Global Boron Trifluoride Market size was valued at USD 290.18 Mn. in 2023 and the total Boron Trifluoride revenue is expected to grow by 5.6 % from 2024 to 2030, reaching nearly USD 424.94 Mn.Boron Trifluoride Market Overview:

Boron Trifluoride, a non-flammable compressed gas, serves as a potent acidic catalyst or co-catalyst in diverse organic synthesis reactions. Its applications extend to the production of synthetic oils, lubricant additives, and high-purity boron isotopes. Boron Trifluoride plays a pivotal role in various processes, including the alkylation of aromatic hydrocarbons, polymerization of phenolic and epoxy resins, and various isomerization, esterification, and condensation reactions. The Boron Trifluoride market is expected to witness a rapid growth during the forecast period, primarily driven by its versatile utility spanning diverse industries. Within the chemical and petrochemical sectors, Boron Trifluoride serves as an indispensable catalyst, facilitating a plethora of chemical transformations. Its significance further extends into the electronics industry, where it is employed in the production of semiconductors and integrated circuit fabrication. The rising demand for specialty chemicals, coupled with expansions within the automotive and aerospace sectors, significantly bolsters market expansion. Recent developments in the BF3 market underscore a commitment to environmentally friendly production methods, aligning with regulatory mandates. For instance, in 2018, Praxair merged with Linde AG to form Linde plc, one of the world's largest industrial gas companies. This merger might have influenced their operations and strategies. These strategic endeavors, combined with the mounting industrial reliance on BF3, are poised to sustain the market's growth trajectory, firmly establishing it as an indispensable component within the global chemical and electronics sectors.Boron Trifluoride Market Scope and Research Methodology

The Boron Trifluoride Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Boron Trifluoride Market during the forecast period. The research on the Boron Trifluoride Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply, and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.To know about the Research Methodology :- Request Free Sample Report

Boron Trifluoride Market Dynamics:

Growing Demand in the Pharmaceuticals and Electronics industries drives boron Trifluoride Market growth The Boron Trifluoride market is experiencing significant growth driven by various factors across several industries. In pharmaceuticals and agrochemicals, the demand for specialty chemicals has surged, leading to increased BF3 utilization in pharmaceutical intermediates and API synthesis. The flourishing electronics industry, represented by giants like TSMC and Intel, is fueling demand for BF3 in semiconductor production, largely fueled by the widespread adoption of smartphones, laptops, and IoT devices. Environmental concerns have driven the development of eco-friendly BF3 production methods, favoring companies such as Linde plc and Air Products that prioritize sustainability and adhere to regulatory standards. The automotive sector's relentless pursuit of lightweight materials to enhance fuel efficiency, as exampled by BMW's CFRP components, has provided an additional boost to BF3 utilization. Aerospace expansions, led by pioneers such as Boeing and SpaceX, have generated substantial demand for BF3-derived materials, particularly in composites and advanced materials. The oil and gas industry's ongoing exploration activities, including deepwater drilling ventures by ExxonMobil, have resulted in increased BF3 utilization for catalytic processes. The diversification and expansion within the chemical industry have opened up new opportunities for BF3 applications, with companies like Dow Chemical effectively leveraging BF3 catalysts. In the pharmaceutical industry, the relentless research and development endeavors, particularly in vaccine development pursued by Pfizer and Moderna, necessitate BF3-derived intermediates. The global shift towards electric vehicles and renewable energy sources, spearheaded by industry leaders like Tesla and CATL, has led to a heightened demand for BF3 in battery materials, further boosting Boron Trifluoride market growth. High Production Costs with Complex Production and Storage The Boron Trifluoride market growth is hindered by numerous technical and business challenges. From a manufacturing standpoint, ensuring a consistent and high-purity supply of boron and fluorine, both critical raw materials for BF3 poses a major obstacle. The intricate and energy-intensive production procedure, which involves reacting boron oxide with hydrogen fluoride, demands precision and careful handling due to the hazardous nature of these materials. Ensuring safety during production and transportation is paramount due to BF3's reactivity and toxicity, further complicated by its storage as a compressed gas, requiring specialized equipment and stringent safety protocols, and meeting to these protocols can hinder the market growth. Boron Trifluoride market volatility and price fluctuations in raw materials, such as boron and fluorine compounds, disrupt production costs and pricing strategies, impacting profitability. High competition from alternative catalysts and chemicals in various industries, such as the semiconductor sector's exploration of alternative etching materials, creates a dynamic competitive landscape. BF3 production is subject to region-specific chemical regulations and laws, such as the stringent regulations imposed by the U.S. EPA and the EU's REACH regulation, necessitating strict compliance, and adding complexity to operations. Navigating these regional chemical laws while addressing technical and business challenges is crucial for BF3 manufacturers to maintain a competitive edge and ensure safe and compliant production and distribution. Global supply chain disruptions, stricter environmental regulations, rising energy costs, the emergence of alternatives, price fluctuations, stringent health and safety regulations, economic downturns, trade disputes, technological advancements, and transportation risks collectively contribute to the considerable challenges and restraints faced by the Boron Trifluoride market. Boron Trifluoride Role in Powering the Electric Vehicle Revolution The Boron Trifluoride market presents several opportunities across multiple sectors. The growing demand for high-performance semiconductors, driven by the electronics industry's growth and the advent of 5G technology, offers a substantial opening for boron trifluoride suppliers who play a crucial role as dopants in silicon wafer production. Simultaneously, the global shift towards renewable energy sources, exemplified by the rising demand for clean energy technologies like fuel cells and lithium-ion batteries, positions boron trifluoride as a vital component for electric vehicle proliferation. In agriculture, the necessity to boost crop yields due to the expanding population underlines the importance of boron trifluoride in enhancing agricultural product efficiency. The aerospace, automotive, and construction sectors also beckon with the increasing demand for lightweight, high-performance materials such as boron-based composites and polymers, further elevating boron trifluoride's market prospects. The growing concerns regarding air quality and workplace safety fuel the demand for gas detection sensors, where boron trifluoride is indispensable, providing a growth avenue for manufacturers. The steady market for boron trifluoride persists in research and development activities across various industries, sustaining its demand as a reagent or catalyst, particularly in fields like chemistry, materials science, and nanotechnology.Boron Trifluoride Market Segment Analysis:

Based on Type, BF3 Gas dominated the Boron Trifluoride Market in 2023 and is expected to dominate the market over the forecast period. As it is an elemental form, it finds widespread use as a catalyst in various chemical processes, especially in the petrochemical industry. BF3 Tetrahydrofuran Complex is highly favored for its role in organic synthesis, particularly in polymerization reactions and as a Lewis acid catalyst. BF3 Methanol Complex is a critical component in refining and petrochemical applications, while BF3 Diethyl Etherate Complex plays a pivotal role in pharmaceutical and agrochemical manufacturing due to its selective reactivity. BF3 Acetonitrile Complex holds a niche in specialty chemicals and catalysis. While each type caters to specific industrial needs, BF3 Tetrahydrofuran Complex stands out as a popular choice for organic synthesis, showcasing robust adoption levels. Based on Grade, Chemical grade BF3 Dominated the Boron Trifluoride Market. It plays a pivotal role in chemical manufacturing processes across industries. Its versatility as a catalyst and reagent makes it a valuable choice for a wide range of chemical reactions. Electronic grade BF3 is a fast-growing segment in the Boron Trifluoride Market and characterized by its extremely high purity, dominates the semiconductor industry, serving as an essential dopant for silicon wafers to ensure optimal electronic performance. Its adoption is driven by the burgeoning electronics sector and the demand for cutting-edge semiconductor devices. Reagent grade BF3, renowned for its exceptional purity and consistency, finds its applications in research laboratories and pharmaceutical manufacturing, where precision and accuracy are paramount. This segmented approach ensures a resilient Boron Trifluoride market, ready to meet the diverse needs of various industries.Boron Trifluoride Market Regional Insights:

North America dominated the Boron Trifluoride Market in the United States, owing to its robust chemical manufacturing industry and technological advancements. North America not only serves its domestic demand but also exports BF3 to various global markets. Meanwhile, Asia-Pacific emerges as a substantial producing and consuming region, driven by the thriving semiconductor and electronics sectors in countries like China, South Korea, and Japan. These nations produce BF3 for their needs but also import significant quantities to meet the surging demand for high-performance semiconductors. Europe is a fast-growing region in the Boron Trifluoride Market with its emphasis on pharmaceuticals and specialty chemicals, is a fast-growing BF3 consumer, particularly in the reagent grade. Intercontinental trade flows are evident in the import-export dynamics, with North America exporting to both Asia-Pacific and Europe, underscoring the global supply chain intricacies within the BF3 market. South America and the Middle East, while smaller in production and consumption, expected steady growth due to their expanding industrial bases. Boron trifluoride import shipments amounted to 9.7K, serving 489 importers sourced from 435 suppliers, with India, Germany, and the United States being the top three suppliers. India stands out as the largest importer with around 4,323 shipments, followed by the United States with 2,921 shipments, and Taiwan ranking third with 585 shipments, showcasing the global trade dynamics in the Boron Trifluoride Market.Competitive Landscape Boron Trifluoride Market:

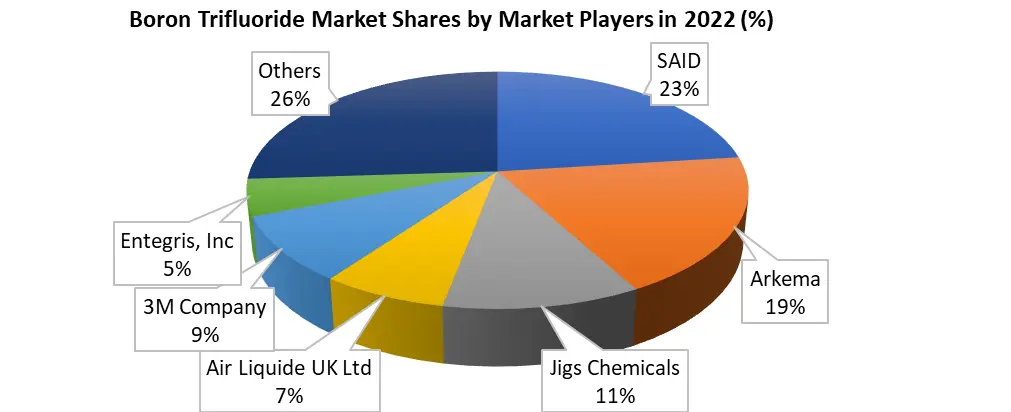

The boron Trifluoride market is highly competitive and is shaped by a diverse array of industry leaders and key players, including 3M Company, Air Liquide UK Ltd, American Elements, Arkema, ATCO Atmospheric and Speciality Gases Private Limited, BASF, Borman, DuPont, Entegris, Inc, Honeywell, and others. These companies offer a wide spectrum of Boron Trifluoride products and services, each striving to maintain a competitive edge through innovative product offerings and sustainability initiatives. For instance, Honeywell is notable for its active involvement in sustainability efforts. While some major players expanding their offerings by merging with other players such as in the 2018 merger between Praxair and Linde AG to form Linde plc, a global industrial gas giant, has significant implications for their strategies and market presence. Arkema's commitment to sustainability is reflected in its development of eco-friendly products, but the latest updates on BF3-related advancements may require more current information to fully understand the competitive scenario in this dynamic market.Boron Trifluoride Market Scope: Inquiry Before Buying

Boron Trifluoride Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 290.18 Bn. Forecast Period 2024 to 2030 CAGR: 5.6% Market Size in 2030: US $ 424.94 Bn. Segments Covered: by Type BF3 (Gas) BF3 Tetrahydrofuran Complex BF3 Methanol Complex BF3 Diethyl Etherate Complex BF3 Acetonitrile Complex Others by Grade Electronic grade Chemical grade Reagent grade by End Use Semiconductor Manufacturing Chemical Manufacturing Pharmaceutical Polymer and Petrochemicals Agrochemicals Others Boron Trifluoride Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Boron Trifluoride Market Key Players

1. 3M Company - St. Paul, Minnesota, USA 2. Air Liquide UK Ltd - Guildford, Surrey, United Kingdom 3. Airgas - Radnor, Pennsylvania, USA 4. American Elements - Los Angeles, California, USA 5. Arkema - Colombes, France 6. ATCO Atmospheric and Speciality Gases Private Limited - Ahmedabad, India 7. BASF - Ludwigshafen, Germany 8. Borman - San Francisco, California, USA 9. DuPont - Wilmington, Delaware, USA 10. Entegris, Inc - Billerica, Massachusetts, USA 11. Honeywell - Charlotte, North Carolina, USA 12. Jigs chemical - Mumbai, India 13. Kishida Chemical Co., Ltd. - Tokyo, Japan 14. Linde plc - Guildford, Surrey, United Kingdom 15. Messer Group - Bad Soden, Germany 16. MilliporeSigma - Burlington, Massachusetts, USA 17. Nacalai - Kyoto, Japan 18. Nippon Gases - Tokyo, Japan 19. SIAD - Bergamo, Italy 20. Sisco Research Laboratories Pvt. Ltd. - Mumbai, India 21. UBE Corporation - Tokyo, Japan Frequently Asked Questions: 1] What segments are covered in the Global Boron Trifluoride Market report? Ans. The segments covered in the Boron Trifluoride Market report are based on Type, Grade, End Use, and Region. 2] Which region is expected to hold the highest share of the Global Boron Trifluoride Market? Ans. The North America region is expected to hold the highest share of the Boron Trifluoride Market. 3] What is the market size of the Global Boron Trifluoride Market by 2030? Ans. The market size of the Boron Trifluoride Market by 2030 is expected to reach USD 424.94 Bn. 4] What is the forecast period for the Global Boron Trifluoride Market? Ans. The forecast period for the Boron Trifluoride Market is 2024-2030. 5] What was the market size of the Global Boron Trifluoride Market in 2023? Ans. The market size of the Boron Trifluoride Market in 2023 was valued at USD 290.18 Bn.

1. Boron Trifluoride Market: Research Methodology 2. Boron Trifluoride Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Boron Trifluoride Market: Dynamics 3.1. Boron Trifluoride Market Trends by Region 3.1.1. Global Boron Trifluoride Market Trends 3.1.2. North America Boron Trifluoride Market Trends 3.1.3. Europe Boron Trifluoride Market Trends 3.1.4. Asia Pacific Boron Trifluoride Market Trends 3.1.5. Middle East and Africa Boron Trifluoride Market Trends 3.1.6. South America Boron Trifluoride Market Trends 3.2. Boron Trifluoride Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Boron Trifluoride Market Drivers 3.2.1.2. North America Boron Trifluoride Market Restraints 3.2.1.3. North America Boron Trifluoride Market Opportunities 3.2.1.4. North America Boron Trifluoride Market Challenges 3.2.2. Europe 3.2.2.1. Europe Boron Trifluoride Market Drivers 3.2.2.2. Europe Boron Trifluoride Market Restraints 3.2.2.3. Europe Boron Trifluoride Market Opportunities 3.2.2.4. Europe Boron Trifluoride Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Boron Trifluoride Market Drivers 3.2.3.2. Asia Pacific Boron Trifluoride Market Restraints 3.2.3.3. Asia Pacific Boron Trifluoride Market Opportunities 3.2.3.4. Asia Pacific Boron Trifluoride Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Boron Trifluoride Market Drivers 3.2.4.2. Middle East and Africa Boron Trifluoride Market Restraints 3.2.4.3. Middle East and Africa Boron Trifluoride Market Opportunities 3.2.4.4. Middle East and Africa Boron Trifluoride Market Challenges 3.2.5. South America 3.2.5.1. South America Boron Trifluoride Market Drivers 3.2.5.2. South America Boron Trifluoride Market Restraints 3.2.5.3. South America Boron Trifluoride Market Opportunities 3.2.5.4. South America Boron Trifluoride Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Boron Trifluoride Industry 3.8. Analysis of Government Schemes and Initiatives For Boron Trifluoride Industry 3.9. The Global Pandemic Impact on Boron Trifluoride Market 4. Boron Trifluoride Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 4.1.1. BF3 (Gas) 4.1.2. BF3 Tetrahydrofuran Complex 4.1.3. BF3 Methanol Complex 4.1.4. BF3 Diethyl Etherate Complex 4.1.5. BF3 Acetonitrile Complex 4.1.6. Others 4.2. Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 4.2.1. Electronic grade 4.2.2. Chemical grade 4.2.3. Reagent grade 4.3. Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 4.3.1. Semiconductor Manufacturing 4.3.2. Chemical Manufacturing 4.3.3. Pharmaceutical 4.3.4. Polymer and Petrochemicals 4.3.5. Agrochemicals 4.3.6. Others 4.4. Boron Trifluoride Market Size and Forecast, by Region (2023-2030) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Boron Trifluoride Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. North America Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 5.1.1. BF3 (Gas) 5.1.2. BF3 Tetrahydrofuran Complex 5.1.3. BF3 Methanol Complex 5.1.4. BF3 Diethyl Etherate Complex 5.1.5. BF3 Acetonitrile Complex 5.1.6. Others 5.2. North America Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 5.2.1. Electronic grade 5.2.2. Chemical grade 5.2.3. Reagent grade 5.3. North America Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 5.3.1. Semiconductor Manufacturing 5.3.2. Chemical Manufacturing 5.3.3. Pharmaceutical 5.3.4. Polymer and Petrochemicals 5.3.5. Agrochemicals 5.3.6. Others 5.4. North America Boron Trifluoride Market Size and Forecast, by Country (2023-2030) 5.4.1. United States 5.4.1.1. United States Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 5.4.1.1.1. BF3 (Gas) 5.4.1.1.2. BF3 Tetrahydrofuran Complex 5.4.1.1.3. BF3 Methanol Complex 5.4.1.1.4. BF3 Diethyl Etherate Complex 5.4.1.1.5. BF3 Acetonitrile Complex 5.4.1.1.6. Others 5.4.1.2. United States Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 5.4.1.2.1. Electronic grade 5.4.1.2.2. Chemical grade 5.4.1.2.3. Reagent grade 5.4.1.3. United States Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 5.4.1.3.1. Semiconductor Manufacturing 5.4.1.3.2. Chemical Manufacturing 5.4.1.3.3. Pharmaceutical 5.4.1.3.4. Polymer and Petrochemicals 5.4.1.3.5. Agrochemicals 5.4.1.3.6. Others 5.4.2. Canada 5.4.2.1. Canada Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 5.4.2.1.1. BF3 (Gas) 5.4.2.1.2. BF3 Tetrahydrofuran Complex 5.4.2.1.3. BF3 Methanol Complex 5.4.2.1.4. BF3 Diethyl Etherate Complex 5.4.2.1.5. BF3 Acetonitrile Complex 5.4.2.1.6. Others 5.4.2.2. Canada Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 5.4.2.2.1. Electronic grade 5.4.2.2.2. Chemical grade 5.4.2.2.3. Reagent grade 5.4.2.3. Canada Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 5.4.2.3.1. Semiconductor Manufacturing 5.4.2.3.2. Chemical Manufacturing 5.4.2.3.3. Pharmaceutical 5.4.2.3.4. Polymer and Petrochemicals 5.4.2.3.5. Agrochemicals 5.4.2.3.6. Others 5.4.3. Mexico 5.4.3.1. Mexico Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 5.4.3.1.1. BF3 (Gas) 5.4.3.1.2. BF3 Tetrahydrofuran Complex 5.4.3.1.3. BF3 Methanol Complex 5.4.3.1.4. BF3 Diethyl Etherate Complex 5.4.3.1.5. BF3 Acetonitrile Complex 5.4.3.1.6. Others 5.4.3.2. Mexico Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 5.4.3.2.1. Electronic grade 5.4.3.2.2. Chemical grade 5.4.3.2.3. Reagent grade 5.4.3.3. Mexico Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 5.4.3.3.1. Semiconductor Manufacturing 5.4.3.3.2. Chemical Manufacturing 5.4.3.3.3. Pharmaceutical 5.4.3.3.4. Polymer and Petrochemicals 5.4.3.3.5. Agrochemicals 5.4.3.3.6. Others 6. Europe Boron Trifluoride Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Europe Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.2. Europe Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.3. Europe Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4. Europe Boron Trifluoride Market Size and Forecast, by Country (2023-2030) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.1.2. United Kingdom Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.1.3. United Kingdom Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.2. France 6.4.2.1. France Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.2.2. France Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.2.3. France Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.3. Germany 6.4.3.1. Germany Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Germany Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.3.3. Germany Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.4. Italy 6.4.4.1. Italy Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.4.2. Italy Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.4.3. Italy Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.5. Spain 6.4.5.1. Spain Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Spain Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.5.3. Spain Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.6. Sweden 6.4.6.1. Sweden Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Sweden Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.6.3. Sweden Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.7. Austria 6.4.7.1. Austria Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Austria Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.7.3. Austria Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Rest of Europe Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 6.4.8.3. Rest of Europe Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7. Asia Pacific Boron Trifluoride Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.3. Asia Pacific Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4. Asia Pacific Boron Trifluoride Market Size and Forecast, by Country (2023-2030) 7.4.1. China 7.4.1.1. China Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.1.2. China Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.1.3. China Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.2. S Korea 7.4.2.1. S Korea Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.2.2. S Korea Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.2.3. S Korea Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.3. Japan 7.4.3.1. Japan Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Japan Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.3.3. Japan Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.4. India 7.4.4.1. India Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.4.2. India Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.4.3. India Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.5. Australia 7.4.5.1. Australia Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.5.2. Australia Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.5.3. Australia Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.6. Indonesia 7.4.6.1. Indonesia Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.6.2. Indonesia Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.6.3. Indonesia Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.7. Malaysia 7.4.7.1. Malaysia Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.7.2. Malaysia Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.7.3. Malaysia Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.8. Vietnam 7.4.8.1. Vietnam Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.8.2. Vietnam Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.8.3. Vietnam Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.9. Taiwan 7.4.9.1. Taiwan Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.9.2. Taiwan Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.9.3. Taiwan Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 7.4.10. Rest of Asia Pacific 7.4.10.1. Rest of Asia Pacific Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 7.4.10.2. Rest of Asia Pacific Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 7.4.10.3. Rest of Asia Pacific Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 8. Middle East and Africa Boron Trifluoride Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 8.3. Middle East and Africa Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 8.4. Middle East and Africa Boron Trifluoride Market Size and Forecast, by Country (2023-2030) 8.4.1. South Africa 8.4.1.1. South Africa Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 8.4.1.2. South Africa Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 8.4.1.3. South Africa Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 8.4.2. GCC 8.4.2.1. GCC Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 8.4.2.2. GCC Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 8.4.2.3. GCC Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 8.4.3. Nigeria 8.4.3.1. Nigeria Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Nigeria Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 8.4.3.3. Nigeria Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 8.4.3.4. ) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 8.4.4.2. Rest of ME&A Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 8.4.4.3. Rest of ME&A Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 9. South America Boron Trifluoride Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 9.1. South America Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 9.2. South America Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 9.3. South America Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 9.4. South America Boron Trifluoride Market Size and Forecast, by Country (2023-2030) 9.4.1. Brazil 9.4.1.1. Brazil Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 9.4.1.2. Brazil Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 9.4.1.3. Brazil Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 9.4.2. Argentina 9.4.2.1. Argentina Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 9.4.2.2. Argentina Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 9.4.2.3. Argentina Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 9.4.3. Rest Of South America 9.4.3.1. Rest Of South America Boron Trifluoride Market Size and Forecast, by Type (2023-2030) 9.4.3.2. Rest Of South America Boron Trifluoride Market Size and Forecast, by Grade (2023-2030) 9.4.3.3. Rest Of South America Boron Trifluoride Market Size and Forecast, by End Use (2023-2030) 10. Global Boron Trifluoride Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Boron Trifluoride Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. 3M Company 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Air Liquide UK Ltd 11.3. Airgas 11.4. American Elements 11.5. Arkema 11.6. ATCO Atmospheric And Speciality Gases Private Limited 11.7. BASF 11.8. Borman 11.9. DuPont 11.10. Entegris, Inc 11.11. Honeywell 11.12. Jigs chemical 11.13. Kishida Chemical Co.,Ltd. 11.14. Linde plc 11.15. Messer Group 11.16. MilliporeSigma 11.17. nacalai 11.18. Nippon Gases 11.19. SIAD 11.20. Sisco Research Laboratories Pvt. Ltd. 11.21. UBE Corporation 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary