Animal Feed Inactive Yeast Market size was valued at USD 2.21 Bn in 2023 and is expected to reach USD 3.15 Bn by 2030, at a CAGR of 5.2%.Animal Feed Inactive Yeast Market Overview

The animal feed inactive yeast market includes the types of feed ingredients that are known as inactive yeast, inactive yeast is a supporting reagent for animal nutritional feed products also inactive yeast is known as yeast cell wall or yeast biomass which is obtained from the cell walls of yeast microorganisms that have been inactivated or rendered non-viable. The Market is thoroughly elaborated by offering information such as market size, key players and their market value, their recent developments as well as their partnerships, mergers, and acquisitions.To know about the Research Methodology :- Request Free Sample Report The graphical representation and structural exclusive information showed the dominating region of the Animal Feed Inactive Yeast Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Market.

Animal Feed Inactive Yeast Market Dynamics

Surging Need for Natural and Organic Feed: With the growing preferences of consumers towards natural and organic goods, the demand for animal feed devoid of synthetic additives or genetically modified organisms is on the rise. Inactive yeast emerges as a compelling choice for organic animal feed, providing a natural and sustainable source of vital nutrients. Its inherent qualities make it an appealing option for meeting the evolving demands of conscientious consumers. Rising Awareness about Animal Health and Nutrition: With the rising awareness about animal health and nutrition in the Animal Feed Inactive Yeast Market with a greater understanding of the impact of nutrition on animal health, there has been a significant growing focus on improving and enhancing the quality of animal feed by using inactive yeast. Proper nutrition gives animals the vigor to grow, develop, and reproduce, and strong immunity to fight off infections. All these advantages lead to more profitable and sustainable agriculture. Inactive yeast is rich in proteins, vitamins, and minerals, which enhance animal digestion, immune function, and overall well-being. This awareness about animal health drives the demand for animal feed inactive yeast market. Embracing Antibiotic-Free Animal Farming: In response to mounting apprehensions surrounding antibiotic resistance, a worldwide movement has gained momentum to curtail the usage of antibiotics in animal farming. As an influential solution, inactive yeast holds remarkable potential due to its bioactive elements, particularly beta-glucans, renowned for their ability to bolster animal immune systems and diminish reliance on antibiotics. This pivotal factor has propelled the widespread adoption of inactive yeast as a compelling natural alternative within the realm of animal feed. Rapid Surge in Livestock Production and Intensification: The expanding global population has sparked an unprecedented need for meat, milk, and other animal-derived commodities. This is increasing the demand for yeast, which in turn is driving the Animal Feed Inactive Yeast Market growth. Consequently, livestock production has undergone a remarkable intensification, with animals being reared in confined spaces that necessitate optimal nutrition strategies. In such a scenario, inactive yeast emerges as a robust and rugged solution, delivering essential nutrients and enhancing feed conversion efficiency, all while maintaining a cost-effective and sustainable approach. Unveiling the Thriving Aquaculture Sector: The aquaculture industry has experienced a remarkable upswing owing to the surging demand for seafood and the declining availability of wild fish stocks. Inactive yeast has emerged as a prominent ingredient in aquaculture feed formulations, boasting a high protein content, a well-balanced amino acid profile, and remarkable benefits for fish growth, overall health, and disease resistance. Its widespread usage in this dynamic industry underscores its ruggedness and reinforces its position as a reliable and resilient choice. Restraints, Challenges, and Opportunities of Animal Feed Inactive Yeast Market Navigating Regulatory Hurdles: The utilization of inactive yeast in animal feed might be subject to varying regulations and restrictions imposed by different countries and regions. Complying with these regulations poses a significant challenge for manufacturers and suppliers, particularly in ensuring the safety and quality of their product. Lack of Awareness and Limited Acceptance: In certain regions or among certain livestock producers, inactive yeast as a feed ingredient may still be relatively unfamiliar or underutilized. The lack of awareness regarding its benefits and limited acceptance by industry stakeholders can impede the growth of the Animal Feed Inactive Yeast Market. Considering the Costs: While inactive yeast offers cost-effective solutions for enhancing feed conversion efficiency, cost considerations can still arise for some livestock producers. Fluctuations in raw material prices, transportation costs, and other factors can influence the overall cost-effectiveness of incorporating inactive yeast into animal feed. Ensuring Reliable Sourcing and Supply Chain: The production of high-quality inactive yeast for animal feed demands careful management of raw materials. Securing a consistent and dependable supply of raw materials, like molasses or other sugar-rich substrates, can be quite a challenge. Maintaining Consistent Product Quality: Keeping the quality and nutritional composition of inactive yeast products consistent poses its own set of challenges. Variations in production processes, fermentation conditions, and raw materials can all have an impact on the final product, making standardization a difficult goal to achieve. Facing Competition from Alternative Feed Ingredients: Inactive yeast faces tough competition from other feed ingredients, such as soybean meal, fish meal, and synthetic additives. This is the major challenge for the global Animal Feed Inactive Yeast Market. Livestock producers have a wide array of choices when it comes to feeding ingredients, and inactive yeast must stand out by highlighting its unique nutritional benefits and cost-effectiveness. Growing Need for Sustainable Feed Solutions: With sustainability taking center stage in the livestock industry, there is a rising demand for feed ingredients that are eco-friendly and resource-efficient. Inactive yeast, as a by-product of the fermentation industry, offers a sustainable and environmentally friendly solution to enhance feed efficiency. Heightened Awareness of Animal Health and Nutrition: Livestock producers are increasingly realizing the significance of animal health and nutrition in maximizing production and profitability. Inactive yeast, with its positive impact on gut health, nutrient absorption, and disease resistance, aligns perfectly with this growing awareness.Animal Feed Inactive Yeast Market Segment Analysis

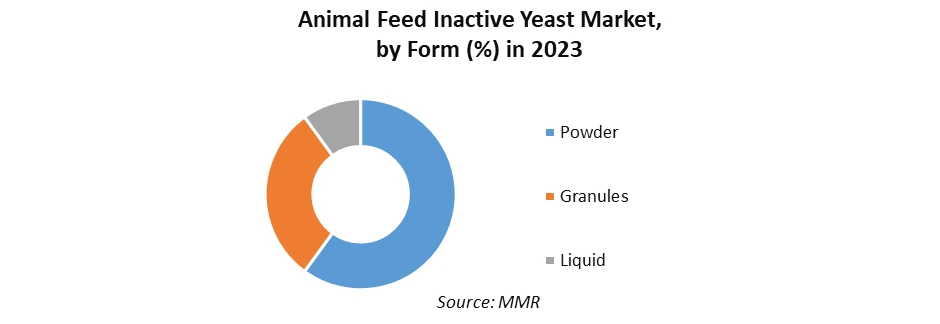

Based on Forms: Powder: Saccharomyces cerevisiae is the most commonly used yeast in animal feed. Other common yeasts in animal feed include brewer's dried yeast, primary dried yeast, and torula dried yeast. Inactivated yeast is an all-natural ingredient that reduces mix times and creates a more extensible dough with improved pan flow. It consists of yeast cells that are no longer living or active so they cannot produce any of the effects of live yeast, such as fermentation. This form of yeast is easily available and easy to use therefore this factor heightens the animal feed inactive yeast market growth. Liquid: This yeast extract is typically used as an animal feed. It is a good source of protein and various nutrients, which are responsible for its efficacy and performance. Animal feed additive yeast extract liquid comes in prevention packaging that retains the quality and efficacy of the product for a prolonged duration. This additive yeast extract liquid promotes intestinal growth and development, repairs mucosal injury, Accelerates protein synthesis, Improves feed palatability, and also promotes the absorption of trace elements and nutrients. The liquid form of inactive yeast is easily dissolvable and reduces the manual work for the mixing process hence this form is as usual as the powder form and helps the animal feed inactive yeast market to grow.

Regional Analysis of Animal Feed Inactive Yeast Market

The Asia Pacific region holds immense growth potential in the animal feed inactive yeast market. The region held the largest share in the global market in 2023. India, another significant market, boasts a thriving poultry industry that harnesses inactive yeast to enhance productivity and feed efficiency. Also, the expanding aquaculture industry in Southeast Asian countries like Vietnam, Thailand, and Indonesia further contributes to the animal feed inactive yeast market's growth in the region. North America plays a vital role in the animal feed inactive yeast market. The region boasts a well-established livestock industry and a rising demand for sustainable feed solutions. The United States leads the regional market, thanks to its significant share. The country's large-scale poultry and swine production sectors, coupled with a focus on animal nutrition and health, drive market growth. Inactive yeast finds extensive use in poultry and swine feed formulations, enhancing growth performance, feed efficiency, and overall animal well-being. Europe is another key region in the animal feed inactive yeast market, known for its strict regulations and standards regarding animal feed safety. The region prioritizes the use of safe and effective feed ingredients, leading to the adoption of inactive yeast. Moreover, countries like Norway and Scotland leverage inactive yeast in fish feed formulations due to their thriving aquaculture sectors. Europe's status as the second-largest market holder stems from its emphasis on animal welfare, sustainable practices, and the demand for high-quality animal products. Animal Feed Inactive Yeast Market Competitive Analysis Lesaffre Group has been actively expanding its market presence in the animal feed sector. In 2020, they introduced ActiSaf Sc 47 HR+ as a new inactive yeast product for ruminant nutrition, aiming to improve rumen function and performance in dairy cows. To further strengthen their capabilities, Lesaffre also acquired Alltech's yeast extract facility in Serbia in 2019, increasing their production capacity. ActiSaf, Fermentis, and Biospringer are among the leading product ranges offered by Lesaffre Group in the animal feed inactive yeast market. Lallemand Inc. has been actively involved in developing new products and forming partnerships. In 2021, they launched Levucell SB EC, a new inactive yeast product specially designed for swine feed to enhance gut health and performance. Lallemand also partnered with Verdant Partners, a leading agricultural advisory firm, to expand its presence in the North American feed industry. Levucell, Alkosel, and YANG are some of the key product ranges offered by Lallemand Inc. for the animal feed inactive yeast market. Angel Yeast has been focused on expanding globally through acquisitions and collaborations. In 2020, they acquired a majority stake in Jiangsu Hualian Animal Nutrition Co., Ltd., a Chinese feed additive company, to strengthen their product portfolio. Angel Yeast also collaborated with Biomin, a leading animal nutrition company, to develop innovative solutions for animal gut health and performance. Aminogrow, SavorStar, and HiCell are among the primary product ranges offered by Angel Yeast in the animal feed inactive yeast market. AB Mauri has been actively expanding their product portfolio and global presence. In 2021, they launched LysiStar, a new inactive yeast product for aquaculture feeds, aiming to improve fish performance and health. AB Mauri also acquired Specialty Blending Co., a U.S.-based manufacturer of ingredient blends for the food and feed industries, to strengthen their presence in the North American market. MauriFeed, LysiStar, and FeedMax are some of the leading product ranges offered by AB Mauri in the animal feed inactive yeast market. Biorigin focuses on product innovation and sustainability. In 2020, they introduced Biorigin X-MOS, a new inactive yeast product for poultry and swine feed, offering benefits such as improved gut health and performance. Biorigin also received sustainability certification from the International Sustainability & Carbon Certification (ISCC) in recognition of their sustainable sourcing and production practices. Biorigin MOS, Biorigin Levucell, and Biorigin Beta glucans are among the primary product ranges offered by Biorigin in the animal feed inactive yeast market.Animal Feed Inactive Yeast Market Scope: Inquire before buying

Global Animal Feed Inactive Yeast Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.21 Bn. Forecast Period 2024 to 2030 CAGR: 5.2% Market Size in 2030: US $ 3.15 Bn. Segments Covered: by Form Powder Granules Liquid by Application Protein supplementation Flavor enhancement Digestibility improvement Immune system support Gut health enhancement Others by Distribution Channel Direct Sales to Farms Distributors/Wholesalers Online Retailers Veterinary Clinics Others Animal Feed Inactive Yeast Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Animal Feed Inactive Yeast Key Players

1. Lesaffre Group 2. Alltech 3. Angel Yeast Co., Ltd. 4. Lallemand Inc. 5. AB Mauri 6. ADM Animal Nutrition 7. Leiber GmbH 8. Oriental Yeast Co., Ltd. 9. Nutreco N.V. 10. Diamond V Mills, Inc. 11. ICC Brazil 12. BiochemZusatzstoffeHandels- und ProduktionsgesellschaftmbH 13. Berg + Schmidt GmbH & Co. KG 14. Sonac BV 15. Associated British Foods plc 16. Kemin Industries, Inc. 17. DSM Animal Nutrition & Health 18. Chr. Hansen Holding A/S 19. Novus International, Inc. 20. Synergy Flavor Frequently Asked Questions 1. What yeast is used in animal feed? Ans: Saccharomyces cerevisiae. Among all the yeast species, S. cerevisiae has been used the most in animal production and nutrition 2. What is the Market estimation by 2030? Ans: The Animal Feed Inactive Yeast Market is estimated to be 3.15 Billion in 2030. 3. What factors are driving the animal feed inactive yeast market? Ans: The Surging Need for Natural and Organic Feed and Rising Awareness about Animal Health and Nutrition are factors driving the animal feed inactive yeast market. 4. What are the top players in the animal feed inactive yeast market? Ans: Lesaffre Group, Alltech, Angel Yeast Co., Ltd., Lallemand Inc., and AB Mauri these key players are established globally in the animal feed inactive yeast market. 5. What segments are covered in the Market report? Ans: Forms, Application and Distribution Channel are the segments are covered in the Animal Feed Inactive Yeast Market report.

1. Animal Feed Inactive Yeast Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Animal Feed Inactive Yeast Market: Dynamics 2.1. Animal Feed Inactive Yeast Market Trends by Region 2.1.1. North America Animal Feed Inactive Yeast Market Trends 2.1.2. Europe Animal Feed Inactive Yeast Market Trends 2.1.3. Asia Pacific Animal Feed Inactive Yeast Market Trends 2.1.4. Middle East and Africa Animal Feed Inactive Yeast Market Trends 2.1.5. South America Animal Feed Inactive Yeast Market Trends 2.2. Animal Feed Inactive Yeast Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Animal Feed Inactive Yeast Market Drivers 2.2.1.2. North America Animal Feed Inactive Yeast Market Restraints 2.2.1.3. North America Animal Feed Inactive Yeast Market Opportunities 2.2.1.4. North America Animal Feed Inactive Yeast Market Challenges 2.2.2. Europe 2.2.2.1. Europe Animal Feed Inactive Yeast Market Drivers 2.2.2.2. Europe Animal Feed Inactive Yeast Market Restraints 2.2.2.3. Europe Animal Feed Inactive Yeast Market Opportunities 2.2.2.4. Europe Animal Feed Inactive Yeast Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Animal Feed Inactive Yeast Market Drivers 2.2.3.2. Asia Pacific Animal Feed Inactive Yeast Market Restraints 2.2.3.3. Asia Pacific Animal Feed Inactive Yeast Market Opportunities 2.2.3.4. Asia Pacific Animal Feed Inactive Yeast Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Animal Feed Inactive Yeast Market Drivers 2.2.4.2. Middle East and Africa Animal Feed Inactive Yeast Market Restraints 2.2.4.3. Middle East and Africa Animal Feed Inactive Yeast Market Opportunities 2.2.4.4. Middle East and Africa Animal Feed Inactive Yeast Market Challenges 2.2.5. South America 2.2.5.1. South America Animal Feed Inactive Yeast Market Drivers 2.2.5.2. South America Animal Feed Inactive Yeast Market Restraints 2.2.5.3. South America Animal Feed Inactive Yeast Market Opportunities 2.2.5.4. South America Animal Feed Inactive Yeast Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Animal Feed Inactive Yeast Industry 2.8. Analysis of Government Schemes and Initiatives For Animal Feed Inactive Yeast Industry 2.9. Animal Feed Inactive Yeast Market Trade Analysis 2.10. The Global Pandemic Impact on Animal Feed Inactive Yeast Market 3. Animal Feed Inactive Yeast Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 3.1.1. Powder 3.1.2. Granules 3.1.3. Liquid 3.2. Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 3.2.1. Protein supplementation 3.2.2. Flavor enhancement 3.2.3. Digestibility improvement 3.2.4. Immune system support 3.2.5. Gut health enhancement 3.2.6. Others 3.3. Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Direct Sales to Farms 3.3.2. Distributors/Wholesalers 3.3.3. Online Retailers 3.3.4. Veterinary Clinics 3.3.5. Others 3.4. Animal Feed Inactive Yeast Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Animal Feed Inactive Yeast Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 4.1.1. Powder 4.1.2. Granules 4.1.3. Liquid 4.2. North America Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 4.2.1. Protein supplementation 4.2.2. Flavor enhancement 4.2.3. Digestibility improvement 4.2.4. Immune system support 4.2.5. Gut health enhancement 4.2.6. Others 4.3. North America Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Direct Sales to Farms 4.3.2. Distributors/Wholesalers 4.3.3. Online Retailers 4.3.4. Veterinary Clinics 4.3.5. Others 4.4. North America Animal Feed Inactive Yeast Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 4.4.1.1.1. Powder 4.4.1.1.2. Granules 4.4.1.1.3. Liquid 4.4.1.2. United States Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Protein supplementation 4.4.1.2.2. Flavor enhancement 4.4.1.2.3. Digestibility improvement 4.4.1.2.4. Immune system support 4.4.1.2.5. Gut health enhancement 4.4.1.2.6. Others 4.4.1.3. United States Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Direct Sales to Farms 4.4.1.3.2. Distributors/Wholesalers 4.4.1.3.3. Online Retailers 4.4.1.3.4. Veterinary Clinics 4.4.1.3.5. Others 4.4.2. Canada 4.4.2.1. Canada Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 4.4.2.1.1. Powder 4.4.2.1.2. Granules 4.4.2.1.3. Liquid 4.4.2.2. Canada Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Protein supplementation 4.4.2.2.2. Flavor enhancement 4.4.2.2.3. Digestibility improvement 4.4.2.2.4. Immune system support 4.4.2.2.5. Gut health enhancement 4.4.2.2.6. Others 4.4.2.3. Canada Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Direct Sales to Farms 4.4.2.3.2. Distributors/Wholesalers 4.4.2.3.3. Online Retailers 4.4.2.3.4. Veterinary Clinics 4.4.2.3.5. Others 4.4.3. Mexico 4.4.3.1. Mexico Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 4.4.3.1.1. Powder 4.4.3.1.2. Granules 4.4.3.1.3. Liquid 4.4.3.2. Mexico Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Protein supplementation 4.4.3.2.2. Flavor enhancement 4.4.3.2.3. Digestibility improvement 4.4.3.2.4. Immune system support 4.4.3.2.5. Gut health enhancement 4.4.3.2.6. Others 4.4.3.3. Mexico Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Direct Sales to Farms 4.4.3.3.2. Distributors/Wholesalers 4.4.3.3.3. Online Retailers 4.4.3.3.4. Veterinary Clinics 4.4.3.3.5. Others 5. Europe Animal Feed Inactive Yeast Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.2. Europe Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.3. Europe Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Animal Feed Inactive Yeast Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.1.2. United Kingdom Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.2.2. France Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.3.2. Germany Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.4.2. Italy Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.5.2. Spain Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.6.2. Sweden Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.7.2. Austria Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 5.4.8.2. Rest of Europe Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.2. Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.1.2. China Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.2.2. S Korea Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.3.2. Japan Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.4.2. India Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.5.2. Australia Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.6.2. Indonesia Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.7.2. Malaysia Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.8.2. Vietnam Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.9.2. Taiwan Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 6.4.10.2. Rest of Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Animal Feed Inactive Yeast Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 7.2. Middle East and Africa Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Animal Feed Inactive Yeast Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 7.4.1.2. South Africa Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 7.4.2.2. GCC Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 7.4.3.2. Nigeria Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 7.4.4.2. Rest of ME&A Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Animal Feed Inactive Yeast Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 8.2. South America Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 8.3. South America Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 8.4. South America Animal Feed Inactive Yeast Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 8.4.1.2. Brazil Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 8.4.2.2. Argentina Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Animal Feed Inactive Yeast Market Size and Forecast, by Form (2023-2030) 8.4.3.2. Rest Of South America Animal Feed Inactive Yeast Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Animal Feed Inactive Yeast Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Animal Feed Inactive Yeast Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Animal Feed Inactive Yeast Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Lesaffre Group 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Alltech 10.3. Angel Yeast Co., Ltd. 10.4. Lallemand Inc. 10.5. AB Mauri 10.6. ADM Animal Nutrition 10.7. Leiber GmbH 10.8. Oriental Yeast Co., Ltd. 10.9. Nutreco N.V. 10.10. Diamond V Mills, Inc. 10.11. ICC Brazil 10.12. BiochemZusatzstoffeHandels- und ProduktionsgesellschaftmbH 10.13. Berg + Schmidt GmbH & Co. KG 10.14. Sonac BV 10.15. Associated British Foods plc 10.16. Kemin Industries, Inc. 10.17. DSM Animal Nutrition & Health 10.18. Chr. Hansen Holding A/S 10.19. Novus International, Inc. 10.20. Synergy Flavor 11. Key Findings 12. Industry Recommendations 13. Animal Feed Inactive Yeast Market: Research Methodology 14. Terms and Glossary