Track Laying Equipment Market was valued at US$ 447.7 M. in 2022. The Global Track Laying Equipment Market size is estimated to grow at a CAGR of 4.13 % over the forecast period.Track Laying Equipment Market Overview:

Track Laying Machines lay the sleepers, rails, and fastenings in place ready to use. In MMR report, we include New Construction Equipment and Renewal Equipment. The report explores the Track Laying Equipment market's segments (Type, Application, and regions). Data has been provided by market participants, and regions (North America, Asia Pacific, Europe, Middle East & Africa, and South America). This market report provides a thorough analysis of the rapid advances that are currently taking place across all industry sectors. Facts and figures, illustrations, and presentations are used to provide key data analysis for the historical period from 2017 to 2022.To know about the Research Methodology :- Request Free Sample Report

Track Laying Equipment Market Dynamics:

The rise in repairs and replacements, and rail travels are creating a demand for the Track Laying Equipment market: The increase in the sales of the lying equipment has increased due to the rise in the components it contains such as sleepers and rails. The increase in the repair and replacements of the defective parts for avoiding the high subsequent cost associated with it is expected to grow the overall growth of the market. Owing to the technological advancements for maintaining the quality standards, the manual laying, and the heavy track structure maintenance as it has a very low and poor quality of the life on the track. The increase in the demand for high-performance efficient machines and withstand of the equipment remains one of the preliminary factors which further leads to the growth of the sales of the track laying equipment market. The track laying operations require a high expenditure for the machines. With help of this equipment, these costs can be reduced by achieving high quality. The growing rail travel and the increasing demand for track laying equipment are raising the growth in demand for the Track Laying Equipment Market. This Track Laying Equipment makes machine handling easy and suitable for carrying from one place to another. Also, the railway sector is shifting towards the refinement cycle for transferring every walk of life. These increasing needs for the light weighted machines and equipment are further expected to drive the market demand of the Track Laying Equipment Market. There is a rise in the demand for light-weighted equipment and machine: The introduction of advanced technologies has led to the enhancement of the railway sector which is requiring light-weighted equipment and machines. Also, there is high demand for high-performance devices or equipment. Also, the increase in rail travel and the demand for quality maintenance is another driver for the development of Track Laying Equipment which in turn promote the growth of the Track Laying Equipment market. Increasing the adoption of heavier structure of the track and the use of Track Laying Equipment is very essential for achieving high-quality working ability. These factors will contribute to affecting the Track Laying Equipment market. Hence, these act as major opportunities for the Track Laying Equipment market. Track Laying equipment requires high expenditure and personnel: The Track Laying Equipment market has advantages like it helps the promoting the growth of the Track Laying Equipment market. But, the market for Track Laying Equipment also has some limitations that can restrain the market and hamper the growth of the Track Laying Equipment market such as the track laying operations require a very high expenditure for the machine and the personnel which can hamper the growth of the market. Also, the original equipment manufacturers (OEM) are collaborating resourceful structures in the modern generation railways that comprise smart machines and the equipment so that they can be handled easily.Track Laying Equipment Market Trends:

The increase in the repair and replacements of the defective parts for avoiding the high subsequent cost associated with it is expected to grow the overall growth of the market. the heavy track structure maintenance as it has a very low and poor quality of the life on the track. These increasing needs for the light weighted machines and equipment are further expected to drive the market. advanced technologies have led to the enhancement of the railway sector which is requiring light-weighted equipment and machines. high demand for high-performance devices or equipment. Also, the increase in rail travel and the demand for quality maintenance is another driver for the development of Track Laying Equipment which in turn promote the growth of the Track Laying Equipment market. Hence these factors are leading to the growth of the Track Laying Equipment market.Track Laying Equipment Market Segment Analysis:

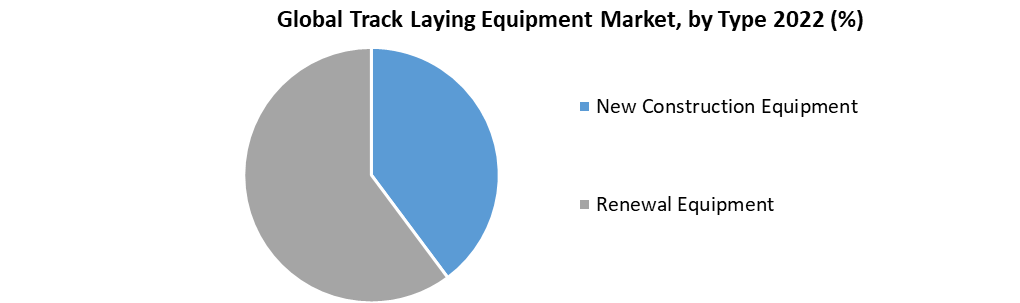

Based on Product types, the Track Laying Equipment Market, track New Construction Equipment, and Renewal Equipment. The New Construction Equipment segment holds the maximum market share in the Track Laying Equipment Market. This is due to increase in the urbanization and modernization has led to an increase in the new construction in the developing and under-developing countries. This has created a major demand for the Track Laying equipment globally. Hence the New Construction Equipment segment holds the maximum market share in the Track Laying Equipment Market. On basis of Applications, The Track Laying Equipment Market is segmented into Heavy rail and urban rail. The urban rail holds the maximum market share of the Track Laying Equipment Market, because of Modernization Urban rail is gaining attention in the railway sector. These factors are responsible for the growth of The Urban Rail segment in the Track Laying Equipment Market. Also, the government is having a huge investment in the urban rails. This would lead to development in the economy of the countries. Hence, the urban rail holds the maximum market share of the Track Laying Equipment Market

Track Laying Equipment Market Regional Insights:

The Asia Pacific region held the largest market share accounting for 87% in 2022. Because Asia Pacific region countries have an increasing number of travels from the railways as well as there is a rise in the disposable income which is rising the demand for rail travel. Also, it is creating a demand for new routes and replacements of the components in this particular region. These factors are would lead to driving the sales for the Track Laying Equipment during the forecast period. There is a rise in the middle-class economy and the appearance is cost-effective from the manufacturers of China would boost the demand for Track Laying Equipment. The North American region is expected to witness significant growth at a CAGR of xx% through the forecast period. Due to the urbanization and modernization in the North American countries, the need to repair replace, and maintenance of the heavy track structures demand for Track Laying Equipment is increasing in this region. Also, there is a surge in rail travel and high maintained quality. North American regions have investments in the Track Laying Equipment market. These factors are increasing the demand and hence, the North American region is expected to witness significant growth in the Track Laying Equipment market. The objective of the report is to present a comprehensive analysis of the global Track Laying Equipment Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Track Laying Equipment Market dynamic, and structure by analyzing the market segments and projecting the Track Laying Equipment Market size. Clear representation of competitive analysis of key players by Design, price, financial position, product portfolio, growth strategies, and regional presence in the Track Laying Equipment Market make the report investor’s guide.Track Laying Equipment Market Scope: Inquiry Before Buying

Global Track Laying Equipment Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 447.7 Mn. Forecast Period 2023 to 2029 CAGR: 4.13% Market Size in 2029: US $ 594.3 Mn. Segments Covered: by Type • New Construction Equipment • Renewal Equipment by Application • Heavy rail • urban rail Track Laying Equipment Market, by Region

• North America (United States, Canada and Mexico) • Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) • Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) • Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) • South America (Brazil, Argentina Rest of South America)Track Laying Equipment Market Key Players are:

• Geismar • Eiffage Rail • Plasser & Theurer • Harsco Corporation • SWIETELSKY • KOMPASS INTERNATIONAL SA • Plasser India • Salcef Group S.p.A. • The PTK Group • Strukton • ROBEL Bahnbaumaschinen GmbH • Plasser & Theurer • CREC • Harsco • Geismar • Matisa • Salcef Group S.p.A. • Kirow • Weihua Frequently Asked Questions: 1) What segments are covered in the Track Laying Equipment Market report? Ans. The segments covered in the Track Laying Equipment Market report are based on Type and Application. 2) Which region holds the highest share in the Track Laying Equipment Market? Ans. Asia Pacific region is expected to hold the highest share in the Track Laying Equipment Market. 3) What is the market size of the Track Laying Equipment Market by 2029? Ans. The market size of the Track Laying Equipment Market by 2029 is US$ 594.3 Mn. 4) What is the forecast period for the Track Laying Equipment Market? Ans. The Forecast period for the Track Laying Equipment Market is 2023-2029. 5) What was the market size of the Track Laying Equipment Market in 2022? Ans. The market size of the Track Laying Equipment Market in 2022 was US$ 447.7 Mn.

1. Global Track Laying Equipment Market Size: Research Methodology 2. Global Track Laying Equipment Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Track Laying Equipment Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Track Laying Equipment Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Track Laying Equipment Market Size Segmentation 4.1. Global Track Laying Equipment Market Size, by Types (2023-2029) • New Construction Equipment • Renewal Equipment 4.2. Global Track Laying Equipment Market Size, by Application (2023-2029) • Heavy rail • urban rail 5. North America Track Laying Equipment Market (2023-2029) 5.1. North America Track Laying Equipment Market Size, by Types (2023-2029) • New Construction Equipment • Renewal Equipment 5.2. North America Track Laying Equipment Market Size by Application (2023-2029) • Heavy rail • urban rail 5.3. North America Track Laying Equipment Market, by Country (2023-2029) • United States • Canada • Mexico 6. European Track Laying Equipment Market (2023-2029) 6.1. European Track Laying Equipment Market, by Types (2023-2029) 6.2. European Track Laying Equipment Market, by Application (2023-2029) 6.3. European Track Laying Equipment Market, by Country (2023-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Track Laying Equipment Market (2023-2029) 7.1. Asia Pacific Track Laying Equipment Market, by Types (2023-2029) 7.2. Asia Pacific Track Laying Equipment Market, by Application (2023-2029) 7.3. Asia Pacific Track Laying Equipment Market, by Country (2023-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. The Middle East and Africa Track Laying Equipment Market (2023-2029) 8.1. The Middle East and Africa Track Laying Equipment Market, by Types (2023-2029) 8.2. The Middle East and Africa Track Laying Equipment Market, by Application (2023-2029) 8.3. The Middle East and Africa Track Laying Equipment Market, by Country (2023-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Track Laying Equipment Market (2023-2029) 9.1. South America Track Laying Equipment Market, by Types (2023-2029) 9.2. South America Track Laying Equipment Market, by Application (2023-2029) 9.3. South America Track Laying Equipment Market, by Country (2023-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Geismar 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. Eiffage Rail 10.3. Plasser & Theurer 10.4. Harsco Corporation 10.5. SWIETELSKY 10.6. KOMPASS INTERNATIONAL SA 10.7. Plasser India 10.8. Salcef Group S.p.A. 10.9. The PTK Group 10.10. Strukton 10.11. ROBEL Bahnbaumaschinen GmbH 10.12. Plasser & Theurer 10.13. CREC 10.14. Harsco 10.15. Geismar 10.16. Matisa 10.17. Salcef Group S.p.A. 10.18. Kirow 10.19. Weihua