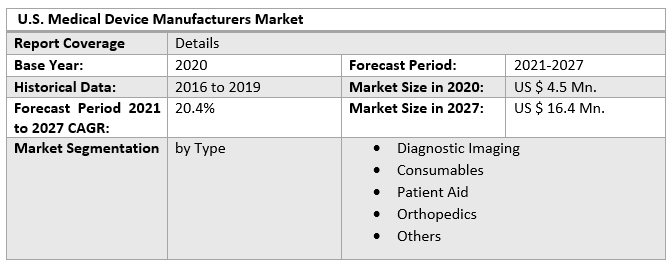

U.S. Medical Device Manufacturers Market size was valued at US$ 4.5 Mn. in 2020 and the total revenue is expected to grow at 20.4 % through 2021 to 2027, reaching nearly US$ 16.4 Mn.U.S. Medical Device Manufacturers Market Overview:

Medical device fabrication encompasses all areas of medical device Typeion, from process design to scale-up and continuous process improvement. It also involves the sterilization and shipment packaging of a gadget. Medical device manufacturers seek to be faster and more efficient throughout the manufacturing process, but they also want to be good corporate citizens. As a result, Typeion necessitates ongoing research into renewable resources, sustainable materials, energy-efficient equipment, and waste-reduction techniques.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2026. 2019 is considered a base year however 2021's numbers are on the real output of the companies in the market. Special attention is given to 2021 and the effect of lockdown on the demand and supply, and the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

U.S. Medical Device Manufacturers Market Dynamics:

The primary market drivers are the rising prevalence of chronic diseases and the country's growing geriatric population. Chronic disorders are more common among people between the ages of 45 and 54. Due to the COVID-19 pandemic, demand for consumable medical gadgets and patient aids such as gloves, syringes, masks, PPE kits, infrared thermometers, pulse oximeters, and testing kits skyrocketed. The scenario opened up rich prospects for both established players and newcomers. However, demand for medical equipment used in elective treatments such as bariatric surgery, joint replacement surgery, and aesthetic surgery has decreased. With favorable government initiatives to re-launch elective treatments, the industry is likely to rebound from mid-2021 onwards. The need for less invasive operations has recently increased, and this is projected to drive the market for medical device suppliers. In comparison to open operations, minimally invasive surgeries have smaller incisions, a shorter hospital stay, faster wound healing, less pain, and surgical wounds, and a lower risk of complications. They also help to keep healthcare costs under control. Advanced inventions, such as printing technology, can be used to keep up with demand in response to the global coronavirus pandemic's unexpected jump in demand. The US government is pouring money into medical devices like pulse oximeters and N95 respirators to make up for shortages. Further, New Type releases, technology developments, and capacity expansion are just a few of the strategic measures implemented by major players to gain a competitive edge. General Motors, for example, has won a $489.4 million order to provide 6,132 ventilators by mid-2020. To boost manufacturing, GM teamed up with Ventec Life Systems.U.S. Medical Device Manufacturers Market Segment Analysis:

The diagnostic imaging segment is anticipated to adhere to the growth of the U.S. Medical Device Manufacturers Market. Due to the rising need for accurate diagnostic methods and technologies, the diagnostic imaging sector had the biggest market share of over 31% in 2020. Chronic diseases, which necessitate long-term medical treatment, made for a major portion of the country's healthcare spending. As a result, healthcare institutions are looking for ways to minimize healthcare expenditures. The imaging equipment sector has had several new Type debuts in recent years, and there are now a huge number of devices in the pipeline. Chronic diseases are becoming more common around the world, and early detection is critical in determining treatment options. The existence of cutting-edge medical equipment in the United States draws a large number of international patients, ensuring that hospitals and healthcare providers continue to invest in the area. Additionally, as the incidence of sports and trauma injuries rises, demand for orthopedic devices rises, resulting in market expansion. Patients in the United States use medical devices more frequently as a result of healthcare expenditure schemes, leading to greater market growth for medical device suppliers. The Primary Cares Initiative (PCI) was introduced by CMS (Center for Medicare & Medicaid Services) in 2019. It is a series of new payment models designed to assist primary care providers in making the move to risk-based payment. The objective of the report is to present a comprehensive analysis of the U.S. Medical Device Manufacturers Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the U.S. Medical Device Manufacturers Market dynamics, structure by analyzing the market segments and projecting the U.S. Medical Device Manufacturers Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the U.S. Medical Device Manufacturers Market make the report investor’s guide.U.S. Medical Device Manufacturers Market Scope: Inquire before buying

U.S. Medical Device Manufacturers Market Key Players

• 3M Healthcare • Abbott • Baxter International, Inc. • B. Braun Melsungen AG • GE Healthcare • Johnson & Johnson Services, Inc. • Medtronic PLC • Boston Scientific Corp. • General Motors • GM • Interprod • General Electrics • Danaher • Stryker • Intuitive SurgicalFAQs:

1. What is the U.S. Medical Device Manufacturers Market value in 2020? Ans: The U.S. Medical Device Manufacturers Market value in 2020 was estimated as 4.5 Billion USD. 2. What is the U.S. Medical Device Manufacturers Market growth? Ans: The U.S. Medical Device Manufacturers Market is anticipated to grow with a CAGR of 20.4% in the forecast period and is likely to reach USD 16.4 Billion by the end of 2027. 3. Which segment is expected to dominate the U.S. Medical Device Manufacturers Market during the forecast period? Ans: The diagnostic imaging segment dominated the U.S. medical device manufacturers market with a share of 31.0% in 2020. This is attributable to the growing demand for accurate diagnostic methods and devices, an increase in the number of sports and trauma injuries is boosting demand for orthopedic devices, leading to market growth. 4. Who are the key players of the U.S. Medical Device Manufacturers Market? Ans: Some key players operating in the U.S. medical device manufacturers market include 3M, Abbott Laboratories, Baxter International, Boston Scientific Corporation, B. Braun Melsungen, GE Healthcare, Johnson and Johnson, and Medtronic. 5. What is the key driving factor for the growth of the U.S. Medical Device Manufacturers Market? Ans: Key factors driving the U.S. medical device manufacturers' market growth include rising cases of chronic disease, favorable reimbursement policies, and increasing adoption of mobile surgery centers.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Technology 2.3.2. Primary Research 2.3.2.1. Data from Primary Technology 2.3.2.2. Breakdown of Primary Technology 3. Executive Summary: U.S. Medical Device Manufacturers Market Size, by Market Value (US$ Mn) 3.1. US Market Segmentation 3.2. US Market Segmentation Share Analysis, 2020 3.2.1. Global 3.2.2. By Region (US) 3.3. Geographical Snapshot of the U.S. Medical Device Manufacturers Market 3.4. Geographical Snapshot of the U.S. Medical Device Manufacturers Market, By Manufacturer share 4. U.S. Medical Device Manufacturers Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (U.S) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (U.S) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (U.S) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (U.S) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Grades 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the U.S. Medical Device Manufacturers Market 5. Supply Side and Demand Side Indicators 6. U.S. Medical Device Manufacturers Market Analysis and Forecast, 2020-2027 6.1. U.S. Medical Device Manufacturers Market Size & Y-o-Y Growth Analysis. 7. U.S. Medical Device Manufacturers Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Type, 2020-2027 7.1.1. Diagnostic Imaging 7.1.2. Consumables 7.1.3. Patient Aid 7.1.4. Orthopedics 7.1.5. Others 8. Competitive Landscape 8.1. Geographic Footprint of Major Players in the U.S. Medical Device Manufacturers Market 8.2. Competition Matrix 8.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 8.2.2. New Grade Launches and Grade Enhancements 8.2.3. Market Consolidation 8.2.3.1. M&A by Regions, Investment, and Verticals 8.2.3.2. M&A, Forward Integration and Backward Integration 8.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 8.3. Company Profile: Key Players 8.3.1. Treez Inc. 8.3.1.1. Company Overview 8.3.1.2. Financial Overview 8.3.1.3. Geographic Footprint 8.3.1.4. Grade Portfolio 8.3.1.5. Business Strategy 8.3.1.6. Recent Developments 8.3.2. 3M Healthcare 8.3.3. Abbott 8.3.4. Baxter International, Inc. 8.3.5. B. Braun Melsungen AG 8.3.6. GE Healthcare 8.3.7. Johnson & Johnson Services, Inc. 8.3.8. Medtronic PLC 8.3.9. Boston Scientific Corp. 8.3.10. General Motors 8.3.11. GM 8.3.12. Inteprod 8.3.13. General Electrics 8.3.14. Danaher 8.3.15. Stryker 8.3.16. Intuitive Surgical 9.Primary Key Insights