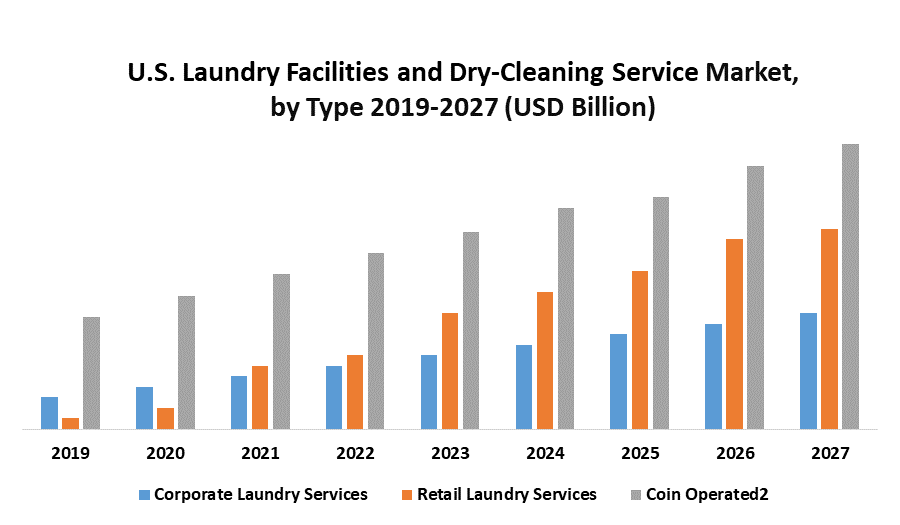

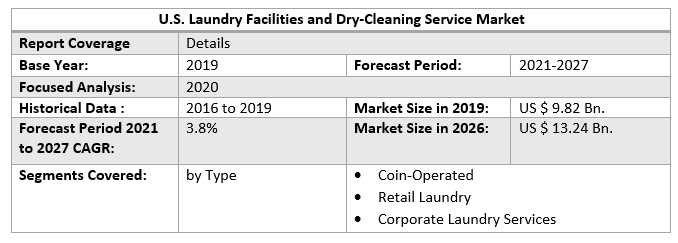

U.S. Laundry Facilities and Dry-Cleaning Service Market size was valued at US$ 9.82 Bn. in 2019 and the total revenue is expected to grow at 3.8% through 2021 to 2027, reaching nearly US$ 13.24 Bn.To know about the Research Methodology :- Request Free Sample Report 2019 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years trends are considered while forecasting the market through 2027. 2020 is a year of exception and analyzed specially with the impact of lockdown by region

U.S. Laundry Facilities and Dry-Cleaning Service Market Overview:

Laundry Facilities and Dry-Cleaning Service Market in U.S. is witnessing significant growth during forecast period owing to large number of working population and growing awareness regrading importance of overall appearance, personal care, and hygiene coupled with impact of social media and emerging trends in fashion and standards of life drives the market growth. The market is starting to introduce advanced computerized lockers inside offices, residential areas and apartment buildings that allow customers to pick up and drop off their laundry anytime. The customers get update of their laundry by a text message when their clothing is ready to be picked up at the locker. Such convenient door-step services boost the laundry market growth in coming years. Moreover, with increasing employment opportunities and workforce in the country, people are getting busier, thereby creating significant opportunities for providers of online laundry services. In 2020, the market size of laundry facilities and dry-cleaning service in U.S. is US $10.20 Bn. It is expected to grow at 3.8% over the forecast period 2021-2027, reaching nearly 13.24 Bn.U.S. Laundry Facilities and Dry-Cleaning Service Market Dynamics:

The U.S. laundry facilities and dry-cleaning service market is expecting significant growth over the forecast period owing to consumers are increasingly becoming more aware of the hygiene, appearance, personal care and look for better solution that are effective and help in overall development of personality. In addition, there has been a prominent change in the lifestyle of consumers, as most of them have a hectic lifestyle which leads to less time for self-home work. So, this grows the market for laundry service. The increasing workforce in corporate is main key factor for growing the demand for laundry and dry-cleaning service market. Furthermore, rising extra income and willing to live comfortable life is contributing to the demand of laundry services in U.S. The market is expected to grow significantly in the near future, as top key players operating in this region rapidly adapted new marketing strategies to acquire maximum number of customer base. Companies are continuously involved in promoting laundry services by using advanced technology for convenience of consumer, not only they provide pickup and delivery facility but also consumer can track their status of cloth through their cellphone. Furthermore, the hospitality and tourism industry expanding rapidly which lead to growth of laundry market. Growth in corporate sector and requirement of good quality of services further increases the potential of this market. Key players make a huge investment in the research and development of technology through which they can provide good quality of service to their customer. Rising hotel and tourism culture to enjoy the moment of life among people is also responsible for growth laundry and dry-cleaning market in U.S. Key players are also stressing on the customer satisfaction by improving their services to international level through on job trainings to their employees. According to the report of society for Human Resource Management (SHRM), 64% of U.S. employees are working from home. This, in turn, has reduce the number of office-going people, ultimately affecting the laundry market. Laundry is a time-consuming task and has become a burden for people with little earning, especially for those working full-time in this business. Recently, LARA introduces the cloud and Internet-of-Things (IoT) in its portfolio, which automatically tags hangers with LED lights to provide visual cues that help businesses track and manage their customer orders.U.S. Laundry Facilities and Dry-Cleaning Service Market Segment Analysis:

Based on the Type, the U.S. laundry facilities and dry-cleaning service market is classified into coin operated, retail laundry services, and corporate laundry services. The coin operated segment dominates the U.S. Laundry Facilities and Dry-Cleaning Service Market owing to growing number of working professionals in the country and commercial facilities used by online laundry services. In 2020 the market share of coin operated laundry service is nearly 38%. Furthermore, the presence of key players offering coin-operated laundries and the increasing collaborations between companies and hotels are expected to boost the market growth of coin operated laundry services. Retail laundry services have major market share in U.S. Laundry Facilities and Dry-Cleaning Service Market. Factors attributing to growth of this segment are reliable and convenient service at a reasonable price. Nowadays, due to changing lifestyles, urbanization and hectic work schedules, which lead growth of retail laundry services segment. Corporate laundry service also capturing the attention of professionals in the US. Many key players offering laundry services make tie up with big multinational companies to provide their services.

U.S. Laundry Facilities and Dry-Cleaning Service Market Regional Analysis:

Owing to high per capita income of population and large number of working professionals. In 2020, the market value of laundry and dry-cleaning market in U.S. is 10.20 Bn. According to the Coin Laundry Association (CLA) report, there were about 37,800 laundromats in the U.S. in 2019 which is going further increases in coming years. Key players, such as Cleanly, FlyCleaners, and ZIP JET, offer discounts on their services to promote their businesses and increase their customer base. The objective of the report is to present a comprehensive analysis of the U.S. laundry facilities and dry-cleaning service market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the U.S. laundry facilities and dry-cleaning service market dynamics, structure by analyzing the market segments and project the U.S. laundry facilities and dry-cleaning service market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the U.S. laundry facilities and dry-cleaning service market make the report investor’s guide.U.S. Laundry Facilities and Dry-Cleaning Service Market Scope: Inquire before buying

U.S. Laundry Facilities and Dry-Cleaning Service Market Key Players

• CSC ServiceWsorks • EnviroStar, Inc. • Alliance Laundry Systems LLC • The Huntington Company • Yates Dry Cleaning & Laundry Services • ZIPS Dry Cleaners • Lavatec Laundry Technology GmbH • Angelica • Cleanly • FlyCleaners • Frigidaire • Cintas • Armark • UniFirst • Venture RaddarFAQ

1. What is the market size of laundry facilities and dry-cleaning market in U.S.? Ans: The U.S. laundry facilities & dry-cleaning services market size was estimated at USD 10.20 billion in 2020 and is expected to reach USD 13.24 billion in 2027. 2. What are the major market players of laundry facilities and dry-cleaning market in U.S? Ans: The major market players of laundry facilities and dry-cleaning market in U.S are Alliance Laundry Systems LLC, The Huntington Company, Yates Dry Cleaning & Laundry Services, ZIPS Dry Cleaners, Lavatec Laundry Technology GmbH, Angelica, Cleanly, FlyCleaners, Frigidaire, Cintas, Armark, UniFirst, and Venture Raddar. 3. Why Dry cleaning is so expensive? Ans: Most of the cost at a dry cleaner has to do with the finishing pressing rather than the cleaning. However, the person that does the actual cleaning and spotting is a skilled worker. There are numerous chemicals and ways of spotting and cleaning that require specific knowledge. Same goes for the presser or finisher. 4. What are the factors responsible for growth of laundry facilities and dry cleaning market in U.S.? Ans: U.S. is the dominating region in the global laundry facilities and dry-cleaning service market owing to high per capita income of population and large number of working professionals. 5. What are the segments of laundry facilities and dry-cleaning market in U.S.? Ans: The segments of laundry facilities and dry-cleaning market in U.S is Type

1.Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: U.S. Laundry Facilities and Dry-Cleaning Service Market Size, by Market Value (US$ Bn.) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.3. Geographical Snapshot of the Laundry Facilities and Dry-Cleaning Service Market, By Manufacturer share 4. U.S. Laundry Facilities and Dry-Cleaning Service Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the U.S. Laundry Facilities and Dry-Cleaning Service Market 5. Supply Side and Demand Side Indicators 6. U.S. Laundry Facilities and Dry-Cleaning Service Market Analysis and Forecasts, 2019-2027 6.1. Market Size (Value) Estimates & Forecast By Type, 2019-2027 6.1.1. Coin-Operated 6.1.2. Retail Laundry 6.1.3. Corporate Laundry Services 7. Competitive Landscape 7.1. Geographic Footprint of Major Players in the U.S. Laundry Facilities and Dry-Cleaning Service Market 7.2. Competition Matrix 7.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 7.2.2. New Product Launches and Product Enhancements 7.2.3. Market Consolidation 7.2.3.1. M&A by Regions, Investment and Verticals 7.2.3.2. M&A, Forward Integration and Backward Integration 7.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 7.3. Company Profile: Key Players 7.3.1. CSC ServiceWsorks. 7.3.1.1. Company Overview 7.3.1.2. Financial Overview 7.3.1.3. Geographic Footprint 7.3.1.4. Product Portfolio 7.3.1.5. Business Strategy 7.3.1.6. Recent Developments 7.3.2. EnviroStar, Inc. 7.3.3. Alliance Laundry Systems LLC 7.3.4. The Huntington Company 7.3.5. Yates Dry Cleaning & Laundry Services 7.3.6. ZIPS Dry Cleaners 7.3.7. Lavatec Laundry Technology GmbH 7.3.8. Angelica 7.3.9. Cleanly 7.3.10. FlyCleaners 7.3.11. Frigidaire 7.3.12. Cintas 7.3.13. Armark 7.3.14. UniFirst 7.3.15. Venture Raddar 8. Primary Key Insights