Advanced Semiconductor Packaging Market size was valued at USD 32.84 Bn. in 2024, and the total Global Advanced Semiconductor Packaging Market revenue is expected to grow by 8.7% from 2025 to 2032, reaching nearly USD 64.01 Bn.Advanced Semiconductor Packaging Market Overview

The Advanced Semiconductor Packaging Market involves the design and development of innovative packaging solutions for semiconductors, catering to the increasing demand for smaller, more powerful, and efficient electronic devices. It encompasses diverse packaging techniques such as 3D IC packaging, Fan-Out Packaging, and Flip-Chip Packaging. Advanced packaging is a subset of traditional packaging. It is not one specific packaging technique, but rather an assortment of approaches for packaging chips that boost computational capabilities while lowering power consumption and cost. For example, fan-out wafer-level packaging and three-dimensional packaging are distinct packaging methods that are both considered advanced packaging techniques.To know about the Research Methodology :- Request Free Sample Report Advanced Semiconductor Packaging is not limited to a specific geographical region. The market has a global presence, with consumers across different continents showing interest in these supplements. This Advanced Semiconductor Packaging Market Report offers a specific and detailed market overview with statistical as well as pre-sized trendy data. This Advanced Semiconductor Packaging Market report showcases the Advanced Semiconductor Packaging market situation with Dynamics, Market Segment, Regional Analysis, and Top Competitor's Market Position. Fundamental to all digital technologies, semiconductor chips are a major focal point in twenty-first-century geoeconomic competition. Nations see it as an imperative to invest heavily in semiconductor innovation to produce more powerful and cost-effective chips as a means to advance their growth, competitiveness, and national security. In this regard, advanced packaging has emerged as a significant pathway for producing more powerful chips. Given the importance of semiconductors to national and economic security, it is critical to appreciate the scope for innovation in advanced packaging and its implications for the global semiconductor industry. This need is recognized in the CHIPS and Science Act, which authorizes at least USD 2.5 billion in FY 2022 alone for a newly established National Advanced Packaging Manufacturing program.

Advanced Semiconductor Packaging Market Dynamics

The Advanced Semiconductor Packaging Market presents significant growth opportunities due to several factors:1. Demand for Miniaturization: The increasing need for smaller and more powerful electronic devices drives the adoption of advanced semiconductor packaging technologies in the Advanced Semiconductor Packaging Market, facilitating miniaturization and improved device performance.

2. Technological Advancements: Ongoing innovations in packaging techniques, such as 3D IC packaging and advanced materials, propel the market forward by enhancing semiconductor performance and addressing complex design challenges.

3. Rising Applications in Automotive Electronics: The proliferation of electronic components in automobiles, especially in advanced driver-assistance systems (ADAS) and connected vehicles, fuels the demand for sophisticated semiconductor packaging solutions.

4. Growth in Telecommunication Infrastructure: The global expansion of 5G technology creates a significant driver for advanced semiconductor packaging, supporting the high-frequency and high-performance requirements of 5G-enabled devices and network infrastructure.

5. Healthcare Electronics Integration: The increasing demand for healthcare electronics, including medical devices and diagnostic equipment, presents an opportunity for Advanced Semiconductor Packaging Market to cater to the specific needs of the healthcare sector.

Packaging comes in many varieties, ranging from the traditional single-die chip or flip chip with wire bonding, to advanced products integrating multiple chipsets in a modular fashion. Design tools have been available to build various packaging structures for the past three decades, but these have only recently been used at scale to design advanced ASICs, processors, and highly integrated SoCs/SIPs. In addition to Advanced Semiconductor Packaging Market pressure to pack more functionality into smaller devices, this trend is being driven by the concept of heterogeneous integration. The concept is even outlined in IEEE Electronics Packaging Society’s (EPS) Heterogeneous Integration Roadmap. In this packaging method, designers take multiple components, which could be supplied by different vendors, and combine them into a single package on top of a substrate and interconnect structure.

The Advanced Semiconductor Packaging Market faces several significant threats that is expected to impact its growth and profitability in the future.1. Supply Chain Disruptions: Disruptions in the global semiconductor supply chain, caused by factors like geopolitical tensions, natural disasters, or pandemics, pose a significant threat to the timely availability of materials and components crucial for semiconductor packaging in the Advanced Semiconductor Packaging Market.

2. Rapid Technological Obsolescence: The fast-paced evolution of semiconductor technologies may render existing packaging solutions obsolete. Companies face the threat of their products becoming outdated, emphasizing the need for continuous innovation to stay competitive.

3. Intellectual Property Theft: The Advanced Semiconductor Packaging Industry faces threats related to intellectual property theft and counterfeiting, particularly with the intricate designs and technologies involved in advanced semiconductor packaging. Unauthorized replication can lead to revenue loss and damage to a company’s reputation.

4. Stringent Regulatory Compliance: The Advanced Semiconductor Packaging Market is subject to increasingly stringent regulations concerning environmental impact, safety, and material usage. Non-compliance poses a threat, as companies need to invest in meeting and adapting to evolving regulatory standards.

5. Global Economic Volatility: Economic uncertainties, geopolitical tensions, and global financial instability can impact consumer spending and corporate investments, directly affecting the demand for electronic devices and semiconductor packaging solutions, and posing a threat to Advanced Semiconductor Packaging Market growth.

Advanced Semiconductor Packaging Market Segment Analysis

Based on Type, Flip-Chip Packaging dominated segment in the Advanced IC Packaging Market by type and is expected to maintain its lead over the forecast period. This dominance is primarily attributed to its widespread adoption across high-performance applications such as microprocessors, graphics processors, automotive electronics, and communication devices. Flip-chip packaging offers significant advantages over traditional wire bonding, including enhanced electrical performance, reduced signal inductance, better heat dissipation, and compact form factors. Based on Application, Automotive segment dominated application segment in the Advanced IC Packaging Market and is expected to maintain its leading position during the forecast period. The dominance of this segment is primarily driven by rapid evolution of vehicle electronics, especially with the rise of electric vehicles (EVs), advanced driver assistance systems (ADAS), in-vehicle infotainment and autonomous driving technologies. Modern vehicles rely heavily on semiconductors for safety, connectivity, battery management and real time processing demanding highly reliable, thermally efficient and compact IC packaging solutions.Advanced Semiconductor Packaging Market Regional Analysis

In North America, a notable trend in the Advanced Semiconductor Packaging Market involves a strong emphasis on technological innovation and sustainability. Companies focus on developing eco-friendly packaging solutions while collaborating with local research institutions to maintain technological leadership, aligning with the region’s commitment to environmental responsibility. The United States Promotes Advanced Packaging Capacity and Innovation to Boost the Advance Semiconductor Packaging Market. There is limited semiconductor packaging capacity in the United States, including advanced packaging. The United States’ share of global packaging capacity stands at 3%. Other than Intel, no semiconductor firms operate large-scale advanced packaging facilities in the United States. While the low margins of traditional packaging coupled with high labor and construction costs in the United States limited domestic investment in traditional packaging, the high-tech, high-value advantages of advanced packaging present a compelling opportunity for the United States to boost its domestic packaging capacity in the Advanced Semiconductor Packaging Market. Advanced packaging offers higher profit margins, thereby making large-scale advanced packaging economically viable in the United States. Further, increased automation in advanced packaging reduces the labor component, making it less dependent on low-cost labor and more attractive for investment in the United States. The 2022 CHIPS and Science Act is an important first step to boost domestic advanced packaging capacity and innovation. The act mandates the National Institute of Standards and Technology (NIST) to create a new National Advanced Packaging Manufacturing Program, which facilitates collaboration between industry and academia for research and innovation in high-performance, space-saving, and multi-functional packaging. It may also provide financial resources to support the construction of advanced packaging facilities. China maintains a vibrant semiconductor packaging industry, which facilitates the development of a strong advanced packaging industry. The U.S. SIA estimates that 22% of all ATP facilities in the world are located in China. Measured by installed capacity, those ATP facilities boast 38% of the worldwide Advanced Semiconductor Packaging Market, the most of any nation. China’s strength in packaging is at least partially due to large U.S. semiconductor companies choosing to locate their ATP facilities in China. For example, U.S.-headquartered semiconductor producers such as Onsemi, Qorvo, and Micron all operate high-volume ATP facilities in China. China recognizes the importance of advanced packaging and is investing in the development of a robust advanced packaging industry. In the wake of U.S. sanctions designed to hamper the growth of the Chinese semiconductor industry, China is reportedly preparing a USD 143 billion package to boost semiconductor production and innovation, including advanced packaging. China’s endeavor to promote advanced packaging is supported by major Chinese semiconductor companies. Huawei, a Chinese technology national champion, is partnering with local firms and is reportedly recruiting packaging experts from foreign firms to accelerate its advanced packaging capabilities. SMIC, a partially state-owned enterprise and the largest semiconductor manufacturer in China is urging other Chinese companies to embrace advanced packaging to increase semiconductor processing power. These companies see investment in advanced packaging capabilities as a means to increase semiconductor power despite both U.S. sanctions and the slowing of Moore’s Law. Advanced Semiconductor Packaging Market Competitive Landscape These companies operate in the Advanced Semiconductor Packaging Market through various strategies such as product innovation, mergers and acquisitions, and partnerships. New entrants like Deca Technologies, Invensas Corporation, and Nanium are adopting innovation in advanced semiconductor packaging, leveraging technologies such as Fan-Out Wafer-Level Packaging (FOWLP) and System-in-Package (SiP). Key players dominating the market include TSMC, Intel, and Samsung. These giants maintain market leadership through substantial investments in research and development, continuous technological advancements, and strategic collaborations. Their established global presence, extensive product portfolios, and a strong emphasis on sustainability ensure they are at the forefront of driving industry trends and meet evolving Market demands, solidifying their dominant positions.Advanced Semiconductor Packaging Market Scope : Inquire before buying

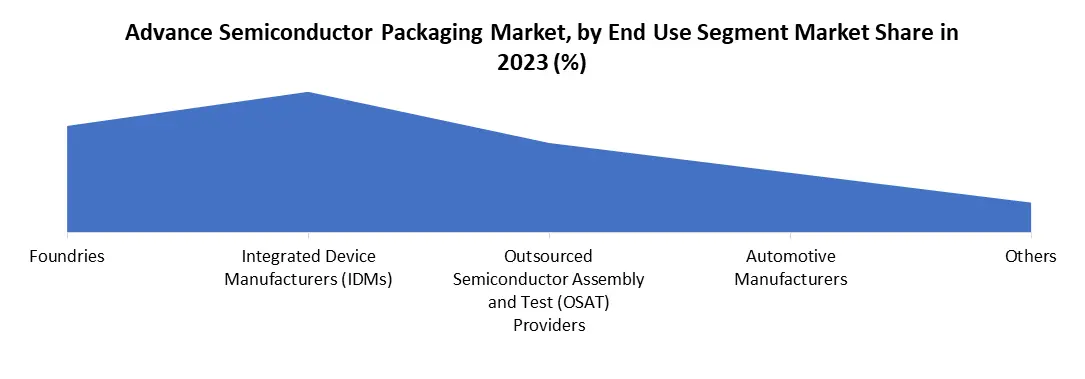

Advanced Semiconductor Packaging Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 32.84 Bn. Forecast Period 2025 to 2032 CAGR: 8.7% Market Size in 2032: USD 64.01 Bn. Segments Covered: by Type Flip-Chip Packaging Fan-Out Packaging 3D Integrated Circuit (IC) Packaging 5D Integrated Circuit (IC) Packaging Others by Interconnect Technology Through-Silicon Vias (TSVs) Wire Bonding Flip-Chip Bumping Copper Pillar Bumping Fan-Out Redistribution Layers (RDL) by Application Consumer Electronics Automotive Industrial Healthcare Telecommunication by End-User Foundries Integrated Device Manufacturers (IDMs) Outsourced Semiconductor Assembly and Test (OSAT) Providers Automotive Manufacturers Others Advanced Semiconductor Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and Rest of APAC) Middle East and Africa (South Africa, GCC, and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Advanced Semiconductor Packaging Key Players Include

1. Intel Corporation 2. Samsung Electronics Co. Ltd. 3. Advanced Micro Devices Inc. (AMD) 4. Taiwan Semiconductor Manufacturing Company Limited (TSMC) 5. ASE Technology Holding Co. Ltd. 6. Amkor Technology Inc. 7. Siliconware Precision Industries Co. Ltd. (SPIL) 8. Powertech Technology Inc. 9. United Microelectronics Corporation (UMC) 10. STATS ChipPAC Pte. Ltd. 11. ChipMOS Technologies Inc. 12. Texas Instruments Incorporated 13. Broadcom Inc. 14. NXP Semiconductors N.V. 15. Micron Technology Inc. 16. Others Frequently Asked Questions and Answers in the Market: 1. How big is the Advanced Semiconductor Packaging market? Ans: The global Advanced Semiconductor Packaging market size was estimated at USD 32.84 Billion in 2024. 2. What is the Advanced Semiconductor Packaging market growth? Ans: The global Advanced Semiconductor Packaging market is expected to grow at a compound annual growth rate of 8.7 % from 2025 to 2032 to reach USD 64.01 Billion by 2032. 3. Which Country accounted for the largest market share? Ans: In 2024, China held the market's largest revenue share of 3%. 4. Who are the key players in the market? Ans: Some key market players are ASE Technology Holding Co. Ltd., Amkor Technology Inc., Siliconware Precision Industries Co. Ltd. (SPIL), Powertech Technology Inc. 5. What are the factors driving the Advanced Semiconductor Packaging market? Ans: The market is experiencing robust growth, driven by the demand for miniaturization.

1. Advanced Semiconductor Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Advanced Semiconductor Packaging Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Key Players Benchmarking 2.3.1. Company Name 2.3.2. Business Segment 2.3.3. End-user Segment 2.3.4. Revenue (2024) 2.3.5. Company Locations 2.4. Leading Advanced Semiconductor Packaging Market Companies, by market capitalization 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 3. Advanced Semiconductor Packaging Market: Dynamics 3.1. Advanced Semiconductor Packaging Market Trends by Region 3.1.1. North America Advanced Semiconductor Packaging Market Trends 3.1.2. Europe Advanced Semiconductor Packaging Market Trends 3.1.3. Asia Pacific Advanced Semiconductor Packaging Market Trends 3.1.4. Middle East and Africa Advanced Semiconductor Packaging Market Trends 3.1.5. South America Advanced Semiconductor Packaging Market Trends 3.2. Advanced Semiconductor Packaging Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Advanced Semiconductor Packaging Market Drivers 3.2.1.2. North America Advanced Semiconductor Packaging Market Restraints 3.2.1.3. North America Advanced Semiconductor Packaging Market Opportunities 3.2.1.4. North America Advanced Semiconductor Packaging Market Challenges 3.2.2. Europe 3.2.2.1. Europe Advanced Semiconductor Packaging Market Drivers 3.2.2.2. Europe Advanced Semiconductor Packaging Market Restraints 3.2.2.3. Europe Advanced Semiconductor Packaging Market Opportunities 3.2.2.4. Europe Advanced Semiconductor Packaging Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Advanced Semiconductor Packaging Market Drivers 3.2.3.2. Asia Pacific Advanced Semiconductor Packaging Market Restraints 3.2.3.3. Asia Pacific Advanced Semiconductor Packaging Market Opportunities 3.2.3.4. Asia Pacific Advanced Semiconductor Packaging Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Advanced Semiconductor Packaging Market Drivers 3.2.4.2. Middle East and Africa Advanced Semiconductor Packaging Market Restraints 3.2.4.3. Middle East and Africa Advanced Semiconductor Packaging Market Opportunities 3.2.4.4. Middle East and Africa Advanced Semiconductor Packaging Market Challenges 3.2.5. South America 3.2.5.1. South America Advanced Semiconductor Packaging Market Drivers 3.2.5.2. South America Advanced Semiconductor Packaging Market Restraints 3.2.5.3. South America Advanced Semiconductor Packaging Market Opportunities 3.2.5.4. South America Advanced Semiconductor Packaging Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Advanced Semiconductor Packaging Industry 3.8. Analysis of Government Schemes and Initiatives For Advanced Semiconductor Packaging Industry 3.9. Advanced Semiconductor Packaging Market Trade Analysis 3.10. The Global Pandemic Impact on Advanced Semiconductor Packaging Market 4. Advanced Semiconductor Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 4.1. Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 4.1.1. Flip-Chip Packaging 4.1.2. Fan-Out Packaging 4.1.3. 3D Integrated Circuit (IC) Packaging 4.1.4. 5D Integrated Circuit (IC) Packaging 4.1.5. Others 4.2. Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 4.2.1. Through-Silicon Vias (TSVs) 4.2.2. Wire Bonding 4.2.3. Flip-Chip Bumping 4.2.4. Copper Pillar Bumping 4.2.5. Fan-Out Redistribution Layers (RDL) 4.3. Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 4.3.1. Consumer Electronics 4.3.2. Automotive 4.3.3. Industrial 4.3.4. Healthcare 4.3.5. Telecommunication 4.4. Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 4.4.1. Foundries 4.4.2. Integrated Device Manufacturers (IDMs) 4.4.3. Outsourced Semiconductor Assembly and Test (OSAT) Providers 4.4.4. Automotive Manufacturers 4.4.5. Others 4.5. Advanced Semiconductor Packaging Market Size and Forecast, by Region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Advanced Semiconductor Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. North America Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 5.1.1. Flip-Chip Packaging 5.1.2. Fan-Out Packaging 5.1.3. 3D Integrated Circuit (IC) Packaging 5.1.4. 5D Integrated Circuit (IC) Packaging 5.1.5. Others 5.2. North America Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 5.2.1. Through-Silicon Vias (TSVs) 5.2.2. Wire Bonding 5.2.3. Flip-Chip Bumping 5.2.4. Copper Pillar Bumping 5.2.5. Fan-Out Redistribution Layers (RDL) 5.3. North America Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 5.3.1. Consumer Electronics 5.3.2. Automotive 5.3.3. Industrial 5.3.4. Healthcare 5.3.5. Telecommunication 5.4. North America Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 5.4.1. Foundries 5.4.2. Integrated Device Manufacturers (IDMs) 5.4.3. Outsourced Semiconductor Assembly and Test (OSAT) Providers 5.4.4. Automotive Manufacturers 5.4.5. Others 5.5. North America Advanced Semiconductor Packaging Market Size and Forecast, by Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 5.5.1.1.1. Flip-Chip Packaging 5.5.1.1.2. Fan-Out Packaging 5.5.1.1.3. 3D Integrated Circuit (IC) Packaging 5.5.1.1.4. 5D Integrated Circuit (IC) Packaging 5.5.1.1.5. Others 5.5.1.2. United States Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 5.5.1.2.1. Through-Silicon Vias (TSVs) 5.5.1.2.2. Wire Bonding 5.5.1.2.3. Flip-Chip Bumping 5.5.1.2.4. Copper Pillar Bumping 5.5.1.2.5. Fan-Out Redistribution Layers (RDL) 5.5.1.3. United States Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 5.5.1.3.1. Consumer Electronics 5.5.1.3.2. Automotive 5.5.1.3.3. Industrial 5.5.1.3.4. Healthcare 5.5.1.3.5. Telecommunication 5.5.1.4. United States Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 5.5.1.4.1. Foundries 5.5.1.4.2. Integrated Device Manufacturers (IDMs) 5.5.1.4.3. Outsourced Semiconductor Assembly and Test (OSAT) Providers 5.5.1.4.4. Automotive Manufacturers 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 5.5.2.1.1. Flip-Chip Packaging 5.5.2.1.2. Fan-Out Packaging 5.5.2.1.3. 3D Integrated Circuit (IC) Packaging 5.5.2.1.4. 5D Integrated Circuit (IC) Packaging 5.5.2.1.5. Others 5.5.2.2. Canada Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 5.5.2.2.1. Through-Silicon Vias (TSVs) 5.5.2.2.2. Wire Bonding 5.5.2.2.3. Flip-Chip Bumping 5.5.2.2.4. Copper Pillar Bumping 5.5.2.2.5. Fan-Out Redistribution Layers (RDL) 5.5.2.3. Canada Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 5.5.2.3.1. Consumer Electronics 5.5.2.3.2. Automotive 5.5.2.3.3. Industrial 5.5.2.3.4. Healthcare 5.5.2.3.5. Telecommunication 5.5.2.4. Canada Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 5.5.2.4.1. Foundries 5.5.2.4.2. Integrated Device Manufacturers (IDMs) 5.5.2.4.3. Outsourced Semiconductor Assembly and Test (OSAT) Providers 5.5.2.4.4. Automotive Manufacturers 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 5.5.3.1.1. Flip-Chip Packaging 5.5.3.1.2. Fan-Out Packaging 5.5.3.1.3. 3D Integrated Circuit (IC) Packaging 5.5.3.1.4. 5D Integrated Circuit (IC) Packaging 5.5.3.1.5. Others 5.5.3.2. Mexico Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 5.5.3.2.1. Through-Silicon Vias (TSVs) 5.5.3.2.2. Wire Bonding 5.5.3.2.3. Flip-Chip Bumping 5.5.3.2.4. Copper Pillar Bumping 5.5.3.2.5. Fan-Out Redistribution Layers (RDL) 5.5.3.3. Mexico Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 5.5.3.3.1. Consumer Electronics 5.5.3.3.2. Automotive 5.5.3.3.3. Industrial 5.5.3.3.4. Healthcare 5.5.3.3.5. Telecommunication 5.5.3.4. Mexico Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 5.5.3.4.1. Foundries 5.5.3.4.2. Integrated Device Manufacturers (IDMs) 5.5.3.4.3. Outsourced Semiconductor Assembly and Test (OSAT) Providers 5.5.3.4.4. Automotive Manufacturers 5.5.3.4.5. Others 6. Europe Advanced Semiconductor Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Europe Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.2. Europe Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.3. Europe Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.4. Europe Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5. Europe Advanced Semiconductor Packaging Market Size and Forecast, by Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.1.2. United Kingdom Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.1.3. United Kingdom Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.1.4. United Kingdom Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.2. France 6.5.2.1. France Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.2.2. France Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.2.3. France Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.2.4. France Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.3.2. Germany Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.3.3. Germany Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Germany Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.4.2. Italy Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.4.3. Italy Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.4.4. Italy Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.5.2. Spain Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.5.3. Spain Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Spain Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.6.2. Sweden Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.6.3. Sweden Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Sweden Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.7.2. Austria Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.7.3. Austria Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Austria Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 6.5.8.2. Rest of Europe Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 6.5.8.3. Rest of Europe Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Rest of Europe Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7. Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.2. Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.3. Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.4. Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5. Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Country (2024-2032) 7.5.1. China 7.5.1.1. China Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.1.2. China Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.1.3. China Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.1.4. China Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.2.2. S Korea Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.2.3. S Korea Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.2.4. S Korea Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.3.2. Japan Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.3.3. Japan Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Japan Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.4. India 7.5.4.1. India Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.4.2. India Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.4.3. India Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.4.4. India Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.5.2. Australia Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.5.3. Australia Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.5.4. Australia Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.6.2. Indonesia Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.6.3. Indonesia Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.6.4. Indonesia Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.7. Malaysia 7.5.7.1. Malaysia Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.7.2. Malaysia Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.7.3. Malaysia Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.7.4. Malaysia Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.8. Vietnam 7.5.8.1. Vietnam Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.8.2. Vietnam Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.8.3. Vietnam Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.8.4. Vietnam Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.9. Taiwan 7.5.9.1. Taiwan Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.9.2. Taiwan Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.9.3. Taiwan Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.9.4. Taiwan Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 7.5.10.2. Rest of Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 7.5.10.3. Rest of Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 7.5.10.4. Rest of Asia Pacific Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 8. Middle East and Africa Advanced Semiconductor Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. Middle East and Africa Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 8.2. Middle East and Africa Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 8.3. Middle East and Africa Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 8.4. Middle East and Africa Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 8.5. Middle East and Africa Advanced Semiconductor Packaging Market Size and Forecast, by Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 8.5.1.2. South Africa Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 8.5.1.3. South Africa Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 8.5.1.4. South Africa Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 8.5.2.2. GCC Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 8.5.2.3. GCC Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 8.5.2.4. GCC Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 8.5.3.2. Nigeria Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 8.5.3.3. Nigeria Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Nigeria Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 8.5.4.2. Rest of ME&A Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 8.5.4.3. Rest of ME&A Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 8.5.4.4. Rest of ME&A Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 9. South America Advanced Semiconductor Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 9.1. South America Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 9.2. South America Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 9.3. South America Advanced Semiconductor Packaging Market Size and Forecast, by Application(2024-2032) 9.4. South America Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 9.5. South America Advanced Semiconductor Packaging Market Size and Forecast, by Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 9.5.1.2. Brazil Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 9.5.1.3. Brazil Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 9.5.1.4. Brazil Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 9.5.2.2. Argentina Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 9.5.2.3. Argentina Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 9.5.2.4. Argentina Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Advanced Semiconductor Packaging Market Size and Forecast, by Type (2024-2032) 9.5.3.2. Rest Of South America Advanced Semiconductor Packaging Market Size and Forecast, by Interconnect Technology (2024-2032) 9.5.3.3. Rest Of South America Advanced Semiconductor Packaging Market Size and Forecast, by Application (2024-2032) 9.5.3.4. Rest Of South America Advanced Semiconductor Packaging Market Size and Forecast, by End-User (2024-2032) 10. Company Profile: Key Players 10.1. Intel Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Samsung Electronics Co. Ltd. 10.3. Advanced Micro Devices Inc. (AMD) 10.4. Taiwan Semiconductor Manufacturing Company Limited (TSMC) 10.5. ASE Technology Holding Co. Ltd. 10.6. Amkor Technology Inc. 10.7. Siliconware Precision Industries Co. Ltd. (SPIL) 10.8. Powertech Technology Inc. 10.9. United Microelectronics Corporation (UMC) 10.10. STATS ChipPAC Pte. Ltd. 10.11. ChipMOS Technologies Inc. 10.12. Texas Instruments Incorporated 10.13. Broadcom Inc. 10.14. NXP Semiconductors N.V. 10.15. Micron Technology Inc. 10.16. Others 11. Key Findings 12. Industry Recommendations 13. Advanced Semiconductor Packaging Market: Research Methodology 14. Terms and Glossary