Global Life Science Analytics Market size was valued at USD 23.20 Billion in 2023 and the total Life Science Analytics Market revenue is expected to grow at 7.7 % from 2024 to 2030, reaching nearly USD 38.99 Billion. Life Science Analytics is the systematic application of computational analysis to biological data generated in various areas of life sciences. It's essentially about using advanced computer tools and techniques to make sense of large, complex datasets related to living organisms and biological processes.To know about the Research Methodology :- Request Free Sample Report The Life Science Analytics market has been subjected to a transformative phase, driven by several key factors such as the exponential growth of data driven by technological advancements, and necessary analytical approaches for meaningful insights. Life science analytics plays a pivotal role in advanced drug development processes (Developing new drugs and therapies more efficiently) by efficiently analyzing vast clinical trial data and facilitating quicker discovery and development of new pharmaceuticals (Discover patterns and insights in biological data). The convergence of these factors positions the Life Science Analytics market as a key player in driving innovation, efficiency, and compliance within the life sciences sector. The need to extract meaningful insights for improved healthcare outcomes. Key players like IQVIA, Oracle, Accenture, Cognizant, and Wipro lead the pack, offering software, services, and hardware solutions. North America holds the largest market share, followed by Europe and Asia Pacific. However, Asia Pacific is expected to exhibit the fastest growth due to rising healthcare expenditure and increased government focus on life sciences development.

Life Science Analytics Market Dynamics:

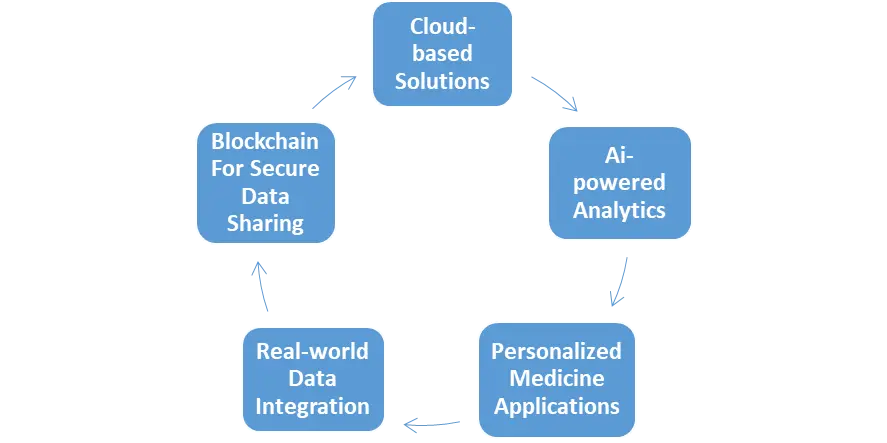

Genomics, Clinical Trials, and Healthcare IT Drive Growth in Life Science Analytics Market In the ever-evolving landscape of life sciences, key drivers have routed the momentum of the Life Science Analytics market. The merging of advancements in genomics, clinical trials, and healthcare information technology (IT) is creating massive and complex datasets. This surge in data necessitates sophisticated analytics solutions to derive meaningful insights, shaping the trajectory of the market. Genomics in medical research has boosted the generation of vast datasets containing intricate genetic information. Simultaneously, the growth of clinical trials and the integration of healthcare IT systems contribute to the complexity of data generated across the life sciences spectrum. The merger of these forces has positioned life science analytics as a critical tool for unraveling the intricacies within these datasets. The life Science Analytics market is gaining prominence globally, various regions are witnessing accelerated growth in life science analytics adoption. The demand for sophisticated analytics tools is particularly pronounced in regions with a robust presence of genomics research, active clinical trial landscapes, and thriving healthcare IT ecosystems. Data Management Hurdles Impede Market Growth in Developing Regions Life Science Analytics companies encounter a difficult restraint in handling complex incoming data with missing values, inconsistencies, and potential preferences. The imperative to invest significant time in data ingestion, organization, and cleaning creates a substantial difficulty. The adoption of advanced technologies faces hindrances, primarily by the high costs, that are unaffordable for small- and medium-sized pharmaceutical and biotech businesses, along with Contract Research Organizations (CROs) operating on tight budgets. The constraint is particularly pronounced in developing nations, where securing funding for information technology over medical technology poses a tough challenge, thereby impeding the overall growth of the Life Science Analytics market. Unlocking Growth Horizons: AI and Machine Learning Integration Fuels Opportunities in the Global Life Science Analytics Market The life science analytics market has a significant opportunity to explain the seamless integration of Artificial Intelligence (AI) and Machine Learning (ML). The technological convergence is not only reshaping the industry but also driving it towards unique growth. With a particular emphasis on regions like North America and Europe, where technological adoption is strong, the integration of AI and ML into life science analytics presents a compelling opportunity. AI and ML play a pivotal role in advancing personalized medicine by refining the analysis of individual patient data, including genetic and health information, which has been the evolution of precision healthcare. Opportunity not only streamlines research processes but also contributes to bringing new drugs to market faster, addressing critical healthcare needs. Emerging Life Science Analytics Market Trends:

Life Science Analytics Market Segment Analysis:

By Type, In the Life Science Analytics market, the segment with the highest market share based on the type of analytics is currently descriptive analytics its estimated share was around 38.56% of the total market in 2023, and predictive and prescriptive analytics are expected to grow at a faster rate. Descriptive analytics caters to the diverse needs of various life science sectors, from clinical research to drug safety monitoring. Descriptive type analytics provides basic insights quickly, facilitating immediate decision-making and process improvement.By Application, Life science companies are increasingly targeting specific customer segments and tailoring their marketing messages based on individual needs and preferences. Analytics plays a crucial role in identifying these Sales & Marketing, analyzing customer behavior, and predicting sales potential. The application with the highest market share in the Life Science Analytics market is Sales and marketing, accounting for a share of around 32% of the total market in 2023. Other applications like Drug Discovery, Research and development, and Clinical trials are expected faster growth. The increasing focus on personalized medicine, faster drug development cycles, and optimizing clinical trial design and analysis have led to the Life Science Analytics market. Real-world data (RWD) analysis is gaining traction in S&M, providing insights into patient outcomes and medication adherence, and helping companies adjust their strategies accordingly.

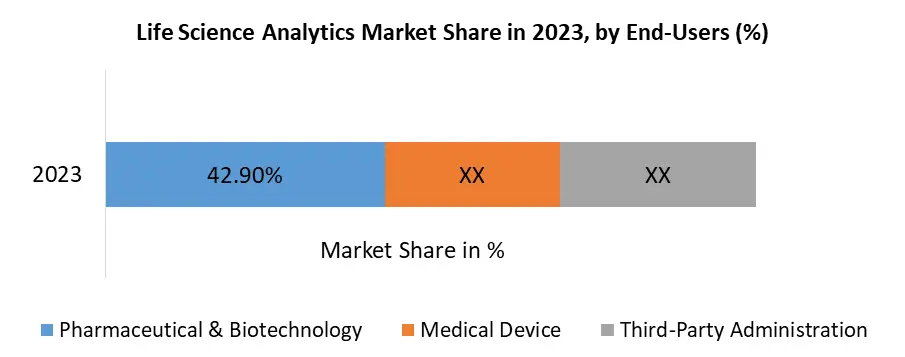

By End-User, Pharmaceuticals and biotech continue to hold the lead, while other segments like Academic Institutions & Research Organizations, and Contract Research Organizations (CROs) are expected to experience significant growth. Increased collaborations between academia and industry, and the outsourcing of research and development activities to CROs and other segments are driving their market in the forecast period 2024-2030. Pharmaceutical and Biotechnology Companies, holding a market share of 42.90% of the total life science analytics market in 2023. Illumina, Thermo Fisher Scientific, and Invitae these companies generate massive amounts of data from research, clinical trials, drug development, and sales and marketing, fueling the need for advanced analytics solutions. Demand for innovation and efficiency this factors Driving Pharmaceutical and Biotech Dominance.

Life Science Analytics Market Regional Insights:

North America holds the highest market share in the Life Science Analytics market in 2023, with an estimated share of 48.5% of the global market share. Dominance is driven by the High concentration of pharmaceutical and biotech companies having significant market share like IQVIA (15%), Oracle (12%), Accenture (10%), Cognizant (8%), and others (55%). North America spends the most on healthcare globally, creating a larger pool of resources for investing in analytics technologies. Europe holds the second largest market share, estimated at around 33.2%. Major players include Thermo Fisher Scientific, Siemens Healthineers, and SAP. Mergers and acquisitions are expected to play a significant role in shaping the competitive landscape of the Life Science Analytics market. Asia Pacific has been the fastest-growing region, expected to reach a market share of around 20% by 2030. Key players include Wipro, Infosys, and FujiFilm. Asia Pacific offers a dynamic and rapidly growing market due to: 1. Increasing healthcare expenditure 2. Governmental focus on life sciences development 3. Emerging local players gaining traction Life Science Analytics Market Competitive Landscapes: IQVIA- Recent acquisitions by IQVIA include Lasso (Nov 2022), Pharmaspectra (Sep 2022), and DMDConnects (Sep 2021). IQVIA reported financial results for the quarter ended December 31, 2023. The company's revenue for the fourth quarter of 2023 was USD 3,868 million, representing a 3.5 percent increase on a reported basis and a 2.6 percent increase at constant compared to the fourth quarter of 2022. The company's full-year 2024 guidance includes approximately USD 300 million of COVID-related revenue step down, about 50 basis points of headwind from foreign exchange, and about 100 basis points of contribution from acquisitions. Oracle- The company has acquired 142 companies, including 6 in the last 5 years, with a total of 30 acquisitions coming from private equity firms. Recent acquisitions by Oracle include NextService (Nov 2023), Newmetrix (Jan 2022), and FOEX (Sep 2022). Additionally, Oracle completed the acquisition of Cerner Corporation in 2022, which was a significant M&A activity for the company. These acquisitions reflect Oracle's strategic efforts to enlarge its portfolio and capabilities across various sectors, including software and internet software and services. Investments in 2023 1. IQVIA acquired Avaloq for USD 5.2 billion to strengthen its real-world data capabilities. 2. Oracle invested in BioAge and its AI-powered platform for drug discovery. 3. Datavant raised USD 500 million to increase its real-world data-sharing platform. 4. Veeva invested in Medidata to bolster its clinical trial management solutions. 5. Roche Dicritifcagnostics acquired TIBCO Spotfire for its advanced analytics capabilities.Life Science Analytics Market Scope: Inquire before buying

Global Life Science Analytics Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 23.20 Bn. Forecast Period 2024 to 2030 CAGR: 7.7% Market Size in 2030: US $ 38.9 Bn. Segments Covered: by Type Descriptive Predictive Prescriptive by Component Software Services by Delivery On-demand On-premises by Application Research and Development Sales and Marketing Support Regulatory Compliance Supply Chain Analytics Pharmacovigilance by End User Medical Device Pharmaceutical & Biotechnology Third-Party Administration Life Science Analytics Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Market Key Players:

North America Life Science Analytics Market Key Players 1. IQVIA(United States) 2. Oracle (United States) 3. Cognizant (United States) 4. GE Healthcare (United States) 5. SAS Institute Inc. (United States) 6. IBM (United States) 7. Microsoft (United States) 8. Thermo Fisher Scientific (United States) 9. Veeva Systems (United States) 10. Alteryx (United States) 11. Datavant (United States) 12. Medidata Solutions (United States) 13. Parexel International (United States) 14. Biogen Inc. (United States) Europe Life Science Analytics Market Key Players 1. Roche Diagnostics (Switzerland) 2. Siemens Healthineers (Germany) 3. Accenture (Ireland) 4. Philips Healthcare (Netherlands) Asia Pacific Life Science Analytics Market Key Players 1. Infosys (Bengaluru, India) 2. Wipro (India) 3. TCS (Tata Consultancy Services) (Mumbai, India) 4. Mahindra Satyam (Bengaluru, India) 5. Reliance Jio Infocomm (Navi Mumbai, India) FAQs: 1. What are the factors driving the Life Science Analytics Market? Ans. Exponential Data Growth, Personalized Medicine, Faster Drug Development, and other various factors are driving the market. 2. Which region is expected to lead the global Market during the forecast period? Ans. The North American region is expected to hold the largest share of the Market. Countries such as the United States, and Canada are focusing on product development and collaborative strategies to enhance their business offerings in the region. 3. What is the projected market size and growth rate of the Life Science Analytics Market? Ans. The Life Science Analytics Market size was valued at USD 23.20 Billion in 2023 and the total Life Science Analytics revenue is expected to grow at a CAGR of 7.7% from 2024 to 2030, reaching nearly USD 38.99 Billion by 2030. 4. What segments are covered in the Life Science Analytics Market report? Ans. The segments covered in the Life Science Analytics Market report are Type, delivery, Component, Application, End-use, and Region. 5. What is the study period of the Life Science Analytics Market? Ans: The Global Life Science Analytics Market is studied from 2023 to 2030.

1. Life Science Analytics Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Life Science Analytics Market: Dynamics 2.1. Life Science Analytics Market Trends by Region 2.1.1. North America Life Science Analytics Market Trends 2.1.2. Europe Life Science Analytics Market Trends 2.1.3. Asia Pacific Life Science Analytics Market Trends 2.1.4. Middle East and Africa Life Science Analytics Market Trends 2.1.5. South America Life Science Analytics Market Trends 2.2. Life Science Analytics Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Life Science Analytics Market Drivers 2.2.1.2. North America Life Science Analytics Market Restraints 2.2.1.3. North America Life Science Analytics Market Opportunities 2.2.1.4. North America Life Science Analytics Market Challenges 2.2.2. Europe 2.2.2.1. Europe Life Science Analytics Market Drivers 2.2.2.2. Europe Life Science Analytics Market Restraints 2.2.2.3. Europe Life Science Analytics Market Opportunities 2.2.2.4. Europe Life Science Analytics Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Life Science Analytics Market Drivers 2.2.3.2. Asia Pacific Life Science Analytics Market Restraints 2.2.3.3. Asia Pacific Life Science Analytics Market Opportunities 2.2.3.4. Asia Pacific Life Science Analytics Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Life Science Analytics Market Drivers 2.2.4.2. Middle East and Africa Life Science Analytics Market Restraints 2.2.4.3. Middle East and Africa Life Science Analytics Market Opportunities 2.2.4.4. Middle East and Africa Life Science Analytics Market Challenges 2.2.5. South America 2.2.5.1. South America Life Science Analytics Market Drivers 2.2.5.2. South America Life Science Analytics Market Restraints 2.2.5.3. South America Life Science Analytics Market Opportunities 2.2.5.4. South America Life Science Analytics Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Life Science Analytics Industry 2.8. Analysis of Government Schemes and Initiatives For Life Science Analytics Industry 2.9. Life Science Analytics Market Trade Analysis 2.10. The Global Pandemic Impact on Life Science Analytics Market 3. Life Science Analytics Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Life Science Analytics Market Size and Forecast, by Type (2023-2030) 3.1.1. Descriptive 3.1.2. Predictive 3.1.3. Prescriptive 3.2. Life Science Analytics Market Size and Forecast, by Component (2023-2030) 3.2.1. Software 3.2.2. Services 3.3. Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 3.3.1. On-demand 3.3.2. On-premises 3.4. Life Science Analytics Market Size and Forecast, by Application (2023-2030) 3.4.1. Research and Development 3.4.2. Sales and Marketing Support 3.4.3. Regulatory Compliance 3.4.4. Supply Chain Analytics 3.4.5. Pharmacovigilance 3.5. Life Science Analytics Market Size and Forecast, by End User (2023-2030) 3.5.1. Medical Device 3.5.2. Pharmaceutical & Biotechnology 3.5.3. Third-Party Administration 3.6. Life Science Analytics Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Life Science Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Life Science Analytics Market Size and Forecast, by Type (2023-2030) 4.1.1. Descriptive 4.1.2. Predictive 4.1.3. Prescriptive 4.2. North America Life Science Analytics Market Size and Forecast, by Component (2023-2030) 4.2.1. Software 4.2.2. Services 4.3. North America Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 4.3.1. On-demand 4.3.2. On-premises 4.4. North America Life Science Analytics Market Size and Forecast, by Application (2023-2030) 4.4.1. Research and Development 4.4.2. Sales and Marketing Support 4.4.3. Regulatory Compliance 4.4.4. Supply Chain Analytics 4.4.5. Pharmacovigilance 4.5. North America Life Science Analytics Market Size and Forecast, by End User (2023-2030) 4.5.1. Medical Device 4.5.2. Pharmaceutical & Biotechnology 4.5.3. Third-Party Administration 4.6. North America Life Science Analytics Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Life Science Analytics Market Size and Forecast, by Type (2023-2030) 4.6.1.1.1. Descriptive 4.6.1.1.2. Predictive 4.6.1.1.3. Prescriptive 4.6.1.2. United States Life Science Analytics Market Size and Forecast, by Component (2023-2030) 4.6.1.2.1. Software 4.6.1.2.2. Services 4.6.1.3. United States Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 4.6.1.3.1. On-demand 4.6.1.3.2. On-premises 4.6.1.4. United States Life Science Analytics Market Size and Forecast, by Application (2023-2030) 4.6.1.4.1. Research and Development 4.6.1.4.2. Sales and Marketing Support 4.6.1.4.3. Regulatory Compliance 4.6.1.4.4. Supply Chain Analytics 4.6.1.4.5. Pharmacovigilance 4.6.1.5. United States Life Science Analytics Market Size and Forecast, by End User (2023-2030) 4.6.1.5.1. Medical Device 4.6.1.5.2. Pharmaceutical & Biotechnology 4.6.1.5.3. Third-Party Administration 4.6.2. Canada 4.6.2.1. Canada Life Science Analytics Market Size and Forecast, by Type (2023-2030) 4.6.2.1.1. Descriptive 4.6.2.1.2. Predictive 4.6.2.1.3. Prescriptive 4.6.2.2. Canada Life Science Analytics Market Size and Forecast, by Component (2023-2030) 4.6.2.2.1. Software 4.6.2.2.2. Services 4.6.2.3. Canada Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 4.6.2.3.1. On-demand 4.6.2.3.2. On-premises 4.6.2.4. Canada Life Science Analytics Market Size and Forecast, by Application (2023-2030) 4.6.2.4.1. Research and Development 4.6.2.4.2. Sales and Marketing Support 4.6.2.4.3. Regulatory Compliance 4.6.2.4.4. Supply Chain Analytics 4.6.2.4.5. Pharmacovigilance 4.6.2.5. Canada Life Science Analytics Market Size and Forecast, by End User (2023-2030) 4.6.2.5.1. Medical Device 4.6.2.5.2. Pharmaceutical & Biotechnology 4.6.2.5.3. Third-Party Administration 4.6.3. Mexico 4.6.3.1. Mexico Life Science Analytics Market Size and Forecast, by Type (2023-2030) 4.6.3.1.1. Descriptive 4.6.3.1.2. Predictive 4.6.3.1.3. Prescriptive 4.6.3.2. Mexico Life Science Analytics Market Size and Forecast, by Component (2023-2030) 4.6.3.2.1. Software 4.6.3.2.2. Services 4.6.3.3. Mexico Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 4.6.3.3.1. On-demand 4.6.3.3.2. On-premises 4.6.3.4. Mexico Life Science Analytics Market Size and Forecast, by Application (2023-2030) 4.6.3.4.1. Research and Development 4.6.3.4.2. Sales and Marketing Support 4.6.3.4.3. Regulatory Compliance 4.6.3.4.4. Supply Chain Analytics 4.6.3.4.5. Pharmacovigilance 4.6.3.5. Mexico Life Science Analytics Market Size and Forecast, by End User (2023-2030) 4.6.3.5.1. Medical Device 4.6.3.5.2. Pharmaceutical & Biotechnology 4.6.3.5.3. Third-Party Administration 5. Europe Life Science Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.2. Europe Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.3. Europe Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.4. Europe Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.5. Europe Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6. Europe Life Science Analytics Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.1.2. United Kingdom Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.1.3. United Kingdom Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.1.4. United Kingdom Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.1.5. United Kingdom Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.2. France 5.6.2.1. France Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.2.2. France Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.2.3. France Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.2.4. France Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.2.5. France Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.3.2. Germany Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.3.3. Germany Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.3.4. Germany Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.3.5. Germany Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.4.2. Italy Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.4.3. Italy Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.4.4. Italy Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.4.5. Italy Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.5.2. Spain Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.5.3. Spain Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.5.4. Spain Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.5.5. Spain Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.6.2. Sweden Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.6.3. Sweden Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.6.4. Sweden Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.6.5. Sweden Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.7.2. Austria Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.7.3. Austria Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.7.4. Austria Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.7.5. Austria Life Science Analytics Market Size and Forecast, by End User (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Life Science Analytics Market Size and Forecast, by Type (2023-2030) 5.6.8.2. Rest of Europe Life Science Analytics Market Size and Forecast, by Component (2023-2030) 5.6.8.3. Rest of Europe Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 5.6.8.4. Rest of Europe Life Science Analytics Market Size and Forecast, by Application (2023-2030) 5.6.8.5. Rest of Europe Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Life Science Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.3. Asia Pacific Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.4. Asia Pacific Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.5. Asia Pacific Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6. Asia Pacific Life Science Analytics Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.1.2. China Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.1.3. China Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.1.4. China Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.1.5. China Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.2.2. S Korea Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.2.3. S Korea Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.2.4. S Korea Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.2.5. S Korea Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.3.2. Japan Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.3.3. Japan Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.3.4. Japan Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.3.5. Japan Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.4. India 6.6.4.1. India Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.4.2. India Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.4.3. India Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.4.4. India Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.4.5. India Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.5.2. Australia Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.5.3. Australia Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.5.4. Australia Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.5.5. Australia Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.6.2. Indonesia Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.6.3. Indonesia Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.6.4. Indonesia Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.6.5. Indonesia Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.7.2. Malaysia Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.7.3. Malaysia Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.7.4. Malaysia Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.7.5. Malaysia Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.8.2. Vietnam Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.8.3. Vietnam Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.8.4. Vietnam Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.8.5. Vietnam Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.9.2. Taiwan Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.9.3. Taiwan Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.9.4. Taiwan Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.9.5. Taiwan Life Science Analytics Market Size and Forecast, by End User (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Life Science Analytics Market Size and Forecast, by Type (2023-2030) 6.6.10.2. Rest of Asia Pacific Life Science Analytics Market Size and Forecast, by Component (2023-2030) 6.6.10.3. Rest of Asia Pacific Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 6.6.10.4. Rest of Asia Pacific Life Science Analytics Market Size and Forecast, by Application (2023-2030) 6.6.10.5. Rest of Asia Pacific Life Science Analytics Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Life Science Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Life Science Analytics Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Life Science Analytics Market Size and Forecast, by Component (2023-2030) 7.3. Middle East and Africa Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 7.4. Middle East and Africa Life Science Analytics Market Size and Forecast, by Application (2023-2030) 7.5. Middle East and Africa Life Science Analytics Market Size and Forecast, by End User (2023-2030) 7.6. Middle East and Africa Life Science Analytics Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Life Science Analytics Market Size and Forecast, by Type (2023-2030) 7.6.1.2. South Africa Life Science Analytics Market Size and Forecast, by Component (2023-2030) 7.6.1.3. South Africa Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 7.6.1.4. South Africa Life Science Analytics Market Size and Forecast, by Application (2023-2030) 7.6.1.5. South Africa Life Science Analytics Market Size and Forecast, by End User (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Life Science Analytics Market Size and Forecast, by Type (2023-2030) 7.6.2.2. GCC Life Science Analytics Market Size and Forecast, by Component (2023-2030) 7.6.2.3. GCC Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 7.6.2.4. GCC Life Science Analytics Market Size and Forecast, by Application (2023-2030) 7.6.2.5. GCC Life Science Analytics Market Size and Forecast, by End User (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Life Science Analytics Market Size and Forecast, by Type (2023-2030) 7.6.3.2. Nigeria Life Science Analytics Market Size and Forecast, by Component (2023-2030) 7.6.3.3. Nigeria Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 7.6.3.4. Nigeria Life Science Analytics Market Size and Forecast, by Application (2023-2030) 7.6.3.5. Nigeria Life Science Analytics Market Size and Forecast, by End User (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Life Science Analytics Market Size and Forecast, by Type (2023-2030) 7.6.4.2. Rest of ME&A Life Science Analytics Market Size and Forecast, by Component (2023-2030) 7.6.4.3. Rest of ME&A Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 7.6.4.4. Rest of ME&A Life Science Analytics Market Size and Forecast, by Application (2023-2030) 7.6.4.5. Rest of ME&A Life Science Analytics Market Size and Forecast, by End User (2023-2030) 8. South America Life Science Analytics Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Life Science Analytics Market Size and Forecast, by Type (2023-2030) 8.2. South America Life Science Analytics Market Size and Forecast, by Component (2023-2030) 8.3. South America Life Science Analytics Market Size and Forecast, by Delivery(2023-2030) 8.4. South America Life Science Analytics Market Size and Forecast, by Application (2023-2030) 8.5. South America Life Science Analytics Market Size and Forecast, by End User (2023-2030) 8.6. South America Life Science Analytics Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Life Science Analytics Market Size and Forecast, by Type (2023-2030) 8.6.1.2. Brazil Life Science Analytics Market Size and Forecast, by Component (2023-2030) 8.6.1.3. Brazil Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 8.6.1.4. Brazil Life Science Analytics Market Size and Forecast, by Application (2023-2030) 8.6.1.5. Brazil Life Science Analytics Market Size and Forecast, by End User (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Life Science Analytics Market Size and Forecast, by Type (2023-2030) 8.6.2.2. Argentina Life Science Analytics Market Size and Forecast, by Component (2023-2030) 8.6.2.3. Argentina Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 8.6.2.4. Argentina Life Science Analytics Market Size and Forecast, by Application (2023-2030) 8.6.2.5. Argentina Life Science Analytics Market Size and Forecast, by End User (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Life Science Analytics Market Size and Forecast, by Type (2023-2030) 8.6.3.2. Rest Of South America Life Science Analytics Market Size and Forecast, by Component (2023-2030) 8.6.3.3. Rest Of South America Life Science Analytics Market Size and Forecast, by Delivery (2023-2030) 8.6.3.4. Rest Of South America Life Science Analytics Market Size and Forecast, by Application (2023-2030) 8.6.3.5. Rest Of South America Life Science Analytics Market Size and Forecast, by End User (2023-2030) 9. Global Life Science Analytics Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Life Science Analytics Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. IQVIA (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Oracle (United States) 10.3. Cognizant (United States) 10.4. GE Healthcare (United States) 10.5. SAS Institute Inc. (United States) 10.6. IBM (United States) 10.7. Microsoft (United States) 10.8. Thermo Fisher Scientific (United States) 10.9. Veeva Systems (United States) 10.10. Alteryx (United States) 10.11. Datavant (United States) 10.12. Medidata Solutions (United States) 10.13. Parexel International (United States) 10.14. Biogen Inc. (United States) 10.15. Roche Diagnostics (Switzerland) 10.16. Siemens Healthineers (Germany) 10.17. Accenture (Ireland) 10.18. Philips Healthcare (Netherlands) 10.19. Infosys (Bengaluru, India) 10.20. Wipro (India) 10.21. TCS (Tata Consultancy Services) (Mumbai, India) 10.22. Mahindra Satyam (Bengaluru, India) 10.23. Reliance Jio Infocomm (Navi Mumbai, India) 11. Key Findings 12. Industry Recommendations 13. Life Science Analytics Market: Research Methodology 14. Terms and Glossary