Wind Turbine Tower Market size was valued at USD 31.25 Billion in 2022 and is expected to grow by 7.90% from 2023 to 2029, reaching nearly USD 53.22 Billion. The wind turbine tower is a tall structure of steel or other materials that carry the blade rotor. The tall steel or other material structure that houses the blade rotor is what makes up a wind turbine tower. Large wind turbine towers are constructed from strong materials like lattice, steel, or concrete. A steel profile that has been welded serves as the basis for the lattice tower. The energy production capability of the wind turbine and the size of its blades determine the wind turbine tower's length. Additionally, the airflow and efficiency determine the wind turbine tower's height. Governments of countries across the world are encouraging wind energy as an alternative to conventional energy sources, which in turn positively influences the wind turbine towers market. The report provides a comprehensive analysis of every aspect of the Wind Turbine Tower market including the market size and growth rate, with a historic period of 2017–2022 and forecasts for 2023–2029 while 2022 is considered as a base year for estimations. The report also covers devoted sections for each segment along with regional coverage through information and statistics on the drivers, restraints, opportunities, challenges, trends, and other factors impacting global Wind Turbine Tower market growth. Additionally, the report covers the exclusive analysis of the market by using marketing tools such as Porter’s Five Forces Analysis, Pricing Analysis, SWOT Analysis, PESTLE Analysis, and Competitive benchmarking, among others.To know about the Research Methodology :- Request Free Sample Report

Wind Turbine Tower Market Dynamics:

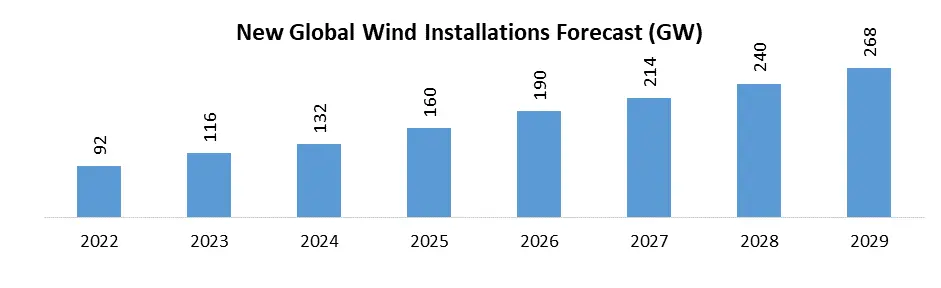

Increasing Investment in Wind Energy Driving the Growth of the Wind Turbine Tower Market The power generation industry has been compelled to shift to cleaner, more environmentally friendly energy sources by a rise in environmental protection regulations all around the world. The development of renewable energy power generation is a top priority for major economies throughout the world as a way to lessen their reliance on conventional power generation using fossil fuels. A significant renewable energy source that has the potential to address many global concerns is wind energy. The world erected 60.4 GW of new wind power projects in 2019, bringing the total amount of wind power installed to 651 GW. The Asia Pacific area contributed 50.7% of all new installations or 30.6 GW. Thus, the enormous yearly increase in wind power capacity is undoubtedly strengthening the wind turbine tower market across the world. Government Initiatives and Incentives to Boost the Growth of the Wind Turbine Tower Market The past record of investments in renewable energy over the last few years demonstrates that efforts are well underway to lessen the world's reliance on coal and other fossil fuels. As a result, multiple new wind energy projects are being established all over the world and will begin steadily adding to the world's energy mix in the next years. The significant role played by government efforts and policies is one of the main factors influencing the wind turbine tower market’s growth. The main energy policies that are specifically targeted at the wind industry are found in many nations, including the U.S., China, Japan, and EU nations. These policies include feed-in tariffs, tax credits, net metering, and capital subsidies. For instance, the Government of India offers a 10-year income tax holiday for wind power generation projects. 100% exemption from excise duty on specific wind turbine components. The wind energy sector is expected to grow significantly in India, thanks to the proposed incentives.Global Development in Wind Energy Industry to Boost Wind Turbine Tower Market Growth The market for wind turbine towers is driven by a variety of factors, including the enormous number of developing ventures and advancements in the wind control age division. The establishment of wind control age frameworks around the world is supported by the growing need for environmentally friendly technologies and sound governance practices. The global wind turbine tower market is expected to rise as a result of the development of the Asia-Pacific region's emerging economies, with China and India having the highest rates of growth and demand. The significant financial, ecological, and social advantages touted are relied upon to exponentially increase the arrangement of clean advancements for generating electricity. One of the most encouraging developments in sustainable energy is the development of wind turbine towers. The global market for wind turbine towers is expected to grow as a result of the development of wind energy sources incorporating new technology. These factors are expected to drive the wind turbine tower market's growth during the forecast period.

Wind Turbine Tower Market Segment Analysis:

By Type, the Wind Turbine Tower Market is segmented into Steel Tower, and Hybrid Tower. The Concrete Tower segment accounted for the largest market share in 2022. Concrete Tower are quite strong, transporting them is inexpensive, and most of the materials are readily available nearby. Large turbines are also taller and heavier, which require larger rotors. Thanks to their high strength, concrete wind towers tend to be more affordable than tubular steel towers for these sorts of turbines. Large-capacity wind turbines are becoming more affordable thanks to technological advances. Due to their high strength, concrete wind towers are more affordable than tubular steel towers for these sorts of turbines. Therefore, it is expected that the market for concrete wind towers would be primarily driven by factors such as the rising share of large wind turbines, relatively high stability of concrete tower cost, reduced transportation requirements, and local availability of concrete tower material.By Deployment, the Wind Turbine Tower Market is segmented into onshore and offshore. The onshore segment held the largest share in 2022 and it is expected to remain dominant through the forecast period. Onshore installation emits low carbon emissions and it has a low economic cost structure as compared to offshore deployment. According to MMR analysts, more than 250 GW of new offshore wind capacity is expected to be installed over the next decade under current policies. 2030’s capacity is seven times greater than the current market size.

Wind Turbine Tower Market Regional Insights:

Asia Pacific held the largest market share of the global Wind Turbine Tower Market in 2022. Over the forecast period, Asia Pacific is anticipated to dominate the global market. Onshore wind installation is primarily concentrated in the Asia-Pacific region. Thanks to growing industrialization and urbanization, countries like China, India, and Australia continue to report higher electricity demands. The world's total onshore and offshore wind power capacity hit 830 GW by the end of 2022. Over half of this comes from China. In China, thermal energy sources provided close to 70% of the electricity generated in 2022. The nation has been attempting to boost the percentage of cleaner and renewable sources in electricity generation due to the rising pollution from thermal sources. India has the fourth-largest installed wind power capacity worldwide as of 2022. The northern, southern, and western regions of the country are where these projects are primarily located. As a result, the Asia-Pacific region's attempts to diversify its energy sources and enhance its renewable infrastructure are expected to drive the growth of the wind energy industry and raise demand for wind turbine towers over the forecast period.Europe region is expected to grow at a significant growth rate through the forecast period.n In 2022, Europe installed 17 GW of new wind energy capacity across the region. This is not even half of what the EU should be building to be on track to deliver its 2030 Climate and Energy goals. Among new wind installations in Europe, 81% of installations from 2022, were onshore wind. Additionally, Changing the energy and power industry growth with increasing importance towards renewable power generation is boosting the wind turbine tower market growth.

Wind Turbine Tower Market Competitive Landscape

The market for wind turbine tower market is competitive, with the presence of well-known players competing for dominance. These companies are focusing on developing cutting-edge, energy-efficient methods to get a competitive energy-efficient. For instance, in 2022, Vestas invested in a Swedish firm Danish turbine which develops and manufactures wind turbine towers. Danish turbine uses laminated veneer lumber, or LVL, to make turbine towers. As technology develops, the size of wind turbines is increasing, but this poses challenges when it comes to the logistics of deployment. In 2022, April, Modvion installed a 30-meter tower on an island near the Swedish city of Gothenburg, and the company plans to build its first commercial tower in 2022. The companies in the wind turbine tower industry are increasing their production capacities by establishing new plants and expanding the existing ones. The strong barriers to entry are expected to the limited number of new entrants entering the global market. Some of the major players in the wind turbine tower market are Enel Green Power, Arcosa Inc., Bergey Wind Power Co., Bouygues Construction SA, Broadwind, Energy Inc, CS WIND Corp., Dongkuk S and C, KGW Schweriner Maschinen und Anlagenbau GmbH, Marmen Inc., Trinity Structural Towers Inc., and Valmont Industries Inc.Wind Turbine Tower Market Scope: Inquiry Before Buying

Wind Turbine Tower Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 31.25 Bn Forecast Period 2023 to 2029 CAGR: 7.90% Market Size in 2029: USD 53.22 Bn Segments Covered: by Type 1. Steel Tower 2. Concrete Tower 3. Hybrid Tower by Deployment 1. Onshore 2. Offshore by End-Users 1.Industrial 2. Commercial 3. Residential 4. Utility Wind Turbine Tower Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Wind Turbine Tower Market, Key Players are

1. Arcosa Inc. (United States) 2. Bergey Wind Power Co. (United States) 3. Clipper Windpower Plc. (United States) 4. XzeresWind Corp. (United States) 5. Trinity Structural Towers Inc. (United States) 6. Valmont Industries Inc. (United States) 7. Bouygues Construction SA (United States) 8. Broadwind Energy Inc (United States) 9. Marmen Inc. (Canada) 10. KGW Schweriner Maschinen und Anlagenbau GmbH (Germany) 11. Enel Green Power (Italy) 12. ENERCON GmbH (Germany) 13. CS WIND Corp. (South Korea) 14. Dongkuk S and C (South Korea) 15. Sinovel (China) 16. Dongfang Electric Corporation (China) FAQs: 1. What was the global market size of the Market in 2022? Ans. The Global Wind Turbine Tower Market size was valued at USD 31.25 Billion. 2. What is the study period for the Market? Ans. 2017-2029 is the study period for the Wind Turbine Tower Market. 3. What is the growth rate of the Market? Ans. The Wind Turbine Tower Market is growing at a CAGR of 7.90% over forecast the period. 4. What are the major key players in the Global Market? Ans. The major key players in the Global Wind Turbine Tower Market are Enel Green Power, Arcosa Inc., Bergey Wind Power Co., Bouygues Construction SA, Broadwind, Energy Inc, CS WIND Corp., Dongkuk S and C, KGW Schweriner Maschinen und Anlagenbau GmbH, Marmen Inc., Trinity Structural Towers Inc., and Valmont Industries Inc. 5. What is the forecast period for the Market? Ans. The forecast period for the Market is 2023-2029.

1. Wind Turbine Tower Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Wind Turbine Tower Market: Dynamics 2.1. Wind Turbine Tower Market Trends by Region 2.1.1. North America Wind Turbine Tower Market Trends 2.1.2. Europe Wind Turbine Tower Market Trends 2.1.3. Asia Pacific Wind Turbine Tower Market Trends 2.1.4. Middle East and Africa Wind Turbine Tower Market Trends 2.1.5. South America Wind Turbine Tower Market Trends 2.2. Wind Turbine Tower Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Wind Turbine Tower Market Drivers 2.2.1.2. North America Wind Turbine Tower Market Restraints 2.2.1.3. North America Wind Turbine Tower Market Opportunities 2.2.1.4. North America Wind Turbine Tower Market Challenges 2.2.2. Europe 2.2.2.1. Europe Wind Turbine Tower Market Drivers 2.2.2.2. Europe Wind Turbine Tower Market Restraints 2.2.2.3. Europe Wind Turbine Tower Market Opportunities 2.2.2.4. Europe Wind Turbine Tower Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Wind Turbine Tower Market Drivers 2.2.3.2. Asia Pacific Wind Turbine Tower Market Restraints 2.2.3.3. Asia Pacific Wind Turbine Tower Market Opportunities 2.2.3.4. Asia Pacific Wind Turbine Tower Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Wind Turbine Tower Market Drivers 2.2.4.2. Middle East and Africa Wind Turbine Tower Market Restraints 2.2.4.3. Middle East and Africa Wind Turbine Tower Market Opportunities 2.2.4.4. Middle East and Africa Wind Turbine Tower Market Challenges 2.2.5. South America 2.2.5.1. South America Wind Turbine Tower Market Drivers 2.2.5.2. South America Wind Turbine Tower Market Restraints 2.2.5.3. South America Wind Turbine Tower Market Opportunities 2.2.5.4. South America Wind Turbine Tower Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Wind Turbine Tower Industry 2.8. Analysis of Government Schemes and Initiatives For Wind Turbine Tower Industry 2.9. Wind Turbine Tower Market Trade Analysis 2.10. The Global Pandemic Impact on Wind Turbine Tower Market 3. Wind Turbine Tower Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 3.1.1. Steel Tower 3.1.2. Concrete Tower 3.1.3. Hybrid Tower 3.2. Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 3.2.1. Onshore 3.2.2. Offshore 3.3. Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 3.3.1. Industrial 3.3.2. Commercial 3.3.3. Residential 3.3.4. Utility 3.4. Wind Turbine Tower Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Wind Turbine Tower Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 4.1.1. Steel Tower 4.1.2. Concrete Tower 4.1.3. Hybrid Tower 4.2. North America Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 4.2.1. Onshore 4.2.2. Offshore 4.3. North America Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 4.3.1. Industrial 4.3.2. Commercial 4.3.3. Residential 4.3.4. Utility 4.4. North America Wind Turbine Tower Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 4.4.1.1.1. Steel Tower 4.4.1.1.2. Concrete Tower 4.4.1.1.3. Hybrid Tower 4.4.1.2. United States Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 4.4.1.2.1. Onshore 4.4.1.2.2. Offshore 4.4.1.3. United States Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 4.4.1.3.1. Industrial 4.4.1.3.2. Commercial 4.4.1.3.3. Residential 4.4.1.3.4. Utility 4.4.2. Canada 4.4.2.1. Canada Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 4.4.2.1.1. Steel Tower 4.4.2.1.2. Concrete Tower 4.4.2.1.3. Hybrid Tower 4.4.2.2. Canada Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 4.4.2.2.1. Onshore 4.4.2.2.2. Offshore 4.4.2.3. Canada Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 4.4.2.3.1. Industrial 4.4.2.3.2. Commercial 4.4.2.3.3. Residential 4.4.2.3.4. Utility 4.4.3. Mexico 4.4.3.1. Mexico Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 4.4.3.1.1. Steel Tower 4.4.3.1.2. Concrete Tower 4.4.3.1.3. Hybrid Tower 4.4.3.2. Mexico Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 4.4.3.2.1. Onshore 4.4.3.2.2. Offshore 4.4.3.3. Mexico Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 4.4.3.3.1. Industrial 4.4.3.3.2. Commercial 4.4.3.3.3. Residential 4.4.3.3.4. Utility 5. Europe Wind Turbine Tower Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.2. Europe Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.3. Europe Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 5.4. Europe Wind Turbine Tower Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.1.2. United Kingdom Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.1.3. United Kingdom Wind Turbine Tower Market Size and Forecast, by End-Users(2022-2029) 5.4.2. France 5.4.2.1. France Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.2.2. France Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.2.3. France Wind Turbine Tower Market Size and Forecast, by End-Users(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.3.2. Germany Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.3.3. Germany Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.4.2. Italy Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.4.3. Italy Wind Turbine Tower Market Size and Forecast, by End-Users(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.5.2. Spain Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.5.3. Spain Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.6.2. Sweden Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.6.3. Sweden Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.7.2. Austria Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.7.3. Austria Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 5.4.8.2. Rest of Europe Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 5.4.8.3. Rest of Europe Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6. Asia Pacific Wind Turbine Tower Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.2. Asia Pacific Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.3. Asia Pacific Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4. Asia Pacific Wind Turbine Tower Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.1.2. China Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.1.3. China Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.2.2. S Korea Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.2.3. S Korea Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.3.2. Japan Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.3.3. Japan Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.4. India 6.4.4.1. India Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.4.2. India Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.4.3. India Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.5.2. Australia Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.5.3. Australia Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.6.2. Indonesia Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.6.3. Indonesia Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.7.2. Malaysia Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.7.3. Malaysia Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.8.2. Vietnam Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.8.3. Vietnam Wind Turbine Tower Market Size and Forecast, by End-Users(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.9.2. Taiwan Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.9.3. Taiwan Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 6.4.10.3. Rest of Asia Pacific Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 7. Middle East and Africa Wind Turbine Tower Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 7.2. Middle East and Africa Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 7.3. Middle East and Africa Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 7.4. Middle East and Africa Wind Turbine Tower Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 7.4.1.2. South Africa Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 7.4.1.3. South Africa Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 7.4.2.2. GCC Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 7.4.2.3. GCC Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 7.4.3.2. Nigeria Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 7.4.3.3. Nigeria Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 7.4.4.2. Rest of ME&A Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 7.4.4.3. Rest of ME&A Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 8. South America Wind Turbine Tower Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 8.2. South America Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 8.3. South America Wind Turbine Tower Market Size and Forecast, by End-Users(2022-2029) 8.4. South America Wind Turbine Tower Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 8.4.1.2. Brazil Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 8.4.1.3. Brazil Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 8.4.2.2. Argentina Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 8.4.2.3. Argentina Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Wind Turbine Tower Market Size and Forecast, by Type (2022-2029) 8.4.3.2. Rest Of South America Wind Turbine Tower Market Size and Forecast, by Deployment (2022-2029) 8.4.3.3. Rest Of South America Wind Turbine Tower Market Size and Forecast, by End-Users (2022-2029) 9. Global Wind Turbine Tower Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Wind Turbine Tower Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Arcosa Inc. (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bergey Wind Power Co. (United States) 10.3. Clipper Windpower Plc. (United States) 10.4. XzeresWind Corp. (United States) 10.5. Trinity Structural Towers Inc. (United States) 10.6. Valmont Industries Inc. (United States) 10.7. Bouygues Construction SA (United States) 10.8. Broadwind Energy Inc (United States) 10.9. Marmen Inc. (Canada) 10.10. KGW Schweriner Maschinen und Anlagenbau GmbH (Germany) 10.11. Enel Green Power (Italy) 10.12. ENERCON GmbH (Germany) 10.13. CS WIND Corp. (South Korea) 10.14. Dongkuk S and C (South Korea) 10.15. Sinovel (China) 10.16. Dongfang Electric Corporation (China) 11. Key Findings 12. Industry Recommendations 13. Wind Turbine Tower Market: Research Methodology 14. Terms and Glossary