The Xylitol Market size was valued at USD 555.07 Million in 2024 and the total Xylitol revenue is expected to grow at a CAGR of 5.3% from 2025 to 2032, reaching nearly USD 839.02 Million.Xylitol Market Introduction:

Xylitol, commonly known as wood sugar, is a naturally occurring sugar found in raspberries, mushrooms, corn, and oats, among other fruits, vegetables, and grains. It's usually derived from birch or corn trees. When xylitol is derived from plants, it can be utilised as an artificial sweetener that has a number of advantages. It's suitable for diabetics, comprises only a third of the calories in sugar, and doesn't cause tooth damage. In fact, there's evidence that it can help you avoid cavities.To know about the Research Methodology :- Request Free Sample Report

Xylitol Market Drivers:

Rising Number Of Diabetic Populations The rising number of diabetics is one of the key factors increasing xylitol demand. Additionally, the increased demand for xylitol is due to dental disorders such as cavities and gum infections all across the world. Xylitol is a sugar alternative that allows consumers to have more options when it comes to food and beverage goods while still keeping their calorie intake under control. It is a food ingredient that has a flavor similar to sugar but does not have the same number of calories. Xylitol has a sweet flavor and is therefore advantageous to diabetic individuals. The prevention of health-related issues such as diabetes, obesity, and high cholesterol has become a global phenomenon among the population, causing the xylitol market to rise. Xylitol also plays an important role in weight management, which has resulted in a large increase in the use of xylitol-infused goods in recent years.Xylitol Market Challenges:

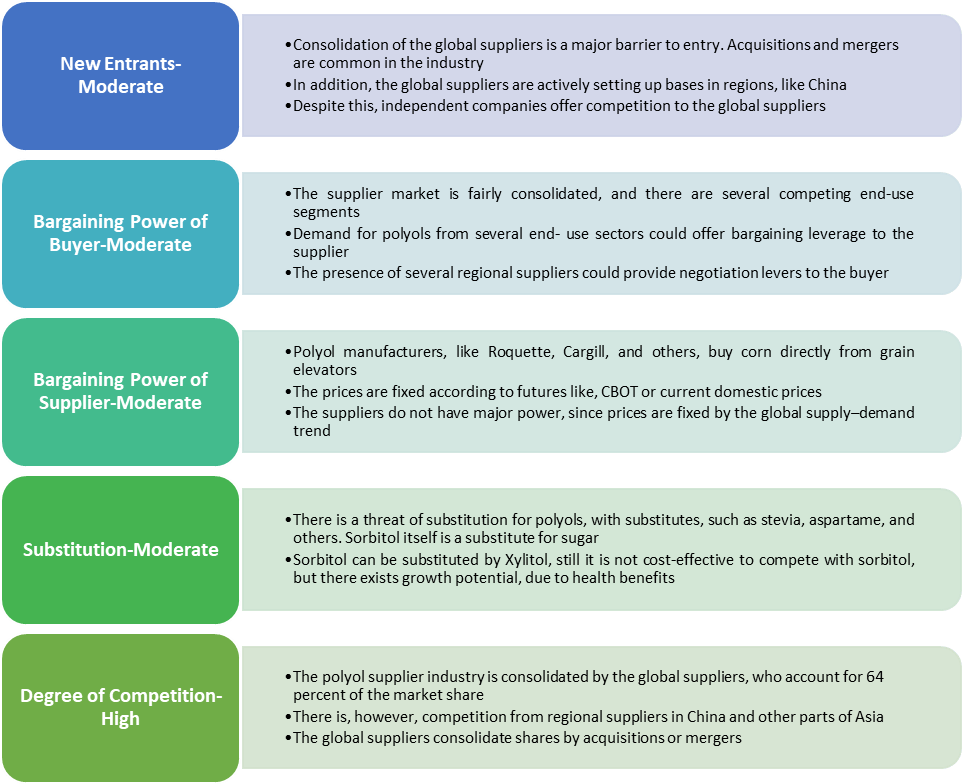

Stringent regulations The global xylitol market is being stifled by government laws governing the use of xylitol as a sweetener. Several regulatory authorities, such as the Food and Drug Administration, have their own rules governing the use of xylitol. Thus, there are delays in the release of new xylitol-infused goods. Also, changing climatic circumstances are expected to have an impact on source availability, which has an impact on overall xylitol output. Moreover, pure xylose is necessary for xylitol synthesis, which is costly and in short supply. So, the price of xylitol has increased, which has an impact on the xylitol market's growth. Variations in xylitol supply and the availability of replacement polyols such as sorbitol, maltol, and mannitol, among others, are expected to hamper the market growth.Xylitol Market PORTER’s Analysis:

Xylitol Market Segmentation Analysis:

Based on Application Segment: From 2024 to 2032, the personal care application segment is expected to grow at the quickest rate of 6.8%. By improving salivary flow and pH, limiting the growth of dangerous bacteria, and reducing plaque levels, irritation, and tooth erosion, reduces the incidence of dental caries. The personal care segment is expected to increase significantly over the estimated period as a result of these factors. When compared to ordinary sugar, xylitol has 40% fewer calories. A teaspoon of sugar provides 16 calories compared to 9.6 calories in a teaspoon of xylitol. Because of its nice cooling effect, it is utilized as a sugar alternative in chewing gum manufacture. Chewing gums, mints, lozenges, and candies containing xylitol are widely available in North America, Europe, and Asia. The chewing gum industry is expected to comprise 68% of global xylitol consumption by 2024. Bakery goods, sauces, condiments, medications, and nutraceuticals are all examples of where they can be used.Xylitol Market Regional Insights:

In 2024, Asia Pacific dominated the global market, accounting for more than 39% of total sales. China is the world's key producer of xylitol, while China, India, and Thailand are among the region's top users. It's a versatile natural sweetener that's found in a variety of chewing gums, nutraceuticals, and diabetic foods. China is the world's leading exporter. China's main export destinations in the market are the United States, Europe, India, and other South Asian countries. Over the forecast period, Europe is expected to have the highest CAGR of 7.02 percent. Finland has a major existing player in the European regional market. The majority of xylitol produced in Finland is exported to nations in the European Union. Increased demand for low-calorie foods from health-conscious customers in Europe is expected to drive market growth in Europe over the next few years. The objective of the report is to present a comprehensive analysis of the global Xylitol market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Xylitol dynamics, structure by analyzing the market segments and projecting the Xylitol size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the global Xylitol market make the report investor’s guide.Xylitol Market Scope: Inquire before buying

Xylitol Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 555.07 Mn. Forecast Period 2025 to 2032 CAGR: 5.3% Market Size in 2032: USD 839.02 Mn. Segments Covered: by Form Powder Liquid by Application Chewing Gums Food Personal Care Pharmaceuticals Confectionary Others Xylitol Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Xylitol Market, Key Players

1. Cargill Incorporated 2. DuPont 3. CSPC Shengxue Glucose Co., Ltd. 4. Mitsubishi Shoji Foodtech Co., Ltd. 5. Novagreen Inc. 6. Shandong Futaste Co., Ltd. 7. zuChem Inc. 8. Zhejiang Huakang Pharmaceutical Co., Ltd. 9. Roquette group 10.Fortress Global Enterprises Inc. 11.Merck KGaA 12.AVANSCHEM 13.Foodchem International Corporation 14.Ingredion 15.Herboveda 16.DFI Corporation 17.Yusweet Xylitol Technology Co., ltd. 18.GELERIYA PRODUCTS 19.SALVAVIDAS PHARMACEUTICAL PVT LTD. 20.Advance Inorganics 21.Fengchen Group Co., Ltd. 22.RAS Greeen SweetnersFrequently Asked Questions:

1. Which region has the largest share in Xylitol Market? Ans: The Asia Pacific held the largest share in 2024. 2. What was the Global Xylitol Market size in 2024? Ans: The Global Xylitol Market size was USD 555.07 Million in 2024. 3. What segments are covered in the Xylitol market? Ans: Xylitol Market is segmented into Form, Application and Region. 4. Who are the key players in the Xylitol market? Ans: The important key players in the Xylitol Market are – Cargill Incorporated, DuPont, CSPC Shengxue Glucose Co., Ltd., Mitsubishi Shoji Foodtech Co., Ltd., Novagreen Inc., Shandong Futaste Co., Ltd., zuChem Inc., Zhejiang Huakang Pharmaceutical Co., Ltd, Roquette group, Fortress Global Enterprises Inc., Merck KGaA, AVANSCHEM, Foodchem International Corporation, Ingredion, Herboveda, DFI Corporation, Yusweet Xylitol Technology Co.,ltd., GELERIYA PRODUCTS, SALVAVIDAS PHARMACEUTICAL PVT LTD., Advance Inorganics, Fengchen Group Co.,Ltd., and RAS Greeen Sweetners. 5. What is the study period of this market? Ans: The Xylitol Market is studied from 2024 to 2032.

1. Xylitol Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Xylitol Market: Dynamics 2.1. Xylitol Market Trends by Region 2.1.1. North America Xylitol Market Trends 2.1.2. Europe Xylitol Market Trends 2.1.3. Asia Pacific Xylitol Market Trends 2.1.4. Middle East and Africa Xylitol Market Trends 2.1.5. South America Xylitol Market Trends 2.2. Xylitol Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Xylitol Market Drivers 2.2.1.2. North America Xylitol Market Restraints 2.2.1.3. North America Xylitol Market Opportunities 2.2.1.4. North America Xylitol Market Challenges 2.2.2. Europe 2.2.2.1. Europe Xylitol Market Drivers 2.2.2.2. Europe Xylitol Market Restraints 2.2.2.3. Europe Xylitol Market Opportunities 2.2.2.4. Europe Xylitol Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Xylitol Market Drivers 2.2.3.2. Asia Pacific Xylitol Market Restraints 2.2.3.3. Asia Pacific Xylitol Market Opportunities 2.2.3.4. Asia Pacific Xylitol Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Xylitol Market Drivers 2.2.4.2. Middle East and Africa Xylitol Market Restraints 2.2.4.3. Middle East and Africa Xylitol Market Opportunities 2.2.4.4. Middle East and Africa Xylitol Market Challenges 2.2.5. South America 2.2.5.1. South America Xylitol Market Drivers 2.2.5.2. South America Xylitol Market Restraints 2.2.5.3. South America Xylitol Market Opportunities 2.2.5.4. South America Xylitol Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Xylitol Industry 2.8. Analysis of Government Schemes and Initiatives For Xylitol Industry 2.9. Xylitol Market Trade Analysis 2.10. The Global Pandemic Impact on Xylitol Market 3. Xylitol Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Xylitol Market Size and Forecast, by Form (2024-2032) 3.1.1. Powder 3.1.2. Liquid 3.2. Xylitol Market Size and Forecast, by Application (2024-2032) 3.2.1. Chewing Gums 3.2.2. Food 3.2.3. Personal Care 3.2.4. Pharmaceuticals 3.2.5. Confectionary 3.2.6. Others 3.3. Xylitol Market Size and Forecast, by Region (2024-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Xylitol Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Xylitol Market Size and Forecast, by Form (2024-2032) 4.1.1. Powder 4.1.2. Liquid 4.2. North America Xylitol Market Size and Forecast, by Application (2024-2032) 4.2.1. Chewing Gums 4.2.2. Food 4.2.3. Personal Care 4.2.4. Pharmaceuticals 4.2.5. Confectionary 4.2.6. Others 4.3. North America Xylitol Market Size and Forecast, by Country (2024-2032) 4.3.1. United States 4.3.1.1. United States Xylitol Market Size and Forecast, by Form (2024-2032) 4.3.1.1.1. Powder 4.3.1.1.2. Liquid 4.3.1.2. United States Xylitol Market Size and Forecast, by Application (2024-2032) 4.3.1.2.1. Chewing Gums 4.3.1.2.2. Food 4.3.1.2.3. Personal Care 4.3.1.2.4. Pharmaceuticals 4.3.1.2.5. Confectionary 4.3.1.2.6. Others 4.3.2. Canada 4.3.2.1. Canada Xylitol Market Size and Forecast, by Form (2024-2032) 4.3.2.1.1. Powder 4.3.2.1.2. Liquid 4.3.2.2. Canada Xylitol Market Size and Forecast, by Application (2024-2032) 4.3.2.2.1. Chewing Gums 4.3.2.2.2. Food 4.3.2.2.3. Personal Care 4.3.2.2.4. Pharmaceuticals 4.3.2.2.5. Confectionary 4.3.2.2.6. Others 4.3.3. Mexico 4.3.3.1. Mexico Xylitol Market Size and Forecast, by Form (2024-2032) 4.3.3.1.1. Powder 4.3.3.1.2. Liquid 4.3.3.2. Mexico Xylitol Market Size and Forecast, by Application (2024-2032) 4.3.3.2.1. Chewing Gums 4.3.3.2.2. Food 4.3.3.2.3. Personal Care 4.3.3.2.4. Pharmaceuticals 4.3.3.2.5. Confectionary 4.3.3.2.6. Others 5. Europe Xylitol Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Xylitol Market Size and Forecast, by Form (2024-2032) 5.2. Europe Xylitol Market Size and Forecast, by Application (2024-2032) 5.3. Europe Xylitol Market Size and Forecast, by Country (2024-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.1.2. United Kingdom Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.2. France 5.3.2.1. France Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.2.2. France Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.3. Germany 5.3.3.1. Germany Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.3.2. Germany Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.4. Italy 5.3.4.1. Italy Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.4.2. Italy Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.5. Spain 5.3.5.1. Spain Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.5.2. Spain Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.6. Sweden 5.3.6.1. Sweden Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.6.2. Sweden Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.7. Austria 5.3.7.1. Austria Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.7.2. Austria Xylitol Market Size and Forecast, by Application (2024-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Xylitol Market Size and Forecast, by Form (2024-2032) 5.3.8.2. Rest of Europe Xylitol Market Size and Forecast, by Application (2024-2032) 6. Asia Pacific Xylitol Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Xylitol Market Size and Forecast, by Form (2024-2032) 6.2. Asia Pacific Xylitol Market Size and Forecast, by Application (2024-2032) 6.3. Asia Pacific Xylitol Market Size and Forecast, by Country (2024-2032) 6.3.1. China 6.3.1.1. China Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.1.2. China Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.2. S Korea 6.3.2.1. S Korea Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.2.2. S Korea Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.3. Japan 6.3.3.1. Japan Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.3.2. Japan Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.4. India 6.3.4.1. India Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.4.2. India Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.5. Australia 6.3.5.1. Australia Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.5.2. Australia Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.6.2. Indonesia Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.7.2. Malaysia Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.8.2. Vietnam Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.9.2. Taiwan Xylitol Market Size and Forecast, by Application (2024-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Xylitol Market Size and Forecast, by Form (2024-2032) 6.3.10.2. Rest of Asia Pacific Xylitol Market Size and Forecast, by Application (2024-2032) 7. Middle East and Africa Xylitol Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Xylitol Market Size and Forecast, by Form (2024-2032) 7.2. Middle East and Africa Xylitol Market Size and Forecast, by Application (2024-2032) 7.3. Middle East and Africa Xylitol Market Size and Forecast, by Country (2024-2032) 7.3.1. South Africa 7.3.1.1. South Africa Xylitol Market Size and Forecast, by Form (2024-2032) 7.3.1.2. South Africa Xylitol Market Size and Forecast, by Application (2024-2032) 7.3.2. GCC 7.3.2.1. GCC Xylitol Market Size and Forecast, by Form (2024-2032) 7.3.2.2. GCC Xylitol Market Size and Forecast, by Application (2024-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Xylitol Market Size and Forecast, by Form (2024-2032) 7.3.3.2. Nigeria Xylitol Market Size and Forecast, by Application (2024-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Xylitol Market Size and Forecast, by Form (2024-2032) 7.3.4.2. Rest of ME&A Xylitol Market Size and Forecast, by Application (2024-2032) 8. South America Xylitol Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Xylitol Market Size and Forecast, by Form (2024-2032) 8.2. South America Xylitol Market Size and Forecast, by Application (2024-2032) 8.3. South America Xylitol Market Size and Forecast, by Country (2024-2032) 8.3.1. Brazil 8.3.1.1. Brazil Xylitol Market Size and Forecast, by Form (2024-2032) 8.3.1.2. Brazil Xylitol Market Size and Forecast, by Application (2024-2032) 8.3.2. Argentina 8.3.2.1. Argentina Xylitol Market Size and Forecast, by Form (2024-2032) 8.3.2.2. Argentina Xylitol Market Size and Forecast, by Application (2024-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Xylitol Market Size and Forecast, by Form (2024-2032) 8.3.3.2. Rest Of South America Xylitol Market Size and Forecast, by Application (2024-2032) 9. Global Xylitol Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Xylitol Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Cargill Incorporated 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. DuPont 10.3. CSPC Shengxue Glucose Co., Ltd. 10.4. Mitsubishi Shoji Foodtech Co., Ltd. 10.5. Novagreen Inc. 10.6. Shandong Futaste Co., Ltd. 10.7. zuChem Inc. 10.8. Zhejiang Huakang Pharmaceutical Co., Ltd. 10.9. Roquette group 10.10. Fortress Global Enterprises Inc. 10.11. Merck KGaA 10.12. AVANSCHEM 10.13. Foodchem International Corporation 10.14. Ingredion 10.15. Herboveda 10.16. DFI Corporation 10.17. Yusweet Xylitol Technology Co., ltd. 10.18. GELERIYA PRODUCTS 10.19. SALVAVIDAS PHARMACEUTICAL PVT LTD. 10.20. Advance Inorganics 10.21. Fengchen Group Co., Ltd. 10.22. RAS Greeen Sweetners 11. Key Findings 12. Industry Recommendations 13. Xylitol Market: Research Methodology 14. Terms and Glossary