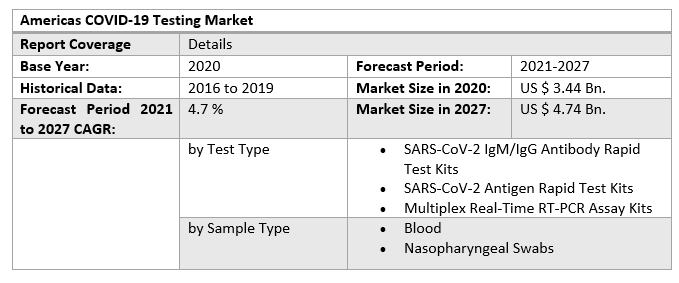

The Americas COVID-19 Testing Market size was valued at US$ 3.44 Bn in 2020 and the total revenue is expected to grow at 4.7% through 2021 to 2027, reaching nearly US$ 4.74 Bn.Americas COVID-19 Testing Market Overview:

The rising severity of COVID-19 as a result of virus mutation is encouraging market participants to conduct research and develop new testing kits that would provide an early and exact diagnosis of COVID-19 as well as effective patient management. Also Americas Covid-19 testing market is grabbing more attention due to rapid technological investment and growing infrastructure.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2020 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done good in lockdown also and specific strategic analysis of those companies is done in the report.

Americas COVID-19 Testing Market Dynamics:

The growing number of companies entering this market, as well as the increasing number of product approvals by regulatory agencies around the world. The US FDA has approved 28 antigen diagnostic tests for COVID-19 diagnosis as of June 16, 2021. As a result, regulatory organizations play a critical role in boosting the market growth. For example, Vatic Health, a U.K.-based company, received the CE mark in April 2021 for their COVID-19 viral on-the-spot' saliva antigen test. Antigen-based testing has switched the focus of many operational organizations from traditional PCR-based testing to antigen-based testing, which they see as a viable source of revenue in the coming years. Reasons boosting the market comprise an insufficiency of molecular testing materials due to strict lockdowns, a reduced requirement for supplies, and an increase in demand for mass testing to stop SARS-CoV-2 from spreading over the world among healthy individuals. However, due to the government's research and launch of vaccinations and vaccination efforts, demand for COVID-19 testing kits in the Americas is likely to fall by the end of 2021. However, due to frequent mutations and the development of new virus strains, testing will likely continue in the coming years.Americas COVID-19 Testing Market Segment Analysis:

The SARS-CoV-2 Antigen Rapid Test Kits segment is dominating the Test Type segment of the Americas COVID-19 Testing Market: In the current context, the COVID-19 antigen tests are gaining acceptance since they are simple to use, patient-friendly, and have a shorter test-to-result time. The key drivers driving the uptake of antigen-based test techniques are time and scalability constraints related to SARS-CoV-2 PCR testing. This factor is projected to lift the growth of the market. Concerns about the prevalence and frequency of these variants are expected to drive the need for more testing. As a result, the market for COVID-19 antigen tests is predicted to increase rapidly in the coming years. Low-cost rapid-testing kits for large-scale testing are in considerable demand, especially in countries with undeveloped healthcare systems like India, to assist manage COVID-19 outbreaks. India and the United States are currently the leading contributors of total COVID-19 cases worldwide. The virus's development into newer strains may also be to blame for the increase in COVID-19 cases. These factors necessitate speedy mass testing in a variety of contexts.The Nasopharyngeal Swab segment is considered to supplement the growth of the Americas COVID-19 Testing Mark Nasopharyngeal swabs are gaining wide acceptance to their inexpensive cost, convenience of use, and lack of discomfort. By the end of 2021, the segment will have a market share of around 84 %. The greatest option for oropharyngeal swabs or blood or stool investigation is nasopharyngeal swab (NPS) testing. An NPS is commonly used to screen for various respiratory virus infections, and it has largely replaced nasopharyngeal aspiration in this setting because of its accuracy and ease. However, inadequate NPS testing methods could reduce this test to a simple nasal swab. Even with proper technique, the NPS is inherently painful, and a patient or the NPS operator may retract before the swab reaches the correct place and is saturated with mucus. However, when testing for hepatitis or other respiratory viruses, the overall impact of the proper process on the accuracy of results in NPS testing has received little attention. More tests are performed in drive-through settings to improve convenience, increase throughput, and comply with social distancing regulations. Despite its fast popularity, there hasn't been a thorough examination of its impact on testing accuracy, and patient and operator placement may not be optimal for the correct NPS technique. The observation of facilities allowing patients to self-administer swabs tailored to reach the nasopharynx is even more disturbing.

Americas COVID-19 Testing Market Regional Analysis:

North America is estimated to dominate the growth of the market in the forecast period. On the other side of the coin, with the increasing number of SARS-CoV-2 cases in the country, the U.S. has undertaken several initiatives related to antigen testing. US., the market is estimated to grow at a CAGR of 5.6% during the forecast period. The growth is attributed to expenditure on the healthcare system, and the rising disposable income of individuals. For instance, in May 2021, the Centers for Disease Control and Prevention (CDC) allowed the use of at-home SARS-CoV-2 antigen tests for international travelers arriving in the U.S. Such factors are expected to increase the use of antigen tests in turn supplementing the revenue generation. Further, as per the statistics, around 4.31 Cr cases have been registered in US. with a death rate of 6.9 lakhs. Canada is predicted to offer significant potential opportunities for the COVID-19 testing market, with a CAGR of 4.8 percent expected through 2031. The market will be driven by the presence of a government-funded healthcare system and favorable reimbursement policies in Canada. The objective of the report is to present a comprehensive analysis of the Americas COVID-19 Testing Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Americas COVID-19 Testing Market dynamics, structure by analyzing the market segments and project the Americas COVID-19 Testing Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Americas COVID-19 Testing Market make the report investor’s guide.Americas COVID-19 Testing Market Scope: Inquire before buying

Americas COVID-19 Testing Market, by Region

• North America o US o Canada o Mexico • South America o Brazil o Argentina o Rest of South AmericaAmericas COVID-19 Testing Market Key Player

• Sky Medical Supplies & Equipment LLC. • Sugentech, Inc. • Novacyt Group • Aurora Instruments Ltd. • PRIMA Lab SA • SD Biosensor, INC. • Gold Standard Diagnostics • Eurofins Technologies • Biomerieux SA • Danaher • Acon • Pfizer • Abbott • Avellino • BD • Bio Fire • BiomerieuxFAQs:

1. What is the Americas COVID-19 Testing market value in 2020? Ans: Americas COVID-19 Testing market value in 2020 was estimated as 3.44 Billion USD. 2. What is the Americas COVID-19 Testing market growth? Ans: The Americas COVID-19 Testing market is anticipated to grow with a CAGR of 4.7% in the forecast period and is likely to reach USD 4.74 Billion by the end of 2027. 3. Which Sample Type segment is expected to dominate the Americas COVID-19 Testing market during the forecast period? Ans: The Nasopharyngeal Swabs segment is projected to lead the market growth owing to low cost and precise treatment option as compared to other and accounted to a market share of 84% in 2021. 4. Who are the key players in the Americas COVID-19 Testing market? Ans: Some key players operating in the Americas COVID-19 Testing market include Sky Medical Supplies & Equipment LLC., Sugentech, Inc., Novacyt Group, Aurora Instruments Ltd., PRIMA Lab SA, SD Biosensor, INC., Gold Standard Diagnostics, Eurofins Technologies, Biomerieux SA, Danaher, Abbott, Avellino, BD, Bio Fire, Biomerieux. 5. What is the key driving factor for the growth of the Americas COVID-19 Testing market? Ans: Key factors that are driving the Americas COVID-19 Testing market growth include the Increase covid-19 pandemic and rising mortality rate, absence of a vaccine, and proper channelize treatment option.

1.Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Americas COVID-19 Testing Market Size, by Market Value (US$ Bn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2020 3.2.1. Global 3.2.2. By Region (North America, South America,) 3.3. Geographical Snapshot of the Americas COVID-19 Testing Market 3.4. Geographical Snapshot of the Americas COVID-19 Testing Market, By Manufacturer share 4. Americas COVID-19 Testing Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (North America, South America,) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (North America, South America,) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (North America, South America) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (North America, South America) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. The threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. The threat of Substitute Grades 4.1.6.5. The intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the Americas COVID-19 Testing Market 5. Supply Side and Demand Side Indicators 6. Americas COVID-19 Testing Market Analysis and Forecast, 2020-2027 6.1. Americas COVID-19 Testing Market Size & Y-o-Y Growth Analysis. 7. Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 7.1.1. SARS-CoV-2 IgM/IgG Antibody Rapid Test Kits 7.1.2. SARS-CoV-2 Antigen Rapid Test Kits 7.1.3. Multiplex Real-Time RT-PCR Assay Kits 7.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 7.2.1. Blood 7.2.2. Nasopharyngeal Swabs 8. Americas COVID-19 Testing Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. North America 8.1.2. South America 9. North America Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 9.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 9.1.1. SARS-CoV-2 IgM/IgG Antibody Rapid Test Kits 9.1.2. SARS-CoV-2 Antigen Rapid Test Kits 9.1.3. Multiplex Real-Time RT-PCR Assay Kits 9.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 9.2.1. Blood 9.2.2. Nasopharyngeal Swabs 10. North America Americas COVID-19 Testing Market Analysis and Forecasts, By Country 10.1. Market Size (Value) Estimates & Forecast By Country, 2020-2027 10.1.1. US 10.1.2. Canada 10.1.3. Mexico 11. U.S. Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 11.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 11.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 12. Canada Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 12.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 12.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 13. Mexico Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 13.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 13.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 14. South America Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 14.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 14.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 15. South America Americas COVID-19 Testing Market Analysis and Forecasts, by Country 15.1. Market Size (Value) Estimates & Forecast by Country, 2020-2027 15.1.1. Brazil 15.1.2. Argentina 15.1.3. Rest of South America 16. Brazil Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 16.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 16.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 17. Argentina Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 17.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 17.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 18. Rest of South America Americas COVID-19 Testing Market Analysis and Forecasts, 2020-2027 18.1. Market Size (Value) Estimates & Forecast By Test Type, 2020-2027 18.2. Market Size (Value) Estimates & Forecast By Sample Type, 2020-2027 19. Competitive Landscape 19.1. Geographic Footprint of Major Players in the Americas COVID-19 Testing Market 19.2. Competition Matrix 19.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 19.2.2. New Grade Launches and Grade Enhancements 19.2.3. Market Consolidation 19.2.3.1. M&A by Regions, Investment, and Verticals 19.2.3.2. M&A, Forward Integration and Backward Integration 19.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 19.3. Company Profile: Key Players 19.3.1. Pfizer 19.3.1.1. Company Overview 19.3.1.2. Financial Overview 19.3.1.3. Geographic Footprint 19.3.1.4. Grade Portfolio 19.3.1.5. Business Strategy 19.3.1.6. Recent Development 19.3.2. Sky Medical Supplies & Equipment LLC. 19.3.3. Sugentech, Inc. 19.3.4. Novacyt Group 19.3.5. Aurora Instruments Ltd. 19.3.6. PRIMA Lab SA 19.3.7. SD Biosensor, INC. 19.3.8. Gold Standard Diagnostics 19.3.9. Eurofins Technologies 19.3.10. Biomerieux SA 19.3.11. Danaher 19.3.12. Acon 19.3.13. Pfizer 19.3.14. Abbott 19.3.15. Avellino 19.3.16. BD 19.3.17. Bio Fire 19.3.18. Biomerieux 46. Primary Key Insights