Vehicle Grid Integration Market size was valued at USD 16.08 Mn. in 2023 and the total Vehicle Grid Integration revenue is expected to grow by 28.7 % from 2024 to 2030, reaching nearly USD 94.09 Mn.Vehicle Grid Integration Market Overview:

Vehicle Grid Integration (VGI) involves seamlessly integrating electric vehicles (EVs) into the power grid infrastructure, enabling bidirectional energy flow between the vehicle and the grid. This innovative solution utilizes EV batteries to store and supply electricity to the grid during high demand or grid instability. Additionally, VGI allows EV owners to use their vehicle batteries as energy storage units for residential or commercial purposes. This contributes to grid balancing and renewable energy integration efficiency.To know about the Research Methodology :- Request Free Sample Report Increased adoption of electric vehicles is having a significant impact on vehicle grid connectivity. Carbon emission reductions and environmental concerns are driving this trend. Electric vehicles are becoming increasingly available in the marketplace. Grid operators can optimize energy resources, control peak loads, and improve grid stability by integrating Incentives and policies promoting VGI deployments, like vehicle-to-grid (V2G) incentives and smart charging programs, further driving the market growth. The Vehicle Grid Integration market presents various opportunities for growth and innovation. Advances in vehicle-to-grid (V2G) technology, such as bidirectional chargers and smart grid solutions, enable EV owners to engage in demand response programs and earn money from grid services. Moreover, VGI enables better integration of renewable energy sources into the grid, reducing fossil fuel reliance and improving energy resilience. Governments and energy providers investing in VGI infrastructure can use EV batteries to stabilize the grid. This will facilitate energy storage, and generate increased revenue streams for EV owners. As global EV adoption rises, the Vehicle Grid Integration market is poised for significant growth and transformative impacts on the energy landscape.

Vehicle Grid Integration Market Dynamics

Vehicle Grid Integration Market Drivers Growing Environmental Concerns Propel the Adoption of Vehicle Grid Integration Solutions Vehicle Grid Integration (VGI) solutions are gaining traction around the world as environmental concerns grow, mandating immediate action to decrease carbon emissions and prevent climate change. There is growing awareness of the detrimental effects on the environment and public health as a result of the transportation sector's major contribution to greenhouse gas emissions, particularly through traditional internal combustion engine vehicles. As a result, there has been a clear shift toward more environmentally friendly and sustainable forms of transportation, with electric vehicles (EVs) emerging as a critical solution. Integrating EVs into the power grid and utilizing their batteries as energy storage systems, VGI plays a crucial part in this shift. This two-way energy flow makes it possible to use EV energy that has been saved during times of high demand, which lessens the need for fossil fuel-based power generation and improves grid balancing and energy management. Governments and policymakers worldwide are taking decisive actions to promote EV adoption and incentivize VGI deployment. Through a range of incentives, regulations, and infrastructure development initiatives, governments are encouraging consumers to transition to electric vehicles. Incentives such as tax credits, rebates, and preferential access to carpool lanes create a favorable environment, driving the demand for VGI solutions and advancing sustainable mobility options. VGI not only contributes to mitigating carbon emissions but also enhances energy efficiency. Integrating clean energy sources like solar and wind with EV charging infrastructure, the transportation sector can further support the global transition towards a green mobility revolution. As environmental awareness continues to grow, VGI will play a pivotal role in shaping a sustainable and greener transportation ecosystem, aligning with the collective goal of achieving a more environmentally conscious and resilient future. These aspects are boosting the Vehicle Grid Integration market growth. Vehicle Grid Integration Market Restraint Infrastructural limitations present significant challenges to the implementation Vehicle Grid Integration (VGI) solutions. The lack of adequate charging stations, the absence of smart grid technology, and the need for grid upgrades act as hindrances to the seamless integration of Vehicle Grid Integration market. Additionally, the absence of standardized communication protocols and varying regulations across regions create complexities in integrating VGI effectively. To address these challenges and unleash the full potential of VGI for sustainable transportation and grid optimization, collaborative efforts are required to invest in charging infrastructure, develop smart grid solutions, and establish cohesive regulatory frameworks. Only through coordinated actions and investments can VGI overcome infrastructural limitations and pave the way for a greener and more efficient future. Vehicle Grid Integration Market Opportunity Growing Electric Vehicle Market Offers Lucrative Opportunity for Vehicle Grid Integration Solutions The electric vehicle (EV) market's explosive growth offers a significant window of opportunity for the wide-scale adoption of Vehicle Grid Integration (VGI) technologies. Due to their cost-effectiveness compared to conventional internal combustion engine vehicles and environmental advantages, electric vehicles (EVs) have become a popular choice as the world adopts sustainable transportation solutions more and more. Demand for VGI systems that can maximize the use of EV batteries for grid balancing and energy management has increased as a result of the spike in EV adoption. Bidirectional energy flow between EVs and the power grid is made possible by VGI, allowing EV batteries to store extra energy during times of low demand and send it back to the grid during times of peak demand. This feature improves grid efficiency and the integration of renewable energy sources, lowering reliance on fossil fuels. Governments and utility companies are recognizing the significant potential of VGI in enhancing grid stability and achieving energy efficiency. To encourage VGI implementation, they are investing in charging infrastructure, smart grid technologies, and supportive regulatory frameworks. Additionally, incentives, rebates, and policies aimed at incentivizing EV adoption are further fueling the demand for Vehicle Grid Integration Market. The growing electric vehicle market provides a substantial customer base for VGI solutions, attracting investments from technology providers, energy companies, and grid operators. Collaborative partnerships between automotive manufacturers, utilities, and charging station operators present opportunities for innovative VGI technologies and services. As the electric vehicle market continues to expand, Vehicle Grid Integration Market stands as a lucrative opportunity to accelerate the transition toward a sustainable and grid-integrated transportation ecosystem. Capitalizing on the rising popularity of electric vehicles, VGI contributes to a cleaner and more resilient energy future while addressing the challenges of renewable energy integration and grid optimization. Vehicle Grid Integration Market Segment Analysis: Based on Vehicle Type , the Electric Vehicles (EVs) segment has emerged as the dominant segment in the automotive industry in the year 2023 and is expected to continue its dominance during the forecast period. This prominence is primarily driven by their environmental advantages, technological progress, and increasing consumer preference for sustainable transportation. EVs have increased in accessibility and appeal to consumers all over the world as a result of ongoing advancements in battery technology, the wide-scale construction of charging infrastructure, and various government incentives. Consequently, EVs are driving the transition to greener and cleaner mobility solutions, lowering greenhouse gas emissions and promoting a more sustainable future for transportation.Vehicle Grid Integration Market ,by Vehicle Type (%) in 2023

Based on the Technology, The Vehicle-to-Grid (V2G) segment dominated the Vehicle Grid Integration market in the year 2023 and is expected to continue its dominance during the forecast period. This advanced technology enables bidirectional energy flow between electric vehicles (EVs) and the power grid. With V2G, EVs can not only draw electricity from the grid for charging but also supply surplus energy back to the grid when needed. This capability proves invaluable in balancing energy demand and supply, particularly during peak hours when the grid faces increased stress and strain. V2G has garnered significant attention due to its potential to enhance grid stability, optimize energy resources, and facilitate the integration of renewable energy sources. During periods of high electricity demand or unforeseen power shortages, EVs can serve as mobile energy storage units, providing excess power to the grid. This dynamic interaction allows utilities to leverage EV batteries as distributed energy resources, reducing reliance on conventional power generation methods. Moreover, V2G presents a unique financial opportunity for consumers through participation in demand response programs. EV owners can earn revenue by selling surplus energy stored in their vehicle batteries back to the grid when electricity prices are high. This economic incentive encourages greater adoption of EVs and the widespread implementation of V2G technology. Furthermore, V2G contribute to enhancing grid resilience during emergencies, such as power outages or natural disasters. Equipped with V2G technology, EVs serve as backup power sources for critical facilities, homes, or buildings, ensuring the continuity of essential services and bolstering grid reliability.

Vehicle Grid Integration Market Revenue Share by Technology (%) in 2023

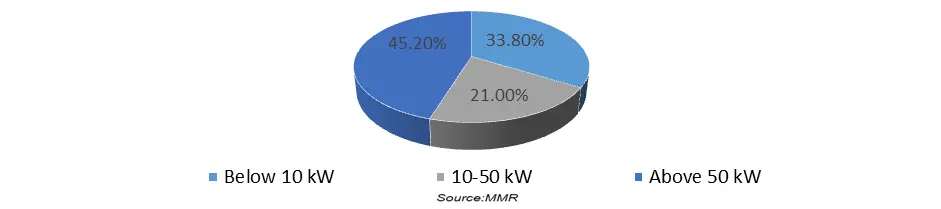

Based on the Power Rating, the Above 50 kW segment dominated the Vehicle Grid Integration market in the year 2022 and is expected to continue its dominance during the forecast period. Charging stations with power ratings above 50 kW have gained significant prominence due to their ability to offer faster charging times, thus enabling EVs to recharge their batteries quickly and efficiently. High-power charging stations, rated above 50 kW, are widely used in various applications, including public charging stations, rest areas along highways, commercial fleet charging, and other high-traffic locations. Their primary advantage lies in drastically reducing charging times compared to lower power chargers. For instance, an EV with a larger battery capacity can be charged from 0% to 80% within a relatively short duration, usually ranging from 30 to 45 minutes. This rapid charging capability enhances the overall convenience and accessibility of EVs, appealing to consumers who value shorter charging sessions.

Vehicle Grid Integration Market Share, By Power Rating in 2023 (%)

Vehicle Grid Integration Market Regional Insights:

Europe region dominated the Vehicle Grid Integration Market in the year 2023 and is expected to continue its dominance during the forecast period. Europe's dominant position in the global market for electric vehicles (EVs) can be attributed to a combination of factors that promote sustainable transportation. The region benefits from strong government support and policies designed to accelerate EV adoption. Many European nations provide alluring financial incentives to EV owners, including tax rebates, subsidies, lowered registration costs, and special access to carpool lanes. These policies support Europe's goal to lowering carbon emissions and battling climate change while also making EVs more financially appealing. Moreover, Europe has made significant strides in establishing a comprehensive and efficient charging infrastructure. The proliferation of public charging stations and the implementation of fast-charging networks have substantially improved the accessibility and convenience of EVs throughout the continent. This well-developed charging infrastructure addresses consumer concerns about limited driving range, instilling greater confidence in electric mobility and encouraging more consumers to opt for EVs. Furthermore, the European Union's strict emission standards have a significant impact on how the car sector is shaped. The strict emission requirements set by the European Union (EU) force automakers to give priority to the creation and sale of cleaner, more environmentally friendly automobiles, including electric ones. As a result, top automakers have made significant investments in EV research and development, resulting in a wide range of electric vehicle options to suit various consumer preferences and price points. Europe's collective commitment to cleaner transportation through stringent regulations and substantial investments in EV technology reinforces its leadership in the sustainable transportation arena.Vehicle Grid Integration Market Scope: Inquire Before Buying

Global Vehicle Grid Integration Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 16.08 Mn. Forecast Period 2024 to 2030 CAGR: 28.7% Market Size in 2030: US $ 94.09 Mn. Segments Covered: by Vehicle Type Lithium-ion Battery Lithium- Sulphur battery Graphene Supercapacitor Others by Technology Automotive Consumer Electronics Industrial Power Others by Power Rating Below 10 kW 10-50 kW Above 50 kW by Application Peak Shaving Frequency Regulation Renewable Energy Integration Demand Response Others Vehicle Grid Integration Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Vehicle Grid Integration Market, Key Players are

1. Tesla Inc. 2. Nissan Motor Corporation 3. BMW Group 4. Mitsubishi Motors Corporation 5. General Motors 6. Ford Motor Company 7. Renault Group 8. Hyundai Motor Company 9. Toyota Motor Corporation 10. Kia Corporation 11. Honda Motor Co., Ltd. 12. Volkswagen Group 13. BYD Auto Co., Ltd. 14. Daimler AG 15. Volvo Car Group 16. Audi AG 17. Mahindra & Mahindra Ltd. 18. Fiat Chrysler Automobiles (FCA) 19. SAIC Motor Corporation Limited 20. Jaguar Land Rover Automotive PLC 21. Geely Automobile Holdings Ltd. 22. Subaru Corporation 23. Chery Automobile Co., Ltd. 24. Proterra Inc. 25. Lucid Motors Inc. Frequently Asked Questions: 1] What segments are covered in the Global Vehicle Grid Integration Market report? Ans. The segments covered in the Vehicle Grid Integration Market report are based on Vehicle Vehicle Type , Price Point, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Vehicle Grid Integration Market? Ans. The North America region is expected to hold the highest share of the Vehicle Grid Integration Market. 3] What is the market size of the Global Vehicle Grid Integration Market by 2030? Ans. The market size of the Vehicle Grid Integration Market by 2030 is expected to reach US$ 94.09 Mn. 4] What is the forecast period for the Global Vehicle Grid Integration Market? Ans. The forecast period for the Vehicle Grid Integration Market is 2024-2030 5] What was the market size of the Global Vehicle Grid Integration Market in 2023? Ans. The market size of the Vehicle Grid Integration Market in 2023 was valued at US$ 16.08 Mn.

1. Vehicle Grid Integration Market: Research Methodology 2. Vehicle Grid Integration Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Vehicle Grid Integration Market: Dynamics 3.1. Vehicle Grid Integration Market Trends by Region 3.1.1. Global Vehicle Grid Integration Market Trends 3.1.2. North America Vehicle Grid Integration Market Trends 3.1.3. Europe Vehicle Grid Integration Market Trends 3.1.4. Asia Pacific Vehicle Grid Integration Market Trends 3.1.5. Middle East and Africa Vehicle Grid Integration Market Trends 3.1.6. South America Vehicle Grid Integration Market Trends 3.2. Vehicle Grid Integration Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Vehicle Grid Integration Market Drivers 3.2.1.2. North America Vehicle Grid Integration Market Restraints 3.2.1.3. North America Vehicle Grid Integration Market Opportunities 3.2.1.4. North America Vehicle Grid Integration Market Challenges 3.2.2. Europe 3.2.2.1. Europe Vehicle Grid Integration Market Drivers 3.2.2.2. Europe Vehicle Grid Integration Market Restraints 3.2.2.3. Europe Vehicle Grid Integration Market Opportunities 3.2.2.4. Europe Vehicle Grid Integration Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Vehicle Grid Integration Market Drivers 3.2.3.2. Asia Pacific Vehicle Grid Integration Market Restraints 3.2.3.3. Asia Pacific Vehicle Grid Integration Market Opportunities 3.2.3.4. Asia Pacific Vehicle Grid Integration Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Vehicle Grid Integration Market Drivers 3.2.4.2. Middle East and Africa Vehicle Grid Integration Market Restraints 3.2.4.3. Middle East and Africa Vehicle Grid Integration Market Opportunities 3.2.4.4. Middle East and Africa Vehicle Grid Integration Market Challenges 3.2.5. South America 3.2.5.1. South America Vehicle Grid Integration Market Drivers 3.2.5.2. South America Vehicle Grid Integration Market Restraints 3.2.5.3. South America Vehicle Grid Integration Market Opportunities 3.2.5.4. South America Vehicle Grid Integration Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. Global 3.6.2. North America 3.6.3. Europe 3.6.4. Asia Pacific 3.6.5. Middle East and Africa 3.6.6. South America 3.7. Key Opinion Leader Analysis For Allogeneic Cell Therapy Industry 3.8. Analysis of Government Schemes and Initiatives For Allogeneic Cell Therapy Industry 3.9. The Global Pandemic Impact on Vehicle Grid Integration Market 4. Vehicle Grid Integration Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 4.1.1. Lithium-ion Battery 4.1.2. Lithium- Sulphur battery 4.1.3. Graphene Supercapacitor 4.1.4. Others 4.2. Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 4.2.1. Automotive 4.2.2. Consumer Electronics 4.2.3. Industrial 4.2.4. Power 4.2.5. Others 4.3. Vehicle Grid Integration Market Size and Forecast, by Power Rating (2023-2030) 4.3.1. Below 10 kW 4.3.2. 10-50 kW 4.3.3. Above 50 kW 4.4. Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 4.4.1. Peak Shaving 4.4.2. Frequency Regulation 4.4.3. Renewable Energy Integration 4.4.4. Demand Response 4.4.5. Others 4.5. Vehicle Grid Integration Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Vehicle Grid Integration Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. North America Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 5.1.1. Lithium-ion Battery 5.1.2. Lithium- Sulphur battery 5.1.3. Graphene Supercapacitor 5.1.4. Others 5.2. North America Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 5.2.1. Automotive 5.2.2. Consumer Electronics 5.2.3. Industrial 5.2.4. Power 5.2.5. Others 5.3. North America Vehicle Grid Integration Market Size and Forecast, by Power Rating (2023-2030) 5.3.1. Below 10 kW 5.3.2. 10-50 kW 5.3.3. Above 50 kW 5.4. North America Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 5.4.1. Peak Shaving 5.4.2. Frequency Regulation 5.4.3. Renewable Energy Integration 5.4.4. Demand Response 5.4.5. Others 5.5. North America Vehicle Grid Integration Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.1.1.1. Lithium-ion Battery 5.5.1.1.2. Lithium- Sulphur battery 5.5.1.1.3. Graphene Supercapacitor 5.5.1.1.4. Others 5.5.1.2. United States Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 5.5.1.2.1. Automotive 5.5.1.2.2. Consumer Electronics 5.5.1.2.3. Industrial 5.5.1.2.4. Power 5.5.1.2.5. Others 5.5.1.3. United States Vehicle Grid Integration Market Size and Forecast, by Power Rating (2023-2030) 5.5.1.3.1. Below 10 kW 5.5.1.3.2. 10-50 kW 5.5.1.3.3. Above 50 kW 5.5.1.4. United States Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 5.5.1.4.1. Peak Shaving 5.5.1.4.2. Frequency Regulation 5.5.1.4.3. Renewable Energy Integration 5.5.1.4.4. Demand Response 5.5.1.4.5. Others 5.5.2. Canada 5.5.2.1. Canada Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.2.1.1. Lithium-ion Battery 5.5.2.1.2. Lithium- Sulphur battery 5.5.2.1.3. Graphene Supercapacitor 5.5.2.1.4. Others 5.5.2.2. Canada Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 5.5.2.2.1. Automotive 5.5.2.2.2. Consumer Electronics 5.5.2.2.3. Industrial 5.5.2.2.4. Power 5.5.2.2.5. Others 5.5.2.3. Canada Vehicle Grid Integration Market Size and Forecast, by Power Rating (2023-2030) 5.5.2.3.1. Below 10 kW 5.5.2.3.2. 10-50 kW 5.5.2.3.3. Above 50 kW 5.5.2.4. Canada Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 5.5.2.4.1. Peak Shaving 5.5.2.4.2. Frequency Regulation 5.5.2.4.3. Renewable Energy Integration 5.5.2.4.4. Demand Response 5.5.2.4.5. Others 5.5.3. Mexico 5.5.3.1. Mexico Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 5.5.3.1.1. Lithium-ion Battery 5.5.3.1.2. Lithium- Sulphur battery 5.5.3.1.3. Graphene Supercapacitor 5.5.3.1.4. Others 5.5.3.2. Mexico Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 5.5.3.2.1. Automotive 5.5.3.2.2. Consumer Electronics 5.5.3.2.3. Industrial 5.5.3.2.4. Power 5.5.3.2.5. Others 5.5.3.3. Mexico Vehicle Grid Integration Market Size and Forecast, by Power Rating (2023-2030) 5.5.3.3.1. Below 10 kW 5.5.3.3.2. 10-50 kW 5.5.3.3.3. Above 50 kW 5.5.3.4. Mexico Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 5.5.3.4.1. Peak Shaving 5.5.3.4.2. Frequency Regulation 5.5.3.4.3. Renewable Energy Integration 5.5.3.4.4. Demand Response 5.5.3.4.5. Others 6. Europe Vehicle Grid Integration Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Europe Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.2. Europe Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.3. Europe Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.4. Europe Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5. Europe Vehicle Grid Integration Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.1.2. United Kingdom Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. United Kingdom Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.1.4. United Kingdom Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.2. France 6.5.2.1. France Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.2.2. France Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. France Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.2.4. France Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.3.2. Germany Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Germany Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.3.4. Germany Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.4.2. Italy Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. Italy Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.4.4. Italy Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.5.2. Spain Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Spain Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.5.4. Spain Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.6.2. Sweden Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Sweden Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.6.4. Sweden Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.7.2. Austria Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Austria Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.7.4. Austria Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 6.5.8.2. Rest of Europe Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Rest of Europe Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 6.5.8.4. Rest of Europe Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Vehicle Grid Integration Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.2. Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.3. Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.4. Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5. Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.1.2. China Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. China Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.1.4. China Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.2.2. S Korea Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. S Korea Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.2.4. S Korea Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.3.2. Japan Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Japan Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.3.4. Japan Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.4. India 7.5.4.1. India Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.4.2. India Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. India Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.4.4. India Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.5.2. Australia Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.5.3. Australia Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.5.4. Australia Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.6.2. Indonesia Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.6.3. Indonesia Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.6.4. Indonesia Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.7.2. Malaysia Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.7.3. Malaysia Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.7.4. Malaysia Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.8.2. Vietnam Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.8.3. Vietnam Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.8.4. Vietnam Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.9.2. Taiwan Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.9.3. Taiwan Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.9.4. Taiwan Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 7.5.10.2. Rest of Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 7.5.10.3. Rest of Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 7.5.10.4. Rest of Asia Pacific Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Vehicle Grid Integration Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 8.1. Middle East and Africa Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 8.2. Middle East and Africa Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 8.3. Middle East and Africa Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 8.4. Middle East and Africa Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 8.5. Middle East and Africa Vehicle Grid Integration Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.1.2. South Africa Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. South Africa Vehicle Grid Integration Market Size and Forecast, by Power Rating (2023-2030) 8.5.1.4. South Africa Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.2.2. GCC Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. GCC Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 8.5.2.4. GCC Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.3.2. Nigeria Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Nigeria Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 8.5.3.4. Nigeria Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 8.5.4.2. Rest of ME&A Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 8.5.4.3. Rest of ME&A Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 8.5.4.4. Rest of ME&A Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 9. South America Vehicle Grid Integration Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030 9.1. South America Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 9.2. South America Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 9.3. South America Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 9.4. South America Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 9.5. South America Vehicle Grid Integration Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 9.5.1.2. Brazil Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 9.5.1.3. Brazil Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 9.5.1.4. Brazil Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 9.5.2.2. Argentina Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 9.5.2.3. Argentina Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 9.5.2.4. Argentina Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Vehicle Grid Integration Market Size and Forecast, by Vehicle Type (2023-2030) 9.5.3.2. Rest Of South America Vehicle Grid Integration Market Size and Forecast, by Technology (2023-2030) 9.5.3.3. Rest Of South America Vehicle Grid Integration Market Size and Forecast, by Power Rating(2023-2030) 9.5.3.4. Rest Of South America Vehicle Grid Integration Market Size and Forecast, by Application (2023-2030) 10. Global Vehicle Grid Integration Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2022) 10.3.5. Company Locations 10.4. Leading Vehicle Grid Integration Market Companies, by market capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Tesla Inc. 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (small, medium, and large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Nissan Motor Corporation 11.3. BMW Group 11.4. Mitsubishi Motors Corporation 11.5. General Motors 11.6. Ford Motor Company 11.7. Renault Group 11.8. Hyundai Motor Company 11.9. Toyota Motor Corporation 11.10. Kia Corporation 11.11. Honda Motor Co., Ltd. 11.12. Volkswagen Group 11.13. BYD Auto Co., Ltd. 11.14. Daimler AG 11.15. Volvo Car Group 11.16. Audi AG 11.17. Mahindra & Mahindra Ltd. 11.18. Fiat Chrysler Automobiles (FCA) 11.19. SAIC Motor Corporation Limited 11.20. Jaguar Land Rover Automotive PLC 11.21. Geely Automobile Holdings Ltd. 11.22. Subaru Corporation 11.23. Chery Automobile Co., Ltd. 11.24. Proterra Inc. 11.25. Lucid Motors Inc. 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary