The Absorption Chillers Market size was valued at USD 1.58 Billion in 2024 and the total Absorption Chillers revenue is expected to grow at a CAGR of 4.76% from 2025 to 2032, reaching nearly USD 2.30 Billion.Absorption Chillers Market Overview

Absorption chillers are refrigeration systems that use a heat source to drive the cooling process, unlike conventional vapor compression chillers that rely on mechanical energy. These chillers work based on the principle of absorption refrigeration, which involves the absorption of a refrigerant vapor into a liquid and then releasing it as a gas to produce cooling. The key feature of absorption chillers is that they utilize waste heat or low-grade heat sources to drive the refrigeration process. This heat can be obtained from various sources such as industrial processes, cogeneration systems, solar thermal energy, or natural gas combustion. As per the study, the absorption chillers market is expected to grow during the forecast period. By using waste heat as an energy input, absorption chillers offer higher energy efficiency compared to vapor compression chillers, making them suitable for applications where waste heat is available. Absorption chillers are commonly used in commercial buildings, industrial facilities, district cooling systems, and applications where both cooling and heat recovery are required. They offer benefits such as reduced electricity consumption, lower environmental impact due to the use of non-ozone-depleting refrigerants, and the ability to integrate with renewable energy sources.To know about the Research Methodology :- Request Free Sample Report

Absorption Chillers Market Dynamics

Government incentives and regulations play a significant role in driving the adoption of absorption chillers. Many governments worldwide have implemented policies and programs to promote energy-efficient technologies and reduce carbon emissions. These initiatives include tax incentives, grants, and rebates for installing energy-efficient cooling systems like absorption chillers. Such incentives encourage end-users to invest in absorption chillers, driving absorption chillers market growth. Additionally, regulations related to energy efficiency and environmental standards also drive the adoption of absorption chillers as businesses strive to comply with these requirements. For instance, a government might launch a program that offers incentives for businesses to replace their existing cooling systems with energy-efficient absorption chillers. These programs raise awareness about the benefits of absorption chillers and encourage their adoption. Governments implement regulations aimed at reducing greenhouse gas emissions and promoting environmentally friendly technologies. These regulations often target the HVAC (heating, ventilation, and air conditioning) sector, which includes cooling systems. As absorption chillers are more energy-efficient and use environmentally friendly refrigerants, they align with these regulations. For example, a government may enforce regulations that restrict the use of certain refrigerants with high global warming potential (GWP) and ozone depletion potential (ODP), thereby promoting the adoption of absorption chillers that use non-ozone-depleting refrigerants. The increasing demand for cooling in commercial buildings, data centers, industrial facilities, and the food and beverage industry is a significant driver for the absorption chillers market. The increasing demand for cooling in various sectors such as commercial buildings, data centers, industrial facilities, and the food and beverage industry is a significant driver for the absorption chillers market. As populations grow and urbanization continues, there is a rising need for efficient and reliable cooling solutions to maintain comfortable working and living environments. Commercial buildings, including offices, shopping malls, and hotels, require cooling to provide a comfortable experience for occupants. Data centers, with their high-density computing equipment, generate substantial heat that needs to be effectively managed to ensure optimal performance and prevent equipment failure. Industrial facilities, such as manufacturing plants, chemical processing units, and power generation facilities, often require cooling for process control and equipment operation. The food and beverage industry relies on cooling systems to maintain product quality, freshness, and safety. Absorption chillers, with their energy efficiency and waste heat utilization capabilities, offer a viable solution to meet the growing demand for cooling in these diverse sectors while minimizing environmental impact. Growing demand for sustainable cooling solutions to drive the absorption chillers market With increasing awareness about environmental sustainability and the need to reduce carbon emissions, there is a growing demand for sustainable cooling solutions. Absorption chillers, with their energy efficiency and use of environmentally friendly refrigerants, are well-positioned to capitalize on this demand. As industries and commercial buildings strive to achieve their sustainability goals, there is an opportunity for absorption chillers to gain market share and become the preferred choice for cooling applications. Emerging markets and infrastructure development to drive the absorption chillers market The absorption chillers market can seize opportunities in emerging markets where infrastructure development is on the rise. As economies grow and urbanization accelerates, the demand for cooling solutions in commercial buildings, hospitals, data centers, and hospitality sectors increases. Market expansion efforts should target these emerging markets, offering reliable and energy-efficient cooling solutions to support their infrastructure development plans. One of the primary challenges or restraints faced by the absorption chillers market is the relatively high initial cost compared to conventional compression chillers. The upfront investment required for absorption chillers can be higher due to the complex design, specialized components, and advanced technology involved in their manufacturing and operation. This cost barrier can hinder the widespread adoption of absorption chillers, especially for budget-constrained customers or organizations. However, it's important to note that while absorption chillers may have higher upfront costs, they often provide long-term cost savings through their energy efficiency and utilization of waste heat. The potential for reduced operating expenses and energy savings over the lifespan of the system can help offset the initial investment. Additionally, government incentives, grants, and financing options may be available in some regions to alleviate the financial burden and promote the adoption of absorption chillers.Absorption Chillers Market Segment Analysis:

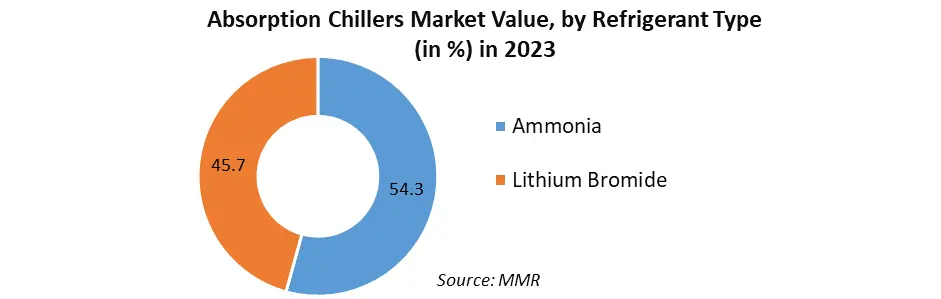

Based on Refrigerant Type, the market is segmented into Ammonia and Lithium Bromide. The Ammonia segment is the dominant segment in the global Absorption Chillers market, accounting for the largest share of 54.3% of the overall revenue in 2024, and is expected to maintain its leading position throughout the forecast period. Ammonia-based absorption chillers are known for their high efficiency and are commonly used in large-scale industrial applications. On the other hand, Lithium Bromide-based absorption chillers are often employed in commercial and residential settings due to their compact size and suitability for smaller cooling loads.

Absorption Chillers Market Regional Insights:

North America holds a significant position in the absorption chillers market due to several key factors. The region is categorized by stringent energy efficiency regulations and sustainability initiatives aimed at reducing carbon emissions and promoting environmentally friendly technologies. These regulations drive the adoption of energy-efficient cooling solutions such as absorption chillers, which offer superior efficiency compared to conventional compression chillers. The focus on sustainability and energy conservation aligns with the increasing awareness and concern for climate change, driving the demand for absorption chillers in North America. The increasing demand for sustainable cooling solutions is a key driver in the North American market. The region experiences high demand for cooling in various sectors, including residential, commercial, and industrial applications. With the rise in temperatures and the need for reliable cooling, there is a growing emphasis on sustainable and energy-efficient cooling technologies. Absorption chillers, with their ability to use waste heat or renewable energy sources, offer a compelling solution to meet this demand. They are particularly suited for applications such as air conditioning in commercial buildings, data centers, and industrial processes, where energy efficiency and environmental considerations are of paramount importance.Absorption Chillers Market Competitive Landscapes:

The competitive landscape of the absorption chillers industry is characterized by several key players competing for market share. These players range from established multinational corporations to smaller regional companies specializing in absorption chillers. The competitive dynamics are influenced by factors such as technological advancements, product offerings, market reach, and customer relationships. In this industry, major Absorption Chillers Market players often invest heavily in research and development to innovate and improve their absorption chiller technologies. They focus on enhancing energy efficiency, optimizing heat transfer, and developing advanced control systems to meet the evolving needs of customers. These technological advancements can give companies a competitive edge by providing more efficient and reliable solutions. Additionally, companies differentiate themselves through their product portfolios, offering a range of absorption chillers with varying capacities, configurations, and applications. They may target specific industries or focus on niche markets to cater to specialized cooling requirements. Absorption Chillers Market companies that can offer comprehensive solutions, including installation, maintenance, and customer support services, have a competitive advantage by providing a complete package to customers. Market reach and distribution networks also play a crucial role in the competitive landscape. Absorption Chillers Market companies with a global presence and well-established distribution channels can reach a wider customer base and gain a competitive edge. They may have regional offices, authorized dealers, and partnerships in different geographical locations, allowing them to effectively market and sell their absorption chillers. The absorption chillers industry's competitive landscape is shaped by technological advancements, diverse product offerings, market reach, and customer relationships. To stay competitive, companies focus on innovation, product differentiation, and building strong customer networks to meet the demand for efficient and sustainable cooling solutions.Absorption Chillers Market Scope: Inquiry Before Buying

Absorption Chillers Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 1.58 Bn. Forecast Period 2025 to 2032 CAGR: 4.76% Market Size in 2032: USD 2.30 Bn. Segments Covered: by Refrigerant Type Ammonia Lithium Bromide by Energy Source Hot Water Treated Steam Heated Others by End Use Industry Food and Beverages Oil and Gas Chemical Others Absorption Chillers Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Absorption Chillers Key Players

1. Thermax Limited (India) 2. Carrier Corporation (United States) 3. Johnson Controls International plc (Ireland) 4. Trane Inc. (Ireland) 5. Broad Air Conditioning Co., Ltd. (China) 6. Robur Corporation (Italy) 7. Yazaki Corporation (Japan) 8. Shuangliang Eco-Energy Systems Co., Ltd. (China) 9. Kawasaki Thermal Engineering Co., Ltd. (Japan) 10. LG Electronics Inc. (South Korea) 11. EAW Energieanlagenbau GmbH (Germany) 12. Hitachi Appliances, Inc. (Japan) 13. Frigel Firenze S.p.A. (Italy) 14. Shuangliang Clyde Bergemann GmbH (Germany) 15. Ebara Corporation (Japan)FAQs:

1] What segments are covered in the Global Absorption Chillers Market report? Ans. The segments covered in the Absorption Chillers report are based on Refrigerant Type, Energy Source, End Use Industry and Region. 2] Which region is expected to hold the highest share in the Global Absorption Chillers Market during the forecast period? Ans. The North America region is expected to hold the highest share of the Absorption Chillers market during the forecast period. 3] What is the market size of the Global Absorption Chillers by 2032? Ans. The market size of the Absorption Chillers by 2032 is expected to reach USD 2.30 Bn. 4] What is the forecast period for the Global Absorption Chillers Market? Ans. The forecast period for the Absorption Chillers market is 2025-2032. 5] What was the Global Absorption Chillers Market size in 2024? Ans: The Global Absorption Chillers Market size was USD 1.58 Billion in 2024.

1. Absorption Chillers Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Absorption Chillers Market: Dynamics 2.1. Absorption Chillers Market Trends by Region 2.1.1. North America Absorption Chillers Market Trends 2.1.2. Europe Absorption Chillers Market Trends 2.1.3. Asia Pacific Absorption Chillers Market Trends 2.1.4. Middle East and Africa Absorption Chillers Market Trends 2.1.5. South America Absorption Chillers Market Trends 2.2. Absorption Chillers Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Absorption Chillers Market Drivers 2.2.1.2. North America Absorption Chillers Market Restraints 2.2.1.3. North America Absorption Chillers Market Opportunities 2.2.1.4. North America Absorption Chillers Market Challenges 2.2.2. Europe 2.2.2.1. Europe Absorption Chillers Market Drivers 2.2.2.2. Europe Absorption Chillers Market Restraints 2.2.2.3. Europe Absorption Chillers Market Opportunities 2.2.2.4. Europe Absorption Chillers Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Absorption Chillers Market Drivers 2.2.3.2. Asia Pacific Absorption Chillers Market Restraints 2.2.3.3. Asia Pacific Absorption Chillers Market Opportunities 2.2.3.4. Asia Pacific Absorption Chillers Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Absorption Chillers Market Drivers 2.2.4.2. Middle East and Africa Absorption Chillers Market Restraints 2.2.4.3. Middle East and Africa Absorption Chillers Market Opportunities 2.2.4.4. Middle East and Africa Absorption Chillers Market Challenges 2.2.5. South America 2.2.5.1. South America Absorption Chillers Market Drivers 2.2.5.2. South America Absorption Chillers Market Restraints 2.2.5.3. South America Absorption Chillers Market Opportunities 2.2.5.4. South America Absorption Chillers Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Absorption Chillers Industry 2.8. Analysis of Government Schemes and Initiatives For Absorption Chillers Industry 2.9. Absorption Chillers Market Trade Analysis 2.10. The Global Pandemic Impact on Absorption Chillers Market 3. Absorption Chillers Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 3.1.1. Ammonia 3.1.2. Lithium Bromide 3.2. Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 3.2.1. Hot Water Treated 3.2.2. Steam Heated 3.2.3. Others 3.3. Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 3.3.1. Food and Beverages 3.3.2. Oil and Gas 3.3.3. Chemical 3.3.4. Others 3.4. Absorption Chillers Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Absorption Chillers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 4.1.1. Ammonia 4.1.2. Lithium Bromide 4.2. North America Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 4.2.1. Hot Water Treated 4.2.2. Steam Heated 4.2.3. Others 4.3. North America Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 4.3.1. Food and Beverages 4.3.2. Oil and Gas 4.3.3. Chemical 4.3.4. Others 4.4. North America Absorption Chillers Market Size and Forecast, by Country (2024-2032) 4.4.1. United States 4.4.1.1. United States Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 4.4.1.1.1. Ammonia 4.4.1.1.2. Lithium Bromide 4.4.1.2. United States Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 4.4.1.2.1. Hot Water Treated 4.4.1.2.2. Steam Heated 4.4.1.2.3. Others 4.4.1.3. United States Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 4.4.1.3.1. Food and Beverages 4.4.1.3.2. Oil and Gas 4.4.1.3.3. Chemical 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 4.4.2.1.1. Ammonia 4.4.2.1.2. Lithium Bromide 4.4.2.2. Canada Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 4.4.2.2.1. Hot Water Treated 4.4.2.2.2. Steam Heated 4.4.2.2.3. Others 4.4.2.3. Canada Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 4.4.2.3.1. Food and Beverages 4.4.2.3.2. Oil and Gas 4.4.2.3.3. Chemical 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 4.4.3.1.1. Ammonia 4.4.3.1.2. Lithium Bromide 4.4.3.2. Mexico Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 4.4.3.2.1. Hot Water Treated 4.4.3.2.2. Steam Heated 4.4.3.2.3. Others 4.4.3.3. Mexico Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 4.4.3.3.1. Food and Beverages 4.4.3.3.2. Oil and Gas 4.4.3.3.3. Chemical 4.4.3.3.4. Others 5. Europe Absorption Chillers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.2. Europe Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.3. Europe Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4. Europe Absorption Chillers Market Size and Forecast, by Country (2024-2032) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.1.2. United Kingdom Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.1.3. United Kingdom Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.2. France 5.4.2.1. France Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.2.2. France Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.2.3. France Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.3. Germany 5.4.3.1. Germany Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.3.2. Germany Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.3.3. Germany Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.4. Italy 5.4.4.1. Italy Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.4.2. Italy Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.4.3. Italy Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.5. Spain 5.4.5.1. Spain Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.5.2. Spain Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.5.3. Spain Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.6. Sweden 5.4.6.1. Sweden Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.6.2. Sweden Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.6.3. Sweden Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.7. Austria 5.4.7.1. Austria Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.7.2. Austria Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.7.3. Austria Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 5.4.8.2. Rest of Europe Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 5.4.8.3. Rest of Europe Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6. Asia Pacific Absorption Chillers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.2. Asia Pacific Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.3. Asia Pacific Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4. Asia Pacific Absorption Chillers Market Size and Forecast, by Country (2024-2032) 6.4.1. China 6.4.1.1. China Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.1.2. China Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.1.3. China Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.2. S Korea 6.4.2.1. S Korea Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.2.2. S Korea Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.2.3. S Korea Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.3. Japan 6.4.3.1. Japan Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.3.2. Japan Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.3.3. Japan Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.4. India 6.4.4.1. India Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.4.2. India Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.4.3. India Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.5. Australia 6.4.5.1. Australia Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.5.2. Australia Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.5.3. Australia Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.6. Indonesia 6.4.6.1. Indonesia Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.6.2. Indonesia Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.6.3. Indonesia Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.7. Malaysia 6.4.7.1. Malaysia Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.7.2. Malaysia Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.7.3. Malaysia Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.8. Vietnam 6.4.8.1. Vietnam Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.8.2. Vietnam Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.8.3. Vietnam Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.9. Taiwan 6.4.9.1. Taiwan Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.9.2. Taiwan Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.9.3. Taiwan Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 6.4.10.2. Rest of Asia Pacific Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 6.4.10.3. Rest of Asia Pacific Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 7. Middle East and Africa Absorption Chillers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 7.2. Middle East and Africa Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 7.3. Middle East and Africa Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 7.4. Middle East and Africa Absorption Chillers Market Size and Forecast, by Country (2024-2032) 7.4.1. South Africa 7.4.1.1. South Africa Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 7.4.1.2. South Africa Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 7.4.1.3. South Africa Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 7.4.2. GCC 7.4.2.1. GCC Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 7.4.2.2. GCC Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 7.4.2.3. GCC Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 7.4.3. Nigeria 7.4.3.1. Nigeria Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 7.4.3.2. Nigeria Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 7.4.3.3. Nigeria Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 7.4.4.2. Rest of ME&A Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 7.4.4.3. Rest of ME&A Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 8. South America Absorption Chillers Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 8.2. South America Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 8.3. South America Absorption Chillers Market Size and Forecast, by End Use Industry(2024-2032) 8.4. South America Absorption Chillers Market Size and Forecast, by Country (2024-2032) 8.4.1. Brazil 8.4.1.1. Brazil Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 8.4.1.2. Brazil Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 8.4.1.3. Brazil Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 8.4.2. Argentina 8.4.2.1. Argentina Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 8.4.2.2. Argentina Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 8.4.2.3. Argentina Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Absorption Chillers Market Size and Forecast, by Refrigerant Type (2024-2032) 8.4.3.2. Rest Of South America Absorption Chillers Market Size and Forecast, by Energy Source (2024-2032) 8.4.3.3. Rest Of South America Absorption Chillers Market Size and Forecast, by End Use Industry (2024-2032) 9. Global Absorption Chillers Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Absorption Chillers Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Thermax Limited (India) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Carrier Corporation (United States) 10.3. Johnson Controls International plc (Ireland) 10.4. Trane Inc. (Ireland) 10.5. Broad Air Conditioning Co., Ltd. (China) 10.6. Robur Corporation (Italy) 10.7. Yazaki Corporation (Japan) 10.8. Shuangliang Eco-Energy Systems Co., Ltd. (China) 10.9. Kawasaki Thermal Engineering Co., Ltd. (Japan) 10.10. LG Electronics Inc. (South Korea) 10.11. EAW Energieanlagenbau GmbH (Germany) 10.12. Hitachi Appliances, Inc. (Japan) 10.13. Frigel Firenze S.p.A. (Italy) 10.14. Shuangliang Clyde Bergemann GmbH (Germany) 10.15. Ebara Corporation (Japan) 11. Key Findings 12. Industry Recommendations 13. Absorption Chillers Market: Research Methodology 14. Terms and Glossary