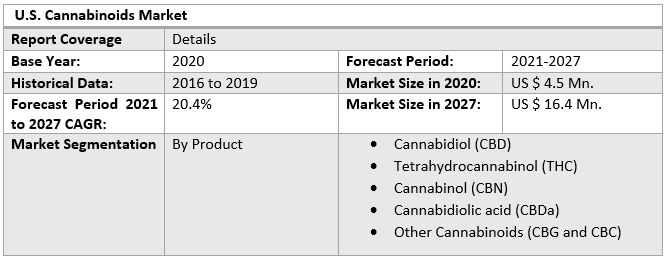

U.S. Cannabinoids Market size was valued at US$ 4.5 Mn. in 2020 and the total revenue is expected to grow at 20.4 % through 2021 to 2027, reaching nearly US$ 16.4 Mn.U.S. Cannabinoids Market Overview:

Cannabinoids are a class of compounds present in marijuana plants. More than 100 additional cannabinoids have been discovered in addition to THC and CBD. The cannabis plant has not been licensed by the FDA for any medical application. The FDA, on the other hand, has approved several medications that contain specific cannabinoids. Epidiolex was approved to treat seizures caused by Lennox-Gastaut syndrome and Dravet syndrome, two rare and severe epilepsy conditions.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2026. 2019 is considered a base year however 2021's numbers are on the real output of the companies in the market. Special attention is given to 2021 and the effect of lockdown on the demand and supply, and the impact of lockdown for the next two years on the market. Some companies have done well in lockdown also and specific strategic analysis of those companies is done in the report.

U.S. Cannabinoids Market Dynamics:

The number of medical practitioners prescribing cannabinoids for various health concerns is increasing, resulting in increased demand for these products and, as a result, market growth. In a study of dermatologists performed in the United States in 2018, nearly 89.4 % of the 531 respondents said they would prescribe cannabidiol (CBD)-based medicines to their patients. Furthermore, around 53.3% of patients inquired about CBD-based products with dermatologists. Furthermore, governments' tax revenues are seen as a way for countries to increase their revenue. Owing to the legalization of CBD and THC in various jurisdictions across the country, the passage of Farm Bill 2018 has provided numerous growth potential in the market. This legalization allows businesses to expand their operations in the United States, which has a favorable impact on the country's market growth. For example, following the passage of the Farm Bill (Agricultural Improvement Act) in the United States, the use of CBD—particularly that produced from hemp and contains less than 0.3 % THC on a dry weight basis—was allowed in 2018. Furthermore, the market is expected to grow due to the rising acceptability and usage of CBD-based medicines over antibiotics throughout the forecast period. The market's expansion is being fueled by an increasing number of consumers choosing isolated cannabis products. Cannabinoid products are used to treat a variety of ailments, including cancer, arthritis, and others. Furthermore, the growing number of medical practitioners prescribing cannabis for health conditions has aided in raising demand and, as a result, the number of consumers seeking treatment with cannabinoids. Further, increasing research and development by government organizations and private companies is likely to lift the growth of the market in the forecast period. Moreover, research funding to promote startups to lunch novel drugs and innovative products in the market.U.S. Cannabinoids Market Segment Analysis:

The Cannabidiol (CBD) segment is anticipated to adhere to the growth of the U.S. Cannabinoids Market. In 2019, the CBD category dominated the US cannabinoid market, accounting for 69.1 percent of total sales. This high percentage is due to an increasing number of consumers selecting isolated cannabis products and increased knowledge of cannabinoid products for health and wellbeing in the United States. The legalization of cannabis-based goods has given the end-user industries tre4mendous potential to grow. The overall growth is likely to be aided by an increase in research activities, increased awareness of synthetic CBD, and increased strategic expenditures by businesses during the forecast period. CBDa products, on the other hand, are expected to rise at the fastest rate over the projected period, owing to potential health advantages and increased efficiency in addressing health issues. The rise in the number of players joining the market, combined with rising knowledge about the health advantages of CBDa, such as pain relief, inflammation reduction, and serotonin reduction, is expected to boost the product segment's expansion throughout the forecast period. For example, in 2019, GreenWay Herbal Products LLC, a U.S.-based company, announced the launch of its CBDa-CBD formula cannabis product line. Such measures will aid in raising awareness of the compound's potential benefits, hence increasing demand in the coming years. The objective of the report is to present a comprehensive analysis of the U.S. Cannabinoids Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the U.S. Cannabinoids Market dynamics, structure by analyzing the market segments and project the U.S. Cannabinoids Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the U.S. Cannabinoids Market make the report investor’s guide.U.S. Cannabinoids Market Scope: Inquire before buying

U.S. Cannabinoids Market Key Players

• Mile High Labs International • Global Cannabinoids • GenCanna • CBD, Inc. Group • SparkCBD • Rhozo Sciences • Maricann, Inc. • Jsuhi Holdings Inc. • Columbia Care • Verano Holding • Holistic Industry • Cannalysis • Demetrix • The Valens Company • Eaze • Treez Inc. • Cresco Labs.FAQs:

1. What is the U.S. Cannabinoids Market value in 2020? Ans: The U.S. Cannabinoids Market value in 2020 was estimated as 4.5 Billion USD. 2. What is the U.S. Cannabinoids Market growth? Ans: The U.S. Cannabinoids Market is anticipated to grow with a CAGR of 20.4% in the forecast period and is likely to reach USD 16.4 Billion by the end of 2027. 3. Which segment is expected to dominate the U.S. Cannabinoids Market during the forecast period? Ans: Cannabidiol (CBD) dominated the U.S. cannabinoids market with the highest share in 2019. This is attributable to the increasing demand for cannabidiol (CBD) for medical and wellness purposes due to its healing properties. 4. Who are the key players of the U.S. Cannabinoids Market? Ans: Some key players operating in the U.S. cannabinoids market include Mile High Labs International; Global Cannabinoids; Rhizo Sciences; GenCanna; SPARKCBD; CBD INC GROUP; and Maricann Group Inc. 5. What is the key driving factor for the growth of the U.S. Cannabinoids Market? Ans: Key factors driving the U.S. cannabinoids market growth include increasing awareness about the therapeutic benefits of cannabinoids, the growing legalization of cannabis and its derivatives in various countries.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Technology 2.3.2. Primary Research 2.3.2.1. Data from Primary Technology 2.3.2.2. Breakdown of Primary Technology 3. Executive Summary: U.S. Cannabinoids Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2020 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the U.S. Cannabinoids Market 3.4. Geographical Snapshot of the U.S. Cannabinoids Market, By Manufacturer share 4. U.S. Cannabinoids Market Overview, 2020-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.1.1. Global 4.1.1.2. By Region (U.S) 4.1.2. Restraints 4.1.2.1. Global 4.1.2.2. By Region (U.S) 4.1.3. Opportunities 4.1.3.1. Global 4.1.3.2. By Region (U.S) 4.1.4. Challenges 4.1.4.1. Global 4.1.4.2. By Region (U.S) 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porter Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Grades 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the U.S. Cannabinoids Market 5. Supply Side and Demand Side Indicators 6. U.S. Cannabinoids Market Analysis and Forecast, 2020-2027 6.1. U.S. Cannabinoids Market Size & Y-o-Y Growth Analysis. 7. U.S. Cannabinoids Market Analysis and Forecasts, 2020-2027 7.1. Market Size (Value) Estimates & Forecast By Product, 2020-2027 7.1.1. Cannabidiol (CBD) 7.1.2. Tetrahydrocannabinol (THC) 7.1.3. Cannabinol (CBN) 7.1.4. Cannabidiolic acid (CBDa) 7.1.5. Other Cannabinoids (CBG and CBC) 8. U.S. Cannabinoids Market Analysis and Forecasts, By Region 8.1. Market Size (Value) Estimates & Forecast By Region, 2020-2027 8.1.1. US 9. U.S. Cannabinoids Market Analysis and Forecasts, 2020-2027 9.1. Market Size (Value) Estimates & Forecast By Product, 2020-2027 9.1.1. Cannabidiol (CBD) 9.1.2. Tetrahydrocannabinol (THC) 9.1.3. Cannabinol (CBN) 9.1.4. Cannabidiolic acid (CBDa) 9.1.5. Other Cannabinoids (CBG and CBC) 10. Competitive Landscape 10.1. Geographic Footprint of Major Players in the U.S. Cannabinoids Market 10.2. Competition Matrix 10.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Fiber Grades, and R&D Investment 10.2.2. New Grade Launches and Grade Enhancements 10.2.3. Market Consolidation 10.2.3.1. M&A by Regions, Investment, and Verticals 10.2.3.2. M&A, Forward Integration and Backward Integration 10.2.3.3. Partnership, Joint Ventures, and Strategic Alliances/ Sales Agreements 10.3. Company Profile: Key Players 10.3.1. Treez Inc. 10.3.1.1. Company Overview 10.3.1.2. Financial Overview 10.3.1.3. Geographic Footprint 10.3.1.4. Grade Portfolio 10.3.1.5. Business Strategy 10.3.1.6. Recent Developments 10.3.2. Mile High Labs International 10.3.3. Global Cannabinoids 10.3.4. GenCanna 10.3.5. CBD, Inc. Group 10.3.6. SparkCBD 10.3.7. Rhozo Sciences 10.3.8. Maricann, Inc. 10.3.9. Jsuhi Holdings Inc. 10.3.10. Columbia Care 10.3.11. Verano Holding 10.3.12. Holistic Industry 10.3.13. Cannalysis 10.3.14. Demetrix 10.3.15. The Valens Company 10.3.16. Eaze 10.3.17. Treez Inc. 10.3.18. Cresco Labs. Primary Key Insights