The United Kingdom Electric Vehicle Market size was valued at USD 642.30 Million in 2023 and the total Electric Vehicle revenue in the United Kingdom is expected to grow at a CAGR of 9.82% from 2024 to 2030, reaching nearly USD 1237.39 Million by 2030. The United Kingdom ranks 5th globally in EY's EV Country Readiness Index for the Electric Vehicle (EV) transition, maintaining a strong position despite mounting challenges in supply and regulation. As a result, the United Kingdom's electric vehicle market has witnessed significant growth in recent years and is expected to grow at a rapid pace during the forecast period. China holds the top spot, followed by Norway, while the US jumps to 3rd, with Sweden slipping to 4th. However, the UK faces setbacks in supply (from 7th to 8th) and regulation (from 3rd to 4th) rankings, balanced by robust demand for EVs and the upcoming 2030 ban on new Internal Combustion Engine (ICE) vehicle sales. This encourages consumers and businesses to embrace electric alternatives, thereby supporting the electric vehicle market in the United Kingdom. EV penetration in the UK, including Battery Electric Vehicles (BEVs) and Plug-in Hybrid Electric Vehicles (PHEVs), reached 26% in 2023, a notable surge from 21% last year but trailing behind Norway (81%), Sweden (53%), and the Netherlands (35%). The UK anticipates 71% of new vehicle launches from 2023 to 2027 to be EVs, up from 60% in 2022, demonstrating increasing market orientation towards electric mobility. Maria Bengtsson, EY’s UK Electric Vehicle Lead, acknowledges the UK's progress but emphasizes learning from China's effective regulation and localized supply chain implementation. Challenges in the UK include potential delays in the Zero Emissions Vehicle (ZEV) Mandate and unclear supply plans, highlighting the need for collaborative efforts between OEMs and the Government. Supply and infrastructure challenges persist, with China leading global EV production (55%), followed by the US (11%) and Germany (10%), while the UK's share remains below 1%. However, the UK aims to boost battery production to 41 gigawatt hours (GWh) by 2027, a substantial increase from 2GWh in 2022, enhancing global competitiveness. UK infrastructure growth includes a reported 42% increase in public charge points to 48,450 by August 2023. Yet, the UK struggles with fast-charging infrastructure, with China holding nearly 90% of global stock in 2022 compared to the UK's 0.8%. David Borland, EY UK & Ireland Automotive Leader, notes the UK's robust new car registrations, are largely driven by increasing EV sales. He highlights challenges in infrastructure, highlighting the need for prioritizing EV charger numbers, locations, and speed for sustained demand. The UK maintains its 6th position globally for EV demand, with continuous growth in new car registrations. Concerns about upfront EV costs (36% of respondents) gradually recede as price parity between EVs and ICE vehicles improves, with the UK and Italy leading in affordability. High fuel prices and ICE vehicle penalties motivate UK buyers towards EVs, but high charging costs and inadequate infrastructure deter many. UK's 2023 EV sales are expected to grow by 36%, trailing the top 20 market average of 64%, marking an increase from 22.7% in 2022. Despite a slip in regulatory ranking, the UK intensifies EV support, investing £ 1.6 bn in charging infrastructure and earmarking funds for battery production and research. The £ 12 bn green industrial revolution plan aims for Net Zero emissions by 2050, driving an electric future. Hence, the UK maintains its prominent position in the global EV market despite supply and regulatory challenges. The nation's EV penetration, demand surge, and strategic initiatives signify a resilient trajectory toward a sustainable EV future, urging for ongoing improvements in regulation, supply chain resilience, and charging infrastructure for enhanced competitiveness of the United Kingdom electric vehicle market.To know about the Research Methodology :- Request Free Sample Report

United Kingdom Electric Vehicle Market: MMR Findings

A. Steady Ranking Among Top 20 Markets: According to an MMR study, the UK maintains its 5th position globally for EV transition preparedness, consistent with its ranking from the previous year. This positioning underscores the nation's sustained efforts in advancing toward an electric future. B. Shifts in Supply and Regulatory Rankings: While the UK retains its overall top-tier standing, there's been a slight dip in specific aspects. The ranking for EV supply slipped from 7th to 8th year-on-year, signaling potential challenges in this area. Similarly, the regulatory ranking fell from 3rd to 4th, emphasizing evolving hurdles in regulatory frameworks. C. Consistent EV Demand Standing: The UK remains 6th in EV demand, aligning with its 2023 ranking. This consistency highlights the ongoing interest and consumer traction toward electric vehicles within the market. D. Sales Growth Projection: Anticipated EV sales growth in the UK is substantial, and expected to rise by 36% year-on-year. Although this represents a notable surge from the previous year's 22.7%, it lags behind the average growth rate seen across the top 20 markets globally, which stands at 64%.Rapid Surge In Startups Intensifies The Competition Within The United Kingdom Electric Vehicle Market The United Kingdom is currently experiencing a rapid surge in start-ups venturing into the electric vehicle EV market, fostering a competitive landscape characterized by innovation and intense rivalry within the United Kingdom electric vehicle market. This influx of start-ups reflects a convergence of several factors driving entrepreneurial interest and investment in the burgeoning EV sector. The global shift towards sustainable transportation solutions has gained significant momentum, fueled by concerns over climate change and environmental sustainability. This is expected to be the key factor driving the United Kingdom electric vehicle market growth. This overarching trend has created a ripe market for EVs, prompting entrepreneurs to seize opportunities in this rapidly evolving space. Moreover, governmental initiatives and policies aimed at reducing carbon emissions and promoting cleaner transportation alternatives have incentivized and catalyzed the United Kingdom electric vehicle industry's growth. The UK government's commitments to ban the sale of new internal combustion engine vehicles by 2030, coupled with various incentives for EV adoption, have spurred increased interest among entrepreneurs and start-ups. Technological advancements and the evolution of battery technologies have significantly lowered entry barriers for startups, enabling them to explore innovative solutions in electric mobility. The increasing accessibility of crucial technologies and components necessary for EV production has empowered startups to enter the market with unique offerings and differentiated approaches.

10 Top Electric Vehicle Startups And Companies In the United Kingdom

In addition, the growing consumer demand for electric vehicles has played a pivotal role in attracting startups in the United Kingdom. Consumers are increasingly seeking environmentally friendly transportation options, leading to a surge in demand for EVs. This rising demand has created a substantial market opportunity that startups are eager to capitalize on by introducing novel products and services. The attraction of the EV market is amplified by the potential for disruptive innovation. Startups recognize the transformative potential of EVs, not only in the automotive sector but also in ancillary industries such as energy, infrastructure, and technology. This recognition of the broader impact and multifaceted opportunities offered by EVs motivates entrepreneurs to enter and compete in the United Kingdom electric vehicle market. Besides that, the interest of key players in the UK's EV market is driven by various factors. The regulatory environment, marked by stringent emission reduction targets and government mandates, has catalyzed interest among established automakers, tech companies, and startups alike. The impending ban on internal combustion engine vehicles has created a sense of urgency, compelling both existing and new players to innovate and invest in EV technology and infrastructure. Moreover, the supportive ecosystem comprising research institutions, academic collaborations, and government-backed initiatives has fostered an environment conducive to innovation and R&D in electric mobility. Additionally, the growing consumer awareness and acceptance of electric vehicles have bolstered the confidence of key players in the United Kingdom electric vehicle market. The increasing preference for cleaner and sustainable transportation options has led to a surge in demand for EVs, encouraging automakers and startups to expand their EV portfolios and invest in enhancing charging infrastructure. Furthermore, the evolving nature of the automotive industry, marked by a shift towards mobility-as-a-service (MaaS) models and the integration of smart technologies, has enticed key players to delve deeper into the EV domain. The potential for innovation in connected, autonomous, and shared electric vehicles has attracted significant interest and investment from established automakers and tech giants.

Company Focus Location Founded AVID Technology Ltd Designs and manufactures high-performance electric drive systems Cramlington, UK 2004 zeVie cars Support and assistance for transitioning to electric vehicles London, UK - QPT Ltd Next-gen power electronics for efficient electric motors Cambridge, UK 2019 EV-Bugs Ltd Conversion of vehicles to electric to reduce emissions Banchory, UK 2020 Gin e-bikes Affordable e-bikes promoting green energy and sustainability Reading, UK 2021 FUROSYSTEMS LTD Designs, manufactures, and sells high-performance EVs London, UK 2016 Apian Healthcare drone technology for faster and greener healthcare London, UK 2020 Tevva Motors Extended-range electric trucks powered by glycerin London, UK 2012 Askary.io AI-driven EV charging solutions for simplified charging London, UK 2021 Qbots Energy Ltd Smart energy services for businesses using AI Manchester, UK 2018 The UK Leads The Charge In New Electric Vehicle (EV) Sales Among The Majority Of EU Countries, Setting An Impressive Pace In The Race Towards Sustainable Transportation. According to the most recent data for 2023 from the European Automobile Manufacturers’ Association (ACEA), the UK is among the top ten EU countries (including the UK) for EVs as a share of total new car sales, with battery electric vehicles (BEVs) accounting for 16.1% of such sales between January and June of 2023. As such, the UK is currently running ahead of other major economies such as Germany and France. Thus, the UK's electric vehicle market has been a leader among EU countries for new EV sales, boasting a significant market share exceeding government targets. However, recent political shifts and debates within the ruling Conservative Party have triggered concerns regarding potential implications for the United Kingdom electric vehicle market growth. The Conservative Party's recent stance, seemingly advocating for petrol-powered vehicles, has raised eyebrows, including Prime Minister Rishi Sunak's review of low-traffic neighborhoods, signaling a pro-motorist approach post-Uxbridge by-election win. The pushback against the zero-emission vehicle (ZEV) mandates, led by Business Secretary Kemi Badenoch, further fueled apprehensions about potential setbacks in the United Kingdom electric vehicle market's growth. Despite the UK's impressive EV adoption rates, the conservative stance and resistance towards stringent EV targets have sparked debates. Experts caution that deviating from ambitious EV mandates might impede investment and job creation. Notably, the UK's success in EV adoption positions it as a pivotal player but risks losing its competitive edge if it doesn't align with global EV goals.

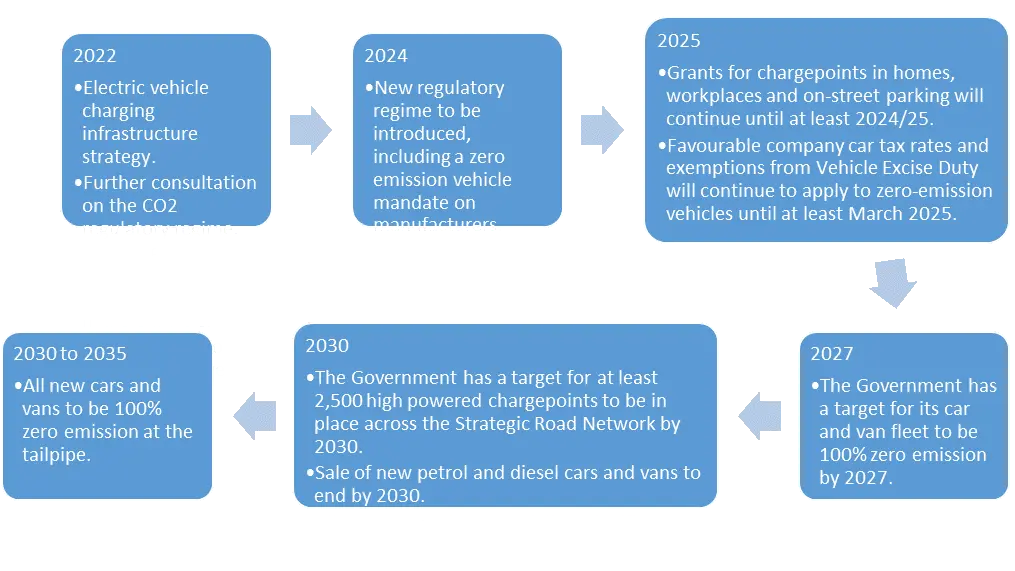

Milestones in the Government’s 2035 Delivery Plan

The Energy and Climate Intelligence Unit's (ECIU) research underscores a crucial aspect of the UK's car industry, revealing that over 80% of cars manufactured in the UK are exported, with 57% destined for the EU. Given the EU, China, and the US's stringent targets for restricting petrol and diesel vehicle sales, the ECIU emphasizes the financial prudence of the UK's investment in bolstering its EV manufacturing base. Failure to respond adequately to these global EV policies, as forecast by the ECIU's conservative scenario, is expected to result in a substantial £ 13.2 bn decline in UK car export revenues by 2030, posing a significant threat to the nation's automotive sector. The existing UK target mandates car manufacturers to ensure a minimum of 22% of new sales come from Zero-Emission Vehicles (ZEVs), progressively reaching 80% by 2030 and aiming for a complete transition to 100% ZEVs by 2035. However, Business Secretary Kemi Badenoch's reservations about the stringency of these targets conflict with the UK Climate Change Committee's 2023 Progress Report, indicating the UK's trajectory is on track to surpass these goals. Any relaxation of these targets, as suggested by some policymakers, is expected to potentially hinder the sales growth observed in the United Kingdom electric vehicle market. Government Measures To Encourage Uptake Of Electric Vehicles, Support The United Kingdom Electric Vehicle Market Growth The UK government has pursued various strategies and policies to stimulate the adoption of electric vehicles over the years, aiming to bolster infrastructure, offer incentives, and set ambitious targets. These initiatives have spanned multiple administrations, showcasing a commitment to a cleaner automotive landscape, further supporting the United Kingdom Electric Vehicle market growth. Labour Government Initiatives: During the Labour Government's tenure, efforts focused on kickstarting the infrastructure needed for EVs. This included a £20 million investment to support charging infrastructure development in select cities and regions. Commitments like achieving 100,000 electric vehicle charging points by the end of a particular parliament term exemplified their aspirations. Coalition Government Approach: The 2010 Coalition Agreement committed to a national recharging network but pivoted away from an extensive public infrastructure, prioritizing home and workplace charging. This shift drew some criticism, but the emphasis remained on enabling charging primarily at these locations. Conservative Government's Road to Zero Strategy: The Conservative Government introduced the Road to Zero Strategy in 2018, a comprehensive plan envisioning the phasing out of petrol and diesel vehicles while supporting zero-emission road transport. It set the stage for the transition by outlining targets for ceasing the sale of conventional vehicles and ramping up charging infrastructure. Decarbonization Plan and Regulatory Framework: The government's Decarbonizing Transport Plan reiterated the commitment to encouraging cleaner vehicles without restricting consumer choices. To achieve this, the plan highlighted ongoing support, including grants for home and workplace charging points until at least 2024/25, and favorable tax incentives until March 2025.Industry Electrification Plans

A number of vehicle manufacturers have announced changes to the types of vehicles that they will be producing.These concerted efforts and policy implementations have significantly influenced the UK's EV market. Manufacturers' commitments to transitioning their fleets to electric variants by specific deadlines, including the pledges by companies like Ford, Volvo, and Bentley, signal a profound shift toward electrification. The introduction of funding schemes, city initiatives like Go Ultra Low Cities, and the proposed Zero Emission Vehicle mandate starting in 2024 is instrumental in boosting EV infrastructure and consumer confidence. These measures create a conducive environment for manufacturers and consumers alike, paving the way for accelerated EV adoption in the UK and supporting the United Kingdoms electric vehicle market size. Thus, these government-led measures, combining infrastructure investments, incentivizing schemes, and ambitious phase-out targets for conventional vehicles, have propelled the UK towards a more sustainable transportation landscape. The consistent policy focus on encouraging electric vehicles has substantially contributed to the United Kingdom Electric Vehicle market growth and heightened consumer interest in EVs across the country.

Bentley aims to only offer electric vehicles by 2030, even though their first electric vehicle is not expected until 2025; Ford plan for every car sold in Europe to be plug-in hybrid electric vehicles by 2026 and pure-electric by 2030; General Motors plan to sell only electric vehicles by 2035 and be carbon neutral by 2040; Groupe PSA which includes Peugeot, Citroen, DS Automobiles, Opel, and Vauxhall, have committed to offering electrified versions of all their vehicles by 2025; Honda aims for all European models to be electric by 2022; Jaguar plan to be an ‘all-electric luxury brand’ by 2025, whilst Land Rover is phasing out all-diesel vehicles by 2026, with the Jaguar Land Rover brand aiming for net-zero carbon emissions by 2039; Lotus is due to release its final petrol-powered vehicle in 2021, with only electric models to be sold from 2028; Peugeot aims to electrify all its vehicles by 2023, using a combination of battery electric vehicles (for smaller models) and plug-in hybrid electric vehicles (for larger vehicles); Vauxhall plan to have a hybrid or electric variant of all models by 2024; Volvo anticipating to sell battery electric vehicles and plugin hybrid electric vehicles only from 2025, en route to electric-only sales from 2030. United Kingdom Electric Vehicle Market Scope: Inquiry Before Buying

United Kingdom Electric Vehicle Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 642.30 Mn. Forecast Period 2024 to 2030 CAGR: 9.82% Market Size in 2030: US $ 1237.39 Mn. Segments Covered: by Vehicle Type Two-Wheelers Passenger Cars Commercial Vehicles by Type Battery Electric Vehicle Plug-in Hybrid Electric Vehicle Fuel Cell Electric Vehicle by Vehicle Drive Type Front Wheel Drive Rear Wheel Drive All-Wheel Drive by Vehicle Class Low-priced Mid-priced Luxury by End-User Private Commercial United Kingdom Electric Vehicle Market Key Players:

1. Tesla (Palo Alto, California, USA) 2. BMW (Munich, Germany) 3. Mini (Oxford, United Kingdom - part of BMW Group) 4. Ford (Dearborn, Michigan, USA) 5. Hyundai (Seoul, South Korea) 6. Kia Corporation (Seoul, South Korea) 7. Nissan (Yokohama, Japan) 8. Volkswagen (Wolfsburg, Germany) 9. Chevrolet Bolt EV (Detroit, Michigan, USA - part of General Motors) 10. Rivian (Irvine, California, USA) 11. Audi (Ingolstadt, Germany) 12. Renault (Boulogne-Billancourt, France) 13. Jaguar (Whitley, United Kingdom) 14. Porsche (Stuttgart, Germany) 15. MG Motor (Longbridge, Birmingham, United Kingdom) 16. Volvo (Gothenburg, Sweden) 17. Peugeot (Paris, France) 18. Citroën (Saint-Ouen, France) 19. Fiat (Turin, Italy) 20. Skoda (Mladá Boleslav, Czech Republic) 21. SEAT (Martorell, Spain) 22. Smart (Böblingen, Germany) 23. Honda (Minato, Tokyo, Japan) 24. Vauxhall (Luton, United Kingdom - part of Stellantis) 25. DS Automobiles (Paris, France - part of Stellantis)FAQs:

1. What are the growth drivers for the United Kingdom Electric Vehicle Market? Ans. Government incentives, increased environmental awareness, advancements in technology, expanding charging infrastructure, and automakers' commitment to producing more EV models are expected to be the major driver for the United Kingdom Electric Vehicle Market. 2. What is the major restraint for the United Kingdom Electric Vehicle Market growth? Ans. The limited charging infrastructure, including the availability of charging stations and concerns about charging times.are expected to be the major restraining factor for the United Kingdom Electric Vehicle Market growth. 3. What is the projected market size and growth rate of the United Kingdom Electric Vehicle Market? Ans. The United Kingdom Electric Vehicle Market size was valued at USD 642.30 Million in 2023 and the total Electric Vehicle revenue in the United Kingdom is expected to grow at a CAGR of 9.82% from 2024 to 2030, reaching nearly USD 1237.39 Million by 2030. 4. What segments are covered in the United Kingdom Electric Vehicle Market report? Ans. The segments covered in the United Kingdom Electric Vehicle Market report are Vehicle Type, Type, Vehicle Drive Type, Vehicle Class, and End-User.

1. United Kingdom Electric Vehicle Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 1.3.1. United Kingdom Electric Vehicle Market Size (2023) & Forecast (2024-2030), and Y-O-Y (%) 1.3.2. United Kingdom Electric Vehicle Market Size (USD Million) and Market Share (%), By Segments 2. United Kingdom Electric Vehicle Market: Overview 2.1. Overview of the United Kingdom automotive industry 2.2. EV Infrastructure Development in United Kingdom 2.3. Evolution and adoption of Electric Vehicles in United Kingdom 2.4. Analysis of Government Schemes and Initiatives For the United Kingdom Electric Vehicle Industry 2.5. Impact of policies on market growth 2.6. Import Duties and Tariffs on Electric Vehicles 3. United Kingdom Electric Vehicle Market: Consumer Adoption and Trends 3.1. Consumer preferences and buying behavior in the EV market 3.2. Factors Influencing Adoption Rates 3.3. Consumer feedback and satisfaction with EVs 4. United Kingdom Electric Vehicle Market: Dynamics 4.1. United Kingdom Electric Vehicle Market Trends 4.2. United Kingdom Electric Vehicle Market Dynamics 4.2.1. United Kingdom Electric Vehicle Market Drivers 4.2.2. United Kingdom Electric Vehicle Market Restraints 4.2.3. United Kingdom Electric Vehicle Market Opportunities 4.2.4. United Kingdom Electric Vehicle Market Challenges 4.3. PORTER’s Five Forces Analysis 4.4. PESTLE Analysis 4.5. Technological Roadmap 4.6. Technological Innovations 4.6.1. Overview of technological advancements in EVs 4.6.2. Battery technology improvements and their impact 4.6.3. Integration of AI, connectivity, and autonomous features 4.7. Regulatory Landscape 4.8. Key Opinion Leader Analysis For the United Kingdom Electric Vehicle Industry 4.9. The COVID-19 Pandemic Impact on the United Kingdom Electric Vehicle Market 5. United Kingdom Electric Vehicle Market: Quantitative Analysis 5.1. Total Electric Vehicle Production in United Kingdom (2019-2023) 5.2. Top 10 EV Brands and Their Sales in United Kingdom (2023) 5.3. Number of electric vehicle (EV) charging locations in United Kingdom and Insights 5.4. Electric Vehicle’s Price Trend Analysis (2019-2023) 6. United Kingdom Electric Vehicle Market: Competitive Landscape 6.1. MMR Competition Matrix 6.2. Company Market Share Analysis (%) – 2023 6.3. MMR Competitive Landscape 6.4. Key Players Benchmarking 6.4.1. Company Name 6.4.2. Company Headquarter 6.4.3. United Kingdom Location 6.4.4. Product Segment 6.4.5. End-user Segment 6.4.6. Company Total Revenue (2023) 6.5. Market Structure 6.5.1. Market Leaders 6.5.2. Market Followers 6.5.3. Emerging Players 6.6. Mergers and Acquisitions Details 7. United Kingdom Electric Vehicle Market: Market Size and Forecast by Segmentation (by Value in USD Million And Volume in Units) (2023-2030) 7.1. United Kingdom Electric Vehicle Market Size and Forecast, by Vehicle Type (2023-2030) 7.1.1. Two-Wheelers 7.1.2. Passenger Cars 7.1.3. Commercial Vehicles 7.2. United Kingdom Electric Vehicle Market Size and Forecast, by Type (2023-2030) 7.2.1. Battery Electric Vehicle 7.2.2. Plug-in Hybrid Electric Vehicle 7.2.3. Fuel Cell Electric Vehicle 7.3. United Kingdom Electric Vehicle Market Size and Forecast, by Vehicle Drive Type (2023-2030) 7.3.1. Front Wheel Drive 7.3.2. Rear Wheel Drive 7.3.3. All-Wheel Drive 7.4. United Kingdom Electric Vehicle Market Size and Forecast, by Vehicle Class (2023-2030) 7.4.1. Low-priced 7.4.2. Mid-priced 7.4.3. Luxury 7.5. United Kingdom Electric Vehicle Market Size and Forecast, by End-User (2023-2030) 7.5.1. Private 7.5.2. Commercial 8. Company Profile: Key Players 8.1. Tesla 8.1.1. Company Overview 8.1.2. Business Portfolio 8.1.3. Financial Overview 8.1.4. SWOT Analysis 8.1.5. Strategic Analysis 8.1.6. Recent Developments 8.2. Riversimple 8.3. YASA 8.4. Zenobe Energy 8.5. Ford of Britain 8.6. Richard Garrett & Sons 8.7. United Electric Car Company 8.8. Sunbeam Commercial Vehicles 8.9. Switch Mobility 8.10. Others 9. Key Findings and Analyst Recommendations 10. United Kingdom Electric Vehicle Market: Research Methodology 11. Terms and Glossary