The Wood Fencing Market size was valued at USD 8.1 Bn. In 2022, the total Wood Fencing Market revenue is expected to grow by 4.2 % from 2023 to 2029, reaching nearly USD 10.95 Bn. Wood Fencing Market Wood fencing used wooden materials to construct barriers around a property or specific area. It is a popular choice for residential, commercial, and agricultural purposes. Wood Fencing offers natural aesthetics and a versatile look to the home. Wood fences also provide a physical barrier that blocks the view from the outside, offering privacy to homeowners. Fencing can help create a safe environment by keeping children and pets within a designated area and preventing access to potential risks. Increasing construction activities, residential renovations, and a growing emphasis on outdoor living spaces drive the Wood Fencing Market growth. Wood fencing is also widely used in commercial settings such as retail properties, offices, and recreational facilities. In the agricultural sector, wood fences are used for livestock containment, pasture enclosures, and farm perimeters. The need for security, safety, and boundary marking drives the demand for Wood Fencing Market.Wood Fencing Market Snapshot

To know about the Research Methodology :- Request Free Sample Report

Wood Fencing Market Dynamics

Driver Rising Residential Construction and Renovations boost the market growth The demand for wood fencing is closely related to residential construction activities. As new houses are built or existing homes undergo renovations, the need for fencing increases. Homeowners choose wood fences for their homes for privacy, and the ability to enhance the overall look of their properties. Wood fences are a popular choice due to their natural appeal, versatility, and ability to enhance the overall look of a home. The construction of new residential properties directly contributes to the demand for wood fencing materials and installation services. Wood fences are often preferred in renovation projects because they can transform the appearance of a property. Homeowners may opt for wood fencing to match their desired aesthetic, complement landscaping features, to create defined outdoor living spaces. Increasing Outdoor Living Spaces Drives the Market Growth Outdoor living spaces often require enclosure to create a sense of privacy and boundary. Wood fencing serves this purpose effectively, allowing homeowners to establish a designated area for their outdoor activities. Privacy is a key consideration when designing outdoor living spaces. Homeowners want to enjoy their outdoor areas without feeling exposed to neighbors. Wood fencing offers a solid barrier that blocks the view from the outside, creating a private and secure environment for outdoor activities. The desire for privacy and security drives the demand for wood fences as an essential component of outdoor living spaces. Wood fences align well with the concept of increasing outdoor living spaces as they create a natural and organic connection with the surrounding environment. Wood is a renewable and sustainable material that blends changes with nature. It complements the greenery, trees, and other natural elements present in outdoor spaces. The desire to maintain a close connection with nature drives the demand for wood fences as an integral part of outdoor living areas. Outdoor living spaces are intended to be long-lasting investments. Homeowners seek durable and low-maintenance solutions to withstand outdoor conditions. Wood fences, particularly those made from naturally durable wood offer longevity and durability. Restrain Competition from Alternative Materials Hampers market growth Wood fencing faces competition from alternative fencing materials such as vinyl, aluminum, and composite materials. These materials offer benefits like low maintenance and durability, and diverse design options. Homeowners and property owners may choose these alternatives over wood fencing due to their longevity and reduced maintenance requirements. Alternative materials offer a wide range of design options and styles that provide various aesthetic preferences. Vinyl and composite materials provide the same appearance as wood, providing the look of wood fencing without the associated maintenance. Homeowners looking for specific designs or customization options may find alternative materials more suitable for their needs. This led to a shift in consumer preferences towards non-wood fencing options and hinder the growth of the wood fencing market. Opportunity Growing Demand for Sustainable and Eco-Friendly Materials Creates Lucrative Growth Opportunities for the Market. Increasing environmental awareness and growing demand for sustainable and eco-friendly products boosts Wood Fencing Market growth. Consumers are becoming more conscious of seeking products. Therefore they always try to choose the product that has a minimum negative impact on the environment. Wood, as a natural and renewable resource, has a number of environmental benefits. It is sourced from responsibly managed forests and made from reclaimed and recycled wood, reducing deforestation and carbon emissions. Positioning wood fencing as an eco-friendly choice attracts environmentally conscious customers and differentiates it from alternative materials. Wood fencing benefits from certifications and labelling programs that verify its sustainability credentials. Certifications such as the Forest Stewardship Council ensure that wood products are sourced from responsibly managed forests. By obtaining and promoting these certifications, wood fencing manufacturers can demonstrate their commitment to sustainable practices and provide customers with assurance about the environmental impact of their products. This factor attracts environmentally conscious buyers and creates lucrative growth opportunities for the Wood Fencing Market growth.Wood Fencing Market Segment Analysis

Based on the Application, The residential segment dominates the global Wood Fencing Market in the year 2022. Wood fences offer a classic and natural look that enhances the visual appeal of residential properties. The warm tones and organic texture of wood blend well with various architectural styles, creating an attractive and charming atmosphere. Wood fencing is available in a wide range of styles, designs, and finishes, providing homeowners with numerous options to suit their specific preferences and property requirements. Therefore demand for wood fences increased in the residential sector. Additionally, wood is customized to match the desired look and functionality which is a major reason to adopt the wood fencing. Wood fences provide an effective barrier, offering privacy and security to homeowners. This factor significantly accelerates the Wood Fencing Market Growth. The wood used in fencing is highly durable when properly maintained. With regular sealing or staining, wood fences can withstand the elements and last for many years. Additionally, in case of damage or wear, individual boards can be easily replaced without requiring the entire fence to be replaced. These all factors help to boost the demand for wood fencing in the residential sector.Wood Fencing Market, by Application (%) in 2022

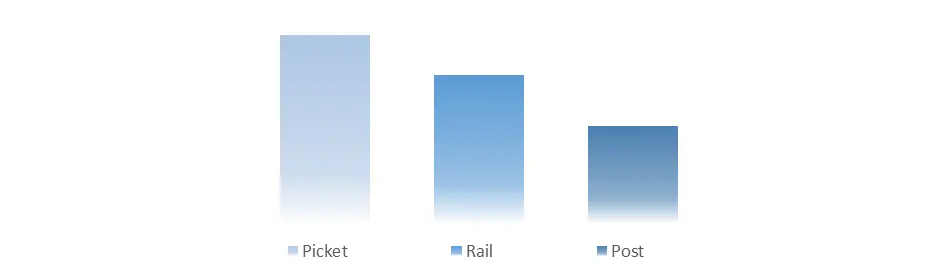

Based on Product Type, The Picket segment dominates the global Wood Fencing Market in the year 2022. Picket wood fencing provides a traditional as well as charming look to the fencing. Also, Picket fences add instant curb appeal to residential properties. It creates a welcoming and inviting atmosphere, giving the impression of a well-maintained and cared-for home. Picket fences offer a balance between privacy and openness. While they do not provide complete privacy like solid wood and vinyl fences, they still create a visible boundary that demarcates the property's perimeter. Picket fences can help keep pets and children within the yard and act as a deterrent to unwanted foot traffic. Moreover, Wood picket fences are relatively easy to maintain. They typically require regular cleaning, occasional painting or staining, and minor repairs. Homeowners who value the natural beauty of wood can easily restore and maintain the fence's appearance with simple maintenance tasks. Therefore demand for picket wood fences is rapidly growing.

Wood Fencing Market by Product (%) in 2022

Regional Insights

Asia Pacific region dominates the Wood Fencing Market in the year 2022. The Asia Pacific region is witnessed a rapidly growing population as well as urban development. Therefore the rising demand for residential, commercial, and industrial construction is growing at the fastest rate. Rising construction need for fencing solutions. Due to the benefits of wood fencing, it is a popular choice in the region. Additionally, The Asia Pacific region is rich in forests and has abundant wood resources. Countries like Indonesia and Malaysia are major producers of timber and wood products, so the steady supply of raw materials for wood fencing production helps to boost the market growth in this region. The rising concerns about security and privacy, homeowners and businesses are increasingly investing in fencing solutions. Wood fences, especially those designed for privacy or with added security features, are in demand across the Asia Pacific region.Wood Fencing Market Scope : Inquire Before Buying

Global Wood Fencing Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 8.21 Bn. Forecast Period 2023 to 2029 CAGR: 4.2% Market Size in 2029: US $ 10.95 Bn. Segments Covered: by Product Picket Rail Post by Species Cedar Redwood Whitewood Douglas fir by Application Residential Fencing Commercial Fencing Agricultural Fencing Industrial fencing by Distribution Channel Manufacturers Retail stores Online platforms Others Wood Fencing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Wood Fencing Market, Key Players are

1. Jacksons Fencing 2. Travis Perkins 3. Redwood Empire Sawmill 4. Treeway Fencing Ltd 5. Bekaert 6. Pine River Group Home, Inc. 7. Seven Trust 8. Sierra Pacific Industries 9. Mendocino Forest Products Company, LLC 10. L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench 11. BarretteWood 12. Smart Wood Boards 13. Cedarline Industries 14. Universal Forest Products, Inc. 15. West Fraser Timber Co. Ltd. 16. Weyerhaeuser Company 17. Millwood, Inc.Frequently Asked Questions:

1] What segments are covered in the Global Wood Fencing Market report? Ans. The segments covered in the Wood Fencing Market report are based on Product, Species, Application, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Copper Sputtering Target? Ans. The Asia Pacific region is expected to hold the highest share of the Wood Fencing Market. 3] What is the market size of the Global Wood Fencing Market by 2029? Ans. The market size of the Wood Fencing Market by 2029 is expected to reach US$ 10.95 Bn. 4] What is the forecast period for the Global Wood Fencing Market? Ans. The forecast period for the Wood Fencing Market is 2023-2029. 5] What was the market size of the Global Wood Fencing Market in 2021? Ans. The market size of the Wood Fencing Market in 2022 was valued at US$ 8.21 Bn.

1. Wood Fencing Market: Research Methodology 2. Wood Fencing Market: Executive Summary 3. Wood Fencing Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Wood Fencing Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Wood Fencing Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Wood Fencing Market Size and Forecast, by Product (2022-2029) 5.1.1. Picket 5.1.2. Rail 5.1.3. Post 5.2. Wood Fencing Market Size and Forecast, by Species (2022-2029) 5.2.1. Cedar 5.2.2. Redwood 5.2.3. Whitewood 5.2.4. Douglas fir 5.3. Wood Fencing Market Size and Forecast, by Application (2022-2029) 5.3.1. Residential Fencing 5.3.2. Commercial Fencing 5.3.3. Agricultural Fencing 5.3.4. Industrial Fencing 5.4. Wood Fencing Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.1. Manufacturers 5.4.2. Retail stores 5.4.3. Online platforms 5.4.4. Others 5.5. Wood Fencing Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Wood Fencing Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Wood Fencing Market Size and Forecast, by Product (2022-2029) 6.1.1. Picket 6.1.2. Rail 6.1.3. Post 6.2. North America Wood Fencing Market Size and Forecast, by Species (2022-2029) 6.2.1. Cedar 6.2.2. Redwood 6.2.3. Whitewood 6.2.4. Douglas fir 6.3. North America Wood Fencing Market Size and Forecast, by Application (2022-2029) 6.3.1. Residential Fencing 6.3.2. Commercial Fencing 6.3.3. Agricultural Fencing 6.3.4. Industrial Fencing 6.4. North America Wood Fencing Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.1. Manufacturers 6.4.2. Retail stores 6.4.3. Online platforms 6.4.4. Others 6.5. North America Wood Fencing Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Wood Fencing Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Wood Fencing Market Size and Forecast, by Product (2022-2029) 7.1.1. Picket 7.1.2. Rail 7.1.3. Post 7.2. Europe Wood Fencing Market Size and Forecast, by Species (2022-2029) 7.2.1. Cedar 7.2.2. Redwood 7.2.3. Whitewood 7.2.4. Douglas fir 7.3. Europe Wood Fencing Market Size and Forecast, by Application (2022-2029) 7.3.1. Residential Fencing 7.3.2. Commercial Fencing 7.3.3. Agricultural Fencing 7.3.4. Industrial Fencing 7.4. Europe Wood Fencing Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.1. Manufacturers 7.4.2. Retail stores 7.4.3. Online platforms 7.4.4. Others 7.5. Europe Wood Fencing Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Wood Fencing Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Wood Fencing Market Size and Forecast, by Product (2022-2029) 8.1.1. Picket 8.1.2. Rail 8.1.3. Post 8.2. Asia Pacific Wood Fencing Market Size and Forecast, by Species (2022-2029) 8.2.1. Cedar 8.2.2. Redwood 8.2.3. Whitewood 8.2.4. Douglas fir 8.3. Asia Pacific Wood Fencing Market Size and Forecast, by Application (2022-2029) 8.3.1. Residential Fencing 8.3.2. Commercial Fencing 8.3.3. Agricultural Fencing 8.3.4. Industrial Fencing 8.4. Asia Pacific Wood Fencing Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.1. Manufacturers 8.4.2. Retail stores 8.4.3. Online platforms 8.4.4. Others 8.5. Asia Pacific Wood Fencing Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Wood Fencing Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Wood Fencing Market Size and Forecast, by Product (2022-2029) 9.1.1. Picket 9.1.2. Rail 9.1.3. Post 9.2. Middle East and Africa Wood Fencing Market Size and Forecast, by Species (2022-2029) 9.2.1. Cedar 9.2.2. Redwood 9.2.3. Whitewood 9.2.4. Douglas fir 9.3. Middle East and Africa Wood Fencing Market Size and Forecast, by Application (2022-2029) 9.3.1. Residential Fencing 9.3.2. Commercial Fencing 9.3.3. Agricultural Fencing 9.3.4. Industrial Fencing 9.4. Middle East and Africa Wood Fencing Market Size and Forecast, by Distribution Channel (2022-2029) 9.4.1. Manufacturers 9.4.2. Retail stores 9.4.3. Online platforms 9.4.4. Others 9.5. Middle East and Africa Wood Fencing Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Wood Fencing Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Wood Fencing Market Size and Forecast, by Product (2022-2029) 10.1.1. Picket 10.1.2. Rail 10.1.3. Post 10.2. South America Wood Fencing Market Size and Forecast, by Species (2022-2029) 10.2.1. Cedar 10.2.2. Redwood 10.2.3. Whitewood 10.2.4. Douglas fir 10.3. South America Wood Fencing Market Size and Forecast, by Application (2022-2029) 10.3.1. Residential Fencing 10.3.2. Commercial Fencing 10.3.3. Agricultural Fencing 10.3.4. Industrial Fencing 10.4. South America Wood Fencing Market Size and Forecast, by Distribution Channel (2022-2029) 10.4.1. Manufacturers 10.4.2. Retail stores 10.4.3. Online platforms 10.4.4. Others 10.5. South America Wood Fencing Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Jacksons Fencing 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Travis Perkins 11.3. Redwood Empire Sawmill 11.4. Treeway Fencing Ltd 11.5. Bekaert 11.6. Pine River Group Home, Inc. 11.7. Seven Trust 11.8. Sierra Pacific Industries 11.9. Mendocino Forest Products Company, LLC 11.10. L.L. Johnson Lumber Mfg. Co. & Johnson’s Workbench 11.11. BarretteWood 11.12. Smart Wood Boards 11.13. Cedarline Industries 11.14. Universal Forest Products, Inc. 11.15. West Fraser Timber Co. Ltd. 11.16. Weyerhaeuser Company 11.17. Millwood, Inc. 12. Key Findings 13. Industry Recommendation