Air Showers Market is worth USD 5.13 Billion in 2023 and is estimated to grow at a CAGR of 7.35% in the forecast period. The forecast revenue hints at around 9.31 billion USD growth by 2030. Air showers are specialized equipment used in various industries, such as semiconductors, healthcare and food and beverage, to maintain clean and controlled environments. They are designed to remove particles, dust and contaminants from individuals before they enter cleanrooms or controlled environments where sensitive processes or products are handled.To know about the Research Methodology :- Request Free Sample Report Air showers are driven by healthcare. Pharmaceutical and medical device cleanrooms need air showers to meet air quality regulations. Air showers keep cleanrooms clean, protecting drugs and medical gadgets. Air showers eliminate hazardous poisons and contaminants from employees' clothing and skin, maintaining pharmaceutical and medical device quality. The food and beverage industry are also using air showers to prevent contamination. Air showers clean visitors with filtered air, reducing dangerous pollutants from entering manufacturing facilities and jeopardising food and beverage safety and quality. Air showers are in demand in many industries; however, some issues may limit the market. Air showers are expensive. Air showers cost thousands to hundreds of thousands of dollars, depending on size, kind and amenities. Small businesses with limited funds or those in non-hygienic industries may be deterred by this upfront expenditure. Air showers are expensive, but they increase cleanliness, product quality and worker safety, making them a viable investment for hygiene-focused companies. North America dominates the global air showers market due to pharmaceutical, biotechnology and food and beverage demand. Europe is the second-largest market, driven by the pharmaceutical, biotechnology, and medical device industries. Asia Pacific is growing because of pharmaceutical, biotechnology, and electronics demand and government incentives in China. Infrastructure, manufacturing, and government backing are driving growth in South America and the Middle East & Africa. CleanZones, Air Science, Terra Universal, ESCO, Bionics Scientific Technologies, Hughes Safety Showers, DuPont, Kimberly-Clark, Royal Imtech, and Illinois Tool Works compete in the air showers market. These firms offer a variety of air shower devices for different industries. They engage in R&D to increase air shower technology, product efficiency, and market demand. Market leaders meet consumer needs and provide reliable decontamination solutions to win market share. Small and medium-sized firms fragment the market.

Air Showers Market Research Methodology

The report on the Air Showers Market covers an in-depth analysis of the industry. Key insights of the report include the Air Showers Market size and the growth rate. A thorough regional analysis of the Air Showers industry is conducted at a global, regional, and country level. Such an analysis provides valuable information on market penetration, regional dominance, and growth strategies adopted by the key players in the market. The major countries in each region are mapped according to their revenue contribution to the global Air Showers Market. To understand the competitive landscape of the Air Showers Market, key players and new entrants in the market are listed. Growth indicators such as company profiles, revenue and share, core competitors, recent developments, new growth strategies, technological advancements, and mergers and acquisitions are covered. The report provides a competitive analysis of Air Showers Market drivers, restraints, opportunities, and growth strategies. PESTLE, SWOT, and Porter’s five forces were used for industry analysis of the Air Showers Market. SWOT analysis is used to identify the strengths and weaknesses of the market. The bottom-up approach was used to estimate the Air Showers Market size. The report includes the Air Showers Market’s major strategic developments, comprising R&D, new product launches, M&A, partnerships, agreements, collaborations, joint ventures, and regional growth of the key competitors. The report includes an analysis of the global, regional, and country levels. Growing demand for air showers in the semiconductors industry is driving the Air Showers Market Air showers keep semiconductor wafers clean. Computer chips and other electronics are made from thin silicon wafers. Due to their sensitive nature, dust, grime and other particles can easily contaminate them, causing product flaws. Air showers remove these particles before workers enter the semiconductor wafer cleanroom. Smartphones, tablets and laptops are driving semiconductor demand. This demand increase affects semiconductor air showers. The worldwide semiconductor market will rise by 7.3% from 2023 to 2030. Air showers will be needed to prevent contamination during semiconductor device fabrication. Air showers in semiconductor manufacturing provide many advantages. Air showers remove particles before employees enter the cleanroom, preventing semiconductor wafer contamination. Air showers prevent production problems by reducing contamination sources. Air showers improve semiconductor product quality. Air showers reduce contamination-related flaws in semiconductor wafer-based electronics, improving reliability and performance. Semiconductor manufacturers gain client satisfaction and brand reputation. They boost semiconductor productivity. By reducing cleanroom pollutants, personnel can spend less time cleaning up and focus more on their main activities, enhancing efficiency. Air showers can save semiconductor makers money. Air showers save money by decreasing the need for expensive cleaning materials and equipment. Preventing contamination-related faults also saves manufacturers money on rework and recalls. Healthcare Industry acts as a driver for the Air Showers Market Cleanrooms for pharmaceutical and medical device production depend on the Air showers Market. Cleanrooms have strict air quality rules. Pharmaceutical and medical device safety and efficacy require these rigorous precautions. Pharmaceutical and medical gadget demand drives air shower demand. Air showers remove particles from employees' clothes and skin before they enter a cleanroom. This prevents pollutants from entering the cleanroom and compromising pharmaceutical and medical device quality. Pharmaceutical and medical device companies gain from air showers. Air showers remove particulates from employees' clothing and skin, preventing dangerous toxins from entering the cleanroom. This greatly protects pharmaceutical and medical device quality. Air showers improve product quality. Air showers reduce contamination-related flaws, improving pharmaceutical and medical device quality. It also boosts productivity. Eliminating extensive post-work cleaning allows staff to focus more on their main tasks, increasing productivity. Air showers reduce costs. Air showers decrease contamination, saving pharmaceutical and medical device makers money on cleaning materials and equipment. Cleanrooms and Air Showers are in demand for many reasons. First, the global population is ageing, increasing pharmaceutical and medical device demand. Chronic diseases like cancer, heart disease and diabetes require medications and medical devices as people age. Thus, safe and effective treatments require cleanrooms and air showers. Personalised medicine is another driver. Personalised medicine focuses on patient-specific therapies. Cleanrooms with air showers are needed because this method requires pharmaceutical and medical devices. Pharmaceutical and medical device companies are also focusing more on quality. Quality control requirements are tightening as manufacturers are under pressure to create high-quality goods. To satisfy these quality standards and produce safe and dependable pharmaceutical and medical products, cleanrooms and air showers are in demand. Increasing use of air showers in the food and beverage industry drives the Air Showers Market Air showers protect food and beverage goods from contamination. These showers clean visitors by blowing filtered air on them. Air showers keep harmful contaminants out and protect food and beverage items. The food and beverage business is adopting air showers for numerous reasons. Consumers are demanding safe and healthy food and beverages. Consumers are increasingly looking for safe, sanitary items due to food safety concerns. Air showers address this desire by adding pollution prevention. Foodborne illness concerns have also driven air shower popularity. Foodborne infections threaten public health and can cause minor discomfort to severe sickness or death. Air showers prevent pollutants from entering food and beverage production facilities, reducing foodborne illness risk. Air shower use is also boosted by government legislation. Many nations require air showers in food and beverage processing plants. These requirements ensure stringent cleanliness standards throughout production to prevent foodborne illnesses and preserve public health. It helps safe and wholesome food and beverage processors. Air showers in these facilities have many benefits. Air showers reduce foodborne illness risk. Food and people can carry foodborne bacteria, viruses and parasites. Air showers reduce foodborne illness risk by eliminating these pollutants from clothing and bodies. It also improves food and beverage quality. Air showers clean products, improving their appearance, flavour and texture. Consumers expect high-quality products. It improves food and beverage production productivity and product quality. Air showers allow workers to spend less time cleaning, which boosts productivity. All these factors are expected to accelerate the market growth rate in the next few years. High Investment is a restraining factor for the Air Showers Market Air showers are costly, depending on size, type and amenities. Air shower prices vary greatly. Standard air showers cost $5,000 to $10,000, while low-profile ones cost $10,000 to $20,000. Tunnel and cart air showers cost $20,000–50,000 and $50,000–100,000, respectively. Air showers' hefty upfront costs may deter some enterprises. Small businesses may struggle to afford an air shower due to a restricted budget. Air showers can also be expensive for businesses in non-hygienic industries. Air showers provide various benefits that may make them worth the investment for some organisations, despite their high upfront cost. Hygiene and sanitation are major benefits. Before entering a cleanroom or controlled environment, air showers remove dust and debris from people. This improves product quality and ensures industry compliance. They protect workers from dangerous pollutants. Air showers make workplaces safer by removing particulates and other harmful elements from workers' clothes and bodies. Businesses considering buying an air shower must weigh the pros and downsides. A detailed cost-benefit analysis helps establish if the investment is warranted. The business's needs, industry, product quality and safety, regulatory compliance and financial feasibility should be considered. An air shower system may be worth the investment if it improves cleanliness, product quality and worker safety. However, if the expenditures are too high or the advantages too small, firms may need to consider other options or whether air showers are necessary for their operations.Air Showers Market Segmentation

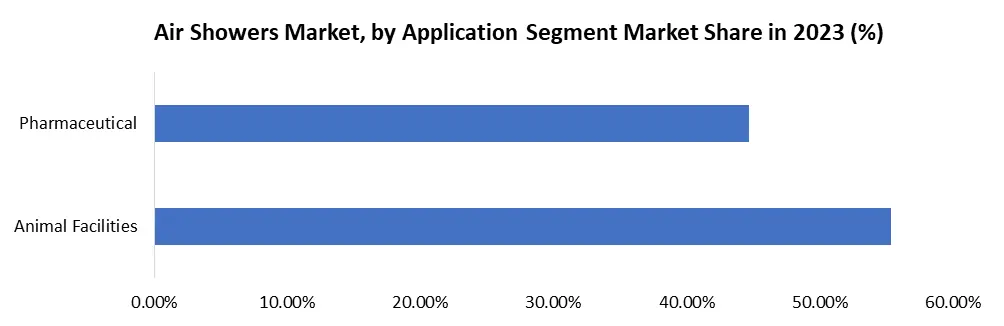

By Type: The Air Showers Market offers a range of solutions catering to specific requirements, with segmentation based on types that include Standard Air Shower (SD), Low Profile Air Shower (LP), Tunnel Air Shower (TN), and Cart Air Shower (CT). The Standard Air Shower represents a conventional yet effective solution for personnel decontamination, ensuring cleanroom standards are met. Low Profile Air Showers are designed with a reduced height profile, ideal for installations with space constraints. Tunnel Air Showers provide a thorough decontamination experience for personnel and goods as they pass through, making them suitable for high-traffic cleanroom environments. Cart Air Showers offer mobility and flexibility, providing decontamination for equipment and materials, and showcasing the market's versatility in meeting diverse user needs. By Application: The Air Showers Market serves various industries, reflecting its adaptability to distinct applications. Categorized by application, the market includes Animal Facilities, Pharmaceutical, and Research Laboratories. Air showers play a crucial role in Animal Facilities by ensuring a controlled and sterile environment, preventing contamination, and safeguarding research integrity. In the Pharmaceutical sector, these systems maintain stringent hygiene standards during the production process, minimizing the risk of product contamination. Research Laboratories benefit from air showers to uphold the purity of experiments, preserving the integrity of scientific research and analysis. This segmentation underscores the market's ability to address the specific cleanliness requirements across diverse industries.

Air Showers Market Regional Insights:

In 2022, North America dominated the global air showers market. Air shower demand from the pharmaceutical, biotechnology, and food & beverage industries is driving this rise. The US Food and Drug Administration (FDA) requires air showers in pharmaceutical manufacturing plants, fuelling North American demand. The region's market dominance is due to tight pharmaceutical production rules and sterility. Air showers are the second-largest in Europe. Pharmaceutical, biotechnology, and medical device companies drive demand in Europe, as in North America. The EU has also mandated air showers in pharmaceutical manufacturing plants, increasing demand for these systems in the region. Air showers are growing as European enterprises comply with these regulations and maintain good hygiene standards. Asia Pacific leads air shower growth. Pharmaceutical, biotechnology and electronics demand is rising. Rising disposable incomes, R&D investments, and manufacturing sector growth contribute to this increase. China has subsidized air shower purchases and given air shower manufacturers tax benefits. These measures boost air shower use and market growth in the region. South America and the Middle East & Africa are minor regions for the air shower market with growing potential. Food, medical and electronics industries drive air shower demand in these regions. These places demand more air showers because of infrastructure and manufacturing investments. Brazil and the UAE have promoted the air showers market. These include air shower subsidies and tax advantages for manufacturers. Government incentives encourage air shower use in many industries and market growth. Air Showers Market Competitive Landscape: Many prominent businesses compete in the air showers market. Key players drive innovation, fulfil client wants and shape the market. CleanZones, Air Science, Terra Universal, ESCO, Bionics Scientific Technologies, Hughes Safety Showers, DuPont, Kimberly-Clark, Royal Imtech and Illinois Tool Works are major air shower manufacturers. These firms offer air showers for various sectors and uses. Standard, low-profile, tunnel and cart air showers are available. Each air shower meets individual needs and decontaminates cleanrooms effectively. These firms offer a variety of air shower styles and features to improve functionality and user experience. Adjustable airflow velocity and direction, programmable timers, integrated alarms for abnormalities, complex control systems and cleanroom protocols and regulations are some of these features. These companies extensively invest in R&D to innovate air shower technologies to stay competitive. They improve product efficiency, dependability and usability. They also study market trends and client preferences to add new features and improve industry standards. These leaders also study industry and application needs. They collaborate with clients to provide customised air shower solutions. They service pharmaceuticals, biotechnology, medical devices, food and beverage processing, electronics and more with this technique. These industry leaders strive to gain market share by delivering a wide selection of air showers and enhancing their features and performance. They lead the air showers market by addressing consumer needs and providing reliable decontamination solutions. Numerous small and medium-sized businesses make the air showers market fragmented. However, Terra Universal Inc., Esco Group, ACMAS Technologies Pvt. Ltd., Bionics Scientific Technologies, Air Science USA, Hughes Safety Showers, Kimberly-Clark Corporation, Du Pont, Illinois Tool Works and Royal Imtech N.V. are major market competitors. These air showers market leaders are always innovating and entering new industries to stay ahead. Terra Universal Inc. recently launched a series of pharmaceutical-specific air showers. The HEPA filter in this product range removes 99.99% of airborne particles and the UV light kills bacteria and viruses. Esco Group expanded its US air shower production factory. This strategic initiative helps the company fulfil rising air shower demand in pharmaceuticals, semiconductors and electronics. Esco Group can serve more customers and capitalise on market growth by increasing manufacturing capacity. Bionics Scientific Technologies Pvt Ltd. secured a USD 1 million contract to deliver air showers to an Indian pharmaceutical company. This honour showcases the company's air shower expertise. Bionics Scientific Technologies Pvt Ltd. stands to gain market share and customers by winning such contracts.Air Showers Market Scope: Inquire Before Buying

Global Air Showers Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 5.13 Bn. Forecast Period 2024 to 2030 CAGR: 7.35% Market Size in 2030: US $ 9.31 Bn. Segments Covered: by Type Standard Air Shower (SD) Low Profile Air Shower (LP) Tunnel Air Shower (TN) Cart Air Shower (CT) by Application Standard Air Shower (SD) Low Profile Air Shower (LP) Tunnel Air Shower (TN) Cart Air Shower (CT) Air Showers Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Air Showers Key Players:

1. CleanZones (United States) 2. Air Science (United States) 3. Terra Universal (United States) 4. ESCO (United States) 5. Bionics Scientific Technologies (India) 6. Hughes Safety Showers (United Kingdom) 7. DuPont (United States) 8. Kimberly-Clark (United States) 9. Royal Imtech (Netherlands) 10. Illinois Tool Works (United States) 11. American Air Filter (AAF) International (United States) 12. Nicotra Gebhardt (Italy) 13. Mach-Aire (United Kingdom) 14. Labconco (United States) 15. Alpi Air & Vacuum Technologies (Italy) 16. SysTech Design Inc. (United States) 17. Berner International (United States) 18. Weiss Technik UK (United Kingdom) 19. ACMAS Technologies Pvt. Ltd. (India) 20. C & R Fab Media Pvt. Ltd. (India) 21. Sinterit (Poland) 22. AAF International (United States) 23. Howorth Air Technology (United Kingdom) 24. Elomatic (Finland) 25. Esco Group (United States) 26. CTS Corporation (United States) 27. Aeroqual (New Zealand) FAQ 1. What are the growth drivers for the Air Showers Market? Ans: Increasing use in the healthcare and food and beverage industry is driving the Air Showers Market growth. 2. What is the major restraint for the Air Showers Market growth? Ans: High investment in air showers restraints the Air Showers Market growth. 3. Which region is leading the global Air Showers Market during the forecast period? Ans: North America is currently leading the Air Showers Market. Asia Pacific is the fastest-growing region during the projected years. 4. What is the projected market size & growth rate of the Air Showers Market? Ans: The Air Showers Market is projected to reach USD 9.31 Bn by the year 2030 with a CAGR of 7.35%. 5. What segments are covered in the Air Showers Market report? Ans: Cleanroom Class, Budget Range, Customization Level, End-User and Distribution Channel is some of the segments that are been covered in the Air Showers Market.

1. Air Showers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Air Showers Market: Dynamics 2.1. Air Showers Market Trends by Region 2.1.1. North America Air Showers Market Trends 2.1.2. Europe Air Showers Market Trends 2.1.3. Asia Pacific Air Showers Market Trends 2.1.4. Middle East and Africa Air Showers Market Trends 2.1.5. South America Air Showers Market Trends 2.2. Air Showers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Air Showers Market Drivers 2.2.1.2. North America Air Showers Market Restraints 2.2.1.3. North America Air Showers Market Opportunities 2.2.1.4. North America Air Showers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Air Showers Market Drivers 2.2.2.2. Europe Air Showers Market Restraints 2.2.2.3. Europe Air Showers Market Opportunities 2.2.2.4. Europe Air Showers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Air Showers Market Drivers 2.2.3.2. Asia Pacific Air Showers Market Restraints 2.2.3.3. Asia Pacific Air Showers Market Opportunities 2.2.3.4. Asia Pacific Air Showers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Air Showers Market Drivers 2.2.4.2. Middle East and Africa Air Showers Market Restraints 2.2.4.3. Middle East and Africa Air Showers Market Opportunities 2.2.4.4. Middle East and Africa Air Showers Market Challenges 2.2.5. South America 2.2.5.1. South America Air Showers Market Drivers 2.2.5.2. South America Air Showers Market Restraints 2.2.5.3. South America Air Showers Market Opportunities 2.2.5.4. South America Air Showers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Air Showers Industry 2.8. Analysis of Government Schemes and Initiatives For Air Showers Industry 2.9. Air Showers Market Trade Analysis 2.10. The Global Pandemic Impact on Air Showers Market 3. Air Showers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Air Showers Market Size and Forecast, by Type (2023-2030) 3.1.1. Standard Air Shower (SD) 3.1.2. Low Profile Air Shower (LP) 3.1.3. Tunnel Air Shower (TN) 3.1.4. Cart Air Shower (CT) 3.2. Air Showers Market Size and Forecast, by Applications (2023-2030) 3.2.1. Standard Air Shower (SD) 3.2.2. Low Profile Air Shower (LP) 3.2.3. Tunnel Air Shower (TN) 3.2.4. Cart Air Shower (CT) 3.3. Air Showers Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Air Showers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Air Showers Market Size and Forecast, by Type (2023-2030) 4.1.1. Standard Air Shower (SD) 4.1.2. Low Profile Air Shower (LP) 4.1.3. Tunnel Air Shower (TN) 4.1.4. Cart Air Shower (CT) 4.2. North America Air Showers Market Size and Forecast, by Applications (2023-2030) 4.2.1. Standard Air Shower (SD) 4.2.2. Low Profile Air Shower (LP) 4.2.3. Tunnel Air Shower (TN) 4.2.4. Cart Air Shower (CT) 4.3. North America Air Showers Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Air Showers Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Standard Air Shower (SD) 4.3.1.1.2. Low Profile Air Shower (LP) 4.3.1.1.3. Tunnel Air Shower (TN) 4.3.1.1.4. Cart Air Shower (CT) 4.3.1.2. United States Air Showers Market Size and Forecast, by Applications (2023-2030) 4.3.1.2.1. Standard Air Shower (SD) 4.3.1.2.2. Low Profile Air Shower (LP) 4.3.1.2.3. Tunnel Air Shower (TN) 4.3.1.2.4. Cart Air Shower (CT) 4.3.2. Canada 4.3.2.1. Canada Air Showers Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Standard Air Shower (SD) 4.3.2.1.2. Low Profile Air Shower (LP) 4.3.2.1.3. Tunnel Air Shower (TN) 4.3.2.1.4. Cart Air Shower (CT) 4.3.2.2. Canada Air Showers Market Size and Forecast, by Applications (2023-2030) 4.3.2.2.1. Standard Air Shower (SD) 4.3.2.2.2. Low Profile Air Shower (LP) 4.3.2.2.3. Tunnel Air Shower (TN) 4.3.2.2.4. Cart Air Shower (CT) 4.3.3. Mexico 4.3.3.1. Mexico Air Showers Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Standard Air Shower (SD) 4.3.3.1.2. Low Profile Air Shower (LP) 4.3.3.1.3. Tunnel Air Shower (TN) 4.3.3.1.4. Cart Air Shower (CT) 4.3.3.2. Mexico Air Showers Market Size and Forecast, by Applications (2023-2030) 4.3.3.2.1. Standard Air Shower (SD) 4.3.3.2.2. Low Profile Air Shower (LP) 4.3.3.2.3. Tunnel Air Shower (TN) 4.3.3.2.4. Cart Air Shower (CT) 5. Europe Air Showers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Air Showers Market Size and Forecast, by Type (2023-2030) 5.2. Europe Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3. Europe Air Showers Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.2. France 5.3.2.1. France Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Air Showers Market Size and Forecast, by Applications (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Air Showers Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Air Showers Market Size and Forecast, by Applications (2023-2030) 6. Asia Pacific Air Showers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Air Showers Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3. Asia Pacific Air Showers Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.4. India 6.3.4.1. India Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Air Showers Market Size and Forecast, by Applications (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Air Showers Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Air Showers Market Size and Forecast, by Applications (2023-2030) 7. Middle East and Africa Air Showers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Air Showers Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Air Showers Market Size and Forecast, by Applications (2023-2030) 7.3. Middle East and Africa Air Showers Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Air Showers Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Air Showers Market Size and Forecast, by Applications (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Air Showers Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Air Showers Market Size and Forecast, by Applications (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Air Showers Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Air Showers Market Size and Forecast, by Applications (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Air Showers Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Air Showers Market Size and Forecast, by Applications (2023-2030) 8. South America Air Showers Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Air Showers Market Size and Forecast, by Type (2023-2030) 8.2. South America Air Showers Market Size and Forecast, by Applications (2023-2030) 8.3. South America Air Showers Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Air Showers Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Air Showers Market Size and Forecast, by Applications (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Air Showers Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Air Showers Market Size and Forecast, by Applications (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Air Showers Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Air Showers Market Size and Forecast, by Applications (2023-2030) 9. Global Air Showers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Air Showers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. CleanZones (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Air Science (United States) 10.3. Terra Universal (United States) 10.4. ESCO (United States) 10.5. Bionics Scientific Technologies (India) 10.6. Hughes Safety Showers (United Kingdom) 10.7. DuPont (United States) 10.8. Kimberly-Clark (United States) 10.9. Royal Imtech (Netherlands) 10.10. Illinois Tool Works (United States) 10.11. American Air Filter (AAF) International (United States) 10.12. Nicotra Gebhardt (Italy) 10.13. Mach-Aire (United Kingdom) 10.14. Labconco (United States) 10.15. Alpi Air & Vacuum Technologies (Italy) 10.16. SysTech Design Inc. (United States) 10.17. Berner International (United States) 10.18. Weiss Technik UK (United Kingdom) 10.19. ACMAS Technologies Pvt. Ltd. (India) 10.20. C & R Fab Media Pvt. Ltd. (India) 10.21. Sinterit (Poland) 10.22. AAF International (United States) 10.23. Howorth Air Technology (United Kingdom) 10.24. Elomatic (Finland) 10.25. Esco Group (United States) 10.26. CTS Corporation (United States) 10.27. Aeroqual (New Zealand) 11. Key Findings 12. Industry Recommendations 13. Air Showers Market: Research Methodology 14. Terms and Glossary