Washing Machine Market size was valued at USD 60.12 Billion in 2023 and the Washing Machine Market revenue is expected to reach USD 80.73 Billion by 2030, at a CAGR of 4.3 % over the forecast period.Washing Machine Market Overview

A washing machine is a household appliance designed for cleaning clothes, linens, and other fabric-based items. It automates the process of washing by using water, detergent, and mechanical action to remove dirt, stains, and odors from the fabrics. Washing machines typically have a large drum where the clothes are placed. The drum rotates, agitating the clothes in water mixed with detergent, which helps to loosen dirt and grime. Modern washing machines have various features such as different wash cycles for different types of fabrics or stains, temperature control, and options for adjusting spin speed. Washing machines have become an essential appliance in households around the world, offering convenience and efficiency in laundry care.To know about the Research Methodology :- Request Free Sample Report The global washing machine market has been steadily growing due to factors such as urbanization, rising disposable incomes, and changing lifestyles. Emerging economies, particularly in Asia-Pacific and Latin America, have been significant drivers of this growth. Washing machine manufacturers are continuously introducing new features and technologies to improve the efficiency, convenience, and performance of washing machines. These include innovations such as energy-efficient models, smart connectivity features, advanced washing algorithms, and water-saving technologies. Washing machine preferences and purchasing patterns vary significantly between regions. Factors such as household size, living standards, infrastructure development, and cultural preferences influence the Washing Machine market dynamics in different parts of the world.

Washing Machine Market Dynamics

Changing Lifestyles and Time Constraints to boost Washing Machine Market growth Busy lifestyles, longer working hours, and dual-income households have led to a greater demand for time-saving solutions, including appliances that automate household chores like laundry. Washing machines provide a convenient solution for individuals and families seeking to balance work, family, and personal time. Continuous technological advancements drive innovation in the washing machine industry, leading to the development of more efficient, convenient, and feature-rich appliances. Technologies such as inverter motors, smart connectivity, water-saving mechanisms, and advanced washing algorithms enhance the performance, energy efficiency, and user experience of washing machines, driving consumer interest and Washing Machine market growth. Growing awareness of environmental issues, including water scarcity and energy consumption, has prompted consumers and governments to prioritize eco-friendly and energy-efficient appliances. Regulatory standards and energy labeling programs encourage washing machine manufacturers to develop washing machines that consume less water and energy, driving the adoption of eco-friendly technologies in the market. Front-loading washing machines have gained popularity over top-loading models due to their superior cleaning performance, energy efficiency, and water-saving features. Consumer preferences for front-loading machines are influenced by factors such as urban living spaces, environmental consciousness, and the desire for modern and aesthetically pleasing appliances. The integration of smart features and connectivity options in washing machines appeals to tech-savvy consumers seeking greater convenience and control over their appliances. Smart washing machines offer features such as remote monitoring, smartphone control, voice commands, and personalized washing recommendations, enhancing the user experience and driving washing machine market demand. The replacement and upgradation cycles of washing machines contribute to market demand, as consumers replace old or outdated appliances with newer models offering improved features, efficiency, and performance. Factors such as product durability, technological obsolescence, and consumer preferences for the latest innovations influence replacement cycles in the washing machine market. High Initial Cost of machines to restrain Washing Machine Market growth The high initial cost associated with home appliance, including washing machine significantly restraints the Washing Machine Market growth. While washing machines offer long-term savings in terms of time, water, and energy efficiency, the upfront investment is a barrier, particularly for budget-conscious consumers or those in regions with lower purchasing power. In mature and developed markets such as North America and Western Europe, the washing machine market is approaching saturation, with a significant portion of households already owning a washing machine. This limits the growth potential in these regions, as manufacturers rely on replacement sales rather than capturing new customers. In developing regions with inadequate infrastructure, such as unreliable electricity supply or limited access to clean water, the adoption of washing machines is hindered. Without proper infrastructure support, consumers face challenges in using and maintaining washing machines effectively, reducing market penetration in these regions. In some regions or demographic segments, there are preference for traditional washing methods, such as hand washing or using communal laundry facilities. Cultural preferences, habits, and beliefs about cleanliness and garment care influence consumer attitudes toward washing machines, limiting washing machine market growth in these segments. Consumers hesitant to invest in washing machines due to concerns about reliability, maintenance costs, and the lifespan of the appliance. Issues such as breakdowns, repairs, and replacement parts availability impact consumer confidence and influence purchase decisions, particularly for products with complex features or advanced technologies. Economic downturns, currency fluctuations, and market volatility impact consumer purchasing behavior and confidence in investing in durable goods like washing machines. Uncertainty about future economic conditions or job stability leads consumers to postpone discretionary purchases, affecting market demand and growth.Washing Machine Market Segment Analysis

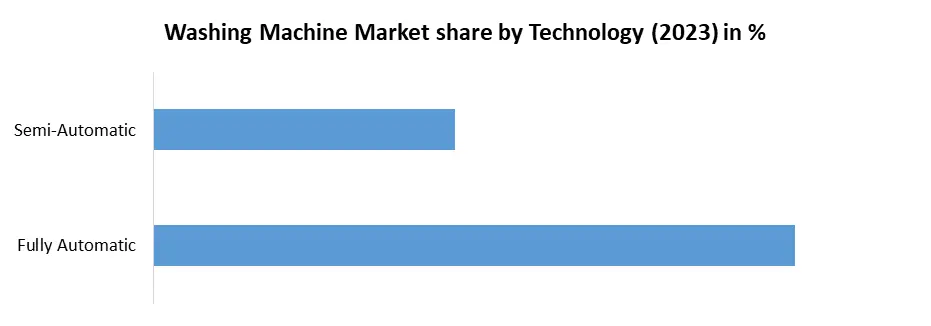

Based on Type, the market is segmented into Front Load and Top Load. The front Load segment dominated the market in 2023 and is expected to hold the largest Washing Machine Market share over the forecast period. The front-load segment in the washing machine industry is a category of washing machines characterized by their design, where the door to load and unload laundry is located on the front of the machine rather than on the top. These machines typically have a horizontal axis drum that tumbles the clothes in a motion that is more gentle compared to top-loading machines. Front-load washing machines have a distinct design that allows users to load and unload laundry from the front of the machine. This design typically includes a horizontally-oriented drum that rotates on a horizontal axis during the wash cycle. This tumbling action is considered more effective in cleaning clothes while being gentler on fabrics compared to the agitator mechanism often found in top-loading machines, which is expected to boost the Washing Machine Market growth. Front-load washing machines are often favored for their sleek and modern appearance. The front-facing door and clean lines of the design contribute to a contemporary aesthetic that complements modern home interiors. Many consumers are drawn to the stylish appearance of front-load machines, considering them not just functional appliances but also design elements in their homes.Based on Technology, the market is segmented into Fully Automatic and Semi-Automatic. The fully Automatic segment dominated the market in 2023 and is expected to hold the largest Washing Machine Market share over the forecast period. Fully automatic washing machines offer a range of pre-set wash programs tailored to different fabric types and soil levels. These programs include options for delicate fabrics, heavy-duty cleaning, quick wash, and more. Advanced sensors in fully automatic machines detect the size of the laundry load and adjust the water level and temperature accordingly to optimize efficiency and performance. Fully automatic washing machines use load-sensing technology to detect the weight and distribution of the laundry load. They adjust the spin speed and distribution of the load to ensure proper balance and prevent vibrations during operation. Washing machine manufacturers are exploring the integration of AI-driven algorithms to optimize wash performance, detect fabric types, and customize wash cycles based on user preferences.

Washing Machine Market Regional Insight

Technological Advancements and Smart Connectivity to boost North America Washing Machine Market growth North America dominated the market in 2023 and is expected to hold the largest North America Washing Machine Market share over the forecast period. In North America, consumers often prioritize convenience and the latest technology in household appliances. The demand for washing machines with advanced features such as smart connectivity, Wi-Fi control, and compatibility with virtual assistants like Amazon Alexa and Google Assistant is driving market growth. Washing machine manufacturers in North America are focusing on developing innovative products to meet these consumer preferences. With increasing awareness of environmental issues and rising energy costs, there is a growing demand for energy-efficient and eco-friendly washing machines in North America. Consumers are seeking appliances with high Energy Star ratings and water-saving features to reduce utility bills and minimize their environmental footprint. Manufacturers are responding by incorporating technologies such as inverter motors, sensor-based wash cycles, and eco-friendly detergents to meet these demands. In mature markets like North America, the countries such as United States, Mexico, and Canada, the replacement and upgradation cycles of washing machines play a significant role in driving Washing Machine market demand. Consumers are willing to invest in newer models offering enhanced features, improved performance, and greater energy efficiency to replace outdated or malfunctioning appliances. Factors such as product durability, warranty coverage, and brand reputation influence purchase decisions during the replacement cycle. Preference for Front-Loading Machines to dominate the Asia Pacific Washing Machine Market growth Front-loading washing machines are gaining popularity in the Asia-Pacific region due to their superior cleaning performance, energy efficiency, and water-saving features. Consumers in densely populated urban areas, where space is limited and water resources are scarce, prefer front-loading machines for their compact design, stackability, and ability to conserve water and energy compared to top-loading models. The Asia-Pacific region is experiencing rapid urbanization and a burgeoning middle class, driving the demand for household appliances like washing machines, which is expected to boost the Asia Pacific Washing Machine Market growth. As more people migrate to urban areas and experience rising incomes, there is a greater propensity to invest in modern conveniences and upgrade from traditional washing methods to automated solutions.The Washing Machine market in India shows regional variations, with certain areas standing out as key contributors. South India emerges as a dominant region in this sector, with Karnataka spearheading advancements. The Indian Washing Machine Market exhibits varying regional dominance influenced by factors like urbanization, demographics, and economic conditions. Metros and Tier-I cities, including Mumbai, Delhi, Bengaluru, and Chennai, have historically held a dominant position due to higher disposable incomes, urban lifestyle preferences, and awareness of advanced technology. These regions have shown greater demand for technologically advanced and fully automatic washing machines, driving market growth. With rapid urbanization and increasing purchasing power in Tier-II and Tier-III cities like Pune, Jaipur, and Lucknow, there has been a notable surge in demand for washing machines, particularly semi-automatic ones, owing to their affordability and adaptability to varying water and power supplies. Rural areas are gradually becoming key growth regions due to rising aspirations and improving living standards, leading to an increasing preference for semi-automatic machines that align with affordability and practicality.

Washing Machine Market Scope: Inquiry Before Buying

Washing Machine Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 60.12 Bn. Forecast Period 2024 to 2030 CAGR: 4.3 % Market Size in 2030: US $ 80.73 Bn. Segments Covered: by Type Front Load Top Load by Technology Fully Automatic Semi-Automatic by Distribution Channel Offline Online Washing Machine Market, by Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Washing Machine Manufacturers include:

Asia Pacific: 1. Samsung Electronics Co., Ltd. (Seoul, South Korea) 2. LG Electronics Inc. (Seoul, South Korea) 3. Haier Group Corporation (Qingdao, Shandong, China) 4. Midea Group (Foshan, Guangdong, China) 5. Panasonic Corporation (Osaka, Japan) 6. Toshiba Corporation(Tokyo, Japan) 7. Hitachi Appliances Inc.(Tokyo, Japan) 8. Sharp Corporation (Sakai, Osaka, Japan) 9. Daewoo Electronics Corporation (Seoul, South Korea) 10. Hisense Group (Qingdao, Shandong, China) 11. Sanyo Electric Co., Ltd. (Moriguchi, Osaka, Japan) Europe: 12. Gorenje Group (Velenje, Slovenia) 13. Arçelik A.Ş.(Istanbul, Turkey) 14. Candy Group (Brugherio, Milan, Italy) 15. Teka Group (Santander, Spain) 16. Asko Appliances (Vara, Sweden) 17. Vestel (Manisa, Turkey) 18. Miele (Gütersloh, Germany) 19. Electrolux AB (Stockholm, Sweden) 20. Bosch Home Appliances (Munich, Germany ) 21. Siemens Home Appliances(Munich, Germany) North America: 22. Whirlpool Corporation (Benton Harbor, Michigan, United States) 23. GE Appliances (a Haier company)(Louisville, Kentucky, United States) 24. Hoover Ltd. (Merthyr Tydfil, Wales, United Kingdom) Frequently asked Questions: 1. What factors contribute to the growth of the global washing machine market? Ans: Urbanization, rising disposable incomes, changing lifestyles, and continuous technological advancements are key factors driving the growth of the global washing machine market. 2. What segment dominates the washing machine market based on type? Ans: The front-load segment dominates the washing machine market due to its design, which is characterized by a front-facing door and a horizontally-oriented drum. 3. What segment dominates the market based on technology? Ans: The fully automatic segment dominates the market, offering pre-set wash programs, advanced sensors, and load-sensing technology for optimized efficiency and performance. 4. How do technological advancements boost the washing machine market in North America? Ans: In North America, advancements such as smart connectivity and energy-saving features drive market growth, meeting consumer preferences for convenience and environmental consciousness. 5. Why do consumers in the Asia-Pacific region prefer front-loading machines? Ans: Consumers in densely populated urban areas prefer front-loading machines for their compact design, stackability, and ability to conserve water and energy, aligning with regional preferences and challenges.

1. Washing Machine Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Washing Machine Market: Dynamics 2.1. Washing Machine Market Trends by Region 2.1.1. North America Washing Machine Market Trends 2.1.2. Europe Washing Machine Market Trends 2.1.3. Asia Pacific Washing Machine Market Trends 2.1.4. Middle East and Africa Washing Machine Market Trends 2.1.5. South America Washing Machine Market Trends 2.2. Washing Machine Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Washing Machine Market Drivers 2.2.1.2. North America Washing Machine Market Restraints 2.2.1.3. North America Washing Machine Market Opportunities 2.2.1.4. North America Washing Machine Market Challenges 2.2.2. Europe 2.2.2.1. Europe Washing Machine Market Drivers 2.2.2.2. Europe Washing Machine Market Restraints 2.2.2.3. Europe Washing Machine Market Opportunities 2.2.2.4. Europe Washing Machine Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Washing Machine Market Drivers 2.2.3.2. Asia Pacific Washing Machine Market Restraints 2.2.3.3. Asia Pacific Washing Machine Market Opportunities 2.2.3.4. Asia Pacific Washing Machine Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Washing Machine Market Drivers 2.2.4.2. Middle East and Africa Washing Machine Market Restraints 2.2.4.3. Middle East and Africa Washing Machine Market Opportunities 2.2.4.4. Middle East and Africa Washing Machine Market Challenges 2.2.5. South America 2.2.5.1. South America Washing Machine Market Drivers 2.2.5.2. South America Washing Machine Market Restraints 2.2.5.3. South America Washing Machine Market Opportunities 2.2.5.4. South America Washing Machine Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Washing Machine Industry 2.8. Analysis of Government Schemes and Initiatives For Washing Machine Industry 2.9. Washing Machine Market Trade Analysis 2.10. The Global Pandemic Impact on Washing Machine Market 3. Washing Machine Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Washing Machine Market Size and Forecast, by Type (2023-2030) 3.1.1. Front Load 3.1.2. Top Load 3.2. Washing Machine Market Size and Forecast, by Technology (2023-2030) 3.2.1. Fully Automatic 3.2.2. Semi-Automatic 3.3. Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 3.3.1. Offline 3.3.2. Online 3.4. Washing Machine Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Washing Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Washing Machine Market Size and Forecast, by Type (2023-2030) 4.1.1. Front Load 4.1.2. Top Load 4.2. North America Washing Machine Market Size and Forecast, by Technology (2023-2030) 4.2.1. Fully Automatic 4.2.2. Semi-Automatic 4.3. North America Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 4.3.1. Offline 4.3.2. Online 4.4. North America Washing Machine Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Washing Machine Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Front Load 4.4.1.1.2. Top Load 4.4.1.2. United States Washing Machine Market Size and Forecast, by Technology (2023-2030) 4.4.1.2.1. Fully Automatic 4.4.1.2.2. Semi-Automatic 4.4.1.3. United States Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.3.1. Offline 4.4.1.3.2. Online 4.4.2. Canada 4.4.2.1. Canada Washing Machine Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Front Load 4.4.2.1.2. Top Load 4.4.2.2. Canada Washing Machine Market Size and Forecast, by Technology (2023-2030) 4.4.2.2.1. Fully Automatic 4.4.2.2.2. Semi-Automatic 4.4.2.3. Canada Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.3.1. Offline 4.4.2.3.2. Online 4.4.3. Mexico 4.4.3.1. Mexico Washing Machine Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Front Load 4.4.3.1.2. Top Load 4.4.3.2. Mexico Washing Machine Market Size and Forecast, by Technology (2023-2030) 4.4.3.2.1. Fully Automatic 4.4.3.2.2. Semi-Automatic 4.4.3.3. Mexico Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.3.1. Offline 4.4.3.3.2. Online 5. Europe Washing Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Washing Machine Market Size and Forecast, by Type (2023-2030) 5.2. Europe Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4. Europe Washing Machine Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.1.3. United Kingdom Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2. France 5.4.2.1. France Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.2.3. France Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.3.3. Germany Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.4.3. Italy Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.5.3. Spain Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.6.3. Sweden Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.7.3. Austria Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Washing Machine Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Washing Machine Market Size and Forecast, by Technology (2023-2030) 5.4.8.3. Rest of Europe Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Washing Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Washing Machine Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4. Asia Pacific Washing Machine Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.1.3. China Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.2.3. S Korea Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.3.3. Japan Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4. India 6.4.4.1. India Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.4.3. India Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.5.3. Australia Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.6.3. Indonesia Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.7.3. Malaysia Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.8.3. Vietnam Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.9.3. Taiwan Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Washing Machine Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Washing Machine Market Size and Forecast, by Technology (2023-2030) 6.4.10.3. Rest of Asia Pacific Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Washing Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Washing Machine Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Washing Machine Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 7.4. Middle East and Africa Washing Machine Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Washing Machine Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Washing Machine Market Size and Forecast, by Technology (2023-2030) 7.4.1.3. South Africa Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Washing Machine Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Washing Machine Market Size and Forecast, by Technology (2023-2030) 7.4.2.3. GCC Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Washing Machine Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Washing Machine Market Size and Forecast, by Technology (2023-2030) 7.4.3.3. Nigeria Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Washing Machine Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Washing Machine Market Size and Forecast, by Technology (2023-2030) 7.4.4.3. Rest of ME&A Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Washing Machine Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Washing Machine Market Size and Forecast, by Type (2023-2030) 8.2. South America Washing Machine Market Size and Forecast, by Technology (2023-2030) 8.3. South America Washing Machine Market Size and Forecast, by Distribution Channel(2023-2030) 8.4. South America Washing Machine Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Washing Machine Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Washing Machine Market Size and Forecast, by Technology (2023-2030) 8.4.1.3. Brazil Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Washing Machine Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Washing Machine Market Size and Forecast, by Technology (2023-2030) 8.4.2.3. Argentina Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Washing Machine Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Washing Machine Market Size and Forecast, by Technology (2023-2030) 8.4.3.3. Rest Of South America Washing Machine Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Washing Machine Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Washing Machine Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Samsung Electronics Co., Ltd. (Seoul, South Korea) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. LG Electronics Inc. (Seoul, South Korea) 10.3. Haier Group Corporation (Qingdao, Shandong, China) 10.4. Midea Group (Foshan, Guangdong, China) 10.5. Panasonic Corporation (Osaka, Japan) 10.6. Toshiba Corporation(Tokyo, Japan) 10.7. Hitachi Appliances Inc.(Tokyo, Japan) 10.8. Sharp Corporation (Sakai, Osaka, Japan) 10.9. Daewoo Electronics Corporation (Seoul, South Korea) 10.10. Hisense Group (Qingdao, Shandong, China) 10.11. Sanyo Electric Co., Ltd. (Moriguchi, Osaka, Japan) 10.12. Gorenje Group (Velenje, Slovenia) 10.13. Arçelik A.Ş.(Istanbul, Turkey) 10.14. Candy Group (Brugherio, Milan, Italy) 10.15. Teka Group (Santander, Spain) 10.16. Asko Appliances (Vara, Sweden) 10.17. Vestel (Manisa, Turkey) 10.18. Miele (Gütersloh, Germany) 10.19. Electrolux AB (Stockholm, Sweden) 10.20. Bosch Home Appliances (Munich, Germany ) 10.21. Siemens Home Appliances(Munich, Germany) 10.22. Whirlpool Corporation (Benton Harbor, Michigan, United States) 10.23. GE Appliances (a Haier company)(Louisville, Kentucky, United States) 10.24. Hoover Ltd. (Merthyr Tydfil, Wales, United Kingdom) 11. Key Findings 12. Industry Recommendations 13. Washing Machine Market: Research Methodology 14. Terms and Glossary