The Urban Air Mobility Market size was valued at USD 3.89 Billion in 2024 and the total Urban Air Mobility revenue is expected to grow at a CAGR of 30.2% from 2025 to 2032, reaching nearly USD 32.14 Billion. Urban Air Mobility is the transportation of passengers, goods, or services using electric Vertical Take-Off and Landing (eVTOL) aircraft, drones, or other aerial vehicles within urban and suburban areas. UAM's primary goal is to address urban congestion challenges and provide efficient, faster, and eco-friendly transportation alternatives. Urban Air Mobility (UAM) aims to address urban congestion and limited ground infrastructure while providing safe, low-carbon, and convenient transportation options for city dwellers. It is estimated that 60% of the world's population will live in urban areas by 2030, making innovations in mobility solutions crucial. Urban Air Mobility offers a promising solution to overcome these challenges by utilizing the largely untapped airspace above cities. Recent advancements in technology have played a crucial role in enabling Urban Air Mobility. Airbus a major aerospace manufacturer, has been actively involved in exploring and developing urban air mobility solutions since 2014. In May 2018, Airbus established Airbus Urban Mobility, a dedicated division focused on commercial urban air mobility services and solutions. Airbus Urban Mobility aims to bring safety, convenience, and the joy of flight to urban inhabitants by providing seamless and integrated urban air mobility services. The company takes a holistic approach to urban air mobility by combining various critical components, including cutting-edge aerial vehicles, infrastructure, and digital platforms. Urban Air Mobility represents a transformative concept that can revolutionize urban transportation by providing safe, low-carbon, and convenient aerial transportation options. As cities grow, investing in and developing urban air mobility solutions becomes imperative to meet urban populations' mobility needs efficiently. Successful implementation will require collaboration among industry stakeholders, policymakers, and the public to overcome regulatory, infrastructure, and social challenges.Urban Air Mobility Market Scope and research methodology:

The scope and research methodology of Urban Air Mobility (UAM) typically covers various aspects, including market segmentation, technology assessment, the regulatory landscape, key player analysis, and future market projections. The research methodology used to study the UAM market involves a combination of primary and secondary research methods. The UAM market covers a wide range of aerial mobility solutions, including electric Vertical Take-Off and Landing (eVTOL) aircraft, passenger drones, cargo drones, and associated infrastructure. Research segments the market based on vehicle type, application (e.g., passenger transportation, cargo delivery, emergency services), and region. The research assesses the latest technologies and innovations related to eVTOL aircraft, propulsion systems, avionics, autonomous flight capabilities, battery technology, charging infrastructure, and enabling technologies. UAM research involves analyzing existing and proposed regulations governing urban air mobility operations. This includes airspace management, safety standards, certification requirements, and integration with existing air traffic management systems. The research identifies and profiles key players, such as established aerospace companies, start-ups, technology firms, and government initiatives involved in the UAM market. Company profiles typically include information on their products, partnerships, funding, and development progress. Future market projections aim to provide insights into potential growth and revenue opportunities within the UAM industry. These projections consider factors such as market trends, technological advancements, regulatory developments, and investment activities. Researchers analyze both primary and secondary research data to derive meaningful insights and draw conclusions about the UAM market's size, growth potential, challenges, and opportunities. This is based on historical data and identified market drivers. The research methodology should transparently state any limitations, assumptions, or potential biases that may influence the findings and conclusions. It is essential to acknowledge uncertainties and variables that may impact projection accuracy.To know about the Research Methodology :- Request Free Sample Report

Market Dynamics:

The Urban Air Mobility Revolution is the Sustainable Future for City Transportation: The Urban Air Mobility market is urban congestion in major cities worldwide. As cities grow, traffic congestion becomes a significant challenge, leading to longer commuting times and decreased productivity. UAM offers a solution to this problem by providing an aerial alternative for short- to medium-distance travel, bypassing ground traffic. Commuters typically spend hours in traffic to reach their workplace in a densely populated city. With the growing focus on environmental sustainability, reducing carbon emissions from transportation has become a global priority. UAM, especially electric-powered eVTOL aircraft, and drones, present an eco-friendly option, decreasing emissions and contributing to cleaner urban air quality. An eVTOL air taxi service powered by renewable energy sources significantly reduces greenhouse gas emissions compared to conventional fossil fuel-driven ground vehicles. Advances in battery technology, electric propulsion systems, lightweight materials, and autonomous flight capabilities have made UAM more feasible and reliable. These technological advancements have attracted investments and accelerated UAM vehicle development. The development of lightweight composite materials and more efficient electric motors has enabled the creation of eVTOL aircraft with extended flight ranges and improved performance. The increasing interest from aerospace companies, technology giants, and startups in the UAM market has resulted in significant investments and research and development efforts. This has led to accelerated innovation and progress in the sector. Major aerospace manufacturers invest in developing and testing eVTOL prototypes, attracting venture capital funding and propelling the industry forward.Mobility Apps Have a Long Road Ahead To Mass Adoption, In 2023 (% of people who have used an app for mobility service)

Safety Concerns and Public Trust are Critical Factors for Urban Air Mobility Adoption. Safety is a paramount concern in the UAM market, given the risks associated with flying vehicles in densely populated urban areas. Robust safety standards and public trust are critical to widespread adoption. A highly publicized accident involving an eVTOL aircraft raises safety concerns and leads to increased scrutiny and regulatory challenges for the entire UAM industry. Integrating UAM into existing airspace and developing appropriate regulations pose significant challenges. Addressing airspace management, air traffic control, and ensuring compliance with existing aviation laws are complex tasks. Different cities or countries have varying regulations and airspace restrictions, making it challenging for UAM operators to navigate smoothly across borders. Establishing a network of airports and charging infrastructure in urban areas requires substantial investment and coordination with urban planning authorities. Infrastructure lack hinders UAM services' growth. An absence of suitable transport and charging stations in a city may delay the launch of Urban Air Mobility services, affecting its feasibility and adoption. Convincing the general public that UAM is safe, reliable, and beneficial is a challenge. Public perception and acceptance play a crucial role in shaping UAM's operation success. Initial hesitancy by the public to use air taxis due to safety concerns or unfamiliarity with the technology impacts initial adoption rates. Integrating UAM into existing air traffic management systems poses challenges in efficiently managing multiple aerial vehicles in urban airspace to ensure safe operations. Without effective air traffic management, conflicts between UAM vehicles and traditional aircraft occur, leading to safety issues and airspace congestion.

Improving emergency patient transfers through urban air mobility. Urban Air Mobility opens up new markets and revenue streams for various industries, including transportation, tourism, medical services, and emergency response. An on-demand medical transport service using UAM vehicles could provide faster and more efficient patient transfers between hospitals, saving critical time in emergency. UAM has the potential to significantly reduce emissions and contribute to sustainable urban mobility, aligning with cities' efforts to reduce their carbon footprint. A city with a successful UAM network can significantly decrease greenhouse gas emissions from ground transportation, progressing toward its environmental goals. The development of UAM will drive advancements in autonomous flight, electric propulsion, and air traffic management. Advancements in autonomous flight technology may lead to more reliable and safer UAM operations, promoting its wider adoption in the market.

Urban Air Mobility Market Segmental Insights:

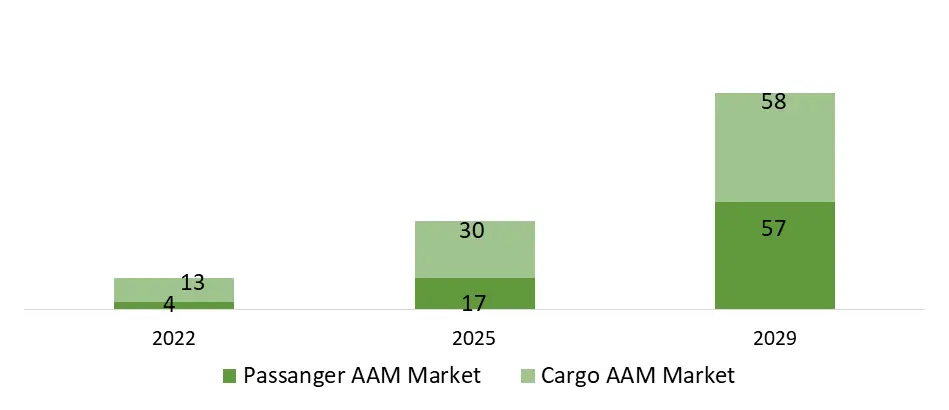

Based on the Platform, In the Urban Air Mobility Market, Air Shuttles and Air Metro dominate the market in 2024 and are expected to grow during the forecast period. Air Shuttles and Air Metro platforms are large-scale aerial vehicles capable of transporting more passengers within urban areas. Air shuttles operate on predefined routes and schedules, while air metros provide more frequent services, similar to traditional mass transit systems. Personal air vehicles are compact aerial vehicles designed for individual use, allowing users to commute between various locations efficiently and independently. Cargo air vehicles are specifically designed for transporting goods and packages, offering faster delivery options for businesses and e-commerce companies. These specialized aerial vehicles are equipped to provide medical assistance and transportation to patients in emergency, enabling quicker response times and critical care. Last-mile delivery vehicles operate in urban areas and provide efficient delivery of goods to their final destinations, reducing ground-based transportation dependency for last-mile logistics. Air taxis are aerial vehicles designed to transport passengers within urban areas, offering a faster and more convenient alternative to ground transportation. They cater to individuals or small groups, offering point-to-point travel.Advanced Air Mobility Market Poised to grow Sevenfold Between 2024- 2030 (US$ billion)

Urban Air Mobility Market Regional Insights:

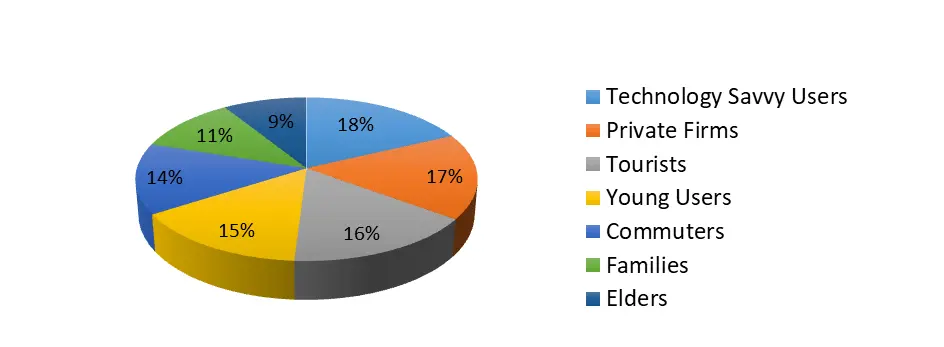

The Urban Air Mobility (UAM) market is expected to vary significantly across different regions, influenced by factors such as the regulatory environment, infrastructure development, technological adoption, population density, and market demand. North America is one of the leading regions in the UAM market in the year 2024. This is driven by strong government support, technological advancements, and substantial investments from both established aerospace companies and startups. The region has a high concentration of major urban centers with significant traffic congestion, making it an attractive market for UAM services. Companies like Uber Air pilot air taxi services in cities like Los Angeles and Dallas. This demonstrates the potential for aerial ridesharing in congested urban areas. Delivery companies in the U.S., such as Amazon Prime Air, have been actively exploring the use of UAM platforms for faster and more efficient last-mile delivery of packages to customers. Urbanization and demand for efficient transportation options make personal air vehicles attractive for urban commuters in North America. North America has been at the forefront of developing autonomous technology, making piloted autonomous platforms a critical segment for testing and deployment. Europe is another significant region in the UAM market, driven by strong regulatory efforts and support from the European Union. The region has a dense network of cities, providing ample opportunities to develop UAM applications. European countries like Germany and France have been actively exploring UAM for medical emergency transportation. This is aimed at reducing response times and improving patient outcomes. Several European cities are exploring the use of UAM air shuttles to connect urban centers and offer efficient transportation for daily commuters. Europe's robust e-commerce industry and emphasis on sustainable logistics create significant potential for cargo air vehicles, addressing the need for fast and eco-friendly last-mile deliveries. Europe is a leader in autonomous technology development, making autonomous platforms a prominent segment of regional UAM deployments. The Asia-Pacific region presents unique opportunities and challenges for the UAM market. The region's fast-growing urban centers, traffic congestion, and increasing urbanization demand innovative mobility solutions. Countries like Japan and South Korea are exploring the use of UAM platforms for inter-city air shuttles, offering faster and more efficient travel options between major metropolitan areas. High population density and urban congestion in several Asian cities present significant opportunities for air taxis as a feasible transportation solution. The vast distances between major urban centers in the Asia-Pacific region demand UAM platforms capable of efficient inter-city travel.Potential Early Adopters Of Urban Air Management, In 2024, (%)

Competitive Landscape

Key Players of the Urban Air Mobility Market profiled in the report include Airbus, Airspacex, Aurora Flight Sciences, Carter Aviation, Embraer SA, Guangzhou EHang Intelligent Technology Co. Ltd, Jaunt Air Mobility Corporation, Joby Aviation Inc., Kitty Hawk, Lilium, Neva Aerospace, Opener, Pipistrel Group, Safran SA, Textron Inc., The Boeing Company, Volocopter GmbH, Wisk Aero LLC, Workhorse Group Inc. This provides huge opportunities to serve many End-uses & customers and expand the Urban Air Mobility Market. In April 2023, Joby Aviation, Inc., a leading eVTOL aircraft manufacturer, announced the third extension of its contract with the United States Air Force under the Agility Prime program. The contract extension, valued at $55 million, brings Joby's existing contract to $131 million. Joby will continue to provide and operate up to nine of its five-seat aircraft, known for their low noise levels and zero operating emissions. In March 2023, Lilium Aviation GmbH, a leader in all-electric vertical take-off and landing (eVTOL) jets, forged a strategic partnership with Air-Dynamic SA, a prominent private jet and helicopter company based in Switzerland. Under the definitive agreement, Air-Dynamic SA committed to purchasing up to five Lilium Jets and secured the orders by depositing. In March 2023, Kakao Mobility, a prominent South Korean mobility technology business, placed a significant preorder for up to 50 units of Vertical's VX4 aircraft. This move expands the number of customer launch regions for Vertical, showcasing the growing interest in electric vertical take-off and landing (eVTOL) technology. In March 2023, Eve Holding, Inc., an innovator in urban air mobility solutions, signed a Letter of Intent (LOI) with Ferrovial Vertiports, a subsidiary of the world's largest infrastructure operator, Ferrovial. The collaboration aims to explore the implementation of Eve Air Mobility's Urban Air Traffic Management (Urban ATM) software solution. This software will play a crucial role in ensuring the safe and reliable operation of vertiports and electric vertical take-off and landing (eVTOL) aircraft.Urban Air Mobility Industry Ecosystem

Urban Air Mobility Market Scope: Inquire Before Buying

Global Urban Air Mobility Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 3.89 Bn. Forecast Period 2025 to 2032 CAGR: 30.2% Market Size in 2032: USD 32.14 Bn. Segments Covered: by Platform Air Taxis Air Shuttles and & Air Metro Personal Air Vehicles Cargo Air Vehicles Air Ambulance & Medical Emergency Vehicles Last-mile Delivery Vehicles by Platform Operation Piloted Autonomous by Range Intercity (>100 Km) Intracity (<100 Km) by Platform Architecture Rotary Wing Fixed Wing Hybrid Fixed Wing by End User Ridesharing Companies Scheduled Operators E-Commerce Companies Hospitals and Medical Agencies Private Operators Urban Air Mobility Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Urban Air Mobility Market, Key Players

1. Airbus 2. Airspacex 3. Aurora Flight Sciences 4. Carter Aviation 5. Embraer SA 6. EHang 7. Jaunt Air Mobility Corporation 8. Joby Aviation Inc. 9. Kitty Hawk 10. Lilium 11. Neva Aerospace 12. Opener 13. Pipistrel Group 14. Safran SA 15. Textron Inc. 16. The Boeing Company 17. Volocopter GmbH 18. Wisk Aero LLC 19. Workhorse Group Inc.FAQs:

1. What are the growth drivers for the Urban Air Mobility Market? Ans. The Urban Air Mobility Revolution is the Sustainable Future for City Transportation and is expected to be the major driver for the Urban Air Mobility Market. 2. What is the major restraint for the Urban Air Mobility Market growth? Ans. Safety Concerns and Public Trust are Critical Factors for Urban Air Mobility Adoption and are expected to be the major restraining factor for the Urban Air Mobility Market growth. 3. Which region is expected to lead the global Urban Air Mobility Market during the forecast period? Ans. North America is expected to lead the global Urban Air Mobility Market during the forecast period. 4. What is the projected market size & growth rate of the Urban Air Mobility Market? Ans. The Urban Air Mobility Market size was valued at USD 3.89 Billion in 2024 and the total Urban Air Mobility revenue is expected to grow at a CAGR of 30.2% from 2025 to 2032, reaching nearly USD 32.14 Billion. 5. What segments are covered in the Urban Air Mobility Market report? Ans. The segments covered in the Urban Air Mobility Market report are Platform, Platform Operations, Range, Platform Architecture, End User and Region.

1. Urban Air Mobility Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Urban Air Mobility Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Competitive Landscape 2.3. Market share analysis of major players 2.4. Products specific analysis 2.4.1. Main suppliers and their market positioning 2.4.2. Key customers and adoption rates across different sectors 2.5. Key Players Benchmarking 2.5.1. Company Name 2.5.2. Platform Segment 2.5.3. End-user Segment 2.5.4. Revenue (2023) 2.5.5. Key Development 2.5.6. Geographic distribution of major customers 2.6. Market Structure 2.6.1. Market Leaders 2.6.2. Market Followers 2.6.3. Emerging Players 2.7. Mergers and Acquisitions Details 3. Urban Air Mobility Market: Dynamics 3.1. Urban Air Mobility Market Trends 3.2. Urban Air Mobility Market Dynamics 3.2.1. Drivers 3.2.2. Restraints 3.2.3. Opportunities 3.2.4. Challenges 3.3. Trends/disruptions Impacting Customer Business 3.4. Ecosystem Analysis 3.4.1. Air traffic management 3.4.2. Infrastructure providers 3.4.3. Technology providers 3.4.4. Service providers 3.5. Key conferences and events, 2024-2025 3.6. PORTER’s Five Forces Analysis 3.6.1. Intensity of the Rivalry 3.6.2. Threat of New Entrants 3.6.3. Bargaining Power of Suppliers 3.6.4. Bargaining Power of Buyers 3.6.5. Threat of Substitutes 3.7. Macroeconomic outlook 3.7.1. Introduction 3.7.2. North America 3.7.3. Europe 3.7.4. Asia pacific 3.7.5. Middle east 3.7.6. Latin America 3.7.7. Africa 3.8. Bill of materials 3.8.1. Bill of materials, by platform 3.8.2. Bill of materials, by urban air mobility infrastructure 3.8.3. Total cost of ownership comparison, by solution 3.9. Business models 3.9.1. Business models for urban air mobility platform operations 3.9.2. Business models for urban air infrastructure operations 3.10. Operational data 3.10.1. Platform data 3.10.1.1. Key urban air mobility platform order books 3.10.1.2. Key urban air mobility platform noise levels 3.10.1.3. Key urban air mobility platform technology readiness level 3.10.1.4. Key urban air mobility platform system supplier landscape 3.11. Regulatory Landscape by Region 3.11.1. North America 3.11.2. Europe 3.11.3. Asia Pacific 3.11.4. South America 3.11.5. MEA 4. Urban Air Mobility Market: Global Market Size and Forecast by Segmentation (by Value in USD Mn) (2024-2032) 4.1. Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 4.1.1. Air Taxis 4.1.2. Air Shuttles and & Air Metro 4.1.3. Personal Air Vehicles 4.1.4. Cargo Air Vehicles 4.1.5. Air Ambulance & Medical Emergency Vehicles 4.1.6. Last-mile Delivery Vehicles 4.2. Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 4.2.1. Piloted 4.2.2. Autonomous 4.3. Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 4.3.1. Intercity (>100 Km) 4.3.2. Intracity (<100 Km) 4.4. Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 4.4.1. Rotary Wing 4.4.2. Fixed Wing Hybrid 4.4.3. Fixed Wing 4.5. Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 4.5.1. Ridesharing Companies 4.5.2. Scheduled Operators 4.5.3. E-Commerce Companies 4.5.4. Hospitals and Medical Agencies 4.5.5. Private Operators 5. North America Urban Air Mobility Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 5.1. North America Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 5.1.1. Air Taxis 5.1.2. Air Shuttles and & Air Metro 5.1.3. Personal Air Vehicles 5.1.4. Cargo Air Vehicles 5.1.5. Air Ambulance & Medical Emergency Vehicles 5.1.6. Last-mile Delivery Vehicles 5.2. North America Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 5.2.1. Piloted 5.2.2. Autonomous 5.3. North America Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 5.3.1. Intercity (>100 Km) 5.3.2. Intracity (<100 Km) 5.4. North America Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 5.4.1. Rotary Wing 5.4.2. Fixed Wing Hybrid 5.4.3. Fixed Wing 5.5. North America Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 5.5.1. Ridesharing Companies 5.5.2. Scheduled Operators 5.5.3. E-Commerce Companies 5.5.4. Hospitals and Medical Agencies 5.5.5. Private Operators 5.6. North America Urban Air Mobility Market Size and Forecast, by Country (2024-2032) 5.6.1. United States 5.6.1.1. United States Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 5.6.1.1.1. Air Taxis 5.6.1.1.2. Air Shuttles and & Air Metro 5.6.1.1.3. Personal Air Vehicles 5.6.1.1.4. Cargo Air Vehicles 5.6.1.1.5. Air Ambulance & Medical Emergency Vehicles 5.6.1.1.6. Last-mile Delivery Vehicles 5.6.1.2. United States Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 5.6.1.2.1. Piloted 5.6.1.2.2. Autonomous 5.6.1.3. United States Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 5.6.1.3.1. Intercity (>100 Km) 5.6.1.3.2. Intracity (<100 Km) 5.6.1.4. United States Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 5.6.1.4.1. Rotary Wing 5.6.1.4.2. Fixed Wing Hybrid 5.6.1.4.3. Fixed Wing 5.6.1.5. United States Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 5.6.1.5.1. Ridesharing Companies 5.6.1.5.2. Scheduled Operators 5.6.1.5.3. E-Commerce Companies 5.6.1.5.4. Hospitals and Medical Agencies 5.6.1.5.5. Private Operators 5.6.2. Canada 5.6.2.1. Canada Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 5.6.2.1.1. Air Taxis 5.6.2.1.2. Air Shuttles and & Air Metro 5.6.2.1.3. Personal Air Vehicles 5.6.2.1.4. Cargo Air Vehicles 5.6.2.1.5. Air Ambulance & Medical Emergency Vehicles 5.6.2.1.6. Last-mile Delivery Vehicles 5.6.2.2. Canada Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 5.6.2.2.1. Piloted 5.6.2.2.2. Autonomous 5.6.2.3. Canada Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 5.6.2.3.1. Intercity (>100 Km) 5.6.2.3.2. Intracity (<100 Km) 5.6.2.4. Canada Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 5.6.2.4.1. Rotary Wing 5.6.2.4.2. Fixed Wing Hybrid 5.6.2.4.3. Fixed Wing 5.6.2.5. Canada Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 5.6.2.5.1. Ridesharing Companies 5.6.2.5.2. Scheduled Operators 5.6.2.5.3. E-Commerce Companies 5.6.2.5.4. Hospitals and Medical Agencies 5.6.2.5.5. Private Operators 5.6.3. Mexico 5.6.3.1. Mexico Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 5.6.3.1.1. Air Taxis 5.6.3.1.2. Air Shuttles and & Air Metro 5.6.3.1.3. Personal Air Vehicles 5.6.3.1.4. Cargo Air Vehicles 5.6.3.1.5. Air Ambulance & Medical Emergency Vehicles 5.6.3.1.6. Last-mile Delivery Vehicles 5.6.3.2. Mexico Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 5.6.3.2.1. Piloted 5.6.3.2.2. Autonomous 5.6.3.3. Mexico Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 5.6.3.3.1. Intercity (>100 Km) 5.6.3.3.2. Intracity (<100 Km) 5.6.3.4. Mexico Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 5.6.3.4.1. Rotary Wing 5.6.3.4.2. Fixed Wing Hybrid 5.6.3.4.3. Fixed Wing 5.6.3.5. Mexico Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 5.6.3.5.1. Ridesharing Companies 5.6.3.5.2. Scheduled Operators 5.6.3.5.3. E-Commerce Companies 5.6.3.5.4. Hospitals and Medical Agencies 5.6.3.5.5. Private Operators 6. Europe Urban Air Mobility Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 6.1. Europe Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.2. Europe Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.3. Europe Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.4. Europe Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.5. Europe Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6. Europe Urban Air Mobility Market Size and Forecast, by Country (2024-2032) 6.6.1. United Kingdom 6.6.1.1. United Kingdom Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.1.2. United Kingdom Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.1.3. United Kingdom Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.1.4. United Kingdom Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.1.5. United Kingdom Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.2. France 6.6.2.1. France Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.2.2. France Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.2.3. France Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.2.4. France Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.2.5. France Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.3. Germany 6.6.3.1. Germany Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.3.2. Germany Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.3.3. Germany Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.3.4. Germany Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.3.5. Germany Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.4. Italy 6.6.4.1. Italy Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.4.2. Italy Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.4.3. Italy Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.4.4. Italy Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.4.5. Italy Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.5. Spain 6.6.5.1. Spain Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.5.2. Spain Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.5.3. Spain Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.5.4. Spain Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.5.5. Spain Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.6. Sweden 6.6.6.1. Sweden Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.6.2. Sweden Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.6.3. Sweden Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.6.4. Sweden Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.6.5. Sweden Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.7. Austria 6.6.7.1. Austria Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.7.2. Austria Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.7.3. Austria Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.7.4. Austria Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.7.5. Austria Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 6.6.8. Rest of Europe 6.6.8.1. Rest of Europe Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 6.6.8.2. Rest of Europe Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 6.6.8.3. Rest of Europe Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 6.6.8.4. Rest of Europe Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 6.6.8.5. Rest of Europe Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7. Asia Pacific Urban Air Mobility Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 7.1. Asia Pacific Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.2. Asia Pacific Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.3. Asia Pacific Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.4. Asia Pacific Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.5. Asia Pacific Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6. Asia Pacific Urban Air Mobility Market Size and Forecast, by Country (2024-2032) 7.6.1. China 7.6.1.1. China Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.1.2. China Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.1.3. China Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.1.4. China Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.1.5. China Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6.2. S Korea 7.6.2.1. S Korea Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.2.2. S Korea Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.2.3. S Korea Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.2.4. S Korea Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.2.5. S Korea Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6.3. Japan 7.6.3.1. Japan Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.3.2. Japan Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.3.3. Japan Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.3.4. Japan Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.3.5. Japan Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6.4. India 7.6.4.1. India Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.4.2. India Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.4.3. India Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.4.4. India Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.4.5. India Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6.5. Australia 7.6.5.1. Australia Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.5.2. Australia Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.5.3. Australia Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.5.4. Australia Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.5.5. Australia Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6.6. ASIAN 7.6.6.1. ASIAN Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.6.2. ASIAN Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.6.3. ASIAN Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.6.4. ASIAN Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.6.5. ASIAN Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 7.6.7. Rest of Asia Pacific 7.6.7.1. Rest of Asia Pacific Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 7.6.7.2. Rest of Asia Pacific Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 7.6.7.3. Rest of Asia Pacific Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 7.6.7.4. Rest of Asia Pacific Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 7.6.7.5. Rest of Asia Pacific Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 8. Middle East and Africa Urban Air Mobility Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 8.1. Middle East and Africa Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 8.2. Middle East and Africa Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 8.3. Middle East and Africa Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 8.4. Middle East and Africa Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 8.5. Middle East and Africa Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 8.6. Middle East and Africa Urban Air Mobility Market Size and Forecast, by Country (2024-2032) 8.6.1. South Africa 8.6.1.1. South Africa Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 8.6.1.2. South Africa Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 8.6.1.3. South Africa Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 8.6.1.4. South Africa Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 8.6.1.5. South Africa Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 8.6.2. S GCC 8.6.2.1. GCC Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 8.6.2.2. GCC Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 8.6.2.3. GCC Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 8.6.2.4. GCC Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 8.6.2.5. GCC Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 8.6.3. Egypt 8.6.3.1. Egypt Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 8.6.3.2. Egypt Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 8.6.3.3. Egypt Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 8.6.3.4. Egypt Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 8.6.3.5. Egypt Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 8.6.4. Nigeria 8.6.4.1. Nigeria Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 8.6.4.2. Nigeria Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 8.6.4.3. Nigeria Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 8.6.4.4. Nigeria Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 8.6.4.5. Nigeria Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 8.6.5. Rest of ME &A 8.6.5.1. Rest of ME &A Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 8.6.5.2. Rest of ME &A Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 8.6.5.3. Rest of ME &A Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 8.6.5.4. Rest of ME &A Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 8.6.5.5. Rest of ME &A Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 9. South America Urban Air Mobility Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 9.1. South America Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 9.2. South America Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 9.3. South America Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 9.4. South America Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 9.5. South America Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 9.6. South America Urban Air Mobility Market Size and Forecast, by Country (2024-2032) 9.6.1. Brazil 9.6.1.1. Brazil Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 9.6.1.2. Brazil Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 9.6.1.3. Brazil Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 9.6.1.4. Brazil Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 9.6.1.5. Brazil Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 9.6.2. Argentina 9.6.2.1. Argentina Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 9.6.2.2. Argentina Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 9.6.2.3. Argentina Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 9.6.2.4. Argentina Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 9.6.2.5. Argentina Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 9.6.3. Rest Of South America 9.6.3.1. Rest of South America Urban Air Mobility Market Size and Forecast, by Platform (2024-2032) 9.6.3.2. Rest of South America Urban Air Mobility Market Size and Forecast, by Platform Operation (2024-2032) 9.6.3.3. Rest of South America Urban Air Mobility Market Size and Forecast, by Range (2024-2032) 9.6.3.4. Rest of South America Urban Air Mobility Market Size and Forecast, by Platform Architecture (2024-2032) 9.6.3.5. Rest of South America Urban Air Mobility Market Size and Forecast, by End User (2024-2032) 10. Company Profile: Key Players 10.1. Airbus 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.3.1. Total Revenue 10.1.3.2. Segment Revenue 10.1.3.3. Annual Revenue 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Airspacex 10.3. Aurora Flight Sciences 10.4. Carter Aviation 10.5. Embraer SA 10.6. EHang 10.7. Jaunt Air Mobility Corporation 10.8. Joby Aviation Inc. 10.9. Kitty Hawk 10.10. Lilium 10.11. Neva Aerospace 10.12. Opener 10.13. Pipistrel Group 10.14. Safran SA 10.15. Textron Inc. 10.16. The Boeing Company 10.17. Volocopter GmbH 10.18. Wisk Aero LLC 10.19. Workhorse Group Inc. 10.20. Honeywell Aerospace 10.21. BLADE INDIA 10.22. Collins Aerospace 10.23. Auterion 10.24. Ferrovial 10.25. Archer Aviation 11. Key Findings and Analyst Recommendations 12. Urban Air Mobility Market: Research Methodology 12.1. Research Data 12.1.1. Secondary Data 12.1.1.1. Key data from secondary sources 12.1.2. Primary Data 12.1.2.1. Key data from Primary sources 12.1.2.2. Breakdown of primaries