The Transportation Seals Market size was valued at USD 13.59 Bn. in 2022 and the total transportation Seals is expected to grow by 7.9 % from 2023 to 2029, reaching nearly USD 23.14 Bn.Transportation Seals Market Overview:

Transportation seals are used to boost performance and effectiveness & help manufacturers to follow strict standards and regulations. They are used for sealing, packing, anti-vibration, supporting, and mounting. The COVID-19 outback hampers the automotive and transportation seals market. Transportation of row material was restricted, due to lockdown and social distancing polices in all region. These problems restricts the market growth for transportation seals market The growth of market is driven by rate of adoption of electric cars in emerging countries, rising electric vehicle infrastructure trends in developing countries, fluctuations in raw material costs. Furthermore, the impact of tariff rates on automobile components in the United States, Europe, and China may also contribute to the demand for gaskets and seals. The market is also expected to be driven by strict rules and regulations set by vehicle organizations and the government on the maximum limit of harmful gas emissions such as carbon monoxide and nitrogen oxide. Furthermore, manufacturers are working on increasing fuel efficiency by offering lightweight, easy-to-assemble, and higher-quality vehicle, O-ring seal components in transportation seals market

Competitive Landscape

Leading Companies Develop and Offer Solutions to Improve Industrial Processes and Reduce Downtime The competition in the global Transporting seals market has grown in recent years due to the existence of several major industry competitors. In the future, a number of these players are expected to hold a sizable portion of the market. Leading transportation seals market companies use R&D projects to create products of higher quality as a vital component of their growth strategies. In an effort to get an advantage over the competition, prominent transportation seals market companies could employ growth methods including new product launches.For example, The introduction of a "low torque resin bearing" by NTN Corporation was announced in August 2022. This bearing might be used for electric water pumps in cooling systems for electric automobiles. Isolast® K-FabTM Seal was introduced by Trelleborg Sealing Solutions in 2022 with the objective of providing long-term sealing and increased productivity in high-temperature semiconductor subfab applications. It was expected that the system will greatly reduce downtime and ownership costs. The market for industrial seals is expected to be influenced by such solutions. The brand-new, exclusive fireproof sealing fabric from Freudenberg was created to withstand harsh circumstances. The solution was more affordable and performed on par with other, industry-standard solutions. To improve the operation of industrial systems, companies like Robco of America provide dependable repair services for all kinds of mechanical seals. Additionally, the company offers top-notch industrial goods around the USA, such as fluid sealing, mechanical seals, metallic gaskets, fiber and high-resistant textiles, mechanical packaging, and mechanical seals. In-depth analyses of the following major companies in the global transportation seals market are provided in the report, along with information on their recent capacity additions, plant, and mergers and acquisitions. for example, Saint-Gobain acquired High Tech Metal Seals in 2020. (HTMS). Following the acquisition of American Seal and Engineering Co., the transaction brought to an end the Group's product line of providing customized sealing industry solutions. In order to manufacture railway-bearing seals in India, National Engineering Industries Ltd. (NEI) and Amsted Seals formed a joint venture (JV) in 2022. Amsted Seals is a significant player on the global scene for metal fabrication and sealing systems. The industrial seal market is expected to grow as a result of these collaborations.

To know about the Research Methodology :- Request Free Sample Report

Transportation Seals Market Dynamics:

Rising awareness of NVH The discomfort of passengers and the durability of the vehicle can both be hampered by noise, vibration, and harshness in cars caused by airborne and structure-borne sounds. The use of NVH-reduction materials in cars helps to lower these sounds and enhance ride comfort. The increasing attention that manufacturers are paying to noise and sound management in both passenger and commercial vehicles helps to increase fuel efficiency, lessen interior noise, and increase durability. Along with the aforementioned advantages of the product, the sector is expected to grow due to changes in customer preferences. Globally, a number of countries have enacted strict standards for vehicle noise. The use of NVH materials including nitrile rubber (NBR), polyurethanes (PU), and polycarbonate (PC) has increased as a result of these standard rules since they help reduce vehicle noise while maintaining performance and safety. growing demand for automobiles globally and growing need for lightweight vehicles and the market for noise-reducing solutions for automobiles is growing as a result of changing lifestyles, greater disposable income, and quick urbanization. It has been shown that customers preference choosing comfortable, lightweight, and eco-friendly vehicles, which drive the transportation and seals market. Growing demand for advanced high-performance seals creates a new opportunity for market players Automotive component makers are looking for new and innovative high-performance materials. Rapid urbanization, an increase in disposable income, and a change in consumer lifestyle are all contributing to the massive transformation of the global automobile sector. Furthermore, the growing demand for passenger and commercial cars includes the favorable effects of globalization, advances in emerging countries' manufacturing capacities, and the adoption of reduced technologies. The new automobile sales will increase by 15% by the end of 2022, with commercial vehicle sales possibly increasing by 16%. High-performance seals are widely employed in several automobile applications, including ride control systems, fuel systems, brake systems, air conditioning systems, and car batteries. As a result, the demand for high-performance sealing material used in automotive components is driven by the increase in vehicle sales. In long-distance travel, high-performance seals can resist high temperatures. Further boosting the need for such seals is the implementation of severe carbon emission standards, which encourages manufacturers to adhere to specifications to reduce emissions and the possibility of unplanned downtime. As a result, there is a growing need for high-performance seals in the automotive sector, which is driving the market and creating a new opportunity for transportation seals market players during the forecast period. Challenges faced by transportation seals market players The seal lip is directly impacted by the pressure of the fluid that has to be sealed. A shorter sealing lip that lowers the contact pressure but also reduces complete flexibility is a feature of an RSS that is designed to decrease pressure-related deformation and stresses. The application is nevertheless constrained in terms of rotational speed and circumferential velocity by an increased overpressure that must be expected at the sealing lip. Along with increased overheating, localized insufficient lubrication on the air side of the sealing lip contact zone is to be expected. This results in concave wear in the region and early seal failure, which expected is to hamper the transportation seals market. A seal’s lifespan is controlled by the working circumstances, which include circumferential speed, temperature, pressure, lubrication, as well as internal and exterior contaminants. The mechanical properties of the sealing material may be adversely affected by an excessive temperature increase. It may also result in the seal's lip hardening or the seal’s lip contact zone breaking, which might cause the seal to prematurely fail, which hamper the transportation seals market.Segment Analysis:

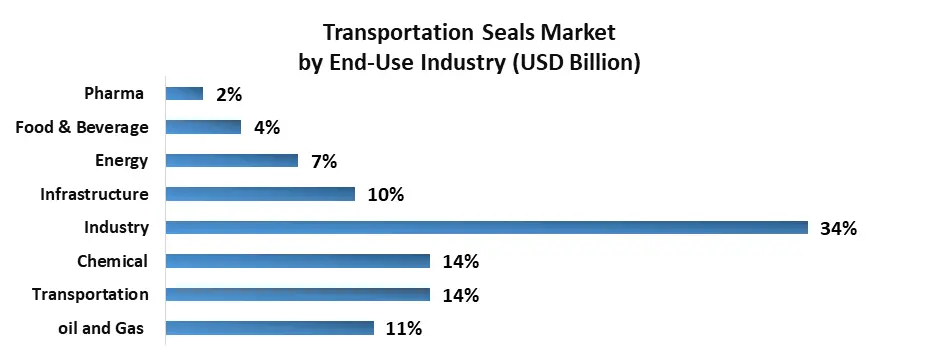

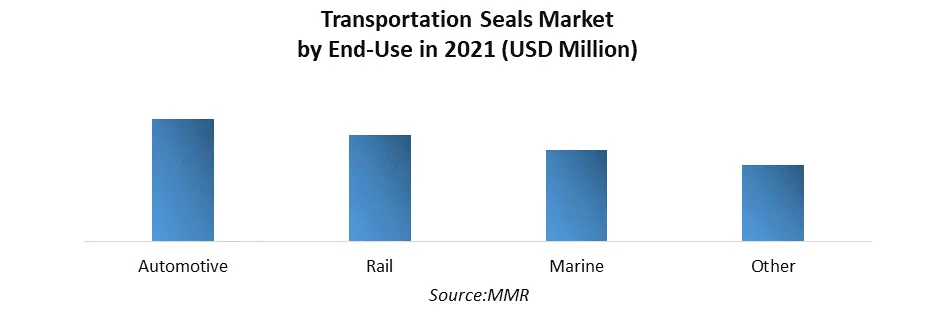

Based on Type, the transportation Seals market is segmented into Lip seals, Gaskets seals, O-ring seals, Other. O-ring seals are expected to dominate during the forecast period. O-ring seals are torus-shaped mechanical gaskets that are sometimes referred to as packing or refractive error joints. They are rubber loops with round sections that are designed to fit into grooves and be squeezed during assembly between two or more pieces to provide a seal at the interface. The world's most popular and fundamental sealing mechanism is the O-ring seal. They are widely utilized in many different applications, from crucial aerospace applications to garden hose couplings, and are highly flexible. These seals are segmented into two types synthetic rubber and thermoplastic elastomer. O-ring seals are widely utilized in important sectors including aerospace and aviation, automotive, chemical and petrochemical, oil and gas, medical, and healthcare, among others, as a result of their flexibility and simple design, which create the huge demand in automotive and transportation seals market during the forecast period. Thanks to their versatility, good sealing, variety of sizes, reusability, and cheap production costs. O-ring seals provide an effective way to improve fuel efficiency thanks to technical improvements. O-ring seals' increased use in automotive components is being fueled by their battery fuel economy and minimal maintenance requirements, which are driving the transportation seals market growth. Furthermore, tight regulations governing the maximum allowable emission of dangerous gases like carbon monoxide and nitrogen oxide, which have been included by automobile organizations and departments, are expected to boost the market. The growth of the transportation seal market is expected to be fueled by the rising usage of cutting-edge materials in the production of O-ring seals for important applications, including the manufacture of aircraft and medical equipment, among others. Based on the End-Use, the transportation seals market is segmented into Aerospace, Automotive, Rail, Marine, and Others. The automotive segment held the largest market share during the forecast period. Automotive Seals are employed for a variety of purposes, including joining the joints, and stopping leaks, while excluding unwanted particles. Seals are often employed in the automobile sector to fill the space between two components in order to prevent leaking when the components are being compressed. Automotive seals are used to induction seal, heat, stuff, and adhere to various sections of autos. They are available in a variety of shapes and sizes. Depending on the purpose and its needs, several materials are used to make seals.Automotive seals, have outstanding dependability and are durable. They can withstand intense vibrations brought on by an engine running as well as extensive use, which drive the transportation seals market. Seals enable the car to operate and function correctly, not just in vehicles but also in motorbikes, ATVs, and off-road heavy gear and equipment, they have a variety of uses.

Transportation Seals Market Regional Insights:

Asia Pasific is expected to dominate the transportation seal market in 2022, followed by Europe, North America, and LAMEA. In 2022, China dominated the global market for transportation seals, during the forecast period, India is expected to develop significantly. The growth of the market for transportation seals is expected to be fueled by improvements in the automotive, aviation, and transportation sectors. Additionally, strong government backing for the expansion of the region's transportation industry is fueling sales growth. The market for transportation seals is growing as a result of many important reasons, including increased NVH awareness and rising demand for sophisticated seals that increase fuel economy. The market's development is also a result of the market economy. The economy of countries such as China, India, Brazil, and South Africa are developing. Since the transportation industry is growing significantly in these countries, the market for transportation seals is expected to benefit greatly from this development. Additionally, the manufacturing of vehicles and the aviation industry are growing in several undeveloped countries, which is expected to boost the market.Transportation Seals Market Scope: Inquiry Before Buying

Transportation Seals Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 13.59 Bn. Forecast Period 2023 to 2029 CAGR: 7.9% Market Size in 2029: US$ 23.14 Bn. Segments Covered: by Type 1. Lip Seals 2. Gaskets 3. O-Ring 4. Other by Motion 1.Static Seals 2. Linear Seals 3. Rotary Seals by End-Use 1. Automotive 2. Rail 3. Marine 4. Other Transportation Seals Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Transportation Seals Market, Key Players are

1. Saint-Gobain S.A. 2. Cooper Standard Holding Inc. 3. Dana Limited 4. Datwyler Holding Inc. 5. Federal-Mogul Corporation 6. Freudenberg Sealing Technologies GmbH & Co. KG, 7. Hutchinson SA, 8. Meccanotecnica Umbra S.p.A., 9. Meggitt Plc, 10. Parker-Hannifin Corporation, 11. SKF, 12. Smiths Group PLC, 13. Tennecco Inc., 14. Toyoda Gosei Co., Ltd., 15. Trelleborg AB. 16. Elringklinger AG 17. Jayem Auto Industries Pvt.Ltd 18. Compagnie de 19. TransDigm Group Incorporated (Kirkhill) 20. Eagle Elastomer, Inc. 21. Marco Rubber & Plastics, LLC 22. MAHLE GmbH 23. Ge Mao Rubber Industrial Co., Ltd. 24. Dataseal India 25. Gallagher Fluid Seals, Inc. 26. ISG Elastomers 27. Allied Metrics Seals & Fasteners, Inc. 28. Apple Rubber Products, Inc. 29. ESP International 30. ORing Industrial Networking Corp 31. Hi-Tech Seals 32. Precision Associates, Inc. 33. Daemar Inc. 34. Arizona Sealing Devices, Inc. 35. Ribblex Prime Industries 36. Atlantic Rubber Company, Inc. Frequently Asked Questions: 1] What segments are covered in the Global Telepsychiatry Market report? Ans. The segments covered in the Telepsychiatry Market report are based on Product, Age group, End-use, and Region. 2] Which region is expected to hold the highest share in the Global Telepsychiatry Market? Ans. The Asia Pasific region is expected to hold the highest share in the Telepsychiatry Market. 3] What is the market size of the Global Telepsychiatry Market by 2029? Ans. The market size of the Telepsychiatry Market by 2029 is expected to reach US$ 23.14 Bn. 4] What is the forecast period for the Global Telepsychiatry Market? Ans. The forecast period for the Telepsychiatry Market is 2023-2029. 5] What was the market size of the Global Telepsychiatry Market in 2022? Ans. The market size of the Telepsychiatry Market in 2022 was valued at US$ 13.59 Bn.

1. Global Transportation Seals Market Size: Research Methodology 2. Global Transportation Seals Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Transportation Seals Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Transportation Seals Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Transportation Seals Market Size Segmentation 4.1. Global Transportation Seals Market Size, by Type (2022-2029) • Lip Seals • Gaskets • O-Ring • Other 4.2. Global Transportation Seals Market Size, by Motion (2022-2029) • Static Seals • Linear Seals • Rotary Seals 4.3. Global Transportation Seals Market Size, by End-Use (2022-2029) • Automotive • Rail • Marine • Other 5. North America Transportation Seals Market (2022-2029) 5.1. North America Transportation Seals Market Size, by Type (2022-2029) • Battery Electric Vehicle • Plugin Hybrid Vehicle • Hybrid Vehicle 5.2. North America Transportation Seals Market Size, by Motion (2022-2029) • Front Wheel Drive • Rear Wheel Drive • All Wheel Drive 5.3. Buses North America Transportation Seals Market Size, by End-Use (2022-2029) • Passenger cars • Commercial Vehicle North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Transportation Seals Market (2022-2029) 6.1. European Transportation Seals Market, by Type (2022-2029) 6.2. European Transportation Seals Market, by Motion (2022-2029) 6.3. European Transportation Seals Market, by End-Use (2022-2029) 6.4. European Transportation Seals Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Transportation Seals Market (2022-2029) 7.1. Asia Pacific Transportation Seals Market, by Type (2022-2029) 7.2. Asia Pacific Transportation Seals Market, by Motion (2022-2029) 7.3. Asia Pacific Transportation Seals Market, by End-Use (2022-2029) 7.4. Asia Pacific Transportation Seals Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Transportation Seals Market (2022-2029) 8.1. Middle East and Africa Transportation Seals Market, by Type (2022-2029) 8.2. Middle East and Africa Transportation Seals Market, by Motion (2022-2029) 8.3. Middle East and Africa Transportation Seals Market, by End-Use (2022-2029) 8.4. Middle East and Africa Transportation Seals Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Transportation Seals Market (2022-2029) 9.1. South America Transportation Seals Market, by Type (2022-2029) 9.2. South America Transportation Seals Market, by Motion (2022-2029) 9.3. South America Transportation Seals Market, by End-Use (2022-2029) 9.4. South America Transportation Seals Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Saint-Gobain S.A 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Cooper Standard Holding Inc. 10.3. Dana Limited 10.4. Datwyler Holding Inc. 10.5. Federal-Mogul Corporation 10.6. Freudenberg Sealing Technologies GmbH & Co. KG, 10.7. Hutchinson SA, 10.8. Meccanotecnica Umbra S.p.A., 10.9. Meggitt Plc, 10.10. Parker-Hannifin Corporation, 10.11. SKF, 10.12. Smiths Group PLC, 10.13. Tennecco Inc., 10.14. Toyoda Gosei Co., Ltd., 10.15. Trelleborg AB. 10.16. Elringklinger AG 10.17. Jayem Auto Industries Pvt.Ltd 10.18. Compagnie de 10.19. TransDigm Group Incorporated (Kirkhill) 10.20. Eagle Elastomer, Inc. 10.21. Marco Rubber & Plastics, LLC 10.22. MAHLE GmbH 10.23. Ge Mao Rubber Industrial Co., Ltd. 10.24. Dataseal India 10.25. Gallagher Fluid Seals, Inc. 10.26. ISG Elastomers 10.27. Allied Metrics Seals & Fasteners, Inc. 10.28. Apple Rubber Products, Inc. 10.29. ESP International 10.30. ORing Industrial Networking Corp 10.31. Hi-Tech Seals 10.32. Precision Associates, Inc. 10.33. Daemar Inc. 10.34. Arizona Sealing Devices, Inc. 10.35. Ribblex Prime Industries 10.36. Atlantic Rubber Company, Inc..