V2X Cybersecurity Market size was valued at US$ 1.67 Bn. in 2023 and the total revenue is expected to grow at a CAGR of 18.5% through 2024 to 2030, reaching nearly US$ 5.42 Bn.V2X Cybersecurity Market Overview:

The automotive cybersecurity industry consists of companies (organizations, sole proprietors, and partnerships) that sell products and services for the security of vehicles from cyberattacks and accidents. Automotive cybersecurity is a term used to describe a group of procedures followed to keep vehicles functioning efficiently. The protection of all electronic systems, various communication networks, control algorithms, and other forms of software against harmful cyberattacks, unauthorized access, or manipulation is referred to as automotive cybersecurity. Network security, application security, endpoint security, wireless security, and cloud security are the primary categories of automobile cybersecurity. Network security refers to a collection of procedures followed to maintain cars in functioning order. These are a collection of settings or guidelines created especially to safeguard the networks' accessibility in connected automobiles. In-vehicle and external cloud services are among the factors that drive the market. Both passenger automobiles and commercial trucks fall under this category of vehicle, which is utilized in a wide range of applications including telematics systems, body control, and comfort systems, entertainment systems, powertrain systems, and others. An increase in cyberattacks on the automotive sector, and increased consumer demand for electric vehicles with connected car technologies are the key driving factors that help to grow the market. However, the market is being restrained by a complicated ecosystem with several stakeholders. Opportunities for the V2X Cybersecurity market include the growing trend of connected and autonomous vehicle technologies that are at risk of cyberattacks and the rising demand for electric cars these key factors are deeply covered in the report.To know about the Research Methodology :- Request Free Sample Report

V2X Cybersecurity Market Dynamics:

V2X cybersecurity is evolving into a new tier of automobile quality

OEMs may now find a variety of options in the automotive sector thanks to the developing wireless communication technology. Innovations in the V2X space are expected to be driven by the growing demand for traffic safety and the OEMs' increased attention to V2X. One of the major features of the vehicle-to-everything ecosystem is high-speed communication. For automobiles traveling on highways, connectivity is important for exchanging data on object recognition, lane changes, traffic conditions, vehicle distances, and services like navigation. However, because of the poor network coverage on roads, automobiles are not connected. For instance, according to the International Telecommunication Union (ITU), there was a discrepancy between the inadequate 29% penetration of 4G in rural regions and the 85% coverage of 4G in metropolitan areas globally in 2020. The advantages of 5G for motor vehicles would only be felt in cities if roads and highways have universal coverage. An ecosystem for V2X is developing. The growing demand from the V2X segment, which is being driven by connected vehicle improvements, is allowing many stakeholders both inside and outside the automotive industry to take advantage of market opportunities. In the upcoming years, V2X technology adoption is expected to be more popular in countries including Japan, China, Germany, and the US. In 2020, the majority of manufacturers, including Volkswagen (Germany), General Motors (US), and Toyota (Japan), began using IEEE 802.11p-based V2X technology. The automotive V2X market is also expected to be driven by rising public and governmental concerns about vehicle safety, technical improvements, and decreasing costs of V2X technology.OEMs, semiconductor firms, telecommunications providers, and government agencies are just a few of the many groups of stakeholders in V2X. To bring improved, connected vehicle services and innovations, several players in the V2X ecosystem are investigating, testing, and investing. A deep study of the V2X stakeholders is provided by MMR, along with other insightful information covered in the report.

Deficiency in infrastructure

The lack of infrastructure for the operation of V2X communication is one of the factors hampering the revenue growth of the V2X cybersecurity industry. The V2X cybersecurity market's growth is expected to get negatively impacted by the V2X technology and faulty functionality. The effectiveness of mobility business models that rely on reliable connections might be severely hampered by a lack of 5G coverage in rural regions. Even though the geographical distribution has not yet been defined, it is important to consider the range of useful applications expected for future 5G networks while overcoming coverage problems. The cost of providing service to rural regions would rise further because of the high frequencies expected for 5G, which would require the installation of more sensor stations connected to the network through fiber optics. During the forecast period, all of these constraints are projected to hinder the market's future growth opportunities for V2X cybersecurity.V2X Cybersecurity Market Segment Analysis:

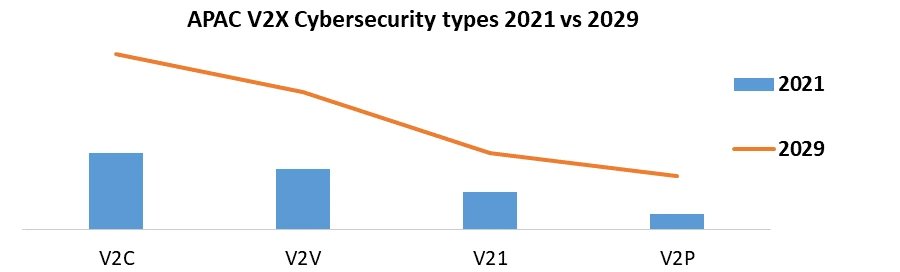

By Unit Type, based on unit type on-board security held the largest market share in 2023. Security Innovation, the market leader in application security testing and training services, revealed its plans to separate its SI-Embedded business unit and found On-board Security as a sister organization. The organization will be made up of the SI-Embedded business unit, which has recently become a global leader in advanced encryption, trusted computing, and vehicle-to-vehicle (V2V) security. The change improves both organizations’ strategic focus and shareholder value. The award-winning Aerolink Vehicle-to-Vehicle (V2V) security libraries and related products, the NTRU post-quantum cryptography algorithm that addresses the existential threat to internet security, and TCG Software Stacks (TSS) that make it easier to implement Trusted Platform Modules are all included in the On-board Security product line (TPMs). The consulting services offered include IoT Secure Attestation Consulting, Connected and Autonomous Vehicle Security Consulting, and Transportation Infrastructure Security Consulting. Currently, the On-Board Unit (OBU) installed behind the truck windscreen communicates with toll barriers, roadside toll stations, and backends. This will work in all European countries where the OBU has passed conformity testing. The distributed On-Board Equipment (OBE) solution easily beats the use of isolated hardware. Among the benefits are increased toll collection accuracy and the resolution of some common OBU issues. Due to this OBU provides V2X safety features, which is driving the OBU segment in the automotive V2X market during the forecast period. Based on the Communication, the Vehicle-to-vehicle segment holds the maximum market share in 2023. Vehicle-to-vehicle also referred to as V2V, is a wireless information exchange between vehicles. Within a defined range, the technology can deliver messages from surrounding vehicles, which help determine the risk of crashes and can allow a driver to take early evasive actions, if necessary. The goal is to create a 360-degree awareness bubble of vehicles within the system’s range. The National Highway Traffic Safety Administration (NHTSA) notes that V2V technologies can greatly improve the effectiveness and accuracy of existing vehicle safety features, which use radar and cameras to detect safety threats. Vehicle-to-vehicle (V2V) communication market growth is expected to be driven by rising concerns about traffic safety. The market for vehicle-to-vehicle (V2V) communications consists of sales of V2V communications technology by companies, single proprietors, and partnerships. This technology enables the wireless transfer of data regarding the speed, position, and heading of the two cars. Cars may send and receive Omni-directional data (up to 10 times per second) thanks to V2V communication technology, which gives them a 360-degree view of other vehicles. The user is forced to recognize dangers and identify potential collision hazards thanks to vehicle-to-vehicle communication. The system may send out a combination of visual, tactile, and audible signs to alert drivers. Drivers have the option to take action in response to these alerts to prevent crashes.by Security type, based on security type endpoint security segment held highest market share in 2023. Innovative software and onboard sensors in connected cars allow them to talk with other cars, other drivers, road infrastructure, and the cloud. In addition to enhancing traffic safety, cars can significantly reduce traffic congestion. Drivers and passengers can benefit from enhanced entertainment systems, navigation systems, safety features, and telematics services, among other things, as a result of advancements in mobile technology. Bosch claims that linked automobiles would have a positive impact on society and people. By 2025, connected automobiles may avert 260,000 collisions, save 11,000 lives, and lower 400,000 tons of CO2 emissions from moving vehicles. Additionally, it is expected that linked vehicles would lessen traffic congestion and 280 million driving hours annually. As a consequence, throughout the time of the forecast, the market for automotive clouds will grow. Additionally, improvements in the Internet of Things (IoT) technologies change how the economy and global value chains work. Due to the massive amount of data these devices provide, IoT has the revolutionary potential to increase value and enhance efficiency. The fast acceptance of linked automobiles is largely due to the Internet of Things. Additionally, it is expected that the deployment of the 5G network would enhance driving capabilities and make cars smarter and safer. The potential of 5G for connected automobiles is being investigated by the industry. For instance, to improve driving performance, the Smart City Wuxi project from Huawei and Audi employs real-time traffic management data from C-V2X. These developments will drive the market's expansion for cloud services for the automobile industry. Based on Connectivity, Dedicated Short-Range Communications (DSRC), a short-range communication protocol, has been traditionally dominant due to its low latency and high reliability that are crucial for real-time vehicle communication and safety applications. Further, in DSRC, vehicles validate the authenticity of the received messages and immediately notify the driver or user if incoming messages are found suspicious, supporting the segment growth. The DSRC also provides a key foundation for V2I and Vehicle-to-Vehicle (V2V) safety by offering robust connectivity between users, creating a positive segment outlook in the market. The cellular segment is witnessing the fast growth owing to the expansion of 5G technology, which offers enhanced bandwidth and lower latency than DSRC. This makes cellular connectivity more adaptable for complex and high-data applications such as autonomous driving and smart city integrations.

In Vehicle type, the passenger cars segment held the highest market share of more than xx% in 2023 and is expected to maintain its dominance over the forecast period. The significant market share can be attributed to the increasing use of V2X cybersecurity solutions in hybrid and electric passenger cars. The large number of passenger cars on the road and their growing integration with vehicle-to-everything (V2X) systems enhancing safety, navigation, and entertainment, significantly contribute to this sector's dominant market share. As passenger cars increasingly incorporate various V2X technologies, they become a focal point for cybersecurity solutions. These solutions are essential for safeguarding consumer data and ensuring vehicle safety, underscoring the critical need for robust cybersecurity measures in the automotive industry. The commercial vehicle segment is experiencing the high growth rate. This surge attributed to the rising emphasis on fleet management, logistics, and operational efficiency. Commercial vehicles, including trucks and buses, are increasingly incorporating V2X technologies to optimize routes, improve safety, and enable real-time data exchange for fleet management. The governments are partnering with smart transportation solution providers to manage the Intelligent Transportation System (ITS) solutions, creating robust opportunities for market growth. As businesses and logistics companies seek to enhance operational efficiency and safety through advanced connectivity, the demand for V2X cybersecurity solutions in the commercial vehicle sector is rapidly increasing, highlighting a growing trend towards securing commercial transportation networks.

V2X Cybersecurity Market Regional Insights:

North America held the highest market share of more than xx% in 2023. In North America, the market is expanding progressively in line with rapid technological advancements in the automotive sector, significant sales of autonomous cars, and supportive government initiatives for smart transportation systems. The presence of major automotive manufacturers and technology providers, coupled with substantial investments in smart city initiatives and autonomous driving research, further reinforces North America's leading position. Additionally, the region's robust focus on developing and implementing comprehensive cybersecurity standards for V2X communication systems supports its dominance in the market. Europe follows closely, driven by similar technological advancements and a robust regulatory framework. The region’s emphasis on data protection and privacy, guided by regulations such as the General Data Protection Regulation (GDPR), compels automotive manufacturers to adopt advanced cybersecurity measures. Europe’s strategic collaborations across the automotive sector, coupled with government funding in cybersecurity initiatives, also play a crucial role in advancing the region’s market share. The rising focus of the region on creating smart transportation infrastructure and integrating V2X technologies into its urban environments boosts market growth. Additionally, the presence of leading automotive manufacturers and technology companies in countries such as Germany, France, and the UK contributes to the region's strong position in the market. The push toward greener and smarter mobility solutions also fuels investments in V2X cybersecurity across Europe.

Competitive landscape

The V2X cybersecurity market is dominated by major key players like Qualcomm Technologies, Inc, Continental AG, ESCRYPT, AUTOCRYPT Co., Ltd., and Autotalks These businesses provide cybersecurity for V2Xs and have robust international distribution networks. AUTOCRYPT Co., Ltd., AUTOCRYPT is a market leader in transportation security technology. AUTOCRYPT started as an internal project at Penta Security Systems Inc. The AUTOCRYPT, as the Best Auto Cybersecurity Product/Solution of 2019 by TU-Automotive, continues to set the standard for mobility and transportation security with a multi-layered, comprehensive approach. AUTOCRYPT makes ensuring that security is addressed before cars are put on the road by providing security solutions for V2X/C-V2X, V2G (including PnC security), in-vehicle security, and Fleet Management. Qualcomm, Leading wireless technology innovator Qualcomm Incorporated offers V2X solutions. It operates in four business segments: QCT, QTL, QSI, and reconciling items. The QCT business segment of Qualcomm Technologies, Inc., a fully owned subsidiary of Qualcomm Incorporated, provides C-V2X (cellular vehicle-to-everything) chipsets for the V2X market. The company's V2X solution improves security against online threats and supports both Dedicated Short Range Communications (DSRC) and C-V2X. The 170 offices of Qualcomm Inc. are dispersed across 28 countries, including China, Japan, Mexico, the United States, the United Kingdom, France, South Korea, and India.These key players maintain professional relationships with a wide range of businesses and strategic collaborations with independent consultants from around the world. To provide information on the global v2x cybersecurity market, also these businesses have created new products, used development strategies, and new product launching, and engaged in alliances, mergers, and acquisitions. They are making an alliance with Tire1, and Tire2 suppliers to kill the competition in global as well as regional markets.

V2X Cybersecurity Industry Ecosystem

V2X Cybersecurity Market Scope: Inquire before buying

V2X Cybersecurity Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1.67 Bn Forecast Period 2024 to 2030 CAGR: 18.5% Market Size in 2030: USD 5.42 Bn Segments Covered: by Unit On-Board Units Roadside Units by Communication Vehicle-to-Vehicle (V2V) Vehicle-to-Infrastructure (V2I) Vehicle-to-Pedestrian (V2P) Vehicle-to-Grid (V2G) Vehicle-to-Cloud (V2C) by Security type Endpoint Security Software Security Cloud Security by Connectivity Cellular DSRC by Vehicle type Passenger Commercial by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key Players are:

1. Altran 2. Aptiv 3. Autocrypt 4. Autotalks Ltd. 5. Blackberry Certicom 6. Continental 7. Denso Corporation 8. Escrypt 9. Green Hills Software 10.Harman International 11.ID Quantique 12.IDNomic 13.Infineon Technologies AG 14.Karamba Security 15.Lear Corporation 16.NXP 17.Onboard Security (Qualcomm) 18.Saferide Technologies 19.Secunet 20.STMicroelectronics 21.Trillium Secure Inc. 22.Vector Informatik GmbHFrequently Asked Questions:

1] What segments are covered in the Global V2X Cybersecurity Market report? Ans. The segments covered in the V2X Cybersecurity Market report are based on Unit, Communication, Security type, Connectivity and Vehicle type. 2] Which region is expected to hold the highest share in the Global V2X Cybersecurity Market? Ans. The North America region is expected to hold the highest share in the V2X Cybersecurity Market. 3] What is the market size of the Global V2X Cybersecurity Market by 2030? Ans. The market size of the V2X Cybersecurity Market by 2030 is expected to reach US$ 5.42 Bn. 4] What is the forecast period for the Global V2X Cybersecurity Market? Ans. The forecast period for the V2X Cybersecurity Market is 2024-2030. 5] What was the market size of the Global V2X Cybersecurity Market in 2023? Ans. The market size of the V2X Cybersecurity Market in 2023 was valued at US$ 1.67 Bn.

1. V2X Cybersecurity Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global V2X Cybersecurity Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Product Segment 2.5.3. Vehicle type Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. V2X Cybersecurity Market: Dynamics 3.1. V2X Cybersecurity Market Trends 3.2. V2X Cybersecurity Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. Identification of potential security risks, and strategies for strengthening cybersecurity measures across the supply chain.V2X Cybersecurity Threats and Solutions 3.3.1. Standards 3.3.2. Services 3.3.3. Recent developments 3.3.4. European telecommunication standards institute 3.4. Technology Analysis 3.4.1. Intelligent Transport system 3.4.2. Cooperative intelligent transport system 3.4.3. Cellular vehicle-to-everything 3.4.4. LTE V2X 3.4.5. 5G V2X 3.4.6. Blockchain technology 3.4.7. Edge computing 3.4.8. 6G V2X 3.4.9. Vehicle security operations centre 3.5. Ecosystem Analysis 3.5.1. Production, Research & Development 3.5.2. Distributors and Suppliers 3.5.3. End users 3.5.4. Regulatory and Standards Impact 3.6. PORTER’s Five Forces Analysis 3.6.1. Intensity of the Rivalry 3.6.2. Threat of New Entrants 3.6.3. Bargaining Power of Suppliers 3.6.4. Bargaining Power of Buyers 3.6.5. Threat of Substitutes 3.7. Investment scenario 3.7.1. Investments scenario, 2019-2023 3.8. Key characteristics of V2X attacks 3.8.1. Overview of various attack types such as spoofing, jamming, man-in-the-middle (MITM), denial-of-service (DoS), and malware injection targeting V2X systems. 3.8.2. Identification of weak points in vehicle-to-vehicle (V2V), vehicle-to-infrastructure (V2I), and vehicle-to-network (V2N) communications susceptible to cyberattacks 3.9. Regulatory Landscape by Region 3.9.1. North America 3.9.2. Europe 3.9.3. Asia Pacific 3.9.4. South America 3.9.5. MEA 4. V2X Cybersecurity Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2023-2030) 4.1. V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 4.1.1. On-Board Units 4.1.2. Roadside Units 4.2. V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 4.2.1. Vehicle-to-Vehicle (V2V) 4.2.2. Vehicle-to-Infrastructure (V2I) 4.2.3. Vehicle-to-Pedestrian (V2P) 4.2.4. Vehicle-to-Grid (V2G) 4.2.5. Vehicle-to-Cloud (V2C) 4.3. V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 4.3.1. Endpoint Security 4.3.2. Software Security 4.3.3. Cloud Security 4.4. V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 4.4.1. Cellular 4.4.2. DSRC 4.5. V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 4.5.1. Passenger 4.5.2. Commercial 5. North America V2X Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 5.1. North America V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 5.1.1. On-Board Units 5.1.2. Roadside Units 5.2. North America V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 5.2.1. Vehicle-to-Vehicle (V2V) 5.2.2. Vehicle-to-Infrastructure (V2I) 5.2.3. Vehicle-to-Pedestrian (V2P) 5.2.4. Vehicle-to-Grid (V2G) 5.2.5. Vehicle-to-Cloud (V2C) 5.3. North America V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 5.3.1. Endpoint Security 5.3.2. Software Security 5.3.3. Cloud Security 5.4. North America V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 5.4.1. Cellular 5.4.2. DSRC 5.5. North America V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 5.5.1. Passenger 5.5.2. Commercial 5.6. North America V2X Cybersecurity Market Size and Forecast, by Country (2023-2030) 5.6.1. United States 5.6.1.1. United States V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 5.6.1.1.1. On-Board Units 5.6.1.1.2. Roadside Units 5.6.1.2. United States V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 5.6.1.2.1. Vehicle-to-Vehicle (V2V) 5.6.1.2.2. Vehicle-to-Infrastructure (V2I) 5.6.1.2.3. Vehicle-to-Pedestrian (V2P) 5.6.1.2.4. Vehicle-to-Grid (V2G) 5.6.1.2.5. Vehicle-to-Cloud (V2C) 5.6.1.3. United States V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 5.6.1.3.1. Endpoint Security 5.6.1.3.2. Software Security 5.6.1.3.3. Cloud Security 5.6.1.4. United States V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 5.6.1.4.1. Cellular 5.6.1.4.2. DSRC 5.6.1.5. United States V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 5.6.1.5.1. Passenger 5.6.1.5.2. Commercial 5.6.2. Canada 5.6.2.1. Canada V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 5.6.2.1.1. On-Board Units 5.6.2.1.2. Roadside Units 5.6.2.2. Canada V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 5.6.2.2.1. Vehicle-to-Vehicle (V2V) 5.6.2.2.2. Vehicle-to-Infrastructure (V2I) 5.6.2.2.3. Vehicle-to-Pedestrian (V2P) 5.6.2.2.4. Vehicle-to-Grid (V2G) 5.6.2.2.5. Vehicle-to-Cloud (V2C) 5.6.2.3. Canada V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 5.6.2.3.1. Endpoint Security 5.6.2.3.2. Software Security 5.6.2.3.3. Cloud Security 5.6.2.4. Canada V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 5.6.2.4.1. Cellular 5.6.2.4.2. DSRC 5.6.2.5. Canada V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 5.6.2.5.1. Passenger 5.6.2.5.2. Commercial 5.6.3. Mexico 5.6.3.1. Mexico V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 5.6.3.1.1. On-Board Units 5.6.3.1.2. Roadside Units 5.6.3.2. Mexico V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 5.6.3.2.1. Vehicle-to-Vehicle (V2V) 5.6.3.2.2. Vehicle-to-Infrastructure (V2I) 5.6.3.2.3. Vehicle-to-Pedestrian (V2P) 5.6.3.2.4. Vehicle-to-Grid (V2G) 5.6.3.2.5. Vehicle-to-Cloud (V2C) 5.6.3.3. Mexico V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 5.6.3.3.1. Endpoint Security 5.6.3.3.2. Software Security 5.6.3.3.3. Cloud Security 5.6.3.4. Mexico V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 5.6.3.4.1. Cellular 5.6.3.4.2. DSRC 5.6.3.5. Mexico V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 5.6.3.5.1. Passenger 5.6.3.5.2. Commercial 6. Europe V2X Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 6.1. Europe V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.2. Europe V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.3. Europe V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.4. Europe V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.5. Europe V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6. Europe V2X Cybersecurity Market Size and Forecast, by Country (2023-2030) 6.6.1. United Kingdom 6.6.1.1. United Kingdom V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.1.2. United Kingdom V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.1.3. United Kingdom V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.1.4. United Kingdom V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.1.5. United Kingdom V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.2. France 6.6.2.1. France V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.2.2. France V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.2.3. France V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.2.4. France V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.2.5. France V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.3. Germany 6.6.3.1. Germany V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.3.2. Germany V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.3.3. Germany V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.3.4. Germany V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.3.5. Germany V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.4. Italy 6.6.4.1. Italy V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.4.2. Italy V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.4.3. Italy V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.4.4. Italy V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.4.5. Italy V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.5. Spain 6.6.5.1. Spain V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.5.2. Spain V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.5.3. Spain V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.5.4. Spain V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.5.5. Spain V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.6. Sweden 6.6.6.1. Sweden V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.6.2. Sweden V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.6.3. Sweden V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.6.4. Sweden V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.6.5. Sweden V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.7. Austria 6.6.7.1. Austria V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.7.2. Austria V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.7.3. Austria V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.7.4. Austria V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.7.5. Austria V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 6.6.8.2. Rest of Europe V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 6.6.8.3. Rest of Europe V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 6.6.8.4. Rest of Europe V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 6.6.8.5. Rest of Europe V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7. Asia Pacific V2X Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 7.1. Asia Pacific V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.2. Asia Pacific V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.3. Asia Pacific V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.4. Asia Pacific V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.5. Asia Pacific V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6. Asia Pacific V2X Cybersecurity Market Size and Forecast, by Country (2023-2030) 7.6.1. China 7.6.1.1. China V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.1.2. China V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.1.3. China V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.1.4. China V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.1.5. China V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6.2. S Korea 7.6.2.1. S Korea V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.2.2. S Korea V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.2.3. S Korea V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.2.4. S Korea V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.2.5. S Korea V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6.3. Japan 7.6.3.1. Japan V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.3.2. Japan V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.3.3. Japan V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.3.4. Japan V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.3.5. Japan V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6.4. India 7.6.4.1. India V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.4.2. India V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.4.3. India V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.4.4. India V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.4.5. India V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6.5. Australia 7.6.5.1. Australia V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.5.2. Australia V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.5.3. Australia V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.5.4. Australia V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.5.5. Australia V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6.6. ASIAN 7.6.6.1. ASIAN V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.6.2. ASIAN V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.6.3. ASIAN V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.6.4. ASIAN V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.6.5. ASIAN V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 7.6.7. Rest of Asia Pacific 7.6.7.1. Rest of Asia Pacific V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 7.6.7.2. Rest of Asia Pacific V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 7.6.7.3. Rest of Asia Pacific V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 7.6.7.4. Rest of Asia Pacific V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 7.6.7.5. Rest of Asia Pacific V2X Cybersecurity Market Size and Forecast, by Vehicle type (2023-2030) 8. Middle East and Africa V2X Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 8.2. Middle East and Africa V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 8.3. Middle East and Africa V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 8.4. Middle East and Africa V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.5. Middle East and Africa V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 8.6. Middle East and Africa V2X Cybersecurity Market Size and Forecast, by Country (2023-2030) 8.6.1. South Africa 8.6.1.1. South Africa V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 8.6.1.2. South Africa V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 8.6.1.3. South Africa V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 8.6.1.4. South Africa V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.6.1.5. South Africa V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 8.6.2. S GCC 8.6.2.1. GCC V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 8.6.2.2. GCC V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 8.6.2.3. GCC V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 8.6.2.4. GCC V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.6.2.5. GCC V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 8.6.3. Egypt 8.6.3.1. Egypt V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 8.6.3.2. Egypt V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 8.6.3.3. Egypt V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 8.6.3.4. Egypt V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.6.3.5. Egypt V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 8.6.4. Nigeria 8.6.4.1. Nigeria V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 8.6.4.2. Nigeria V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 8.6.4.3. Nigeria V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 8.6.4.4. Nigeria V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.6.4.5. Nigeria V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 8.6.5. Rest of ME &A 8.6.5.1. Rest of ME &A V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 8.6.5.2. Rest of ME &A V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 8.6.5.3. Rest of ME &A V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 8.6.5.4. Rest of ME &A V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 8.6.5.5. Rest of ME &A V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 9. South America V2X Cybersecurity Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 9.1. South America V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 9.2. South America V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 9.3. South America V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 9.4. South America V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 9.5. South America V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 9.6. South America V2X Cybersecurity Market Size and Forecast, by Country (2023-2030) 9.6.1. Brazil 9.6.1.1. Brazil V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 9.6.1.2. Brazil V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 9.6.1.3. Brazil V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 9.6.1.4. Brazil V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 9.6.1.5. Brazil V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 9.6.2. Argentina 9.6.2.1. Argentina V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 9.6.2.2. Argentina V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 9.6.2.3. Argentina V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 9.6.2.4. Argentina V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 9.6.2.5. Argentina V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 9.6.3. Rest Of South America 9.6.3.1. Rest of South America V2X Cybersecurity Market Size and Forecast, by Unit (2023-2030) 9.6.3.2. Rest of South America V2X Cybersecurity Market Size and Forecast, by Communication (2023-2030) 9.6.3.3. Rest of South America V2X Cybersecurity Market Size and Forecast, by Security type (2023-2030) 9.6.3.4. Rest of South America V2X Cybersecurity Market Size and Forecast, by Technology (2023-2030) 9.6.3.5. Rest of South America V2X Cybersecurity Market Size and Forecast, by Connectivity (2023-2030) 10. Company Profile: Key Players 10.1. Altran 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.3.1. Total Revenue 10.1.3.2. Segment Revenue 10.1.3.3. Annual Revenue 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Aptiv 10.3. Autocrypt 10.4. Autotalks Ltd. 10.5. Blackberry Certicom 10.6. Continental 10.7. Denso Corporation 10.8. Escrypt 10.9. Green Hills Software 10.10. Harman International 10.11. ID Quantique 10.12. IDNomic 10.13. Infineon Technologies AG 10.14. Karamba Security 10.15. Lear Corporation 10.16. NXP 10.17. Onboard Security (Qualcomm) 10.18. Saferide Technologies 10.19. Secunet 10.20. STMicroelectronics 10.21. Trillium Secure Inc. 10.22. Vector Informatik GmbH 11. Key Findings and Analyst Recommendations 12. V2X Cybersecurity Market: Research Methodology 12.1. Research Data 12.1.1. Secondary Data 12.1.1.1. Secondary sources 12.1.1.2. Key data from secondary sources 12.1.2. Primary Data 12.1.2.1. Primary interviews from demand and supply side 12.1.2.2. Key insights from industry experts 12.1.2.3. Breakdown of primary interviews 12.1.2.4. Primary participants 12.2. Market size estimation 12.2.1. Bottom-up Approach 12.2.1.1. Market size estimation notes 12.2.2. Top-down Approach 12.2.2.1. Market size estimation notes