Waterproofing Products Market size was valued at USD 39.27 Billion in 2023 and the total Waterproofing Products Market is expected to grow at a CAGR of 5.19 % from 2024 to 2030, reaching nearly USD 55.97 Billion.Global Waterproofing Products Definition:

Waterproofing products are manufactured to prevent the penetration of water into a building or structure. They are commonly used in construction projects to protect against water damage and leaks, and are also used for sealing roofs, foundations. The waterproofing products are used to protect and preserve surfaces from water damage, mold, and other forms of moisture-related degradation.Waterproofing Products Market Overview:

The waterproofing products market growth is driven by the high demand for water-resistant materials in various applications. The market includes a wide range of products like coatings, membranes, sealants, and other specialty products. Waterproofing products are used in the construction industry for waterproofing foundations, roofs, walls, and other structures. Additionally, the waterproofing products market growth is driven by factors such as the rising demand for waterproofing products in emerging economies, the increasing use of waterproofing products in the construction industry, and the growing awareness about the benefits of using waterproofing products to prevent water damage and improve the longevity of structures. The Asia-Pacific region is expected to hold dominant position in the global waterproofing products market during the forecast period because of increasing demand for waterproofing products in the construction industry, particularly in countries like China, India, and Japan. North America and Europe are also expected to witness significant growth in the market because of high demand for waterproofing products in residential and commercial buildings. The key players operating in the waterproofing products market include BASF SE, Pidilite Industries Ltd., Sika AG, Carlisle Companies Inc., The Dow Chemical Company, GAF Materials Corporation, Johns Manville Corporation, and Kemper System America, Inc. The waterproofing products manufacturers are focusing on product innovation, expansion, and acquisition strategies to gain a competitive edge in the waterproofing products market.To know about the Research Methodology :- Request Free Sample Report

Competitive LandScape:

The global waterproofing products market is highly competitive, with several established players operating in the market. Some of the key players in the market include BASF SE, Sika AG, Carlisle Companies Inc., GAF Materials Corporation, Johns Manville Corporation, and Pidilite Industries Ltd. These companies are actively involved in mergers and acquisitions, partnerships, and collaborations to strengthen their position in waterproofing products market and expand their product portfolio. The waterproofing products is also characterized by the presence of several regional players who offer products specifically designed for the local market. These players compete with the established players by offering competitive pricing, superior quality products, and better customer service. Several startups and small and medium-sized enterprises (SMEs) are focusing on developing innovative and eco-friendly waterproofing products to meet the growing demand for sustainable construction materials. The global waterproofing products market is expected to witness increased competition because of the entry of new players in the market. Companies are investing heavily in research and development to develop innovative products that offer superior performance and durability. A growing demand for new-age waterproofing solutions, which are more effective, durable, and environment-friendly is encouraging to key players operating in the waterproofing products market to introduce innovative solution. According to the analysis, the waterproofing products market is expected to remain highly competitive during the forecast period with players focusing on product innovation, pricing strategies, and strategic partnerships to gain a competitive edge in the market.Waterproofing Products Market Dynamics:

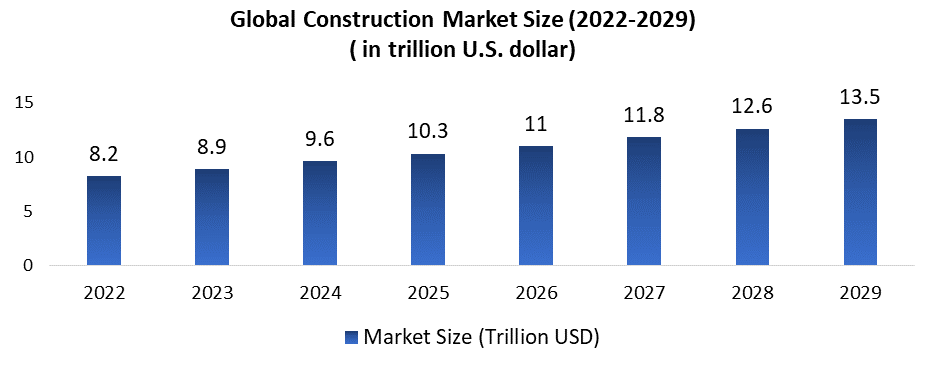

The waterproofing products market growth is driven by several factors like demand for waterproofing products in the construction industry, increasing awareness about the benefits of waterproofing, and the rising demand for environmentally friendly waterproofing products. Some of the key dynamics that are currently shaping the waterproofing products market are as follow as: Growth in construction industry is expected to drive the demand for waterproofing products The growth in the construction industry is a major driver of the demand for waterproofing products. Waterproofing products are used to protect buildings and other structures from water damage caused by rain, snow, and other forms of moisture. As the construction industry grows, more buildings and structures are being built, which increases the demand for waterproofing products. In addition, the use of waterproofing products is becoming increasingly common in both new construction projects and renovation projects. The building codes and regulations are becoming more stringent. building owners and managers are increasingly recognizing the importance of waterproofing products, which are protecting their properties from water damage. As climate change leads to more extreme weather conditions, the need for effective waterproofing becomes even more critical. The demand for eco-friendly and sustainable waterproofing solutions in recent years is increasing at a rapid rate. The trend is expected to continue in the future, as the construction industry is becoming more focused on sustainability and reducing its environmental impact. In addition, advancements in waterproofing technology have led to the development of more innovative and effective waterproofing products, which are expected to drive demand during the forecast period. Rising Demand for Environmentally Friendly Waterproofing Products The rising demand for environmentally friendly waterproofing products is a trend that has been gaining momentum in recent years, and is expected to continue in the coming years. The rising demand for environmentally friendly products is also affecting the waterproofing industry. Many companies are now offering waterproofing products that are made from sustainable and non-toxic materials. Some companies are now offering waterproofing solutions that are made from recycled materials, such as rubber, plastic, and other synthetic materials. In addition to being better for the environment, eco-friendly waterproofing products are also appealing to consumers who are looking for solutions that are safe for use around their homes. As a result, many manufacturers are now prioritizing sustainability in their product development and marketing efforts, and are seeing positive results from their investments in environmentally friendly waterproofing products. The trend towards environmentally friendly waterproofing products is expected to continue as more consumers become aware of the impact of traditional waterproofing products on the environment and seek out sustainable alternatives. The technological advancements in waterproofing products have revolutionized the construction and maintenance industries. With improved materials and methods, waterproofing products are offering better protection against water intrusion, leaks, and moisture-related damages. Some insights into technological advancements in waterproofing products are as follow as: Improved Materials: One of the most significant advancements in waterproofing products is the use of new and improved materials. For example, there are now high-performance polymer-based coatings, advanced rubberized asphalt membranes, and thermoplastic olefin (TPO) roofing membranes are available in the market. Innovative waterproofing products materials provide superior waterproofing and can withstand harsh weather conditions. Innovative Applications: Waterproofing products are now used in new and innovative ways. For example, some manufacturers have developed spray-on membranes that can be applied to walls, roofs, and floors to create a seamless waterproofing barrier. Smart Technologies: Waterproofing products are also incorporating smart technologies that can monitor and control moisture levels in buildings. For example, some waterproofing products have built-in sensors that detect water leaks and trigger alarms. Other products can be controlled remotely using smartphone apps. Technological advancements in waterproofing products have greatly improved the performance, durability, and sustainability of these products. As technology continues to advance, we can expect even more innovative solutions to emerge in the future.Waterproofing Products market challenges

With the growing demand for waterproofing products, the waterproofing products market is becoming increasingly competitive. Many new players are entering the market, making it challenging for established companies to maintain their market share. On the other hand, The waterproofing products are generally expensive, making them unaffordable for many consumers that is expected to limit the growth of the waterproofing products market and reduce demand. Additionally, Waterproofing products require skilled professionals for installation. The lack of skilled labor factor is expected to become a challenge for companies to install their products, leading to delays and increased costs. Many waterproofing products contain chemicals that can be harmful to the environment. Companies must address these concerns and develop eco-friendly products to remain competitive in the market. The detail description of the challenges in the waterproofing products have discussed in the global waterproofing products market report.

Waterproofing Products Market Porter Five Force Analysis Model:

Threat of new entrants: The threat of new entrants to the waterproofing products market is moderate. The industry is highly competitive, capital-intensive, requiring significant investment in research and development, production facilities, and marketing. Bargaining power of suppliers: The bargaining power of suppliers in the waterproofing products market is moderate to high. The industry relies on a variety of raw materials, including polymers, resins, and additives, which are subject to price fluctuations and availability. Bargaining power of buyers: The bargaining power of buyers in the waterproofing products market is moderate. Buyers include construction companies, homeowners, and building owners who use waterproofing products to protect their structures from water damage. Threat of substitutes: The threat of substitutes in the waterproofing products market is low. Waterproofing products are essential for protecting buildings and structures from water damage, and there are few viable substitutes. Rivalry among existing competitors: The rivalry among existing competitors in the waterproofing products market is high. The industry is highly fragmented, with numerous players competing for market share. Established brands have significant advantages, including economies of scale and established distribution channels.Waterproofing Products Market Segment Analysis:

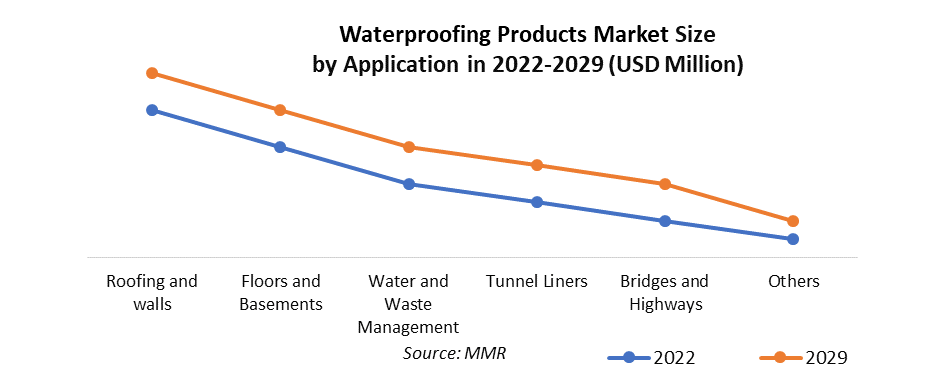

The waterproofing products market is segmented into four main types: membranes, coatings, sealants, and others. Waterproofing membranes are thin sheets or films made of materials such as bitumen, PVC, EPDM, or TPO. These are commonly used for roofing, underground waterproofing, and as a vapor barrier. Waterproofing coatings are liquid-applied materials that form a seamless, protective layer over the substrate. Waterproofing coatings products have made of different materials such as acrylic, polyurethane, epoxy, or silicone. Coatings are versatile and can be applied to various surfaces such as roofs, walls, and foundations. Waterproofing sealants are typically used to seal joints and gaps in structures, preventing water from penetrating through. They can be made of different materials such as silicone, polyurethane, or polysulfide. Sealants are flexible and can accommodate movement in the substrate. Other waterproofing products include cementitious coatings, crystalline waterproofing, and water repellents. Based on type, membranes are expected to continue its dominant position during the forecast period. Waterproofing membranes are thin layers of material that are applied to surfaces to prevent the penetration of water or other liquids. They are also used in construction projects to prevent leaks in buildings, tunnels, bridges, and other structures. The market for waterproofing products as membranes is expected to grow during the forecast period because of high construction activities and the requirement for better protection of buildings and infrastructure. The waterproofing products market includes a wide range of products, including sheet membranes, liquid membranes, and others. The market is highly competitive, with many players operating globally, such as Sika AG, BASF SE, GAF Materials Corporation, and The Dow Chemical Company. The demand for the waterproofing products membranes is expected to grow at more than 5.6% rate of CAGR during the forecast period. Roofing and walls segment held more than 25.6% share in the global Waterproofing Products Market Waterproofing products are essential for protecting roofs and walls from water damage, which can lead to structural damage and costly repairs. As a result, the demand for waterproofing products in the roofing and wall industries is significant. Common waterproofing products used in roofing include asphalt shingles, synthetic membranes, and coatings such as silicone or acrylic. waterproofing products are used to prevent water from penetrating the building envelope and causing damage to the structure. These products include coatings, sealants, and membranes, which can be applied to the exterior or interior walls. The demand for waterproofing products in roofing and walls is driven by a range of factors, including the need to comply with building codes and regulations, the desire to prevent costly water damage, and the increasing awareness of the importance of sustainable building practices. As a result, the market for waterproofing products is expected to grow at a high rate of CAGR during the forecast period.

Waterproofing Products Market Regional Insights:

The North American waterproofing products market is expected to grow significantly because of its high demand from the construction industry, particularly in the United States. The region is witnessing a surge in infrastructure projects, which is driving the demand for waterproofing products. Additionally, stringent regulations related to building codes and energy conservation are further fueling the growth of the market. The European waterproofing products market growth is driven by increasing government investments in infrastructure projects, such as transportation and energy. The region has stringent environmental regulations that are driving the adoption of eco-friendly waterproofing products. The increasing focus on green building and sustainable construction practices is further propelling the demand for waterproofing products in the region. Additionally, the Middle East and Africa region is witnessing significant investments in infrastructure development, particularly in the Gulf countries, which is driving the demand for waterproofing products. Additionally, the region's harsh climate conditions and the need to protect buildings from water damage are also fueling the growth of the market. The Latin America waterproofing products market is projected to witness steady growth by increasing construction activities in the region. The demand for waterproofing products is driven by the need to protect buildings from water damage caused by heavy rainfall and high humidity. The region's growing population and urbanization are also driving the demand for residential and commercial infrastructure, which is boosting the growth of the waterproofing products market. Asia Pacific Market Overview: The Asia Pacific waterproofing products market is a rapidly growing industry that provides products and services related to waterproofing in the construction and building sector. The region includes countries such as China, India, Japan, South Korea, Australia, and many more, and it is expected to be the largest market for waterproofing products globally in the coming years. The waterproofing products market growth is driven by various factors such as the growing demand for high-quality and long-lasting building structures, increasing construction activities, and rising awareness about the benefits of waterproofing products. Additionally, the need for efficient and durable waterproofing solutions in industries such as infrastructure, residential, commercial, and industrial construction is also boosting the waterproofing products market growth. Many companies operating in the waterproofing products market are focusing on product innovation, strategic collaborations, and mergers and acquisitions to gain a competitive edge in the market.Waterproofing Products demand in India

In India, the demand for waterproofing products has been steadily increasing due to the country's monsoon climate, where heavy rainfall is experienced during the monsoon season. Additionally, the country's rapid urbanization and growth in construction activities have also driven the demand for waterproofing products. The major applications of waterproofing products in India include the construction of buildings, bridges, roads, and other infrastructure projects. Some of the commonly used waterproofing products in India include bitumen, polyurethane, acrylic, and cementitious coatings. The market for waterproofing products in India is expected to grow during the forecast period because of government's focus on infrastructure development and housing for all initiatives. Furthermore, the increasing awareness of the benefits of waterproofing and the need to reduce maintenance costs has also led to the growth of the waterproofing products market in India. Furthermore, the increasing investments in infrastructure development by various governments across the globe are expected to drive the demand for waterproofing products. As infrastructure projects involve a large investment, waterproofing products become crucial to ensuring the longevity of these projects. The automotive industry is also expected to contribute to the growth of the waterproofing products industry. As vehicles become more advanced and sophisticated, there is an increasing need for waterproofing products to protect the sensitive electronic components of the vehicles from water damage.Waterproofing Products Market Scope: Inquiry Before Buying

Waterproofing Products Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 39.27 Bn Forecast Period 2024 to 2030 CAGR: 5.19% Market Size in 2030: USD 55.97 Bn Segments Covered: by Type Membranes Coatings Sealants Others by Application Roofing and walls Floors and Basements Water and Waste Management Tunnel Liners Bridges and Highways Others Waterproofing Products Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Waterproofing Products Key Players:

1. BASF SE 2. Sika AG 3. The Dow Chemical Company 4. Pidilite Industries Limited 5. RPM International Inc. 6. Carlisle Companies Inc. 7. Fosroc International Ltd. 8. Mapei S.p.A. 9. Johns Manville 10. GAF Materials Corporation 11. GCP Applied Technologies Inc. 12. Fyfe Asia Pte Ltd. 13. Kryton International Inc. 14. Henkel AG & Co. KGaA 15. Tremco Inc.FAQs:

1] What segments are covered in the Global Waterproofing Products Market report? Ans. The segments covered in the Waterproofing Products report are based on Type, Application and Region. 2] Which region is expected to hold the highest share in the Global Waterproofing Products Market during the forecast period? Ans. The Asia Pacific region is expected to hold the highest share of the Waterproofing Products Market during the forecast period. 3] What is the market size of the Global Waterproofing Products by 2030? Ans. The market size of the Waterproofing Products by 2030 is expected to reach US$ 55.97 Bn. 4] What is the forecast period for the Global Waterproofing Products Market? Ans. The forecast period for the Waterproofing Products Market is 2024-2030. 5] What was the market size of the Global Waterproofing Products in 2023? Ans. The market size of the Waterproofing Products in 2023 was valued at US$ 39.27 Bn.

1. Waterproofing Products Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Waterproofing Products Market: Dynamics 2.1. Waterproofing Products Market Trends by Region 2.1.1. North America Waterproofing Products Market Trends 2.1.2. Europe Waterproofing Products Market Trends 2.1.3. Asia Pacific Waterproofing Products Market Trends 2.1.4. Middle East and Africa Waterproofing Products Market Trends 2.1.5. South America Waterproofing Products Market Trends 2.2. Waterproofing Products Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Waterproofing Products Market Drivers 2.2.1.2. North America Waterproofing Products Market Restraints 2.2.1.3. North America Waterproofing Products Market Opportunities 2.2.1.4. North America Waterproofing Products Market Challenges 2.2.2. Europe 2.2.2.1. Europe Waterproofing Products Market Drivers 2.2.2.2. Europe Waterproofing Products Market Restraints 2.2.2.3. Europe Waterproofing Products Market Opportunities 2.2.2.4. Europe Waterproofing Products Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Waterproofing Products Market Drivers 2.2.3.2. Asia Pacific Waterproofing Products Market Restraints 2.2.3.3. Asia Pacific Waterproofing Products Market Opportunities 2.2.3.4. Asia Pacific Waterproofing Products Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Waterproofing Products Market Drivers 2.2.4.2. Middle East and Africa Waterproofing Products Market Restraints 2.2.4.3. Middle East and Africa Waterproofing Products Market Opportunities 2.2.4.4. Middle East and Africa Waterproofing Products Market Challenges 2.2.5. South America 2.2.5.1. South America Waterproofing Products Market Drivers 2.2.5.2. South America Waterproofing Products Market Restraints 2.2.5.3. South America Waterproofing Products Market Opportunities 2.2.5.4. South America Waterproofing Products Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Waterproofing Products Industry 2.8. Analysis of Government Schemes and Initiatives For Waterproofing Products Industry 2.9. Waterproofing Products Market Trade Analysis 2.10. The Global Pandemic Impact on Waterproofing Products Market 3. Waterproofing Products Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Waterproofing Products Market Size and Forecast, by Type (2023-2030) 3.1.1. Membranes 3.1.2. Coatings 3.1.3. Sealants 3.1.4. Others 3.2. Waterproofing Products Market Size and Forecast, by Application (2023-2030) 3.2.1. Roofing and walls 3.2.2. Floors and Basements 3.2.3. Water and Waste Management 3.2.4. Tunnel Liners 3.2.5. Bridges and Highways 3.2.6. Others 3.3. Waterproofing Products Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Waterproofing Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Waterproofing Products Market Size and Forecast, by Type (2023-2030) 4.1.1. Membranes 4.1.2. Coatings 4.1.3. Sealants 4.1.4. Others 4.2. North America Waterproofing Products Market Size and Forecast, by Application (2023-2030) 4.2.1. Roofing and walls 4.2.2. Floors and Basements 4.2.3. Water and Waste Management 4.2.4. Tunnel Liners 4.2.5. Bridges and Highways 4.2.6. Others 4.3. North America Waterproofing Products Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Waterproofing Products Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Membranes 4.3.1.1.2. Coatings 4.3.1.1.3. Sealants 4.3.1.1.4. Others 4.3.1.2. United States Waterproofing Products Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Roofing and walls 4.3.1.2.2. Floors and Basements 4.3.1.2.3. Water and Waste Management 4.3.1.2.4. Tunnel Liners 4.3.1.2.5. Bridges and Highways 4.3.1.2.6. Others 4.3.2. Canada 4.3.2.1. Canada Waterproofing Products Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Membranes 4.3.2.1.2. Coatings 4.3.2.1.3. Sealants 4.3.2.1.4. Others 4.3.2.2. Canada Waterproofing Products Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Roofing and walls 4.3.2.2.2. Floors and Basements 4.3.2.2.3. Water and Waste Management 4.3.2.2.4. Tunnel Liners 4.3.2.2.5. Bridges and Highways 4.3.2.2.6. Others 4.3.3. Mexico 4.3.3.1. Mexico Waterproofing Products Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Membranes 4.3.3.1.2. Coatings 4.3.3.1.3. Sealants 4.3.3.1.4. Others 4.3.3.2. Mexico Waterproofing Products Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Roofing and walls 4.3.3.2.2. Floors and Basements 4.3.3.2.3. Water and Waste Management 4.3.3.2.4. Tunnel Liners 4.3.3.2.5. Bridges and Highways 4.3.3.2.6. Others 5. Europe Waterproofing Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.2. Europe Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3. Europe Waterproofing Products Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Waterproofing Products Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Waterproofing Products Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Waterproofing Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Waterproofing Products Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Waterproofing Products Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Waterproofing Products Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Waterproofing Products Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Waterproofing Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Waterproofing Products Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Waterproofing Products Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Waterproofing Products Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Waterproofing Products Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Waterproofing Products Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Waterproofing Products Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Waterproofing Products Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Waterproofing Products Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Waterproofing Products Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Waterproofing Products Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Waterproofing Products Market Size and Forecast, by Application (2023-2030) 8. South America Waterproofing Products Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Waterproofing Products Market Size and Forecast, by Type (2023-2030) 8.2. South America Waterproofing Products Market Size and Forecast, by Application (2023-2030) 8.3. South America Waterproofing Products Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Waterproofing Products Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Waterproofing Products Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Waterproofing Products Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Waterproofing Products Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Waterproofing Products Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Waterproofing Products Market Size and Forecast, by Application (2023-2030) 9. Global Waterproofing Products Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Waterproofing Products Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. BASF SE 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Sika AG 10.3. The Dow Chemical Company 10.4. Pidilite Industries Limited 10.5. RPM International Inc. 10.6. Carlisle Companies Inc. 10.7. Fosroc International Ltd. 10.8. Mapei S.p.A. 10.9. Johns Manville 10.10. GAF Materials Corporation 10.11. GCP Applied Technologies Inc. 10.12. Fyfe Asia Pte Ltd. 10.13. Kryton International Inc. 10.14. Henkel AG & Co. KGaA 10.15. Tremco Inc 11. Key Findings 12. Industry Recommendations 13. Waterproofing Products Market: Research Methodology 14. Terms and Glossary