Global Agricultural Inoculant Market size was valued at USD 1.22 Billion in 2022 and the total Global Agricultural Inoculant revenue is expected to grow by 10.8% from 2023 to 2029, reaching nearly USD 2.47 Bn.Agricultural Inoculant Market Overview:

Agricultural Inoculants are as called Microbial inoculants beneficial microorganisms that are applied to the soil or the plant in order to improve productivity and crop health it basically contains beneficial microbes which promote plant growth. They possess many benefits which aid in delivering nutrients thus promoting plant growth which is why they are used in agriculture as amendments for soil and plants. The Agricultural Inoculants Market grows as its increases usage which improves the productivity of the crop and preferences for organic products are emerging. On the other side, the government is providing subsidies to support farmers which is a great move by the government. Market key players like IAB, S.L., BASF SE, Soil Technologies, etc. are manufacturing the agricultural inoculants with advanced technology that growing the awareness in the organic farming and environment sustainability which has increases the demand for the Agricultural Inoculant Market.To know about the Research Methodology :- Request Free Sample Report Drivers Increase in Organic Farming and Growing demand for Sustainable Agriculture drives the market The Agricultural Inoculant Market has been growing as awareness of organic farming is increasing among farmers. Organic food products have encouraged organic farming practices as consumers prefer organic food widely. In organic farming systems, agricultural inoculants are an essential part as it provides nutrient enrichments and pest management. Reducing synthetic chemicals, and the agriculture industry shifting sustainable practices that minimize the environmental impact. Large-scale farming operations like export-oriented agriculture, often require good soil fertility and nutrient. Agricultural inoculants offer cost-effective solutions to address these needs and Agricultural inoculants, like microbial and bio-fertilizers offer nutrient availability, health of the plant, and sustainable solutions by improving soil fertility. Hence, the growing demand for organic and eco-friendly farming practices is stimulating the adoption of agricultural inoculants which leads to increased Global Agricultural Inoculant Market growth. Restraints Limited Awareness and Cost Consideration can restraint the market The awareness of agricultural inoculants is increasing but still, there is a knowledge gap among farmers and some stakeholders about their proper usage, benefits, and method of application. Lack of awareness among farmers can hamper the adoption of inoculants as farmers are not sure to implement the new practices without a clear understanding. Farmers who have limited financial resources are not able to buy these inoculant products as it is higher in cost compared to traditional chemicals, especially among small-scale farmers. It is important to know the long-term benefits of agricultural inoculants. Hence, Unawareness of agricultural inoculants among farmers can deter the growth of the Agricultural Inoculant Market. Agricultural Inoculant Market Opportunity Increasing Demand and Improving Soil Health creates opportunity As the demand for organic food products is rising across the world that provides a substantial opportunity for manufacturers of agricultural inoculants. Consumers are prioritizing healthy food options which are environment friendly. Soil degradation is the main challenge in modern agriculture. Agricultural inoculants offer solutions to improve nutrient availability, and soil health, and promote nutrient cycling. It promotes sustainable farming practices and reduces chemical inputs which play an important role. Crop productivity presents creates an opportunity for the adoption of microbial inoculants as inoculants restore and maintain soil fertility. Advancements in technology for the development of inoculant formulations, and innovation in application offer the opportunity for the Global Agricultural Inoculant Market.

Agricultural Inoculant Market Segment Analysis:

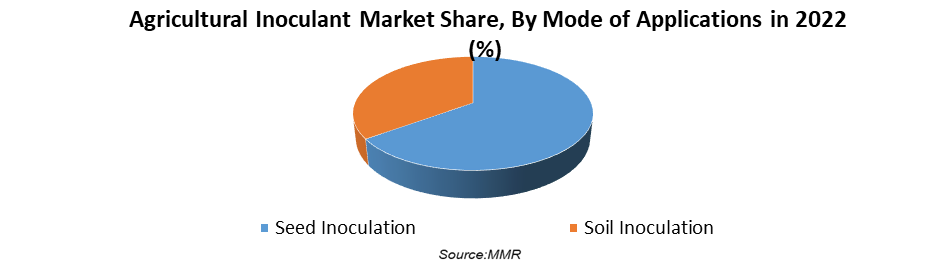

Based on Crop Type, Cereals & Grains has dominated the market in the year 2022 and is expected to lead the market during the forecast period. Consumption of agricultural inoculants for cereal crops such as rice, wheat, and corn is driving the market in the countries like U.S., Spain, China, etc. The oilseeds and pulses segment is anticipated to grow rapidly in the agricultural inoculants industry during the forecast period. The use of agricultural inoculants such as soybean, beans, and peas in the countries U.S., Brazil, Canada, and Argentina is increasing the growth of the oilseeds and pulses segment. According to MMR studies, Agricultural Inoculant Market is growing in the crop segment. Based on the Mode of Application, The seed inoculation segment has dominated the market in 2022 and is expected to dominate during the forecast period. The seed inoculation produces nutritious and high-quality crops and provides crop protection. It is a simple method that is mostly used in the United States and Europe because of its effectiveness that forming mutualistic relationships with nitrogen-fixing bacteria such as legumes. Soil inoculation applies inoculant products directly to the soil, before planting or during the growth of the crop. Soil inoculants can benefit a wide range of crops by improving their nutrient intake, root development, and environmental hazards. Hence, Market is growing rapidly

Regional Insights:

North America has dominated the market in the year 2022 and is expected to dominate during the forecast period. In Northern America, the U.S. leads the Agricultural Inoculants Market due to advances in farming techniques and farmers are implementing new technologies to increase the productivity of soil and crop yielding due to shrinking agricultural growth. Cana da is the country where the market is boosting rapidly followed by Mexico. The European market has the second-largest market share in the year 2022 as the UK and Germany are anticipated to accelerate the growth of agricultural inoculants. Microbes are mostly in the countries like France, Italy, and Spain. Whereas the Asia-Pacific is expected to grow the fastest during the forecast period. The growth of the Asia Pacific region in the agricultural inoculants market can be attributed primarily to the large area under organic agriculture, particularly in countries such as India, China, and Australia.

Agricultural Inoculant Market Scope: Inquire before buying

Agricultural Inoculant Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 1.22 Billion. Forecast Period 2023 to 2029 CAGR: 10.8% Market Size in 2029: US$ 2.47 Billion. Segments Covered: by Crop Type Cereals & Grains Oilseeds & Pulses Fruit & Vegetables Others by Mode of Application Seed Inoculation Soil Inoculation by Microbes Bacterial Fungal Others by Form Solid Liquid Granular Others Agricultural Inoculant Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players

1. IAB, S.L. 2. BASF SE 3. Horticultural Alliance, Inc. 4. Soil Technologies Corporation 5. Syngenta AG 6. America's Best Inoculant 7. BIAGRO S.A 8. Bayer 9. Advanced Biological Marketing Inc. 10. Dow Chemical Company 11. E. I. du Pont de Nemours and Company 12. AquaBella Organics 13. Corteva Inc 14. BASF SE 15. Bayer AG 16. Novozymes A/S 17. Brettyoung 18. Rizobacter Argentina S.A. 19. Italpollina S.p.A. 20. Verdesian Life Sciences LLC Frequently Asked Questions: 1] What segments are covered in the Global Agricultural Inoculant Market report? Ans. The segments covered in the Agricultural Inoculant Market report are based on Crop Type, Mode of Applications, Microbes, Form, and Regions. 2] Which region is expected to hold the highest share in the Global Agricultural Inoculant Market? Ans. The North America region is expected to hold the highest share of the Global Agricultural Inoculant Market. 3] What is the market size of the Global Agricultural Inoculant Market by 2029? Ans. The market size of the Global Market by 2029 is expected to reach US$ 2.47 Billion. 4] What is the forecast period for the Global Agricultural Inoculant Market? Ans. The forecast period for the Global Agricultural Inoculant Market is 2023-2029. 5] What was the market size of the Global Agricultural Inoculant Market in 2022? Ans. The market size of the Global Agricultural Inoculant Market in 2022 was valued at US$ 1.22 Billion.

1. Agricultural Inoculant Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Agricultural Inoculant Market: Dynamics 2.1. Agricultural Inoculant Market Trends by Region 2.1.1. North America Agricultural Inoculant Market Trends 2.1.2. Europe Agricultural Inoculant Market Trends 2.1.3. Asia Pacific Agricultural Inoculant Market Trends 2.1.4. Middle East and Africa Agricultural Inoculant Market Trends 2.1.5. South America Agricultural Inoculant Market Trends 2.2. Agricultural Inoculant Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Agricultural Inoculant Market Drivers 2.2.1.2. North America Agricultural Inoculant Market Restraints 2.2.1.3. North America Agricultural Inoculant Market Opportunities 2.2.1.4. North America Agricultural Inoculant Market Challenges 2.2.2. Europe 2.2.2.1. Europe Agricultural Inoculant Market Drivers 2.2.2.2. Europe Agricultural Inoculant Market Restraints 2.2.2.3. Europe Agricultural Inoculant Market Opportunities 2.2.2.4. Europe Agricultural Inoculant Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Agricultural Inoculant Market Drivers 2.2.3.2. Asia Pacific Agricultural Inoculant Market Restraints 2.2.3.3. Asia Pacific Agricultural Inoculant Market Opportunities 2.2.3.4. Asia Pacific Agricultural Inoculant Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Agricultural Inoculant Market Drivers 2.2.4.2. Middle East and Africa Agricultural Inoculant Market Restraints 2.2.4.3. Middle East and Africa Agricultural Inoculant Market Opportunities 2.2.4.4. Middle East and Africa Agricultural Inoculant Market Challenges 2.2.5. South America 2.2.5.1. South America Agricultural Inoculant Market Drivers 2.2.5.2. South America Agricultural Inoculant Market Restraints 2.2.5.3. South America Agricultural Inoculant Market Opportunities 2.2.5.4. South America Agricultural Inoculant Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Agricultural Inoculant Industry 2.8. Analysis of Government Schemes and Initiatives For Agricultural Inoculant Industry 2.9. Agricultural Inoculant Market Trade Analysis 2.10. The Global Pandemic Impact on Agricultural Inoculant Market 3. Agricultural Inoculant Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 3.1.1. Cereals & Grains 3.1.2. Oilseeds & Pulses 3.1.3. Fruit & Vegetables 3.1.4. Others 3.2. Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 3.2.1. Seed Inoculation 3.2.2. Soil Inoculation 3.3. Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 3.3.1. Bacterial 3.3.2. Fungal 3.3.3. Others 3.4. Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 3.4.1. Solid 3.4.2. Liquid 3.4.3. Granular 3.4.4. Others 3.5. Agricultural Inoculant Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Agricultural Inoculant Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 4.1.1. Cereals & Grains 4.1.2. Oilseeds & Pulses 4.1.3. Fruit & Vegetables 4.1.4. Others 4.2. North America Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 4.2.1. Seed Inoculation 4.2.2. Soil Inoculation 4.3. North America Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 4.3.1. Bacterial 4.3.2. Fungal 4.3.3. Others 4.4. North America Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 4.4.1. Solid 4.4.2. Liquid 4.4.3. Granular 4.4.4. Others 4.5. North America Agricultural Inoculant Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 4.5.1.1.1. Cereals & Grains 4.5.1.1.2. Oilseeds & Pulses 4.5.1.1.3. Fruit & Vegetables 4.5.1.1.4. Others 4.5.1.2. United States Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 4.5.1.2.1. Seed Inoculation 4.5.1.2.2. Soil Inoculation 4.5.1.3. United States Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 4.5.1.3.1. Bacterial 4.5.1.3.2. Fungal 4.5.1.3.3. Others 4.5.1.4. United States Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 4.5.1.4.1. Solid 4.5.1.4.2. Liquid 4.5.1.4.3. Granular 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 4.5.2.1.1. Cereals & Grains 4.5.2.1.2. Oilseeds & Pulses 4.5.2.1.3. Fruit & Vegetables 4.5.2.1.4. Others 4.5.2.2. Canada Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 4.5.2.2.1. Seed Inoculation 4.5.2.2.2. Soil Inoculation 4.5.2.3. Canada Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 4.5.2.3.1. Bacterial 4.5.2.3.2. Fungal 4.5.2.3.3. Others 4.5.2.4. Canada Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 4.5.2.4.1. Solid 4.5.2.4.2. Liquid 4.5.2.4.3. Granular 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 4.5.3.1.1. Cereals & Grains 4.5.3.1.2. Oilseeds & Pulses 4.5.3.1.3. Fruit & Vegetables 4.5.3.1.4. Others 4.5.3.2. Mexico Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 4.5.3.2.1. Seed Inoculation 4.5.3.2.2. Soil Inoculation 4.5.3.3. Mexico Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 4.5.3.3.1. Bacterial 4.5.3.3.2. Fungal 4.5.3.3.3. Others 4.5.3.4. Mexico Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 4.5.3.4.1. Solid 4.5.3.4.2. Liquid 4.5.3.4.3. Granular 4.5.3.4.4. Others 5. Europe Agricultural Inoculant Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.1. Europe Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.1. Europe Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.1. Europe Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5. Europe Agricultural Inoculant Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.1.2. United Kingdom Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.1.3. United Kingdom Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.1.4. United Kingdom Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.2. France 5.5.2.1. France Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.2.2. France Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.2.3. France Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.2.4. France Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.3.2. Germany Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.3.3. Germany Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.3.4. Germany Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.4.2. Italy Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.4.3. Italy Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.4.4. Italy Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.5.2. Spain Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.5.3. Spain Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.5.4. Spain Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.6.2. Sweden Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.6.3. Sweden Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.6.4. Sweden Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.7.2. Austria Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.7.3. Austria Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.7.4. Austria Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 5.5.8.2. Rest of Europe Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 5.5.8.3. Rest of Europe Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 5.5.8.4. Rest of Europe Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6. Asia Pacific Agricultural Inoculant Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.2. Asia Pacific Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.3. Asia Pacific Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.4. Asia Pacific Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5. Asia Pacific Agricultural Inoculant Market Size and Forecast, by Country (2022-2029) 6.5.1. China 6.5.1.1. China Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.1.2. China Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.1.3. China Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.1.4. China Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.2.2. S Korea Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.2.3. S Korea Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.2.4. S Korea Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.3.2. Japan Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.3.3. Japan Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.3.4. Japan Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.4. India 6.5.4.1. India Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.4.2. India Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.4.3. India Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.4.4. India Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.5.2. Australia Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.5.3. Australia Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.5.4. Australia Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.6.2. Indonesia Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.6.3. Indonesia Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.6.4. Indonesia Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.7.2. Malaysia Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.7.3. Malaysia Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.7.4. Malaysia Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.8.2. Vietnam Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.8.3. Vietnam Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.8.4. Vietnam Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.9.2. Taiwan Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.9.3. Taiwan Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.9.4. Taiwan Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 6.5.10.2. Rest of Asia Pacific Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 6.5.10.3. Rest of Asia Pacific Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 6.5.10.4. Rest of Asia Pacific Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 7. Middle East and Africa Agricultural Inoculant Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 7.2. Middle East and Africa Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 7.3. Middle East and Africa Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 7.4. Middle East and Africa Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 7.5. Middle East and Africa Agricultural Inoculant Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 7.5.1.2. South Africa Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 7.5.1.3. South Africa Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 7.5.1.4. South Africa Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 7.5.2.2. GCC Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 7.5.2.3. GCC Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 7.5.2.4. GCC Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 7.5.3.2. Nigeria Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 7.5.3.3. Nigeria Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 7.5.3.4. Nigeria Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 7.5.4.2. Rest of ME&A Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 7.5.4.3. Rest of ME&A Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 7.5.4.4. Rest of ME&A Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 8. South America Agricultural Inoculant Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 8.2. South America Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 8.3. South America Agricultural Inoculant Market Size and Forecast, by Microbes(2022-2029) 8.4. South America Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 8.5. South America Agricultural Inoculant Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 8.5.1.2. Brazil Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 8.5.1.3. Brazil Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 8.5.1.4. Brazil Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 8.5.2.2. Argentina Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 8.5.2.3. Argentina Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 8.5.2.4. Argentina Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Agricultural Inoculant Market Size and Forecast, by Crop Type (2022-2029) 8.5.3.2. Rest Of South America Agricultural Inoculant Market Size and Forecast, by Mode of Application (2022-2029) 8.5.3.3. Rest Of South America Agricultural Inoculant Market Size and Forecast, by Microbes (2022-2029) 8.5.3.4. Rest Of South America Agricultural Inoculant Market Size and Forecast, by Form (2022-2029) 9. Global Agricultural Inoculant Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Agricultural Inoculant Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. IAB, S.L. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. BASF SE 10.3. Horticultural Alliance, Inc. 10.4. Soil Technologies Corporation 10.5. Syngenta AG 10.6. America's Best Inoculant 10.7. BIAGRO S.A 10.8. Bayer 10.9. Advanced Biological Marketing Inc. 10.10. Dow Chemical Company 10.11. E. I. du Pont de Nemours and Company 10.12. AquaBella Organics 10.13. Corteva Inc 10.14. BASF SE 10.15. Bayer AG 10.16. Novozymes A/S 10.17. Brettyoung 10.18. Rizobacter Argentina S.A. 10.19. Italpollina S.p.A. 10.20. Verdesian Life Sciences LLC 11. Key Findings 12. Industry Recommendations 13. Agricultural Inoculant Market: Research Methodology 14. Terms and Glossary