Global Wholesale Products Market size was valued at USD 52170.13 Billion in 2023 and is expected to grow at a CAGR of 8.4% from 2024 to 2030 to reach USD 91754.40 Billion by 2030.Wholesale Products Market Overview

The wholesale products market is a crucial component of the global economy, which acts as the intermediary between manufacturers and retailers. It includes a wide range of goods, from consumer electronics, clothing, food products, industrial machinery, etc. Automation and data analytics are highly transforming the wholesale industry. The international trade agreements and advancements in logistics are facilitating globalization. The rising e-commerce is significantly impacting the wholesale market. By embracing innovation, focusing on sustainability and effectively managing their supply chains, wholesalers are increasingly positioning themselves for long-term success in this ever-changing wholesale products industry.To know about the Research Methodology :- Request Free Sample Report

Wholesale Products Market Dynamics

Sustainable Distribution Practices to Reduce Carbon Footprint As the wholesale products market evolves, businesses are increasingly focusing on making their distribution practices more sustainable. Sustainable distribution practices not only benefit the environment but also offer significant advantages for wholesalers. By adopting sustainable distribution practices, wholesalers reduce their carbon footprint, save money, and enhance customer service. One way wholesalers make their distribution more sustainable is by using recycled materials for packaging and shipping. This include utilizing recycled paper for packing material, using recyclable plastic bags or containers, or even employing refillable containers for shipping products. In addition to using recycled materials, wholesalers also opt for green transportation options. This involves using electric vehicles, hybrid vehicles, or bicycles for local deliveries. For larger fleets, investing in alternative fuels such as biodiesel or compressed natural gas further reduce carbon emissions. Streamlining operations is another key aspect of sustainable distribution for wholesale products. Wholesalers consolidate shipments to reduce fuel consumption, utilize real-time tracking to optimize delivery routes and automate processes to minimize paperwork and waste. By implementing sustainable distribution practices, wholesalers not only contribute to environmental conservation but also stand to benefit financially. By reducing their carbon footprint, wholesalers can save money on fuel and operating costs. Moreover, improved customer service resulting from efficient and eco-friendly distribution practices can give wholesalers a competitive edge in today’s market.Role of Technology in the Future of Wholesale Technology is revolutionizing the wholesale products market, offering new opportunities for wholesalers to improve efficiency, reduce costs, and adapt to changing consumer behavior. Innovations such as artificial intelligence, automation, and blockchain are reshaping the industry landscape. For instance, AI is enabling wholesalers to analyze customer data and predict consumer behavior, while automation is enhancing efficiency in the supply chain. Additionally, blockchain technology is improving transparency and security within the supply chain, ensuring trust and accountability. Consumer behavior is also driving significant changes in the wholesale products market, particularly with the growing preference for online shopping. The rise of e-commerce has created both opportunities and challenges for wholesalers. While it has expanded its reach and customer base, it has also intensified competition and necessitated adaptation to changing consumer preferences. The impact of e-commerce on traditional brick-and-mortar wholesalers is particularly pronounced. To compete effectively in this increasingly digital landscape, traditional wholesalers are implementing various strategies. Developing an online presence, leveraging digital marketing, and offering exceptional customer service are becoming imperative. Furthermore, traditional wholesalers are capitalizing on the strengths of brick-and-mortar stores by providing personalized services and in-store experiences. These efforts of wholesalers are creating opportunities for the Wholesale Products Market growth. Examples of Successful E-Commerce Wholesalers: Companies that have adapted to the Shift to Online Channels:

Sustainability Trends Implications for Wholesale Distribution Clean, green deliveries with electric vehicles 1. Increased demand for eco-friendly delivery processes 2. Pressure to maximize delivery efficiency and create an eco-friendly fleet 3. Adoption of electric vehicles for lower carbon footprint 4. Operational and cost advantages 5. Example: IKEA Australia’s commitment to EVs Warehouses with a smaller footprint 1. Cost reduction and environmental credentials through leaner operations 2. Use of vertical and multi-story warehouses for space efficiency 3. Multi-storey warehouses in central locations reduce land use and emissions 4. Maximized space utilization and reduced energy consumption Smart packaging to enhance products’ lifecycle 1. Use of advanced materials and technologies to improve sustainability 2. Reduction of environmental footprint throughout the product lifecycle. 3. Improved traceability, inventory management, and waste reduction 4. Example: Technology for clean separation of labels from plastic containers Eco-conscious product lines 1. Changes in procurement processes and product lines to meet consumer demand 2. Shift towards plant-based and sustainable ingredients 3. Development of specific sustainable product lines by retailers 4. Example: The Iconic and H&M Sustainable packaging and the circular economy 1. Preference for eco-friendly packaging and sustainable sourcing methods 2. Support for recycling and reuse initiatives 3. Government targets for reusable, compostable, or recyclable packaging by 2025 4. Focus on increased recycled content 1. MSY INVEST SPRL: Based in Europe, MSY INVEST SPRL is a wholesale and dropshipping company specializing in Home and Kitchen Appliances, Care and Beauty Items, Fitness products, and more. With a robust online presence, including a user-friendly e-commerce website and active social media accounts, MSY INVEST SPRL leverages data analytics to personalize the customer experience and offer targeted promotions. Renowned for providing high-quality products at competitive prices, they have emerged as one of the leading wholesale and dropshipping companies in Europe.

2. Wayfair: Wayfair, a prominent online home goods retailer, has successfully transitioned into a wholesale business, offering a diverse range of products to businesses and organizations. With a comprehensive e-commerce website and active social media presence, Wayfair utilizes data analytics to enhance the customer experience and deliver tailored promotions.

3. Alibaba: As one of the largest e-commerce companies globally, Alibaba is a key player in the wholesale market. Offering a wide array of products and services to businesses, including sourcing, logistics, and marketing, Alibaba has established a formidable digital presence. With a comprehensive e-commerce platform and a mobile app, Alibaba effectively serves the needs of businesses worldwide.

Supply Chain Disruption Challenging the Market Growth Supply chain disruptions, such as natural disasters, geopolitical tensions, and trade disputes, have a significant impact on the wholesale products market. Interruptions in the supply chain leads to delays in product delivery, increased transportation costs, and shortages of inventory. Wholesalers develop robust supply chain management strategies to mitigate these risks and ensure business continuity. Challenges of Supply Chain Management and its Impact on Wholesale Products Market:In response to the supply chain disruptions caused by the COVID-19 pandemic, Kellogg's, Nike, and HP implemented various strategies to mitigate the impact and ensure business continuity.

1. Kellogg's shifted its focus to producing more of its popular products to meet the increased demand for cereals, noodles, and snacks as people stayed home during the pandemic. The company also secured alternate local suppliers for materials and packaging, ensuring a steady supply chain. Additionally, Kellogg's invested in automation to increase efficiency and reduce costs while maintaining high levels of production.

2. Nike accelerated its plans to expand direct online sales, shifting inventory destined for stores to fulfill online orders. The company also invested in radio-frequency identification (RFID) technology to track and manage inventory effectively, ensuring products were available to meet consumer demand.

3. HP experienced increased demand for notebook computers and printers as people transitioned to remote work and learning. The company focused on ramping up production and investing in automation to streamline processes and reduce costs. Additionally, HP introduced new products and services to meet the changing needs of consumers, including subscription ink services and centralised billing for commercial clients working from home.

Wholesale Products Market Segment Analysis

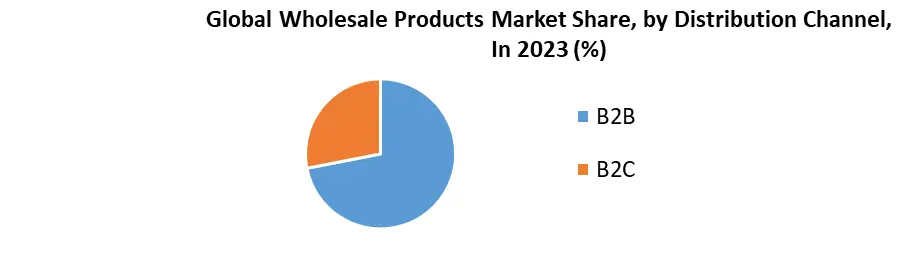

Based on Distribution Channel: The market is segmented into B2B and B2C. The B2B held the largest Wholesale Products Market share in 2023. This is attributed to the established network of wholesalers and distributors, along with the rising trend of B2B e-commerce. The future of B2B e-commerce presents promising opportunities for wholesale businesses. By embracing a comprehensive e-commerce strategy tailored to the unique needs of B2B customers, wholesalers are expected to stay ahead of the curve. This includes investing in user-friendly online platforms, offering flexible payment options, personalizing the shopping experience, and leveraging technology for automation and efficiency. The B2C segment is expected to grow at a high rate during the forecast period. Wholesalers to capitalize on their strengths by directly targeting consumers through specially designed B2C websites or by partnering with external marketplaces. Often, these B2C initiatives operate under a new brand name. By establishing dedicated digital platforms with streamlined transaction processes, wholesalers are expected to engage directly with consumers, offering competitive pricing and attractive deals. To ensure cost-effectiveness, wholesalers to opt for a commerce platform that facilitates B2X commerce, minimizing additional expenses associated with adopting a new business model.

Wholesale Products Market Regional Insights

Asia Pacific Wholesale Products Market held the largest share in the global market in 2023. This is attributed to the huge population, increasing urbanization, strong trade dynamics and robust economic activities. In the Asia Pacific region, the Indian Wholesale Products Market is one of the major shareholders. Recently, the Wholesale inflation in India remained in negative territory for the sixth consecutive month, with prices falling by 0.26 percent in September, according to the study. This follows a five-month high of -0.52 percent recorded in August 2023. Economists, polled by Reuters, had anticipated a 0.5 percent rise in the wholesale price index for September. The decline in wholesale prices was primarily attributed to a fall in prices of chemical and chemical products, mineral oils, textiles, basic metals, and food products compared to the same period last year, as stated by the Commerce Ministry. Inflation in the food index rose to 1.54 percent in September, while primary articles saw a continued easing with a 3.70 percent reading. Meanwhile, manufactured products prices fell by 1.34 percent in September.North America Wholesale Products Market is the second-largest market due to its well-established wholesale infrastructure and significant consumer spending. In the region, the US held the major share of the regional market in 2023. US wholesale prices unexpectedly fell by 0.1% in December, following a similar decline in November, primarily due to another sharp drop in the energy index. The producer price index (PPI) increase of 0.2% month-on-month, excluding food, energy, and trade. However, PPI rose by 1.0% in 2023, a significant slowdown from the previous year. In February 2024, U.S. wholesale inventories rebounded by 0.5%, following a 0.2% decline in January. This suggests a potential contribution to first-quarter economic growth. Year-on-year, inventories dropped by 1.5%. Private inventory investment deducted 0.47 percentage points from GDP growth in Q4 but is expected to improve in Q1. Wholesale motor vehicle inventories rose by 0.9%, while stocks of lumber, professional equipment, metals, and machinery increased. However, stocks of farm products and petroleum fell.

Wholesale Products Market Scope: Inquire Before Buying

Global Wholesale Products Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 52170.13 Bn. Forecast Period 2024 to 2030 CAGR: 8.4% Market Size in 2030: US $ 91754.40 Bn. Segments Covered: by Product Category Consumer Electronics Apparel and Accessories Home and Garden Health and Beauty Food and Beverages Others by Product Ownership Wholesale/Distribution Chain Independent Wholesalers by Distribution Channel B2B B2C Wholesale Products Market, by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Russia, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Wholesale Products Key Players

North America: 1. Amazon Business 2. MegaGoods 3. DollarDays 4. Wholesale Central 5. Costco Wholesale 6. B&G Foods 7. Sysco Corporation Europe: 8. Metro Group 9. Booker 10. Bestway Wholesale 11. Unilever Asia-Pacific: 12. eWorldTrade 13. DHgate 14. Alibaba Group 15. Global Sources 16. Made-in-China.com 17. Flipkart Wholesale Frequently Asked Questions: 1] What is the expected growth rate of the Global Wholesale Products Market? Ans. The Global Wholesale Products Market is expected to grow at a rate of 8.4% during the forecast period. 2] Which region dominated the Global Wholesale Products Market in 2023? Ans. Asia Pacific dominated the Global Wholesale Products Market in 2023. 3] What is the expected Global Wholesale Products Market size by 2030? Ans. The Wholesale Products Market size is expected to reach USD 91754.40 Bn by 2030. 4] What was the Global Wholesale Products Market size in 2023? Ans. The Global Wholesale Products Market size in 2023 was USD 52170.13 Bn. 5] Which countries held the largest Wholesale Products market share in 2023? Ans. The US and India held the largest Wholesale Products market share in 2023.

1. Wholesale Products Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Wholesale Products Market: Dynamics 2.1. Wholesale Products Market Trends by Region 2.1.1. North America Wholesale Products Market Trends 2.1.2. Europe Wholesale Products Market Trends 2.1.3. Asia Pacific Wholesale Products Market Trends 2.1.4. Middle East and Africa Wholesale Products Market Trends 2.1.5. South America Wholesale Products Market Trends 2.2. Wholesale Products Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Wholesale Products Market Drivers 2.2.1.2. North America Wholesale Products Market Restraints 2.2.1.3. North America Wholesale Products Market Opportunities 2.2.1.4. North America Wholesale Products Market Challenges 2.2.2. Europe 2.2.2.1. Europe Wholesale Products Market Drivers 2.2.2.2. Europe Wholesale Products Market Restraints 2.2.2.3. Europe Wholesale Products Market Opportunities 2.2.2.4. Europe Wholesale Products Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Wholesale Products Market Drivers 2.2.3.2. Asia Pacific Wholesale Products Market Restraints 2.2.3.3. Asia Pacific Wholesale Products Market Opportunities 2.2.3.4. Asia Pacific Wholesale Products Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Wholesale Products Market Drivers 2.2.4.2. Middle East and Africa Wholesale Products Market Restraints 2.2.4.3. Middle East and Africa Wholesale Products Market Opportunities 2.2.4.4. Middle East and Africa Wholesale Products Market Challenges 2.2.5. South America 2.2.5.1. South America Wholesale Products Market Drivers 2.2.5.2. South America Wholesale Products Market Restraints 2.2.5.3. South America Wholesale Products Market Opportunities 2.2.5.4. South America Wholesale Products Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Wholesale Products Industry 2.8. Analysis of Government Schemes and Initiatives For Wholesale Products Industry 2.9. Wholesale Products Market Trade Analysis 2.10. The Global Pandemic Impact on Wholesale Products Market 3. Wholesale Products Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 3.1.1. Consumer Electronics 3.1.2. Apparel and Accessories 3.1.3. Home and Garden 3.1.4. Health and Beauty 3.1.5. Food and Beverages 3.1.6. Others 3.2. Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 3.2.1. Wholesale/Distribution Chain 3.2.2. Independent Wholesalers 3.3. Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. B2B 3.3.2. B2C 3.4. Wholesale Products Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Wholesale Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 4.1.1. Consumer Electronics 4.1.2. Apparel and Accessories 4.1.3. Home and Garden 4.1.4. Health and Beauty 4.1.5. Food and Beverages 4.1.6. Others 4.2. North America Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 4.2.1. Wholesale/Distribution Chain 4.2.2. Independent Wholesalers 4.3. North America Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. B2B 4.3.2. B2C 4.4. North America Wholesale Products Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 4.4.1.1.1. Consumer Electronics 4.4.1.1.2. Apparel and Accessories 4.4.1.1.3. Home and Garden 4.4.1.1.4. Health and Beauty 4.4.1.1.5. Food and Beverages 4.4.1.1.6. Others 4.4.1.2. United States Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 4.4.1.2.1. Wholesale/Distribution Chain 4.4.1.2.2. Independent Wholesalers 4.4.1.3. United States Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. B2B 4.4.1.3.2. B2C 4.4.2. Canada 4.4.2.1. Canada Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 4.4.2.1.1. Consumer Electronics 4.4.2.1.2. Apparel and Accessories 4.4.2.1.3. Home and Garden 4.4.2.1.4. Health and Beauty 4.4.2.1.5. Food and Beverages 4.4.2.1.6. Others 4.4.2.2. Canada Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 4.4.2.2.1. Wholesale/Distribution Chain 4.4.2.2.2. Independent Wholesalers 4.4.2.3. Canada Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. B2B 4.4.2.3.2. B2C 4.4.3. Mexico 4.4.3.1. Mexico Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 4.4.3.1.1. Consumer Electronics 4.4.3.1.2. Apparel and Accessories 4.4.3.1.3. Home and Garden 4.4.3.1.4. Health and Beauty 4.4.3.1.5. Food and Beverages 4.4.3.1.6. Others 4.4.3.2. Mexico Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 4.4.3.2.1. Wholesale/Distribution Chain 4.4.3.2.2. Independent Wholesalers 4.4.3.3. Mexico Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. B2B 4.4.3.3.2. B2C 5. Europe Wholesale Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.2. Europe Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.3. Europe Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Wholesale Products Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.1.2. United Kingdom Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.1.3. United Kingdom Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.2.2. France Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.2.3. France Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.3.2. Germany Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.3.3. Germany Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.4.2. Italy Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.4.3. Italy Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.5.2. Spain Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.5.3. Spain Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.6.2. Sweden Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.6.3. Sweden Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.7.2. Austria Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.7.3. Austria Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 5.4.8.2. Rest of Europe Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 5.4.8.3. Rest of Europe Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Wholesale Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.2. Asia Pacific Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.3. Asia Pacific Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Wholesale Products Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.1.2. China Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.1.3. China Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.2.2. S Korea Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.2.3. S Korea Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.3.2. Japan Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.3.3. Japan Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.4.2. India Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.4.3. India Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.5.2. Australia Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.5.3. Australia Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.6.2. Indonesia Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.6.3. Indonesia Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.7.2. Malaysia Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.7.3. Malaysia Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.8.2. Vietnam Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.8.3. Vietnam Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.9.2. Taiwan Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.9.3. Taiwan Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 6.4.10.2. Rest of Asia Pacific Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 6.4.10.3. Rest of Asia Pacific Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Wholesale Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 7.2. Middle East and Africa Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 7.3. Middle East and Africa Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Wholesale Products Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 7.4.1.2. South Africa Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 7.4.1.3. South Africa Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 7.4.2.2. GCC Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 7.4.2.3. GCC Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 7.4.3.2. Nigeria Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 7.4.3.3. Nigeria Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 7.4.4.2. Rest of ME&A Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 7.4.4.3. Rest of ME&A Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Wholesale Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 8.2. South America Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 8.3. South America Wholesale Products Market Size and Forecast, by Distribution Channel(2023-2030) 8.4. South America Wholesale Products Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 8.4.1.2. Brazil Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 8.4.1.3. Brazil Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 8.4.2.2. Argentina Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 8.4.2.3. Argentina Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Wholesale Products Market Size and Forecast, by Product Category (2023-2030) 8.4.3.2. Rest Of South America Wholesale Products Market Size and Forecast, by Product Ownership (2023-2030) 8.4.3.3. Rest Of South America Wholesale Products Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Wholesale Products Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Wholesale Products Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amazon Business 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. MegaGoods 10.3. DollarDays 10.4. Wholesale Central 10.5. Costco Wholesale 10.6. B&G Foods 10.7. Sysco Corporation 10.8. Metro Group 10.9. Booker 10.10. Bestway Wholesale 10.11. Unilever 10.12. eWorldTrade 10.13. DHgate 10.14. Alibaba Group 10.15. Global Sources 10.16. Made-in-China.com 10.17. Flipkart Wholesale 11. Key Findings 12. Industry Recommendations 13. Wholesale Products Market: Research Methodology 14. Terms and Glossary