The Vehicle Tracking Market size was valued at USD 27.43 Billion in 2024 and the total Vehicle Tracking revenue is expected to grow at a CAGR of 14% from 2025 to 2032, reaching nearly USD 78.27 Billion.Overview

Vehicle tracking is the process of monitoring a vehicle's location using GPS technology. It ensures proper use of vehicles and aids in recovery if stolen. Real-time tracking relies on GPS and cellular systems, transmitting coordinates to a service for immediate monitoring. Non-real-time systems record coordinates for later retrieval. It's widely deployed for fleet management, improving efficiency and aiding in theft recovery.To know about the Research Methodology:-Request Free Sample Report The primary purpose of GPS for car tracking systems is to get both instantaneous and historical information on a vehicle’s location, speed, routes, idling, and stoppage points. While hardware collects this information, the software offers all this information in a neatly packed and digestible format. Basic GPS tracking provides real-time location monitoring, ideal for cost-effective solutions. White-label GPS software offers advanced features with custom branding. Mobile fleet tracking apps provide on-the-go convenience for managers and drivers. Personal vehicle tracking suits smaller operations, while enterprise fleet tracking integrates telematics for comprehensive management. Vehicle Tracking Systems in logistics optimize fleet operations by providing real-time location data, route optimization, and maintenance insights and drive the Vehicle Tracking Market growth. Applications such as NaviLap enhance efficiency, offering features like geofencing, alerts, and analytics for comprehensive fleet management. Cartrack Holdings Limited, Verizon Communication Inc, Tomtom, Inc, At&T Inc, Inseego Corp, Spireon Inc, and others are some Vehicle Tracking companies. In that, Verizon Connect offers cutting-edge GPS fleet tracking software, revolutionizing how businesses manage their vehicles. This telematics solution provides a 360-degree view of fleet operations, optimizing productivity and reducing costs. Trusted by fleets of all sizes, it ensures real-time updates on vehicle status, fuel consumption, and maintenance needs. With features like electric vehicle tracking, trend analysis, and smart dispatching, Verizon Connect caters to diverse industries, including logistics, construction, and utilities. The platform's seamless integration, automated alerts, and comprehensive analytics make it an indispensable tool for efficient and secure fleet management, aligning with industry demands for streamlined operations and compliance.

Vehicle Tracking Market Dynamics:

Integration of IoT and Advanced Telematics to Drive the Market Growth The integration of Internet of Things (IoT) technologies and advanced telematics is revolutionizing the vehicle tracking landscape and is expected to boost the Vehicle Tracking Market growth. Enhanced connectivity and data-sharing capabilities empower businesses to gather real-time insights, enabling proactive decision-making. The seamless integration of IoT into vehicle tracking systems not only improves operational efficiency but also opens up opportunities for innovative applications such as predictive maintenance and dynamic route optimization. As businesses increasingly prioritize data-driven strategies, the demand for IoT-enabled vehicle tracking solutions is on the rise. IoT solutions enhance fleet management, predictive maintenance, and connectivity between vehicles and OEMs. Advanced IoT sensors continuously collect data on various parameters, optimizing vehicle performance and user experience. The evolution from connected cars to autonomous vehicles is driven by cloud computing and data analytics, marking a new era in automotive manufacturing. Benefits include improved vehicle maintenance, remote software updates, real-time telematics, and enhanced safety through vehicle-to-vehicle and vehicle-to-infrastructure communications. As automotive IoT continues to advance, the line between vehicles and connected devices blurs, promising an integrated and efficient future in the automotive industry. The automotive industry is undergoing a paradigm shift with the integration of IoT, leading to the emergence of smart cars and connected vehiclesThe Increase in Adoption of the Mobility-as-a-Service (MaaS) in Vehicle Tracking Systems to Create Lucrative Opportunity for Market Growth There is a rise in the adoption of Mobility-as-a-Service (MaaS) for the reduction of traffic and carbon emissions. Many companies and governments across the world are encouraged to use this system. Mobility as a Service (MaaS) is reshaping the global fleet industry, responding to shifts like the scrutiny of internal combustion engines and changing perspectives on company automobiles. MaaS combines diverse transportation modes into an on-demand, holistic solution accessible through a single app and payment method. They are introducing ride-hailing, carpooling, sharing the car, and various other options for commuters rather than using their vehicles. The companies that are using vehicle tracking systems are gaining advantages from this service by assisting their hardware and software devices and gaining various insights regarding pickup drop and vehicle telematics and payment activities. Currently, there is a surge in the adoption of mobility as a service. Some of the mobility service providers are DiDi, Ola, Uber, Lyft, and others. These factors are creating opportunities for the Vehicle Tracking Market expansion. AutoPi.io, based in Denmark, offers cutting-edge solutions for Mobility as a Service (MaaS) through real-time vehicle tracking and advanced diagnostics. Elevate fleet management, efficiency, and customer experience with seamless integration into existing MaaS platforms. Ensure optimal vehicle performance, proactively schedule maintenance and minimize downtime for a reliable MaaS fleet. For vehicle tracking, MaaS enhances telematics, serving as a bridge between asset management and mobility planning. Fleet owners benefit from user-customized trip planning, intermodal travel facilitation, and unique recommendations based on user preferences. The MaaS ecosystem connects mobility demanders, transportation service providers, and platform owners. Vehicle Tracking Market Trends: With the increasing advancements, Modernization in digital technologies has led to an increase in smartphone adoption, which further has contributed to easy access to online logistics services. This is increasing the demand for vehicle tracking systems. Also, the increase in adoption of Artificial Intelligence (AI), and the Internet of Things (IoT) has enhanced the service with this smart technology. Vehicle Tracking system commonly uses GPS or GLONASS technology for identifying the location of a vehicle, but also Automatic Vehicle Location Technology is used for the detection of vehicles. This vehicle's information is seen on electronic maps with the use of the Internet or specialized software. GPS is a Global Positioning System that includes vehicle tracking and monitoring, vehicle maintenance, vehicle diagnostics, fuel management, route optimization, driver management, and safety management. Many companies and governments across the world are encouraged to use Mobility-as-a-Service (MaaS) for the reduction of traffic and carbon emissions. As a result, these factors are increasing demand for Vehicle Tracking devices and are expected to the Vehicle Tracking Market size growth. Vehicle tracking systems are increasingly incorporating AI and ML algorithms to analyze vast amounts of data generated by GPS devices and sensors. This enables predictive analytics for route optimization, maintenance scheduling, and fuel efficiency. The smart algorithms can also detect patterns, providing valuable insights for fleet management and overall operational enhancement. For instance, the future of GPS tracking is witnessing several emerging trends Vehicle Tracking Market and innovations that promise to reshape the way we navigate, track assets, and optimize logistics. Some of the key trends are highlighted below:

The adoption of GPS tracking and telematics has become widespread, leading to a competitive market with diverse solutions tailored to different industries. The integration of advanced technologies such as IoT, machine learning, and AI has further enhanced the capabilities of fleet tracking systems and is expected to drive the Vehicle Tracking Market growth. Vehicle Tracking is a system that comprises the use of automatic vehicle location in a single vehicle that includes software that collects fleet data for a complete picture of the location of the vehicle. The Vehicle Tracking system commonly uses GPS or GLONASS technology for identifying the location of a vehicle, but also Automatic Vehicle Location Technology is used for the detection of vehicles. This Vehicle information is seen on electronic maps with the use of the Internet or specialized software. GPS is a Global Positioning System that includes vehicle tracking and monitoring, vehicle maintenance, vehicle diagnostics, fuel management, route optimization, driver management, and safety management. For maintaining such fleets, a cloud-based management system is required, such as artificial intelligence (AI), the intelligence of things (IoT), and big data analytics are used. The Vehicle owners and the fleet operators track the vehicles in real-time and also check whether the driver is following the suggested path or if there are any diversions in the path. Some important activities of the vehicle tracking system include vehicle and driver tracking, assets management, two-way communication, driver safety, time management, and others. Some advantages of a vehicle tracking system are rapid response and access, covering a wide range area, low cost, and helping the vendors to increase and improve their productivity. All the factors and the advantages of the vehicle tracking system, fleet operators and logistics businesses also invest in the vehicle tracking technology is expected to lead to an increase in the demand for vehicle tracking in the Vehicle Tracking Market. Vehicle Tracking Market Restraining Factors: The vehicle tracking system has many advantages and also contributes a lot towards the emerging advanced technologies, but many vehicle owners and fleet operators are facing trouble in measuring the accurate fuel consumption of the vehicle, owing to the lack of technical knowledge of operating fuel monitoring tools. Such factors are expected to drive the Vehicle Tracking Market growth over the forecast period. There are special design sensors that are used in the fuel tanks that send a notification to the user's mobile and sets and user computers about the level of fuel in the vehicle with the help of the cloud computing system. As a result, a proper understanding of the system is required. Data that is related to the vehicle contains sensitive information such as the vehicle’s make, driver’s details, and the traveling routes. This data can be used to exploit and carry out some malicious and criminal activities, which include vehicle robberies or planned crimes. Data privacy infringement is one of the main reasons that is discouraging the end customers from using these vehicle tracking systems. Also, there are events like unauthorized access to multiple vehicle systems or breaking into the in-vehicle connectivity system. The other reason like that hackers hack the system and access the vehicle computer system, and exploit the data that is stored in these systems. Hence, data privacy infringement and the cyber security threat related to vehicle tracking systems are expected to hinder the growth of the Vehicle Tracking Market.

Vehicle Tracking Market Segment Analysis

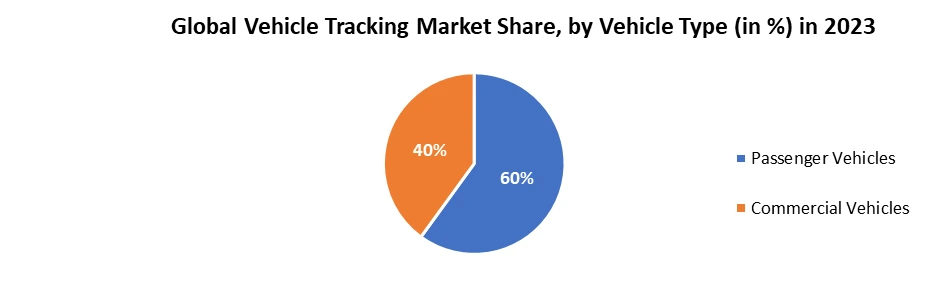

By Vehicle Type: Based on vehicle type, the commercial vehicles segment held the largest Vehicle Tracking Market share in 2024. The segment is primarily driven by the escalating demand for effective fleet management. The Passenger Vehicles segment is mostly used by medium-sized and small-sized businesses. This led to an increase in the vehicle tracking systems in passenger vehicles. Also, the growing disposition of fleet operators has improved the experience of the end customers and has thereby anticipated the growth of the Passenger vehicles segment having the largest market share. Businesses are prioritizing equipped commercial vehicles with tracking devices to optimize operations, cut fuel expenses, improve route planning, and ensure punctual deliveries. Notably, Mullen Automotive's introduction of Commercial Pulse in October exemplifies this trend, offering a comprehensive telematics solution with features like real-time tracking, driver safety monitoring, and maintenance notifications. This surge in advanced solutions is propelling growth in the commercial vehicles segment, enhancing fleet management processes and overall efficiency.

Vehicle Tracking Market Regional Analysis

North America accounted for the largest Vehicle Tracking Market share in 2024. The convergence of tracking devices with IoT in this region facilitates seamless communication and data exchange among vehicles and connected devices. Real-time data analysis, predictive maintenance, and intelligent decision-making are key benefits, significantly improving fleet operational efficiency. This integration not only optimizes route planning but also enables proactive maintenance, reducing downtime and operational costs. The advanced functionalities of IoT-enabled tracking devices are becoming increasingly indispensable in the dynamic landscape of transportation and logistics in North America. The Global Positioning System (GPS) has emerged as a transformative force, significantly impacting diverse sectors. Initially developed by the U.S. Department of Defense for military purposes, it transitioned to civilian use in response to the Korean Airlines disaster in 1983. President Clinton's commitment in 2000 ensured civilians access to un-degraded GPS signals, marking a pivotal moment. Over the past two decades, GPS technology has revolutionized industries such as agriculture, construction, and aerospace. Its economic impact is extensive, contributing to improved efficiency, reduced costs, and enhanced safety. Despite challenges in governance and privacy concerns, GPS continues to evolve. Precision farming, with GPS-guided tractors and location-aware data, exemplifies its future applications. As a paradigmatic example of accessible information's transformative potential, GPS remains a cornerstone in the technological landscape, with its influence expected to grow across various sectors. In the Asia Pacific region, the Vehicle Tracking Market is thriving due to several factors. The increasing adoption of advanced technologies, rapid urbanization, and the expansion of the e-commerce sector are driving the demand for efficient fleet management and logistics solutions. Growing economies, such as China and India, are witnessing a surge in the number of commercial vehicles, leading to a higher need for tracking and management systems. Government initiatives to enhance road safety and the transportation infrastructure are also contributing to the market's growth. The Asia Pacific region is characterized by a robust market for GPS and telematics-based solutions, making vehicle tracking systems integral to fleet operations across various industries. The objective of the report is to present a comprehensive analysis of the global Vehicle Tracking Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear, futuristic view of the industry to the decision-makers. The reports also help in understanding the Vehicle Tracking Market dynamic and structure by analyzing the market segments and projecting the Vehicle Tracking Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Vehicle Tracking Market make the report investor’s guide.Vehicle Tracking Market Scope: Inquire before buying

Global Vehicle Tracking Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 27.43 Bn. Forecast Period 2025 to 2032 CAGR: 14% Market Size in 2032: USD 78.27 Bn. Segments Covered: by Component Hardware Software by Vehicle Type Passenger Vehicles Commercial Vehicles by Technology GPS/Satellite GPRS/Cellular Network Dual Mode by End-User Transportation & Logistic Construction & Manufacturing Aviation Retail Government & Defense Other Vehicle Tracking Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)Vehicle Tracking Key Players by Region:

North America: 1.VerizonCommunications Inc. (USA) 2. Geotab Inc. (Canada) 3. CalAmp (USA) 4. ORBCOMM Inc. (USA) 5. Xirgo Technologies, LLC (USA) 6. Spireon Inc. (USA) 7. Inseego Corp. (USA) 8. Fortive Corporation (Everett, Washington, USA) 9. AT&T Inc. (USA) 10. Laipac Technology Inc. (Canada) 11. Trackimo Inc. (New York, USA) 12. CalAmp (USA) Europe: 13. TomTom International B.V. (Netherlands) 14. Teltonika (Vilnius, Lithuania) 15. Continental AG (Hanover, Germany) 16. Robert Bosch GmbH (Gerlingen, Germany) 17. other APAC: 1. Denso Corporation (Japan) 2. NEC Corporation 3. Cartrack 4. Other Frequently Asked Questions: 1] What is the growth rate of the Global Vehicle Tracking Market? Ans. The Global Vehicle Tracking Market is growing at a significant rate of 14 % during the forecast period. 2] Which region is expected to dominate the Global Vehicle Tracking Market? Ans. North America is expected to dominate the Vehicle Tracking Market during the forecast period. 3] What is the expected Global Vehicle Tracking Market size by 2032? Ans. The Vehicle Tracking Market size is expected to reach USD 78.27 Bn by 2032. 4] Which are the top players in the Global Vehicle Tracking Market? Ans. The major top players in the Global Vehicle Tracking Market are TomTom International B.V. (Netherlands), Teltonika (Vilnius, Lithuania) and others. 5] What are the factors driving the Global Vehicle Tracking Market growth? Ans. The growth of mobilization and industrialization and the adoption of %g technology are expected to drive the Vehicle Tracking Market growth. 6] What was the Global Vehicle Tracking Market size in 2024? Ans: The Global Vehicle Tracking Market size was USD 27.43 Billion in 2024.

1. Vehicle Tracking Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Vehicle Tracking Market: Dynamics 2.1. Vehicle Tracking Market Trends by Region 2.1.1. North America Vehicle Tracking Market Trends 2.1.2. Europe Vehicle Tracking Market Trends 2.1.3. Asia Pacific Vehicle Tracking Market Trends 2.1.4. Middle East and Africa Vehicle Tracking Market Trends 2.1.5. South America Vehicle Tracking Market Trends 2.2. Vehicle Tracking Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Vehicle Tracking Market Drivers 2.2.1.2. North America Vehicle Tracking Market Restraints 2.2.1.3. North America Vehicle Tracking Market Opportunities 2.2.1.4. North America Vehicle Tracking Market Challenges 2.2.2. Europe 2.2.2.1. Europe Vehicle Tracking Market Drivers 2.2.2.2. Europe Vehicle Tracking Market Restraints 2.2.2.3. Europe Vehicle Tracking Market Opportunities 2.2.2.4. Europe Vehicle Tracking Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Vehicle Tracking Market Drivers 2.2.3.2. Asia Pacific Vehicle Tracking Market Restraints 2.2.3.3. Asia Pacific Vehicle Tracking Market Opportunities 2.2.3.4. Asia Pacific Vehicle Tracking Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Vehicle Tracking Market Drivers 2.2.4.2. Middle East and Africa Vehicle Tracking Market Restraints 2.2.4.3. Middle East and Africa Vehicle Tracking Market Opportunities 2.2.4.4. Middle East and Africa Vehicle Tracking Market Challenges 2.2.5. South America 2.2.5.1. South America Vehicle Tracking Market Drivers 2.2.5.2. South America Vehicle Tracking Market Restraints 2.2.5.3. South America Vehicle Tracking Market Opportunities 2.2.5.4. South America Vehicle Tracking Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For the Vehicle Tracking Industry 2.8. Analysis of Government Schemes and Initiatives For the Vehicle Tracking Industry 2.9. The Global Pandemic Impact on Vehicle Tracking Market 3. Vehicle Tracking Market: Global Market Size and Forecast by Segmentation (by Value) (2024-2032) 3.1. Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 3.1.1. Hardware 3.1.2. Software 3.2. Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 3.2.1. Passenger Vehicles 3.2.2. Commercial Vehicles 3.3. Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 3.3.1. GPS/Satellite 3.3.2. GPRS/Cellular Network 3.3.3. Dual Mode 3.4. Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 3.4.1. Transportation & Logistic 3.4.2. Construction & Manufacturing 3.4.3. Aviation 3.4.4. Retail 3.4.5. Government & Defense 3.4.6. Other 3.5. Vehicle Tracking Market Size and Forecast, by Region (2024-2032) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Vehicle Tracking Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 4.1. North America Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 4.1.1. Hardware 4.1.2. Software 4.2. North America Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 4.2.1. Passenger Vehicles 4.2.2. Commercial Vehicles 4.3. North America Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 4.3.1. GPS/Satellite 4.3.2. GPRS/Cellular Network 4.3.3. Dual Mode 4.4. North America Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 4.4.1. Transportation & Logistic 4.4.2. Construction & Manufacturing 4.4.3. Aviation 4.4.4. Retail 4.4.5. Government & Defense 4.4.6. Other 4.5. North America Vehicle Tracking Market Size and Forecast, by Country (2024-2032) 4.5.1. United States 4.5.1.1. United States Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 4.5.1.1.1. Hardware 4.5.1.1.2. Software 4.5.1.2. United States Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 4.5.1.2.1. Passenger Vehicles 4.5.1.2.2. Commercial Vehicles 4.5.1.3. United States Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 4.5.1.3.1. GPS/Satellite 4.5.1.3.2. GPRS/Cellular Network 4.5.1.3.3. Dual Mode 4.5.1.4. United States Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 4.5.1.4.1. Transportation & Logistic 4.5.1.4.2. Construction & Manufacturing 4.5.1.4.3. Aviation 4.5.1.4.4. Retail 4.5.1.4.5. Government & Defense 4.5.1.4.6. Other 4.5.2. Canada 4.5.2.1. Canada Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 4.5.2.1.1. Hardware 4.5.2.1.2. Software 4.5.2.2. Canada Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 4.5.2.2.1. Passenger Vehicles 4.5.2.2.2. Commercial Vehicles 4.5.2.3. Canada Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 4.5.2.3.1. GPS/Satellite 4.5.2.3.2. GPRS/Cellular Network 4.5.2.3.3. Dual Mode 4.5.2.4. Canada Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 4.5.2.4.1. Transportation & Logistic 4.5.2.4.2. Construction & Manufacturing 4.5.2.4.3. Aviation 4.5.2.4.4. Retail 4.5.2.4.5. Government & Defense 4.5.2.4.6. Other 4.5.3. Mexico 4.5.3.1. Mexico Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 4.5.3.1.1. Hardware 4.5.3.1.2. Software 4.5.3.2. Mexico Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 4.5.3.2.1. Passenger Vehicles 4.5.3.2.2. Commercial Vehicles 4.5.3.3. Mexico Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 4.5.3.3.1. GPS/Satellite 4.5.3.3.2. GPRS/Cellular Network 4.5.3.3.3. Dual Mode 4.5.3.4. Mexico Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 4.5.3.4.1. Transportation & Logistic 4.5.3.4.2. Construction & Manufacturing 4.5.3.4.3. Aviation 4.5.3.4.4. Retail 4.5.3.4.5. Government & Defense 4.5.3.4.6. Other 5. Europe Vehicle Tracking Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. Europe Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.2. Europe Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.3. Europe Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.4. Europe Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5. Europe Vehicle Tracking Market Size and Forecast, by Country (2024-2032) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.1.2. United Kingdom Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.1.3. United Kingdom Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.1.4. United Kingdom Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.2. France 5.5.2.1. France Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.2.2. France Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.2.3. France Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.2.4. France Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.3. Germany 5.5.3.1. Germany Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.3.2. Germany Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.3.3. Germany Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.3.4. Germany Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.4. Italy 5.5.4.1. Italy Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.4.2. Italy Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.4.3. Italy Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.4.4. Italy Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.5. Spain 5.5.5.1. Spain Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.5.2. Spain Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.5.3. Spain Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.5.4. Spain Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.6. Sweden 5.5.6.1. Sweden Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.6.2. Sweden Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.6.3. Sweden Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.6.4. Sweden Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.7. Austria 5.5.7.1. Austria Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.7.2. Austria Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.7.3. Austria Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.7.4. Austria Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 5.5.8.2. Rest of Europe Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 5.5.8.3. Rest of Europe Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 5.5.8.4. Rest of Europe Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6. Asia Pacific Vehicle Tracking Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Asia Pacific Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.2. Asia Pacific Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.3. Asia Pacific Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.4. Asia Pacific Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5. Asia Pacific Vehicle Tracking Market Size and Forecast, by Country (2024-2032) 6.5.1. China 6.5.1.1. China Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.1.2. China Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.1.3. China Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.2. China Vehicle Tracking Market Size and Forecast, by End User (2024-2032) S Korea 6.5.2.1. S Korea Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.2.2. S Korea Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.2.3. S Korea Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.2.4. S Korea Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.3. Japan 6.5.3.1. Japan Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.3.2. Japan Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.3.3. Japan Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.3.4. Japan Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.4. India 6.5.4.1. India Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.4.2. India Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.4.3. India Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.4.4. India Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.5. Australia 6.5.5.1. Australia Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.5.2. Australia Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.5.3. Australia Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.5.4. Australia Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.6. Indonesia 6.5.6.1. Indonesia Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.6.2. Indonesia Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.6.3. Indonesia Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.6.4. Indonesia Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.7. Malaysia 6.5.7.1. Malaysia Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.7.2. Malaysia Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.7.3. Malaysia Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.7.4. Malaysia Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.8. Vietnam 6.5.8.1. Vietnam Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.8.2. Vietnam Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.8.3. Vietnam Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.8.4. Vietnam Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.9. Taiwan 6.5.9.1. Taiwan Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.9.2. Taiwan Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.9.3. Taiwan Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.9.4. Taiwan Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 6.5.10.2. Rest of Asia Pacific Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 6.5.10.3. Rest of Asia Pacific Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 6.5.10.4. Rest of Asia Pacific Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 7. Middle East and Africa Vehicle Tracking Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 7.1. Middle East and Africa Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 7.2. Middle East and Africa Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 7.3. Middle East and Africa Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 7.4. Middle East and Africa Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 7.5. Middle East and Africa Vehicle Tracking Market Size and Forecast, by Country (2024-2032) 7.5.1. South Africa 7.5.1.1. South Africa Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 7.5.1.2. South Africa Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.1.3. South Africa Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 7.5.2. South Africa Vehicle Tracking Market Size and Forecast, by End User (2024-2032) GCC 7.5.2.1. GCC Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 7.5.2.2. GCC Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.2.3. GCC Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 7.5.2.4. GCC Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 7.5.3. Nigeria 7.5.3.1. Nigeria Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 7.5.3.2. Nigeria Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.3.3. Nigeria Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 7.5.3.4. Nigeria Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 7.5.4.2. Rest of ME&A Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 7.5.4.3. Rest of ME&A Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 7.5.4.4. Rest of ME&A Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 8. South America Vehicle Tracking Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032 8.1. South America Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 8.2. South America Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 8.3. South America Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 8.4. South America Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 8.5. South America Vehicle Tracking Market Size and Forecast, by Country (2024-2032) 8.5.1. Brazil 8.5.1.1. Brazil Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 8.5.1.2. Brazil Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.1.3. Brazil Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 8.5.1.4. Brazil Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 8.5.2. Argentina 8.5.2.1. Argentina Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 8.5.2.2. Argentina Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.2.3. Argentina Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 8.5.2.4. Argentina Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Vehicle Tracking Market Size and Forecast, by Component (2024-2032) 8.5.3.2. Rest Of South America Vehicle Tracking Market Size and Forecast, by Vehicle Type (2024-2032) 8.5.3.3. Rest Of South America Vehicle Tracking Market Size and Forecast, by Technology (2024-2032) 8.5.3.4. Rest Of South America Vehicle Tracking Market Size and Forecast, by End User (2024-2032) 9. Global Vehicle Tracking Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Vehicle Tracking Market Companies, by Market Capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Verizon 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Geotab Inc. 10.3. Cartrack 10.4. TomTom International B.V. 10.5. CalAmp 10.6. Teltonika 10.7. ORBCOMM Inc. 10.8. Xirgo Technologies, LLC 10.9. Laipac Technology Inc. 10.10. Trackimo Inc. 10.11. Spireon Inc. 10.12. Inseego Corp. 10.13. Fortive Corporation 10.14. AT&T Inc. 10.15. Continental AG 10.16. Robert Bosch GmbH 10.17. Verizon Communications Inc. 10.18. Geotab Inc. 11. Key Findings 12. Industry Recommendations 13. Vehicle Tracking Market: Research Methodology