Aesthetics Injectables Market size was valued at USD 11.36 Billion in 2023 and the Aesthetics Injectables Market revenue is expected to reach USD 25.55 Billion by 2030, at a CAGR of 12.80% over the forecast period.Aesthetics Injectables Market Overview

Aesthetic injectables, often known as dermal fillers, are medications that help with bioengineering or face rejuvenation. As people become older, their facial skin loses subcutaneous fat & draws closer to their facial muscles, causing more visible smile lines and wrinkles. As a result of this, the facial skin stretches, resulting in volume loss. These concerns can be addressed with aesthetic injectables or dermal fillers, which aid in the treatment of early signs of aging or add benefit to a facial rejuvenation process. Hyaluronic acid has the largest market share due to the rising usage of dermal fillers in aesthetic operations. The category is expanding due to a growth in the number of facial treatments and rising demand for aesthetic procedures. In addition, hyaluronic acid provides several benefits, including better hydration, elasticity, and UV protection by reversing free radical damage. These elements contribute to the hyaluronic acid industry's overall growth. It is also obvious that hyaluronic acid demand is fast increasing, indicating that the Aesthetics Injectables market is expected to continue to grow gradually during the forecast period. Aesthetics Injectables are not limited to a specific geographical region. The Aesthetics Injectables Market has a global presence, with consumers across different continents interested in these supplements. This Aesthetics Injectables Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Aesthetics Injectables Market report showcases the Aesthetics Injectables market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position.To know about the Research Methodology :- Request Free Sample Report

Aesthetics Injectables Market Dynamics

Rising concern about physical appearance With the growing influence of social media, people are increasingly conscious about their looks and physical appearance. Many feel pressurized to maintain a certain aesthetic standard set by society or the media. This has led to the rise of cosmetic procedures and non-invasive treatments that can help people look younger and better without undergoing extensive surgeries. Aesthetic injectables allow altering specific parts of the face through temporary injections, thereby addressing the concern areas instantly. Procedures like wrinkle-relaxing injections and dermal fillers are used extensively to smoothen fine lines, and plump thin lips, and lift sagging jawlines or cheek areas. Moreover, these procedures involve minimal downtime, allowing people to resume work or normal activities immediately after the treatment. The non-invasive nature and temporary effects make aesthetic injectables very appealing to people who want to look polished and refreshed with ease. Need for anti-aging treatments Aging is an inevitable process that starts showing its effects in 30s on the facial skin and structure. Factors like sun exposure, pollution, and stress gradually take a toll leading to the formation of wrinkles, loss of volume, and definition. While this was considered a natural part of life earlier, people today want ways to slow down or reverse the visible signs of aging. The desire to look and feel younger has increased manifold. As the world population is aging significantly and medical interventions have improved life expectancy, more people are also looking to maintain their youthfulness for longer through various procedures. Aesthetic injectables are seen as an effective and affordable solution for dealing with multiple aging concerns at once. Fillers help restore lost volume in areas like cheeks and lips, making one's face look plumper and defined. Injection of botulinum toxin paralyzes facial muscles temporarily reducing deep lines and wrinkles. Such non-invasive anti-aging treatments allow people to shave off few years from their facial appearance, thereby boosting self-confidence and well-being. Delaying the natural aging process has become a priority for many today, driving the demand for aesthetic injectables on a global level.Aesthetics Injectables Market Segment Analysis

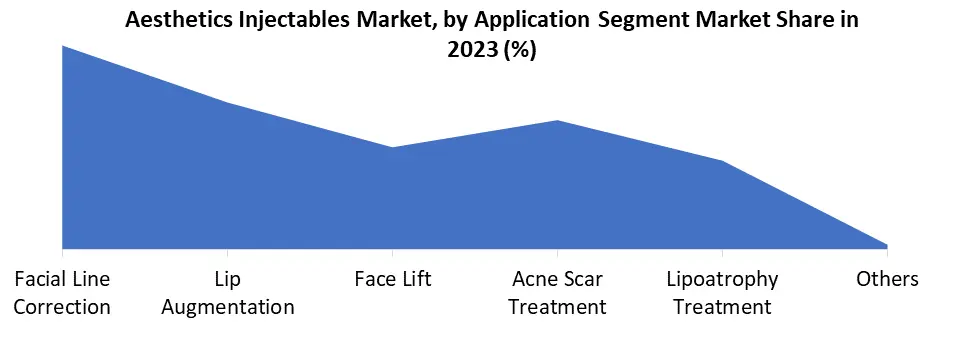

Based on end-use, the medSpa segment dominated the Aesthetics Injectables market and accounted for the largest revenue share of 46.8% in 2023. It is anticipated to continue its dominance with a CAGR of 12.2% over the forecast period. Medspa is a facility where cosmetic services are provided under the supervision of a licensed physician. All non-invasive treatments are performed in these facilities, which include facial injections, non-invasive body contouring, skin rejuvenation, and laser treatments by experienced professionals. These facilities follow all the regulatory policies and standards set by the government and have to be mandatorily owned by a physician. MedSpas are increasingly adopting novel treatment systems to gain a higher market share. The employees in medspas need to have a license in aesthetics as well as medical education.Based on application, the facial line correction segment dominated the market and accounted for the largest revenue share of 33.1% in 2023 in the global Aesthetics Injectables. Facial line correction is a significant application within the facial injectables market, catering to the preferences of individuals seeking nonsurgical cosmetic enhancements. This growth is owing to the increasing use of facial injectables for aesthetic procedures such as facial lines, wrinkles on the face, and lip lines. Factors such as growing awareness about aesthetic procedures and rising disposable income are expected to boost the Aesthetics Injectables market growth. An increase in the use of facial injectables for parentheses lines, wrinkles on the face, lip lines, lip augmentation, lip border restoration, perioral lines, and crow’s feet lines is expected to assist in market growth. The growing interest in physical appearance along with an increase in disposable income among the middle-class population in developing countries such as India is expected to boost demand for facial injectables for aesthetic purposes during the forecast period.

Aesthetics Injectables Market Regional Analysis

North America accounted for the leading market share in 2023. This is ascribed to a large population seeking aesthetic enhancements, a strong emphasis on youthful appearances, and high disposable income among consumers. Advancements in injectable techniques, product formulations, and safety measures have contributed to market expansion in North America. The region has a well-established healthcare infrastructure, with a significant presence of specialized clinics, medical spas, and cosmetic surgery centers offering facial injectable treatments. The market in North America is highly competitive, with leading manufacturers and pharmaceutical companies introducing innovative products to cater to the growing demand. The Aesthetics Injectables market in the Asia Pacific is experiencing rapid growth driven by a large population, an increase in disposable income, a growing beauty consciousness, and a rise in demand for non-surgical cosmetic procedures. The Aesthetics Injectables market in the region is characterized by expanding aesthetic clinics, advancements in technology, and the strong presence of key market players.Aesthetics Injectables Market Competitive Landscape

On March 20, 2024, Merz Aesthetics, the world's largest dedicated medical aesthetics company, announced the launch of a new complete educational ecosystem called MAX Merz Aesthetics Exchange. Based on trusted, science-based aesthetics knowledge, it provides an inclusive approach that crosses traditional barriers, ensuring a transformative educational experience customized to the evolving requirements of learners worldwide. On February 1, 2024, Merz Aesthetics announced that Radiesse has been approved to treat the décolleté area. Radiesse is a regenerative biostimulator that may regenerate numerous components of skin tissue, resulting in healthier-looking skin. The product is now approved for usage in the décolletage, increasing its versatility.In June 2023, Galderma, a pharmaceutical company, announced that the U.S. Food and Drug Administration (FDA) approved Restylane Eyelight for the treatment of undereye hollows, often known as dark shadows, in individuals over 21. Restylane Eyelight, an undereye hyaluronic acid (HA) dermal filler, is the first and only treatment in the U.S. designed with NASHA Technology to address volume loss under the eyes, providing patients with natural-looking results. In March 2023, Galderma announced the launch of FACE by Galderma, a unique aesthetic visualization tool powered by augmented reality (AR) that allows aesthetic experts and patients to preview injectable therapy outcomes before treatment begins. This unique method provides patients with a simulated real-time "before and after" view of what is feasible with a tailored treatment plan, perhaps alleviating patient anxieties regarding injectable results.

Aesthetics Injectables Market Scope: Inquiry Before Buying

Aesthetics Injectables Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 11.36 Bn. Forecast Period 2024 to 2030 CAGR: 12.8% Market Size in 2030: US $ 25.55 Bn. Segments Covered: by Product Collagen & PMMA Microspheres Hyaluronic Acid (HA) Botulinum Toxin Type A Calcium Hydroxylapatite (CaHA) Poly-L-lactic Acid (PLLA) Platelet-Rich Plasma (PRP) Therapy Others by Application Facial Line Correction Lip Augmentation Face Lift Acne Scar Treatment Lipoatrophy Treatment Others by End-use MedSpas Dermatology Clinics Hospitals Aesthetics Injectables Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Aesthetics Injectables Key Players Include

1. AbbVie 2. Galderma 3. Merz Pharma 4. Teoxane Laboratories 5. Sinclair Pharma 6. Suneva Medical 7. Croma-Pharma GmbH 8. Luminera Derm 9. Johnson & Johnson 10. Revance Therapeutics 11. Hyaltech Ltd 12. Bioxis Pharmaceuticals 13. Prollenium Medical Technologies 14. SciVision Biotech Inc. 15. Bloomage BioTechnology Corporation Ltd.Frequently Asked Questions

1. What are the primary drivers fueling growth in the aesthetics injectables market? Ans: Increasing demand for minimally invasive cosmetic procedures and advancements in injectable technologies are key driver. 2. Which regions show the most promising growth prospects in the aesthetics injectables market? Ans: Regions with rising disposable incomes and a growing aging population, such as Asia-Pacific and North America, are expected to exhibit significant growth. 3. What regulatory factors impact the aesthetics injectables market? Ans: Regulations regarding product safety, approval processes, and advertising standards influence market dynamics and entry barriers. 4. How do market trends impact the competitive landscape of aesthetic injectables? Ans: Emerging trends such as personalized treatments, combination therapies, and innovative product launches shape competition and market positioning strategies. 5. What are the key challenges faced by stakeholders in the aesthetics injectables market? Ans: Challenges include pricing pressures, stringent regulatory requirements, and competition from alternative cosmetic procedures.

1. Aesthetics Injectables Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Aesthetics Injectables Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2022) 2.3.5. Company Locations 2.4. Market Structure 2.4.1. Market Leaders 2.4.2. Market Followers 2.4.3. Emerging Players 2.5. Mergers and Acquisitions Details 3. Aesthetics Injectables Market: Dynamics 3.1. Aesthetics Injectables Market Trends 3.2. Aesthetics Injectables Market Dynamics 3.2.1. Aesthetics Injectables Market Drivers 3.2.2. Aesthetics Injectables Market Restraints 3.2.3. Aesthetics Injectables Market Opportunities 3.2.4. Aesthetics Injectables Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. Aesthetics Injectables Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 4.1.1. Collagen & PMMA Microspheres 4.1.2. Hyaluronic Acid (HA) 4.1.3. Botulinum Toxin Type A 4.1.4. Calcium Hydroxylapatite (CaHA) 4.1.5. Poly-L-lactic Acid (PLLA) 4.1.6. Platelet-Rich Plasma (PRP) Therapy 4.1.7. Others 4.2. Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 4.2.1. Facial Line Correction 4.2.2. Lip Augmentation 4.2.3. Face Lift 4.2.4. Acne Scar Treatment 4.2.5. Lipoatrophy Treatment 4.2.6. Others 4.3. Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 4.3.1. MedSpas 4.3.2. Dermatology Clinics 4.3.3. Hospitals 4.4. Aesthetics Injectables Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Aesthetics Injectables Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 5.1.1. Collagen & PMMA Microspheres 5.1.2. Hyaluronic Acid (HA) 5.1.3. Botulinum Toxin Type A 5.1.4. Calcium Hydroxylapatite (CaHA) 5.1.5. Poly-L-lactic Acid (PLLA) 5.1.6. Platelet-Rich Plasma (PRP) Therapy 5.1.7. Others 5.2. North America Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 5.2.1. Facial Line Correction 5.2.2. Lip Augmentation 5.2.3. Face Lift 5.2.4. Acne Scar Treatment 5.2.5. Lipoatrophy Treatment 5.3. Others North America Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 5.3.1. MedSpas 5.3.2. Dermatology Clinics 5.3.3. Hospitals 5.4. North America Aesthetics Injectables Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Aesthetics Injectables Market Size and Forecast, By Product(2023-2030) 5.4.1.1.1. Collagen & PMMA Microspheres 5.4.1.1.2. Hyaluronic Acid (HA) 5.4.1.1.3. Botulinum Toxin Type A 5.4.1.1.4. Calcium Hydroxylapatite (CaHA) 5.4.1.1.5. Poly-L-lactic Acid (PLLA) 5.4.1.1.6. Platelet-Rich Plasma (PRP) Therapy 5.4.1.1.7. Others 5.4.1.2. United States Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 5.4.1.2.1. Facial Line Correction 5.4.1.2.2. Lip Augmentation 5.4.1.2.3. Face Lift 5.4.1.2.4. Acne Scar Treatment 5.4.1.2.5. Lipoatrophy Treatment 5.4.1.3. United States Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 5.4.1.3.1. MedSpas 5.4.1.3.2. Dermatology Clinics 5.4.1.3.3. Hospitals 5.4.2. Canada 5.4.2.1. Canada Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 5.4.2.1.1. Collagen & PMMA Microspheres 5.4.2.1.2. Hyaluronic Acid (HA) 5.4.2.1.3. Botulinum Toxin Type A 5.4.2.1.4. Calcium Hydroxylapatite (CaHA) 5.4.2.1.5. Poly-L-lactic Acid (PLLA) 5.4.2.1.6. Platelet-Rich Plasma (PRP) Therapy 5.4.2.1.7. Others 5.4.2.2. Canada Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 5.4.2.2.1. Facial Line Correction 5.4.2.2.2. Lip Augmentation 5.4.2.2.3. Face Lift 5.4.2.2.4. Acne Scar Treatment 5.4.2.2.5. Lipoatrophy Treatment 5.4.2.3. Canada Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 5.4.2.3.1. MedSpas 5.4.2.3.2. Dermatology Clinics 5.4.2.3.3. Hospitals 5.4.3. Mexico 5.4.3.1. Mexico Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 5.4.3.1.1. Collagen & PMMA Microspheres 5.4.3.1.2. Hyaluronic Acid (HA) 5.4.3.1.3. Botulinum Toxin Type A 5.4.3.1.4. Calcium Hydroxylapatite (CaHA) 5.4.3.1.5. Poly-L-lactic Acid (PLLA) 5.4.3.1.6. Platelet-Rich Plasma (PRP) Therapy 5.4.3.1.7. Others 5.4.3.2. Mexico Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 5.4.3.2.1. Facial Line Correction 5.4.3.2.2. Lip Augmentation 5.4.3.2.3. Face Lift 5.4.3.2.4. Acne Scar Treatment 5.4.3.2.5. Lipoatrophy Treatment 5.4.3.3. Mexico Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 5.4.3.3.1. MedSpas 5.4.3.3.2. Dermatology Clinics 5.4.3.3.3. Hospitals 6. Europe Aesthetics Injectables Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.2. Europe Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.3. Europe Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4. Europe Aesthetics Injectables Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.1.2. United Kingdom Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.1.3. United Kingdom Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.2. France 6.4.2.1. France Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.2.2. France Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.2.3. France Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.3.2. Germany Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.3.3. Germany Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.4.2. Italy Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.4.3. Italy Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.5.2. Spain Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.5.3. Spain Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.6.2. Sweden Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.6.3. Sweden Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.7. Russia 6.4.7.1. Russia Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.7.2. Russia Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.7.3. Russia Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 6.4.8.2. Rest of Europe Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 6.4.8.3. Rest of Europe Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7. Asia Pacific Aesthetics Injectables Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.2. Asia Pacific Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.3. Asia Pacific Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4. Asia Pacific Aesthetics Injectables Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.1.2. China Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.1.3. China Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.2.2. S Korea Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.2.3. S Korea Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.3.2. Japan Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.3.3. Japan Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4.4. India 7.4.4.1. India Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.4.2. India Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.4.3. India Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.5.2. Australia Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.5.3. Australia Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4.6. ASEAN 7.4.6.1. ASEAN Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.6.2. ASEAN Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.6.3. ASEAN Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 7.4.7. Rest of Asia Pacific 7.4.7.1. Rest of Asia Pacific Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 7.4.7.2. Rest of Asia Pacific Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 7.4.7.3. Rest of Asia Pacific Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 8. Middle East and Africa Aesthetics Injectables Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 8.2. Middle East and Africa Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 8.3. Middle East and Africa Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 8.4. Middle East and Africa Aesthetics Injectables Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 8.4.1.2. South Africa Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 8.4.1.3. South Africa Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 8.4.2.2. GCC Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 8.4.2.3. GCC Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 8.4.3. Rest of ME&A 8.4.3.1. Rest of ME&A Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 8.4.3.2. Rest of ME&A Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 8.4.3.3. Rest of ME&A Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 9. South America Aesthetics Injectables Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 9.2. South America Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 9.3. South America Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 9.4. South America Aesthetics Injectables Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 9.4.1.2. Brazil Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 9.4.1.3. Brazil Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 9.4.2.2. Argentina Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 9.4.2.3. Argentina Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Aesthetics Injectables Market Size and Forecast, By Product (2023-2030) 9.4.3.2. Rest Of South America Aesthetics Injectables Market Size and Forecast, By Application (2023-2030) 9.4.3.3. Rest Of South America Aesthetics Injectables Market Size and Forecast, By End-Use (2023-2030) 10. Company Profile: Key Players 10.1. AbbVie 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Galderma 10.3. Merz Pharma 10.4. Teoxane Laboratories 10.5. Sinclair Pharma 10.6. Suneva Medical 10.7. Croma-Pharma GmbH 10.8. Luminera Derm 10.9. Johnson & Johnson 10.10. Revance Therapeutics 10.11. Hyaltech Ltd 10.12. Bioxis Pharmaceuticals 10.13. Prollenium Medical Technologies 10.14. SciVision Biotech Inc. 10.15. Bloomage BioTechnology Corporation Ltd. 11. Key Findings 12. Analyst Recommendations 13. Aesthetics Injectables Market: Research Methodology