Key Players 5.1.10. Recent Developments 5.2. Abbott 5.3. Healthscope 5.4. Danaher Corporation 5.5. Dickinson and Company 5.6. Bio-Rad Laboratories 5.7. Primary Health Care 5.8. Sonic Healthcare 5.9. Quest Diagnostics 5.10. F. Hoffmann-La Roche 5.11. Healius Limited 5.12. Austech Medical Laboratories 5.13. I-Med Radiology Network 5.14. Healius 5.15. Ellume 6. Industry Recommendations 7. Australia Medical and Diagnostic Laboratory Service Market: Research Methodology