Global Tourism Event Market size was valued at USD 1665.6 Bn in 2023 and Tourism Event market revenue is expected to reach USD 2206.61 Bn by 2030, at a CAGR of 4.1% over the forecast period (2024-2030).Tourism Event Market Overview

Event tourism relates to private and public event. It brings out lot of money onto host community with valuable contributor to tourism economy. Events are very important part of tourism industry, but now tourism events has its own tourism industry spreaded in many regions. Events attract people and people spend money, which is expected to boost the market growth.Tourism Event Market Dynamics

Economic conditions play a significant role in driving the tourism event market. The attractiveness of a destination is a crucial driver for tourism events. Unique natural landscapes, cultural heritage, historical sites, and modern infrastructure draw visitors to a location. Events organized in popular tourist destinations or those with a distinctive appeal tend to attract more attendees, leading to increased demand for tourism event experiences. Effective marketing and promotion strategies play a vital role in driving the tourism event industry. Creative advertising campaigns targeted online marketing, social media presence, and collaborations with influencers can generate buzz and awareness about the event, attracting a larger audience. Strategic partnerships with travel agencies, airlines, and hotels help in promoting the event and driving attendance. Shifts in consumer preferences and behavior significantly contribute for the Tourism Event Market growth. Today's travelers often seek unique and immersive experiences, and attending events can fulfill this desire. Consumers are increasingly looking for events that align with their interests, such as music festivals, sports competitions, cultural celebrations, and culinary experiences. Event organizers that cater to these evolving preferences have the potential to attract more attendees. Sustainability has become a significant market driver in the tourism industry, including tourism events. Today's travelers are increasingly conscious of their environmental impact and seek events that prioritize sustainability practices. Events that incorporate eco-friendly initiatives, promote local cultures, support local communities, and minimize waste attract environmentally conscious attendees and gain a competitive edge and helps to increase Event Tourism Market share.To know about the Research Methodology :- Request Free Sample Report

Benefits of Event Tourism

Destination Promotion and Branding: Hosting events can significantly enhance the promotion and branding of a destination. High-profile events attract media attention and provide an opportunity for the destination to showcase its attractions, culture, and hospitality. Positive exposure through event coverage can lead to increased tourism beyond the event period, as attendees may be inspired to return for future visits or recommend the destination to others. Event tourism helps create a positive image and enhances the visibility and reputation of the host destination. Cultural Exchange and Community Engagement: Events often celebrate local traditions, arts, and cultural heritage, providing opportunities for cultural exchange between visitors and the local community. Event tourism allows visitors to experience the destination's unique customs, traditions, and artistic expressions, fostering cross-cultural understanding and appreciation. Moreover, events can strengthen community engagement by involving local businesses, artists, performers, and volunteers, promoting a sense of pride and unity among residents. Social and Cultural Legacy: Events can leave a lasting social and cultural legacy in the host destination. They provide opportunities to develop and improve local infrastructure, such as event venues, transportation systems, and accommodations. These infrastructure developments can benefit the local community beyond the event, attracting further tourism and enhancing the quality of life for residents. Events can also support the preservation and revitalization of cultural traditions, encouraging the local community to value and protect their heritage. Boost to Ancillary Industries: Event tourism benefits various ancillary industries that support the event and its attendees. These include event management companies, catering services, transportation providers, accommodation providers, equipment rental companies, and local retailers. The increased demand for goods and services from these industries during events stimulates their growth and generates employment opportunities.Types of Tourism Events

1. Cultural or Festival Event Tourism Fair 2. Sports Event Tourism 3. Business Events 4. Music and Entertainment Events 5. Spiritual and Religious Tourism 6. Travel Trade ShowsStrategic growth opportunities in Event Tourism Market

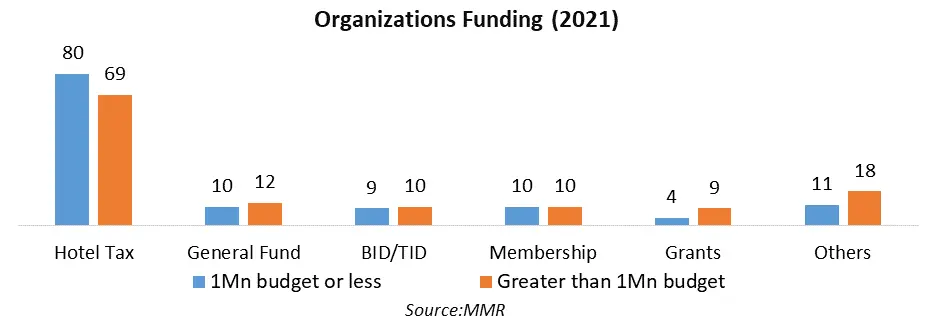

Currently, the ecosystem is very vibrant and robust in many ways. In order to build upon the opportunities for advancing cultural tourism there are three keys fundamentally necessary and oriented towards actionable items. Opportunities are: Invest in Excellence The ability to offer excellence is critical to competitiveness as a distinct, authentic, and cultural brand. Such, the pursuit of investment in excellence is necessary for all creative endeavors that have the potential to be attractive to cultural tourists. Organizations that administer existing pools of money to fund creative projects, and new or future trends become part of the economic mechanism of growing the creative sector and is expected to present a lucrative opportunity for the Event Tourism Market growth. Concerted action To leverage the investments and efforts in the creative and tourism industries, the industries need to work together toward the common goal of making more attractive cities and therefore destinations for cultural tourists contributing to grow overall revenue and direct local spending. Advancing event tourism presents an opportunity for a collaborative effort among the parties. Discover, Share, and connect the story Cohesiveness and articulate marketing are essential to spread the world beyond what’s happening in the cultural realm. As in the case for concerted action, multiple parties are involved in and take responsibility for these efforts. The creative industries plays a critical role in a global marketplace. The cultural heritage is one of its most valuable assets, which is expected to boost the Event tourism market penetration.Restraints of Event Tourism Market

Seasonality and Dependence on Specific Events to restrain the Tourism Event Market Growth Many events are seasonal or limited to specific dates, which creates challenges for the event tourism market. Visitors travel to a destination during the event period, leading to fluctuations in demand throughout the year. Dependence on specific events also means that if an event is canceled or faces challenges, and has a significant negative impact on the tourism market in that destination. Events bring many unwanted social impacts and environmental impacts too. It encourage economic leakage in the event tourism industry. The negative impact of event tourism is increased cost of living, traffic congestion, crowding, crime, property damage, deterioration of natural, cultural, or historical resources, and discomfort experienced by residents and local businesses. During periods of economic recession or instability, individuals and organizations back on travel and discretionary spending, affecting event attendance and participation. Fluctuations in exchange rates impact the cost of traveling to and attending events, making it more expensive for international visitors and potentially reducing their numbers and is expected to restrain the Tourism Event Market Growth. Events held in regions or countries experiencing political unrest or instability may face reduced attendance due to safety concerns and travel advisories. High-profile events are potential targets for security threats, leading to increased security measures and potential deterrents for attendees. Increasing concerns about climate change and the occurrence of natural disasters affect event planning and attendance, particularly for outdoor events in vulnerable regions. There is a growing demand for sustainable event practices, which present challenges for organizers in terms of resource management, waste reduction, and carbon footprint mitigation, and restaurants the Tourism Event industry growth. Multiple events occurring simultaneously in the same location or targeting the same audience lead to a dilution of attendance and competition for resources, sponsors, and exhibitors. The proliferation of events in certain sectors or destinations results in oversaturation, making it challenging for organizers to attract attendees and differentiate their offerings.Tourism Event Market Regional Insight

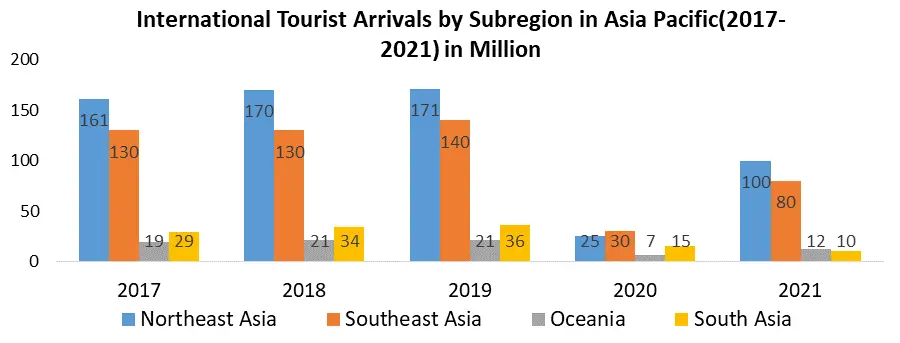

North America region dominated the Tourism event market in 2023 and is expected to hold the largest tourism event market share over the forecast period. The North American tourism event market is a dynamic and vibrant industry that offer a wide range of events attracting domestic and international travelers. The region hosts music festivals such as Coachella, Lollapalooza, and Bonnaroo with enthusiasts from around the world. North America celebrates its multiculturalism through events like Pride Parades, cultural heritage festivals, and ethnic celebrations, promoting inclusivity and attracting visitors from diverse backgrounds. Golf courses and tennis tournaments such as Masters Tournament, US Open, and Wimbledon are famous especially in the United States. New York City's Broadway theater district is popular for its performances such as musicals, plays, and live shows, which is mostly attracting tourists. The North America region heavily spends on adventure activities such as skiing, snowboarding, surfing, rock climbing and many more including many more.Asia Pacific region is expected to boost the Tourism Event Market over the forecast period. Countries like Japan, Thailand, and India host vibrant and culturally significant events that attract domestic and international tourists. Realizing the opportunities that sustainable tourism provides economic growth for future and a pathway to self-efficiency to achieve social and economic priorities in pacific island countries, which is expected to boost the regional Tourism Event industry growth. Economic growth in Asia Pacific was strong before COVID-19, as average annual gross domestic product (GDP) in 19 countries reached 4.0% or higher; led by Bangladesh (8.2%), Armenia (7.6%), Nepal (7.0%), and Viet Nam (7.0%). In 2020, 3.15 Bn people in Asia Pacific had internet access, up 1 billion in just 5 years, 6 with 53.4% of all households having access.Generation Z and Millennials comprise the largest share of population, particularly in India, Indonesia, Malaysia, Pakistan, and the Philippines, thus constituting an important consumer group in these countries.

Tourism Event Market Segment Analysis

Based on Event type, the market is segmented into Cultural or Festival Event Tourism Fair, Sports Event Tourism, Business Events, Music and Entertainment Events, Spiritual and Religious Tourism, and Travel Trade Shows. Sports Event Tourism segment held the largest Tourism Event Market share in 2023 and is expected to dominate the market over the forecast period. Sports tourism is the fastest growing sector in tourism. Tourist are intrested in sports activities during trips even though their main objective is not sports activities. Various sports events attracts participants and destinations try to add local flavours to distinguish themselves and provide authentic local experience. Mega sports events such as Olympics and World Cups are catalyst for tourism developme nt including destination branding, infrastructure development, and other economic and social benefits and all these factors is expected to boost the segment growth in the Tourism Event Market.Based on Channel, the market is segmented into Virtual channel and physical channel. Physical channel is expected to hold the largest market share in 2023 and is expected to dominate the Tourism Event Market over the forecast period. Physical events build more memorable connections wiyh personal contact that has no replacement. Face to face event add more interactions to distinctive element and creates long-lasting impact, which is expected to boost the market growth. Physical channel provides personalized feedback, which is most importan thing in any event and helps to boost the Tourism Event Market penetration. Based on organization size, the market is segmented into Corporations, Associations, Government agencies, and Non-profit organizations. Non-Profit organizations segment is expected to dominate the market over the forecast period. The organizations helps to create an incredible travel experience. Non-profit is integrating health technology into indigenous societies, or exploring the culture around Cuzco, Peru. It ensure federal reimbursement requirements and provide an unprecedented audit trail of all transactions, which is expected to boost the Tourism event market growth.

Tourism Event Market Competitive Landscape

Tourism Event key players are adopting innovative growth strategies to boost the market growth over the forecast period. The competitive landscape of the Tourism Event Sensors market is characterized by the presence of several established players and a growing number of new entrants. The competitive landscape of the Tourism Event market is shaped by strategic partnerships, collaborations, acquisitions and Tourism Event Market penetration. Tourism Event services providers are partnering with each other to leverage their respective strengths and capabilities to develop new and innovative solutions. Companies are acquiring players in the market to expand their product offerings, enhance their market reach, and gain a competitive advantage in the market. Live nation worldwide has gain faster pace in the facst growing livestreaming space, and has also suffered a loss during COVID 19 restrictions.Tourism Event Market Scope: Inquire before buying

Tourism Event Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: USD 1665.6 Bn Forecast Period 2024 to 2030 CAGR: 4.1% Market Size in 2030: USD 2206.61 Bn Segments Covered: by Event Type Cultural or Festival Event Tourism Fair Sports Event Tourism Business Events Music and Entertainment Events Spiritual and Religious Tourism Travel Trade Shows by Channel Virtual Channel Physical Channel by Revenue Source On-line registration Off-line registration Sponsorship Others by Age group Below 18 years 18 – 50 years Above 50 years by Organization size Corporations Associations Government agencies Non-profit organizations Tourism Event Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tourism Event key players include

1. Reed Exhibitions 2. Informa Markets 3. Messe Frankfurt 4. Clarion Events 5. Emerald Expositions 6. ITE Group 7. Tarsus Group 8. GL Events 9. Comexposium 10. Messe München 11. Fiera Milano 12. Koelnmesse 13. Messe Düsseldorf 14. Easyfairs 15. Deutsche Messe 16. Messe Berlin 17. U.S. Sports Congress 18. International Association of Exhibitions and Events (IAEE) 19. Professional Convention Management Association (PCMA)Frequently Asked Questions:

1] What is the growth rate of the Global Tourism Event Market? Ans. The Global Tourism Event Market is growing at a significant rate of 4.1% over the forecast period. 2] Which region is expected to dominate the Global Tourism Event Market? Ans. North America region is expected to dominate the Tourism Event Market over the forecast period. 3] What is the expected Global Tourism Event Market size by 2030? Ans. The market size of the Tourism Event Market is expected to reach USD 2206.61 Bn by 2030. 4] Who are the top players in the Global Tourism Event Industry? Ans. The major key players in the Global Tourism Event Market are GL Events, Comexposium, Messe München, and Fiera Milano. 5] Which factors are expected to drive the Global Tourism Event Market growth by 2030? Ans. Strong Economic conditions is expected to drive the Tourism Event Market growth over the forecast period (2024-2030).

1. Tourism Event Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Tourism Event Market: Dynamics 2.1. Tourism Event Market Trends by Region 2.1.1. North America Tourism Event Market Trends 2.1.2. Europe Tourism Event Market Trends 2.1.3. Asia Pacific Tourism Event Market Trends 2.1.4. Middle East and Africa Tourism Event Market Trends 2.1.5. South America Tourism Event Market Trends 2.2. Tourism Event Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Tourism Event Market Drivers 2.2.1.2. North America Tourism Event Market Restraints 2.2.1.3. North America Tourism Event Market Opportunities 2.2.1.4. North America Tourism Event Market Challenges 2.2.2. Europe 2.2.2.1. Europe Tourism Event Market Drivers 2.2.2.2. Europe Tourism Event Market Restraints 2.2.2.3. Europe Tourism Event Market Opportunities 2.2.2.4. Europe Tourism Event Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Tourism Event Market Drivers 2.2.3.2. Asia Pacific Tourism Event Market Restraints 2.2.3.3. Asia Pacific Tourism Event Market Opportunities 2.2.3.4. Asia Pacific Tourism Event Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Tourism Event Market Drivers 2.2.4.2. Middle East and Africa Tourism Event Market Restraints 2.2.4.3. Middle East and Africa Tourism Event Market Opportunities 2.2.4.4. Middle East and Africa Tourism Event Market Challenges 2.2.5. South America 2.2.5.1. South America Tourism Event Market Drivers 2.2.5.2. South America Tourism Event Market Restraints 2.2.5.3. South America Tourism Event Market Opportunities 2.2.5.4. South America Tourism Event Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Tourism Event Industry 2.8. Analysis of Government Schemes and Initiatives For Tourism Event Industry 2.9. Tourism Event Market Trade Analysis 2.10. The Global Pandemic Impact on Tourism Event Market 3. Tourism Event Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Tourism Event Market Size and Forecast, by Event type (2023-2030) 3.1.1. Cultural or Festival Event Tourism Fair 3.1.2. Sports Event Tourism 3.1.3. Business Events 3.1.4. Music and Entertainment Events 3.1.5. Spiritual and Religious Tourism 3.1.6. Travel Trade Shows 3.2. Tourism Event Market Size and Forecast, by Channel (2023-2030) 3.2.1. Virtual Channel 3.2.2. Physical Channel 3.3. Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 3.3.1. On-line registration 3.3.2. Off-line registration 3.3.3. Sponsorship 3.3.4. Others 3.4. Tourism Event Market Size and Forecast, by Age group (2023-2030) 3.4.1. Below 18 years 3.4.2. 18 – 50 years 3.4.3. Above 50 years 3.5. Tourism Event Market Size and Forecast, by Organization size (2023-2030) 3.5.1. Corporations 3.5.2. Associations 3.5.3. Government agencies 3.5.4. Non-profit organizations 3.6. Tourism Event Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Tourism Event Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Tourism Event Market Size and Forecast, by Event type (2023-2030) 4.1.1. Cultural or Festival Event Tourism Fair 4.1.2. Sports Event Tourism 4.1.3. Business Events 4.1.4. Music and Entertainment Events 4.1.5. Spiritual and Religious Tourism 4.1.6. Travel Trade Shows 4.2. North America Tourism Event Market Size and Forecast, by Channel (2023-2030) 4.2.1. Virtual Channel 4.2.2. Physical Channel 4.3. North America Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 4.3.1. On-line registration 4.3.2. Off-line registration 4.3.3. Sponsorship 4.3.4. Others 4.4. North America Tourism Event Market Size and Forecast, by Age group (2023-2030) 4.4.1. Below 18 years 4.4.2. 18 – 50 years 4.4.3. Above 50 years 4.5. North America Tourism Event Market Size and Forecast, by Organization size (2023-2030) 4.5.1. Corporations 4.5.2. Associations 4.5.3. Government agencies 4.5.4. Non-profit organizations 4.7. North America Tourism Event Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Tourism Event Market Size and Forecast, by Event type (2023-2030) 4.6.1.1.1. Cultural or Festival Event Tourism Fair 4.6.1.1.2. Sports Event Tourism 4.6.1.1.3. Business Events 4.6.1.1.4. Music and Entertainment Events 4.6.1.1.5. Spiritual and Religious Tourism 4.6.1.1.6. Travel Trade Shows 4.6.1.2. United States Tourism Event Market Size and Forecast, by Channel (2023-2030) 4.6.1.2.1. Virtual Channel 4.6.1.2.2. Physical Channel 4.6.1.3. United States Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 4.6.1.3.1. On-line registration 4.6.1.3.2. Off-line registration 4.6.1.3.3. Sponsorship 4.6.1.3.4. Others 4.6.1.4. United States Tourism Event Market Size and Forecast, by Age group (2023-2030) 4.6.1.4.1. Below 18 years 4.6.1.4.2. 18 – 50 years 4.6.1.4.3. Above 50 years 4.6.1.5. United States Tourism Event Market Size and Forecast, by Organization size (2023-2030) 4.6.1.5.1. Corporations 4.6.1.5.2. Associations 4.6.1.5.3. Government agencies 4.6.1.5.4. Non-profit organizations 4.6.2. Canada 4.6.2.1. Canada Tourism Event Market Size and Forecast, by Event type (2023-2030) 4.6.2.1.1. Cultural or Festival Event Tourism Fair 4.6.2.1.2. Sports Event Tourism 4.6.2.1.3. Business Events 4.6.2.1.4. Music and Entertainment Events 4.6.2.1.5. Spiritual and Religious Tourism 4.6.2.1.6. Travel Trade Shows 4.6.2.2. Canada Tourism Event Market Size and Forecast, by Channel (2023-2030) 4.6.2.2.1. Virtual Channel 4.6.2.2.2. Physical Channel 4.6.2.3. Canada Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 4.6.2.3.1. On-line registration 4.6.2.3.2. Off-line registration 4.6.2.3.3. Sponsorship 4.6.2.3.4. Others 4.6.2.4. Canada Tourism Event Market Size and Forecast, by Age group (2023-2030) 4.6.2.4.1. Below 18 years 4.6.2.4.2. 18 – 50 years 4.6.2.4.3. Above 50 years 4.6.2.5. Canada Tourism Event Market Size and Forecast, by Organization size (2023-2030) 4.6.2.5.1. Corporations 4.6.2.5.2. Associations 4.6.2.5.3. Government agencies 4.6.2.5.4. Non-profit organizations 4.6.3. Mexico 4.6.3.1. Mexico Tourism Event Market Size and Forecast, by Event type (2023-2030) 4.6.3.1.1. Cultural or Festival Event Tourism Fair 4.6.3.1.2. Sports Event Tourism 4.6.3.1.3. Business Events 4.6.3.1.4. Music and Entertainment Events 4.6.3.1.5. Spiritual and Religious Tourism 4.6.3.1.6. Travel Trade Shows 4.6.3.2. Mexico Tourism Event Market Size and Forecast, by Channel (2023-2030) 4.6.3.2.1. Virtual Channel 4.6.3.2.2. Physical Channel 4.6.3.3. Mexico Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 4.6.3.3.1. On-line registration 4.6.3.3.2. Off-line registration 4.6.3.3.3. Sponsorship 4.6.3.3.4. Others 4.6.3.4. Mexico Tourism Event Market Size and Forecast, by Age group (2023-2030) 4.6.3.4.1. Below 18 years 4.6.3.4.2. 18 – 50 years 4.6.3.4.3. Above 50 years 4.6.3.5. Mexico Tourism Event Market Size and Forecast, by Organization size (2023-2030) 4.6.3.5.1. Corporations 4.6.3.5.2. Associations 4.6.3.5.3. Government agencies 4.6.3.5.4. Non-profit organizations 5. Europe Tourism Event Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.2. Europe Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.3. Europe Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 5.4. Europe Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.5. Europe Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6. Europe Tourism Event Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.1.2. United Kingdom Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.1.3. United Kingdom Tourism Event Market Size and Forecast, by Revenue Source(2023-2030) 5.6.1.4. United Kingdom Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.1.5. United Kingdom Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.2. France 5.6.2.1. France Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.2.2. France Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.2.3. France Tourism Event Market Size and Forecast, by Revenue Source(2023-2030) 5.6.2.4. France Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.2.5. France Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.3.2. Germany Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.3.3. Germany Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 5.6.3.4. Germany Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.3.5. Germany Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.4.2. Italy Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.4.3. Italy Tourism Event Market Size and Forecast, by Revenue Source(2023-2030) 5.6.4.4. Italy Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.4.5. Italy Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.5.2. Spain Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.5.3. Spain Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 5.6.5.4. Spain Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.5.5. Spain Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.6.2. Sweden Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.6.3. Sweden Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 5.6.6.4. Sweden Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.6.5. Sweden Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.7.2. Austria Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.7.3. Austria Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 5.6.7.4. Austria Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.7.5. Austria Tourism Event Market Size and Forecast, by Organization size (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Tourism Event Market Size and Forecast, by Event type (2023-2030) 5.6.8.2. Rest of Europe Tourism Event Market Size and Forecast, by Channel (2023-2030) 5.6.8.3. Rest of Europe Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 5.6.8.4. Rest of Europe Tourism Event Market Size and Forecast, by Age group (2023-2030) 5.6.8.5. Rest of Europe Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6. Asia Pacific Tourism Event Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.2. Asia Pacific Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.3. Asia Pacific Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.4. Asia Pacific Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.5. Asia Pacific Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6. Asia Pacific Tourism Event Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.1.2. China Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.1.3. China Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.1.4. China Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.1.5. China Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.2.2. S Korea Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.2.3. S Korea Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.2.4. S Korea Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.2.5. S Korea Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.3.2. Japan Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.3.3. Japan Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.3.4. Japan Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.3.5. Japan Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.4. India 6.6.4.1. India Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.4.2. India Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.4.3. India Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.4.4. India Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.4.5. India Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.5.2. Australia Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.5.3. Australia Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.5.4. Australia Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.5.5. Australia Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.6.2. Indonesia Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.6.3. Indonesia Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.6.4. Indonesia Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.6.5. Indonesia Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.7.2. Malaysia Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.7.3. Malaysia Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.7.4. Malaysia Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.7.5. Malaysia Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.8.2. Vietnam Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.8.3. Vietnam Tourism Event Market Size and Forecast, by Revenue Source(2023-2030) 6.6.8.4. Vietnam Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.8.5. Vietnam Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.9.2. Taiwan Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.9.3. Taiwan Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.9.4. Taiwan Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.9.5. Taiwan Tourism Event Market Size and Forecast, by Organization size (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Tourism Event Market Size and Forecast, by Event type (2023-2030) 6.6.10.2. Rest of Asia Pacific Tourism Event Market Size and Forecast, by Channel (2023-2030) 6.6.10.3. Rest of Asia Pacific Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 6.6.10.4. Rest of Asia Pacific Tourism Event Market Size and Forecast, by Age group (2023-2030) 6.6.10.5. Rest of Asia Pacific Tourism Event Market Size and Forecast, by Organization size (2023-2030) 7. Middle East and Africa Tourism Event Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Tourism Event Market Size and Forecast, by Event type (2023-2030) 7.2. Middle East and Africa Tourism Event Market Size and Forecast, by Channel (2023-2030) 7.3. Middle East and Africa Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 7.4. Middle East and Africa Tourism Event Market Size and Forecast, by Age group (2023-2030) 7.5. Middle East and Africa Tourism Event Market Size and Forecast, by Organization size (2023-2030) 7.6. Middle East and Africa Tourism Event Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Tourism Event Market Size and Forecast, by Event type (2023-2030) 7.6.1.2. South Africa Tourism Event Market Size and Forecast, by Channel (2023-2030) 7.6.1.3. South Africa Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 7.6.1.4. South Africa Tourism Event Market Size and Forecast, by Age group (2023-2030) 7.6.1.5. South Africa Tourism Event Market Size and Forecast, by Organization size (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Tourism Event Market Size and Forecast, by Event type (2023-2030) 7.6.2.2. GCC Tourism Event Market Size and Forecast, by Channel (2023-2030) 7.6.2.3. GCC Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 7.6.2.4. GCC Tourism Event Market Size and Forecast, by Age group (2023-2030) 7.6.2.5. GCC Tourism Event Market Size and Forecast, by Organization size (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Tourism Event Market Size and Forecast, by Event type (2023-2030) 7.6.3.2. Nigeria Tourism Event Market Size and Forecast, by Channel (2023-2030) 7.6.3.3. Nigeria Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 7.6.3.4. Nigeria Tourism Event Market Size and Forecast, by Age group (2023-2030) 7.6.3.5. Nigeria Tourism Event Market Size and Forecast, by Organization size (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Tourism Event Market Size and Forecast, by Event type (2023-2030) 7.6.4.2. Rest of ME&A Tourism Event Market Size and Forecast, by Channel (2023-2030) 7.6.4.3. Rest of ME&A Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 7.6.4.4. Rest of ME&A Tourism Event Market Size and Forecast, by Age group (2023-2030) 7.6.4.5. Rest of ME&A Tourism Event Market Size and Forecast, by Organization size (2023-2030) 8. South America Tourism Event Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Tourism Event Market Size and Forecast, by Event type (2023-2030) 8.2. South America Tourism Event Market Size and Forecast, by Channel (2023-2030) 8.3. South America Tourism Event Market Size and Forecast, by Revenue Source(2023-2030) 8.4. South America Tourism Event Market Size and Forecast, by Age group (2023-2030) 8.5. South America Tourism Event Market Size and Forecast, by Organization size (2023-2030) 8.6. South America Tourism Event Market Size and Forecast, by Country (2023-2030) 8.7.1. Brazil 8.6.1.1. Brazil Tourism Event Market Size and Forecast, by Event type (2023-2030) 8.6.1.2. Brazil Tourism Event Market Size and Forecast, by Channel (2023-2030) 8.6.1.3. Brazil Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 8.6.1.4. Brazil Tourism Event Market Size and Forecast, by Age group (2023-2030) 8.6.1.5. Brazil Tourism Event Market Size and Forecast, by Organization size (2023-2030) 8.7.2. Argentina 8.6.2.1. Argentina Tourism Event Market Size and Forecast, by Event type (2023-2030) 8.6.2.2. Argentina Tourism Event Market Size and Forecast, by Channel (2023-2030) 8.6.2.3. Argentina Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 8.6.2.4. Argentina Tourism Event Market Size and Forecast, by Age group (2023-2030) 8.6.2.5. Argentina Tourism Event Market Size and Forecast, by Organization size (2023-2030) 8.7.3. Rest Of South America 8.6.3.1. Rest Of South America Tourism Event Market Size and Forecast, by Event type (2023-2030) 8.6.3.2. Rest Of South America Tourism Event Market Size and Forecast, by Channel (2023-2030) 8.6.3.3. Rest Of South America Tourism Event Market Size and Forecast, by Revenue Source (2023-2030) 8.6.3.4. Rest Of South America Tourism Event Market Size and Forecast, by Age group (2023-2030) 8.6.3.5. Rest Of South America Tourism Event Market Size and Forecast, by Organization size (2023-2030) 9. Global Tourism Event Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Tourism Event Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Reed Exhibitions 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Informa Markets 10.3. Messe Frankfurt 10.4. Clarion Events 10.5. Emerald Expositions 10.6. ITE Group 10.7. Tarsus Group 10.8. GL Events 10.9. Comexposium 10.10. Messe München 10.11. Fiera Milano 10.12. Koelnmesse 10.13. Messe Düsseldorf 10.14. Easyfairs 10.15. Deutsche Messe 10.16. Messe Berlin 10.17. U.S. Sports Congress 10.18. International Association of Exhibitions and Events (IAEE) 10.19. Professional Convention Management Association (PCMA) 11. Key Findings 12. Industry Recommendations 13. Tourism Event Market: Research Methodology 14. Terms and Glossary