Global Transmission Fluid Market size was valued at USD 40.5 Bn. in 2022 and the total Transmission Fluid revenue is expected to grow by 3.1 % from 2023 to 2029, reaching nearly USD 55.1 Bn.Transmission Fluid Market Overview

The transmission Fluid Market is stated as one of the fluids utilized in vehicles for manual and automatic transmissions during the movement of the engine. Transmission Fluid Market is usually obtainable in red or green color. It is dyed in turn to differentiate it from other fluids and motor oils utilized in vehicles. The transmission fluids market is expected to observe Transmission Fluid Market growth at a rate of 3.95%. MMR analyzed the transmission fluids market and provides analysis and insights regarding the various factors expected to be dominant throughout the forecast period while providing their impacts on the market’s growth. The rise in the demand for technologically advanced vehicles with unique drivetrains that deliver comfort of driving is rising the growth of the Transmission Fluid Market. Major factors that increase the growth of the Transmission Fluid Market in the forecast period are the rise in the automotive industry. Also, the technological development in the passenger vehicles sector is further forcing the growth of the market. Transmission Fluid Market provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of developing revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application places and dominance, product approvals, product launches, geographical expansions, technological innovations in the market.To know about the Research Methodology :- Request Free Sample Report

Transmission Fluid Market Dynamics

Transmission Fluid Market Drivers Increasing Demand for Passenger and Commercial Vehicles in Emerging Economies The demand for commercial and passenger vehicles in India, China, Brazil, and South Korea is growing because of rapid development in the automotive and infrastructure industry. According to the International Organisation of Motor Vehicle Manufacturers (OICA), since 2005, the automobile industry has shown rapid growth in emerging economies because of rapid industrialization and increased foreign direct investment (FDI), so it has created well-paid jobs in developing economies, increasing customers buying power. During the COVID-19 pandemic, demand for passenger cars has increased as people chosen private vehicles to travel instead of public transportation. The transport of food and medical supplies increased the demand for commercial vehicles during the pandemic Over the past decades, the automotive market has developed immensely in R&D, production capacity, competitive standards, and continuous development. Transmission Fluid Market Challenges Developed Countries Stable Passenger Car Market Negatively Impacts Transmission Fluid Demand The US, Germany, and Japan are the developed countries, and the passenger car market is matured in this region as most of the population owns at least one car per person. So, no major driving factors increase the demand for passenger cars. Consequently, it affect the transmission fluid market. According to the US Bureau of Transportation Statistics, the average number of vehicles in the household is 1.9. As per Worldatlas, Germany has 566 cars per 1000 people, China has 173 cars per 1000 individuals, Indonesia has 78 vehicles per 1000 individuals, and India has 225 cars per 1000 individuals. The data mentioned above, developed countries has a significantly high number of cars, and because of that, the demand for passenger cars has stable in developed countries. The points mentioned above indicate that the passenger car market in developed nations like the US, Germany, and Japan is developed. So, the demand for passenger cars is stable and will negatively impact the transmission fluid demand. Transmission Fluid Market Opportunities Rapid Growth in Electric Vehicle Market The Electric vehicle (EVs) runs on electric motors but transmitting the power from motors to wheel transmission gathering is compulsory in electric vehicle transmission. The EVs run on the electric motor, they still require some emollient, such as transmission fluid, for improved performance of the vehicle. Governments and many automotive manufacturers are focusing on electric cars to increase the production and use of electric vehicles. Electric cars has become popular among customers because of rising crude oil prices. The EVs help reach environmental objectives. The electric vehicles are more efficient so, the increase in the EV fluids market increase the demand for transmission fluid.Competitive Landscape

The transmission fluids market is highly competitive, with several major players competing for market share. Some of the key players in the market include The transmission fluids market competitive landscape provides details by the competitor. BASF SE, Chevron Corporation., Exxon Mobil Corporation., Royal Dutch Shell plc, bp p.l.c., Total, LUKOIL, Petroliam Nasional Berhad (PETRONAS), The Lubrizol Corporation, FUCHS, Amsoil, Inc., Pennzoil, Valvoline LLC, PetroChina Company Limited. Royal Dutch Shell plc, bp p.l.c. The company is mainly focused on its downstream business segment, as it has a strong revenue-generating segment with a high return on investment. It focuses on expansion as the key growth strategy. It has made a large number of expansions to meet the increasing demand from customers and strengthen its position in the global lubricants market. In January 2021, the company announced a joint venture. The integrated product portfolio meets the unique needs of companies engaged in North America. In May 2019, the company opened its first lubricant laboratory in India.Transmission Fluid Market Segment Analysis

Based on Type, The Automatic transmission fluid segment dominates the Transmission Fluid Market in the year 2022 and the same during the forecast year. The transmission fluids market is segmented into automatic transmission fluid (ATF), manual transmission fluid (MTF), and others. Others are further sub-segmented into dual-clutch transmission fluid (DCT) and continuously variable transmission fluid (CVT). Which one should decide on really depends upon the vehicle and its model. It is recommended to consult with a transmission expert or in a nearby service centre.No matter what transmission fluid opts for, a consumer should not compromise the quality. If advanced vehicles such as an SUV or the latest model then also consider using CVT fluid for the transmission as it is an advanced version of transmission oil crafted to work with advanced cars, SUVs, and trucks.Based on the base oil, The synthetic oil segment dominates the Transmission Fluid Market in the year 2022 and the same during the forecast year. The synthetic oil dominates the market in the year 2022 and is expected to do the same during the forecast period. The transmission fluids market is segmented into mineral oil, synthetic oil, and semi-synthetic oil. Synthetic oils are becoming widely popular in the market for their greater protection and the increase of performance it advances to vehicles. Synthetic oils are chemically adapted with extracts and have fewer impurities, making them less thick than mineral oils. Synthetic oils are used for many modern vehicle engines. They protect engines from wear, oxidation, and corrosion and have dispersant properties.

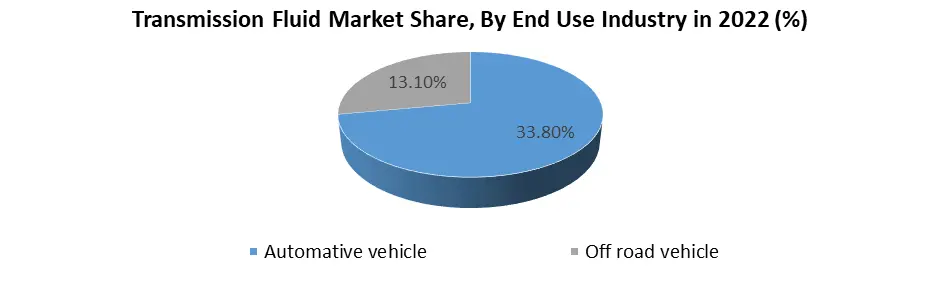

Based on the end-use industry, The off-road vehicles segment dominates the Transmission Fluid Market in the year 2022 and the same during the forecast year with a market share of about 55%. The transmission fluids market is segmented into automotive and off-road vehicles. Automotive is further sub-segmented into passenger vehicles and commercial vehicles. The purpose of the fluids used in off-road vehicles, such as construction vehicles and agricultural machinery, is to deliver optimal on-road force by providing wear protection for transmission machinery for longer vehicle life. Asia Pacific is one of the largest regional markets in off-road vehicles application paid to the growth of the construction industry. Additionally, with the increase in infrastructural development across the globe, the condition for these oils in various vehicles is also significantly increasing. Growth of the construction industry in emerging markets of China, India, Brazil, and Mexico remains a key factor driving the demand for off-road vehicles application globally.

Regional Insights

Asia Pacific region dominated the transmission fluid market in the year 2022 and same during the forecast years due to the change in the manufacturing landscape towards the advancing countries. The transmission fluids market is analyzed and market size, and volume information is provided by country, type, and base oil. The rise in the numerous growing industries, such as construction, automotive, and mining which will more increase the growth of the transmission fluids market in the region during the forecast period. North America is projected to observe a significant amount of growth in the transmission fluids market due to the occurrence of major key players. The expenditure in the construction sector is further anticipated to drive the growth of the transmission fluids market in the region in recent years. The country section also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as consumption volumes, production sites, and volumes, import-export analysis, price trend analysis, cost of raw materials, and downstream and upstream value chain analysis are some of the major pointers used to forecast the market scenario for individual countries. The presence and availability of global brands and their challenges faced due to large competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.Transmission Fluid Market Scope: Inquire before buying

Transmission Fluid Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 40.5 Bn. Forecast Period 2023 to 2029 CAGR: 3.1% Market Size in 2029: US $ 55.1 Bn. Segments Covered: by Type 1. Automatic 2. Manual by Base Oil 1. Synthetic 2. Semi synthetic 3. Mineral by End Users 1. Automotive Vehicle 2. Off-Road Vehicle Transmission Fluid Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Transmission Fluid Key Players

1. BASF SE, Chevron Corporation. 2. Exxon Mobil Corporation. 3. Royal Dutch Shell plc bp p.l.c. 4. LUKOIL 5. Petroliam Nasional Berhad (PETRONAS) 6. The Lubrizol Corporation 7. FUCHS 8. Amsoil, Inc. 9. Pennzoil 10. Valvoline LLC 11. PetroChina Company Limited 12. Phillips 66 Company. 13. Calumet Branded Products, LLC 14. Evonik Industries AG 15. Sinopec 16. Afton Chemical 17. Idemitsu Kosan Co., Ltd. 18. Millers Oil Ltd Frequently Asked Questions: 1] What segments are covered in the Transmission Fluid Market report? Ans. The segments covered in the market report are based on Type, base oil, End user Industries, and Region. 2] Which region is expected to hold the highest share in the Transmission Fluid Market? Ans. The Asia pasific region is expected to hold the highest share of the market. 3] What is the market size of the market by 2029? Ans. The market size of the market by 2029 is expected to reach US$ 55.1 Bn. 4] What is the forecast period for the Transmission Fluid Market? Ans. The forecast period for the market is 2022-2029. 5] What was the market size of the Transmission Fluid Market in 2022? Ans. The market size of the market in 2022 was valued at US$ 40.5 Bn.

1. Transmission Fluid Market: Research Methodology 2. Transmission Fluid Market: Executive Summary 3. Transmission Fluid Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Transmission Fluid Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Transmission Fluid Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Transmission Fluid Market Size and Forecast, by Type (2022-2029) 5.1.1. Automatic 5.1.2. Manual 5.2. Transmission Fluid Market Size and Forecast, by Base Oil (2022-2029) 5.2.1. Synthetic 5.2.2. Semi synthetic 5.2.3. Mineral 5.3. Transmission Fluid Market Size and Forecast, by End User Industries (2022-2029) 5.3.1. Automative 5.3.2. Off roads 6. North America Transmission Fluid Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Transmission Fluid Market Size and Forecast, by Type(2022-2029) 6.1.1. Automatic 6.1.2. Manual 6.2. North America Transmission Fluid Market Size and Forecast, by Base Oil (2022-2029) 6.2.1. Synthetic 6.2.2. Semi synthetic 6.2.3. Mineral 6.3. North America Transmission Fluid Market Size and Forecast, by End User Industries (2022-2029) 6.3.1. Automative 6.3.2. Off roads 7. Europe Transmission Fluid Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Transmission Fluid Market Size and Forecast, by Type (2022-2029) 7.1.1. Automatic 7.1.2. Manual 7.2. Europe Transmission Fluid Market Size and Forecast, by Base Oil (2022-2029) 7.2.1. Synthetic 7.2.2. Semi synthetic 7.2.3. Mineral 7.3. Europe Transmission Fluid Market Size and Forecast, by End User Industries (2022-2029) 7.3.1. Automative 7.3.2. Off roads 8. Asia Pacific Transmission Fluid Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Transmission Fluid Market Size and Forecast, by Type (2022-2029) 8.1.1. Automatic 8.1.2. Manual 8.2. Asia Pacific Transmission Fluid Market Size and Forecast, by Base Oil (2022-2029) 8.2.1. Synthetic 8.2.2. Semi synthetic 8.2.3. Mineral 8.3. Asia Pacific Transmission Fluid Market Size and Forecast, by End User Industries (2022-2029) 8.3.1. Automative 8.3.2. Off roads 9. Middle East and Africa Transmission Fluid Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Transmission Fluid Market Size and Forecast, by Type (2022-2029) 9.1.1. Automatic 9.1.2. Manual 9.2. Middle East and Africa Transmission Fluid Market Size and Forecast, by Base Oil (2022-2029) 9.2.1. Synthetic 9.2.2. Semi synthetic 9.2.3. Mineral 9.3. Middle East and Africa Transmission Fluid Market Size and Forecast, by End User Industries (2022-2029) 9.3.1. Automative 9.3.2. Off roads 10. South America Transmission Fluid Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Transmission Fluid Market Size and Forecast, by Type (2022-2029) 10.1.1. Automatic 10.1.2. Manual 10.2. South America Transmission Fluid Market Size and Forecast, by Base Oil (2022-2029) 10.2.1. Synthetic 10.2.2. Semi synthetic 10.2.3. Mineral 10.3. South America Transmission Fluid Market Size and Forecast, End User Industries (2022-2029) 10.3.1. Automative 10.3.2. Off roads 11. Company Profile: Key players 11.1 BASF SE, Chevron Corporation. 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2 Exxon Mobil Corporation. 11.3 Royal Dutch Shell plc 11.4 bp p.l.c.Total 11.5 LUKOIL 11.6 Petroliam Nasional Berhad (PETRONAS) 11.7 The Lubrizol Corporation 11.8 FUCHS 11.9 Amsoil, Inc. 11.10 Pennzoil 11.11 Valvoline LLC 11.12 PetroChina Company Limited 11.13 Phillips 66 Company. 11.14 Calumet Branded Products, LLC 11.15 Evonik Industries AG 11.16 Sinopec 11.17 Afton Chemical 11.19 Idemitsu Kosan Co., Ltd. 11.19 Millers Oil Ltd 12.Key Findings 13.Industry Recommendation