Global Water Filtration System Market was valued at USD 14.25 Bn in 2024 and is expected to reach USD 28.75 Bn by 2032, growing at a CAGR of 9.17% during forecast period.Global Water Filtration System Market Overview:

The Water Filtration System Market refers to the market for products and technologies designed to remove contaminants, impurities, and harmful substances from water, ensuring it is safe for consumption, industrial use, or other applications. Water Filtration System can include chemical, physical, and biological processes that address water quality issues like turbidity, bacteria, dissolved solids, metals, and other pollutants.To know about the Research Methodology : Request Free Sample Report The market incorporates technologies such as reverse osmosis (RO), activated carbon filters, ultrafiltration, ultraviolet (UV) sterilization, and ion-exchange systems, which are widely adopted to ensure safe, clean, and sustainable water supply across industries, households, and public infrastructure.

Global Water Filtration System Market Dynamics:

Government Initiatives to Combat Water Pollution Boost Market for Filtration Solutions: Growing pressure on industrial and commercial facilities to mitigate water pollution is expected to drive significant growth in the Water Filtration System market globally. Regional governments across the world are implementing stricter regulations to address the environmental impact of business operations, mainly concerning water contamination. For example, in June 2025, the U.K. granted the Water Services Regulation Authority (Ofwat) enhanced powers, allowing it to impose penalties, including the banning of executive bonuses, for companies responsible for water pollution. This creativity is part of the Water (Special Measures) Act 2025. Likewise regulatory measures are being accepted by other nations to promote the adoption of Water Filtration System in manufacturing and industrial facilities, ensuring that wastewater is properly treated before being released into natural water sources. These governmental actions are expected to create significant growth opportunities for the global Water Filtration System market in the coming years. Rising Awareness of Waterborne Diseases As global health awareness continues to grow, there is a significant surge in the demand for Water Filtration System. Water remains a major vehicle for the transmission of diseases like cholera, dysentery, and typhoid fever. According to the World Health Organization, unsafe drinking water causes approximately 485,000 deaths annually from diarrheal diseases worldwide. This alarming statistic has prompted both consumers and governments to prioritize access to clean water, especially in regions such as sub-Saharan Africa and South Asia, where waterborne diseases are prevalent. Consequently, community-based water purification initiatives are being increasingly implemented. In India, Kent RO Systems has made a notable impact by offering affordable reverse osmosis (RO) purifiers, selling over 225,000 units annually and capturing around 40% of the market share. These efforts not only improve public health but also drive the growing demand for Water Filtration System Market.Expanding Demand for Water Filtration System in Commercial and Industrial Sectors As industries expand and urbanization accelerates, the demand for clean, high-quality water has surged, driving growth in the Water Filtration System Market. This trend has prompted businesses and institutions to invest in advanced purification technologies. Commercial Water Filtration System are essential in hospitals, hotels, schools, manufacturing plants, and other high-usage facilities to provide safe water for drinking, cleaning, and operational processes. These systems utilize various treatment methods, including reverse osmosis (RO), ultrafiltration (UF), microfiltration, deionization, and ultraviolet (UV) disinfection, ensuring the removal of contaminants such as heavy metals, dissolved solids, bacteria, and chemical pollutants. In the industrial sector, water purification is critical in industries such as pharmaceuticals, petrochemicals, energy, and food processing, where maintaining strict water quality standards is necessary to preserve product integrity and comply with environmental regulations. The growth in these sectors directly fuels the demand for customized, high-capacity purification systems that optimize water reuse, reduce waste, and enhance sustainability. As water scarcity continues to be a growing global concern, both commercial and industrial entities are increasingly adopting water recycling and reuse strategies to minimize freshwater consumption, further driving the Water Filtration System Market. Governments around the world are implementing stricter regulations and sustainability initiatives to promote efficient water management, accelerating the adoption of industrial and commercial water purification systems. Advanced technologies, such as heat-subitizable reverse osmosis systems, skid-mounted RO plants, and hybrid purification systems with automated monitoring capabilities, are becoming more prevalent. These innovations ensure operational efficiency, cost-effectiveness, and minimal environmental impact, making them the preferred choice for businesses seeking sustainable solutions. Companies that prioritize clean water solutions also enjoy improved corporate responsibility and enhanced brand perception, as customers and stakeholders increasingly value organizations with strong environmental and health-conscious policies. The ongoing advancements in filtration and purification technologies continue to revolutionize the Water Filtration System Market, making high-performance systems more accessible, efficient, and cost-effective. Benefits of Commercial & Industrial Water Filtration System

Technological Progress in Water Filtration System Boosts Industry Growth The global Water Filtration System Market is poised for significant growth, fuelled by ongoing advancements in filtration techniques. Recent innovations, such as desalination processes using nanofillers, are creating new opportunities within the industry. Desalination techniques, which purify seawater, are especially crucial for communities with limited access to fresh water, particularly in remote areas. The Middle East has seen a rise in the number of desalination plants across major countries, highlighting the growing demand for advanced water treatment solutions. Ongoing research into integrating renewable energy sources, such as solar power, into desalination plants is expected to further boost market expansion. The Global Clean Water Desalination Alliance (GCWDA) aims to ensure that 20% of desalination plants are powered by renewable energy by the end of 2025, underscoring the potential for sustainable water purification methods. In addition to desalination, nanofiltration techniques utilizing nanoparticles are being introduced as novel technologies in Water Filtration System. These techniques can be enhanced with carbon nanotubes, making nanofiltration more effective than traditional methods like reverse osmosis and ultrafiltration, particularly when dealing with pathogens and heavy metals. These innovations are expected to drive continued growth and open new avenues for industry players in the Water Filtration System Market. Water Filtration System Share in % - by Major Companies in 2024

Water Filtration System Market Growth Hindered by Environmental Issues: The Water Filtration System Market is facing significant challenges due to rising concerns over the environmental impact of certain filtration technologies. While these systems play a crucial role in offering clean water, processes such as reverse osmosis (RO) produce brine water, a byproduct that can lead to water pollution and environmental degradation. Brine, which contains high concentrations of salt and other contaminants, is often discharged into water bodies, negatively impacting aquatic ecosystems and water quality. This issue is particularly concerning in areas with limited capacity to manage brine disposal, presenting an obstacle to sustainable water treatment practices. In addition to brine disposal, the energy-intensive nature of large-scale Water Filtration System, particularly desalination technologies, raises environmental concerns. These systems need substantial energy to operate, which not only increases operational costs but also contributes to a higher carbon footprint. As governments and industries globally prioritize sustainability and renewable energy, the energy demands of traditional filtration methods could face increased scrutiny. To address these challenges, the Water Filtration System Market is exploring energy-efficient technologies and renewable energy integration, aiming to reduce environmental damage while continuing to meet growing water purification needs. Limited Standardization and Quality Compliance The limited standardization, fragmented regulations, and weak enforcement of quality compliance remain major restraints. Despite the availability of national standards and regulatory frameworks, inconsistent implementation and low consumer awareness hinder market maturity and product reliability. Role of BIS and Certification Standards The Bureau of Globaln Standards (BIS) plays a pivotal role in maintaining water quality and consumer safety. Key standards include: • IS 10500:2012: Defines permissible limits for physical, chemical, and microbiological parameters in drinking water. • IS 16240:2015: Specifies requirements for RO-based Point-of-Use (PoU) systems. • IS 14724, IS 14743, and IS 11755: Govern UV, activated carbon, and ceramic filtration systems, respectively. The BIS certification process involves product testing in accredited laboratories, factory inspection, and issuance of a certification mark valid for two years. This certification assures that the purifier meets national safety and performance benchmarks, reinforcing consumer confidence. Market Entry Analysis and Strategies for the Global Water Filtration System Market The Water Filtration System Market offers significant growth opportunities for both new entrants and established companies, with strategic partnerships playing a pivotal role in market success. New players can reduce operational risks and improve cost competitiveness by partnering with local OEMs or technology firms. For example, collaborations with Indian OEMs specializing in membrane or pump manufacturing enable global players to achieve cost efficiency and ensure a steady supply chain. Additionally, tie-ups with EPC contractors and infrastructure firms in the municipal segment provide access to public tenders and long-term maintenance contracts, while distribution partnerships with established appliance brands or online platforms can accelerate market penetration in the residential and commercial markets. Furthermore, partnering with state water boards or public utilities enhances credibility and offers opportunities for long-term operation and maintenance contracts, ensuring sustainable growth in the sector.

However, new entrants face challenges in competing with established companies that benefit from economies of scale, extensive distribution networks, and strong brand loyalty. To overcome these barriers, startups must invest in advanced filtration technologies and significant marketing efforts, including promotional campaigns and influencer partnerships, to gain market recognition. Established brands dominate retail channels and e-commerce platforms, making it difficult for newcomers to secure visibility. While cost advantages and brand recognition pose obstacles, new players can differentiate themselves by focusing on innovative, eco-friendly, and energy-efficient filtration technologies that meet the growing consumer demand for sustainability. With the right strategic partnerships, new entrants can capitalize on these opportunities, fostering long-term success in the evolving Water Filtration System Market. Pricing Trends & Structure Analysis for Global Water Filtration System Market Water purifiers are essential for ensuring access to safe drinking water, and their pricing structure varies significantly across regions due to a range of factors, including water quality, economic conditions, and technological advancements. The primary technologies used in water purifiers, such as UV (Ultraviolet), RO (Reverse Osmosis), and gravity-based models, each come with different pricing strategies influenced by their features and market demand.

In developed markets like North America and Europe, where consumers have higher disposable incomes and access to advanced technologies, RO and UV-based purifiers dominate the market. These systems are priced higher due to the sophisticated technology and energy consumption involved in their operation. Meanwhile, gravity-based purifiers, which are simpler and more affordable, cater to budget-conscious consumers in these regions. In contrast, emerging markets in Asia-Pacific, Africa, and South America see a different pricing structure. Due to economic constraints and the need for affordable solutions, gravity-based and UV purifiers are more commonly used. RO systems are generally more expensive and are only affordable in higher-income households or specific urban areas with severe water contamination issues.

Global Water Filtration System Market Segment Analysis:

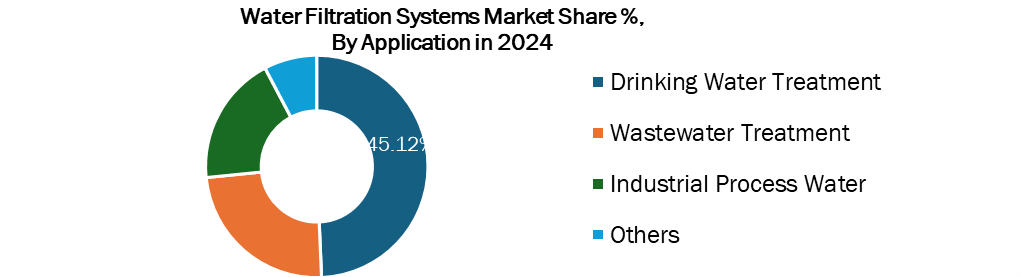

Based on technology, Reverse Osmosis (RO) Filtration Systems dominated the Global Water Filtration System Market in 2024 with value share of nearly 38.53%. RO purifiers are widely preferred due to their high efficiency, lower electricity consumption, and continuous technological advancements. The RO segment is projected to grow at the highest CAGR of xx% during the forecast period, driven by increasing demand from both urban and rural consumers. In contrast, the UV and gravity-based purifier segments are expected to witness slower growth due to lower efficiency and cost-effectiveness compared to RO systems, particularly among low-income consumers.In 2024, Drinking Water Treatment accounted for the largest value share of 45.12% and is expected to grow at a CAGR of xx% during forecast period in Water Filtration System Market. This growth is primarily driven by rising public health awareness, increasing urbanization, and government-backed programs promoting safe drinking water access. The Wastewater Treatment segment is also expanding, supported by stricter discharge norms for industries and growing environmental concerns. In the industrial sector, the emphasis on water reuse and recycling is further stimulating the demand for high-efficiency filtration systems.

Global Water Filtration System Market Geographical Analysis:

North America emerged as the largest value Global Water Filtration System Market share in 2024, accounting for a significant 34.87% the total market. One of the primary drivers is increasing concern about impurities in household water, prompting consumers to invest in reliable and effective purification systems. The U.S. Environmental Protection Agency (EPA) has identified various water contaminants, compelling households to install advanced filtration systems to improve water quality and ensure safety. Additionally, advancements in technology have made Water Filtration System more affordable, allowing consumers to access high-quality solutions at a lower cost. Another contributing factor is the growing popularity of smart Water Filtration System, which offer real-time monitoring of water quality. These systems enhance consumer experience and promote greater adoption by providing users with detailed data on their water’s condition. The expanding health and wellness trend is also fueling the demand for purified water, with more consumers opting for bottled water. In fact, North America dominated nearly 35% of the global Water Filtration System market revenue in 2025, with the U.S. and Canada accounting for a significant portion of this share. The increasing awareness about the health implications of contaminated water is accelerating the adoption of residential water filtration solutions. Furthermore, regional governments are investing in large-scale water infrastructure, including wastewater treatment plants and desalination facilities. For example, the Water Infrastructure Finance and Innovation Act (WIFIA) in the U.S. has supported investments exceeding USD 43 billion since 1987 for water infrastructure projects, enhancing the region’s filtration capacity.Asia-Pacific is expected to become the second-largest revenue generator for the Water Filtration System market during the forecast period. China is expected to lead the region, driven by increased use of Water Filtration System across residential, commercial, and industrial sectors. In May 2025, Viomi Technology Co., Ltd., a leading Chinese technology company, announced the launch of the Kunlun 4 Pro Alkaline Mineral Water Purifier, which uses Artificial Intelligence (AI) to replicate the natural mineralization process of water. This innovation highlights the technological advancements taking place in the region. Furthermore, the growing population and rising disposable incomes in Asia-Pacific will continue to drive demand for Water Filtration System, contributing to higher regional revenue growth over the forecast period. India’s Key Import Partners in Water Filtration System (2024) India’s import landscape for Water Filtration System is characterized by a diverse mix of global suppliers, ranging from high-value technology innovators to cost-efficient mass producers. In 2024, the market continues to demonstrate a strong reliance on technologically advanced imports from developed economies, while maintaining volume support from low-cost Asian exporters.

The United States leads the Water Filtration System Market, contributing around one-third of India’s total import value. American suppliers are recognized for providing premium water treatment technologies and advanced filtration equipment, catering to both municipal and industrial end users. Their dominance reflects India’s growing demand for quality-driven and high-performance systems. Singapore follows closely, serving as a regional distribution and logistics hub for global water technology brands. Its strategic position and trade-friendly infrastructure make it a key node in the supply chain, facilitating the flow of imported systems and components into India. China remains the volume leader, accounting for over half of India’s imported units. Chinese manufacturers supply a wide range of low-cost and high-volume filtration systems, particularly targeting residential and semi-industrial applications. Their competitive pricing and large-scale production continue to strengthen China’s role as India’s most significant quantity supplier.

Global Water Filtration System Market Recent Development:

Leading companies in Global Water Filtration System Market were focusing on research and development to innovate new products or improve existing ones. This could involve developing Water Filtration System derivatives with enhanced properties or applications to cater to specific industry needs.

Year Description In September 2024 A consortium consisting of Suez, Siemens, and the Abu Dhabi National Energy Company (TAQA) has signed a memorandum of understanding to collaborate on desalination projects targeting emerging markets. As climate change and droughts continue to escalate global demand for drinking water, desalination technologies are becoming key solutions, and this partnership aims to contribute to addressing these growing challenges. In February 2025 Thermo Fisher Scientific publicised a deal to acquire the purification and filtration business of Solventum in cash for USD 4.1 billion in February 2025. The agreement is synergistic to Solventum, which has aligned its efforts towards core areas including wound care and biopharma filtration and is accompanying Thermo Fisher to create new growth opportunities for its business in the Water Filtration System Market. Water Filtration System Market Scope:Inquire before buying

Global Water Filtration System Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 14.25 Bn. Forecast Period 2025 to 2032 CAGR: 9.17% Market Size in 2032: USD 28.75 Bn. Segments Covered: by Technology Type Reverse Osmosis (RO) Filtration Systems Ultraviolet (UV) Disinfection Systems Ultrafiltration (UF) Systems Carbon Filters (Activated Carbon) Gravity-based Others by Application Drinking Water Treatment Wastewater Treatment Industrial Process Water Others by End Use Industry Residential Commercial Municipal Industrial Water Filtration System Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Global Water Filtration System Market, Key Players:

1. A O. Smith Corporation 2. Pentair plc 3. Veolia Water Technologies 4. Xylem Inc. 5. Brita GmbH 6. Culligan International 7. Coway Co, Ltd. 8. Wikipedia 9. 3M Company 10. MANN+HUMMEL 11. BWT AG 12. Kent RO Systems Ltd. 13. Eureka Forbes Ltd. 14. Tata Chemicals Ltd. 15. Ion Exchange (Global) Ltd. 16. Kurita Water Industries Ltd. 17. Kemira Chemicals Global Pvt. Ltd. 18. Aquafilsep Inc. 19. Inox Water Systems Pvt. Ltd. 20. Silver Filtration Global Ltd. 21. Pure Water Enterprises Pvt. Ltd. 22. Haier (Group 23. Midea (Group) 24. Whirlpool Corporation 25. Panasonic Corporation 26. TORAY Industries 27. GREE Electric Appliances 28. APEC Water Systems 29. Atlas Filtri Sr.l. 30. Haier / Ecowater Systems 31. OthersFAQs

1. What is the projected market size and growth rate of the Market? Ans: Global Water Filtration System Market was valued at USD 14.25 Bn in 2024 and is expected to reach USD 28.75 Bn by 2032, growing at a CAGR of 9.17% during forecast period. 2. What segments are covered in the Market report? Ans : The segments covered in the market report are Technology Type, Application,End Use Industry and Region. 3. What is scope of the Global Water Filtration System Market report? Ans : The Global Water Filtration System Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period.

1. Water Filtration System Market Introduction 1.1. Water Filtration System Market Overview 1.1.1. Definitions 1.1.2. Scope Consideration 1.2. Executive Summary 1.2.1. Market Outlook 1.2.2. Segment Outlook 1.3. Worldwide Market Development 2. Global Insights: Water Filtration System Market 2.1. Water Filtration System Valuation Analysis 2024 2.1.1. Global Market Size 2024 and forecast 2025-2032 (USD Billion) 2.1.2. Year-over-year growth rate 2024-2032 (%) 2.1.3. Global Market Share Analysis 2024 (%) by Region and Segments 2.2. Water Filtration System Industry Trends in 2024 and Future Outlook 2.3. Water Filtration System as a Key Growth Drivers in the Global Economy 2.4. Challenges of Global Water Filtration System Market 2.5. The High-Growth Opportunity for Water Filtration System in Global Market 2.5.1. Opportunity for New Entrance 2.5.2. Opportunity for Established Players 2.6. Water Filtration System Buyers Prioritize Capabilities for Voluntary Carbon Reporting 2.6.1. High Priority (%) 2.6.2. Medium Priority (%) 2.7. Software Spending Surge: Carbon Accounting Takes the Lead 2.8. Water Filtration System Market Analysis Tools 2.8.1. Porter’s Analysis 2.8.2. PESTEL Analysis 2.9. Industry Value Chain Analysis 2.10. Regulatory Landscape in Water Filtration System Market 2.11. Water Filtration System Services Pricing Models Analysis 2.12. Capabilities Criteria for Water Filtration System Applications 2.13. Statistical Insights and Trends Reporting 3. Water Filtration System Market Segmentation Analysis: Global Market Size and Forecast (by Value USD Mn) (2024-2032) 3.1. Global Water Filtration System Market Size and Forecast, By Technology Type (2024-2032) 3.1.1. Reverse Osmosis (RO) Filtration Systems 3.1.2. Ultraviolet (UV) Disinfection Systems 3.1.3. Ultrafiltration (UF) Systems 3.1.4. Carbon Filters (Activated Carbon) 3.1.5. Gravity-based 3.1.6. Others 3.2. Global Water Filtration System Market Size and Forecast, By Application (2024-2032) 3.2.1. Drinking Water Treatment 3.2.2. Wastewater Treatment 3.2.3. Industrial Process Water 3.2.4. Others 3.3. Global Water Filtration System Market Size and Forecast, By End Use Industry (2024-2032) 3.3.1. Residential 3.3.2. Commercial 3.3.3. Municipal 3.3.4. Industrial 3.4. Global Water Filtration System Market Size and Forecast, by Region (2024-2032) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. Deep Dive: North America 4.1.1. North America Market Size 2024 and forecast 2025-2032 (USD Billion) 4.1.2. Year-over-year growth 2024-2032 (%) 4.1.3. North America Market Share Analysis 2024 (%) by Countries 4.2. North America Water Filtration System Market Trends in 2024 and Future Outlook 4.3. North America Water Filtration System Market Growth Driver 4.4. Challenges of North America Water Filtration System Market 4.5. Growth Opportunity for Water Filtration System in North America Market 4.6. Regulatory Landscape in North America Water Filtration System Industry 4.7. North America Water Filtration System Market Segmentation and Sub Segmentation Analysis: Market Size and Forecast (by Value USD Mn) (2024-2032) 4.7.1. By Technology Type 4.7.1.1. Reverse Osmosis (RO) Filtration Systems 4.7.1.2. Ultraviolet (UV) Disinfection Systems 4.7.1.3. Ultrafiltration (UF) Systems 4.7.1.4. Carbon Filters (Activated Carbon) 4.7.1.5. Gravity-based 4.7.1.6. Others 4.7.2. By Applications 4.7.2.1. Drinking Water Treatment 4.7.2.2. Wastewater Treatment 4.7.2.3. Industrial Process Water 4.7.2.4. Others 4.7.3. By End Use Industry 4.7.3.1. Residential 4.7.3.2. Commercial 4.7.3.3. Municipal 4.7.3.4. Industrial 4.7.4. North America Water Filtration System Market Share (%), Size and Forecast (by Value USD Mn) (2024-2032) by Country 4.7.4.1. United States 4.7.4.1.1. By Technology Type 4.7.4.1.2. By Applications 4.7.4.1.3. By End-User Industry 4.7.4.2. Canada 4.7.4.3. Mexico 5. Deep Dive: Europe 5.1.1. Europe Market Size 2024 and forecast 2025-2032 (USD Billion) 5.1.2. Year-over-year growth 2024-2032 (%) 5.1.3. Europe Market Share Analysis 2024 (%) 5.2. Europe Water Filtration System Industry Trends in 2024 and Future Outlook 5.3. Water Filtration System as a Key Growth Driver in the Europe Economy 5.4. Challenges of Europe Water Filtration System Market 5.5. Growth Opportunity for Water Filtration System in Europe Market 5.6. Regulatory Landscape in Europe WATER FILTRATION SYSTEM Industry 5.7. Europe Water Filtration System Market Segmentation and Sub Segmentation Analysis: Market Size and Forecast (by Value USD Mn) (2024-2032) 5.7.1. By Technology Type 5.7.1.1. Reverse Osmosis (RO) Filtration Systems 5.7.1.2. Ultraviolet (UV) Disinfection Systems 5.7.1.3. Ultrafiltration (UF) Systems 5.7.1.4. Carbon Filters (Activated Carbon) 5.7.1.5. Gravity-based 5.7.1.6. Others 5.7.2. By Applications 5.7.2.1. Drinking Water Treatment 5.7.2.2. Wastewater Treatment 5.7.2.3. Industrial Process Water 5.7.2.4. Others 5.7.3. By End Use Industry 5.7.3.1. Residential 5.7.3.2. Commercial 5.7.3.3. Municipal 5.7.3.4. Industrial 5.7.4. Europe Water Filtration System Market Share (%), Size and Forecast (by Value USD Mn) (2024-2032) by Country 5.7.4.1. United Kingdom 5.7.4.1.1. By Technology Type 5.7.4.1.2. By Applications 5.7.4.1.3. By End-User Industry 5.7.4.2. France 5.7.4.3. Germany 5.7.4.4. Italy 5.7.4.5. Spain 5.7.4.6. Sweden 5.7.4.7. Russia 5.7.4.8. Rest of Europe 6. Deep Dive: Asia Pacific 6.1.1. Asia Pacific Market Size 2024 and forecast 2025-2032 (USD Billion) 6.1.2. Year-over-year growth 2024-2032 (%) 6.1.3. Asia Pacific Market Share Analysis 2024 (%) 6.2. Asia Pacific Water Filtration System Industry Trends in 2024 and Future Outlook 6.3. Water Filtration System as a Key Growth Driver in the Asia Pacific Economy 6.4. Challenges of Asia Pacific Water Filtration System Market 6.5. Growth Opportunity for Water Filtration System in Asia Pacific Market 6.6. Regulatory Landscape in Asia Pacific Water Filtration System Industry 6.7. Asia Pacific Water Filtration System Market Segmentation and Sub Segmentation Analysis: Market Size and Forecast (by Value USD Mn) (2024-2032) 6.7.1. By Technology Type 6.7.1.1. Reverse Osmosis (RO) Filtration Systems 6.7.1.2. Ultraviolet (UV) Disinfection Systems 6.7.1.3. Ultrafiltration (UF) Systems 6.7.1.4. Carbon Filters (Activated Carbon) 6.7.1.5. Gravity-based 6.7.1.6. Others 6.7.2. By Applications 6.7.2.1. Drinking Water Treatment 6.7.2.2. Wastewater Treatment 6.7.2.3. Industrial Process Water 6.7.2.4. Others 6.7.3. By End Use Industry 6.7.3.1. Residential 6.7.3.2. Commercial 6.7.3.3. Municipal 6.7.3.4. Industrial 6.7.4. Asia Pacific Water Filtration System Market Share (%), Size and Forecast (by Value USD Mn) (2024-2032) by Country 6.7.4.1. China 6.7.4.1.1. By Technology Type 6.7.4.1.2. By Applications 6.7.4.1.3. By End-User Industry 6.7.4.2. S Korea 6.7.4.3. Japan 6.7.4.4. India 6.7.4.5. Australia 6.7.4.6. Indonesia 6.7.4.7. Malaysia 6.7.4.8. Philippines 6.7.4.9. Thailand 6.7.4.10. Vietnam 6.7.4.11. Rest of Asia Pacific 7. Deep Dive: Middle East and Africa 7.1.1. Middle East and Africa Market Size 2024 and forecast 2025-2032 (USD Billion) 7.1.2. Year-over-year growth 2024-2032 (%) 7.1.3. Middle East and Africa Market Share Analysis 2024 (%) 7.2. Middle East and Africa Water Filtration System Industry Trends in 2024 and Future Outlook 7.3. Water Filtration System as a Key Growth Driver in the Middle East and Africa Economy 7.4. Challenges of Middle East and Africa Water Filtration System Market 7.5. Growth Opportunity for Water Filtration System in Middle East and Africa Market 7.6. Regulatory Landscape in Middle East and Africa Water Filtration System Industry 7.7. Middle East and Africa Water Filtration System Market Segmentation and Sub Segmentation Analysis: Market Size and Forecast (by Value USD Mn) (2024-2032) 7.7.1. By Technology Type 7.7.1.1. Reverse Osmosis (RO) Filtration Systems 7.7.1.2. Ultraviolet (UV) Disinfection Systems 7.7.1.3. Ultrafiltration (UF) Systems 7.7.1.4. Carbon Filters (Activated Carbon) 7.7.1.5. Gravity-based 7.7.1.6. Others 7.7.2. By Applications 7.7.2.1. Drinking Water Treatment 7.7.2.2. Wastewater Treatment 7.7.2.3. Industrial Process Water 7.7.2.4. Others 7.7.3. By End Use Industry 7.7.3.1. Residential 7.7.3.2. Commercial 7.7.3.3. Municipal 7.7.3.4. Industrial 7.7.4. Middle East and Africa Water Filtration System Market Share (%), Size and Forecast (by Value USD Mn) (2024-2032) by Country 7.7.4.1. South Africa 7.7.4.1.1. By Technology Type 7.7.4.1.2. By Applications 7.7.4.1.3. By End-User Industry 7.7.4.2. GCC 7.7.4.3. Egypt 7.7.4.4. Nigeria 7.7.4.5. Turkey 7.7.4.6. Rest of ME&A 8. Deep Dive: South America 8.1.1. South America Market Size 2024 and forecast 2025-2032 (USD Billion) 8.1.2. Year-over-year growth 2024-2032 (%) 8.1.3. South America Market Share Analysis 2024 (%) 8.2. South America Water Filtration System Industry Trends in 2024 and Future Outlook 8.3. Water Filtration System as a Key Growth Driver in the South America Economy 8.4. Challenges of South America Water Filtration System Market 8.5. Growth Opportunity for Water Filtration System in South America Market 8.6. Regulatory Landscape in South America Water Filtration System Industry 8.7. South America Water Filtration System Market Segmentation and Sub Segmentation Analysis: Market Size and Forecast (by Value USD Mn) (2024-2032) 8.7.1. By Technology Type 8.7.1.1. Reverse Osmosis (RO) Filtration Systems 8.7.1.2. Ultraviolet (UV) Disinfection Systems 8.7.1.3. Ultrafiltration (UF) Systems 8.7.1.4. Carbon Filters (Activated Carbon) 8.7.1.5. Gravity-based 8.7.1.6. Others 8.7.2. By Applications 8.7.2.1. Drinking Water Treatment 8.7.2.2. Wastewater Treatment 8.7.2.3. Industrial Process Water 8.7.2.4. Others 8.7.3. By End Use Industry 8.7.3.1. Residential 8.7.3.2. Commercial 8.7.3.3. Municipal 8.7.3.4. Industrial 8.7.4. South America Water Filtration System Market Share (%), Size and Forecast (by Value USD Mn) (2024-2032) by Country 8.7.4.1. Brazil 8.7.4.1.1. By Technology Type 8.7.4.1.2. By Applications 8.7.4.1.3. By End-User Industry 8.7.4.2. Argentina 8.7.4.3. Colombia 8.7.4.4. Chile 8.7.4.5. Rest Of South America 9. Global Water Filtration System Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. Pricing of Software 9.3.4. End-user Segment 9.3.5. Revenue (2024) 9.3.6. Market Share (%) 9.3.7. Clients of Company 9.4. Market Structure 9.4.1. Market Leaders 9.4.2. Market Followers 9.4.3. Emerging Players 9.5. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. A O. Smith Corporation 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Recent Developments 10.2. Pentair plc 10.3. Veolia Water Technologies 10.4. Xylem Inc. 10.5. Brita GmbH 10.6. Culligan International 10.7. Coway Co, Ltd. 10.8. Wikipedia 10.9. 3M Company 10.10. MANN+HUMMEL 10.11. BWT AG 10.12. Kent RO Systems Ltd. 10.13. Eureka Forbes Ltd. 10.14. Tata Chemicals Ltd. 10.15. Ion Exchange (Global) Ltd. 10.16. Kurita Water Industries Ltd. 10.17. Kemira Chemicals Global Pvt. Ltd. 10.18. Aquafilsep Inc. 10.19. Inox Water Systems Pvt. Ltd. 10.20. Silver Filtration Global Ltd. 10.21. Pure Water Enterprises Pvt. Ltd. 10.22. Haier (Group 10.23. Midea (Group) 10.24. Whirlpool Corporation 10.25. Panasonic Corporation 10.26. TORAY Industries 10.27. GREE Electric Appliances 10.28. APEC Water Systems 10.29. Atlas Filtri Sr.l. 10.30. Haier / Ecowater Systems 10.31. Others 11. Key Findings 12. Industry Recommendations 13. Water Filtration System Market: Research Methodology 14. Terms and Glossary