Global Unmanned Traffic Management Market size was valued at USD 810 Million. in 2022 and the total Unmanned Traffic Management revenue is expected to grow by 23.17 % from 2023 to 2029, reaching nearly USD 3483.53 Million.Unmanned Traffic Management Market Overview:

Unmanned Traffic Management is nothing but how the airspace will manage the multiple operations of unmanned air vehicles (UAVs) or drones where air traffic services are not provided. Drones are becoming more predominant in various industries such as agriculture, surveillance, logistics, and transportation. There is an increasing need for systems to ensure safe, efficient, and organized drone operations. The primary objective of the UTM is to provide a framework for managing drone traffic in the present airspace alongside manned aircraft. The Unmanned Traffic Management Market has witnessed substantial growth in recent years, due to the rising demand for commercial drone applications, and advancements in drone technology. Hence, The UTM market is expected to expand as the usage of drones is widespread.To know about the Research Methodology :- Request Free Sample Report

Drivers

Advancements in UTM solutions and Drone Technology drive the market. Technological advancements like processing data, machine learning, and artificial intelligence boost the development of UTM solutions in an effective manner. Innovation in technology has led to the development of drones with long-lasting flight times, payload capacity increases, better battery life, and improved sensors. These advancements make drones more capable and reliable, fueling the adoption and requiring an effective UTM system. Drone technology independence is improving business applications and operational procedures. The media, entertainment, surveying, logistics, advertising, remote sensing, precision agriculture, cleaning up contaminated areas, real estate, building, environment monitoring, forest monitoring, transportation, and emergency management & disaster response applications are the industries interested in using drones. These are the advancements in technology that drives the Unmanned Traffic Management Market. Restraints Cybersecurity, Public, and Privacy Concerns can restraint the market Securing the data and UTM infrastructure is crucial to maintain the safety and dependability of drone operations from cyber attackers. The use of technology and connectivity in unmanned traffic management systems is increasing and hence it opens up potential weaknesses to cyberattacks. Drones that have cameras and sensors can raise privacy concerns among the public. Guaranteeing that drone operations respect the privacy rights of the public and building public trust in the responsible use of drones is vital for extensive UTM adoption. But the rules and requirements for drone flights are varying according to different countries and regions which can be challenging. UTM systems also exchange real-time data and information with drone or unmanned aerial vehicle(UAV) pilots so that they can manage activities securely. As a result, data hacking and cyber threats are the factors that can hamper the Unmanned Traffic Management Market. Unmanned Traffic Management Market Opportunity Increased Use of Drones in Commercial Applications creates an opportunity The usage of drones in commercial applications is increasing in a wide range. Various industries including logistics, agriculture, surveying, transportation, and many more utilized drones. Additionally, the increasing demand for military forces and law enforcement communication systems is increasing the purchases of next-generation military drones which will boost the market expansion. There is a tremendous opportunity for unmanned traffic management systems for managing the difficult traffic flow in urban environments as there is the development of Urban Air Mobility i.e. UAM technology. Drones generate large amounts of data, such as images, videos, and sensor readings during operations. This data is valuable for many companies and industries to provide processing, analysis, and insights from the data. As businesses understand the benefits of drones and their usage to improve efficiency and reduce costs. Hence, the demand for Unmanned Traffic Management Market is increasing as UTM systems are used to manage increased drone traffic.Unmanned Traffic Management Market Segment Analysis:

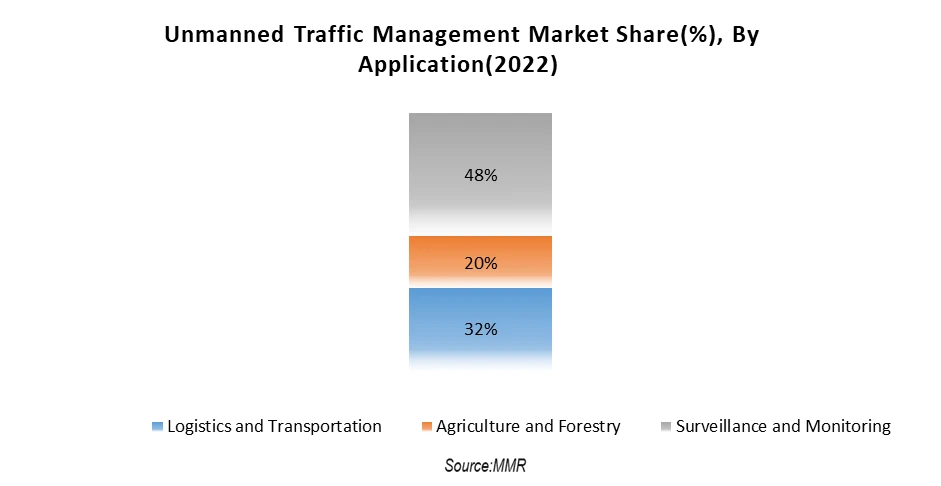

Based on the Component,The software segment has dominated the market in the year 2022 and is expected to dominate the market during the forecast period. Where air traffic services are not provided the UTM software is used, that is how the airspace will be managed to allow multiple drone operations which are conducted beyond visual line-of-sight (BVLOS). UTM software assists pilots to avoid flying into prohibited zones, it aims to track all unmanned air vehicles(UAV) in the air and display the restricted and unrestricted airspaces. The hardware segment is expected to register a market share of CAGR 17.8% during the forecast period as the demand for communication, superior sensing, and data transferring devices is increasing for in unmanned air vehicles(UAV).Based on the Application,The surveillance and monitoring segment has dominated the market in the year 2022 and is expected to dominate during the forecast period. The demand for surveillance and monitoring is increasing because the systems that can ensure accurate surveillance and monitoring of UAVs are in high demand. The transportation of drones is increasing in developed countries and hence, logistics and transportation are anticipated to dominate the UTM market. There are various types of drones and the growing necessity for small drones is used for aerial photography and videography, to deliver food and essential medical supplies. Whereas the demand for agriculture & forestry is rising as the demand for deployment of UAVs in the agriculture sector is increasing.

Unmanned Traffic Management Market Regional Insights:

North America dominated the market in the year 2022 and is expected to dominate during the forecast period. The early adoption of drone technology and supportive regulatory environments increased the demand in this region. The expansion of the North America Market is because the use of UAVs for military, surveillance, and logistical applications is increasing. Europe is also expected to offer significant growth opportunities during the forecast period. The rise in investments by numerous government agencies in drone beyond visual line-of-sight(BLVOS) operations increases the demand for Unmanned Traffic Management Market in Europe region. Both regions have made extensive progress in creating unmanned traffic management systems for various applications such as surveillance, monitoring, mapping, delivery, and inspection. Asia Pacific is also anticipated to offer substantial growth for UTM systems.The objective of the report is to present a comprehensive analysis of the Unmanned Traffic Management Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Market dynamics, and structure by analyzing the market segments and projecting the Unmanned Traffic Management Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Unmanned Traffic Management Market makes the report investor’s guide.

Global Unmanned Traffic Management Market Scope: Inquire before buying

Global Unmanned Traffic Management Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 810 Mn. Forecast Period 2023 to 2029 CAGR: 23.17% Market Size in 2029: US $ 3483.53 Mn. Segments Covered: by Type Persistent Non-Persistent by Component Software Hardware by Application Logistics and Transportation Agriculture and Forestry Surveillance and Monitoring by End-User Airports Emergency Service and Local Authorities Drone Operators or Pilots Recreational Users Unmanned Traffic Management Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Unmanned Traffic Management Market Key Players

1. Lockheed Martin Corp [North Bethesda, Maryland, in Washington, D.C., U.S.] 2. Leonardo SpA 3. Thales SA 4. Raytheon Technologies Corp 5. Altitude Angel Ltd 6. Frequentis AG 7. AirMap Inc [Santa Monica, California, U.S.] 8. Unify NV 9. ANRA Technologies 10. OneSky Systems Inc 11. Airbus SE 12. Terra Drone Corporation 13. Droniq GmbH 14. PrecisionHawk Inc 15. Intelligent Automation 16. Analytical Graphics 17. SZ DJI Technology Co., Ltd. 18. Harris Corporation 19. Nova Systems Frequently Asked Questions: 1] What segments are covered in the Global Unmanned Traffic Management Market report? Ans. The segments covered in the Unmanned Traffic Management Market report are based on Type, Component, Application, End-User, and Region. 2] Which region is expected to hold the highest share of the Global Unmanned Traffic Management Market? Ans. The North American region is expected to hold the highest share of the Unmanned Traffic Management Market. 3] What is the market size of the Global Unmanned Traffic Management Market by 2029? Ans. The market size of the Unmanned Traffic Management Market by 2029 is expected to reach US$ 3483.53 Million. 4] What is the forecast period for the Global Unmanned Traffic Management Market? Ans. The forecast period for the Unmanned Traffic Management Market is 2023-2029. 5] What was the market size of the Global Unmanned Traffic Management Market in 2022? Ans. The market size of the Unmanned Traffic Management Market in 2022 was valued at US$ 810 Million.

TOC 1. Unmanned Traffic Management Market: Research Methodology 2. Unmanned Traffic Management Market: Executive Summary 3. Unmanned Traffic Management Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Unmanned Traffic Management Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Unmanned Traffic Management Market Size and Forecast by Segments (by Value USD) 5.1. Unmanned Traffic Management Market Size and Forecast, by Type (2022-2029) 5.1.1. Persistent 5.1.2. Non-Persistent 5.2. Unmanned Traffic Management Market Size and Forecast, by Component (2022-2029) 5.2.1. Software 5.2.2. Hardware 5.3. Unmanned Traffic Management Market Size and Forecast, by Application (2022-2029) 5.3.1. Logistics and Transportation 5.3.2. Agriculture and Forestry 5.3.3. Surveillance and Monitoring 5.4. Unmanned Traffic Management Market Size and Forecast, by End-User (2022-2029) 5.4.1. Airports 5.4.2. Emergency Service and Local Authorities 5.4.3. Drone Operators or Pilots 5.4.4. Recreational Users 5.5. Unmanned Traffic Management Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Unmanned Traffic Management Market Size and Forecast (by Value USD) 6.1. North America Unmanned Traffic Management Market Size and Forecast, by Type (2022-2029) 6.1.1. Persistent 6.1.2. Non-Persistent 6.2. North America Unmanned Traffic Management Market Size and Forecast, by Component (2022-2029) 6.2.1. Software 6.2.2. Hardware 6.3. North America Unmanned Traffic Management Market Size and Forecast, by Application (2022-2029) 6.3.1. Logistics and Transportation 6.3.2. Agriculture and Forestry 6.3.3. Surveillance and Monitoring 6.4. North America Unmanned Traffic Management Market Size and Forecast, by End-User (2022-2029) 6.4.1. Airports 6.4.2. Emergency Service and Local Authorities 6.4.3. Drone Operators or Pilots 6.4.4. Recreational Users 6.5. North America Unmanned Traffic Management Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Unmanned Traffic Management Market Size and Forecast (by Value USD) 7.1. Europe Unmanned Traffic Management Market Size and Forecast, by Type (2022-2029) 7.1.1. Persistent 7.1.2. Non-Persistent 7.2. Europe Unmanned Traffic Management Market Size and Forecast, by Component (2022-2029) 7.2.1. Software 7.2.2. Hardware 7.3. Europe Unmanned Traffic Management Market Size and Forecast, by Application (2022-2029) 7.3.1. Logistics and Transportation 7.3.2. Agriculture and Forestry 7.3.3. Surveillance and Monitoring 7.4. Europe Unmanned Traffic Management Market Size and Forecast, by End-User (2022-2029) 7.4.1. Airports 7.4.2. Emergency Service and Local Authorities 7.4.3. Drone Operators or Pilots 7.4.4. Recreational Users 7.5. Europe Unmanned Traffic Management Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Unmanned Traffic Management Market Size and Forecast (by Value USD) 8.1. Asia Pacific Unmanned Traffic Management Market Size and Forecast, by Type (2022-2029) 8.1.1. Persistent 8.1.2. Non-Persistent 8.2. Asia Pacific Unmanned Traffic Management Market Size and Forecast, by Component(2022-2029) 8.2.1. Software 8.2.2. Hardware 8.3. Asia Pacific Unmanned Traffic Management Market Size and Forecast, by Application (2022-2029) 8.3.1. Logistics and Transportation 8.3.2. Agriculture and Forestry 8.3.3. Surveillance and Monitoring 8.4. Asia Pacific Unmanned Traffic Management Market Size and Forecast, by End-User (2022-2029) 8.4.1. Airports 8.4.2. Emergency Service and Local Authorities 8.4.3. Drone Operators or Pilots 8.4.4. Recreational Users 8.5. Asia Pacific Unmanned Traffic Management Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Unmanned Traffic Management Market Size and Forecast (by Value USD) 9.1. Middle East and Africa Unmanned Traffic Management Market Size and Forecast, by Type (2022-2029) 9.1.1. Persistent 9.1.2. Non-Persistent 9.2. Middle East and Africa Unmanned Traffic Management Market Size and Forecast, by Component (2022-2029) 9.2.1. Software 9.2.2. Hardware 9.3. Middle East and Africa Unmanned Traffic Management Market Size and Forecast, by Application (2022-2029) 9.3.1. Logistics and Transportation 9.3.2. Agriculture and Forestry 9.3.3. Surveillance and Monitoring 9.4. Middle East and Africa Unmanned Traffic Management Market Size and Forecast, by End-User (2022-2029) 9.4.1. Airports 9.4.2. Emergency Service and Local Authorities 9.4.3. Drone Operators or Pilots 9.4.4. Recreational Users 9.5. Middle East and Africa Unmanned Traffic Management Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Unmanned Traffic Management Market Size and Forecast (by Value USD) 10.1. South America Unmanned Traffic Management Market Size and Forecast, by Type (2022-2029) 10.1.1. Persistent 10.1.2. Non-Persistent 10.2. South America Unmanned Traffic Management Market Size and Forecast, by Component (2022-2029) 10.2.1. Software 10.2.2. Hardware 10.3. South America Unmanned Traffic Management Market Size and Forecast, by Application (2022-2029) 10.3.1. Logistics and Transportation 10.3.2. Agriculture and Forestry 10.3.3. Surveillance and Monitoring 10.4. South America Unmanned Traffic Management Market Size and Forecast, by End-User (2022-2029) 10.4.1. Airports 10.4.2. Emergency Service and Local Authorities 10.4.3. Drone Operators or Pilots 10.4.4. Recreational Users 10.5. South America Unmanned Traffic Management Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Lockheed Martin Corporation 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Leonardo SpA 11.3. Thales SA 11.4. Raytheon Technologies Corp 11.5. Altitude Angel Ltd 11.6. Frequentis AG 11.7. AirMap Inc [Santa Monica, California, U.S.] 11.8. Unify NV 11.9. ANRA Technologies 11.10. OneSky Systems Inc 11.11. Airbus SE 11.12. Terra Drone Corporation 11.13. Droniq GmbH 11.14. PrecisionHawk Inc 11.15. Intelligent Automation 11.16. Analytical Graphics 11.17. SZ DJI Technology Co., Ltd. 11.18. Harris Corporation 11.19. Nova Systems 12. Key Findings 13. Industry Recommendation