The Wireless Sensor Market expected to hit USD 32.14 Bn by 2029 from USD 10.6 Bn in 2021 at a CAGR of 18 % during the forecast periodWireless Sensor Market Overview

Wireless sensors are capable to measure and collect real-time physical conditions such as temperature, humidity, pollution level and sound and transmit data wirelessly. It uses communication technologies such as Bluetooth, wi-Fi and Zigbee to alert individuals in the worst situations regarding inventory and conditions of machinery and keeps a record. Wireless sensor is the soul of the Internet of Things (IoT).To know about the Research Methodology :- Request Free Sample Report

Research Methodology

The Wireless Sensor Market report includes market share, growth hubs, competitive landscape, restraints and regional insights. The report analyses the market through segments such as product type and industry vertical along with their multiple sub-segments. The report provides data regarding mergers and acquisitions and investment in research and developments by major key manufacturers. The bottom-up approach is used to estimate the size of the market by value and volume. The data has been collected through primary and secondary research methods. Collected data later analysed by tools such as SWOT, PORTER’s five force model and PESTLE analysis. The report provides political, social, economic, technological, environmental and legal aspects of the Wireless Sensor Market in major geographic regions such as North America, Asia Pacific, Middle East and Africa, Europe and South America.Wireless Sensor Market Dynamics

Drivers: The development of technologies that reduces energy consumption and the growing automation in multiple industries are expected to drive the Wireless Sensor Market. Wireless sensors are used to gather data from remote locations and areas that are hard to explore due to their flexibility, ease of installation and most importantly they can be operated from anywhere. These factors have been driving the popularity of Wireless Sensors in automobile, healthcare, construction and infrastructure industries. The report provides an analysis of the benefits regarding wireless sensors in each and every industry with customization. The technologies such as RFID used in Wireless Sensors, make electronic devices easy to integrate for data monitoring in factories. Also, Wireless Sensor provides data in alarming situations such as flood detection, fire detection, water management, gas emission and soil observance. The area of usage and applications offered by Wireless Sensor are limitless, which is expected to drive the Wireless Sensor Market globally. The existing energy harvesting technologies are facing some limitations that increase the demand for the deployment of the internet of things (IoT), which drives the Wireless Sensor Market. The industrial sector is becoming more and more digital due to the introduction of advanced Wireless Sensor and machine-to-machine (M2M) system that completely eliminates human intervention. The cabled part in the industry for connection, monitoring and record keeping is eliminated due to the adoption of wireless sensors in IoT. It removes the cost of installation and maintenance and allows the deployment of IoT with wireless sensors in a specific task. The government initiatives for smart cities, advancement in 5G and the growth in consumer electronic products penetration across the globe, increases the use of IoT in residential areas. Also, the demand for wearable electronics and IoT-connected devices has become major elements to drive the Wireless Sensor Market. Major Key manufacturers are highly investing in wireless technologies and details have been included in the market report to assist new market entrants in their strategies. Restraints: The high risk associated with data privacy and security-related concerns is one of the prime factors that constrain the market. Also, the IoT provides the best service in residential, commercial and other industry sectors but when it’s deployed in remote areas it creates challenges regarding batteries and maintenance that hampers the market. The new trend of deploy and forget is emerged to overcome the problem of wireless sensor deployment in remote areas. All the drivers and restraints are included in the Wireless Sensor Market report with their best solutions.Wireless Sensor Market Regional Insights

Asia Pacific is expected to grow at a significant rate throughout the forecast period. Governments of developing economies of the region such as China, India, Japan and others are promoting wireless sensor technologies and adopting the internet of things (IoT) for smart city projects that are expected to drive the Asia Pacific Wireless Sensor Market. Also, the investment by major key manufacturers and partnerships with government institutions has been driving the market in the Asia Pacific. The Middle East and Africa held a significant share of the market and are expected to dominate the Wireless Sensor Market during the forecast period. Tel Aviv, a city in Israel is the first city that owned the tag of an actual smart city which drives the demand for wireless sensors. Increased military spending and schemes for digitization in the Middle East helping the region to hold the largest share. Europe imports almost 60 percent of its energy and to minimize the dependency, the region is adopting IoT n their industry and governance which is expected to lower the power consumption. Competitive Landscape Major Key manufacturers of the Wireless Sensor Market are STMicroelectronics, Emerson Electric Co., Honeywell International Inc., Siemens AG, Schneider Electric, General Electric Company and NXP Semiconductors. Among them, Honeywell announced an emission management solution (EMS), which makes emission measurement, monitoring, reporting and record-keeping simple. The EMS solution is expected to drive the growth of the Wireless Sensor Market during the forecast period. Sensor AG develops specific sensors in the fields of photonics, pressure and electronics for applications in medical, transportation and other industries.

Wireless Sensor Market Segment Analysis:

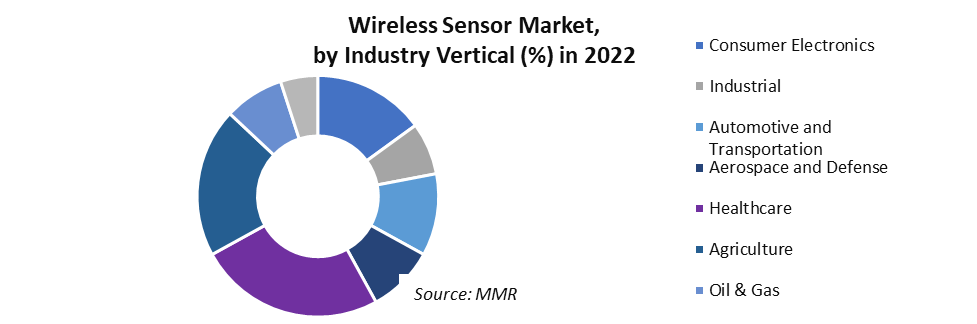

The Wireless Sensor Market is segmented into product types and industry verticals. In product type, biosensors held the largest share of the market and are expected to dominate the market throughout the forecast period. Biosensors have been applied in the screening of diseases and veterinary applications. Whereas, the flow sensor is an emerging segment based on product type, due to the trend of industrial automation through industrial IoT. Based on industry verticals, the market is segmented into various sub-segments. Among them, healthcare segment in Wireless Sensor Market is expected to dominate the market over the forecast period.Wireless Sensor Market Scope: Inquiry Before Buying

Wireless Sensor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 10.06 Bn. Forecast Period 2023 to 2029 CAGR: 18.05 % Market Size in 2029: US $ 32.14 Bn. Segments Covered: by Product Type 1. Biosensors 2. Temperature Sensor 3.Pressure Sensor 4. Humidity Sensors 5. Gas Sensors 6. Flow Sensors 7. Level Sensors 8. Motion and Positioning Sensors 9. Others by Industry Vertical 1. Consumer Electronics 2. Industrial 3.Automotive and Transportation 4. Aerospace and Defense 5. Healthcare 6. Agriculture 7. Oil & Gas 8. Others by Technology 1.Bluetooth 2.Wi-Fi and WLAN 3.Zigbee 4.WirelessHART 5.RFID 6. EnOcean 7.Others Wireless Sensor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Wireless Sensor Market Key Players include:

1. Texas Instruments Inc. 2. STMicroelectronics 3. Emerson Electric Co. 4. Honeywell International Inc. 5. Siemens AG 6. Schneider Electric 7. General Electric Company 8. NXP Semiconductors 9. Rockwell Automation Inc. 10.TE Connectivity Ltd. 11.Broadcom Inc. 12.Infineon Technologies 13.Microchip Technology 14.Intel Corporation 15.3M India Frequently Asked Questions: 1] What is the growth rate of the Market? Ans. The Wireless Sensor Market is growing at a CAGR of 18.05 % during the forecast period. 2] Which region is expected to dominate the Market? Ans. North America is expected to dominate the Wireless Sensor Market during the forecast period. 3] What is the market size of the Market by 2029? Ans. The size of the Wireless Sensor Market by 2029 is expected to reach USD 32.14 Bn. 4] Which are the top key players of the Market? Ans. The major key players in the Wireless Sensor Market are Coinbase, Bitpay, Binance, Gox and others. 5] What factors are driving the growth of the Market in 2022? Ans. The Wireless Sensor Market is expected to grow due to factors such as fast transaction time and elimination of intermediaries.

1. Global Wireless Sensor Market: Research Methodology 2. Global Wireless Sensor Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Wireless Sensor Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Wireless Sensor Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Wireless Sensor Market Segmentation 4.1 Global Wireless Sensor Market, by Product Type (2022-2029) • Biosensors • Temperature Sensor • Pressure Sensor • Humidity Sensors • Gas Sensors • Flow Sensors • Level Sensors • Motion and Positioning Sensors • Others 4.2 Global Wireless Sensor Market, by Industry Vertical (2022-2029) • Consumer Electronics • Industrial • Automotive and Transportation • Aerospace and Defense • Healthcare • Agriculture • Oil & Gas • Others 4.3 Global Wireless Sensor Market, by Technology (2022-2029) • Bluetooth • Wi-Fi and WLAN • Zigbee • WirelessHART • RFID • EnOcean • Others 5. North America Wireless Sensor Market(2022-2029) 5.1 North America Wireless Sensor Market, by Product Type (2022-2029) • Biosensors • Temperature Sensor • Pressure Sensor • Humidity Sensors • Gas Sensors • Flow Sensors • Level Sensors • Motion and Positioning Sensors • Others 5.2 North America Wireless Sensor Market, by Industry Vertical (2022-2029) • Consumer Electronics • Industrial • Automotive and Transportation • Aerospace and Defense • Healthcare • Agriculture • Oil & Gas • Others 5.3 North America Wireless Sensor Market, by Technology (2022-2029) • Bluetooth • Wi-Fi and WLAN • Zigbee • WirelessHART • RFID • EnOcean • Others 5.4 North America Wireless Sensor Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Wireless Sensor Market (2022-2029) 6.1. European Wireless Sensor Market, by Product Type (2022-2029) 6.2. European Wireless Sensor Market, by Industry Vertical (2022-2029) 6.3. European Wireless Sensor Market, by Technology (2022-2029) 6.4. European Wireless Sensor Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Wireless Sensor Market (2022-2029) 7.1. Asia Pacific Wireless Sensor Market, by Product Type (2022-2029) 7.2. Asia Pacific Wireless Sensor Market, by Industry Vertical (2022-2029) 7.3. Asia Pacific Wireless Sensor Market, by Technology (2022-2029) 7.4. Asia Pacific Wireless Sensor Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Wireless Sensor Market (2022-2029) 8.1 Middle East and Africa Wireless Sensor Market, by Product Type (2022-2029) 8.2. Middle East and Africa Wireless Sensor Market, by Industry Vertical (2022-2029) 8.3. Middle East and Africa Wireless Sensor Market, by Technology (2022-2029) 8.4. Middle East and Africa Wireless Sensor Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Wireless Sensor Market (2022-2029) 9.1. South America Wireless Sensor Market, by Product Type (2022-2029) 9.2. South America Wireless Sensor Market, by Industry Vertical (2022-2029) 9.3. South America Wireless Sensor Market, by Technology (2022-2029) 9.4 South America Wireless Sensor Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Texas Instruments Inc. 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 STMicroelectronics 10.3 Emerson Electric Co. 10.4 Honeywell International Inc. 10.5 Siemens AG 10.6 Schneider Electric 10.7 General Electric Company 10.8 NXP Semiconductors 10.9 Rockwell Automation Inc. 10.10 TE Connectivity Ltd. 10.11 Broadcom Inc. 10.12 Infineon Technologies 10.13 Microchip Technology 10.14 Intel Corporation 10.15 3M India