Global Artificial Intelligence Market size was valued at USD 162.33 Bn. in 2023 and the total Artificial Intelligence revenue is expected to grow by 31.7 % from 2024 to 2030, reaching nearly USD 1115.58 Bn.Artificial Intelligence Market Overview:

Artificial intelligence (AI) is often considered the driving force behind modern innovation. Artificial intelligence has an influence on society as a whole, whether in the private, public, or commercial spheres. There are high hopes for the application of artificial intelligence, given the wide range of sectors where it is now being used or may be used, as well as the present attention on it in the political realm, the scientific community, and consumer circles. Aside from the technological challenges raised by AI, it also raises concerns about data sovereignty, the future of labour, and ethical usage, to mention a few. The adoption of new technology and artificial intelligence (AI) helps innovation in the production of the Artificial Intelligence Market. In this setting, two criteria are critical for success. The first is the requirement for highly motivated and qualified personnel who have learned to work effectively with AI. The second requirement is for a supportive environment that, in addition to supporting safe and organized usage of AI, promotes its adoption at both the national and international levels. In the not-too-distant future, AI is likely to be a significant driver of enterprise competitiveness. The ability to exploit AI technology is expected to be one of the primary defining features of competitive advantage across all major sectors. While the strategy changes depending on the size and industry of the business, management teams who do not focus on leading in AI and profiting from the consequent product innovation, labour efficiency, and capital leverage risk falling behind. As a result, the Artificial Intelligence Market is expected to increase its demand during the forecast period.Artificial Intelligence Market Report Scope:

The Artificial Intelligence market is segmented based on Solution, Technology, End-Use, and Region. The growth of various segments helps report users acquire knowledge of the many growth factors expected to be prevalent throughout the market and develop different strategies to help identify core application areas and the gap in the target market. The report provides an in-depth analysis of the market and contains meaningful insights, facts, historical data, and statistically supported and industry-validated market statistics. It also includes estimates based on an appropriate set of assumptions and methodologies. A bottom-up approach has been used to estimate the market size. Key Players in the Artificial Intelligence market are identified through secondary research and their market revenues are determined through primary and secondary research. Secondary research included a review of annual and financial reports of leading manufacturers, while primary research included interviews with important opinion leaders and industry experts such as skilled front-line personnel, entrepreneurs, and marketing professionals. Some of the leading key players in the global Artificial Intelligence market include Advanced Micro Devices, AiCure, Arm Limited and Atomwise, Inc. They are continuously strategizing on mergers and acquisitions, strategic alliances, joint ventures, and partnerships for the growth of their market shares. The report is not only a representation of global players but also covers the market holding of local players in each country. Market structure by country with market holding by market leaders, market followers, and local players make this report a comprehensive and insightful industry outlook. The report has covered the mergers and acquisitions, strategic alliances, joint ventures, and partnerships happening in the market by region, by investment, and their strategic intent.To know about the Research Methodology :- Request Free Sample Report

Artificial Intelligence Market Dynamics:

The emerging AI applications in industry 4.0: Digitization is a major change in the way products are developed. Industry 4.0, the fourth industrial revolution, intends to improve the developments brought on by the third computerised industrial revolution. This necessitates the development of smart equipment with more data access to become more effective and productive by making real-time decisions. The fourth industrial revolution is heavily reliant on digital transformation and adds to its long-term viability. AI in industrial robotics paves the path for a new generation of collaborative robots. They are intended to cooperate with individuals on the assembly line. Because of their more intelligent design, they can be deployed much faster. Industrial robots and predictive maintenance work hand in hand. This new technology allows robots to check their accuracy and performance, alerting them when a repair is necessary to minimize costly downtime. Additional advantages include greater operational and programming time savings, as well as increased efficiency when implementing intuitionistic fuzzy approaches to control robot motion or voice applications for human-robot interface systems. Complicated regulatory requirements to hinder AI adoption: Industrial settings are frequently subject to compliance legislation that influence operations, such as technical, legal, and business requirements, as well as government restrictions. Compliance standards can range from product safety to public health and safety, environmental consequences, and workplace safety, depending on the market and sector, but they can also explicitly prescribe controls surrounding automation systems. Regulatory restrictions, which frequently demand substantial validation and verification of changes to industrial processes, might conflict with the aims of automation via AI, which favours quick adaptation of processes via closed-loop input. AI training challenges in the industry: Much of the current hype around AI has revolved around the success of "deep learning." Most of these results are based on supervised learning style issues, in which deep neural networks are trained with labelled training data. While collecting the volume of labelled training data necessary to properly train machine learning models may be difficult in any domain, it can be especially difficult in industrial contexts because few examples of the most intriguing "black swan" events—such as part or product failures—occur. This raises the training complexity and, as a result, the total expense of constructing the machine learning system. Data acquisition and storage complexities: Unlike "born digital" data acquired from online interaction logs, for example, industrial AI systems frequently rely on data captured via sensors that strive to digitally reflect the actual environment. Unfortunately, this technique can provide naturally noisy datasets. Sensor data might potentially be large. Acquiring and keeping this data for analysis may be incredibly difficult. Additionally, simulation is commonly utilized because of the high expense of producing training data under a wide range of situations. High-fidelity simulations, often known as "digital twins," may be extremely useful, but they are also complex to design and maintain, as well as computationally expensive to operate.Artificial Intelligence Market Segment Analysis:

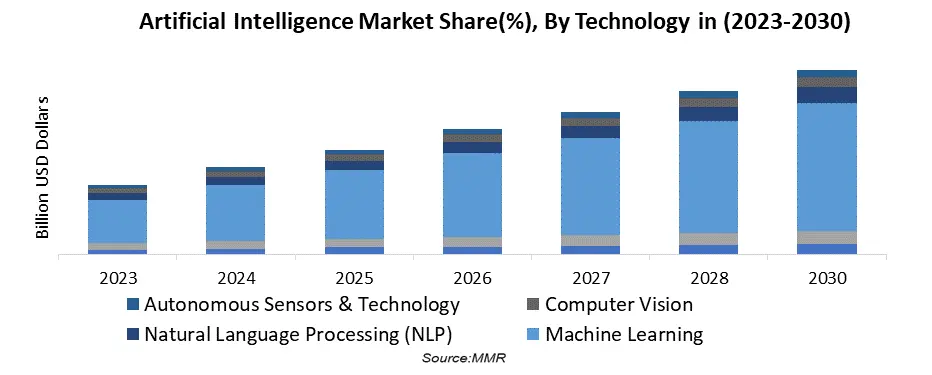

By Solution, the software segment dominated the AI market in 2023 with total shares of xx%. The growth can be ascribed to advancements in information storage capacity, high computing power, and parallel processing capabilities to provide high-end services. Also, the capacity to collect data, give real-time insights, and enhance decision-making has positioned it to grab the majority of the market. Libraries for creating and implementing AI systems, including primitives, linear algebra, inference, sparse matrices, video analytics, and numerous hardware connection capabilities, are included in artificial intelligence software packages. Over the forecast period, the necessity for organizations to comprehend and analyze visual material to acquire relevant insights is likely to drive the use of artificial intelligence software. Companies use AI services to lower total operating costs, resulting in higher profits. Companies are using Artificial Intelligence as a Service, or AIAAS, to gain a competitive advantage over the cloud. Installation, integration, maintenance, and support are all examples of artificial intelligence services. AI hardware comprises chipsets such as GPUs, CPUs, Application-specific Integrated Circuits (ASICs), and Field-programmable Gate Arrays (FPGAs) (FPGA). Because of the high computational capabilities required by AI frameworks, GPUs and CPUs now dominate the AI hardware industry.By Technology, the deep learning segment held xx% in total Artificial Intelligence Market shares in 2023. The growth can be ascribed to its complex data-driven applications, such as text/content or audio recognition. Deep learning provides profitable investment prospects by assisting in the resolution of big data volume difficulties. For example, in 2021, Zebra Medical Vision partnered with TELUS Ventures to extend AI solutions to clinical care settings and new modalities and improve the accessibility of the former's deep learning capabilities in North America. Significant investments in AI are covered by machine learning and deep learning. It covers AI platforms as well as cognitive applications like tagging, grouping, classification, hypothesis generation, alerting, filtering, navigation, and visualization, all of which aid in the creation of informative, intelligent, and cognitively-enabled solutions. The growing implementation of cloud-based computing systems and on-premises hardware for the safe and secure restoration of massive volumes of data has opened the way for the analytics platform's evolution. Growing R&D spending by industry leaders also plays an important role in promoting the use of artificial intelligence technology. The NLP segment is likely to gain traction throughout the forecast period. NLP is rapidly being utilized in a variety of industries to better comprehend client preferences, changing trends, purchasing behaviour, decision-making processes, and other factors.

Artificial Intelligence Market Regional Insights:

North America dominated the market, accounting for more than 40.0% of revenue in 2022 in total Artificial Intelligence Market. The market dominance can be ascribed to favorable government measures to promote AI use across numerous industries. For example, in February 2021, the U.S. President introduced the American AI Initiative as the country's plan for developing artificial intelligence leadership. As part of the project, federal authorities increased public trust in AI-based systems by developing standards for their development and real-world use in a variety of industrial sectors.The APAC artificial intelligence market is expected to grow at a CAGR of 8.6% during the forecast period. Dramatically increased expenditures in artificial intelligence were the primary region for the market growth. For example, in April 2018, Baidu, Inc., a Chinese internet behemoth, revealed that it had reached formal agreements with investors to sell its financial services division (FSG), which provides wealth management, consumer lending, and other commercial services. Carlyle Investment Management LLC and Tarrant Capital IP, LLC are the lead investors, with involvement from ABC International and Taikanglife, among others. In addition, a rising number of AI start-ups in the continent are driving AI adoption to increase operational efficiency and allow process automation.

Artificial Intelligence Market Scope: Inquiry Before Buying

Artificial Intelligence Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 162.33 Bn. Forecast Period 2024 to 2030 CAGR: 31.7% Market Size in 2030: US $ 1115.58 Bn. Segments Covered: by Solution Hardware Software Services by Technology AI Robotics Deep Learning Machine Learning Natural Language Processing (NLP) Computer Vision Autonomous Sensors & Technology Others by Function Cybersecurity Finance and Accounting Human Resource Management Sales and Marketing Legal and Compliance Operations Supply Chain Management by End-Users Healthcare BFSI Law Retail Advertising & Media Automotive & Transportation Agriculture Manufacturing Others Artificial Intelligence Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Artificial Intelligence Market Key Players

1. Advanced Micro Devices - United States 2. AiCure - United States 3. Arm Limited - United Kingdom 4. Atomwise, Inc. - United States 5. Baidu, Inc. - China 6. Clarifai, Inc. - United States 7. Cyrcadia Health - United States 8. Enlitic, Inc. - United States 9. Google LLC - United States 10. H2O.ai - United States 11. HyperVerge, Inc. - India 12. International Business Machines Corporation (IBM) - United States 13. Intel Corporation - United States 14. Iris.ai AS - Norway 15. Burst IQ - United States 16. Microsoft - United States 17. NVIDIA Corporation - United States 18. Sensely, Inc. - United States 19. Nano X Imaging - IsraelFrequently Asked Questions:

1. Which region is expected to dominate the Artificial Intelligence Market at the end of the forecast period? Ans. North America is expected to dominate the Artificial Intelligence market at the end of the forecast period. 2. What is the growth rate of the APAC Artificial Intelligence Market? Ans. APAC Artificial Intelligence Market is expected to grow at a CAGR of 31.7% during the forecast period. 3. What is expected to drive the growth of the Artificial Intelligence Market in the forecast period? Ans. The emerging AI applications in Industry 4.0 drive the AI market during the forecast period. 4. What is the projected market size and growth rate of the Artificial Intelligence Market? Ans. Artificial Intelligence Market was valued at US$ 162.8 Bn. in 2023 and the total Artificial Intelligence revenue is expected to grow at 25.4% from 2024 to 2030, reaching nearly US$ 1115.58 Bn. 5. What segments are covered in the Artificial Intelligence Market report? Ans. The segments covered are Solution, Technology, Function, End-Use and Region.

1. Artificial Intelligence Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Artificial Intelligence Market: Dynamics 2.1. Artificial Intelligence Market Trends by Region 2.1.1. North America Artificial Intelligence Market Trends 2.1.2. Europe Artificial Intelligence Market Trends 2.1.3. Asia Pacific Artificial Intelligence Market Trends 2.1.4. Middle East and Africa Artificial Intelligence Market Trends 2.1.5. South America Artificial Intelligence Market Trends 2.2. Artificial Intelligence Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Artificial Intelligence Market Drivers 2.2.1.2. North America Artificial Intelligence Market Restraints 2.2.1.3. North America Artificial Intelligence Market Opportunities 2.2.1.4. North America Artificial Intelligence Market Challenges 2.2.2. Europe 2.2.2.1. Europe Artificial Intelligence Market Drivers 2.2.2.2. Europe Artificial Intelligence Market Restraints 2.2.2.3. Europe Artificial Intelligence Market Opportunities 2.2.2.4. Europe Artificial Intelligence Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Artificial Intelligence Market Drivers 2.2.3.2. Asia Pacific Artificial Intelligence Market Restraints 2.2.3.3. Asia Pacific Artificial Intelligence Market Opportunities 2.2.3.4. Asia Pacific Artificial Intelligence Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Artificial Intelligence Market Drivers 2.2.4.2. Middle East and Africa Artificial Intelligence Market Restraints 2.2.4.3. Middle East and Africa Artificial Intelligence Market Opportunities 2.2.4.4. Middle East and Africa Artificial Intelligence Market Challenges 2.2.5. South America 2.2.5.1. South America Artificial Intelligence Market Drivers 2.2.5.2. South America Artificial Intelligence Market Restraints 2.2.5.3. South America Artificial Intelligence Market Opportunities 2.2.5.4. South America Artificial Intelligence Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Artificial Intelligence Industry 2.8. Analysis of Government Schemes and Initiatives For Artificial Intelligence Industry 2.9. Artificial Intelligence Market Trade Analysis 2.10. The Global Pandemic Impact on Artificial Intelligence Market 3. Artificial Intelligence Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 3.1.1. Hardware 3.1.2. Software 3.1.3. Services 3.2. Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 3.2.1. AI Robotics 3.2.2. Deep Learning 3.2.3. Machine Learning 3.2.4. Natural Language Processing (NLP) 3.2.5. Computer Vision 3.2.6. Autonomous Sensors & Technology 3.2.7. Others 3.3. Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 3.3.1. Cybersecurity 3.3.2. Finance and Accounting 3.3.3. Human Resource Management 3.3.4. Sales and Marketing 3.3.5. Legal and Compliance 3.3.6. Operations 3.3.7. Supply Chain Management 3.4. Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 3.4.1. Healthcare 3.4.2. BFSI 3.4.3. Law 3.4.4. Retail 3.4.5. Advertising & Media 3.4.6. Automotive & Transportation 3.4.7. Agriculture 3.4.8. Manufacturing 3.4.9. Others 3.5. Artificial Intelligence Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Artificial Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 4.1.1. Hardware 4.1.2. Software 4.1.3. Services 4.2. North America Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 4.2.1. AI Robotics 4.2.2. Deep Learning 4.2.3. Machine Learning 4.2.4. Natural Language Processing (NLP) 4.2.5. Computer Vision 4.2.6. Autonomous Sensors & Technology 4.2.7. Others 4.3. North America Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 4.3.1. Cybersecurity 4.3.2. Finance and Accounting 4.3.3. Human Resource Management 4.3.4. Sales and Marketing 4.3.5. Legal and Compliance 4.3.6. Operations 4.3.7. Supply Chain Management 4.4. North America Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 4.4.1. Healthcare 4.4.2. BFSI 4.4.3. Law 4.4.4. Retail 4.4.5. Advertising & Media 4.4.6. Automotive & Transportation 4.4.7. Agriculture 4.4.8. Manufacturing 4.4.9. Others 4.5. North America Artificial Intelligence Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.1.3. Services 4.5.1.2. United States Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 4.5.1.2.1. AI Robotics 4.5.1.2.2. Deep Learning 4.5.1.2.3. Machine Learning 4.5.1.2.4. Natural Language Processing (NLP) 4.5.1.2.5. Computer Vision 4.5.1.2.6. Autonomous Sensors & Technology 4.5.1.2.7. Others 4.5.1.3. United States Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 4.5.1.3.1. Cybersecurity 4.5.1.3.2. Finance and Accounting 4.5.1.3.3. Human Resource Management 4.5.1.3.4. Sales and Marketing 4.5.1.3.5. Legal and Compliance 4.5.1.3.6. Operations 4.5.1.3.7. Supply Chain Management 4.5.1.4. United States Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 4.5.1.4.1. Healthcare 4.5.1.4.2. BFSI 4.5.1.4.3. Law 4.5.1.4.4. Retail 4.5.1.4.5. Advertising & Media 4.5.1.4.6. Automotive & Transportation 4.5.1.4.7. Agriculture 4.5.1.4.8. Manufacturing 4.5.1.4.9. Others 4.5.2. Canada 4.5.2.1. Canada Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.1.3. Services 4.5.2.2. Canada Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 4.5.2.2.1. AI Robotics 4.5.2.2.2. Deep Learning 4.5.2.2.3. Machine Learning 4.5.2.2.4. Natural Language Processing (NLP) 4.5.2.2.5. Computer Vision 4.5.2.2.6. Autonomous Sensors & Technology 4.5.2.2.7. Others 4.5.2.3. Canada Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 4.5.2.3.1. Cybersecurity 4.5.2.3.2. Finance and Accounting 4.5.2.3.3. Human Resource Management 4.5.2.3.4. Sales and Marketing 4.5.2.3.5. Legal and Compliance 4.5.2.3.6. Operations 4.5.2.3.7. Supply Chain Management 4.5.2.4. Canada Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 4.5.2.4.1. Healthcare 4.5.2.4.2. BFSI 4.5.2.4.3. Law 4.5.2.4.4. Retail 4.5.2.4.5. Advertising & Media 4.5.2.4.6. Automotive & Transportation 4.5.2.4.7. Agriculture 4.5.2.4.8. Manufacturing 4.5.2.4.9. Others 4.5.3. Mexico 4.5.3.1. Mexico Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.1.3. Services 4.5.3.2. Mexico Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 4.5.3.2.1. AI Robotics 4.5.3.2.2. Deep Learning 4.5.3.2.3. Machine Learning 4.5.3.2.4. Natural Language Processing (NLP) 4.5.3.2.5. Computer Vision 4.5.3.2.6. Autonomous Sensors & Technology 4.5.3.2.7. Others 4.5.3.3. Mexico Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 4.5.3.3.1. Cybersecurity 4.5.3.3.2. Finance and Accounting 4.5.3.3.3. Human Resource Management 4.5.3.3.4. Sales and Marketing 4.5.3.3.5. Legal and Compliance 4.5.3.3.6. Operations 4.5.3.3.7. Supply Chain Management 4.5.3.4. Mexico Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 4.5.3.4.1. Healthcare 4.5.3.4.2. BFSI 4.5.3.4.3. Law 4.5.3.4.4. Retail 4.5.3.4.5. Advertising & Media 4.5.3.4.6. Automotive & Transportation 4.5.3.4.7. Agriculture 4.5.3.4.8. Manufacturing 4.5.3.4.9. Others 5. Europe Artificial Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.2. Europe Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.4. Europe Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5. Europe Artificial Intelligence Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.1.2. United Kingdom Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.1.3. United Kingdom Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.1.4. United Kingdom Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.2. France 5.5.2.1. France Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.2.2. France Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.2.3. France Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.2.4. France Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.3.2. Germany Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.3.3. Germany Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.3.4. Germany Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.4.2. Italy Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.4.3. Italy Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.4.4. Italy Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.5.2. Spain Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.5.3. Spain Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.5.4. Spain Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.6.2. Sweden Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.6.3. Sweden Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.6.4. Sweden Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.7.2. Austria Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.7.3. Austria Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.7.4. Austria Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 5.5.8.2. Rest of Europe Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 5.5.8.3. Rest of Europe Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 5.5.8.4. Rest of Europe Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6. Asia Pacific Artificial Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.2. Asia Pacific Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.4. Asia Pacific Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5. Asia Pacific Artificial Intelligence Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.1.2. China Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. China Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.1.4. China Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.2.2. S Korea Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. S Korea Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.2.4. S Korea Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.3.2. Japan Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Japan Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.3.4. Japan Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.4. India 6.5.4.1. India Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.4.2. India Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. India Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.4.4. India Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.5.2. Australia Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Australia Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.5.4. Australia Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.6.2. Indonesia Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Indonesia Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.6.4. Indonesia Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.7.2. Malaysia Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Malaysia Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.7.4. Malaysia Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.8.2. Vietnam Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Vietnam Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.8.4. Vietnam Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.9.2. Taiwan Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.9.3. Taiwan Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.9.4. Taiwan Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 6.5.10.2. Rest of Asia Pacific Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 6.5.10.3. Rest of Asia Pacific Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 6.5.10.4. Rest of Asia Pacific Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 7. Middle East and Africa Artificial Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 7.2. Middle East and Africa Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 7.4. Middle East and Africa Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 7.5. Middle East and Africa Artificial Intelligence Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 7.5.1.2. South Africa Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. South Africa Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 7.5.1.4. South Africa Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 7.5.2.2. GCC Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. GCC Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 7.5.2.4. GCC Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 7.5.3.2. Nigeria Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Nigeria Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 7.5.3.4. Nigeria Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 7.5.4.2. Rest of ME&A Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. Rest of ME&A Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 7.5.4.4. Rest of ME&A Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 8. South America Artificial Intelligence Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 8.2. South America Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 8.3. South America Artificial Intelligence Market Size and Forecast, by Function(2023-2030) 8.4. South America Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 8.5. South America Artificial Intelligence Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 8.5.1.2. Brazil Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. Brazil Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 8.5.1.4. Brazil Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 8.5.2.2. Argentina Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. Argentina Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 8.5.2.4. Argentina Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Artificial Intelligence Market Size and Forecast, by Solution (2023-2030) 8.5.3.2. Rest Of South America Artificial Intelligence Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Rest Of South America Artificial Intelligence Market Size and Forecast, by Function (2023-2030) 8.5.3.4. Rest Of South America Artificial Intelligence Market Size and Forecast, by End-Users (2023-2030) 9. Global Artificial Intelligence Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Artificial Intelligence Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Advanced Micro Devices - United States 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. AiCure - United States 10.3. Arm Limited - United Kingdom 10.4. Atomwise, Inc. - United States 10.5. Baidu, Inc. - China 10.6. Clarifai, Inc. - United States 10.7. Cyrcadia Health - United States 10.8. Enlitic, Inc. - United States 10.9. Google LLC - United States 10.10. H2O.ai - United States 10.11. HyperVerge, Inc. - India 10.12. International Business Machines Corporation (IBM) - United States 10.13. Intel Corporation - United States 10.14. Iris.ai AS - Norway 10.15. Burst IQ - United States 10.16. Microsoft - United States 10.17. NVIDIA Corporation - United States 10.18. Sensely, Inc. - United States 10.19. Nano X Imaging - Israel 11. Key Findings 12. Industry Recommendations 13. Artificial Intelligence Market: Research Methodology 14. Terms and Glossary